This strategy is called the Floor Traders Method Forex Strategy With No Stop Loss.

It is a variation of the forex floor traders’ method forex strategy. The only difference is there is no initial stop loss placed when you open a trade.

A trailing stop loss(TSL) is activated when your open trade is in profit, and I will suggest some ideas on how can do this.

Disclaimer: As with all forex trading strategies on this site, we should treat all these systems like ideas that need to be tested, and We do not recommend you test this method out on a live account.

How The Trading Strategy Works

The floor traders method forex strategy is a moving average crossover forex trading strategy consisting of a nine ema and 18 ema.

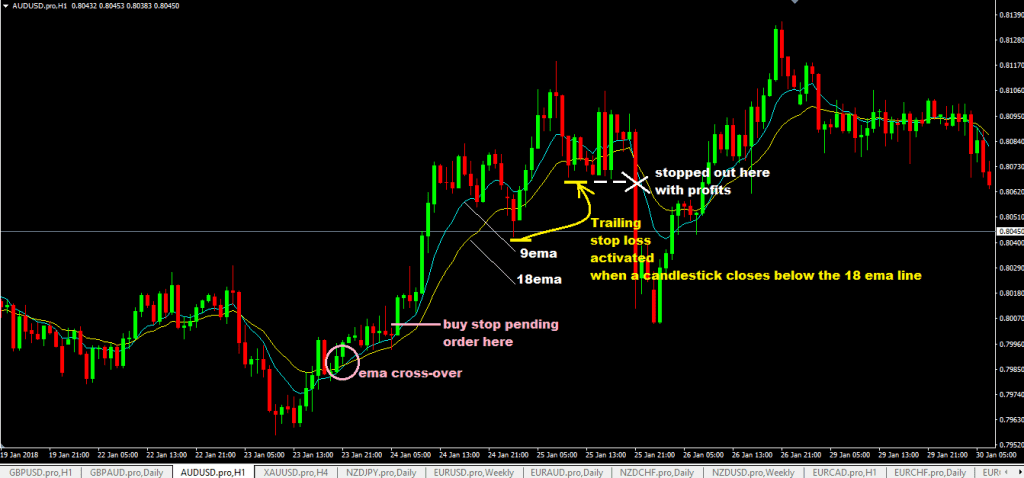

For a buy scenario, you wait for nine ema to cross 18 ema to the upside and the price to move above and away from the two moving averages for some time to escape from the two EMA(exponential moving averages). Still, the price will fall back down to touch one or both of the exponential moving averages after a while.

You can watch for a rebound or chart price or a rally of price once prices start touching the EMA(exponential moving averages).

One way of buying on the rebounding price is to watch for forex reversal candlestick chart patterns. For a buy entry, you need to be watching for bullish reversal chart candlestick patterns.

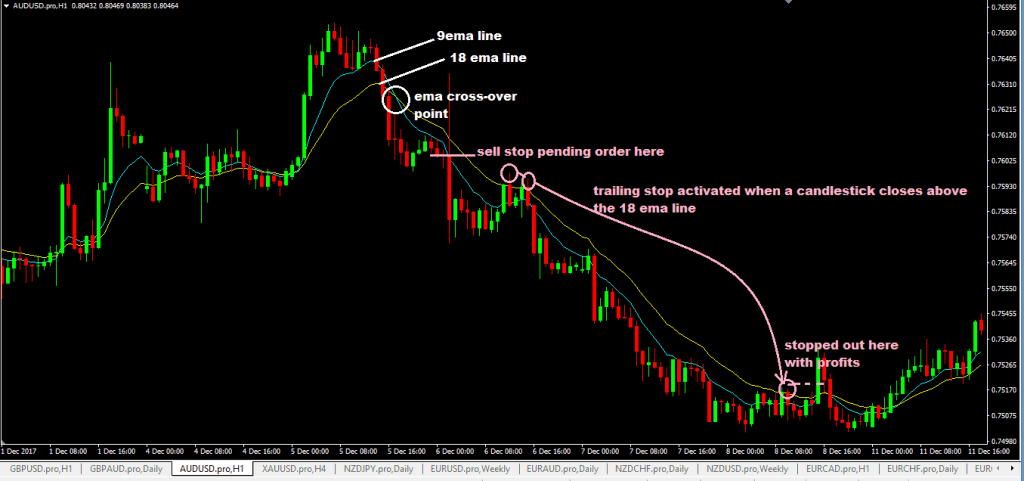

Now, it would be the exact opposite of a buy entry setup for a sell trade entry.

Buying Rules of The Forex Floor Traders Method Trading Strategy With No Stop Loss

- 9ema crosses over 18ema to the upside, and the price moves away and up from the two moving average indicators.

- Watch for a bullish reversal candlestick when the price falls back sometime later and touches the 9ema or the 18ema.

- place a buy stop order 1-2 pips above the high of that bullish reversal candlestick

- Do Not put any stop loss.

- Open a trailing stop loss as soon as a chart candlestick closes below the 18ema line and place it at least five pips below the low of that candlestick. Continue doing that for each subsequent chart candlestick that closes below the 18 ema line until your Stop gets hit with a profit.

Selling Rules of The Forex Floor Traders Method Strategy With No Stop Loss

The selling rules of the forex floor traders method strategy with no stop loss(SL) will be the exact opposite of the strategy buying rules given above:

- 9ema crosses 18ema to the downside, and the price moves away and up from the two moving average indicators.

- When the price moves back up some time later and touches the 9ema or the 18ema, watch for a bearish chart reversal candlestick.

- put a pending sell stop order 1-2 pips below the low of that bearish reversal chart candlestick pattern

- Do Not put any stop loss.

- Open a trailing stop loss as soon as a chart candlestick closes above the 18ema line and place it at least five pips above the high of that candlestick. Continue doing that for each subsequent chart candlestick that closes below the 18 ema line until your Stop gets hit out with a profit.

Advantages of The Floor Traders Method Forex Strategy With No Stop Loss

- good profit-making opportunities in a forex strong trending market

- the removal of placing the initial stop loss eliminates false price spikes that prematurely can take your stop loss

- You can pyramid by adding onto more open trades and thereby increase your profits as the market price continues to go in the direction of your trade until your Stop gets hit out with big profits locked in with your trailing stops.

Disadvantages of The Floor Traders Method Forex Strategy With No Stop Loss

- A risky method with no initial stop loss as the price can reverse immediately after you are in open trade, so you need to have a maximum loss level which you must be willing to take (If the price goes past this max loss amount, I’m out!) therefore We do not suggest you use this system with a live mt4 money account.

- This is a trend trading forex strategy so that you will have too many false signals in any flat or sideways market.

Read More: One Minute Forex Scalping Strategy With Stochastic Fisher Indicator