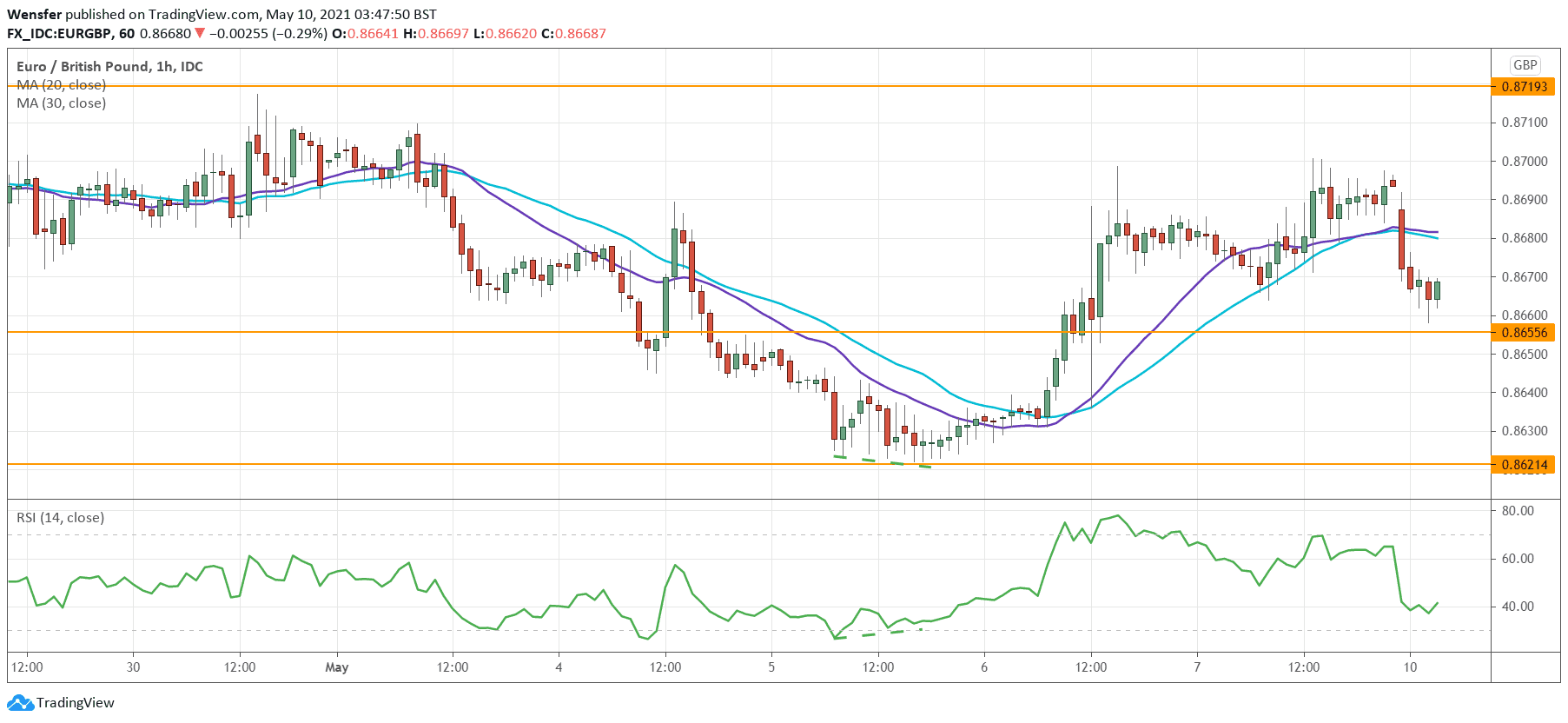

GER 30 tests previous record high

The DAX has recouped recent losses as risk sentiment made its way back in the market. By clearing the previous crash point at 15270 the price action has confirmed the bullish MA cross.

The index then established support at 15100. As it climbs back towards the peak at 15520, an overbought RSI could be the rally’s Achilles’ heel.

Profit-taking near the resistance level may trigger a brief retracement.

On the upside, a breakout could extend the rally to a new record high.

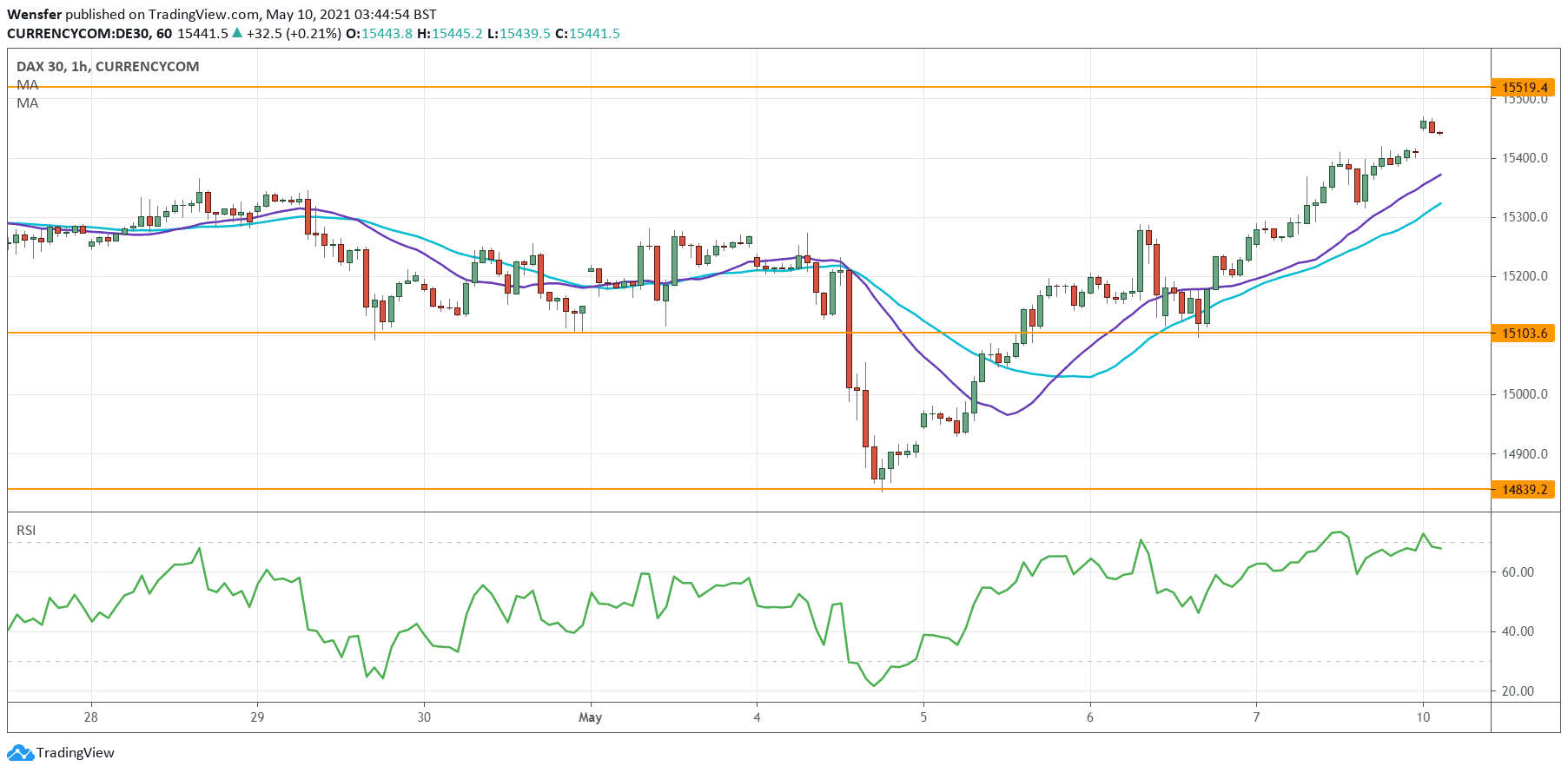

USDCAD tumbles towards 2017’s low

The US dollar fell as the unemployment rate rose to 6.1% in April from a previous 5.8%.

The February 2018 low at 1.2250 has failed to contain the bearish mood. The market remains unidirectional to the south.

The RSI has dipped into the oversold territory and could trigger some short-covering from intraday players. Though selling into strength is likely to be the motto if the price climbs back towards 1.2280.

September 2017’s low at 1.2060 would be the next target when the sell-side doubles down.

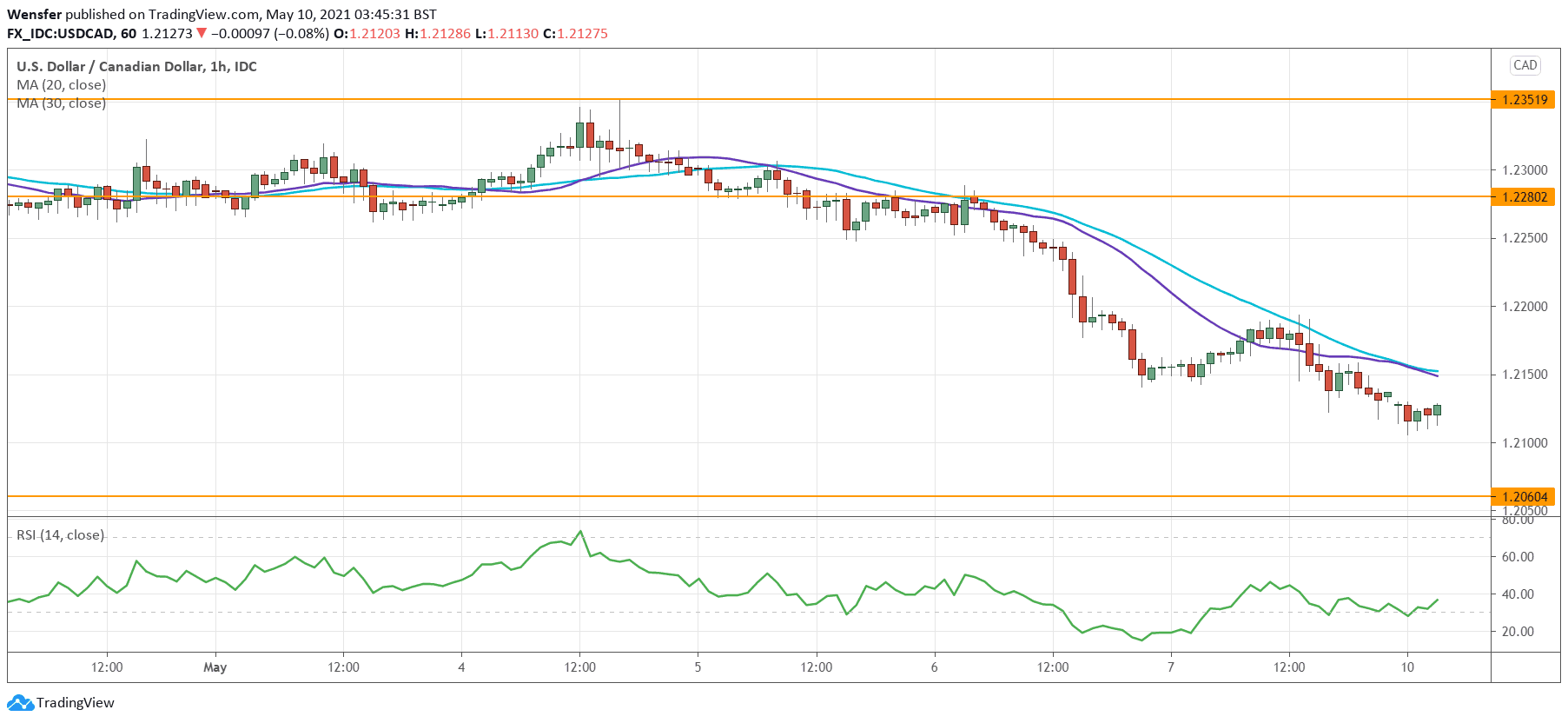

EURGBP looks to break out of range

The euro rose after ECB official Martin Kazaks said the ECB could reduce emergency bond purchases (PEPP).

The pair has found strong buying interest in the demand zone above 0.8600. An RSI divergence on this major support was a foresign that the selling pressure had lost steam.

The current rebound is still within a consolidation range between 0.8610 and 0.8720.

A bullish breakout may open the path towards 0.8780. A failure to do so would lead to a pullback to test bids at 0.8655.