The modified Moving Average indicator is a straightforward but visually informative forex indicator based on the standard moving average. It draws a modified forex moving average directly in another window of the trading chart. This indicator is available for MT4 versions of the meta trading platform.

In Normal Moving Average, It sums up the last p price and divides the summation by the p (number of samples). Instead, if we divide the summation by the value of the last price (e.g., the close price of the last candle), then we have an oscillating MA:

OSC_MA(i) = c0 - [x(i+p) + x(i+p-1) + ... + x(i+1) + x(i)] / x(i) , i = 0 : Bars;Where c0 is a constant to shift the result toward zero (c0 is set to p).

Example and strategy

- For the best accuracy and utilization, it is suggested to use this indicator in the 1-Minute time frame and for the purpose of scalping or day trading.

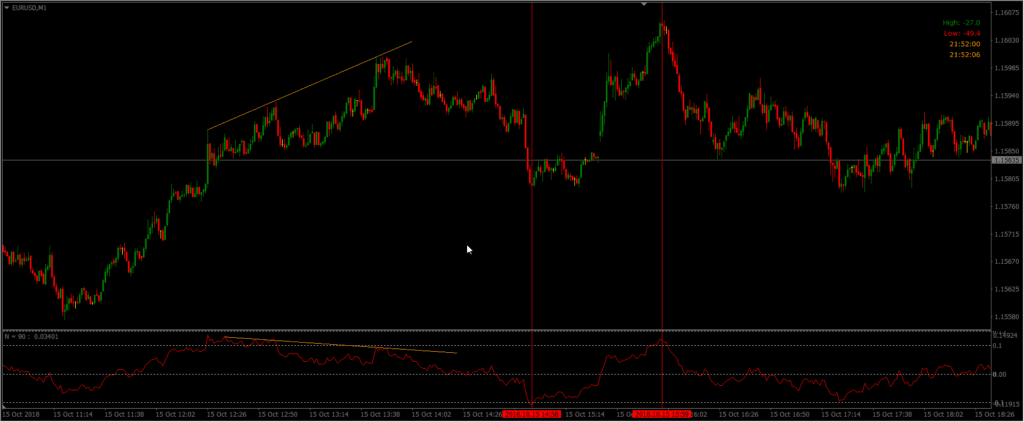

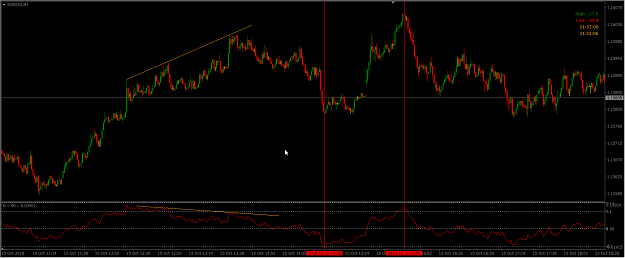

- The indicator is best to use in divergence conditions. When the indicator shows divergence, then I find that the 1-Minute trend (and sometimes hourly trend) reverse soon or price holds at that level (i.e. waiting for divergence and trading in the direction of the hourly trend are vital).

- Regions between 0.1 ~ 0.15 (selling region) & -0.1 ~ -0.15 (buying region) are of concern when default options are set (period = 90 in 1-Minute time frame). Rarely the indicator approaches 0.2 and -0.2 and beyond.

- Attention to the support and resistance zones and trend lines would help the trader for better entry and exit points.

- In a short trend, pullbacks from level “0” may be the initial of consequent waves to reach higher highs or lower lows, and trade the pullback (from 0) in a trend seems a safer trade.

Modified MA Forex indicator system isn’t a standalone trading indicator, This indicator can be very useful for your trading as additional chart analysis, to find trade exit position(TP/SL), and more. While traders of all experience levels can use this system, it can be beneficial to practice trading on an MT4 demo account until you become consistent and confident enough to go live. You can open a real or demo trading account with most of MT4 Forex brokers.

Modified Moving Average Indicator Downloads

Discussion

Warning! If you do not know how to install this forex indicator, please read the MetaTrader Indicators Tutorial.

Do you have any more suggestions regarding this forex indicator? You can always discuss about the modified forex moving average with the other traders and MQL programmers on the indicators forums.

Thanks, the M1 is my favorite TF will definitely observe this indicator and keep updated on my observations

Hello fellow traders. I’m new to this website. I’m surprised to see only 1 comment, to say the least. I’ve backtested this indicator. At 1st I was looking for divergence but then I realized there is another way I can use this tool. Hopefully, it will add value to the reader’s trading.

I added a zero line to the modified moving average, then I added a 100SMA, 20SMA, and a 7SMA.

For Long signal: when the modified MA is above zero and then the 20SMA crosses above the 200SMA. (the 7SMA crossing the 200SMA can be used for more aggressinve entry) Enter long at the close of the candle.

For SHORT signal: when the modified MA is below zero and the 20SMA crosses below the 200SMA. (the 7SMA crossing the 200SMA can be used for more aggressive entry) Enter at the close of the candle.

I was backtesting using a trade simulator on the 1H timeframe. At the writing of this, I had backtested 17 months.

I had a 25pips SL and 100pips TP. I would recommend closing 70% of the position after 50pips.

The modified MA is a good filter and it has a very strong relationship with 100MA and also complements the moving averages very well.

In conclusion in my opinion this indicator can be used with any pair.

20SMA crosses above 100SMA, not the 200SMA.

[…] Moving Average: This component helps confirm the RSI signal, ensuring that the trade aligns with the overall […]

[…] Media móvil suave : este componente ayuda a confirmar la señal RSI, asegurando que la operación se alinee con la tendencia general del mercado. […]