GBPUSD grinds to 3-month high

Sterling carries on its ascent as Britain’s jobless rate dropped to 4.8% between January and March. The pound was supported by rising bids after it broke above 1.4150.

The breakout confirms the bullish MA cross from last Friday. February’s peak at 1.4240 is a major resistance ahead. Its breach could extend the rally to 1.44s.

In the meantime, there is a limited risk to the downside as an overbought RSI within this supply zone may trigger profit-takings. 1.4130 is the immediate support should this happen.

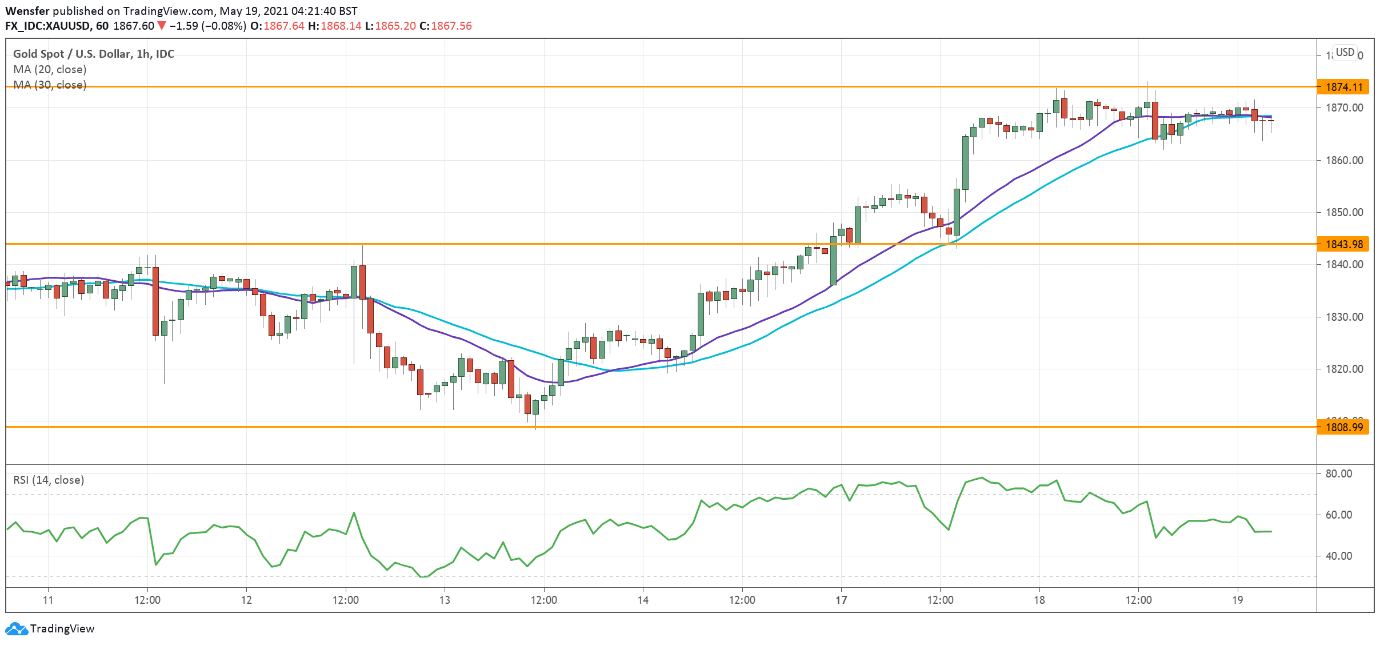

USOIL retraces from major supply zone

Oil prices stay high as reopenings across Europe raise expectations of demand recovery.

WTI is currently hovering under March’s peak at 67.90, a critical supply area where stiff pressure can be expected from profit-taking and fresh shorting.

The price is likely to go sideways in the short term to build up momentum. The RSI has returned to the neutrality zone. A rebound from the area near 64.30 would suggest solid support.

Further down, 63.30 is critical in safeguarding the current uptrend.

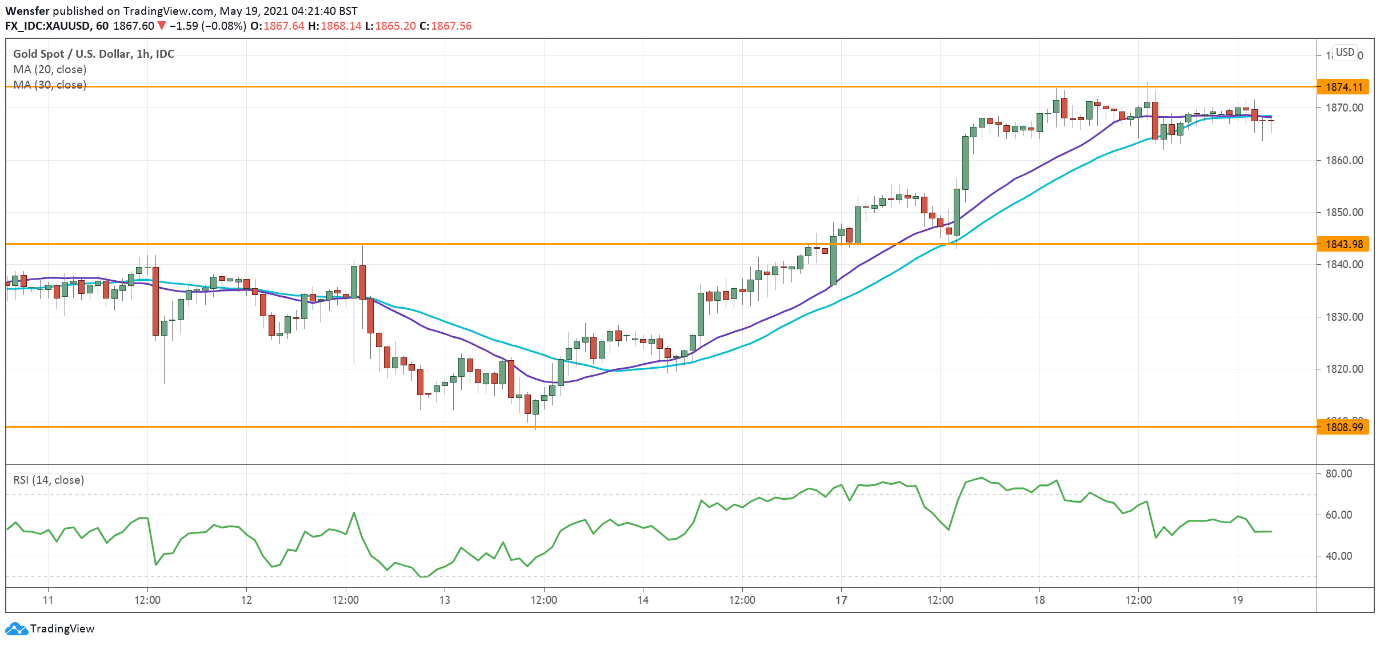

XAUUSD tests daily resistance

Weakness in the US dollar continues to fuel demand for bullions. Gold has been inching up along the 30-hour moving average. Bullish sentiment takes a foothold after a series of higher highs.

The price action is now testing a key resistance level at 1874 from the daily timeframe. Combined with an overextended RSI, the supply pressure could prompt short-term traders to cash in. 1844 would be the first support in case of a correction.

On the upside, a bullish breakout may send the price to the psychological level of 1900.