Scalping is not an uncommon term in the world of forex trading. You might have come across scalping strategies at least once, even if you are a newbie in this field. The end goal of scalping is to make a small profit through the small price movements, which are common throughout the day. A forex scalper buys or sells an asset and then holds it for a short period to generate the profits. However, you will have to be willing to dedicate a few hours of a day if you plan to step into this strategy. A 1-minute scalping strategy is an approach that needs a bit of time and concentration put into to be successful despite the name having the words 1 minute on it.

Number of exponential moving averages (EMA)

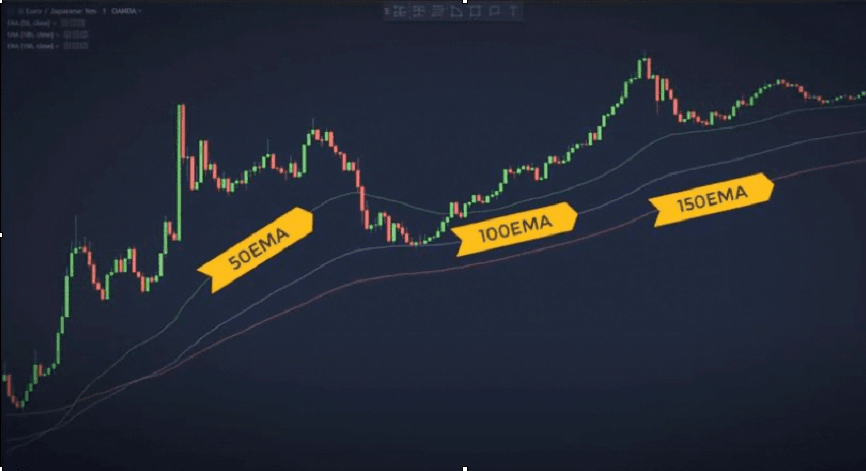

This forex scalping strategy, like many other of its kind, relies on exponential moving averages. An average trader typically uses two or more moving averages to gain a general trend of price movement. This helps to better understand the main direction and to trigger more precise entries or exits in the market. Our strategy uses three moving averages to monitor short, medium, and long-term market trends. This allows us to estimate the trend’s intensity from multiple time frames.

- Read More A Simple Forex EMA Strategy

This is a 1-min chart of Euro-Yen with the three exponential moving averages: the 50, 100, and 150-period averages.

The 50 period EMA shows us the short-term trend while the 100 and 150 periods EMAs show the medium and long-term trends. Using longer-term EMAs somewhat eliminates the inevitable market noise. But you don’t have to use this exact setup. Any number of ema combinations can be used here. The types of Entry setups you are looking for, and the timeframes you are trading are the factors that determined that. So, feel free to use Every other moving averages.

If you look at the first part of the chart, you will notice that the price stays above the 50 periods EMA the entire time. The fact that all three EMAs are trending higher at around forty-five-degree angles during the first part of the chart is significant. Here all three moving averages are in agreement, in line, almost parallel, with strong trend consensus. This is the kind of behavior we’ll look for on our chart.

Pullbacks

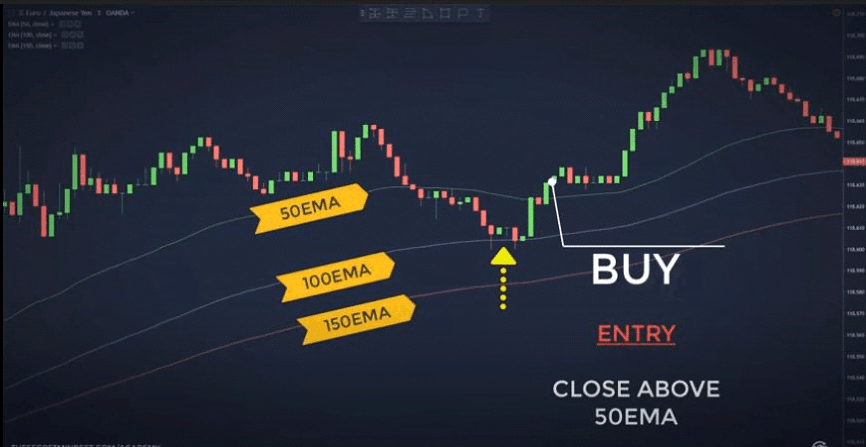

In the mid part of the chart, the price eventually brakes and falls below the 50 periods EMA. This signals a short-term weakness, but it soon resumes the uptrend at the 100 periods EMA. This confirms the medium- and long-term strength of this chart. The strength of the trend will always remain intact until the price breaks below the 150 periods EMA.

After we identified the main direction of the chat, we need to wait for a pullback to locate undervalued and overvalued entries into the established trends. Our goal here is to find opportunities when the price is considered overvalued or undervalued, as this presents excellent opportunities to “buy low in uptrends, and sell high in a downtrend.”

The goal of the pullback trade is to take advantage of situations when all three moving averages are indicating the same direction. The price is in an established trend, either bullish or bearish. Any pullback to the first or second EMA offers a buying or selling opportunity. This setup is effective because it makes you buy below the price and sell the above price while keeping you disciplined to the current trend.

How to enter a trade?

The vital part of entering a trade is to identify the current trend of the market. All three EMAs must be trending in agreement in a bullish or bearish manner. A slope ranging from 30 to 60 degrees is enough. But it is much better if all three EMA’s trending at a 45-degree angle. That kind of slope identifies a strong trend.

The next step involves waiting for the market to show a pullback towards either the 50 or 100 periods EMA. As said before, price should go down beyond the 50 periods EMA, but make sure it doesn’t go too low beyond the 100 EMA. It must go below 150 EMA. Once price moves beyond either of the moving averages, we need price confirmation. The entry should happen when the price moves back in the direction of the current trend, just beyond the 50-period EMA.

How to manage the trade.

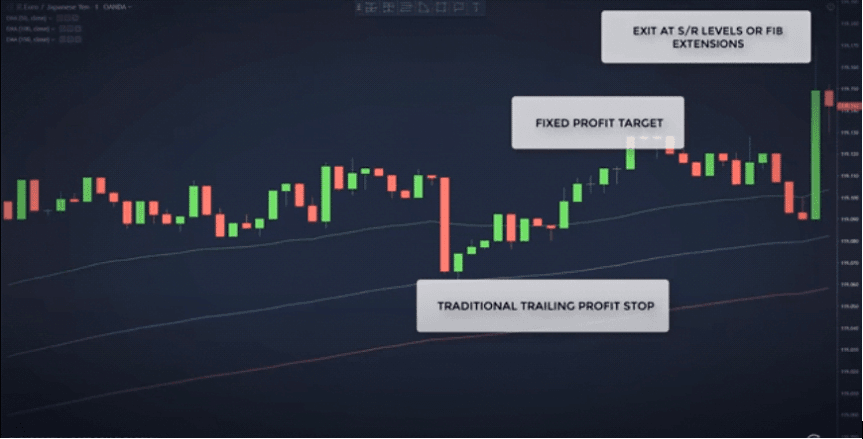

Many exit tactics can be used for the pullback trade. The room for error is tiny when you are scalping as you are trading with high leverage while looking for a small profit.

The ugly truth about scalping is that it’s unpredictable, and any price swing can hit your stop loss. It is better to move your stops to break-even as soon as possible to diminish your risks. When this is done, you will get stopped out a lot at break-even, but it’s always better to have several trades in a row with zero profit, than the same number of losing trades. This is also why it is wise to look to play the break-even trade when you are 5 to 6 pips in profit. There is a good chance that the market will hit your stop loss and continue in your initial direction when you have 5 pips in profit. However, this will protect you in the long run and save you more than you could have lost.

Yet, if you have a more significant risk aversion, having a traditional trailing profit stop and a fixed profit target as well as exiting at the next support and resistance levels, or at a fibo extension if you trade with fib numbers, are other tactics you could use too.

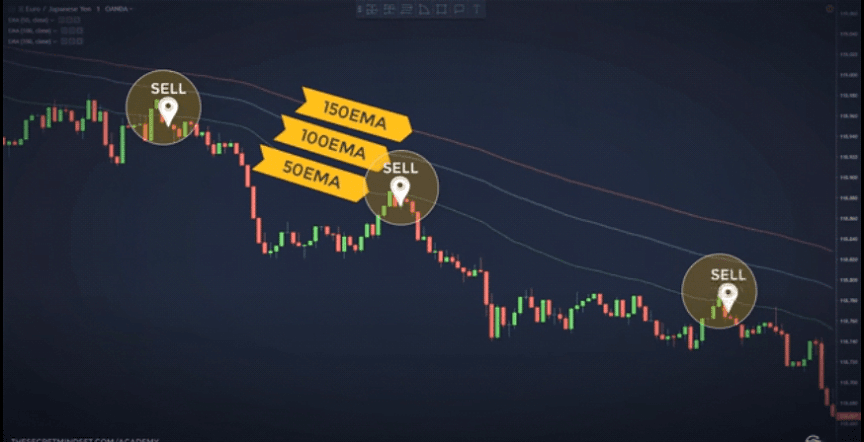

This is a chart where all the three EMA’s are trending lower at 45-degree angles is a good example of choosing a currency pair during a strong trend. As mentioned before, this behavior of EMAs show the strength of the trend, and trading in the direction of such an established trend increases your chances for a profitable outcome. We should wait for the price to break above the 50 EMA in order to have a much profitable “sell” in this chart. Once price dips above the first EMA, we look for price to close back below the 50-period average in order to trigger a long position, which occurred several times in this chart. You can use any period moving average you like to manage your trades here too. You could and should adapt the period of the EMAs to fit your style of trading.

How does this strategy work?

We do this scalping strategy by merely waiting for the price to come up or go down as of the direction since it went below the 50 EMA. But many other traders, especially the novice ones, immediately short the market when they see the price closing below the 50 EMA as they don’t care about the general trend. They are the reason we wait for the price to return above the 50 EMA. We want to have trapped traders below us, to fuel our long positions. The stops of the traders shorting below the 50 EMA are above the 50 EMA. So, when the price returns above the moving average, our scalping trade gets an extra boost from the stop of trapped traders. So, what we do here is taking advantage of those novice traders who are shorting the market below 50 EMA.

Things to keep in mind

• Being impulsive is one of the most undesirable traits for forex scalping. One should always improve their self-discipline and self-control before entering the world of scalping. The line between scalping and gambling is fragile. It is common to see excited traders on a winning streak abandoning their own rules in pursuit of fast money and lose everything.

• Scalping needs solid risk management. It is one of those trading methods that are often performed with a bad risk-reward ratio. The market provides many opportunities to enter high probability setups that can make high profits for a scalper. But this trading style could also wipe out profits of days and weeks with ease. So, it’s better not to risk more than 0.5% of your total balance. Remember, it’s not 5% but 0.5%.

• Keep your lot sizes lower. Small lots help you to keep losses down until your trading improves and is consistently profitable. Smaller the forex lot size you have, lower the risk you will face. You could always increase your lot with the experience you gather.

Scalping has been proven to be an extremely effective strategy where risks are low, but the profits are frequent. Yet, it is vital to understand that scalping is not easy work. Scalpers are rewarded according to their amount of efforts. To be successful in this strategy, it is important to be sure whether it matches your trading style and abilities.

is there ea with this strategy?

[…] this scalping strategy, the trader needs to make a minimum of 10 trades within a single day to capitalize on any minor […]

[…] it win no matter which direction the price moves. As long as the price moves, it wins. The risk with this strategy is consolidation areas. So combined with some manual analysis in areas where you know the […]

[…] Read More: A low-risk approach for better profits; one-minute forex scalping strategy […]