Scalping is a fast-paced, highly rewarding trading style that involves capitalizing on tiny price movements throughout the day. However, it requires a sharp focus, quick decision-making, and strict discipline. The Simple Pin Bar Forex Scalping Strategy is designed to take advantage of these small fluctuations by using one of the most reliable reversal patterns in trading—the Pin Bar.

In this article, we’ll explain how the Pin Bar pattern works, how to trade it in a short timeframe, and how to use this Forex Scalping strategy to scalp the Forex markets effectively.

What is a Pin Bar?

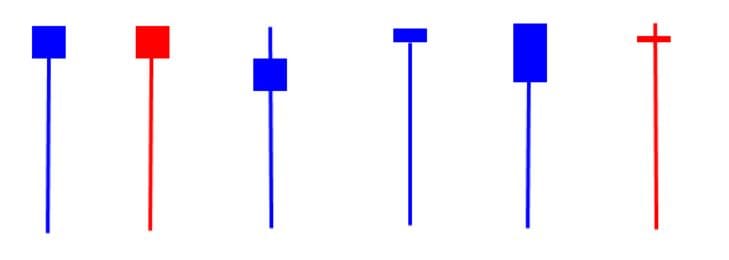

A Pin Bar is a candlestick pattern with a long wick and a small body. The long wick indicates a rejection of price in one direction, while the small body shows minimal price movement from open to close. The Pin Bar is a strong signal of potential trend reversals because it shows the market’s sharp rejection of prices.

Pin Bars provide a great opportunity for quick trades by identifying potential reversal points for scalping. Here’s what a typical Pin Bar looks like:

- Bullish Pin Bar: A small body near the top of the candle with a long lower wick, indicating that sellers pushed the price down, but buyers quickly regained control.

- Bearish Pin Bar: A small body near the bottom of the candle with a long upper wick, indicating that buyers pushed the price up, but sellers regained control.

Read More Pinbar Detector Forex Indicator Free Download

Time Frame

Since we are scalping, we will focus on the 5-minute timeframe. This timeframe provides enough volatility and trading opportunities without being too fast, which is crucial for those not using algorithmic trading systems.

Entry Rules

To trade the Pin Bar effectively, follow these simple rules:

- Look for Pin Bars at Trend Reversal Points: They signal a potential reversal, so look for them at the end of trends or in consolidation phases.

- Strict Pin Bar Identification: Only trade pin bars with wicks that are at least twice their body size. The body should be near the edge of the candle to qualify as a Pin Bar.

- Direction of the Pin Bar: Enter a buy trade if a bullish Pin Bar forms at the bottom of a downtrend. Enter a sell trade if a bearish Pin Bar forms at the top of an uptrend.

Stop Loss

Place your stop loss a few pips below the wick of the Pin Bar in a bullish trade or a few pips above the wick in a bearish trade. This ensures that your risk is minimized if the market moves against you.

Take Profit and Exit Strategy

Use recent fractals, higher highs, or lower lows as natural support and resistance levels for your Take Profit targets. If the market structure allows, you can also use multiple take-profit levels.

If you spot a reversal candle or other significant price action, you may close the trade to manually secure profits early.

Download a Collection of Indicators, Courses, and EA for FREE

Example of a Pin Bar Scalping Trade

Buy Trade Example

On the EUR/USD chart, we spot a bullish Pin Bar at the bottom of a downtrend. The long lower wick suggests strong buyer rejection of lower prices, and the small body at the top confirms a potential reversal. We enter the trade at the close of the Pin Bar, setting the stop loss below the wick and targeting the next significant resistance level as the Take Profit.

Sell Trade Example

Later, on the same chart, we identify a bearish Pin Bar at the top of an uptrend. The long upper wick indicates seller rejection of higher prices, and the small body near the bottom confirms a potential downward reversal. We enter a sell trade, placing the stop loss just above the wick of the Pin Bar and targeting the next support level as the take-profit.

Advantages of Pin Bar Forex Scalping Strategy

- Quick, High-Probability Entries: The Pin Bar is a strong reversal signal, allowing you to enter trades at the right time for quick profits.

- Small Stop Loss: With Pin Bar setups, you can use a very tight stop loss, allowing for higher position sizes and better risk-to-reward ratios.

- Multiple Trading Opportunities: Pin Bars appear frequently throughout the day, especially in volatile markets. This provides ample trading opportunities for scalpers.

- Simplicity: Pin Bar trading is relatively simple compared to more complex strategies, making it ideal for beginners and seasoned traders.

Conclusion

The Simple Pin Bar Forex Scalping Strategy offers traders a quick and effective way to profit from short-term price fluctuations. Pin Bars, with their easy-to-identify structure, are reliable reversal signals that work exceptionally well in the fast-paced world of scalping. When combined with proper risk management, a disciplined approach, and a sharp eye for reversal setups, this Forex Scalping strategy can help traders make consistent gains.