Forex Master Levels is an MT4 system developed for the MT4 platform. It’s designed to provide traders with actionable signals and insights, helping them to identify potential entry and exit points in the market. The system claims to offer non-repaint buy/sell signals, meaning once a signal is given, it stays fixed. It gives traders confidence that the indicators won’t change or ‘repaint’ their positions retrospectively.

The strength of Forex Master Levels lies in its ability to provide traders with control and insights previously unseen in the Forex market. It boasts a suite of tools designed to help users quickly master the system, manage risk efficiently, and identify market trends. The developers claim that the system excels in detecting trends, which are crucial for profitable trades in the Forex market.

The system boasts several features that stand out in the crowded field of Forex trading tools:

- Non-repaint signals: Ensuring that once a trading signal has been established, it will not change.

- User-friendly interface: Even those new to trading can navigate and utilize the system effectively.

- Comprehensive dashboard: An on-screen information hub that allows traders to see various metrics and signals at a glance.

This MT4 System is straightforward. Even a complete beginner can start trading and making profits with this system. You can set it to send you a signal alert via Mobile Notification, platform pop-ups, and Email. This is helpful as it means you do not need to stare at the charts all day, waiting for signals to appear, and you can monitor multiple charts simultaneously.

Forex Master Levels can be used on any Forex currency pair and other assets such as stocks, commodities, cryptos, precious metals, oil, gas, etc. You can also use it on any time frame that suits you best, from the 30-minute through to the 1-month charts.

This MT4 System is entirely manual. The indicators produce the signals, but any decisions to enter the market and set protection or profitable exit stops will depend on the trader. Therefore, the trader must be familiar with the principles of risk and reward and use initial support and resistance areas to set entries and exits.

Forex Master Levels can give you trading signals you can take as they are or add your additional chart analysis to filter the signals further, which is recommended. While traders of all experience levels can use this system, practicing trading on an MT4 demo account can be beneficial until you become consistent and confident enough to go live.

This MT4 System Indicators Explained

The MT4 System is comprised of a suite of proprietary custom indicators, each playing a specific role in the trading process. Here’s a more detailed look at each component:

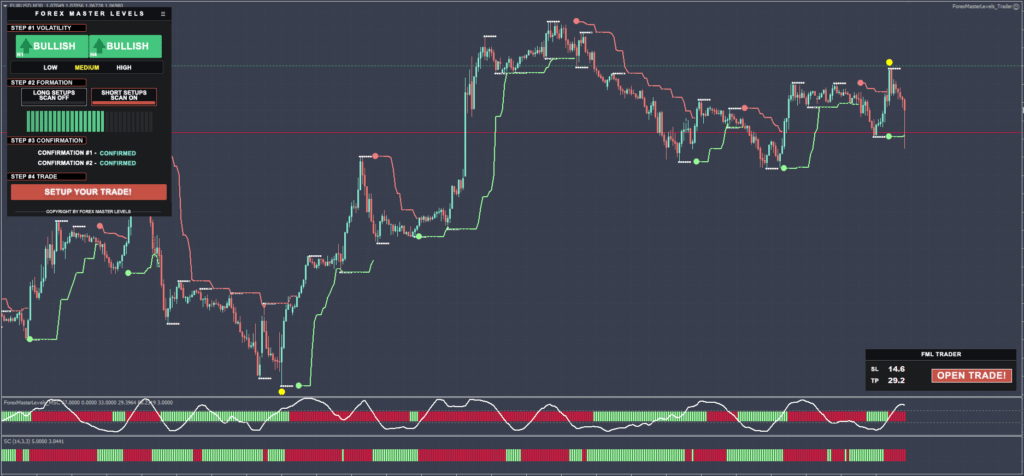

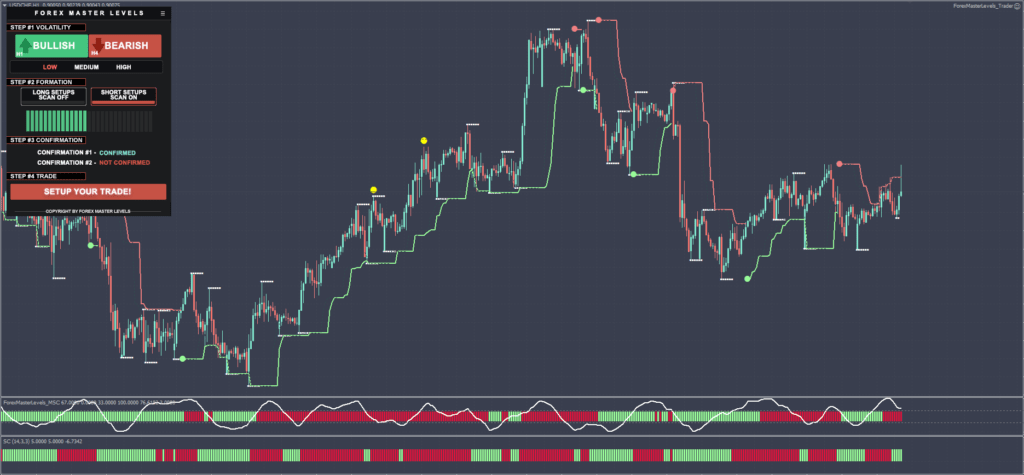

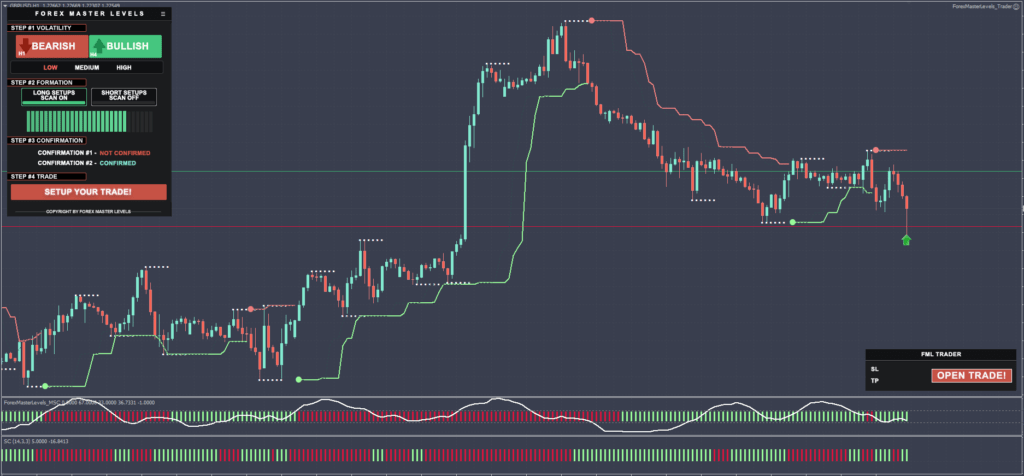

- FML Super Dashboard Indicator:

- Volatility: Displays the current trend and market volatility, showing whether it’s low, medium, or high.

- Formation: Allows you to scan for potential trade setups and shows how close you are to the next setup.

- Confirmation: Provides an automated check to confirm if the trade setup is valid or not.

- Trade: Offers a trade setup window that guides you through the process of entering a trade, including instructions on stop loss and take profit placements.

- FML Super Signal Indicator:

- Serves as the primary signal generator of the system, predicting market turns and potential entry points with green (for bullish) and red (for bearish) arrows.

- The signals provided by this indicator do not repaint, meaning once a signal is given, it will not change in hindsight.

- FML Expert Exhaustion Indicator:

- Indicates when a trend may be losing momentum by placing a yellow dot on the chart.

- These dots help determine when to exit trades or expect the end of a current trend cycle.

- FML Confirmation Indicators:

- FML MSC (Market Swing Confirmation): Combines custom MACD and momentum indicators, represented by a histogram and a white line based on stochastic RSI.

- For bullish setups, the MSC must show green bars with the white line at or below the 30 level.

- For bearish setups, it must show red bars with the white line at or above the 70 level.

- FML SSC (Swing stochastic Confirmation): Integrates stochastic and volume indicators, presented as a histogram to gauge market sentiment.

- Green bars on the SSC indicate a potential bullish setup.

- Red bars suggest a potential bearish setup.

- FML MSC (Market Swing Confirmation): Combines custom MACD and momentum indicators, represented by a histogram and a white line based on stochastic RSI.

- FML HiLow Stops:

- Helps to identify and place initial stop losses by using custom fractals to pinpoint potential highs and lows in the market.

- This is instrumental in setting protective measures for your trades.

- FML Channel:

- Works in tandem with the HiLow Stops, showing if the market is achieving higher highs in an uptrend or lower lows in a downtrend.

- This can assist in better managing trailing stops and understanding market structure.

Each of these indicators contributes to the overall functionality of this MT4 System. They are designed to work together to provide a clear and concise framework for entering and exiting trades, managing risk, and aiming for consistent profitability in the Forex market. Users should understand how each component functions individually and how they interrelate to make the most out of the system.

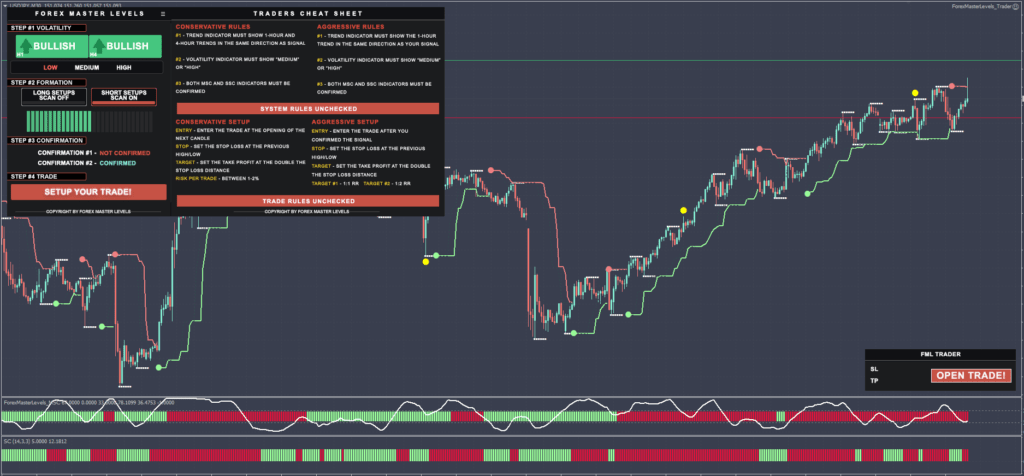

The MT4 system provides structured rules for trading, which can be followed conservatively or aggressively:

- Conservative Trading: Involves confirming trends and volatility with the Super Dashboard, identifying formations, confirming trade validity, and setting up trades following specific entry points, stop loss, and take profit levels.

- Aggressive Trading: You can find trading rules for this in the manual. It does involve a more risk-tolerant approach, potentially acting on weaker signals or foregoing some confirmation steps.

Download a Collection of Indicators, Courses, and EA for FREE

Trading rules for Forex Master Levels

Remember to tighten your Stop Losses around High Impact News Releases or avoid trading at least 15 minutes before and after these events when using Forex Master Levels.

As always, to achieve good results, remember about proper money management. To be a profitable trader, you must master discipline, emotions, and psychology. It is crucial to know when and when not to trade. Avoid trading during unfavorable times and market conditions like low volume/volatility conditions, beyond major sessions, exotic currency pairs, wider spread, etc.

- Volatility and Trend Confirmation:

- Verify the trend on the FML Super Dashboard is Green for long trades or Red for short trades on both the 1-hour and 4-hour charts.

- Ensure the volatility is medium (yellow) or high (Green) before proceeding.

- Formation:

- Use the “Long Setups Scan” on the Dashboard for bullish setups or the “Short Setups Scan” for bearish setups.

- The “Level Radar” will indicate your proximity to a potential trade setup with Green bars.

- Wait for an alert that indicates a signal has been found.

- Confirmation:

- The Dashboard should automatically confirm a valid setup with a Green “Confirmed” label for both the MSC and SSC indicators.

- Manual Confirmation (Optional):

- For bullish setups, MSC histogram bars should be Green with a white line at or below 30. SSC histogram bars should be Green.

- For bearish setups, MSC histogram bars should be Red with a white line at or above 70. SSC histogram bars should be Red.

- Enter The Trade:

- Click on the “Setup Your Trade!” button to access the trade cheat sheet with detailed instructions.

- Confirm that all rules are checked and followed before entering the trade.

- Enter a long trade at the opening of the first candle after a Green signal arrow and a short trade after a Red signal arrow.

- Set the stop loss at the previous low for long trades and the previous high for short trades, as the HiLow indicator indicates.

- The take profit level should be set to ensure a 1:2 Risk-Reward Ratio, with the target being twice the distance from the entry point to the stop loss.

Conclusion

The Forex Master Levels system offers a structured and detailed methodology for Forex trading, providing various indicators and rules to help traders make calculated decisions. However, as with any trading system, potential users should be aware that risk is always involved in trading and that past performance does not indicate future results. Traders must do their due diligence and possibly seek out reviews and performance history before committing to such an MT4 System.

Thanks Admin.

merci beaucoup pour l’indicateur je viens de le téléchargé je part essayer ça sur un compte démo et je reviendrai vers vous avec des résultat après une semaine

What is the result?

hi

no link to download this indi?tx

Some bug, I dont get the arrow buttons