If you are searching for a forex scalping strategy to trade either the EURUSD or GBPUSD, try this simple EURUSD GBPUSD forex scalping strategy.

It comes with a bit of chart price action as a trade entry signal: a forex reversal chart candlestick pattern.

What chart timeframes are suitable for this scalping system?

It is suggested that you use a 5-minute timeframe. You can even try a 1-minute timeframe.

Indicator Required: RSI with settings set at 14 periods.

You want to trade this strategy when the market is active, so the forex trading market sessions that you should be entering trading in are the London forex market sessions and the New York Forex Session.

Pin Bar Trade Entry Signal

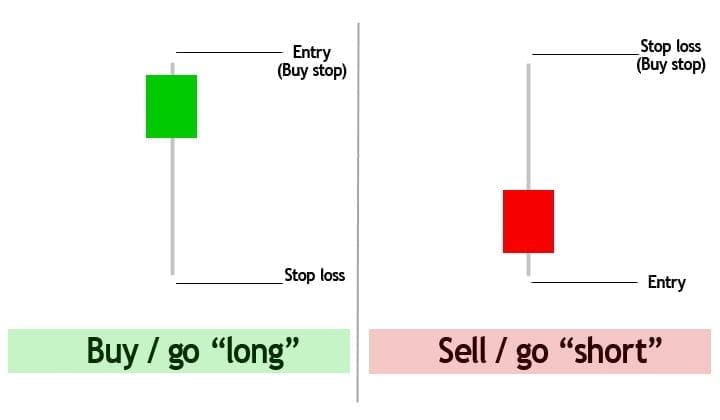

The buy and sell entry signals are the bullish and bearish signals, respectively as you can see in the diagram below:

THE BUYING RULES

- The market must be in going on a downtrend.

- Check if the indicator RSI line is below the 70 indicator level, which indicates an oversold market condition.

- Then keep watching for a bullish chart pin bar to form.

- Place a pending buy stop order 1-3 pips above the high of that bullish pin bar.

- Then place stop loss(SL) 1-2 pips below the bullish pin bar.

- For take-profit target options, you can use a risk: reward ratio of 1:3 or use a previous swing high point as your take-profit target. Or, if there was a big chart downswing move, use 50% of the distance to calculate your take profit(TP) target.

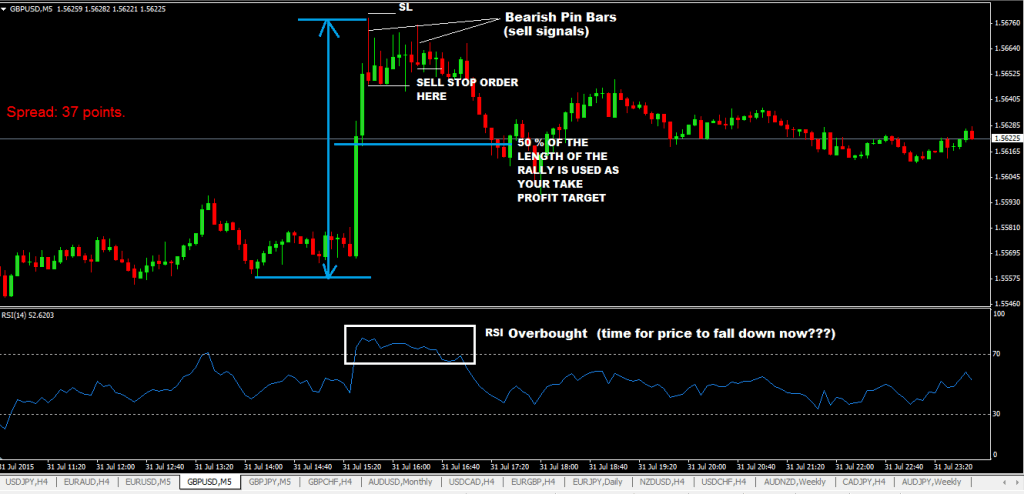

THE SELLING RULES

- The market must be in an uptrend

- Check if the indicator RSI line is above 70, which indicates an oversold condition.

- Once the RSI is above 70 levels, keep watching to see if you see a bearish chart pin bar form.

- place a sell stop order 1-3 pips under the low of that chart bearish pin bar/candlestick

- then place your stop loss(SL) 1-2 pips above the high of that bearish chart pin bar/candlestick

- For take profit(TP), if there was a good rally prior, you measure the distance of the rally in pips and take the 50 % level of the rally move as your take profit target. Other take-profit target options would be using a risk: reward ratio of 1:3 or a previous chart swing low point.

Disadvantages of Simple EURUSD GBPUSD Forex Scalping Strategy

- The overbought & oversold chart indications of the RSI don’t always give an accurate forex market picture because the RSI (a non-trend following forex indicator) and the market trend share an inverse relationship.

- So whenever the market exhibits a strong chart trend, the RSI loses its value and vice versa, which leads to a bit of inaccurate overbought or oversold forex market indications based on strong or weak forex market trends.

Advantages of Simple EURUSD GBPUSD Forex Scalping Strategy

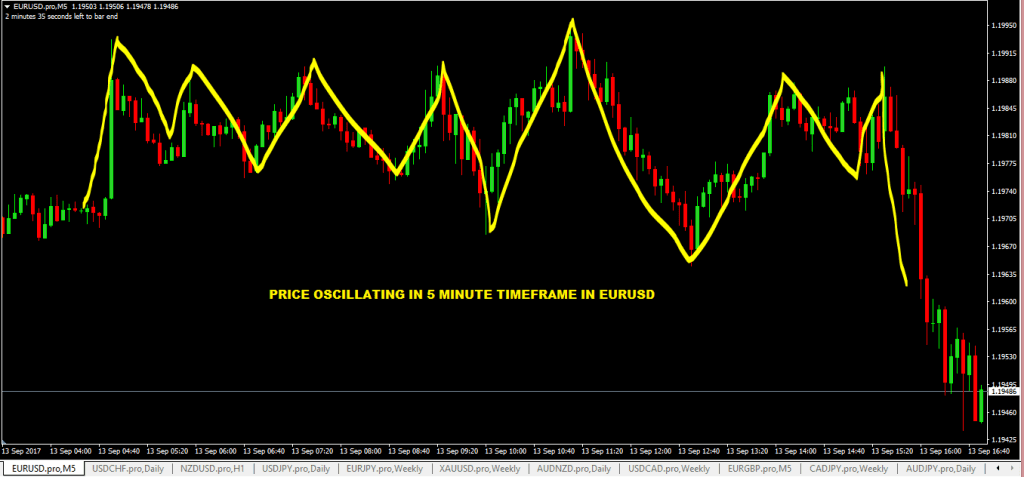

- The RSI is a forex oscillator and therefore works best in an oscillating market. In other words, when the price moves up and down within a channel, the scalping system should give some good results.

What is an oscillating Forex market?

- Forex Oscillation is when you’ve just had a bit of a big extended move.

- And then the forex market switches hard against the market trend. And then it changes back, but it can’t break loose and continue the trend. And then it hits back again.

- One day the sellers win. The next day, the buyers will win. It’s a volatile, saw-tooth pattern on the mt4 chart. And it marks the end of a market trend.

- Markets can oscillate at the top or the bottom. It applies to anything that trades, bonds, stocks, commodities, etc.

Read More: 20 Pips GBPJPY Forex Scalping Strategy