This Trend Reversal Strategy is a powerful approach for identifying market reversals. This MT5 strategy is designed to help traders spot potential trend shifts using the Elliott Wave Oscillator (EWO) and the Highest High – Lowest Low SR indicators. While seasoned traders often rely on price action and patterns to detect reversals, these technical indicators offer a more objective way to confirm market movements, making it an ideal strategy for both novice and experienced traders.

By combining these two indicators, the strategy aligns with the fundamental principles of price action, offering a systematic and reliable method for identifying trend reversals in real time.

Indicators Used in This MT5 Strategy

Elliott Wave Oscillator (EWO)

The Elliott Wave Oscillator is a momentum indicator developed from the Elliott Wave Theory. The EWO tracks price movements using two moving averages: the 5-period and the 34-period Simple Moving Averages (SMA). The difference between these two averages is displayed as a histogram. When the 5-period SMA moves above the 34-period SMA, the EWO plots positive values, and when it falls below, the EWO plots negative values.

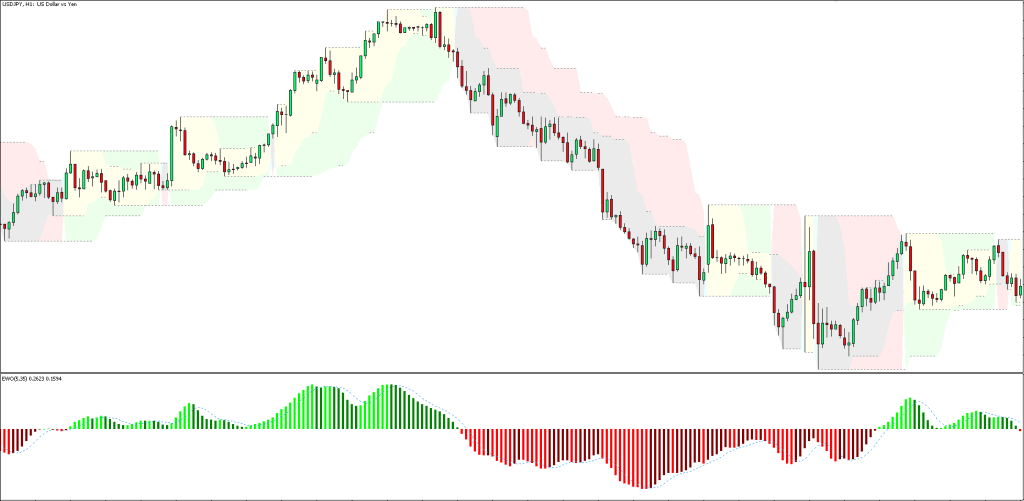

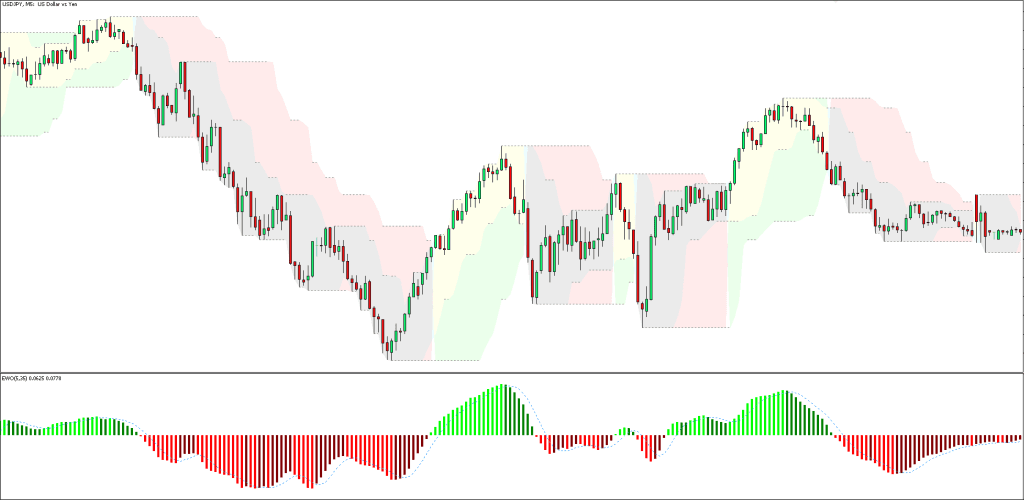

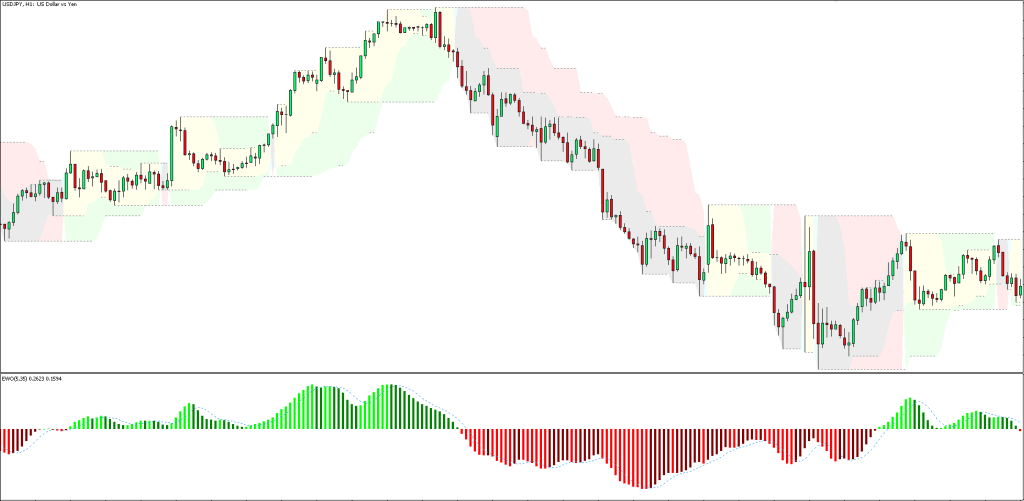

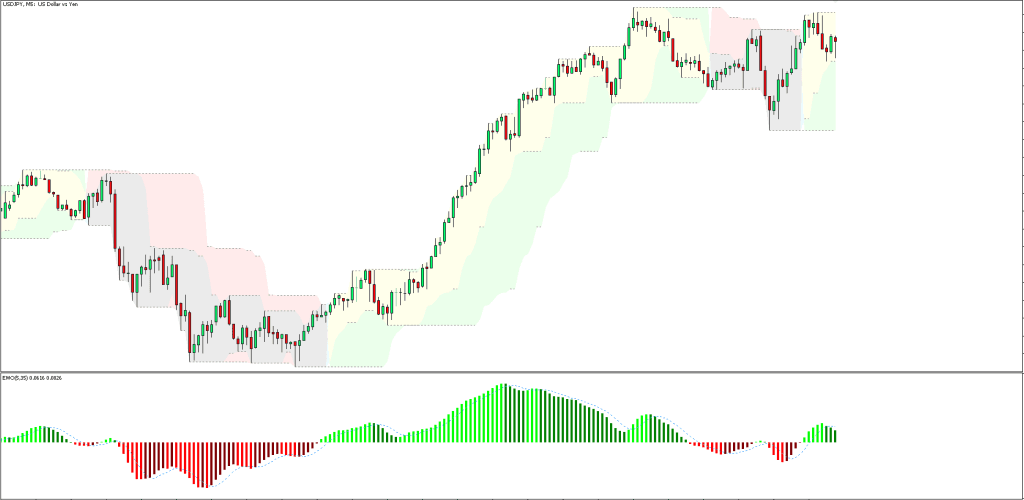

The EWO also highlights the strength of trends. Lime bars indicate increasing bullish momentum, while green bars show weakening bullish momentum. Red bars suggest growing bearish strength, and maroon bars signal a weakening bearish trend. A dashed line, based on the moving average of the EWO bars, acts as a signal line for trend confirmation.

Highest High – Lowest Low SR Indicator

The Highest High – Lowest Low SR Indicator assists in identifying support and resistance levels based on recent price extremes. It analyzes the highs and lows over a specified period to determine the highest highs and lowest lows, plotting these as dotted lines on the chart. Additionally, the indicator shades areas between these levels to indicate potential trend direction:

- Bullish Trend: Areas shaded in yellow and green when the price breaks above a resistance level.

- Bearish Trend: Areas shaded in violet and pink when the price drops below a support level.

This MT5 Strategy can give you trading signals you can take as they are or add your additional chart analysis to filter the signals further, which is recommended. While traders of all experience levels can use this system, practicing trading on an MT4 demo account can be beneficial until you become consistent and confident enough to go live.

This Elliott Wave Oscillator Strategy is entirely manual. The indicators produce the signals, but any decisions to enter the market and set protection or profitable exit stops will depend on the trader. Therefore, the trader must be familiar with the principles of risk and reward and use initial support and resistance areas to set entries and exits.

Trend Reversal Strategy can be used on any Forex currency pair and other assets such as stocks, commodities, cryptos, precious metals, oil, gas, etc. You can also use it on any time frame that suits you best.

Download a Collection of Indicators, Courses, and EA for FREE

Trading Rules for this Trend Reversal Strategy

When using this trend reversal strategy, remember to tighten your Stop Losses around High-Impact News Releases or avoid trading for at least 15 minutes before and after these events.

As always, proper money management is key to achieving good results. To be a profitable trader, you must master discipline, emotions, and psychology. It is crucial to know when and when not to trade. Avoid trading during unfavorable times and market conditions like low volume/volatility, beyond major sessions, exotic currency pairs, wider spread, etc.

The Elliott Wave Oscillator MT5 strategy combines both indicators to detect and confirm trend reversals:

- The Highest High – Lowest Low SR indicator first identifies the reversal point by tracking breakouts above resistance or breakdowns below support.

- The EWO then confirms the reversal by assessing momentum and trend strength.

Buy Conditions

- A bullish momentum candle must close above a significant resistance level identified by the Highest High – Lowest Low SR indicator.

- The Elliott Wave Oscillator should plot a lime bar, indicating bullish momentum, with the bar positioned above its signal line.

Sell Conditions

- A bearish momentum candle should close below a major support level identified by the Highest High – Lowest Low SR indicator.

- The Elliott Wave Oscillator must plot a red bar, indicating bearish momentum, below its signal line.

Exiting Conditions

For both buy and sell trades:

- Set the stop loss just above or below the resistance or support level identified by the Highest High – Lowest Low SR indicator.

- Use a trailing stop loss, moving it one or two support/resistance levels behind price action, locking in profits as the trend develops.

Conclusion

This Trend Reversal Strategy offers a systematic approach to identifying and trading market reversals by combining momentum analysis with support and resistance levels. By using the Elliott Wave Oscillator for momentum confirmation and the Highest High – Lowest Low SR Indicator for key price levels, traders can make more informed decisions that align with fundamental price action concepts. As with any trading MT5 strategy, practicing proper risk management and perhaps testing the approach on a demo account before applying it to live markets is essential.