As the name says, the 200EMA And Stochastic Indicator Forex Scalping Strategy are based on the 200 exponential moving(EMA) and the stochastic forex indicator.

The 200 EMA is used to find the market trend:

- if the price is moving below the 200 ema, the trend is down

- if the price is moving over the 200 ema, the trend is up

What about the stochastic indicator?

Well, the purpose of the stochastic indicator is to see if the market is oversold or overbought:

- Based on this trading strategy, if stochastic is above the 80 levels, it is deemed an overbought so expect the price to fall.

- It is deemed oversold if the stochastic is below the 20 levels, so expect the price to rise.

That is the background of this forex scalping system.

Trading Parameters

Currency Pairs: Any

Timeframes: Any, preferably 5 minutes and above.

Forex Indicators: 200 ema and stochastic indicator. The stochastic indicator settings are the default settings if you are using the forex MT4 platform.

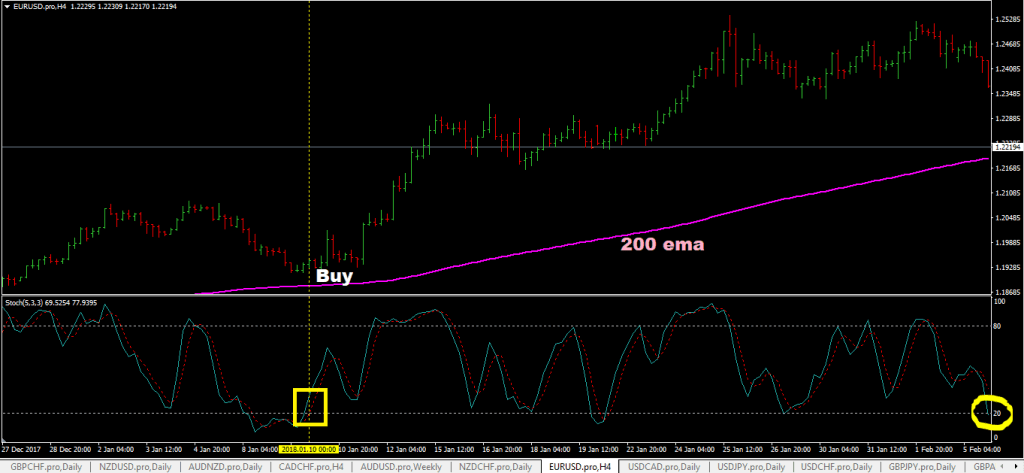

Buy Trading Rules

Here’s how the simple buying rules work: you buy only when the trend is up, which is shown when the price moves above the 200 ema line and the stochastic lines have gone past the 20 lines and are starting to point up at the close of the chart candlestick.

- Ensure the forex market is in an uptrend by checking if the price is traveling above the 200 exponential moving average indicators.

- They check the stochastic lines to see if they have gone below the 20 lines and are now turning and pointing up.

- Once the above two simple conditions are satisfied, immediately initiate a buy entry market order at the close of the candlestick.

- Stop-loss(SL) would be based on the chart timeframe you trade, so if you are using a daily or a 4hr timeframe, you should place a stop loss at 10-40 pips.

- For take profit(TP), aim for a risk: reward of 1:3, or if there is a previous chart swing high point, use that as your take profit target level.

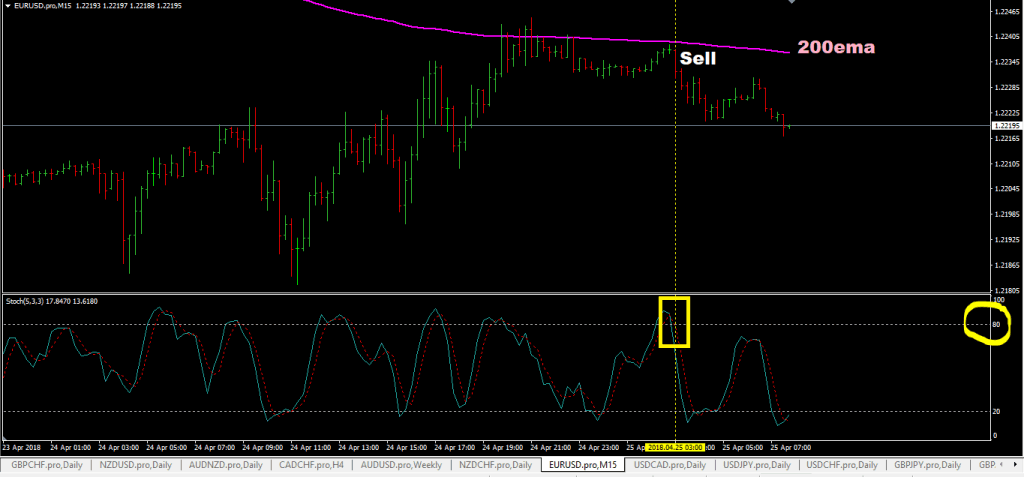

Sell Trading Rules

- Ensure the market is downtrend by checking to see if the price is traveling below the 200 exponential moving average indicators.

- They check the stochastic lines to see if they have gone above the 80 lines and are now turning and pointing down.

- Once the above two simple conditions are satisfied, immediately initiate a sell entry market order at the close of the candlestick.

- Stop-loss(SL) would be based on the timeframe you trade, so if you are using a daily or a 4hr timeframe, you should place a stop loss at 10-40 pips above the entry price.

- For take profit(TP), aim for a risk: reward of 1:3, or if there is a previous chart swing low point, use that as your take profit(TP) target level.

Disadvantages of the Forex 200 EMA And Stochastic Indicator Scalping Strategy

- This scalping strategy will not work well in a non-trending or sideways forex market as there will be too many false entry signals.

- the stochastic forex indicator is an oscillator that oscillates between two extreme ends, and one big problem you will find is that there will be times the trend will be still strong, but the indicator will be giving an opposite signal

Advantages Of The Forex 200 Ema And Stochastic Indicator Scalping System

- Having two indicators, 200 ema for trading with the trend and a stochastic indicator to measure the trend’s strength, gives the system an added layer of checks before buying on selling.

- A further layer of check that can apply would be to use forex reversal candlesticks as a further trade entry confirmation.

Thanks Admin will test it.

Where is the link to download it ? Please share the link admin.

My email: [email protected]