When you’re just starting out in the forex world, it can be difficult to know where to begin. With so many indicators and strategies to choose from, it’s hard to know what’s best for your trading needs. In this article, we’ll take a look at some of the best forex indicators for beginners to use.

We’ll start by discussing some of the most popular indicators, including the Moving Average Convergence/Divergence (MACD) indicator, the Relative Strength Index (RSI) indicator, and the Stochastic Oscillator indicator. We’ll also examine how to use these indicators in your trading strategy.

So, if you’re just starting out in forex or if you’re looking for a new indicator to add to your toolkit, read on for our recommendations for the best forex indicators for beginners.

What Are Forex Indicators?

Forex indicators are tools that help you make better trading decisions by giving you a clearer picture of what’s going on in the market. They come in all shapes and sizes, but the most common type is the technical indicator.

Technical indicators are mathematical calculations that are based on past prices and volumes. They help you measure market trends, support and resistance levels, and momentum. When used correctly, they can give you an edge over other traders and help you make more profitable trades.

The Most Important Indicators for Beginners

When you’re first starting out in forex, it’s important to use indicators that are easy to understand and that will give you a good idea of what’s going on in the market.

There are a few indicators that are essential for beginners. The first is the Moving Average, which is a simple line chart that shows the average price of a currency over a set period of time. This is a good indicator to use to smooth out price fluctuations and get a general idea of the trend.

The second is the Relative Strength Index (RSI), which measures the momentum of a currency. This indicator can help you determine whether a currency is overbought or oversold.

These are just two of the most important indicators for beginners. There are many other indicators that can be useful, depending on your trading style and goals.

We have 200+ Premium Indicators, Trading Systems, and strategies FREE to Download HERE.

Using Moving Averages to Identify Patterns

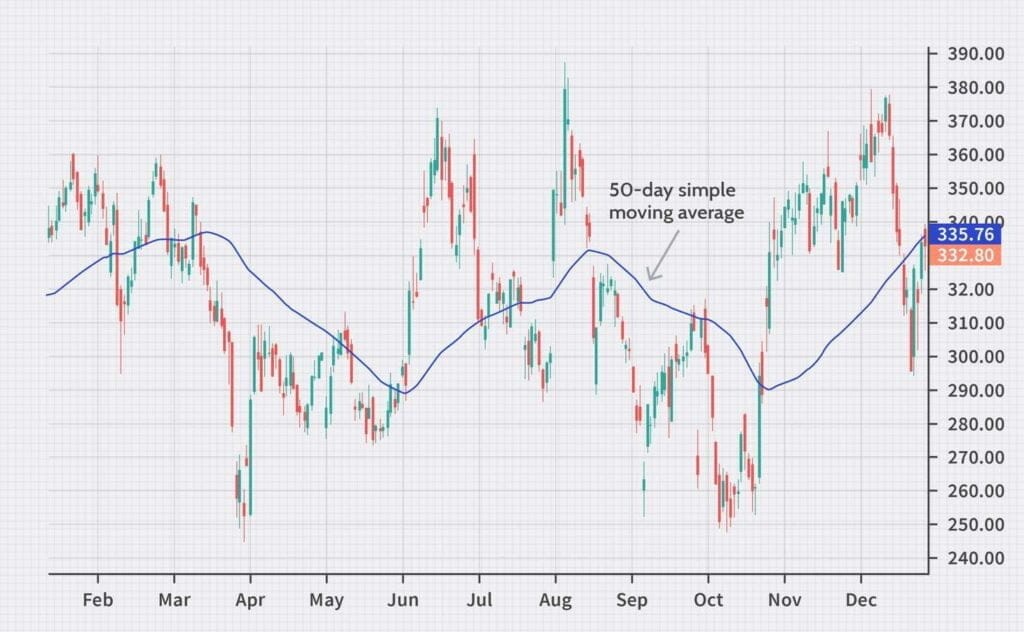

One of the best Forex indicators for beginners is the moving average. It’s a tool that smooths out price data to help you identify patterns.

With a moving average, you can see how a currency is performing over a period of time. This can help you make more informed decisions when trading. For example, if the moving average is heading downward, that might be a sign that the currency is losing value.

There are different types of moving averages, each with its own benefits and drawbacks. But as a beginner, it’s best to start with the simple moving average and then build on your knowledge from there.

Parabolic SAR – The Stop and Reverse Indicator

The next indicator I’m going to talk about is the Parabolic SAR. This stands for Stop and Reverse, and it’s a great indicator to use when identifying trend reversals or corrections.

Essentially, what this indicator does is plot dots on a chart that show when there’s been a reversal in the price trend. When the dots move above the price candles, that’s an indication to sell, while when they move below, it signals to buy.

The beauty of this indicator is that it’s easy to use and understand. Plus, it can be combined with other indicators like MACD or Moving Averages to provide additional context for trading decisions.

So if you’re just getting started with trading forex and need an easy-to-use technical indicator, I’d definitely recommend giving Parabolic SAR a try.

Stochastic Oscillator: Understanding Market Momentum

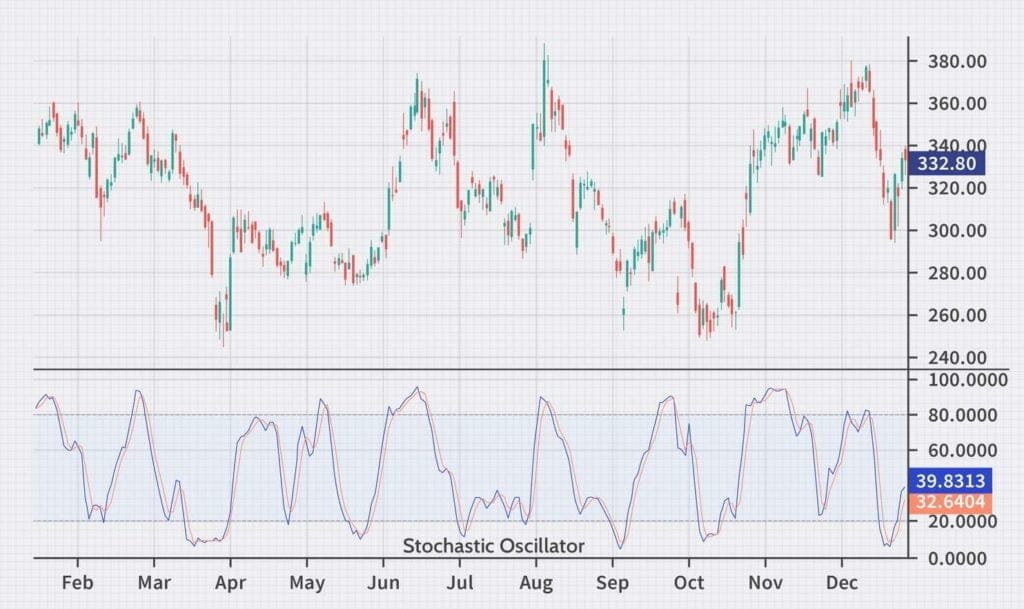

The stochastic oscillator is a great indicator for traders who want to gain insight into market momentum. It helps identify overbought and oversold levels, as well as trend reversals.

To understand how the stochastic oscillator works, it’s important to know what two components it comprises. The %K line is a measure of market momentum, and the %D line is a smoothed-out version of the %K line, which makes it easier to read and interpret the signals that are being sent out.

The stochastic oscillator will generate a signal when the %K line crosses over the %D line. If the %K line crosses over from below, it indicates an uptrend, while if it crosses over from above, it indicates a downtrend. Knowing these signals can help you make better trading decisions and increase your chances of success in forex trading.

Analyzing Bollinger Bands in Forex Trading

Bollinger bands are great for spotting trends, and they are one of the most widely used forex indicators. They consist of three different lines – a simple moving average (SMA), an upper band, and a lower band. When the price of an asset moves between the two outer bands, it is said to be in a trend.

The SMA is the middle line, and it helps you to determine whether the current trend is likely to continue or reverse direction. When the price moves above or below the SMA line, it gives an indication that something has changed in market conditions and that you should look out for possible reversal opportunities.

Bollinger bands also allow traders to determine when volatility increases or decreases in market price – when the bands are wide apart, there is high volatility; when they are close together, there is lower volatility (and vice versa). Knowing which indicator works best during varying market conditions can help you create more profitable trading strategies.

Conclusion

In short, there are a number of helpful forex indicators that are available to beginners. When choosing indicators, it is important to consider the goals of the trader and the type of analysis that is being performed.

There are a number of different indicators that can be used to measure different aspects of the market. Some indicators are designed to measure price, while others are designed to measure momentum or volume. It is important to understand the basic concepts of forex analysis in order to use the indicators effectively.

These Best Forex Indicators for Beginners can be a great tool for beginners, but they should be used in conjunction with other analysis tools.