We bet you are here because you are after james16 price action forex trading strategies.

Well, the best news is I have 6 of James16’s forex price action trading strategies which I have researched and compiled in an easy-to-read manner so you can read and understand the price action patterns he uses and the trading rules.

Disclaimer: We are presenting my interpretation of forex james16 price action trading strategies. We may not be 100% right. But We think We will be pretty close to being suitable for those We don’t get right.

Makes sense?

James16 was a trader who started a thread over at forexfactory.com about price action trading and had a reasonably large following when it began.

From what We know, he is no longer active on that thread.

Where is he from?

I don’t know. I don’t care.

Strategy Trading Timeframes

James16 is a big fan of trading the daily chart and the weekly timeframes.

Why?

Because he says that larger timeframes eliminate much of the noise found in smaller chart timeframes and give more chance for your forex trades to become more successful.

Currency Pairs

James16 price action forex trading strategies are not limited to being traded on just a few specific mt4 currency pairs. You can trade the james16 price action forex trading strategies on any mt4 currency pairs you want.

Forex Indicators

James16 has been documented well to use these simple moving averages(SMA): 21, 79, and 365. EMA 89.

The primary purpose of using these moving averages was for him to identify dynamic support and resistance levels.

James16 Trade Entries

So how does James16 trade? What does he focus on? Well, here’s what I’ve found:

- in a downtrend market, Jame16 looks for opportunities to sell in a rally.

- In an uptrend market, he seems to buy on the dips.

To do that, he focuses on:

- price action on chart support and resistance levels

- also, price action on chart Fibonacci levels

Jame16 trade forex entries are based on 2 to 4 bars reversal patterns clustered near what he calls “levels/areas/points of confluence”.

So here are the six price action chart forex patterns that James16 uses and has built forex trading strategies around them.

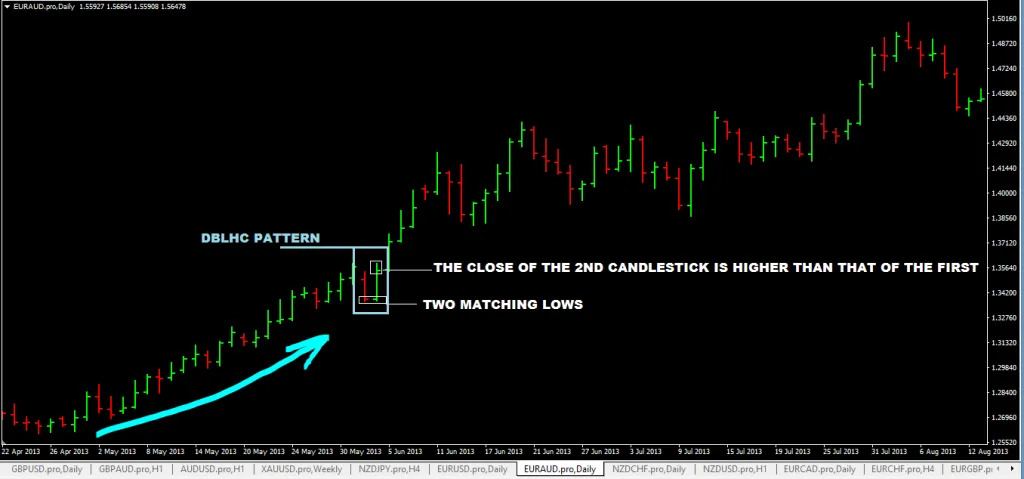

#1:Forex Double Bar Low Higher Close (DBLHC) Strategy

The DBLHC is a 2-bar pattern.

The first and the second chart bar should have matching lows or lows within two pips of each other.

In other words, their chart lows are almost on the same price level.

Now the 2nd bar is the virtual bar. This chart bar must close higher than the high of the first chart bar.

Once these simple conditions are satisfied, you have a DBLHC forex price pattern.

The DBLHC is a bullish chart pattern. When you see this chart pattern, you should be looking to enter buy.

Here’s what a DBLHC chart pattern looks like:

#2:Forex Double Bar High Lower Close (DBHLC) Strategy

The DBHLC is also a 2-bar pattern.

The first and the second chart bar should have matching highs. Or the highs must be within 2 pips of each other. In other words, highs are almost on the same chart price level.

The second chart bar must have a close lower than the close of the first chart bar.

When these simple conditions are satisfied, what you have is a DBHLC chart pattern.

The DBHLC chart pattern is bearish. This means you open sell when you see the DBHLC chart pattern form.

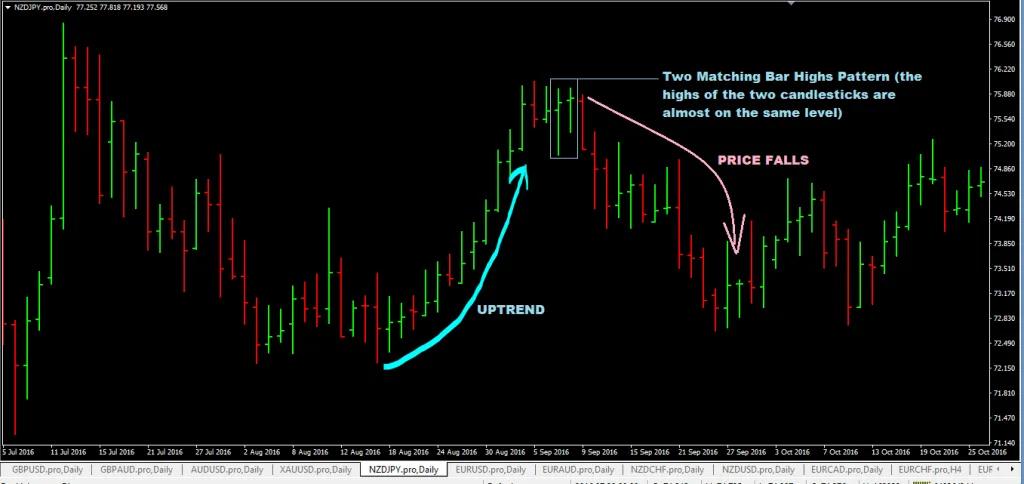

#3: Two Matching Highs Chart Pattern Strategy

The two matching highs chart pattern is a two candlestick pattern. It consists of two bullish candlesticks with the same or almost identical highs.

This is a bearish reversal chart candlestick pattern.

Another simple thing is that it can be hard to find in fx charts as it is one of those forex reversal chart candlestick patterns that does not regularly form, especially if you are enter trading based on the daily charts.

If you decide to open trade this pattern using a much smaller timeframe, then there’s a better chance that you’ll be able to see a lot more two matching highs patterns than from a daily chart perspective.

Ideally, it would be good if you were looking for the two matching highs pattern in an uptrend when the chart price hits a resistance level or in a downtrend when the price makes a temporary rally, and should these matching highs form, it can lead to the chart continuation of that downtrend.

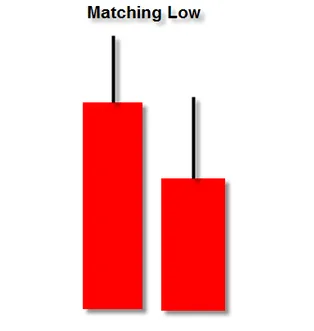

#4: Forex Two Matching Lows Pattern Strategy

The two matching chart lows pattern is made up of two chart bearish bars that have that same low. It is a chart bullish reversal pattern.

And again, same as to the two matching highs pattern, this chart pattern rarely tends to form on mt4 forex charts, especially if you are trading the daily charts.

If you go down to much smaller chart timeframes, you may have a greater chance of getting or seeing two matching lows chart patterns forming.

The fact that those chart bars have made a low on the same chart price level indicates that a chart support level has been made, and the market may be due for a reversal upward (uptrend).

It would be best if you were looking for two matching lows patterns on support levels or in an uptrend market when the price makes a dip; look for a matching chart lows pattern to buy.

#5: Forex Bearish Outside Vertical Bar(BEOVB) Strategy

The forex bearish outside vertical bar is a two candlestick pattern; as the name says, it is a bearish reversal pattern.

Ideally, you want to look for BEOVB patterns in an uptrend when the price hits a resistance level or when the price is in a downtrend and there’s a minor rally.

The first chart candlestick must be bullish.

The second chart candlestick must be bearish with the following characteristics:

- it must have a low that is lower than that of the first chart candlestick

- it must have a candle high that is higher than that of the first chart candlestick

- it also must have a candle close that is lower than that of the first chart candlestick

#6: Bullish Outside Vertical Bar(BUOVB)

The bullish outside vertical bar is a two candlestick pattern; as the name says, it is a bullish reversal pattern.

It would be best if you looked for BUOVB patterns in dips in a rally or in support levels to buy.

The first candlestick is bearish.

But the second candlestick must be bullish. It is the characteristics of the 2nd chart candlestick that defines what the chart bullish outside vertical bar is:

- the second chart candlestick must have a high, higher than that of the first chart candlestick

- it also must have a candle low, lower than that of the first chart candlestick.

- the second chart candlestick must also have a candle close that is higher than the close of the first chart candlestick

#7:Forex Pin Bar Strategy

The pin bar or the Pinocchio chart pattern because it lies (Like in the story of Pinocchio, the more lies Pinocchio tells, his nose grows!) about the market’s direction.

The long nose exposes the lie.

So Simply this is what happens:

- Traders will place market orders in levels of resistance and support, and the price makes a short-lived break of that chart level, and the traders think they made the right choice.

- But soon, this changes, and they start losing money when the long nose starts forming. (tail of the pin bar)

- The pin bar is beginning to form, and as soon as the bar is close to or within the chart support or resistance levels, you now have a confirmed pin bar.

- Once that pin bar closes, the price moves in the other direction!

The mt4 chart below shows a chart bearish pin bar setup:

- Price was in an up trend until it hit the chart resistance level

- when the chart pin bar was made, it made a break of the chart resistance level but then closed back under that chart resistance level

- price then moved downward from there.

This mt4 chart below shows a bullish pin bar trade setup:

- as you can see, the price was in a downtrend and hit a support level and made a break for it, but didn’t sustain that break

- after the pin bar formed, the price moved up

How To Trade These Patterns? Trading Rules

- If you are trading these patterns on the 4hr or the mt4 daily timeframe, We suggest you use stop orders: buy stop orders for bullish pattern setups and sell stop orders for bearish pattern setups.

- For a bullish pattern, place a pending buy stop order at least 1-2 pips above the high of the 2nd candlestick pattern. Whether it is a two-pattern candlestick pattern or a pin bar pattern, it is pretty straightforward.

- Place it at least two pips below the low of the entire pattern for stop loss on a bullish pattern setup.

- For take profit(TP) targets on bullish pattern setups, use risk: reward of 1:3 or look for previous swing highs (peaks) and use them as your take profit target levels.

What about bearish patterns?

Do the exact opposite.

[…] panel. Users can hide or show the panel at their convenience, ensuring it doesn’t obstruct price action […]