With the US election results in, the potential impact on the economy, Federal Reserve decisions, and financial markets is becoming clearer. Leadership changes often bring shifts in policies that can ripple across multiple sectors, affecting everything from interest rates to currency values. In this article, we’ll explain how the election outcome could shape the economic landscape, influence the FOMC’s outlook, and drive movements in the forex and crypto markets. Let’s dive into what these results mean for investors and market trends ahead.

US Election Results: Trump’s Victory and Its Economic Implications

Donald Trump’s victory in the 2024 U.S. presidential election will bring significant changes to the economy, financial markets, and Federal Reserve policies. His proposed agenda, which includes substantial tax cuts and heightened tariffs, is anticipated to impact inflation and interest rates. Analysts predict these measures could lead to increased inflation, potentially pushing prices higher and prompting the Federal Reserve to consider rate adjustments to manage economic growth.

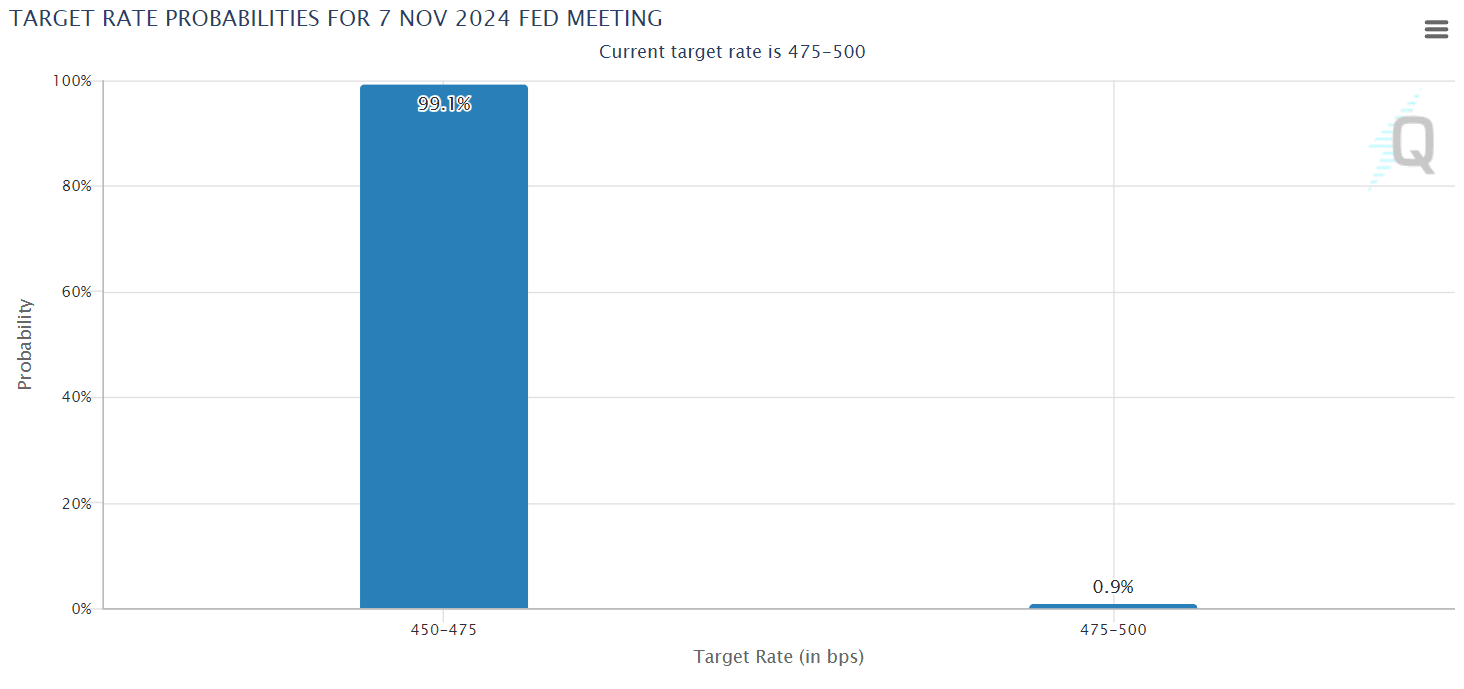

In the upcoming FOMC meeting, a 0.25% rate cut is expected as the Fed aims to support economic stability amid these potential shifts. However, with inflation likely to rise again, the central bank may need to adjust its stance in the months ahead. The election’s immediate aftermath has already stirred financial markets, with the dollar strengthening and stock futures rising as investors anticipate changes under the new administration.

Meanwhile, cryptocurrencies like Bitcoin have surged, driven by expectations of possible regulatory adjustments. As the new administration’s policies take shape, their effects on the economy and markets will continue to unfold, making it essential for investors and policymakers to stay vigilant.

FOMC Outlook: How Trump’s Win Could Shape Upcoming Federal Reserve Decisions

Today’s FOMC meeting holds particular significance as it follows Donald Trump’s recent election victory, introducing fresh considerations for the Federal Reserve’s policy approach. With the new administration set to pursue substantial tax cuts and tariff changes, the Fed now faces the dual challenge of supporting economic growth while potentially managing an upswing in inflation. Analysts expect a 0.25% rate cut as a short-term measure to promote stability amid anticipated policy shifts.

However, if Trump’s fiscal policies start pushing inflation higher, the Fed may need to adjust its approach in the months ahead, potentially considering rate hikes to keep inflation under control. Investors are watching today’s meeting closely, as the Fed’s guidance will provide critical insights into how it plans to navigate this evolving economic landscape, impacting everything from stock markets to currency values.

Forex Market Forecast: Examining Currency Movements

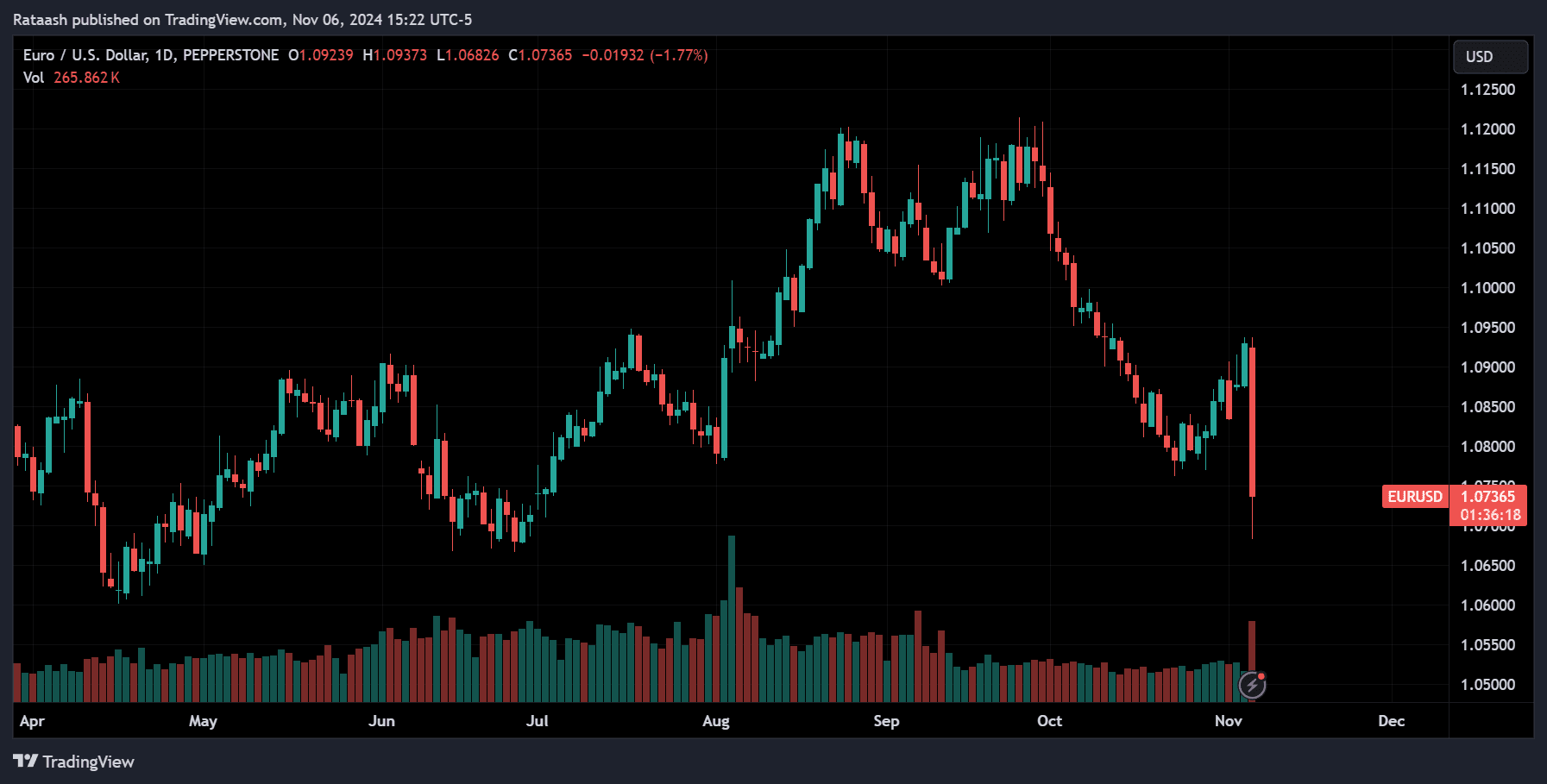

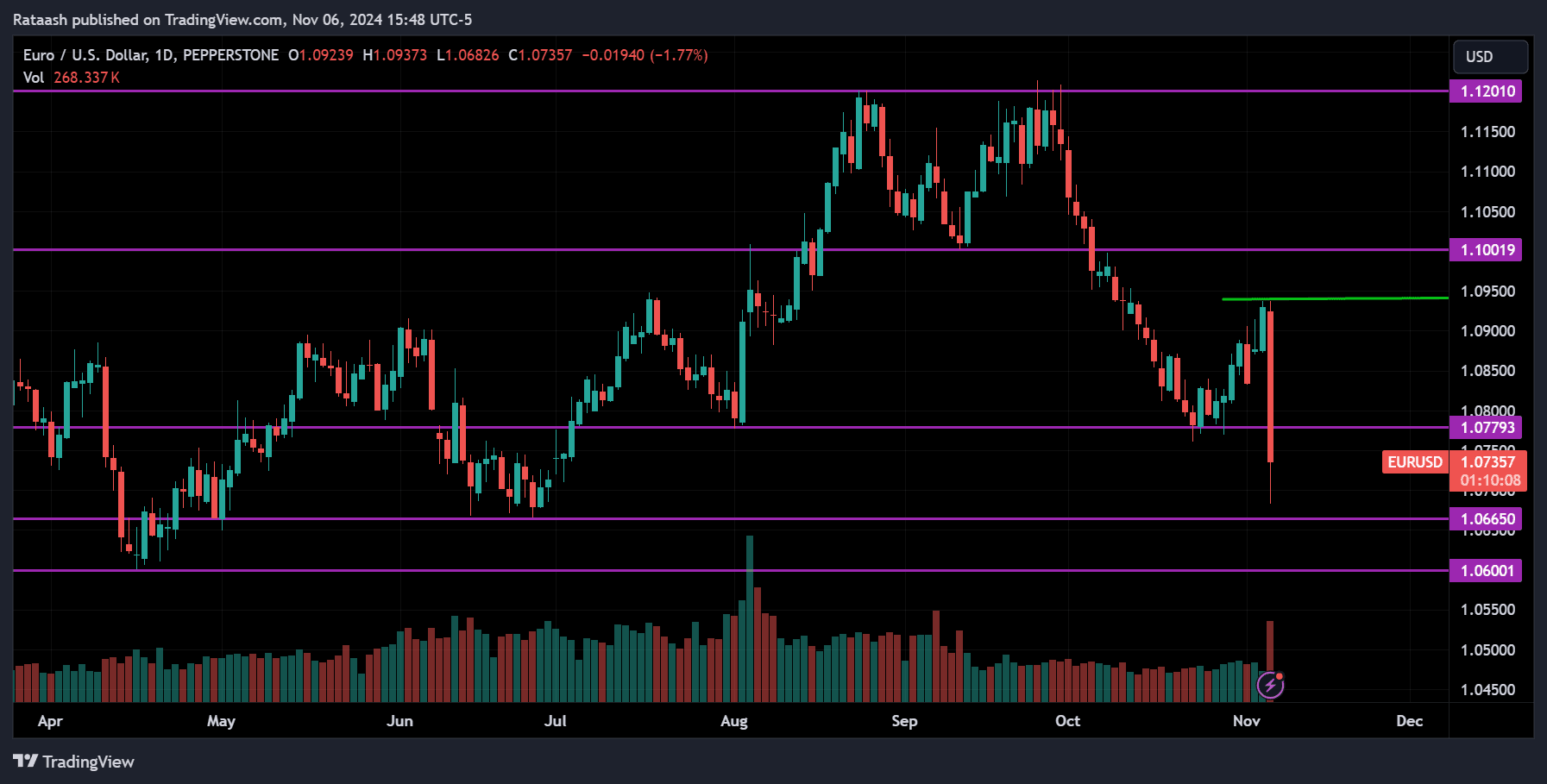

The forex market is seeing notable movement today, with the U.S. dollar strengthening significantly, especially against the euro. This has led to a decline in EUR/USD, as confidence in the dollar grows amidst expectations of supportive fiscal policies under the new administration. A stronger dollar signals investor optimism about U.S. economic growth prospects, and as the FOMC meeting unfolds, further insights into interest rate adjustments may reinforce this upward trend for USD. Traders are keeping a close eye on the dollar, anticipating continued strength that could shape currency movements in the coming weeks.

Now, for day trading purposes, let’s take a closer look at the price action of EURUSD.

On the daily chart, the price began to fall from the 1.09500 resistance level and dropped to a support range of around 1.06800.

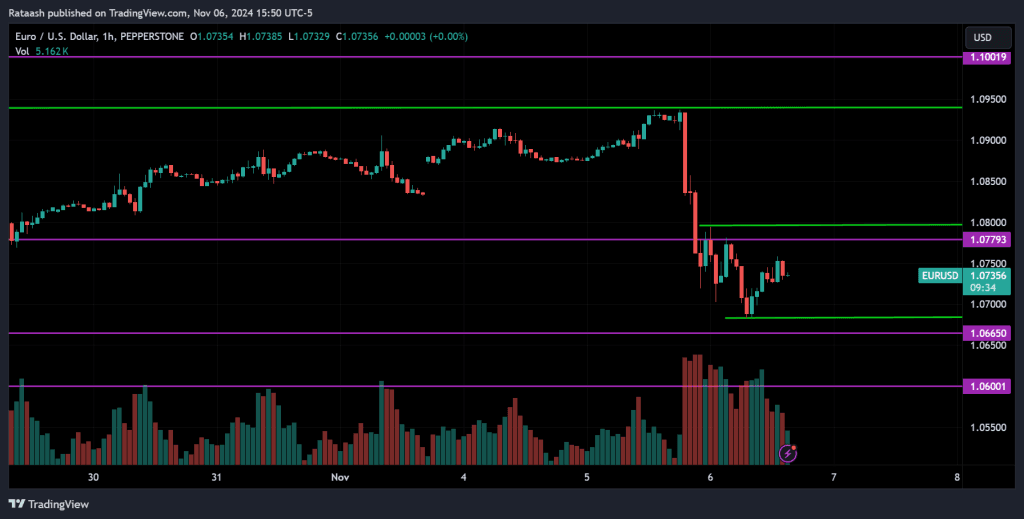

Looking at the 1-hour chart, the price has started to pull back and is now moving toward the resistance level at 1.08000. If it breaks above this level, we can expect the price to rise back to the 1.09500 range. However, if the price pulls back and falls below the 1.06650 support range, it could continue down to the 1.06000 level.

We expect that once the FOMC decision is announced as anticipated, EUR/USD may start moving up again, as easier policies and a growing economy could weaken the dollar, reducing its value over time.

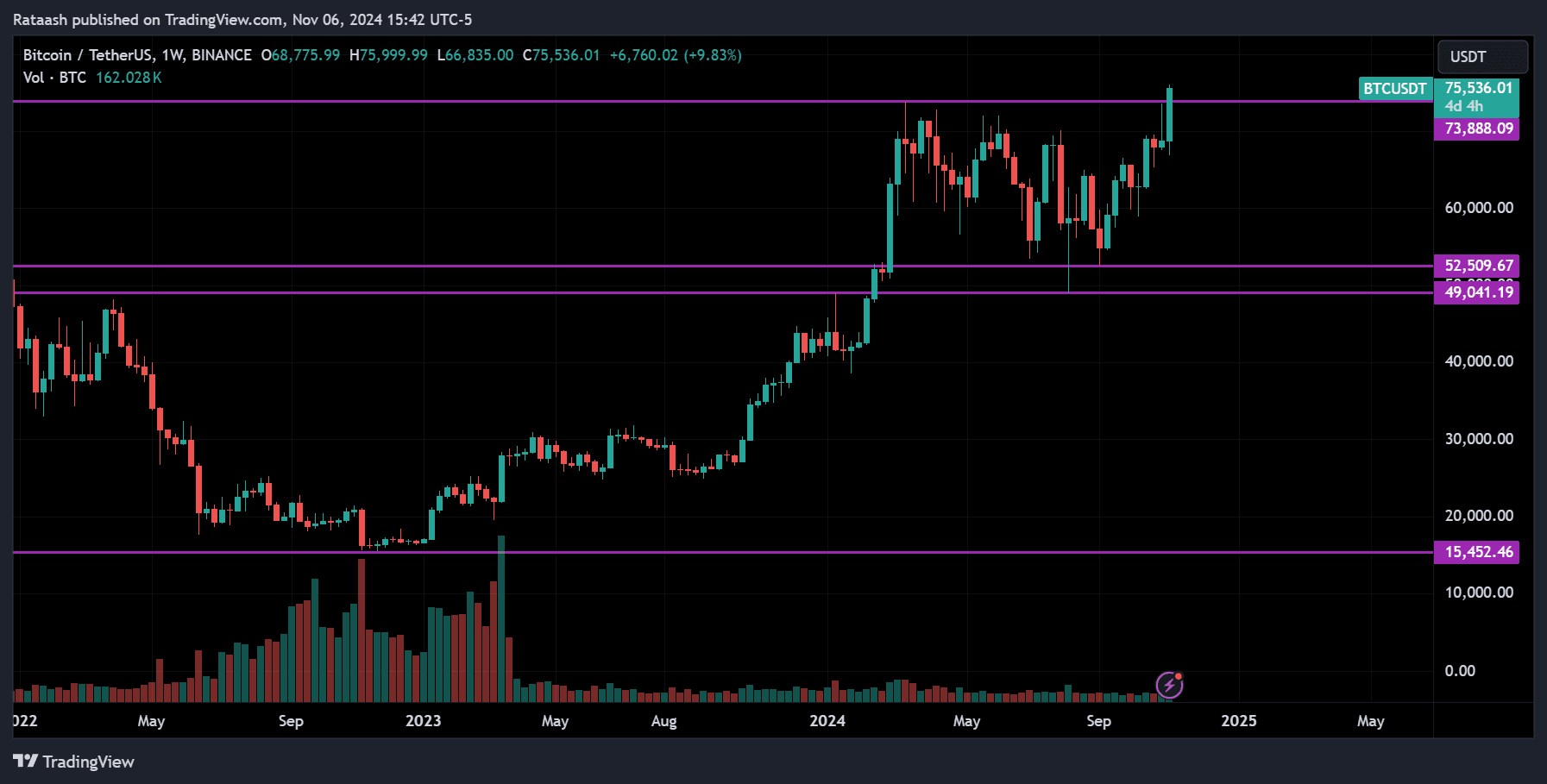

Potential Impact of Trump’s Victory on BTC

President Donald Trump’s victory could be fueling a new surge in Bitcoin, which recently broke out of a long consolidation phase. Currently trading around $75,500, BTC has surpassed its previous all-time high of $73,800. Bitcoin could continue its upward momentum if conditions remain favorable, possibly setting sights on the $100,000 mark. As investors respond to the potential shifts in economic policies under Trump’s administration, Bitcoin’s role as a key alternative asset may gain further traction in the market.

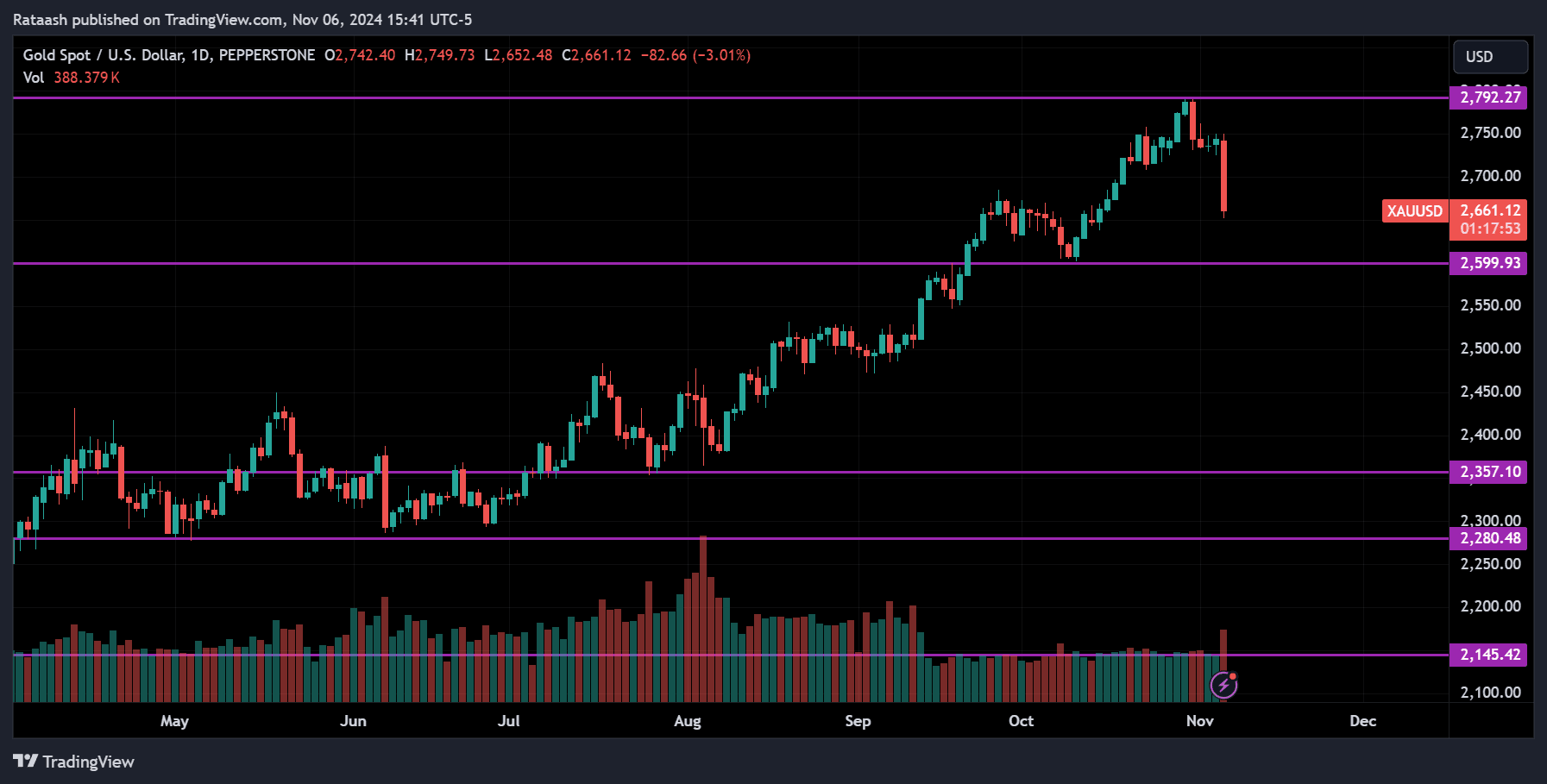

Gold Forecast: Potential Price Shifts Under New US Leadership

With new U.S. leadership, the outlook for gold (XAU/USD) may experience a notable shift. After reaching a high of $2,790, gold prices have recently begun to decline, as investor sentiment pivots toward a strengthening economy. As confidence in pro-business policies grows, more investors may move capital from safe-haven assets like gold into business ventures and stocks, reducing demand for gold and potentially driving prices lower.

If the economy continues to thrive and inflation remains stable, gold may find it challenging to reclaim recent highs. This shift could lead to a downtrend as capital flows increasingly favor growth-oriented investments over traditional hedges like gold.

Conclusion

In conclusion, the recent U.S. election results have set a dynamic stage for the economy, financial markets, and Federal Reserve decisions. With new policies on the horizon, the Federal Reserve is faced with balancing inflation and economic growth, particularly as today’s FOMC meeting might introduce short-term rate adjustments. The strengthening U.S. dollar reflects investor optimism, causing significant movements in forex markets, especially as USD gains traction against major currencies.

For alternative assets, the response has been mixed. Bitcoin is gaining momentum, with potential for further growth as it reaches new highs, while gold prices have begun to soften as investors shift focus toward business investments. As the administration’s policies continue to take shape, market responses will evolve, keeping investors and policymakers vigilant in navigating this changing landscape. The coming months will reveal the full impact of these shifts, shaping opportunities and challenges across the financial spectrum.