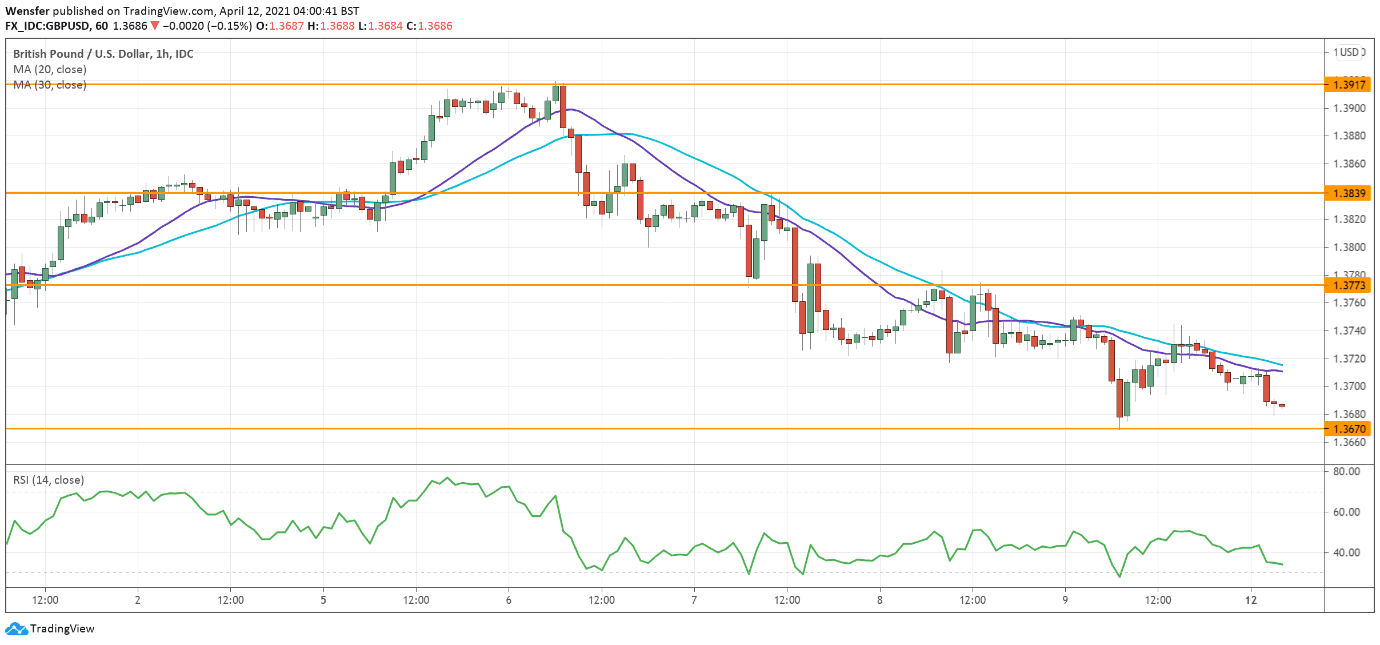

GBPUSD meets critical support

The pound falls back as traders take profit after a strong performance from the start of the year.

The price action has retreated to March’s low at 1.3670, a support on the daily chart to keep the uptrend intact. The pair is likely to consolidate from that major level while the RSI recovers from the sub-30 area.

1.3770 is the immediate resistance and a bullish breakout may convince buyers that the correction is over.

To the downside, 1.3600 would be the target if the pair struggles to find bids.

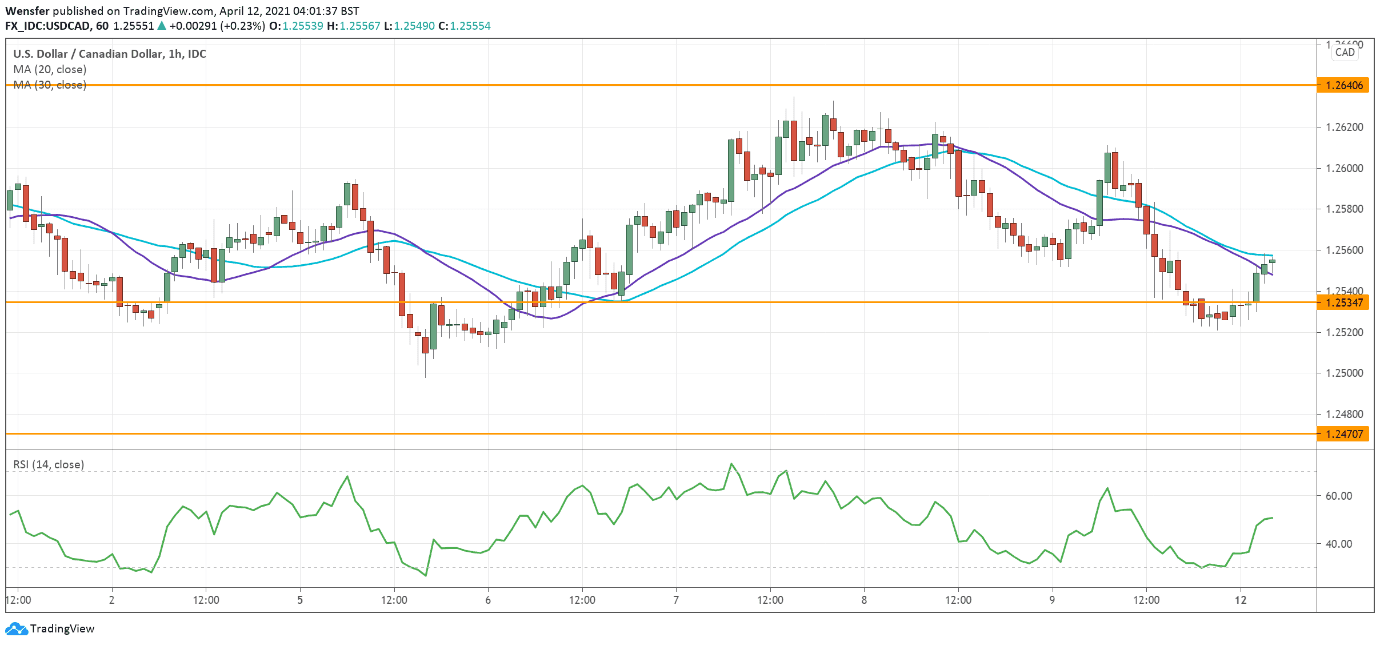

USDCAD struggles to bounce higher

A fall in Canada’s unemployment rate from 8.2 % to 7.5 % in March helped lift the loonie against its US counterpart.

The pair has met strong selling pressure around the supply area (1.2640) found on the daily chart.

An overbought RSI has prompted short-term traders to take profit. However, the price’s subsequent failure to make a higher high signals weakness in the past week’s rally.

A drop below 1.2535 could trigger a broader sell-off in the continuation of the downtrend with 1.2470 as the next target.

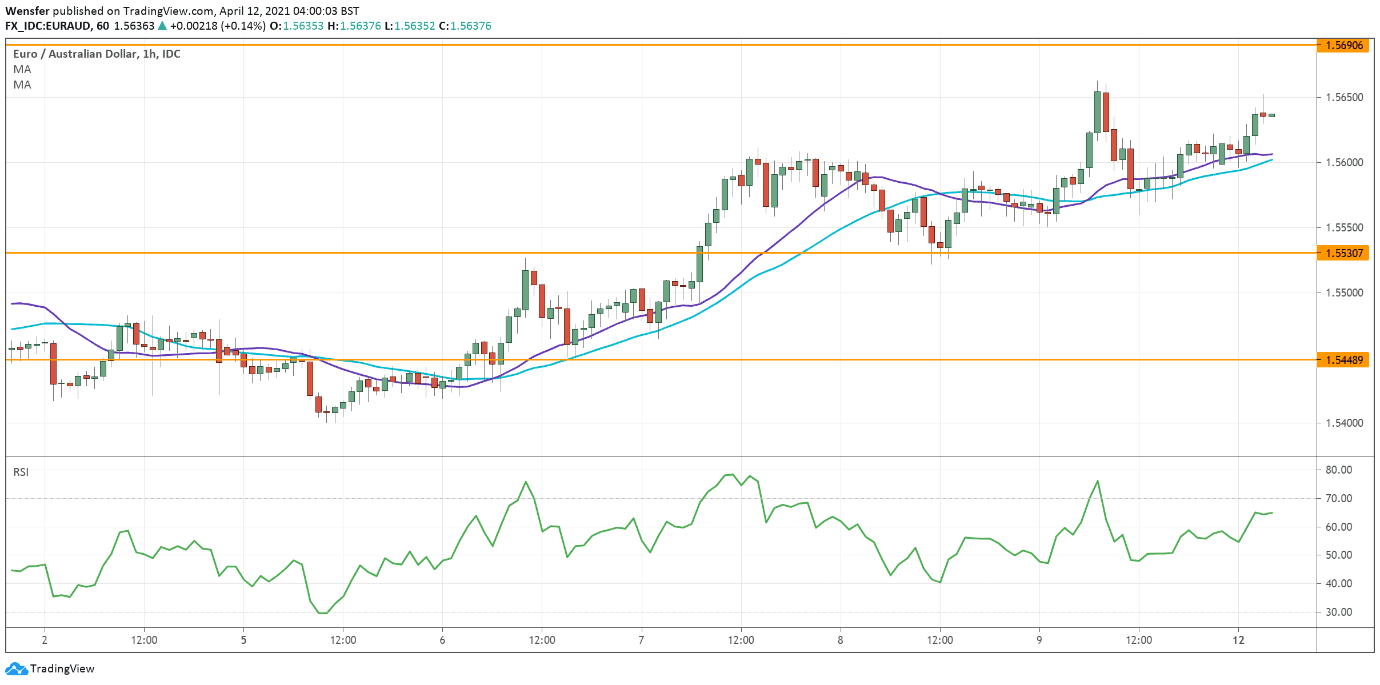

EURAUD pierces through multiple resistances

The Aussie was spoiled by the government’s restrictions on the AstraZeneca vaccine which would delay its vaccination campaign.

After bouncing off a three-year low (1.5260) the euro has been building up its momentum. The latest surge above the key resistance at 1.5600 suggests that buyers are gaining confidence and aiming for 1.5690.

An overbought RSI might temper the optimism and 1.5530 is first support in case of a pullback. As long as the price is above the base of the recent rally (1.5430), the bias will remain bullish.