Buy-and-hold (B&H) forex strategy is prevalent in stock markets but is often deemed useless or even dangerous in the Forex market. Many articles and books state that a buy-and-hold forex strategy does not apply in currency trading. While there are certain limitations to using the buy-and-hold forex strategy in the FX market compared to equity markets, it is a viable technique that would appeal to many foreign exchange fx traders or investors.

Buy-and-hold, as it name suggests, consists of two simple stages. The first is the process of choosing and buying one currency with another. The second stage of B&H is a holding period of several years for the bought currency rate to rise against the currency sold. Although there is only “buy” in the name of this forex strategy, B&H traders are not limited to the long side of the trades. Short selling works equally well in the Forex market.

Is it even possible in Forex?

The main argument of the experts, who oppose buy-and-hold in simple Forex trading, is that currencies lack the main advantage of the market stocks. Whereas a company’s value may soar hundreds of percent up due to some fundamental event (for example: entering new markets, successful invention, lack of competition, etc.), currencies cannot similarly rally against each other. The only exclusion is third-world currencies devaluating rapidly due to some political or financial turmoil. Of course, those are out of this strategy’s scope.

While this argument is entirely valid, it does not remove the possibility of using buy-and-hold with currencies. The lack of rapid growth is easily compensated with high leverage (up to 1:2000). At the same time, the inability of currencies to depreciate similarly to shares makes long-term Forex trading more flexible and controllable.

One of the possible obstacles to employing the B&H forex strategy is a Forex broker. Firstly, it should be good enough to outlive the planned long-term entry trade, execute the exit trade, and transfer the initial investment with good profit to the trader’s bank account. Secondly, it should be willing to hold the forex trader’s position open for that long. The last factor should not be overlooked, as online Forex brokers earn from spreads and commissions that depend on the frequency of trading. This frequency is too low for a broker to make anything significant in buy-and-hold. The only possibility for them to benefit from a long-term position is to tune the interest rate payments in their favor. That is why a choice of a broker for a B&H position is almost as important as a choice of currencies.

It looks like the carry trade.

A lot of similarities can be drawn between buy-and-hold and carry trade strategies. Both imply long-term holding periods, benefit substantially from the favorable interest rate difference, and do not have defined entry and exit rules. At the same time, the differences between these two trading techniques are pretty significant:

- In B&H, using a protective (and, sometimes, trailing) stop-loss can be an advantage.

- Unlike carry trade, buy-and-hold does not require a stable and growing global economy.

- While receiving a favorable interest rate rollover is a bonus for buy-and-hold positions, it is not a requirement.

- Good B&H positions need more confirmations and conditions for entering. Positive carry alone is not enough.

buy-and-hold Features

- Long-term profit potential.

- Trades with positive overnight interest rate payments bring additional profit.

- “Set-and-forget” trading style.

- A negative overnight interest rate can be a severe problem.

- No clear entry/exit criteria.

- It requires a lot of patience (especially if swaps are negative).

- The broker should be reliable enough to last for years.

How to trade?

- The choice of an mt4 currency pair plays a crucial role in the buy-and-hold strategy. Ideally, a currency pair should pay positive swaps in the direction of the trade. But you can skip that part if the negative swap is negligible compared to the expected long-term gain.

- Fundamental factors should be of high priority here. Long-term considerations, such as central bank rules, global sentiments, and trends in unemployment rates, could serve as a beacon.

- Should enter A buy-and-hold position either at minimal leverage or with enough free margin locked in the real Forex account to prevent margin call or even stop-out.

- Although it can use to gain some additional advantage, trade timing is not as important as conventional FX trading. Delaying for a pull-back can cost the overall trading opportunity and should be considered only in exceptional cases.

- A long period of waiting should be employed. It is not uncommon for the Forex B&H strategy positions to last for years and even decades.

- Exiting a buy-and-hold entry trade is even trickier than entering. Ideally, a long-term currency investor exits such a position only when there is a need for capital, or the market conditions have changed dramatically. Alternatively, the B&H position can be closed when some large profit target or an intolerable loss level is reached.

Download a Collection of Indicators, Courses, and EA for FREE

Examples

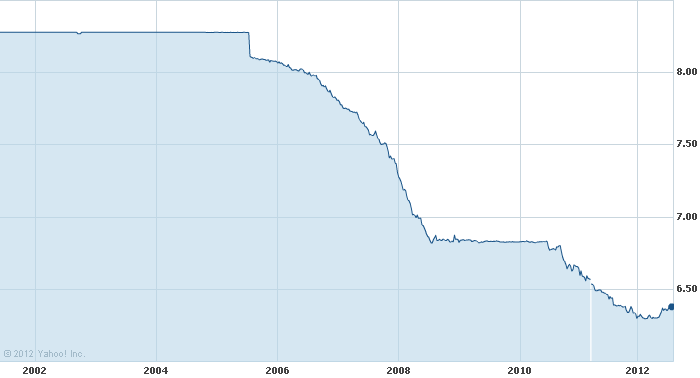

USD/CNY

The first example depicts the USD/RMB pair(USD/CNY, US dollar vs. the Chinese yuan or renminbi) mt4 currency pair. Which was, and still is, in a long-term market downtrend thanks to the adverse US trade balance with China and the slow yuan revaluation by the People’s Bank of China. Not only a long-term investor would good profit from a nearly constant mt4 currency pair decline, but he would also earn significantly from the positive difference between the high Chinese interest rate and the low rate used by the Federal Reserve.

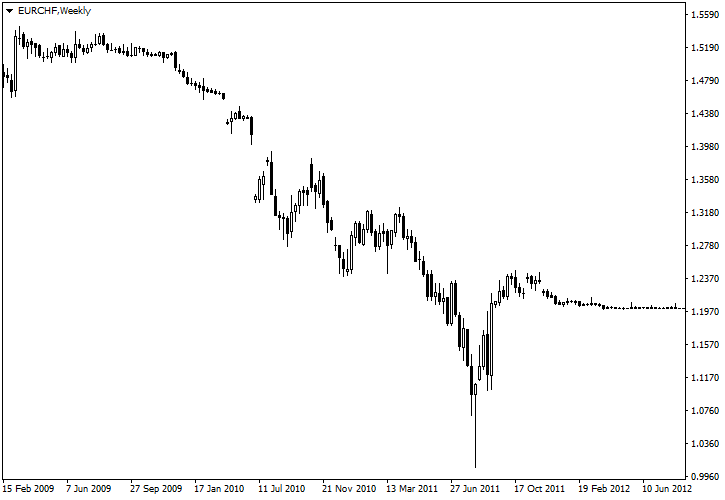

EUR/CHF Pair

The second example is EUR/CHF pair (euro vs. the Swiss franc). The pre-1999 part of the shown chart is synthetic but is entirely valid. The currency pair has been trading in a long-term downtrend since the 1970s. To trade this bearish buy-and-hold strategy setup, one would need to be able to endure quite a lot of significant drawdown periods combined with the prevalence of the negative interest rate difference between CHF and EUR.

Warning!

Use this strategy at your own risk. fxcracked.com cannot be responsible for any losses associated with using any strategy presented on the site. Using this strategy on the real account is not recommended without testing it on the demo first.

Discussion:

Do you have any more suggestions regarding this forex strategy? You can always discuss the Buy-and-Hold forex Strategy with your fellow Forex traders on the Trading Systems and Strategies forum.