Commitments of Traders Report

Commitments of Traders report is released by CFTC every Friday and contains the data on long and short futures and options positions throughout US exchanges. It includes information on the following currency pairs: USD/CHF, USD/CAD, GBP/USD, USD/JPY, EUR/USD, AUD/USD, MXN/USD, RUB/USD, BRL/USD, and NZD/USD. A Forex trader may skew winning chances in his favor by using the data reported on the number of “smart money” positions taken in a given mt4 pair.

The report contains a rather extensive set of quantitative characteristics based on five classes of forex traders:

- Dealer / Intermediary – brokers, banks, and dealers.

- Asset Manager / Institutional – ETFs, hedge funds, big investors.

- Leveraged Funds – private money managers.

- Other reportable – other traders, primarily non-investors who need to hedge risks.

- Nonreportables – everyone else.

Suppose you want to follow some category of traders. In that case, it should be either money Dealers or Asset Managers, as these two categories consist of the forex “smartest money” — the sell-side of the futures market. The simplest way would be to buy a currency pair whenever the number of Dealer long contracts rises, and short contracts fall. Of course, numerous modifications are possible based on adding other categories into the formula or using additional market data for entries.

The backtesting results of more than thirty forex strategies based on CoT data reports have shown that most of such forex strategies (following Dealer trades) offer a positive edge from a long-term perspective. The most consistent strategy is presented below.

Buy and Sell with Dealers/Intermediary Traders

Surprisingly, the most straightforward interpretation of the Commitments of Traders reports yields a profitable output on all of the checked major currency pairs except AUD/USD, albeit with significant drawdowns over nearly eight years.

Features

- Statistically proven system.

- Only a few minutes per week to dedicate.

- Limitless potential for forex strategy development based on CoT data reports.

- Significant periods of drawdowns (especially the global financial crisis of 2008).

- “Always in the market” mode of trade.

- Profitability levels are not that high.

- The commitment of Traders’ reports releases is sometimes delayed (see Nuances).

How to Trade?

The rules of this strategy are pretty simple:

- But when the number of Dealer long entry positions rises compared to the previous report and the number of short Dealer entry positions falls compared to the previous report.

- Sell when the number of Dealer long entry positions falls compared to the previous data report, and the number of short Dealer entry positions rises compared to the last report data.

- If the number of the long positions and the number of the short positions rise or fall simultaneously, no trading entry signal is generated. The current position remains open.

After the first signal entry is executed, the strategy always remains in the market.

The execution of this forex strategy is also uncomplicated. Every CoT data report has a separate field for changes in positions compared to the previous data report, so there is no need to calculate anything. It can quickly check all seven major currency pairs, and the respective entries and exits are executed.

No stop-loss(SL), take-profit, or additional exit conditions exist. The previous position is closed when a new position in the opposite direction is entered. The position size does not increase when a new CoT report shows a signal entry signal in the same direction.

Examples

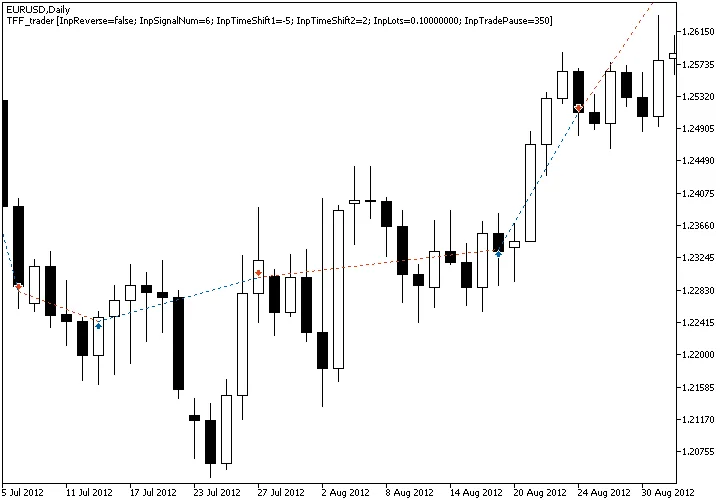

Below is an example of five entry trades executed during the Summer of 2012 based on the forex strategy of following the positions of Dealers and Intermediary traders.

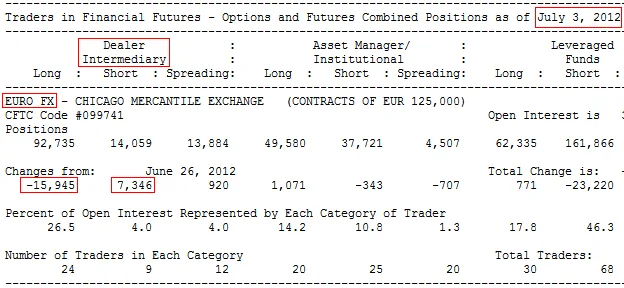

The first entry is a short entry signal generated on July 6, 2012. The following Commitments of Traders report shows the reason for signal entry. The data in the report are valid as of July 3, 2012. We are interested only in Dealer/Intermediary positions (the so-called “smart money”). The currency we are looking at is Euro, meaning that the data is for EUR/USD mt4 currency pair. Changes in Dealer/Intermediary long entry and short positions are reported compared to the previous report (released a week ago).

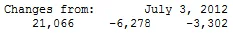

The position is closed next Friday, July 13, 2012, when the report with data for July 10 is released. It shows a rise in long entry contracts and a drop in short contracts, which is a signal for a buy entry trade (the first number longs, the second is entry shorts, and the last one is spreading, which is not used in this forex strategy):

A CoT report released on July 20 shows that the number of long and short contracts increased compared to the previous data report. It means that the position remains open for one week.

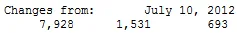

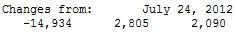

The long entry position lasts two weeks as it is closed on July 27 using the data for July 24. A short position is opened instead of the long one.

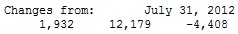

On August 3, when the report with July 31 data becomes available, it only confirms the short entry position:

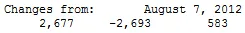

The following Friday, August 10, both sides of the entry contracts rise for EUR/USD, which is not enough to warrant a termination of the current short position:

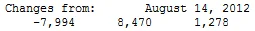

August 17 brings an end to this short entry trade as the Dealers’ long positions grow while their short bets drop. A long position is opened immediately.

It survives for another one week only as the next CoT report reverses the situation:

Nuances

There are some essential precautions to be aware of when trading CoT data reports:

- Do not forget to swap short entry and long entry positions for inverted mt4 currency pairs (USD/CAD, USD/JPY, USD/CHF, and USD/NZD).

- Even though the backtest of this forex strategy on AUD/USD has shown a negative result, it is best to consider the whole set of majors as one portfolio and not exclude AUD/USD from it.

- Remember that the Commitments of forex Traders reports are released every Friday at 15:30 EST and contain data as of Tuesday of that week.

- Sometimes, report releases are postponed due to holidays or unexpected disruptions in the work of the CFTC website. It is the trader’s duty to decide whether to use the data from such postponed reports for trading or ignore them.

- The data for positions in USD/MXN, USD/BRL, USD/RUB, and XAU/USD (gold) is present in the data reports, but the backtesting results were wildly inaccurate for these instruments, and they were omitted from this forex strategy. You could still try trading them at your own risk, which originates mainly in higher spreads.

Download a Collection of Indicators, Courses, and EA for FREE

Warning!

Use this strategy at your own risk. fxcracked.com cannot be responsible for any losses associated with using any strategy presented on the site. Using this strategy on the real account is not recommended without testing it on the demo first.

Discussion

Do you have any questions regarding this strategy? You can always discuss CoT data Report Trading Strategy with your fellow Forex traders on the Trading Systems and Strategies forum.