What is Forex?

To put it another way, trading currencies is made possible by the global financial market.

A profit can be made if you correctly predict that one currency will outperform the other.

It was once possible for people to fly worldwide by plane before the emergence of a global epidemic.

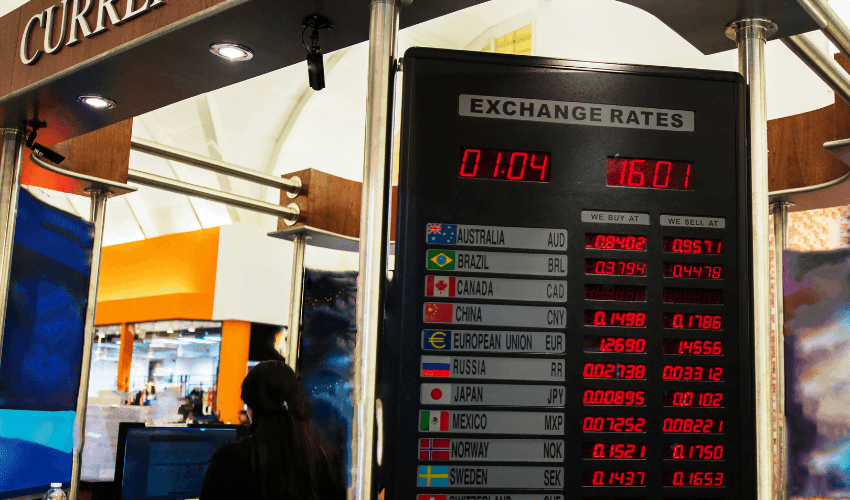

If you’ve ever traveled to another nation, you know how difficult it can be to convert your local cash for the currency of the country you’re visiting at an airport currency exchange.

You see a screen at the counter that shows different exchange rates for other currencies as you approach the counter.

The relative value of two currencies from two distinct countries is an exchange rate.

Assuming you’re an American visiting Japan, you’ve exchanged dollars for yen, or in forex trading terminology, sold dollars for yen.

The last of your yen (Tokyo is costly!) must be exchanged at the currency exchange counter before boarding your flight home. And take note of the shift in currency values. These fluctuations in the foreign currency market allow you to gain money.

“Forex” and “FX” are the most commonly used terms to describe the foreign exchange market.

Currency exchange takes place in the FX market, a worldwide, decentralized market. Because currency exchange prices fluctuate on a second-by-second basis, the market is constantly in flux.

Currency in International trade and tourism

When it comes to international trade and tourism, just a small percentage of cash transactions occur in the “real economy.”

Most currency transactions in the global foreign exchange market are speculative. This is contrary to conventional wisdom.

Some people buy currencies in the hope that they will sell them at a more excellent price in the future.

Compared to the NYSE’s “measly” $22.4 billion per day activity, the foreign currency market appears enormous with its $6.6 TRILLION a day trade volume.

Precisely what is exchanged on the foreign exchange market (forex)?

MONEY is the short and sweet answer. Particularly monetary units.

To make it easier to understand forex trading, we’ll use a basic yet imperfect example to assist you to know.

In the same way that you buy stocks or bonds, you may purchase a currency and become a shareholder in that country.

Put another way: The exchange rate of a currency is usually a direct reflection of how investors feel about that country’s economy.

Buying the Japanese yen, for example, is like buying a “share” in the Japanese economy in forex trading.

You’re placing your money on the fact that the Japanese economy is doing well and will continue to do so in the future.

Hopefully, you’ll make a profit when you sell those “shares” back to the market.

In general, the value of a currency relative to other currencies reflects the health of the country’s economy in question.

Foreign exchange market

The spot where currencies are bought and sold is called the foreign exchange market. The ability to buy and sell goods and services locally and internationally is made possible by coins. To engage in international trade and business, it is necessary to switch between different currencies.

Anyone in the United States who wants to buy cheese from France must pay the French in euros, whether you do it yourself or someone else does it on your behalf (EUR). As a result, the importer in the United States would have to convert the same amount of USD into EUR.

Traveling is the same way. Tourists from France visiting Egypt cannot pay to see the pyramids in euros because that currency is not accepted in Egypt. The tourist must convert their euros for the Egyptian pound at the current exchange rate to use the local money.

Trading currencies on the foreign exchange market has existed for generations at the most basic level. There has been a long history of people exchanging or bartering for goods and services. The forex market as we know it today is indeed a relatively new invention.

New currency markets were opened up in 1971 as the Bretton Woods agreement disintegrated. Foreign currency trading services keep tabs on the fluctuating prices of individual currencies based on factors such as supply and demand.

For the most part, commercial and investment banks trade currencies on their customers in the forex markets. However, there are chances for speculative trading for both professionals and individuals.

As an asset class, currencies have two distinct characteristics:

- It is possible to profit from the difference in interest rates between two currencies.

- Changes in the value of the dollar can be used to your advantage.

An investor can benefit from the difference in interest rates between two economies by either purchasing or selling the currency with a higher interest rate. Because of the substantial interest rate difference, it was the typical practice before the financial crisis of 2008 to short the Japanese yen (JPY) and buy British pounds (GBP). The term “carry trade” is sometimes used to

describe this tactic.

Trading currencies on the forex market is common (Forex, or FX). A 24-hour, seven-day-a-week trading market, it is the only one in the world. Historically, the forex market was dominated by large banks and other institutions working on behalf of their clients. As the market has grown more accessible to the general public, traders and investors of all sizes have begun to engage.

There are no physical locations for trading when it comes to currency markets. Alternatively, a web of connections can be built using trading terminals and computer networks. Traders in this market include financial institutions, investment banks, commercial banks, and individual investors.

Some disadvantages of Forex trading

The foreign currency market is perceived as less transparent than other financial markets. On the over-the-counter (OTC) currency exchange market, no information is required to be disclosed. Institutional liquidity pools can be found all across the market. In theory, a country’s economic characteristics should be the most critical factor in determining a currency’s value. That’s not the case. Currency exchange rates are influenced primarily by large financial

institutions’ interests, as a 2019 poll found.

The spot market for foreign exchange is another name for the FX market. The forwards and futures markets are more commonly used by companies that need to hedge their foreign exchange risk for a specific date in the future.

Read More: Forex Market Analysis – Types of Analysis