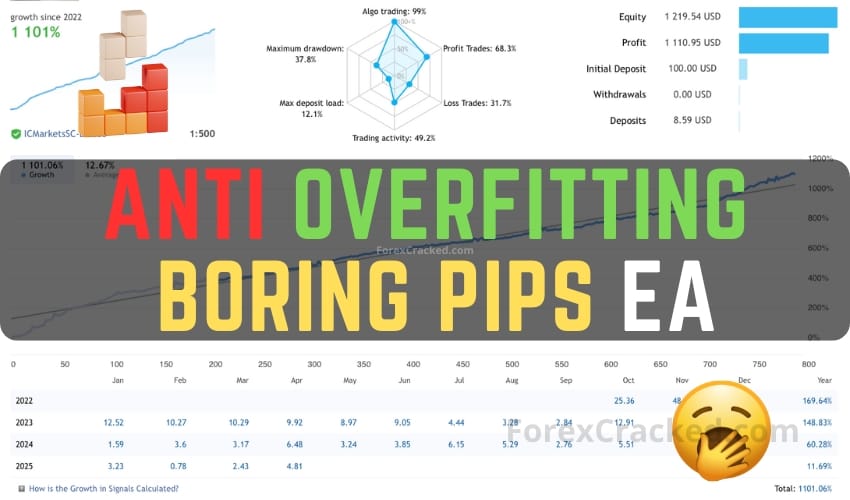

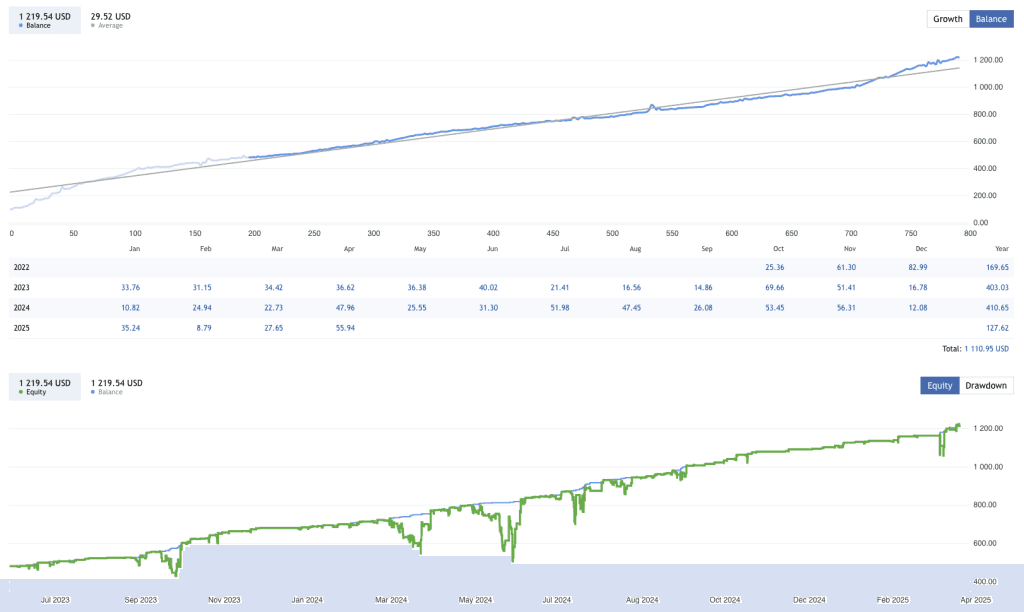

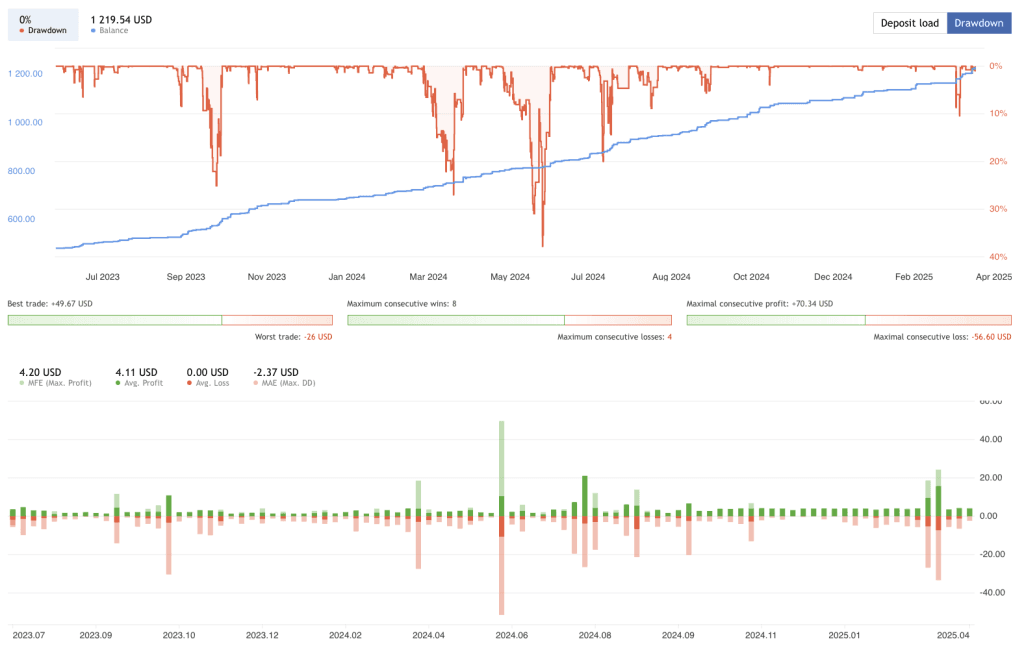

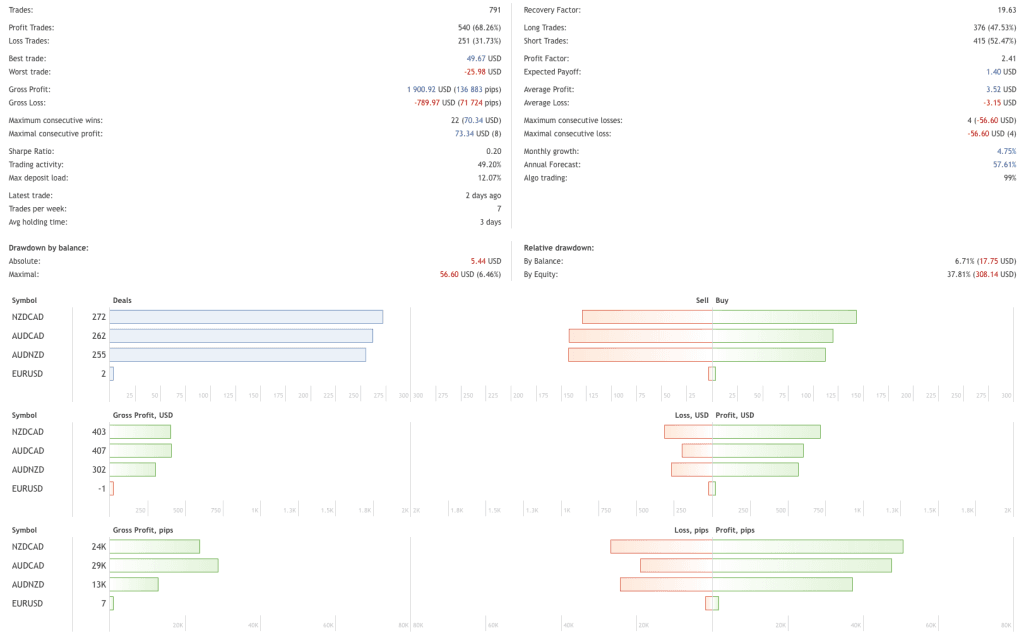

Boring Pips EA is designed to avoid overfitting a common issue in many automated strategies. Using a three-stage optimization process, it aims for more stable live performance. Despite marketing claims of “AI” and “deep learning” in Anti OverFitting EA, its core strategy appears to rely on classic methods such as momentum, supply and demand zones, and Fibonacci levels.

In the world of automated trading, it’s common to come across EA that boast near perfect backtest results. Yet, when it comes to live trading, many of them underperform or completely fail. This discrepancy often points to a common issue: overfitting.

The developer of the Boring Pips EA highlights this:

“Have you ever wondered why most expert advisors are not effective in live trading, despite their perfect backtest performance? The most likely answer is Over-fitting.”

According to the developer, many EAs are programmed to fit historical data too closely. This tight alignment can make the strategy look brilliant in the past but renders it ineffective in real-time, unpredictable environments. Some developers might not even recognize this flaw; others may knowingly use overfitting as a way to make their EA look better than it actually is in order to impress buyers.

Unfortunately, this is quite accurate in many popular EA today.

What Does the Anti OverFitting EA Actually Do?

Anti OverFitting EA combines some classic trading concepts, including:

- Momentum analysis

- Supply and Demand zones

- Fibonacci retracement

According to the Boring Pips EA description, it also uses “cutting-edge artificial intelligence algorithms” and “deep learning” to make decisions based on how prices move across 4 timeframes. For example:

- It scans for potential zones where prices may reverse.

- It observes momentum slowing down in these areas to catch potential reversals.

- It enters trades based on those findings.

- It manages positions using probability-based systems to attempt to make the most out of favorable entries.

In short, it tries to find coordinated movement slowdowns in currency pairs and makes trades when it thinks a reversal is likely. Based on observation, it seems the system focuses on correlated currencies like AUD, CAD, and NZD, which often move in similar ways and can present unique trading setups.

Key Features Summary

- Strategies used – Momentum, supply/demand zones, Fibonacci retracement, and AI-based momentum detection

- Currency pairs – Multi-currency (likely focusing on AUD, CAD, NZD correlations)

- Risk Controls – Includes take profit (with trailing option), fixed stop loss, optional grid and martingale

- Manual options – Traders can manually stop entries or close all positions

- Single Chart Setup – Can trade multiple instruments from one chart

Please test in a demo account first for at least a week. Also, please familiarize yourself and understand how this Anti OverFitting Robot works, then only use it in a real account.

Recommendations for Boring Pips EA

- Minimum account balance of 100$.

- It is made to work on AUDCAD, AUDNZD, and NZDCAD.

- It works on M5. (Work on any TimeFrame)

- This Boring Pips EA should work on VPS continuously to reach stable results. So we recommend running this Anti OverFitting EA on a reliable VPS (Reliable and Trusted FOREX VPS – FXVM)

- Low Spread, Slippage, and quick execution accounts are also recommended (Find the Perfect Broker For You Here)

Download a Collection of Indicators, Courses, and EA for FREE

Real AI or Just Marketing?

While the description mentions AI and deep learning, it’s important to approach those claims with caution. Terms like “artificial intelligence,” “cutting-edge,” and “deep learning” are increasingly used in marketing EAs, sometimes without any real machine learning happening in the background. In most cases, unless specified and demonstrated clearly these claims can be more about sales than substance.

The EA behaves more like a rule based system using traditional technical analysis principles. It’s likely that any “AI” aspect is minimal or symbolic rather than a core feature.

The Anti-Overfitting Optimization in Boring Pips EA

To address this issue, the Boring Pips developer claims to implement a unique “Anti-overfitting” process designed to make the EA more robust and generalizable outside the test data. This process is broken down into three phases:

- Initial Optimization (2010–2019) – The strategy is tuned using nearly a decade of historical data to find stable parameter values.

- Walk-Forward Testing (2019–2022) – These parameters are then tested on entirely unseen data, checking how they hold up without being tailored to it.

- Stress Testing – Finally, the system is put under simulated pressure with factors like entry lag and noise added to verify how it holds up under less-than-ideal conditions.

The idea is that if the Anti OverFitting EA performs well through all three phases, it’s less likely that its performance is simply due to overfitting.

Conclusion

Boring Pips EA appears to be a EA with a strong emphasis on avoiding overfitting, which is a real concern in automated trading. It follows a structured 3-phase optimization method aiming to create more reliable, generalizable strategies. While the Anti OverFitting EA use of “deep learning” and “AI” may just be buzzwords, the general strategy seems grounded in tried-and-true trading concepts, aiming at slow momentum shifts and supply demand reversals.

As with any EA despite claims, sophisticated language, or perfect historical performance the real test always lies in longterm live results.