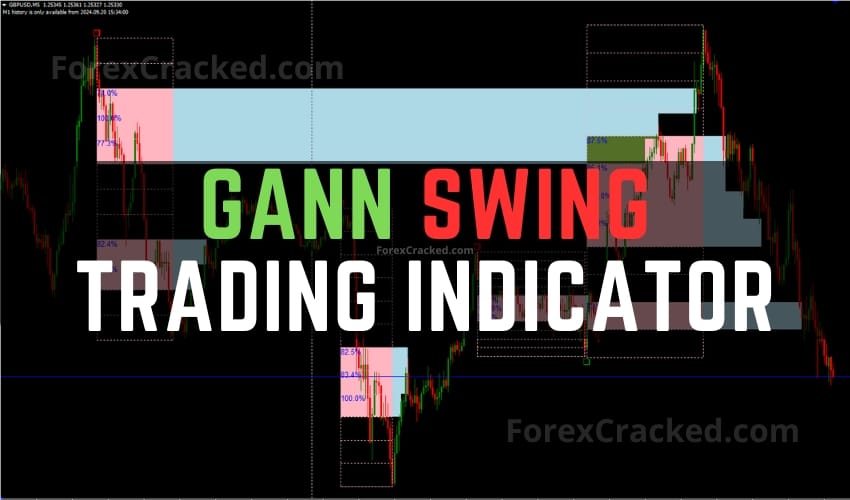

The Gann Swing Trading Indicator is a powerful tool for traders seeking to identify strong levels and optimize entry points based on swing analysis. Inspired by the mathematical principles of the legendary trader W.D. Gann, this indicator is versatile, working seamlessly across all trading instruments and timeframes.

The Swing Trading Indicator is particularly useful for traders who rely on technical analysis and level-based strategies. By analyzing market swings and leveraging the indicator’s grid system, users can identify potential reversal zones and refine their entry and exit points.

Key Features of this Swing Trading Indicator

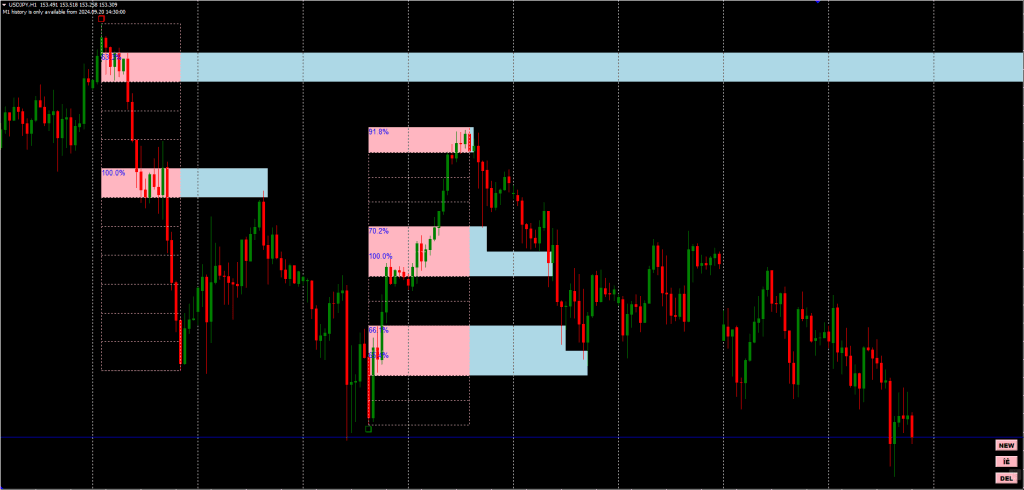

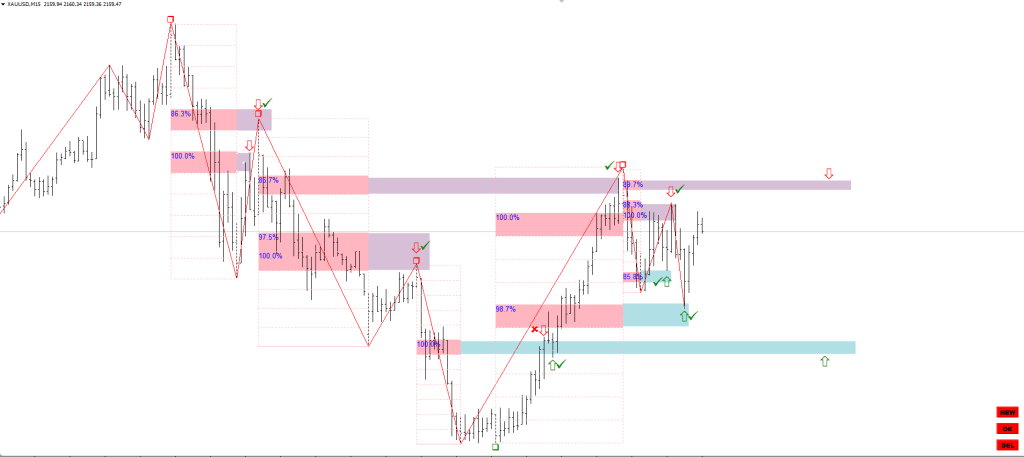

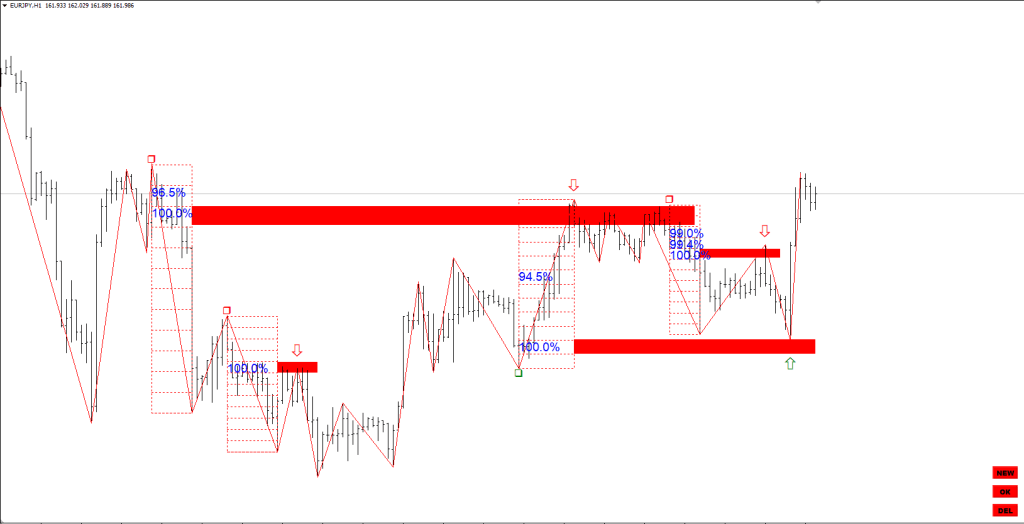

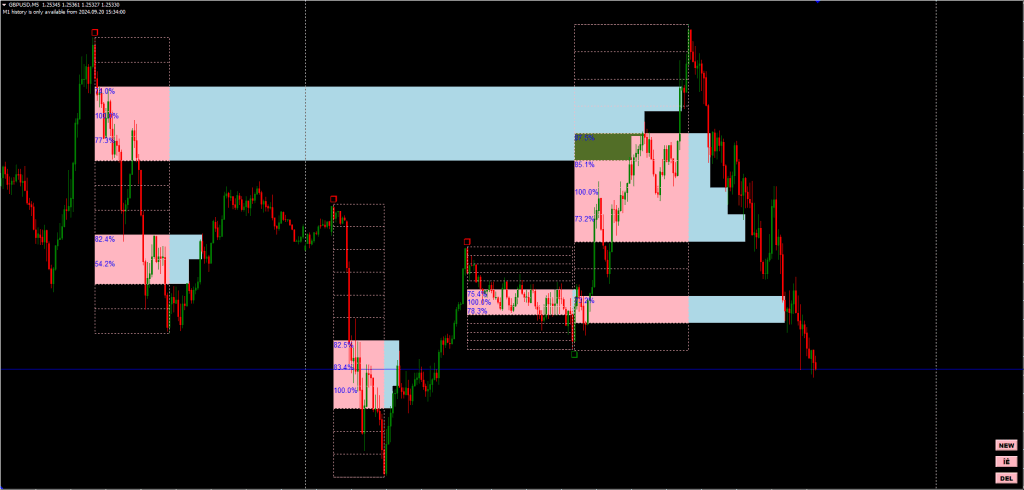

- Manual Control for Precision – The Swing Trading Indicator is fully manual, offering control buttons for an interactive trading experience. Users can create and adjust segments to analyze specific movements, swings, or even a single candle.

- Easy-to-Use Interface – Pressing the NEW button generates a segment that can be placed on the desired price movement or candle. Once positioned, pressing the OK button activates a customizable grid within the segment.

- Customizable Grid Parameters – The grid appears after placing a segment, displaying percentages that traders can adjust to suit their strategies. These percentages indicate the probability of price reversals or corrections, helping traders make informed decisions.

- Focus on Levels – This Gann indicator emphasizes the importance of levels. Higher percentage levels within the grid suggest areas with a greater likelihood of price reversal or correction.

- Universal Application – Designed for flexibility, the indicator functions effectively across all instruments and timeframes, making it suitable for various trading styles.

This Gann Swing Trading isn’t a standalone trading indicator System. Still, it can be very useful for your trading as an additional chart analysis, for finding trade exit positions (TP/SL), and more. While traders of all experience levels can use this system, practicing trading on an MT4 demo account can be beneficial until you become consistent and confident enough to go live. You can open a real or demo trading account with most Forex brokers.

What is Gann?

W.D. Gann, a renowned trader of the early 20th century, developed several trading techniques based on mathematical principles, geometry, and natural cycles. Gann’s methods focus on identifying key levels in the market where reversals or significant price movements are likely to occur.

Gann’s most famous tools and concepts include:

- Gann Angles – A geometric approach to predicting price movements.

- Swing Trading – A method of analyzing price swings to find optimal entry and exit points.

- Cycle Analysis – Identifying patterns and time cycles in markets.

In forex trading, Gann’s methods are widely used to determine support and resistance levels, predict reversals, and analyze market trends. The Swing Trading Indicator brings these principles into modern trading tools, helping traders make data-driven decisions.

Download a Collection of Indicators, Courses, and EA for FREE

How to Use Gann Swing Trading in Forex

Using the Gann Swing Trading in Forex involves a systematic approach to identifying optimal entry and exit points. Here are the steps to effectively use the indicator:

- Prepare Your Chart – Ensure you have loaded the M1 history for accurate data analysis. Select the forex pair and timeframe you wish to trade.

- Analyze Swings – Use the NEW button to create a segment on the chart. Place it over a price movement, swing, or single candle you want to analyze. Press the OK button to activate the grid, which overlays percentages on the selected segment.

- Interpret the Grid – Observe the grid levels and their percentages. Identify areas with higher percentages, as these levels often indicate a strong likelihood of price reversal or correction.

- Make Trading Decisions – Use the levels identified by the grid to place buy or sell orders. For example, if the price approaches a high percentage level and shows signs of reversal, consider entering a trade in the opposite direction.

- Incorporate Risk Management – Always set stop-loss and take-profit levels based on the grid’s insights. Avoid over-leveraging and ensure your trade aligns with your overall risk management plan.

- Monitor and Adjust – Continuously monitor the trade and adjust if the market conditions change. Reapply the indicator to new swings to stay updated with the latest market movements.

By following these steps, traders can harness the power of Gann Swing Trading to gain a deeper understanding of forex price movements and make informed decisions.

- Read More North East Way EA MT4/MT5 FREE Download

Conclusion

The Gann Swing Trading Indicator is a robust tool for traders looking to enhance their technical analysis approach. Its manual control, customizable features, and emphasis on levels make it a valuable addition to any trading strategy. Whether you’re analyzing short-term movements or long-term trends, this indicator provides the flexibility and precision needed for informed decision-making.

ohh fuck that’s a brutal gamechanger.. Good job