In the fast-paced world of Forex trading, measuring performance accurately is essential for long-term success. Markets can be volatile, and traders need reliable ways to assess whether their trading strategies are consistently effective or in need of adjustment. While there are countless indicators and performance measures available, two metrics stand out as particularly informative: Batting Average and Win-Loss Ratio.

Both metrics provide valuable snapshots of a trader’s success rate and risk profile. By understanding how these ratios work and what they reveal about your trading approach, you can better fine-tune your methods for improved profitability and consistency. This comprehensive guide will delve into every critical aspect of Batting Average and Win-Loss Ratio within Forex. We will cover definitions, calculations, interpretations, real-world applications, limitations, and strategic tips to help you become a more informed and successful trader.

Table of Contents

Introduction: The Importance of Performance Metrics in Forex Trading

Forex trading, or foreign exchange trading, is among the largest and most liquid financial markets in the world. Trillions of dollars are exchanged daily, and participants range from individual retail traders to massive institutional funds. In such a dynamic environment, relying on subjective feelings about your performance can be both misleading and dangerous. This is where performance metrics enter the picture.

Performance metrics offer objective insights into various aspects of your trading strategy. They can reveal whether you’re making consistent profits, taking on too much risk, or missing potential opportunities. While some traders might focus on absolute profit and loss (P/L) figures alone, deeper metrics such as Batting Average and Win-Loss Ratio provide more nuanced views of your trades.

Why These Metrics Matter

- Consistency Assessment – Raw profit figures can fluctuate dramatically over short periods. Batting Average and Win-Loss Ratio zero in on consistency, showing how often you are correct and how your wins stack up against your losses.

- Risk Management – By understanding how frequently you win and how those wins compare to your losses, you can tailor your position sizes, stop-loss settings, and overall risk strategy more effectively.

- Strategy Evaluation – You can test multiple strategies side by side and compare their Batting Averages and Win-Loss Ratios to see which method is most sustainable.

- Psychological Edge – Metrics help maintain discipline, offering evidence-based feedback. It’s easy to get emotional when trades go wrong, but metrics can keep you grounded by revealing the true long-term performance.

In essence, performance metrics serve as the foundation for data-driven decision-making in Forex. They allow traders to separate luck from skill, short-term fluctuations from sustainable strategies, and illusions from reality. In the following sections, we will delve deeply into the two metrics that embody these advantages Batting Average and Win-Loss Ratio.

What Is Batting Average in Forex?

Before diving into the nitty-gritty, let’s establish the background of the term. In baseball, a player’s Batting Average is the number of hits divided by the total number of at-bats. A high Batting Average indicates a player who frequently gets on base. Translating this concept into trading, your Batting Average represents the number of profitable trades relative to your total trades.

Definition of Batting Average in Trading

This ratio is typically expressed as a decimal or a percentage. For instance, a Batting Average of 0.60 or 60% implies that 60% of your trades are profitable.

Importance in Forex

In Forex trading, Batting Average gives you a straightforward measure of how often you’re “hitting it right” in the market—i.e., taking profitable positions. It’s particularly valuable for:

- Identifying Strategy Strength: If a trader’s Batting Average is consistently high, the strategy likely excels in picking winning trades.

- Short-Term vs Long-Term Assessment: Over a smaller sample of trades, Batting Average can be misleading due to variance. However, over large sample sizes, it becomes more revealing.

- Confidence Building: A stable Batting Average of 50% or above can give traders confidence that they know how to interpret market signals effectively.

Batting Average vs Other Metrics

While Batting Average shares conceptual similarities with other performance measures such as accuracy or probability of profit, it is more straightforward. It doesn’t account for the magnitude of wins versus losses. This simplicity is both its strength and its limitation. As you’ll see later in this article, combining Batting Average with other metrics like Win-Loss Ratio can provide a more holistic view of performance.

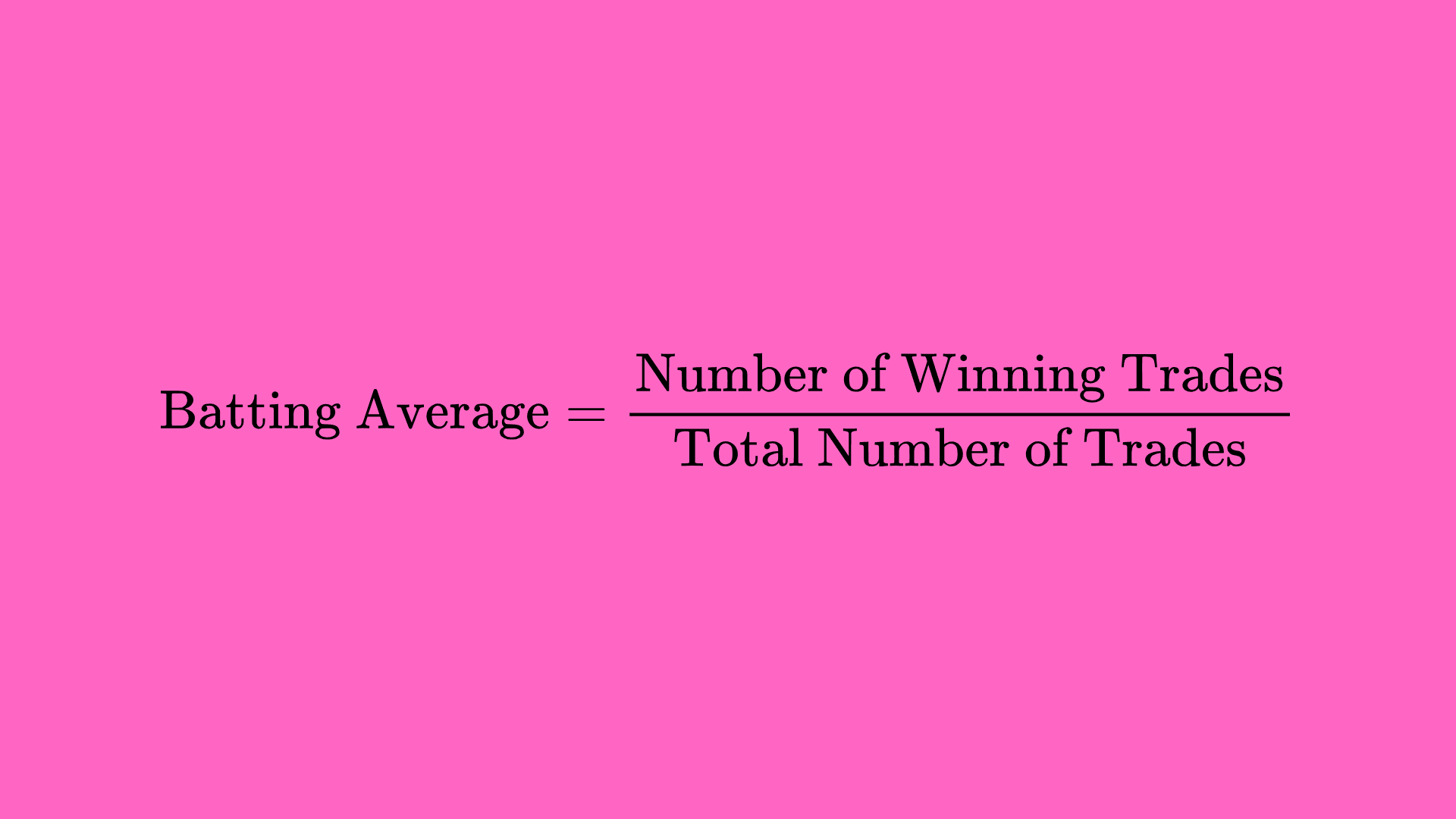

How to Calculate Batting Average

Calculating Batting Average is simple, but the real challenge lies in collecting accurate data. Here’s a step-by-step guide, focusing on the Forex context:

1. Gather Data on All Trades

- Maintain a trading journal or use a trading analytics tool.

- Ensure you record each trade’s outcome: profit or loss.

- Label each trade clearly (buy, sell, currency pair, date, time, outcome).

2. Count the Number of Winning Trades

- Review all the trades for a given period (weekly, monthly, or quarterly).

- Mark each trade as “win” or “loss” based on its net profit or net pips gained.

3. Count the Total Number of Trades

- Sum up all trades executed in that period, including break-even trades if you prefer.

- Some traders exclude break-even trades from the calculation, while others count them. Consistency is key.

4. Apply the Formula

Batting Average = (Number of Winning Trades / Total Number of Trades)

5. Express as Decimal or Percentage

- Decimal form: Example, 0.50 for a 50% Batting Average.

- Percentage form: Example, 50% for the same ratio.

Choosing a Timeframe

When calculating Batting Average, it’s crucial to pick a timeframe that’s large enough to capture the nuances of your trading performance. A short-term sample can present misleading results. Typically, you’d want at least 20-50 trades in your dataset to derive a meaningful ratio.

Data Collection Tools

- Manual Logging: Using spreadsheets to note trade entries, exits, and outcomes.

- Broker Statements: Monthly or quarterly statements often break down trade outcomes.

- Trading Platforms and Software: Some platforms, such as MetaTrader 4/5 or TradingView, have built-in analytics that can help track and calculate performance metrics automatically.

Accuracy Matters

One of the biggest pitfalls in calculating Batting Average is data inaccuracy. Missing a single trade or incorrectly marking a loss as a win (or vice versa) can skew the results. So, it’s critical to be meticulous in record-keeping.

Practical Example of Batting Average

To illustrate how Batting Average might look in a real Forex scenario, consider the following example:

- Trader Profile: Sarah, a part-time Forex trader focusing on major currency pairs (EUR/USD, GBP/USD, USD/JPY).

- Period: 1 Month (about 4 weeks of trading).

Within this one-month timeframe, Sarah executes 20 trades. Let’s assume the outcomes:

- Winning Trades: 12

- Losing Trades: 8

- Total Trades: 20

Applying the formula:

Batting Average = (12/20) = 0.60 = 60%

So, Sarah’s Batting Average is 60%. This means 60% of her trades ended profitably. She’s winning more often than she’s losing, which is a promising sign.

Interpretation

A 60% Batting Average over 20 trades in a month is generally good. However, Sarah needs to consider more factors to determine if her strategy is truly profitable and sustainable:

- How large are her wins compared to her losses?

A 60% win rate means nothing if her losses are significantly larger than her wins. - Is she overtrading?

She took 20 trades in a month, which is moderate, but analyzing the rationale behind each trade is still crucial to avoid burnout or forced trades. - Is the sample size too small?

Over a larger dataset—say 100 trades or more—her Batting Average could fluctuate.

Still, this example highlights how Batting Average offers a quick snapshot of Sarah’s success rate.

Significance, Advantages, and Limitations of Batting Average

While Batting Average is a key metric, it shouldn’t be viewed in isolation. In this section, we will explore why Batting Average is significant, what advantages it offers, and its inherent limitations.

Significance of Batting Average

- Measures Consistency

A stable Batting Average over time suggests that your strategy is performing consistently. Consistency is what most traders aspire to, as it often translates into more predictable returns and manageable drawdowns. - Psychological Boost

Seeing a high Batting Average can be motivational. Traders with a high percentage of winning trades may find it easier to stick to their trading plan, even during market volatility. - Immediate Feedback

Batting Average offers a quick, at-a-glance measure of your performance. If your Batting Average plummets for a particular month, it’s a signal to reassess your strategy or market conditions.

Advantages

- Simplicity: It is very easy to calculate and understand.

- Universality: Almost every trading journal or platform can track wins and losses, making Batting Average widely applicable.

- Ease of Comparison: You can easily compare two strategies by checking which one has the higher Batting Average, at least in terms of frequency of winning trades.

Limitations

- Ignores Trade Size and Risk

Batting Average doesn’t account for the magnitude of each win or loss. You might have a high Batting Average but still lose money if your losing trades are significantly larger than your winning ones. - Short-Term Variance

With fewer trades, variance plays a bigger role in skewing the Batting Average. A streak of bad or good luck could distort the perception of the strategy’s true performance. - Overemphasis on Being Right

Striving for a high Batting Average can lead some traders to exit trades prematurely just to lock in small wins. This approach might inflate their winning percentage but can also limit overall profitability.

When to Use Batting Average

Given these limitations, it’s generally advisable to use Batting Average alongside other metrics especially those that account for profit size or risk profiles, such as Win-Loss Ratio (covered in the next sections), Risk-Reward Ratio, or Profit Factor. Batting Average alone cannot paint a complete picture of your trading performance, but it is a valuable puzzle piece.

What Is the Win-Loss Ratio in Forex?

While Batting Average measures how often you are correct, the Win-Loss Ratio (sometimes referred to as the Win/Loss Ratio or simply W/L Ratio) measures how your average winning trade size compares to your average losing trade size. This metric focuses on the magnitude of wins relative to losses, thus complementing Batting Average.

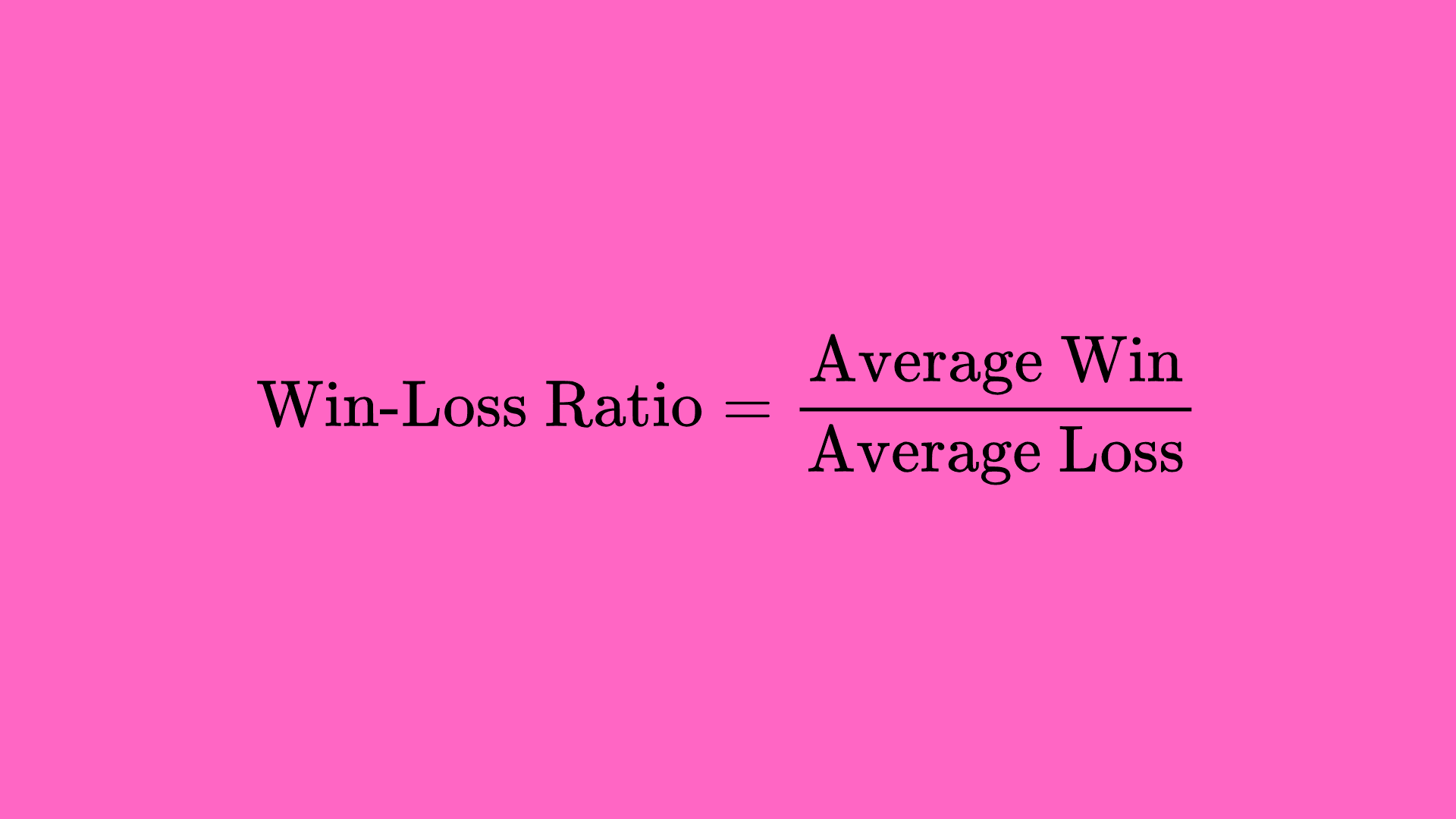

Definition of Win-Loss Ratio

This means you take all your profitable trades and compute the average profit. Then, do the same for your losing trades to compute the average loss. Finally, you divide the former by the latter to obtain your Win-Loss Ratio.

Importance in Forex

In a market as volatile as Forex, the magnitude of price movements matters just as much as the frequency of winning trades. For example, you might win 70% of the time, but if your losses in the remaining 30% are huge, you can still end up with a net loss over the long run. The Win-Loss Ratio tackles this issue by showing if your winners are big enough to offset your losers.

Win-Loss Ratio vs Other Metrics

- Batting Average: Tells you how many times you win out of a set of trades.

- Win-Loss Ratio: Focuses on how large your average wins are compared to your average losses.

Both metrics answer different questions. While Batting Average looks at frequency, Win-Loss Ratio looks at magnitude. Together, they offer a more holistic view of your trading performance.

How to Calculate the Win-Loss Ratio

Calculating the Win-Loss Ratio involves more steps than Batting Average, primarily because you need to track the size of each winning and losing trade rather than just counting how many trades ended in profit or loss.

1. List All Winning Trades

- Sum up the profit of each winning trade in either currency terms (e.g., USD) or pips.

- Count the number of winning trades.

2. Compute Average Win

Average Win = Sum of Profits from Winning Trades / Number of Winning Trades

3. List All Losing Trades

- Sum up the losses for each losing trade in the same unit (currency or pips) used for winning trades.

- Count the number of losing trades.

4. Compute Average Loss

Average Loss = Sum of Losses from Losing Trades / Number of Losing Trades

5. Apply the Formula

Win-Loss Ratio = Average Win / Average Loss

6. Interpret the Result

- A Win-Loss Ratio above 1.0 means your average win is larger than your average loss.

- A Win-Loss Ratio below 1.0 means your average loss is larger than your average win, which can be a red flag unless your Batting Average is very high.

Units of Measurement

Choosing whether to measure your average wins and losses in pips or currency can make a difference in how you interpret this ratio. Some traders prefer pips because it normalizes for different currency pairs with varying exchange rates. Others prefer a monetary measure because it directly ties back to their account balance.

Example of Units

- Pips: If you predominantly trade EUR/USD and GBP/USD, measuring in pips can be consistent.

- Currency: If you trade multiple pairs with significantly different pip values (like USD/JPY vs. GBP/CHF), measuring in base currency might be clearer.

Either approach is valid, but consistency is paramount. If you start measuring your wins in pips, make sure your losses are also expressed in pips for that same data set.

Practical Example of Win-Loss Ratio

Let’s consider a detailed example to illustrate how the Win-Loss Ratio works in a Forex context.

Scenario

- Trader Name: Carlos

- Period: 1 Month

- Total Trades: 10 trades (5 wins and 5 losses)

Below is a breakdown of Carlos’s trades in USD:

Winning Trades

- +$100

- +$120

- +$180

- +$80

- +$150

Sum of winning trades = $100 + $120 + $180 + $80 + $150 = $630

Number of winning trades = 5

Average Win = $630 / 5 = $126

Losing Trades

- -$90

- -$100

- -$70

- -$130

- -$110

Sum of losing trades = $90 + $100 + $70 + $130 + $110 = $500 (since it’s a sum of absolute values for losses)

Number of losing trades = 5

Average Loss = $500 / 5 = $100

Now, we compute the Win-Loss Ratio:

Win-Loss Ratio = Average Win / Average Loss = 126 / 100 = 1.26

Interpretation

A Win-Loss Ratio of 1.26 indicates that, on average, Carlos’s wins are 26% larger than his losses. This is a positive sign because it means he doesn’t have to maintain an extremely high Batting Average to be profitable overall. Even if his Batting Average is close to 50%, he could still generate net profits in the long run as long as his winners sufficiently outpace his losers.

Further Considerations

- Trade Frequency: Carlos only took 10 trades, which is a relatively small sample size. A bigger sample would yield more reliable insights.

- Risk Management: The ratio doesn’t indicate whether Carlos risked $50 or $500 per trade. You’d need to look at additional metrics, such as Risk-Reward Ratio or maximum drawdown, to get a full picture.

- Market Conditions: This ratio might be influenced by a particularly trending market during that month. Market context can shift, so it’s essential to keep updating your metrics over time.

Significance, Advantages, and Limitations of the Win-Loss Ratio

Just like Batting Average, the Win-Loss Ratio offers distinct benefits and also has some caveats. It’s not a magic bullet but a tool that, when combined with other metrics, can provide a clearer view of your trading performance.

Significance of the Win-Loss Ratio

- Focus on Trade Quality

A high Win-Loss Ratio implies that your winning trades capture significantly more profit than what you lose on losing trades. This often indicates good trade entries, exits, and money management. - Resilience to Variance

Traders with a high Win-Loss Ratio can weather periods of lower Batting Averages. Even if they lose more often in a short streak, the bigger wins can offset those losses. - Risk Management Insights

By looking at your Win-Loss Ratio, you can quickly determine if you’re cutting losers too late or perhaps exiting winners too early. Striking the right balance between risk and reward is easier when this metric is tracked.

Advantages

- Emphasizes Profitability: It clearly shows how profitable your winners are relative to your losers.

- Complements Batting Average: Together, both metrics provide a more holistic picture than either metric alone.

- Actionable Feedback: A low Win-Loss Ratio is a strong signal that you need to adjust your trading strategy, particularly in how you set stop losses or take profits.

Limitations

- Doesn’t Reveal Frequency

Win-Loss Ratio ignores how often you’re winning or losing, which can lead to misleading conclusions if assessed by itself. - Can Fluctuate with Outliers

A single very large winning trade or losing trade can disproportionately skew the average. - Sample Size Dependency

Like Batting Average, the Win-Loss Ratio needs a sufficiently large sample of trades to be reliable.

Comparing Batting Average and Win-Loss Ratio

Now that we’ve explored both metrics in detail, it’s time to see how they stack up against each other. Understanding the strengths and weaknesses of each helps traders make more informed decisions.

Key Distinctions

Focus

- Batting Average (BA): Emphasizes the frequency of wins over total trades.

- Win-Loss Ratio (W/L Ratio): Emphasizes the magnitude of average wins relative to average losses.

Interpretation

- BA: A measure of consistency in “guessing” market direction correctly.

- W/L Ratio: A measure of risk-reward effectiveness in each trade.

Primary Use

- BA: Useful for assessing how often your trading strategy is correct.

- W/L Ratio: Useful for assessing how profitable each winning trade is compared to each losing trade.

Why They Work Better Together

- Balanced Insight: A trader with a 70% Batting Average but a poor Win-Loss Ratio might still lose money overall. Conversely, a trader with a modest 40% Batting Average but a high Win-Loss Ratio might be very profitable.

- Effective Strategy Validation: Combining both metrics allows you to see if you’re striking the right balance between being correct often enough (BA) and making large enough profits when you are correct (W/L).

- Risk Management: Some strategies naturally aim for many small winners and a few large losers (scalping), while others have fewer but more substantial winners (swing trading). Checking both metrics clarifies if your chosen approach aligns with your risk tolerance and profitability goals.

Ideal Ranges

- Batting Average: Many professional traders target a Batting Average around 50-60%, although some scalpers aim higher, and some trend-followers can settle for lower but rely on a higher Win-Loss Ratio.

- Win-Loss Ratio: A ratio above 1.0 is generally desirable. However, certain strategies can profit with a ratio below 1.0 if the Batting Average is particularly high.

A synergy of these two metrics provides one of the best snapshots of a Forex trading strategy’s viability.

How to Improve Your Batting Average and Win-Loss Ratio

Knowing your Batting Average and Win-Loss Ratio is only the first step. Implementing specific strategies to improve these metrics is the next challenge. Below are several actionable tips that can help bolster both metrics over time.

1. Refine Entry and Exit Criteria

- Technical Analysis: Use well-tested indicators (e.g., moving averages, RSI, MACD) to identify high-probability trade setups.

- Fundamental Analysis: Keep track of economic calendars, interest rate announcements, and geopolitical events that can move currency markets.

- Exit Strategies: Experiment with trailing stops or partial exits to lock in profits while allowing winners to run.

2. Optimize Risk-Reward Ratio per Trade

- Set Clear Stop-Losses: Placing tighter stop-loss levels can limit the size of your losing trades, helping increase your Win-Loss Ratio.

- Target Realistic Profit Levels: Instead of aiming for unreasonably large gains, use market conditions to set feasible take-profit levels. This balance can improve your Batting Average, as trades are more likely to hit their targets.

3. Manage Position Sizing Properly

- Fixed Percentage Risk: Many traders risk only 1-2% of their account on any single trade. This ensures no single loss decimates your account, potentially improving your long-term Batting Average and Win-Loss Ratio.

- Scaling In and Out: Gradually entering or exiting positions can improve the average price and potentially boost your overall profitability.

4. Improve Discipline and Consistency

- Follow a Trading Plan: Clearly define your strategy’s rules and commit to them. Inconsistent approaches often yield unstable metrics.

- Avoid Overtrading: Taking trades that don’t meet your criteria can hurt both your Batting Average and Win-Loss Ratio. Be selective.

- Maintain a Trading Journal: Document each trade, including rationale and outcome. Regularly review your journal to spot errors or missed opportunities.

5. Continuous Education and Adaptation

- Keep Learning: Markets evolve, and so should your strategy. Stay updated with new trading techniques, market analysis, and software tools.

- Adapt to Market Conditions: If volatility surges, adjust your stops and profit targets. If the market is quiet, consider focusing on range-trading strategies.

- Evaluate Periodically: Check your metrics monthly or quarterly. Identify patterns and make data-driven adjustments.

By focusing on these areas, you can steadily inch toward improving both your Batting Average (how often you win) and your Win-Loss Ratio (how big your wins are relative to your losses).

Common Pitfalls When Using These Metrics

While Batting Average and Win-Loss Ratio can be powerful tools, it’s easy to misuse them. Below are some common pitfalls and how to avoid them.

1. Relying on a Small Sample Size

- Issue: Drawing conclusions from only a handful of trades can lead to misleading interpretations.

- Solution: Wait until you have at least 20-50 trades before placing significant weight on these metrics. The more, the better.

2. Overemphasis on One Metric

- Issue: Focusing solely on Batting Average could tempt you to exit trades prematurely to keep “wins” high, while ignoring poor risk-reward practices. Conversely, focusing solely on Win-Loss Ratio might lead you to hold onto losing trades too long, hoping for a large reversal.

- Solution: Use both metrics in tandem, and combine them with other measures like overall profitability, drawdowns, and risk-reward ratios.

3. Inconsistent Data Collection

- Issue: Missing trades or inaccurately recording profits and losses can render your metrics useless.

- Solution: Standardize your record-keeping. Consider using trading analytics software that automatically logs your trades.

4. Ignoring Market Context

- Issue: A great Batting Average or Win-Loss Ratio during a trending market might decline rapidly in a choppy or range-bound market.

- Solution: Segment your metrics by market condition if possible (e.g., trending vs. ranging) to see how your performance varies.

5. Lack of Continuous Review

- Issue: Metrics can change over time as you modify your strategy, or as the market evolves.

- Solution: Regularly update and review your metrics monthly or quarterly to ensure they still reflect your performance accurately.

By staying aware of these pitfalls, you can use Batting Average and Win-Loss Ratio to drive meaningful improvements in your Forex trading strategy.

Real-World Scenarios: Applying These Metrics in Forex

To bring more clarity, let’s look at two hypothetical but plausible scenarios in Forex trading where Batting Average and Win-Loss Ratio play crucial roles.

Scenario 1: High Batting Average, Low Win-Loss Ratio

- Trader Profile: Mike, a scalper focusing on EUR/USD.

- Batting Average: 70%

- Win-Loss Ratio: 0.80

Mike wins 7 out of every 10 trades, which seems impressive at first glance. However, each losing trade is slightly bigger than each winning trade on average. Suppose his average winning trade nets $20, but his average loss is $25. Over 10 trades, his total profit might be:

- Wins: 7 trades x $20 = $140

- Losses: 3 trades x $25 = $75

- Net Profit: $65 for every 10 trades

This is still profitable, but the margin is not large. If his losing trades become bigger or if his Batting Average dips below 70%, his net could quickly turn negative. In this scenario, increasing the Win-Loss Ratio perhaps by tightening stop losses or capturing slightly larger moves could improve his overall performance.

Scenario 2: Low Batting Average, High Win-Loss Ratio

- Trader Profile: Rina, a trend-following swing trader focusing on GBP/USD.

- Batting Average: 35%

- Win-Loss Ratio: 2.50

Rina only wins 35% of the time, but each winning trade is 2.5 times larger than her average losing trade. Let’s assume, on average, her win is $250, and her loss is $100. Over 10 trades:

- Wins: 3.5 trades (let’s assume 3 or 4 for simplicity) x $250 = ~$875

- Losses: 6.5 trades (6 or 7 trades) x $100 = ~$650

- Net Profit: $225 for every 10 trades

Despite a relatively low Batting Average, Rina’s net profit is higher than Mike’s in this comparison. This reveals the power of a high Win-Loss Ratio. A few big wins can more than compensate for a series of smaller losses. However, Rina’s main challenge might be psychological losing more than half the time can be difficult to endure without solid discipline and conviction in her strategy.

Conclusion from Scenarios

These examples underscore that neither a high Batting Average nor a high Win-Loss Ratio alone guarantees success. The most successful Forex traders often find a balance that aligns with their personality, risk tolerance, and market conditions.

Additional Metrics and Factors to Consider

While Batting Average and Win-Loss Ratio provide valuable insights, Forex trading is complex, and no single or dual-metric approach can paint the full picture. Here are a few additional metrics and factors to consider:

Profit Factor

- Defined as the ratio of your gross profits to your gross losses. A Profit Factor above 1 indicates net profitability, while below 1 indicates net loss.

Risk-Reward Ratio per Trade

- This metric shows how much you stand to gain for each unit of risk. Many traders aim for at least 1:2 (risking $1 to make $2).

Maximum Drawdown

- The largest peak-to-trough drop in your account equity. This is crucial for understanding worst-case scenarios and psychological stress.

Sharpe Ratio or Sortino Ratio

- Measures risk-adjusted returns, though these are more commonly used in portfolio management. They can still be applied to trading strategies to account for volatility.

Trade Duration and Market Conditions

- The time you remain in a trade (seconds vs. days vs. weeks) and the general market environment (trending vs. ranging) can dramatically influence your metrics.

Position Sizing and Leverage

- Forex often involves high leverage. While it can amplify gains, it also amplifies losses. Monitoring how leverage impacts your trades can help you maintain healthier risk management.

Psychological Factors

- Emotions play a huge role. Fear and greed can derail even the best strategies. Incorporating a trading psychology checklist or practicing techniques like mindfulness can improve decision-making.

By integrating these additional metrics and factors with your Batting Average and Win-Loss Ratio, you’ll develop a multi-dimensional understanding of your trading performance, greatly enhancing your edge in the Forex market.

Conclusion

In the Forex trading realm, there is no single number that can encapsulate the complexity of market conditions and trading performance. Batting Average and Win-Loss Ratio are two critical metrics that, when used together, give a far more comprehensive view than when used alone. Batting Average tells you how often you win, while Win-Loss Ratio reveals how much you win relative to how much you lose.

Key Takeaways

Batting Average

- Simple to calculate and understand, it highlights the frequency of winning trades.

- Must be complemented by metrics that account for the size of wins and losses.

Win-Loss Ratio

- Focuses on the magnitude of your wins relative to your losses.

- A ratio above 1.0 usually signifies that your winning trades are more profitable on average than your losing trades.

Combined Approach

- A high Batting Average with a poor Win-Loss Ratio can still be unprofitable, and vice versa.

- Striking the right balance is essential for achieving sustainable profitability in Forex trading.

Continuous Monitoring

- Both metrics should be tracked over a sufficiently large sample size to avoid misleading conclusions.

- Regularly update and review these metrics to adapt to changing market conditions.

Holistic Strategy

- Consider other metrics like Profit Factor, drawdown, Sharpe/Sortino Ratios, and Risk-Reward Ratios for a rounded assessment of your trading performance.

- Factor in psychological components, market conditions, and risk management techniques for an integrated approach.

Forex trading is a journey that demands discipline, continuous learning, and robust data analytics. By understanding the intricacies of Batting Average and Win-Loss Ratio and how these metrics fit into the larger tapestry of trading performance you can equip yourself with the knowledge necessary to make informed decisions, adapt to market fluctuations, and, ultimately, work towards long-term success.

Remember that no single metric or strategy is infallible. The market is ever-changing, and so should your trading skills and analytical methods. Use Batting Average and Win-Loss Ratio as powerful guideposts, but also stay open to refining and augmenting your approach with additional data points and a strong grasp of market fundamentals and psychology. With patience, consistency, and ongoing self-assessment, you’ll be well on your way to sharpening your competitive edge in the vibrant world of Forex trading.