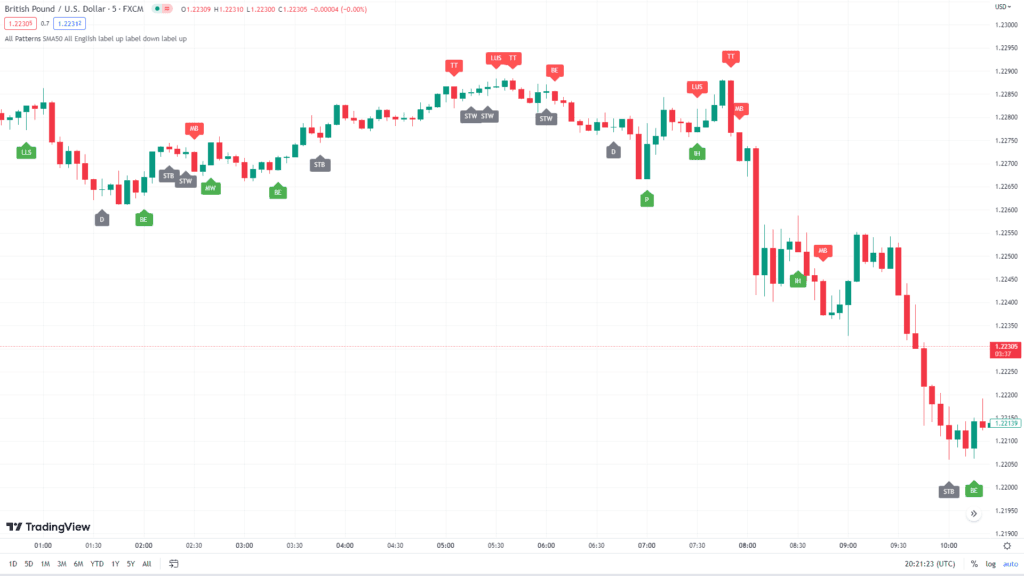

This Candlestick Patterns Detector TradingView Script is an Auto Candlestick Patterns Detector Indicator for TradingView. The emergence of TradingView, a leading social network and charting platform for traders and investors, has dramatically changed the landscape of technical analysis. This platform offers many tools and indicators that help traders make informed decisions. One such powerful addition to TradingView Scripts is the Auto Candlestick Patterns Detector (ACPD).

In this article, we will explore the features and benefits of the Auto Candlestick Patterns Detector. This advanced tool automatically identifies and analyzes candlestick patterns, providing traders with detailed explanations of each pattern when detected.

Table of Contents

What is the Candlestick Patterns Detector Script?

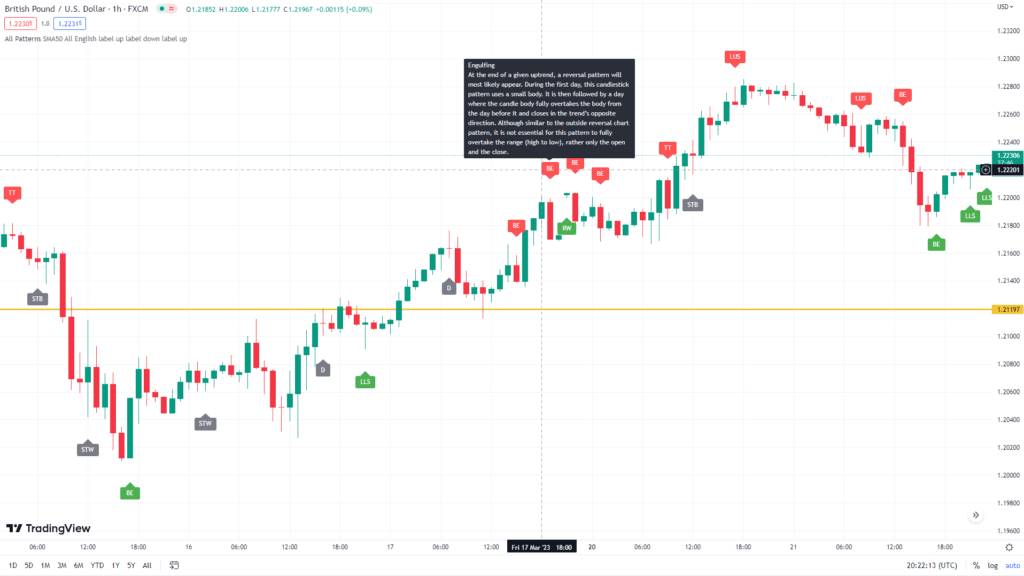

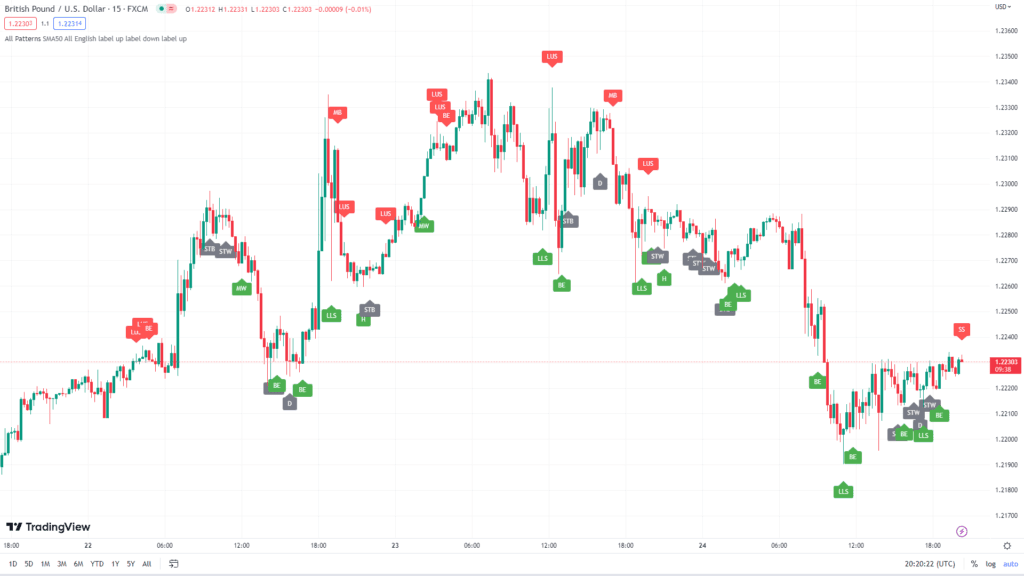

The Auto Candlestick Patterns Detector is an innovative TradingView Script that automatically detects and highlights key candlestick patterns on any chart. This tool is designed to save time and reduce human error by analyzing complex price action data and identifying significant patterns that could signal potential market movements.

This Candlestick Patterns Detector Script can be used on any Forex currency pair and other assets such as commodities, Cryptos, Binary Options, Stock markets, Indices, etc. You can also use it on any time frame that suits you best, from the 1-minutes to the Month charts.

What is Candlestick Patterns

Candlestick patterns are visual representations of price movements in a financial market over a specific period, such as stocks, commodities, or currencies. They are commonly used in technical analysis to predict future price movements and identify potential trading opportunities. Each candlestick consists of a body and wicks (or shadows) that show the opening, closing, high, and low prices for the analyzed period.

Candlestick patterns are based on a Japanese charting technique that dates back to the 18th century. They have gained popularity in Western trading circles due to their ability to convey a large amount of information in a concise, easily interpretable form. Traders use candlestick patterns to identify trend reversals, trend continuation, and market sentiment.

Some of the most common candlestick patterns include:

- Hammer and Hanging Man: These patterns indicate potential trend reversals. A hammer forms at the bottom of a downtrend, while a hanging man appears at the top of an uptrend. Both patterns have a small body with a long lower wick and little to no upper wick.

- Shooting Star and Inverted Hammer: These patterns also signal potential trend reversals. A shooting star forms at the top of an uptrend and has a small body with a long upper wick. An inverted hammer appears at the bottom of a downtrend and has a similar shape but is inverted.

- Bullish and Bearish Engulfing: These patterns indicate strong buying or selling pressure. A bullish engulfing pattern occurs when a small bearish candle is followed by a larger bullish candle that engulfs the previous candle’s body. A bearish engulfing pattern is the opposite, with a small bullish candle followed by a larger bearish candle that engulfs the prior candle’s body.

- Doji: A doji is a candlestick pattern where the opening and closing prices are nearly equal, resulting in a small or nonexistent body. This pattern indicates indecision in the market and can signal a potential trend reversal when it appears after a strong uptrend or downtrend.

- Morning Star and Evening Star: These are three-candle reversal patterns. A morning star occurs at the bottom of a downtrend and consists of a bearish candle, followed by a small-bodied candle (or doji), and then a bullish candle. An evening star is the opposite, appearing at the top of an uptrend with a bullish candle, a small-bodied candle (or doji), and a bearish candle.

These are just a few examples of the candlestick patterns traders use to analyze and predict market movements. Recognizing and understanding these patterns can help traders make more informed decisions and improve their trading strategies.

How it used in Forex Trading

Candlestick patterns are widely used in forex trading to analyze and predict the price movements of currency pairs. They visually represent market sentiment and supply and demand dynamics, helping traders make informed decisions. Here’s how candlestick patterns are utilized in forex trading:

- Identifying Trend Reversals: Candlestick patterns such as hammer, hanging man, shooting star, inverted hammer, morning star, and evening star can signal potential trend reversals. Traders use these patterns to identify when a currency pair’s trend might change direction, allowing them to enter or exit trades at opportune moments.

- Confirming Trend Continuation: Some candlestick patterns, like bullish and bearish engulfing or harami, can help confirm trend continuation. When these patterns appear during an ongoing trend, they suggest that the trend will persist, providing traders with additional confidence in their positions.

- Assessing Market Sentiment: Doji patterns and other indecision candlestick formations can indicate market uncertainty. When these patterns appear, traders may wait for a more decisive pattern or use other technical analysis tools to gain additional insights before making trading decisions.

- Timing Entries and Exits: Candlestick patterns can provide valuable information about potential entry and exit points in the market. For instance, if a trader spots a bullish engulfing pattern after a downtrend, they may consider entering a long position, anticipating that the currency pair will reverse course and start an uptrend.

- Combining with Other Technical Analysis Tools: Traders often use candlestick patterns with other technical analysis tools, such as support and resistance levels, moving averages, and technical indicators (like RSI or MACD). This combination provides a more comprehensive market view, enabling traders to make better-informed decisions.

- Risk Management: Candlestick patterns can also help manage risk. For instance, when a trader enters a trade based on a specific pattern, they may set a stop loss order below the pattern’s low (for a long position) or above the pattern’s high (for a short position). This practice can help limit potential losses if the market moves against their trade.

In summary, candlestick patterns are valuable tools in forex trading, assisting traders in identifying trend reversals and continuations, assessing market sentiment, timing entries, and exits, and managing risk. Forex traders can better understand market dynamics and make more informed decisions by incorporating candlestick analysis into their trading strategies.

Download a Collection of Indicators, Courses, and EA for FREE

Key Features of the Auto Candlestick Patterns Detector

- Comprehensive Pattern Detection: The Candlestick Patterns Detector Script can identify a wide range of candlestick patterns, including popular ones like the Hammer, Shooting Star, Doji, Engulfing, and Morning Star, as well as more obscure patterns that other tools may overlook.

- Real-time Analysis: It continuously analyzes incoming price data to provide real-time pattern detection, ensuring that traders are always up-to-date with the latest market developments.

- Historical Analysis: The ACPD Indicator can also analyze historical price data, giving traders insights into past market behavior and potential future trends.

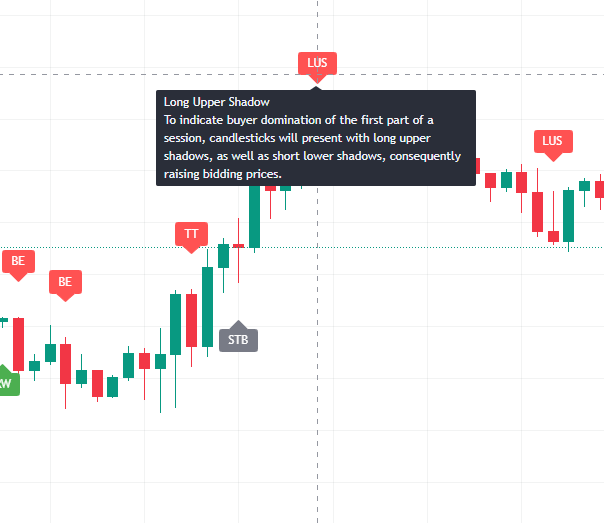

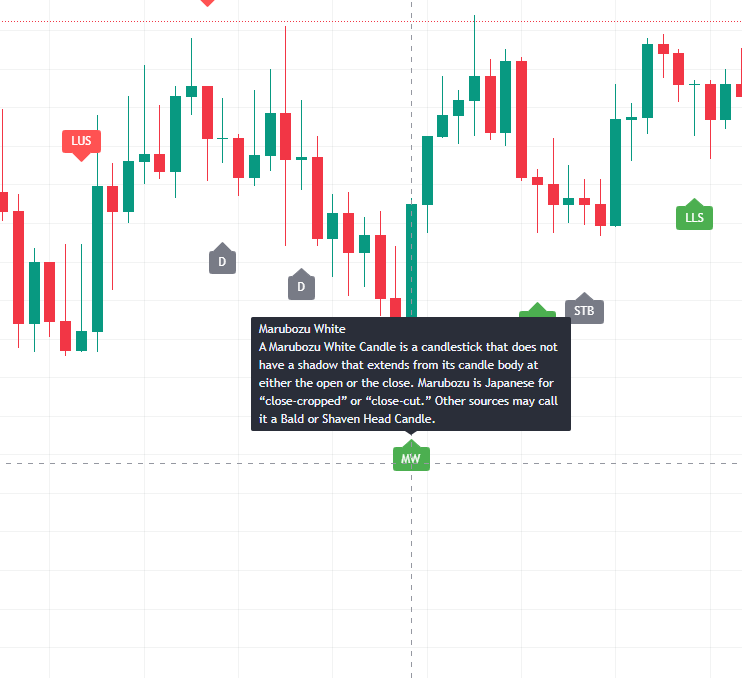

- Detailed Explanation: When the Candlestick Patterns Detector Tradingview detects a candlestick pattern, it provides a detailed explanation of the pattern. This feature is handy when traders hover their mouse cursor over the pattern, as it offers immediate insight into the significance of the detected pattern.

Candlestick Patterns Detecteble by this ACPD Indicator

- Abandoned Baby

- Dark Cloud Cover

- Doji

- Doji Star

- Downside Tasuki Gap

- Dragonfly Doji

- Engulfing

- Evening Doji Star

- Evening Star

- Falling Three Methods

- Falling Window

- Gravestone Doji

- Hammer

- Hanging Man

- Long Upper Shadow

- Marubozu Black

- Marubozu White

- Morning Doji Star

- Morning Star

- On Neck

- Piercing

- Rising Three Methods

- Rising Window

- Shooting Star

- Spinning Top Black

- Spinning Top White

- Three Black Crows

- Three White Soldiers

- Tweezer Bottom

- Tweezer Top

- Up Gap Side by Side White Lines

- Upside Gap Two Crows

- Upside Tasuki Gap

Candlestick Patterns Detector Script

//@version=4

study("*All Candlestick Patterns*", shorttitle = "All Patterns", overlay=true)

C_DownTrend = true

C_UpTrend = true

var trendRule1 = "SMA50"

var trendRule2 = "SMA50, SMA200"

var trendRule = input(trendRule1, "Detect Trend Based On", options=[trendRule1, trendRule2, "No detection"])

if trendRule == trendRule1

priceAvg = sma(close, 50)

C_DownTrend := close < priceAvg

C_UpTrend := close > priceAvg

if trendRule == trendRule2

sma200 = sma(close, 200)

sma50 = sma(close, 50)

C_DownTrend := close < sma50 and sma50 < sma200

C_UpTrend := close > sma50 and sma50 > sma200

C_Len = 14 // ema depth for bodyAvg

C_ShadowPercent = 5.0 // size of shadows

C_ShadowEqualsPercent = 100.0

C_DojiBodyPercent = 5.0

C_Factor = 2.0 // shows the number of times the shadow dominates the candlestick body

C_BodyHi = max(close, open)

C_BodyLo = min(close, open)

C_Body = C_BodyHi - C_BodyLo

C_BodyAvg = ema(C_Body, C_Len)

C_SmallBody = C_Body < C_BodyAvg

C_LongBody = C_Body > C_BodyAvg

C_UpShadow = high - C_BodyHi

C_DnShadow = C_BodyLo - low

C_HasUpShadow = C_UpShadow > C_ShadowPercent / 100 * C_Body

C_HasDnShadow = C_DnShadow > C_ShadowPercent / 100 * C_Body

C_WhiteBody = open < close

C_BlackBody = open > close

C_Range = high-low

C_IsInsideBar = C_BodyHi[1] > C_BodyHi and C_BodyLo[1] < C_BodyLo

C_BodyMiddle = C_Body / 2 + C_BodyLo

C_ShadowEquals = C_UpShadow == C_DnShadow or (abs(C_UpShadow - C_DnShadow) / C_DnShadow * 100) < C_ShadowEqualsPercent and (abs(C_DnShadow - C_UpShadow) / C_UpShadow * 100) < C_ShadowEqualsPercent

C_IsDojiBody = C_Range > 0 and C_Body <= C_Range * C_DojiBodyPercent / 100

C_Doji = C_IsDojiBody and C_ShadowEquals

patternLabelPosLow = low - (atr(30) * 0.6)

patternLabelPosHigh = high + (atr(30) * 0.6)

CandleType = input(title = "Pattern Type", defval="All", options=["Bullish", "Bearish", "Neutral", "All", "Except Neutral"])

language = input(title = "Language", defval="English")

bullishColor = input(title="Bullish Color", type=input.color, defval=color.green)

bearishColor = input(title="Bearish Color", type=input.color, defval=color.red)

neutralColor = input(title="Neutral Color", type=input.color, defval=color.gray)

textColor = input(title="Text Color", type=input.color, defval=color.white)

labelOptions = array.new_string(1, 'none')

array.push(labelOptions, 'xcross')

array.push(labelOptions, 'cross')

array.push(labelOptions, 'scross')

array.push(labelOptions, 'scross')

getLabel(name) =>

(name == 'none') ? label.style_none : (name == 'xcross') ? label.style_xcross : (name == 'cross') ? label.style_cross : (name == 'triangle up') ? label.style_triangleup : (name == 'triangle down') ? label.style_triangledown : (name == 'flag') ? label.style_flag : (name == 'circle') ? label.style_circle : (name == 'arrow up') ? label.style_arrowup : (name == 'arrow down') ? label.style_arrowdown : (name == 'label up') ? label.style_label_up : (name == 'label down') ? label.style_label_down : (name == 'square') ? label.style_square : label.style_diamond

bullishLabel = getLabel(input(title="Bullish Label", options=['none', 'xcross', 'cross', 'triangle up', 'triangle down', 'flag', 'circle', 'arrow up', 'arrow down', 'label up', 'label down', 'square', 'diamond'], defval='label up'))

bearishLabel = getLabel(input(title="Bearish Label", options=['none', 'xcross', 'cross', 'triangle up', 'triangle down', 'flag', 'circle', 'arrow up', 'arrow down', 'label up', 'label down', 'square', 'diamond'], defval='label down'))

neutralLabel = getLabel(input(title="Neutral Label", options=['none', 'xcross', 'cross', 'triangle up', 'triangle down', 'flag', 'circle', 'arrow up', 'arrow down', 'label up', 'label down', 'square', 'diamond'], defval='label up'))

AbandonedBabyInput = input(title = "Abandoned Baby", defval=true)

DarkCloudCoverInput = input(title = "Dark Cloud Cover", defval=true)

DojiInput = input(title = "Doji", defval=true)

DojiStarInput = input(title = "Doji Star", defval=true)

DownsideTasukiGapInput = input(title = "Downside Tasuki Gap", defval=true)

DragonflyDojiInput = input(title = "Dragonfly Doji", defval=true)

EngulfingInput = input(title = "Engulfing", defval=true)

EveningDojiStarInput = input(title = "Evening Doji Star", defval=true)

EveningStarInput = input(title = "Evening Star", defval=true)

FallingThreeMethodsInput = input(title = "Falling Three Methods", defval=true)

FallingWindowInput = input(title = "Falling Window", defval=true)

GravestoneDojiInput = input(title = "Gravestone Doji", defval=true)

HammerInput = input(title = "Hammer", defval=true)

HangingManInput = input(title = "Hanging Man", defval=true)

HaramiCrossInput = input(title = "Harami Cross", defval=true)

HaramiInput = input(title = "Harami", defval=true)

InvertedHammerInput = input(title = "Inverted Hammer", defval=true)

KickingInput = input(title = "Kicking", defval=true)

LongLowerShadowInput = input(title = "Long Lower Shadow", defval=true)

LongUpperShadowInput = input(title = "Long Upper Shadow", defval=true)

MarubozuBlackInput = input(title = "Marubozu Black", defval=true)

MarubozuWhiteInput = input(title = "Marubozu White", defval=true)

MorningDojiStarInput = input(title = "Morning Doji Star", defval=true)

MorningStarInput = input(title = "Morning Star", defval=true)

OnNeckInput = input(title = "On Neck", defval=true)

PiercingInput = input(title = "Piercing", defval=true)

RisingThreeMethodsInput = input(title = "Rising Three Methods", defval=true)

RisingWindowInput = input(title = "Rising Window", defval=true)

ShootingStarInput = input(title = "Shooting Star", defval=true)

SpinningTopBlackInput = input(title = "Spinning Top Black", defval=true)

SpinningTopWhiteInput = input(title = "Spinning Top White", defval=true)

ThreeBlackCrowsInput = input(title = "Three Black Crows", defval=true)

ThreeWhiteSoldiersInput = input(title = "Three White Soldiers", defval=true)

TriStarInput = input(title = "Tri-Star", defval=true)

TweezerBottomInput = input(title = "Tweezer Bottom", defval=true)

TweezerTopInput = input(title = "Tweezer Top", defval=true)

UpsideTasukiGapInput = input(title = "Upside Tasuki Gap", defval=true)

var showBearishSignal = (CandleType =="Bearish" or CandleType == "All" or CandleType == "Except Neutral")

var showBullishSignal = (CandleType =="Bullish" or CandleType == "All" or CandleType == "Except Neutral")

var showNeutralSignal = (CandleType =="Neutral" or CandleType == "All")

getBullishLabel(text, tooltip) =>

label.new(bar_index, patternLabelPosLow, text = text, style = bullishLabel, color = bullishColor, textcolor = textColor, tooltip = tooltip)

getBearishLabel(text, tooltip) =>

label.new(bar_index, patternLabelPosHigh, text = text, style = bearishLabel, color = bearishColor, textcolor = textColor, tooltip = tooltip)

getNeutralLabel(text, tooltip) =>

label.new(bar_index, patternLabelPosLow, text = text, style = neutralLabel, color = neutralColor, textcolor = textColor, tooltip = tooltip)

C_OnNeckBearishNumberOfCandles = 2

C_OnNeckBearish = false

if C_DownTrend and C_BlackBody[1] and C_LongBody[1] and C_WhiteBody and open < close[1] and C_SmallBody and C_Range!=0 and abs(close-low[1])<=C_BodyAvg*0.05

C_OnNeckBearish := true

alertcondition(C_OnNeckBearish, title = "On Neck", message = "New On Neck - Bearish pattern detected.")

if C_OnNeckBearish and OnNeckInput and showBearishSignal

var ttBearishOnNeck = "On Neck\nOn Neck is a two-line continuation pattern found in a downtrend. The first candle is long and red, the second candle is short and has a green body. The closing price of the second candle is close or equal to the first candle's low price. The pattern hints at a continuation of a downtrend, and penetrating the low of the green candlestick is sometimes considered a confirmation. "

getBearishLabel("ON", ttBearishOnNeck)

C_RisingWindowBullishNumberOfCandles = 2

C_RisingWindowBullish = false

if C_UpTrend[1] and (C_Range!=0 and C_Range[1]!=0) and low > high[1]

C_RisingWindowBullish := true

alertcondition(C_RisingWindowBullish, title = "Rising Window", message = "New Rising Window - Bullish pattern detected.")

if C_RisingWindowBullish and RisingWindowInput and showBullishSignal

var ttBullishRisingWindow = "Rising Window\nRising Window is a two-candle bullish continuation pattern that forms during an uptrend. Both candles in the pattern can be of any type with the exception of the Four-Price Doji. The most important characteristic of the pattern is a price gap between the first candle's high and the second candle's low. That gap (window) between two bars signifies support against the selling pressure."

getBullishLabel("RW", ttBullishRisingWindow)

C_FallingWindowBearishNumberOfCandles = 2

C_FallingWindowBearish = false

if C_DownTrend[1] and (C_Range!=0 and C_Range[1]!=0) and high < low[1]

C_FallingWindowBearish := true

alertcondition(C_FallingWindowBearish, title = "Falling Window", message = "New Falling Window - Bearish pattern detected.")

if C_FallingWindowBearish and FallingWindowInput and showBearishSignal

var ttBearishFallingWindow = "Falling Window\nFalling Window is a two-candle bearish continuation pattern that forms during a downtrend. Both candles in the pattern can be of any type, with the exception of the Four-Price Doji. The most important characteristic of the pattern is a price gap between the first candle's low and the second candle's high. The existence of this gap (window) means that the bearish trend is expected to continue."

getBearishLabel("FW", ttBearishFallingWindow)

C_FallingThreeMethodsBearishNumberOfCandles = 5

C_FallingThreeMethodsBearish = false

if C_DownTrend[4] and (C_LongBody[4] and C_BlackBody[4]) and (C_SmallBody[3] and C_WhiteBody[3] and open[3]>low[4] and close[3]<high[4]) and (C_SmallBody[2] and C_WhiteBody[2] and open[2]>low[4] and close[2]<high[4]) and (C_SmallBody[1] and C_WhiteBody[1] and open[1]>low[4] and close[1]<high[4]) and (C_LongBody and C_BlackBody and close<close[4])

C_FallingThreeMethodsBearish := true

alertcondition(C_FallingThreeMethodsBearish, title = "Falling Three Methods", message = "New Falling Three Methods - Bearish pattern detected.")

if C_FallingThreeMethodsBearish and FallingThreeMethodsInput and showBearishSignal

var ttBearishFallingThreeMethods = "Falling Three Methods\nFalling Three Methods is a five-candle bearish pattern that signifies a continuation of an existing downtrend. The first candle is long and red, followed by three short green candles with bodies inside the range of the first candle. The last candle is also red and long and it closes below the close of the first candle. This decisive fifth strongly bearish candle hints that bulls could not reverse the prior downtrend and that bears have regained control of the market."

getBearishLabel("FTM", ttBearishFallingThreeMethods)

C_RisingThreeMethodsBullishNumberOfCandles = 5

C_RisingThreeMethodsBullish = false

if C_UpTrend[4] and (C_LongBody[4] and C_WhiteBody[4]) and (C_SmallBody[3] and C_BlackBody[3] and open[3]<high[4] and close[3]>low[4]) and (C_SmallBody[2] and C_BlackBody[2] and open[2]<high[4] and close[2]>low[4]) and (C_SmallBody[1] and C_BlackBody[1] and open[1]<high[4] and close[1]>low[4]) and (C_LongBody and C_WhiteBody and close>close[4])

C_RisingThreeMethodsBullish := true

alertcondition(C_RisingThreeMethodsBullish, title = "Rising Three Methods", message = "New Rising Three Methods - Bullish pattern detected.")

if C_RisingThreeMethodsBullish and RisingThreeMethodsInput and showBullishSignal

var ttBullishRisingThreeMethods = "Rising Three Methods\nRising Three Methods is a five-candle bullish pattern that signifies a continuation of an existing uptrend. The first candle is long and green, followed by three short red candles with bodies inside the range of the first candle. The last candle is also green and long and it closes above the close of the first candle. This decisive fifth strongly bullish candle hints that bears could not reverse the prior uptrend and that bulls have regained control of the market."

getBullishLabel("RTM", ttBullishRisingThreeMethods)

C_TweezerTopBearishNumberOfCandles = 2

C_TweezerTopBearish = false

if C_UpTrend[1] and (not C_IsDojiBody or (C_HasUpShadow and C_HasDnShadow)) and abs(high-high[1]) <= C_BodyAvg*0.05 and C_WhiteBody[1] and C_BlackBody and C_LongBody[1]

C_TweezerTopBearish := true

alertcondition(C_TweezerTopBearish, title = "Tweezer Top", message = "New Tweezer Top - Bearish pattern detected.")

if C_TweezerTopBearish and TweezerTopInput and showBearishSignal

var ttBearishTweezerTop = "Tweezer Top\nTweezer Top is a two-candle pattern that signifies a potential bearish reversal. The pattern is found during an uptrend. The first candle is long and green, the second candle is red, and its high is nearly identical to the high of the previous candle. The virtually identical highs, together with the inverted directions, hint that bears might be taking over the market."

getBearishLabel("TT", ttBearishTweezerTop)

C_TweezerBottomBullishNumberOfCandles = 2

C_TweezerBottomBullish = false

if C_UpTrend[1] and (not C_IsDojiBody or (C_HasUpShadow and C_HasDnShadow)) and abs(low-low[1]) <= C_BodyAvg*0.05 and C_BlackBody[1] and C_WhiteBody and C_LongBody[1]

C_TweezerBottomBullish := true

alertcondition(C_TweezerBottomBullish, title = "Tweezer Bottom", message = "New Tweezer Bottom - Bullish pattern detected.")

if C_TweezerBottomBullish and TweezerBottomInput and showBullishSignal

var ttBullishTweezerBottom = "Tweezer Bottom\nTweezer Bottom is a two-candle pattern that signifies a potential bullish reversal. The pattern is found during a downtrend. The first candle is long and red, the second candle is green, its lows nearly identical to the low of the previous candle. The virtually identical lows together with the inverted directions hint that bulls might be taking over the market."

getBullishLabel("TB", ttBullishTweezerBottom)

C_DarkCloudCoverBearishNumberOfCandles = 2

C_DarkCloudCoverBearish = false

if (C_UpTrend[1] and C_WhiteBody[1] and C_LongBody[1]) and (C_BlackBody and open >= high[1] and close < C_BodyMiddle[1] and close > open[1])

C_DarkCloudCoverBearish := true

alertcondition(C_DarkCloudCoverBearish, title = "Dark Cloud Cover", message = "New Dark Cloud Cover - Bearish pattern detected.")

if C_DarkCloudCoverBearish and DarkCloudCoverInput and showBearishSignal

var ttBearishDarkCloudCover = "Dark Cloud Cover\nDark Cloud Cover is a two-candle bearish reversal candlestick pattern found in an uptrend. The first candle is green and has a larger than average body. The second candle is red and opens above the high of the prior candle, creating a gap, and then closes below the midpoint of the first candle. The pattern shows a possible shift in the momentum from the upside to the downside, indicating that a reversal might happen soon."

getBearishLabel("DCC", ttBearishDarkCloudCover)

C_DownsideTasukiGapBearishNumberOfCandles = 3

C_DownsideTasukiGapBearish = false

if C_LongBody[2] and C_SmallBody[1] and C_DownTrend and C_BlackBody[2] and C_BodyHi[1] < C_BodyLo[2] and C_BlackBody[1] and C_WhiteBody and C_BodyHi <= C_BodyLo[2] and C_BodyHi >= C_BodyHi[1]

C_DownsideTasukiGapBearish := true

alertcondition(C_DownsideTasukiGapBearish, title = "Downside Tasuki Gap", message = "New Downside Tasuki Gap - Bearish pattern detected.")

if C_DownsideTasukiGapBearish and DownsideTasukiGapInput and showBearishSignal

var ttBearishDownsideTasukiGap = "Downside Tasuki Gap\nDownside Tasuki Gap is a three-candle pattern found in a downtrend that usually hints at the continuation of the downtrend. The first candle is long and red, followed by a smaller red candle with its opening price that gaps below the body of the previous candle. The third candle is green and it closes inside the gap created by the first two candles, unable to close it fully. The bull’s inability to close that gap hints that the downtrend might continue."

getBearishLabel("DTG", ttBearishDownsideTasukiGap)

C_UpsideTasukiGapBullishNumberOfCandles = 3

C_UpsideTasukiGapBullish = false

if C_LongBody[2] and C_SmallBody[1] and C_UpTrend and C_WhiteBody[2] and C_BodyLo[1] > C_BodyHi[2] and C_WhiteBody[1] and C_BlackBody and C_BodyLo >= C_BodyHi[2] and C_BodyLo <= C_BodyLo[1]

C_UpsideTasukiGapBullish := true

alertcondition(C_UpsideTasukiGapBullish, title = "Upside Tasuki Gap", message = "New Upside Tasuki Gap - Bullish pattern detected.")

if C_UpsideTasukiGapBullish and UpsideTasukiGapInput and showBullishSignal

var ttBullishUpsideTasukiGap = "Upside Tasuki Gap\nUpside Tasuki Gap is a three-candle pattern found in an uptrend that usually hints at the continuation of the uptrend. The first candle is long and green, followed by a smaller green candle with its opening price that gaps above the body of the previous candle. The third candle is red and it closes inside the gap created by the first two candles, unable to close it fully. The bear’s inability to close the gap hints that the uptrend might continue."

getBullishLabel("UTG", ttBullishUpsideTasukiGap)

C_EveningDojiStarBearishNumberOfCandles = 3

C_EveningDojiStarBearish = false

if C_LongBody[2] and C_IsDojiBody[1] and C_LongBody and C_UpTrend and C_WhiteBody[2] and C_BodyLo[1] > C_BodyHi[2] and C_BlackBody and C_BodyLo <= C_BodyMiddle[2] and C_BodyLo > C_BodyLo[2] and C_BodyLo[1] > C_BodyHi

C_EveningDojiStarBearish := true

alertcondition(C_EveningDojiStarBearish, title = "Evening Doji Star", message = "New Evening Doji Star - Bearish pattern detected.")

if C_EveningDojiStarBearish and EveningDojiStarInput and showBearishSignal

var ttBearishEveningDojiStar = "Evening Doji Star\nThis candlestick pattern is a variation of the Evening Star pattern. It is bearish and continues an uptrend with a long-bodied, green candle day. It is then followed by a gap and a Doji candle and concludes with a downward close. The close would be below the first day’s midpoint. It is more bearish than the regular evening star pattern because of the existence of the Doji."

getBearishLabel("EDS", ttBearishEveningDojiStar)

C_DojiStarBearishNumberOfCandles = 2

C_DojiStarBearish = false

if C_UpTrend and C_WhiteBody[1] and C_LongBody[1] and C_IsDojiBody and C_BodyLo > C_BodyHi[1]

C_DojiStarBearish := true

alertcondition(C_DojiStarBearish, title = "Doji Star", message = "New Doji Star - Bearish pattern detected.")

if C_DojiStarBearish and DojiStarInput and showBearishSignal

var ttBearishDojiStar = "Doji Star\nThis is a bearish reversal candlestick pattern that is found in an uptrend and consists of two candles. First comes a long green candle, followed by a Doji candle (except 4-Price Doji) that opens above the body of the first one, creating a gap. It is considered a reversal signal with confirmation during the next trading day."

getBearishLabel("DS", ttBearishDojiStar)

C_DojiStarBullishNumberOfCandles = 2

C_DojiStarBullish = false

if C_DownTrend and C_BlackBody[1] and C_LongBody[1] and C_IsDojiBody and C_BodyHi < C_BodyLo[1]

C_DojiStarBullish := true

alertcondition(C_DojiStarBullish, title = "Doji Star", message = "New Doji Star - Bullish pattern detected.")

if C_DojiStarBullish and DojiStarInput and showBullishSignal

var ttBullishDojiStar = "Doji Star\nThis is a bullish reversal candlestick pattern that is found in a downtrend and consists of two candles. First comes a long red candle, followed by a Doji candle (except 4-Price Doji) that opens below the body of the first one, creating a gap. It is considered a reversal signal with confirmation during the next trading day."

getBullishLabel("DS", ttBullishDojiStar)

C_MorningDojiStarBullishNumberOfCandles = 3

C_MorningDojiStarBullish = false

if C_LongBody[2] and C_IsDojiBody[1] and C_LongBody and C_DownTrend and C_BlackBody[2] and C_BodyHi[1] < C_BodyLo[2] and C_WhiteBody and C_BodyHi >= C_BodyMiddle[2] and C_BodyHi < C_BodyHi[2] and C_BodyHi[1] < C_BodyLo

C_MorningDojiStarBullish := true

alertcondition(C_MorningDojiStarBullish, title = "Morning Doji Star", message = "New Morning Doji Star - Bullish pattern detected.")

if C_MorningDojiStarBullish and MorningDojiStarInput and showBullishSignal

var ttBullishMorningDojiStar = "Morning Doji Star\nThis candlestick pattern is a variation of the Morning Star pattern. A three-day bullish reversal pattern, which consists of three candlesticks will look something like this: The first being a long-bodied red candle that extends the current downtrend. Next comes a Doji that gaps down on the open. After that comes a long-bodied green candle, which gaps up on the open and closes above the midpoint of the body of the first day. It is more bullish than the regular morning star pattern because of the existence of the Doji."

getBullishLabel("MDS", ttBullishMorningDojiStar)

C_PiercingBullishNumberOfCandles = 2

C_PiercingBullish = false

if (C_DownTrend[1] and C_BlackBody[1] and C_LongBody[1]) and (C_WhiteBody and open <= low[1] and close > C_BodyMiddle[1] and close < open[1])

C_PiercingBullish := true

alertcondition(C_PiercingBullish, title = "Piercing", message = "New Piercing - Bullish pattern detected.")

if C_PiercingBullish and PiercingInput and showBullishSignal

var ttBullishPiercing = "Piercing\nPiercing is a two-candle bullish reversal candlestick pattern found in a downtrend. The first candle is red and has a larger than average body. The second candle is green and opens below the low of the prior candle, creating a gap, and then closes above the midpoint of the first candle. The pattern shows a possible shift in the momentum from the downside to the upside, indicating that a reversal might happen soon."

getBullishLabel("P", ttBullishPiercing)

C_HammerBullishNumberOfCandles = 1

C_HammerBullish = false

if C_SmallBody and C_Body > 0 and C_BodyLo > hl2 and C_DnShadow >= C_Factor * C_Body and not C_HasUpShadow

if C_DownTrend

C_HammerBullish := true

alertcondition(C_HammerBullish, title = "Hammer", message = "New Hammer - Bullish pattern detected.")

if C_HammerBullish and HammerInput and showBullishSignal

var ttBullishHammer = "Hammer\nHammer candlesticks form when a security moves lower after the open, but continues to rally into close above the intraday low. The candlestick that you are left with will look like a square attached to a long stick-like figure. This candlestick is called a Hammer if it happens to form during a decline."

getBullishLabel("H", ttBullishHammer)

C_HangingManBearishNumberOfCandles = 1

C_HangingManBearish = false

if C_SmallBody and C_Body > 0 and C_BodyLo > hl2 and C_DnShadow >= C_Factor * C_Body and not C_HasUpShadow

if C_UpTrend

C_HangingManBearish := true

alertcondition(C_HangingManBearish, title = "Hanging Man", message = "New Hanging Man - Bearish pattern detected.")

if C_HangingManBearish and HangingManInput and showBearishSignal

var ttBearishHangingMan = "Hanging Man\nWhen a specified security notably moves lower after the open, but continues to rally to close above the intraday low, a Hanging Man candlestick will form. The candlestick will resemble a square, attached to a long stick-like figure. It is referred to as a Hanging Man if the candlestick forms during an advance."

getBearishLabel("HM", ttBearishHangingMan)

C_ShootingStarBearishNumberOfCandles = 1

C_ShootingStarBearish = false

if C_SmallBody and C_Body > 0 and C_BodyHi < hl2 and C_UpShadow >= C_Factor * C_Body and not C_HasDnShadow

if C_UpTrend

C_ShootingStarBearish := true

alertcondition(C_ShootingStarBearish, title = "Shooting Star", message = "New Shooting Star - Bearish pattern detected.")

if C_ShootingStarBearish and ShootingStarInput and showBearishSignal

var ttBearishShootingStar = "Shooting Star\nThis single day pattern can appear during an uptrend and opens high, while it closes near its open. It trades much higher as well. It is bearish in nature, but looks like an Inverted Hammer."

getBearishLabel("SS", ttBearishShootingStar)

C_InvertedHammerBullishNumberOfCandles = 1

C_InvertedHammerBullish = false

if C_SmallBody and C_Body > 0 and C_BodyHi < hl2 and C_UpShadow >= C_Factor * C_Body and not C_HasDnShadow

if C_DownTrend

C_InvertedHammerBullish := true

alertcondition(C_InvertedHammerBullish, title = "Inverted Hammer", message = "New Inverted Hammer - Bullish pattern detected.")

if C_InvertedHammerBullish and InvertedHammerInput and showBullishSignal

var ttBullishInvertedHammer = "Inverted Hammer\nIf in a downtrend, then the open is lower. When it eventually trades higher, but closes near its open, it will look like an inverted version of the Hammer Candlestick. This is a one-day bullish reversal pattern."

getBullishLabel("IH", ttBullishInvertedHammer)

C_MorningStarBullishNumberOfCandles = 3

C_MorningStarBullish = false

if C_LongBody[2] and C_SmallBody[1] and C_LongBody

if C_DownTrend and C_BlackBody[2] and C_BodyHi[1] < C_BodyLo[2] and C_WhiteBody and C_BodyHi >= C_BodyMiddle[2] and C_BodyHi < C_BodyHi[2] and C_BodyHi[1] < C_BodyLo

C_MorningStarBullish := true

alertcondition(C_MorningStarBullish, title = "Morning Star", message = "New Morning Star - Bullish pattern detected.")

if C_MorningStarBullish and MorningStarInput and showBullishSignal

var ttBullishMorningStar = "Morning Star\nA three-day bullish reversal pattern, which consists of three candlesticks will look something like this: The first being a long-bodied red candle that extends the current downtrend. Next comes a short, middle candle that gaps down on the open. After comes a long-bodied green candle, which gaps up on the open and closes above the midpoint of the body of the first day."

getBullishLabel("MS", ttBullishMorningStar)

C_EveningStarBearishNumberOfCandles = 3

C_EveningStarBearish = false

if C_LongBody[2] and C_SmallBody[1] and C_LongBody

if C_UpTrend and C_WhiteBody[2] and C_BodyLo[1] > C_BodyHi[2] and C_BlackBody and C_BodyLo <= C_BodyMiddle[2] and C_BodyLo > C_BodyLo[2] and C_BodyLo[1] > C_BodyHi

C_EveningStarBearish := true

alertcondition(C_EveningStarBearish, title = "Evening Star", message = "New Evening Star - Bearish pattern detected.")

if C_EveningStarBearish and EveningStarInput and showBearishSignal

var ttBearishEveningStar = "Evening Star\nThis candlestick pattern is bearish and continues an uptrend with a long-bodied, green candle day. It is then followed by a gapped and small-bodied candle day, and concludes with a downward close. The close would be below the first day’s midpoint."

getBearishLabel("ES", ttBearishEveningStar)

C_MarubozuWhiteBullishNumberOfCandles = 1

C_MarubozuShadowPercentWhite = 5.0

C_MarubozuWhiteBullish = C_WhiteBody and C_LongBody and C_UpShadow <= C_MarubozuShadowPercentWhite/100*C_Body and C_DnShadow <= C_MarubozuShadowPercentWhite/100*C_Body and C_WhiteBody

alertcondition(C_MarubozuWhiteBullish, title = "Marubozu White", message = "New Marubozu White - Bullish pattern detected.")

if C_MarubozuWhiteBullish and MarubozuWhiteInput and showBullishSignal

var ttBullishMarubozuWhite = "Marubozu White\nA Marubozu White Candle is a candlestick that does not have a shadow that extends from its candle body at either the open or the close. Marubozu is Japanese for “close-cropped” or “close-cut.” Other sources may call it a Bald or Shaven Head Candle."

getBullishLabel("MW", ttBullishMarubozuWhite)

C_MarubozuBlackBearishNumberOfCandles = 1

C_MarubozuShadowPercentBearish = 5.0

C_MarubozuBlackBearish = C_BlackBody and C_LongBody and C_UpShadow <= C_MarubozuShadowPercentBearish/100*C_Body and C_DnShadow <= C_MarubozuShadowPercentBearish/100*C_Body and C_BlackBody

alertcondition(C_MarubozuBlackBearish, title = "Marubozu Black", message = "New Marubozu Black - Bearish pattern detected.")

if C_MarubozuBlackBearish and MarubozuBlackInput and showBearishSignal

var ttBearishMarubozuBlack = "Marubozu Black\nThis is a candlestick that has no shadow, which extends from the red-bodied candle at the open, the close, or even at both. In Japanese, the name means “close-cropped” or “close-cut.” The candlestick can also be referred to as Bald or Shaven Head."

getBearishLabel("MB", ttBearishMarubozuBlack)

C_DojiNumberOfCandles = 1

C_DragonflyDoji = C_IsDojiBody and C_UpShadow <= C_Body

C_GravestoneDojiOne = C_IsDojiBody and C_DnShadow <= C_Body

alertcondition(C_Doji and not C_DragonflyDoji and not C_GravestoneDojiOne, title = "Doji", message = "New Doji pattern detected.")

if C_Doji and not C_DragonflyDoji and not C_GravestoneDojiOne and DojiInput and showNeutralSignal

var ttDoji = "Doji\nWhen the open and close of a security are essentially equal to each other, a doji candle forms. The length of both upper and lower shadows may vary, causing the candlestick you are left with to either resemble a cross, an inverted cross, or a plus sign. Doji candles show the playout of buyer-seller indecision in a tug-of-war of sorts. As price moves either above or below the opening level during the session, the close is either at or near the opening level."

getNeutralLabel("D", ttDoji)

C_GravestoneDojiBearishNumberOfCandles = 1

C_GravestoneDojiBearish = C_IsDojiBody and C_DnShadow <= C_Body

alertcondition(C_GravestoneDojiBearish, title = "Gravestone Doji", message = "New Gravestone Doji - Bearish pattern detected.")

if C_GravestoneDojiBearish and GravestoneDojiInput and showBearishSignal

var ttBearishGravestoneDoji = "Gravestone Doji\nWhen a doji is at or is close to the day’s low point, a doji line will develop."

getBearishLabel("GD", ttBearishGravestoneDoji)

C_DragonflyDojiBullishNumberOfCandles = 1

C_DragonflyDojiBullish = C_IsDojiBody and C_UpShadow <= C_Body

alertcondition(C_DragonflyDojiBullish, title = "Dragonfly Doji", message = "New Dragonfly Doji - Bullish pattern detected.")

if C_DragonflyDojiBullish and DragonflyDojiInput and showBullishSignal

var ttBullishDragonflyDoji = "Dragonfly Doji\nSimilar to other Doji days, this particular Doji also regularly appears at pivotal market moments. This is a specific Doji where both the open and close price are at the high of a given day."

getBullishLabel("DD", ttBullishDragonflyDoji)

C_HaramiCrossBullishNumberOfCandles = 2

C_HaramiCrossBullish = C_LongBody[1] and C_BlackBody[1] and C_DownTrend[1] and C_IsDojiBody and high <= C_BodyHi[1] and low >= C_BodyLo[1]

alertcondition(C_HaramiCrossBullish, title = "Harami Cross", message = "New Harami Cross - Bullish pattern detected.")

if C_HaramiCrossBullish and HaramiCrossInput and showBullishSignal

var ttBullishHaramiCross = "Harami Cross\nThis candlestick pattern is a variation of the Harami Bullish pattern. It is found during a downtrend. The two-day candlestick pattern consists of a Doji candle that is entirely encompassed within the body of what was once a red-bodied candle."

getBullishLabel("HC", ttBullishHaramiCross)

C_HaramiCrossBearishNumberOfCandles = 2

C_HaramiCrossBearish = C_LongBody[1] and C_WhiteBody[1] and C_UpTrend[1] and C_IsDojiBody and high <= C_BodyHi[1] and low >= C_BodyLo[1]

alertcondition(C_HaramiCrossBearish, title = "Harami Cross", message = "New Harami Cross - Bearish pattern detected.")

if C_HaramiCrossBearish and HaramiCrossInput and showBearishSignal

var ttBearishHaramiCross = "Harami Cross\nThis candlestick pattern is a variation of the Harami Bearish pattern. It is found during an uptrend. This is a two-day candlestick pattern with a Doji candle that is entirely encompassed within the body that was once a green-bodied candle. The Doji shows that some indecision has entered the minds of sellers, and the pattern hints that the trend might reverse."

getBearishLabel("HC", ttBearishHaramiCross)

C_HaramiBullishNumberOfCandles = 2

C_HaramiBullish = C_LongBody[1] and C_BlackBody[1] and C_DownTrend[1] and C_WhiteBody and C_SmallBody and high <= C_BodyHi[1] and low >= C_BodyLo[1]

alertcondition(C_HaramiBullish, title = "Harami", message = "New Harami - Bullish pattern detected.")

if C_HaramiBullish and HaramiInput and showBullishSignal

var ttBullishHarami = "Harami\nThis two-day candlestick pattern consists of a small-bodied green candle that is entirely encompassed within the body of what was once a red-bodied candle."

getBullishLabel("BH", ttBullishHarami)

C_HaramiBearishNumberOfCandles = 2

C_HaramiBearish = C_LongBody[1] and C_WhiteBody[1] and C_UpTrend[1] and C_BlackBody and C_SmallBody and high <= C_BodyHi[1] and low >= C_BodyLo[1]

alertcondition(C_HaramiBearish, title = "Harami", message = "New Harami - Bearish pattern detected.")

if C_HaramiBearish and HaramiInput and showBearishSignal

var ttBearishHarami = "Harami\nThis is a two-day candlestick pattern with a small, red-bodied candle that is entirely encompassed within the body that was once a green-bodied candle."

getBearishLabel("BH", ttBearishHarami)

C_LongLowerShadowBullishNumberOfCandles = 1

C_LongLowerShadowPercent = 75.0

C_LongLowerShadowBullish = C_DnShadow > C_Range/100*C_LongLowerShadowPercent

alertcondition(C_LongLowerShadowBullish, title = "Long Lower Shadow", message = "New Long Lower Shadow - Bullish pattern detected.")

if C_LongLowerShadowBullish and LongLowerShadowInput and showBullishSignal

var ttBullishLongLowerShadow = "Long Lower Shadow\nTo indicate seller domination of the first part of a session, candlesticks will present with long lower shadows and short upper shadows, consequently lowering prices."

getBullishLabel("LLS", ttBullishLongLowerShadow)

C_LongUpperShadowBearishNumberOfCandles = 1

C_LongShadowPercent = 75.0

C_LongUpperShadowBearish = C_UpShadow > C_Range/100*C_LongShadowPercent

alertcondition(C_LongUpperShadowBearish, title = "Long Upper Shadow", message = "New Long Upper Shadow - Bearish pattern detected.")

if C_LongUpperShadowBearish and LongUpperShadowInput and showBearishSignal

var ttBearishLongUpperShadow = "Long Upper Shadow\nTo indicate buyer domination of the first part of a session, candlesticks will present with long upper shadows, as well as short lower shadows, consequently raising bidding prices."

getBearishLabel("LUS", ttBearishLongUpperShadow)

C_SpinningTopWhiteNumberOfCandles = 1

C_SpinningTopWhitePercent = 34.0

C_IsSpinningTopWhite = C_DnShadow >= C_Range / 100 * C_SpinningTopWhitePercent and C_UpShadow >= C_Range / 100 * C_SpinningTopWhitePercent and not C_IsDojiBody

C_SpinningTopWhite = C_IsSpinningTopWhite and C_WhiteBody

alertcondition(C_SpinningTopWhite, title = "Spinning Top White", message = "New Spinning Top White pattern detected.")

if C_SpinningTopWhite and SpinningTopWhiteInput and showNeutralSignal

var ttSpinningTopWhite = "Spinning Top White\nWhite spinning tops are candlestick lines that are small, green-bodied, and possess shadows (upper and lower) that end up exceeding the length of candle bodies. They often signal indecision between buyer and seller."

getNeutralLabel("STW", ttSpinningTopWhite)

C_SpinningTopBlackNumberOfCandles = 1

C_SpinningTopBlackPercent = 34.0

C_IsSpinningTop = C_DnShadow >= C_Range / 100 * C_SpinningTopBlackPercent and C_UpShadow >= C_Range / 100 * C_SpinningTopBlackPercent and not C_IsDojiBody

C_SpinningTopBlack = C_IsSpinningTop and C_BlackBody

alertcondition(C_SpinningTopBlack, title = "Spinning Top Black", message = "New Spinning Top Black pattern detected.")

if C_SpinningTopBlack and SpinningTopBlackInput and showNeutralSignal

var ttSpinningTopBlack = "Spinning Top Black\nBlack spinning tops are candlestick lines that are small, red-bodied, and possess shadows (upper and lower) that end up exceeding the length of candle bodies. They often signal indecision."

getNeutralLabel("STB", ttSpinningTopBlack)

C_ThreeWhiteSoldiersBullishNumberOfCandles = 3

C_3WSld_ShadowPercent = 5.0

C_3WSld_HaveNotUpShadow = C_Range * C_3WSld_ShadowPercent / 100 > C_UpShadow

C_ThreeWhiteSoldiersBullish = false

if C_LongBody and C_LongBody[1] and C_LongBody[2]

if C_WhiteBody and C_WhiteBody[1] and C_WhiteBody[2]

C_ThreeWhiteSoldiersBullish := close > close[1] and close[1] > close[2] and open < close[1] and open > open[1] and open[1] < close[2] and open[1] > open[2] and C_3WSld_HaveNotUpShadow and C_3WSld_HaveNotUpShadow[1] and C_3WSld_HaveNotUpShadow[2]

alertcondition(C_ThreeWhiteSoldiersBullish, title = "Three White Soldiers", message = "New Three White Soldiers - Bullish pattern detected.")

if C_ThreeWhiteSoldiersBullish and ThreeWhiteSoldiersInput and showBullishSignal

var ttBullishThreeWhiteSoldiers = "Three White Soldiers\nThis bullish reversal pattern is made up of three long-bodied, green candles in immediate succession. Each one opens within the body before it and the close is near to the daily high."

getBullishLabel("3WS", ttBullishThreeWhiteSoldiers)

C_ThreeBlackCrowsBearishNumberOfCandles = 3

C_3BCrw_ShadowPercent = 5.0

C_3BCrw_HaveNotDnShadow = C_Range * C_3BCrw_ShadowPercent / 100 > C_DnShadow

C_ThreeBlackCrowsBearish = false

if C_LongBody and C_LongBody[1] and C_LongBody[2]

if C_BlackBody and C_BlackBody[1] and C_BlackBody[2]

C_ThreeBlackCrowsBearish := close < close[1] and close[1] < close[2] and open > close[1] and open < open[1] and open[1] > close[2] and open[1] < open[2] and C_3BCrw_HaveNotDnShadow and C_3BCrw_HaveNotDnShadow[1] and C_3BCrw_HaveNotDnShadow[2]

alertcondition(C_ThreeBlackCrowsBearish, title = "Three Black Crows", message = "New Three Black Crows - Bearish pattern detected.")

if C_ThreeBlackCrowsBearish and ThreeBlackCrowsInput and showBearishSignal

var ttBearishThreeBlackCrows = "Three Black Crows\nThis is a bearish reversal pattern that consists of three long, red-bodied candles in immediate succession. For each of these candles, each day opens within the body of the day before and closes either at or near its low."

getBearishLabel("3BC", ttBearishThreeBlackCrows)

C_EngulfingBullishNumberOfCandles = 2

C_EngulfingBullish = C_DownTrend and C_WhiteBody and C_LongBody and C_BlackBody[1] and C_SmallBody[1] and close >= open[1] and open <= close[1] and ( close > open[1] or open < close[1] )

alertcondition(C_EngulfingBullish, title = "Engulfing", message = "New Engulfing - Bullish pattern detected.")

if C_EngulfingBullish and EngulfingInput and showBullishSignal

var ttBullishEngulfing = "Engulfing\nAt the end of a given downward trend, there will most likely be a reversal pattern. To distinguish the first day, this candlestick pattern uses a small body, followed by a day where the candle body fully overtakes the body from the day before, and closes in the trend’s opposite direction. Although similar to the outside reversal chart pattern, it is not essential for this pattern to completely overtake the range (high to low), rather only the open and the close."

getBullishLabel("BE", ttBullishEngulfing)

C_EngulfingBearishNumberOfCandles = 2

C_EngulfingBearish = C_UpTrend and C_BlackBody and C_LongBody and C_WhiteBody[1] and C_SmallBody[1] and close <= open[1] and open >= close[1] and ( close < open[1] or open > close[1] )

alertcondition(C_EngulfingBearish, title = "Engulfing", message = "New Engulfing - Bearish pattern detected.")

if C_EngulfingBearish and EngulfingInput and showBearishSignal

var ttBearishEngulfing = "Engulfing\nAt the end of a given uptrend, a reversal pattern will most likely appear. During the first day, this candlestick pattern uses a small body. It is then followed by a day where the candle body fully overtakes the body from the day before it and closes in the trend’s opposite direction. Although similar to the outside reversal chart pattern, it is not essential for this pattern to fully overtake the range (high to low), rather only the open and the close."

getBearishLabel("BE", ttBearishEngulfing)

C_AbandonedBabyBullishNumberOfCandles = 3

C_AbandonedBabyBullish = C_DownTrend[2] and C_BlackBody[2] and C_IsDojiBody[1] and low[2] > high[1] and C_WhiteBody and high[1] < low

alertcondition(C_AbandonedBabyBullish, title = "Abandoned Baby", message = "New Abandoned Baby - Bullish pattern detected.")

if C_AbandonedBabyBullish and AbandonedBabyInput and showBullishSignal

var ttBullishAbandonedBaby = "Abandoned Baby\nThis candlestick pattern is quite rare as far as reversal patterns go. The first of the pattern is a large down candle. Next comes a doji candle that gaps below the candle before it. The doji candle is then followed by another candle that opens even higher and swiftly moves to the upside."

getBullishLabel("AB", ttBullishAbandonedBaby)

C_AbandonedBabyBearishNumberOfCandles = 3

C_AbandonedBabyBearish = C_UpTrend[2] and C_WhiteBody[2] and C_IsDojiBody[1] and high[2] < low[1] and C_BlackBody and low[1] > high

alertcondition(C_AbandonedBabyBearish, title = "Abandoned Baby", message = "New Abandoned Baby - Bearish pattern detected.")

if C_AbandonedBabyBearish and AbandonedBabyInput and showBearishSignal

var ttBearishAbandonedBaby = "Abandoned Baby\nA bearish abandoned baby is a specific candlestick pattern that often signals a downward reversal trend in terms of security price. It is formed when a gap appears between the lowest price of a doji-like candle and the candlestick of the day before. The earlier candlestick is green, tall, and has small shadows. The doji candle is also tailed by a gap between its lowest price point and the highest price point of the candle that comes next, which is red, tall and also has small shadows. The doji candle shadows must completely gap either below or above the shadows of the first and third day in order to have the abandoned baby pattern effect."

getBearishLabel("AB", ttBearishAbandonedBaby)

C_TriStarBullishNumberOfCandles = 3

C_3DojisBullish = C_Doji[2] and C_Doji[1] and C_Doji

C_BodyGapUpBullish = C_BodyHi[1] < C_BodyLo

C_BodyGapDnBullish = C_BodyLo[1] > C_BodyHi

C_TriStarBullish = C_3DojisBullish and C_DownTrend[2] and C_BodyGapDnBullish[1] and C_BodyGapUpBullish

alertcondition(C_TriStarBullish, title = "Tri-Star", message = "New Tri-Star - Bullish pattern detected.")

if C_TriStarBullish and TriStarInput and showBullishSignal

var ttBullishTriStar = "Tri-Star\nA bullish TriStar candlestick pattern can form when three doji candlesticks materialize in immediate succession at the tail-end of an extended downtrend. The first doji candle marks indecision between bull and bear. The second doji gaps in the direction of the leading trend. The third changes the attitude of the market once the candlestick opens in the direction opposite to the trend. Each doji candle has a shadow, all comparatively shallow, which signify an interim cutback in volatility."

getBullishLabel("3S", ttBullishTriStar)

C_TriStarBearishNumberOfCandles = 3

C_3Dojis = C_Doji[2] and C_Doji[1] and C_Doji

C_BodyGapUp = C_BodyHi[1] < C_BodyLo

C_BodyGapDn = C_BodyLo[1] > C_BodyHi

C_TriStarBearish = C_3Dojis and C_UpTrend[2] and C_BodyGapUp[1] and C_BodyGapDn

alertcondition(C_TriStarBearish, title = "Tri-Star", message = "New Tri-Star - Bearish pattern detected.")

if C_TriStarBearish and TriStarInput and showBearishSignal

var ttBearishTriStar = "Tri-Star\nThis particular pattern can form when three doji candlesticks appear in immediate succession at the end of an extended uptrend. The first doji candle marks indecision between bull and bear. The second doji gaps in the direction of the leading trend. The third changes the attitude of the market once the candlestick opens in the direction opposite to the trend. Each doji candle has a shadow, all comparatively shallow, which signify an interim cutback in volatility."

getBearishLabel("3S", ttBearishTriStar)

C_KickingBullishNumberOfCandles = 2

C_MarubozuShadowPercent = 5.0

C_Marubozu = C_LongBody and C_UpShadow <= C_MarubozuShadowPercent/100*C_Body and C_DnShadow <= C_MarubozuShadowPercent/100*C_Body

C_MarubozuWhiteBullishKicking = C_Marubozu and C_WhiteBody

C_MarubozuBlackBullish = C_Marubozu and C_BlackBody

C_KickingBullish = C_MarubozuBlackBullish[1] and C_MarubozuWhiteBullishKicking and high[1] < low

alertcondition(C_KickingBullish, title = "Kicking", message = "New Kicking - Bullish pattern detected.")

if C_KickingBullish and KickingInput and showBullishSignal

var ttBullishKicking = "Kicking\nThe first day candlestick is a bearish marubozu candlestick with next to no upper or lower shadow and where the price opens at the day’s high and closes at the day’s low. The second day is a bullish marubozu pattern, with next to no upper or lower shadow and where the price opens at the day’s low and closes at the day’s high. Additionally, the second day gaps up extensively and opens above the opening price of the day before. This gap or window, as the Japanese call it, lies between day one and day two’s bullish candlesticks."

getBullishLabel("K", ttBullishKicking)

C_KickingBearishNumberOfCandles = 2

C_MarubozuBullishShadowPercent = 5.0

C_MarubozuBearishKicking = C_LongBody and C_UpShadow <= C_MarubozuBullishShadowPercent/100*C_Body and C_DnShadow <= C_MarubozuBullishShadowPercent/100*C_Body

C_MarubozuWhiteBearish = C_MarubozuBearishKicking and C_WhiteBody

C_MarubozuBlackBearishKicking = C_MarubozuBearishKicking and C_BlackBody

C_KickingBearish = C_MarubozuWhiteBearish[1] and C_MarubozuBlackBearishKicking and low[1] > high

alertcondition(C_KickingBearish, title = "Kicking", message = "New Kicking - Bearish pattern detected.")

if C_KickingBearish and KickingInput and showBearishSignal

var ttBearishKicking = "Kicking\nA bearish kicking pattern will occur, subsequently signaling a reversal for a new downtrend. The first day candlestick is a bullish marubozu. The second day gaps down extensively and opens below the opening price of the day before. There is a gap between day one and two’s bearish candlesticks."

label.new(bar_index, patternLabelPosHigh, text="K", style = label.style_label_down, color = bearishColor, textcolor = textColor, tooltip = ttBearishKicking)

getBearishLabel("K", ttBearishKicking)

var ttAllCandlestickPatterns = "All Candlestick Patterns\n"

label.new(bar_index, patternLabelPosLow, text="Collection", style = label.style_label_up, color = neutralColor, textcolor = textColor, tooltip = ttAllCandlestickPatterns)How to Install TradingView Custom Scripts

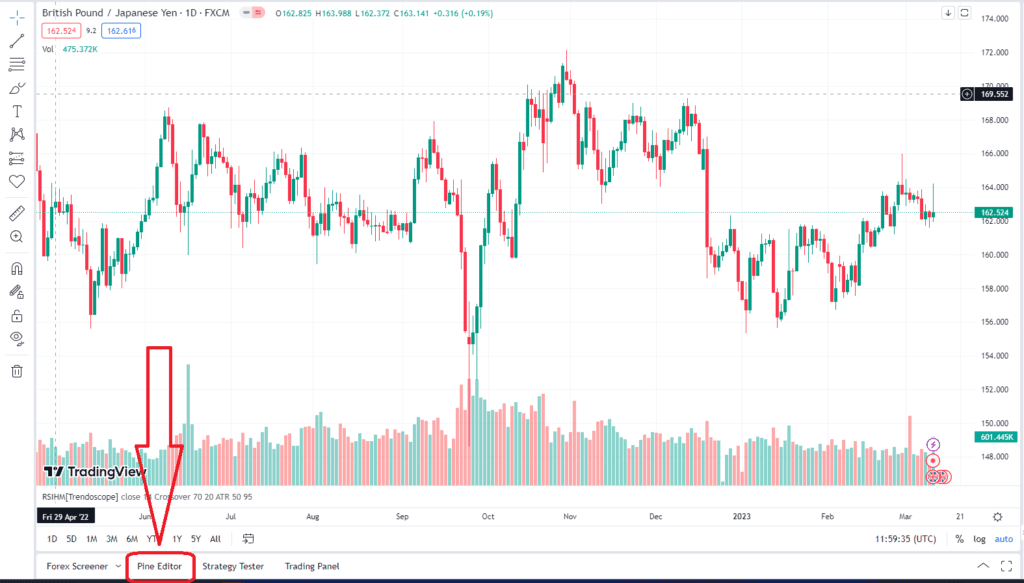

How to Install TradingView Script – Quick Guide

- First, open up a TradingView chart and find the “Indicators” tab.

- Then Go to My scripts and Select the “Create” option. (or click on the “Pine Editor” tab)

- Copy and Paste the script into the designated field.

- Once you’ve added the script, click “Publish script” to save it. (or click “Save” and “Add to Chart”)

- Now you can access your script anytime by clicking Indicators and the “My Scripts” tab and selecting it from the created script list.

- Finally, run your trading program through your Scripts tab and watch for any indicators that may appear on your chart!

Conclusion

The Auto Candlestick Patterns Detector for TradingView Script is a game-changing tool revolutionizing technical analysis. By automatically detecting and analyzing key candlestick patterns and providing detailed explanations when detected, this innovative script helps traders make better-informed decisions and improve their overall trading performance. As the world of trading continues to evolve, tools like the ACPD will become increasingly vital in helping traders stay ahead of the curve and succeed in today’s competitive markets.

Following the above given instructions, I’m receiving the following error: No Showcase active chart doesn’t contain the study you are going to publish