SETTING UP PAYAPA

RELATIVE STRENGTH INDEX (RSI)

- Period: 1

- Apply to: Close

- Style: 1-pixel black/white color

- Levels: 10 Description – Buy

- 50 Description – Wait

- 90 Description – Sell

MOVING AVERAGE

- Period: 5

Shift: 0

Method: Exponential

Apply to: Close

Style: 1-pixel yellow color - Period: 8

Shift: 0

Method: Exponential

Apply to: Close

Style: 1-pixel blue color - Period: 200

Shift: 0

Method: Exponential

Apply to: Close

Style: 2-pixel red color - Period: 13

Shift: 0

Method: Exponential

Apply to: Close

Style: 1-pixel white color - Period: 21

Shift: 0

Method: Exponential

Apply to Close

Style: 1-pixel purple color

YOUR CHART SHOULD LOOK LIKE THIS:

HOW DOES THIS STRATEGY WORKS?

When you get any strategy or setup, you must understand the combination and how it detects the market trends and reversals.

With this strategy, the Relative Strength Index (RSI) and the Moving Averages (EMAs or Exponential Moving Averages) are used to help us get signals for trend reversals.

The reason we use RSI is to get the “overbought” and “oversold” momentum. The 200EMAs are used as the support and resistance when the market is at Level 50. You either sell or buy when the EMAs bounce off the 200EMA.

PLEASE STUDY THE CHARTS BELLOW

The chart below shows the overbought momentum EURJPY pair on M15 chart.

As you can see, all the EMAs have reached Level 90 and began changing direction (downtrend). This means the pair has lost its buy momentum and the sellers have taken over.

The chart below shows the oversold momentum EURJPY pair on the H1 chart.

As you can see, all the EMAs have reached Level 10 and began changing direction (uptrend). This means the pair has lost its sell momentum and the buyers have taken over.

WHEN TO BUY OR SELL

SELL: When all EMAs meet up at Level 90 and have all completely bend down pointing to the start of a downtrend. Make sure all the EMAs are beneath the 200EMA and the 200EMA is above the EMAs.

Study the chart below:

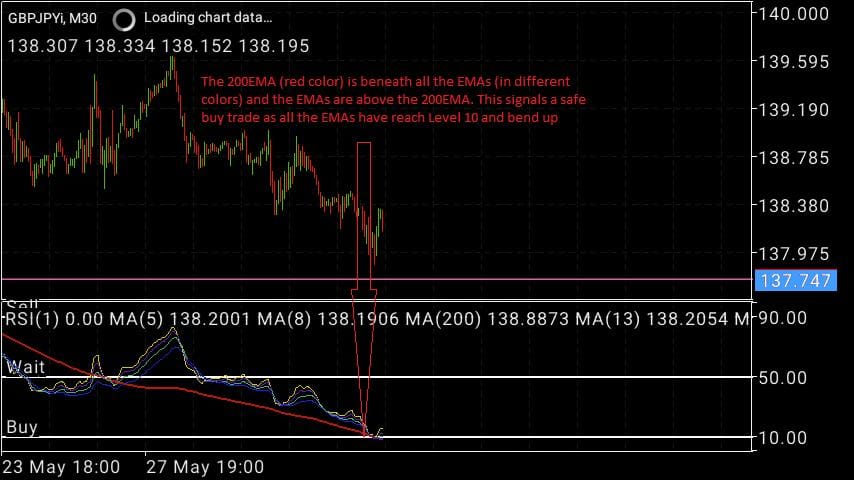

BUY: When all EMAs meet up at Level 10 and have all completely bend up pointing to the start of an uptrend. Make sure all the EMAs are above the 200EMA and the 200EMA is beneath the EMAs.

Study the chart below:

WHEN TO TAKE PROFIT

• When you placed a sell trade you then take profit (TP) when all the EMAs have reach Level 10. On M15 and lower time frames set your TP 25 to 35 pips.

• When you placed a buy trade you then take profit (TP) when all the EMAs have reach Level 90. On M15 and lower time frames set your TP 25 to 35 pips.

WHEN NOT TO BUY OR SELL

• You do not sell when the EMAs are not all bent down and when the 200EMA is not above all the EMAs.

• You do not buy when all the EMAs are not bent up and when the 200EMA is not below the EMAs.

THE 200EMA SUPPORT AND RESISTANCE

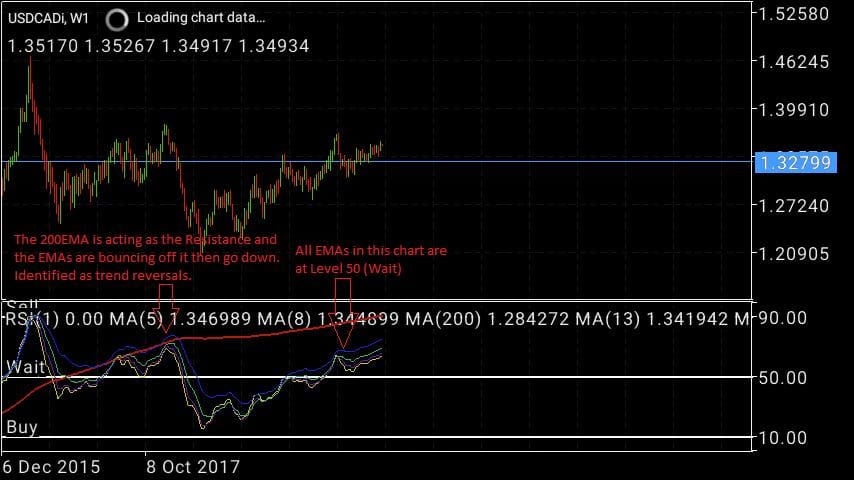

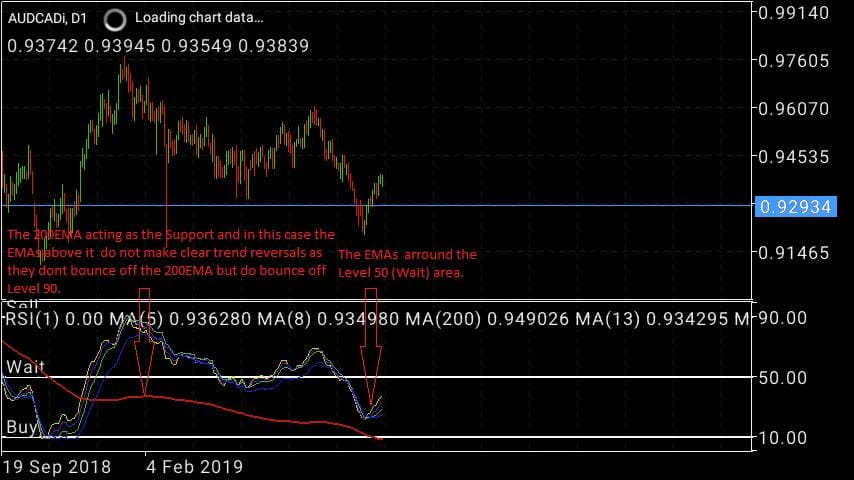

The 200EMAs are used as the support and resistance when the market is at Level 50. You either sell or buy when the EMAs bounce off the 200EMA.

Up trend, trend reversal when all EMAs are at Level 50.

Down trend, trend reversals when all the EMAs are at Level 50

PLEASE PRACTICE ON THE DEMO ACCOUNT FIRST TILL YOU MASTER PAYAPA. THIS STRATEGY BEST WORKS ON LOWER TIME FRAMES AND IS VERY GOOD FOR SCALPING BUT CAN BE USED ON HIGHER TIME FRAMES.

I also recommend that you checkout our review site to find our best forex ea, indicators, strategy, brokers at https://fxcracked.com/

Read More : A Simple Forex EMA Strategy

Download a Collection of Indicators, Courses, and EA for FREE

Such a bad system.

why so?? I changed the RSI to 8 on a 5min TF on TradingView and it doesn’t seem that bad.

hi.thanks for share . how i can leet moving averages drawn over rsi?

if someone provide template most thankful

Bob’s your uncle

Payapa Forex strategy

just so we are clear thats a template lol 😂

terribly useless