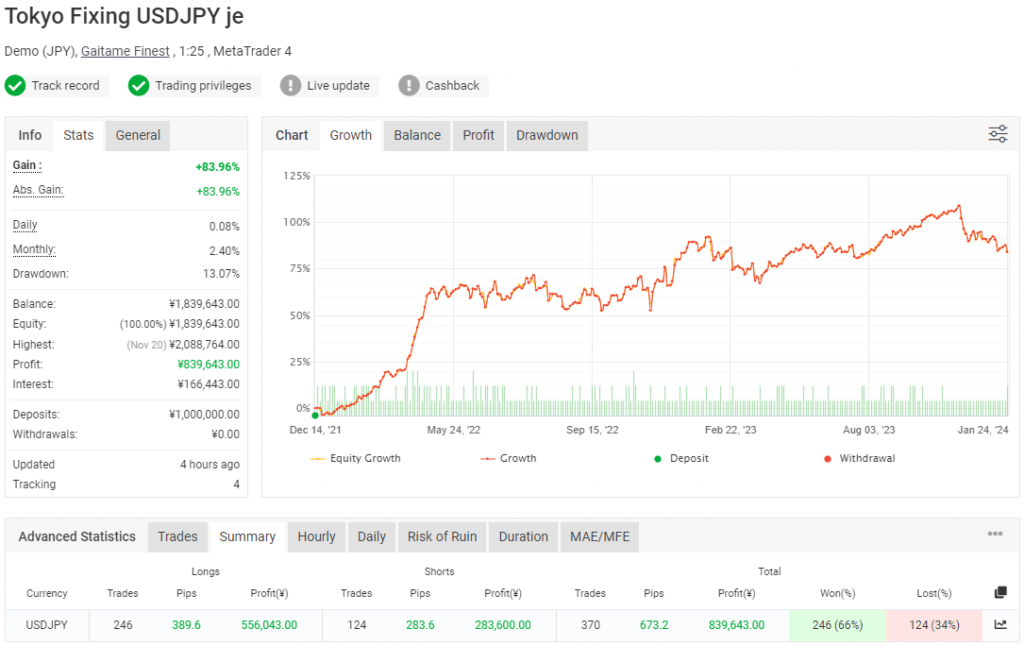

Tokyo USDJPY EA is a Forex EA, especially on the USDJPY currency pair. At the heart of this EA lies the Relative Strength Index (RSI Indicator), a momentum oscillator that measures the speed and change of price movements. This EA harnesses the RSI to determine optimal trade entry points, focusing on specific time windows when the market dynamics are most favorable.

The USDJPY EA operates on a concise timetable. It initiates Buy orders from midnight to the early morning hours, Japan time. These orders are then closed at 9:55 AM Japan time. Conversely, Sell orders are placed precisely at 9:55 AM for those eyeing the bearish trends. This approach ensures that the trading is concentrated during times when the market is anticipated to offer the most potential based on historical patterns and volatility associated with the Tokyo market opening hours.

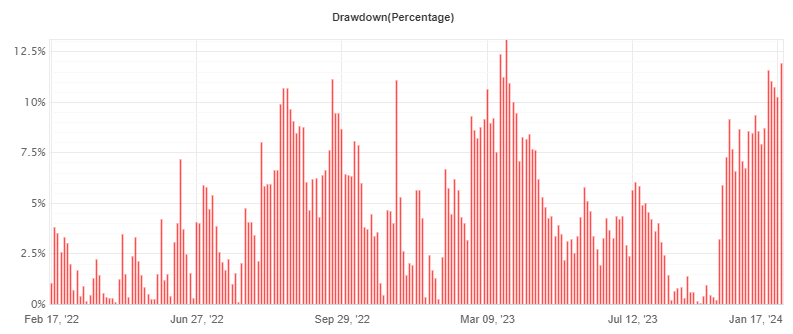

Understanding and managing risk is a cornerstone of successful trading. This USDJPY EA is built with this principle in mind. It refrains from employing high-risk strategies such as Martingale. Instead, it adheres to a one-trade-at-a-time policy, ensuring that the trading activity is both manageable and not overleveraged.

Each trade is protected with a Take Profit (TP) and a Stop Loss (SL) mechanism. While the TP and SL are set at 100 pips, the EA’s internal logic fine-tunes these numbers to more practical averages of about 10 pips for TP and 9 pips for SL. This subtle approach not only protects the investment but also aligns the trading strategy with the inherently volatile nature of the Forex market.

Please test in a demo account first for at least a week. Also, please familiarize yourself with and understand how this USDJPY EA works, then only use it in a real account.

Recommendation for USDJPY EA

- Minimum account balance of 100$ for 0.01 lot.

- It is specially designed to work on USDJPY. (Work on any pair)

- It works best on M5 TimeFrames. (Work on any time frame)

- This USDJPY EA should work on VPS continuously to reach stable results. So we recommend running this MT5 EA Download on a reliable VPS (Reliable and Trusted FOREX VPS – MyfxVPS)

- The EA is NOT sensitive to spread and slippage. But We advise using a good ECN broker (Find the Perfect Broker For You Here)

Download a Collection of Indicators, Courses, and EA for FREE

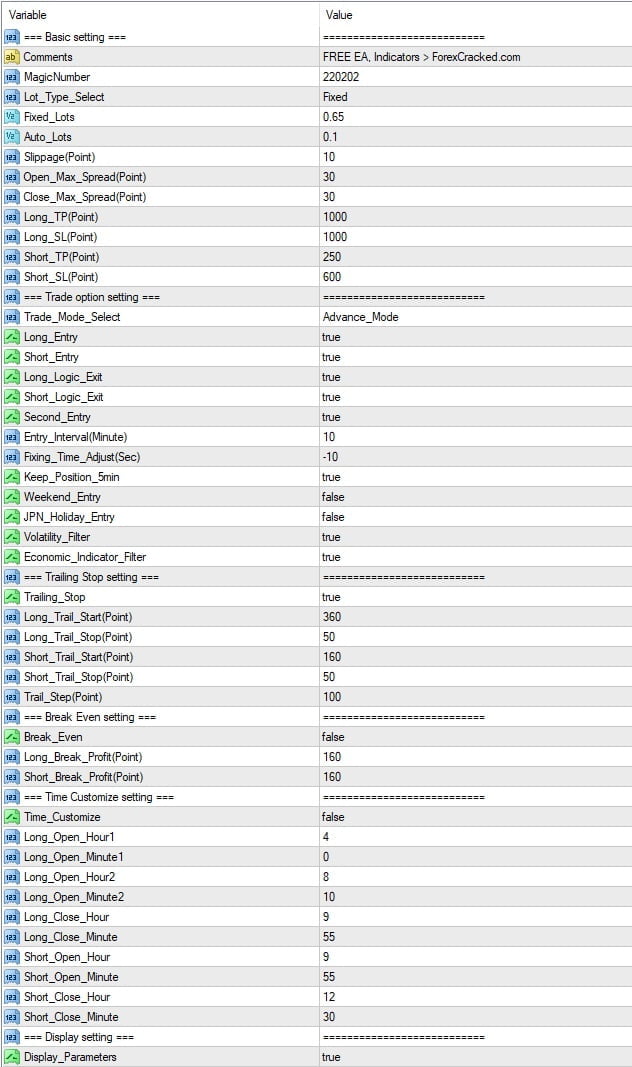

Input Parameters

- Comments: The comment section.

- Magic Number: USDJPY EA identification number.

- Lot Type Select:

- Fixed: It uses a simple interest operation (fixed lot).

- Auto Freemargin: It uses an automatic compound interest operation function based on surplus margin.

- Auto Balance: USDJPY EA Uses an automatic compound interest operation function based on the account balance.

- Fixed Lots: Number of lots during simple interest operation (applicable when Lot Type Select is Fixed).

- Auto Lots: Number of lots per 100,000 currency balance during compound interest operation (applicable when Lot Type Select is Auto Freemargin or Auto Balance).

- Slippage: Allowable slippage.

- Open Max Spread: Allowable spread for new orders.

- Close Max Spread: Allowable spread for settlement orders.

- Long TP: Buy profit margin.

- Long SL: Buy stop loss range.

- Short TP: Sell profit range.

- Short SL: Selling loss cut range.

- Trade Mode Select:

- Advance Mode: Trade on days other than Goto days (Selling is only entered in the middle and end of the month).

- Extra Mode: Trades are performed on days other than Goto days.

- Gotobi Only Mode: Trade only on Goto days (5, 10, 15, 20, 25, 30 days). If Goto Day is a Saturday or Sunday, Friday will be Goto Day.

- Gotobi and Friday Mode: Trade on Gotobi and Friday.

- Gotobi on Friday Mode: Trade only on Friday goto days.

- Long Entry: true/false (Permit/prohibit buy entry).

- Short Entry: true/false (Allow/prohibit sell entry).

- Long Logic Exit: true/false (Permit/prohibit buy internal logic settlement, excluding time settlement, TP, SL).

- Short Logic Exit: true/false (Allow/prohibit sell internal logic settlement, excluding time settlement, TP, SL).

- Second Entry: true/false (Allow/disallow new buy entries on the same day after closing the buy position before the mid-market time, Japan time).

- Entry Interval: When the Second Entry is true, the time (in minutes) to prohibit new buy entries if the buy position is closed before the mid-market price time.

- Fixing Time Adjust: Adjustment of buy settlement and sell entry time at mid-price time (in seconds).

- Keep Position 5min: true/false (Enable/disable holding the position for at least 5 minutes).

- Weekend Entry: true/false (permit/prohibited USDJPY EA to trade late at night on Fridays and weekends).

- JPN Holiday Entry: true/false (Entry permission/prohibition on Japanese holidays, corresponding to 2010 to 2023).

- Volatility Filter: true/false (Use/not use volatility filter, prohibit trading when price movement is large).

- Trailing Stop: true/false (Enable/disable trailing stop function).

- Long Trail Start: Profit margin to start trailing buy (in points).

- Long Trail Stop: Loss cut price range (in points) from the current price after the start of buying trailing. (*Please make the value larger than the stop level).

- Short Trail Start: Profit margin to start selling trailing (in points).

- Short Trail Stop: Loss cut price range (in points) from the current price after the start of selling trailing. (*Please make the value larger than the stop level).

- Trail Step: The profit margin interval at which the stop loss value is updated after the start of trailing.

- Break Even: true/false (Enable/disable breakeven function).

- Long Break Profit: When the profit margin exceeds this value, set the stop loss value as the entry value.

- Short Break Profit: When the profit margin exceeds this value, set the stop loss value as the entry value.

- Time Customize: true/false (Apply/not apply time customization settings).

- Long Open Hour 1: Buy entry start time.

- Long Open Minute 1: Buy entry start time.

- Long Open Hour 2: Buy entry end time.

- Long Open Minute 2: Buy entry end time.

- Long Close Hour: Settlement time of buy position.

- Long Close Minute: Closing time of buy position.

- Short Open Hour: Sell entry time.

- Short Open Minute: Sell entry time.

- Short Close Hour: Sell position settlement time.

- Short Close Minute: Settlement time of short position.

- Display Parameters: true/false (Show/hide parameters of USDJPY EA on the chart).

Conclusion

Tokyo USDJPY EA focuses on the RSI indicator and adheres to a specific trading window aligned with the Tokyo market hours; this EA offers a structured approach to trading the USDJPY pair. Its inbuilt safeguards against high-risk strategies and its consideration for the impact of spread on profitability make it a compelling tool for traders looking to navigate the Forex market with an edge. As with any trading tool or strategy, potential users should approach with an understanding of the risks involved and consider the USDJPY EA as part of a diversified trading strategy.

Lizenz abgelaufen

NÃO FUNCIONA