The forex market is a fabulous place for individual investors, large and small, to engage in exciting, fast-paced, and probably profitable trades. First, You need a Forex account to participate in forex currency trading. For That, you need a good Forex broker. While most stock-market brokerages allow you to trade bonds, mutual funds, and other financial instruments, forex brokerage accounts are mostly standalone entities. Here is what you need to understand Before opening a brokerage account.

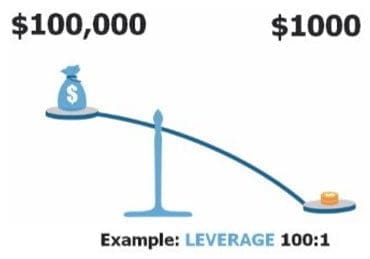

Leverage

One of the main benefits of trading currencies is that the tremendous amount of leverage even small-time traders are allowed. Typical leverage is 100:1, meaning for every $1 in your forex broker account, you can control up to $100 in currencies. A 1,000$ would allow you to manage $100,000 of currency, so if the currency price went up by 1%, That’s a $1,000 you would double your money! But if the currency price went down by just 1%, you would lose all $1,000 of your investment. But What if the currency went down by 2%? Theoretically, you would lose $2,000. More than what you have in your account, but in reality, a brokerage will generally step in and prevent this kind of loss.

Your main decision is to decide what level of leverage you need. Leverage is given based on credit-worthiness, so if your credit report is pretty low, you might want to pursue Higher Leverage like 1:500. Which still gives you a lot of room to profit but limits your risk. Also, some country have limited Max leverage like UK that has a Max Leverage of 1:30 (But There is Still brokers let u use higher leverage)

Spreads And Commission

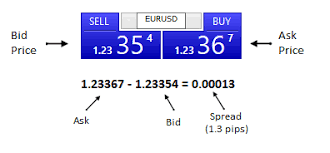

When opening a trade, FOR EVERY TRANSACTION, the broker charges a commission. This is calculated at the opening time of the trade, no matter how long it is being kept open, it will charge from your account. After all, Forex broker are not running a charity, and for the services they provide, they charge for a fee. But Most Forex broker gives you the ability to skip commission by giving higher spread. Choosing Commission or lower spread depends on your trading style Ex: For Scalper or Scalping EA, the Lower spread is highly recommended.

Forex currency pairs have a bid/ask spread, meaning a market maker can pay less for a currency than he’s willing to sell it for. These spreads are extremely small, but when they add up over time, it is going to be costly.

Not every brokerage has an equivalent spreads, so it’s essential to review the standard Different between the bid and ask prices before selecting a broker

Other Considerations

First and foremost, among all other considerations are the currency pairs that a given brokerage deals. For example, if you would like to perform a CHF/JPY, you’ll be got to find a brokerage that gives that currency pair. Virtually every forex brokerage deals in the main currency pairs, Like the USD vs. each of the following currencies: EUR, GBP, AUD, NZD, CAD, CHF, and the JPY. but most of the brokers deal in a lot of “cross-currency” pair

Finally, it’s essential to deal with a reputable broker. Currency trading is far less regulated than most other financial markets, and there are many fly-by-night companies in the business. Be sure to investigate the company before sending them a check for a few thousand dollars. It will be time well spent. But You Don’t have to worry about that we did the most of the work and narrow down the best brokers for you.

- Read More Best Forex Brokers

hi mr silent

what is the best broker for ea