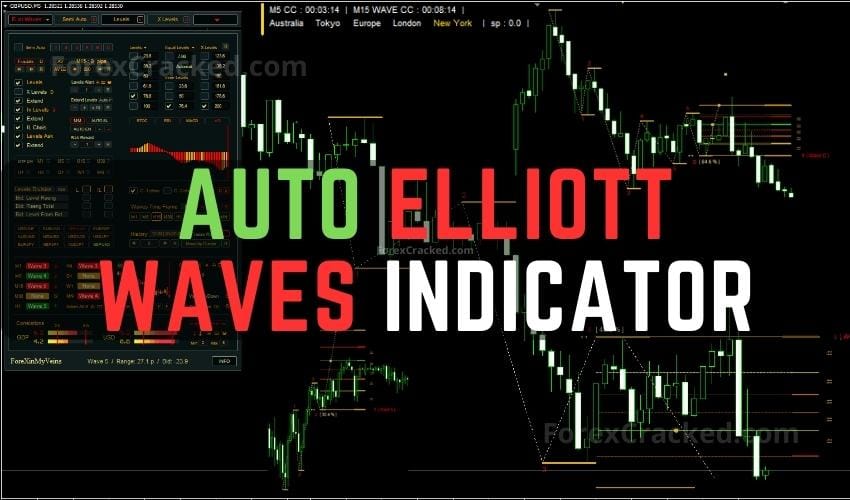

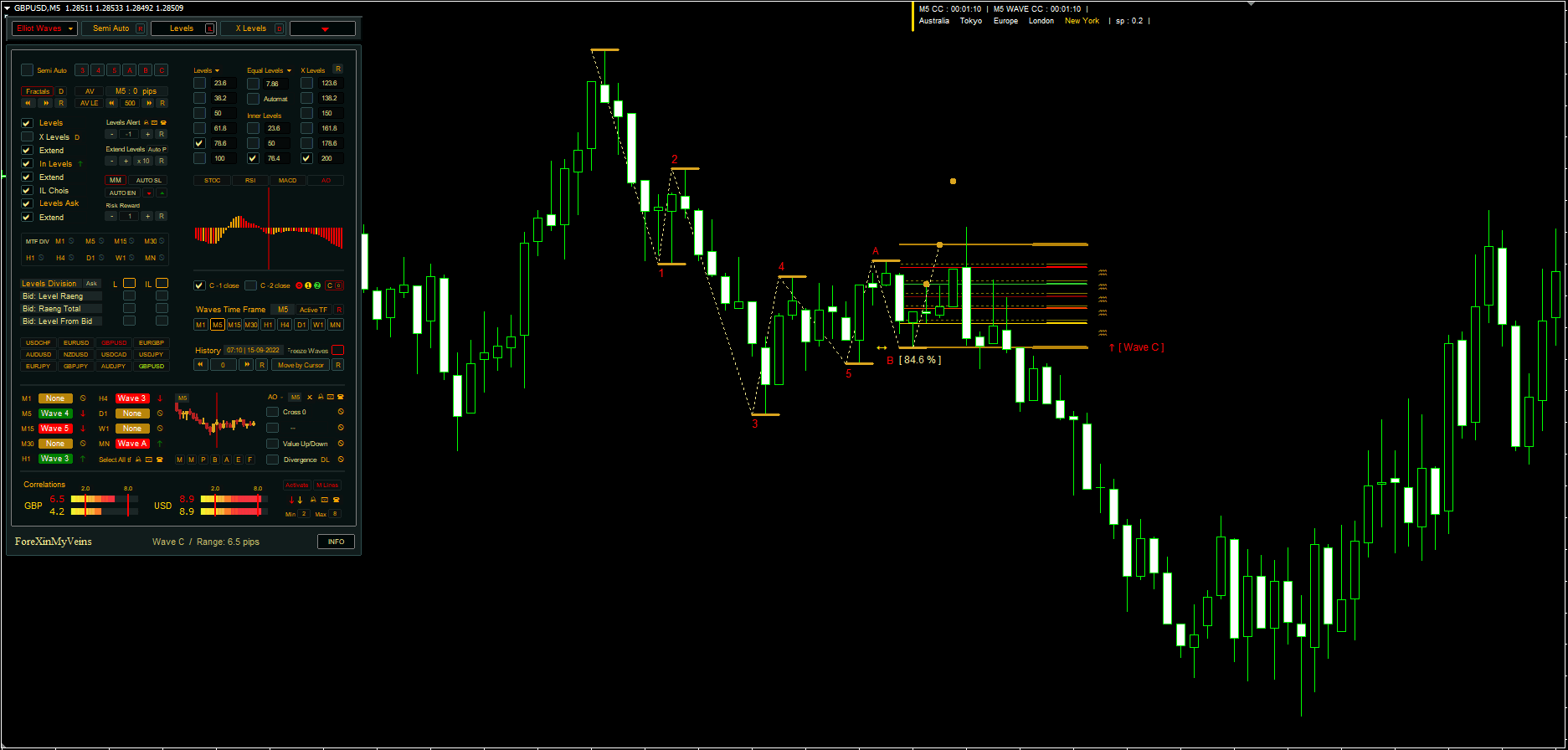

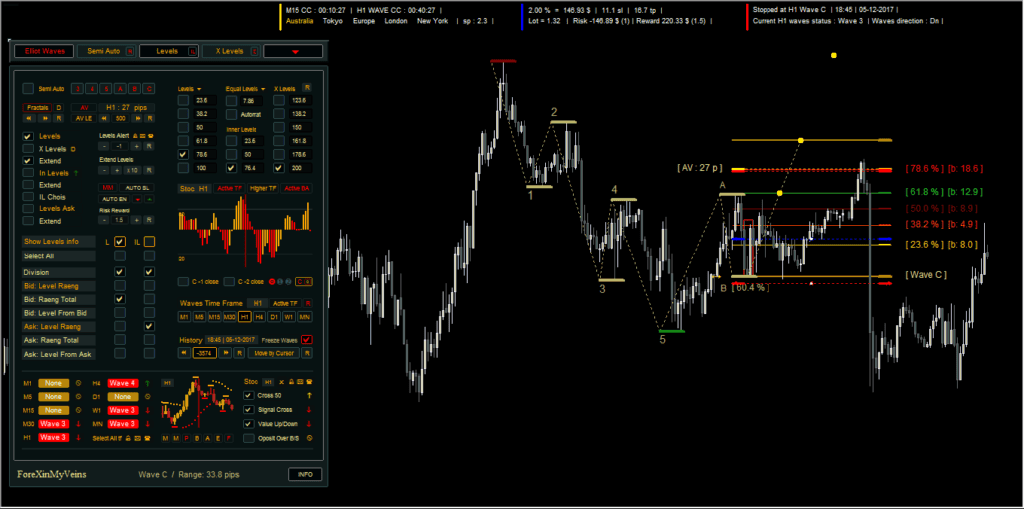

This Auto Elliott Waves Indicator is an Indicator for MT4 that automatically spots Elliott Waves and plots them on the chart. Packed with an array of amazing features and a high level of customization, this sophisticated tool incorporates the principles of the Elliott Waves theory to provide a seamless trading experience.

The two main features of the Auto Elliott Waves Indicator are the Fully Automatic Waves and the Semi-Automatic Waves.

In the fully automatic mode, the software places waves on the chart based on the fractals of the selected time frame. This eliminates the need for traders to manually identify and apply the waves, enabling them to focus more on strategy and less on technical analysis.

On the other hand, the semi-automatic mode gives traders the flexibility to manually place the waves anywhere on the chart while ensuring compliance with the basic wave principles. The software guides you through wave placement, ensuring a balance of control and convenience.

This Elliott Waves Indicator MT4 can be used on any Forex currency pair and other assets such as commodities, Cryptos, Binary Options, Stock markets, Indices, etc. You can also use it on any time frame that suits you best, from the 1-minutes to the Month charts.

What are Elliott Waves

Elliott Wave Theory is a form of technical analysis that finance traders use to analyze financial market cycles and forecast market trends by identifying extremes in investor psychology, highs and lows in prices, and other collective factors. Ralph Nelson Elliott developed it in the late 1930s, and his theory stipulates that markets move in repeated cycles, which he attributed to the ever-changing mood of investors, influenced by a range of external factors.

Elliott proposed that these market cycles result from investors’ reactions to outside influences or the predominant psychology of the masses at the time. He found that mass psychology’s upward and downward swings always showed up in the same repetitive patterns, which were then divided further into patterns he termed “waves”.

The Elliott Wave Principle says that markets are patterned, and these patterns are directly linked to trader psychology – optimism and pessimism. The theory identifies two types of waves: impulse waves and corrective waves.

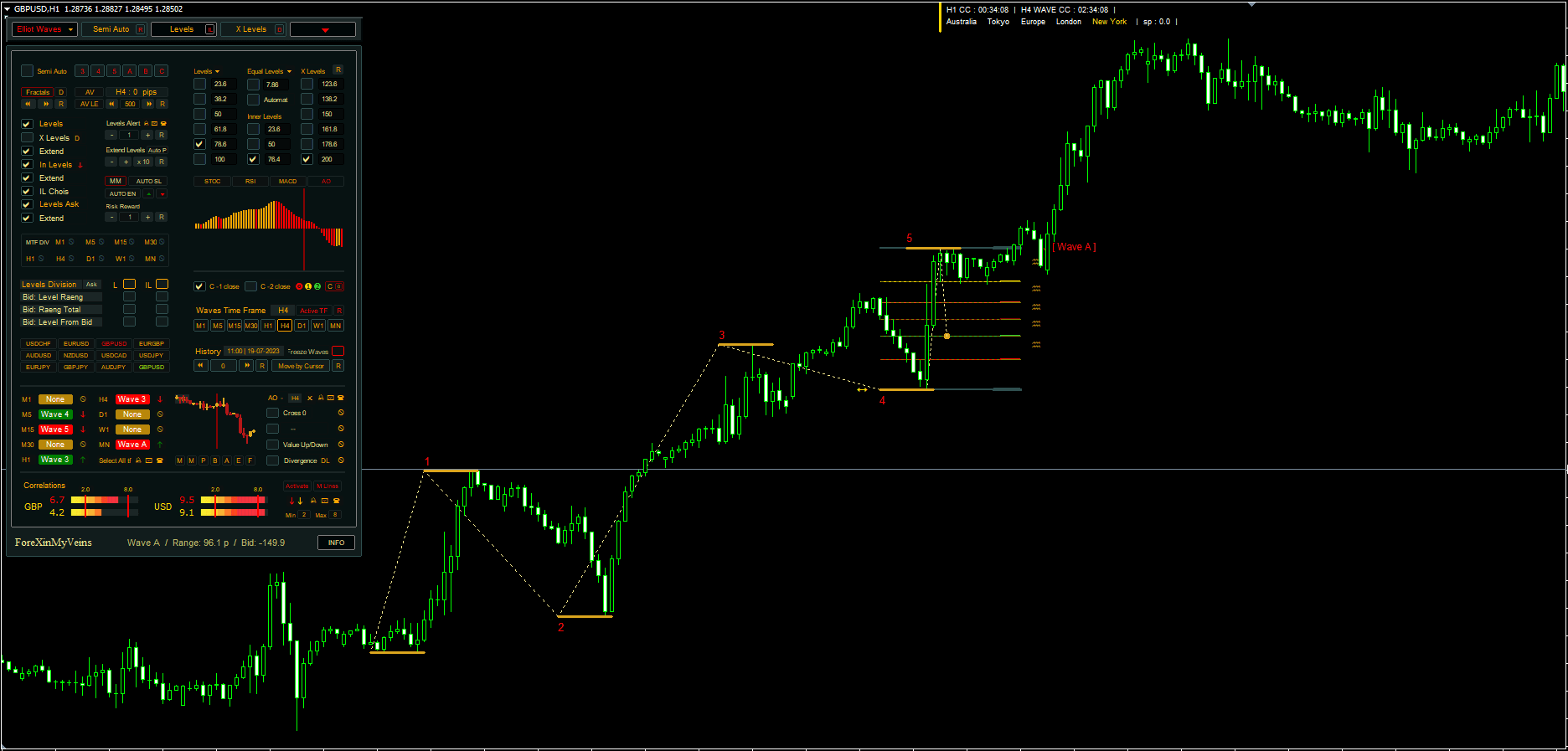

- Impulse Waves: In the Elliott Wave Theory, impulse waves consist of five smaller waves and move in the same direction as the trend of the next larger size. They play a key role in the overall pattern, creating a ‘net’ movement in the same direction as the larger trend.

- Corrective Waves: Corrective waves, on the other hand, consist of three smaller waves and move against the trend of the next larger size. These waves illustrate the periods in the market where the trend ‘corrects’ itself.

Combined, impulse and corrective waves form a complete cycle of eight waves. In addition, the theory states that these eight-wave cycles are part of larger patterns. The cycle keeps repeating, and understanding where the market is within this cycle helps traders predict future price movements.

It’s worth noting that while the Elliott Wave theory can provide a broad roadmap for where a market might be heading, it’s not always considered to be a precise timing tool. Nevertheless, it’s widely used by traders and analysts for planning trading strategies and market analysis.

How it used in Forex Trading

Elliott Wave Theory is a popular tool forex traders use for market analysis and strategic planning. The theory’s emphasis on wave cycles aids in predicting price action by identifying market extremes in investor psychology, as well as price highs and lows. Here’s how it’s applied in forex trading:

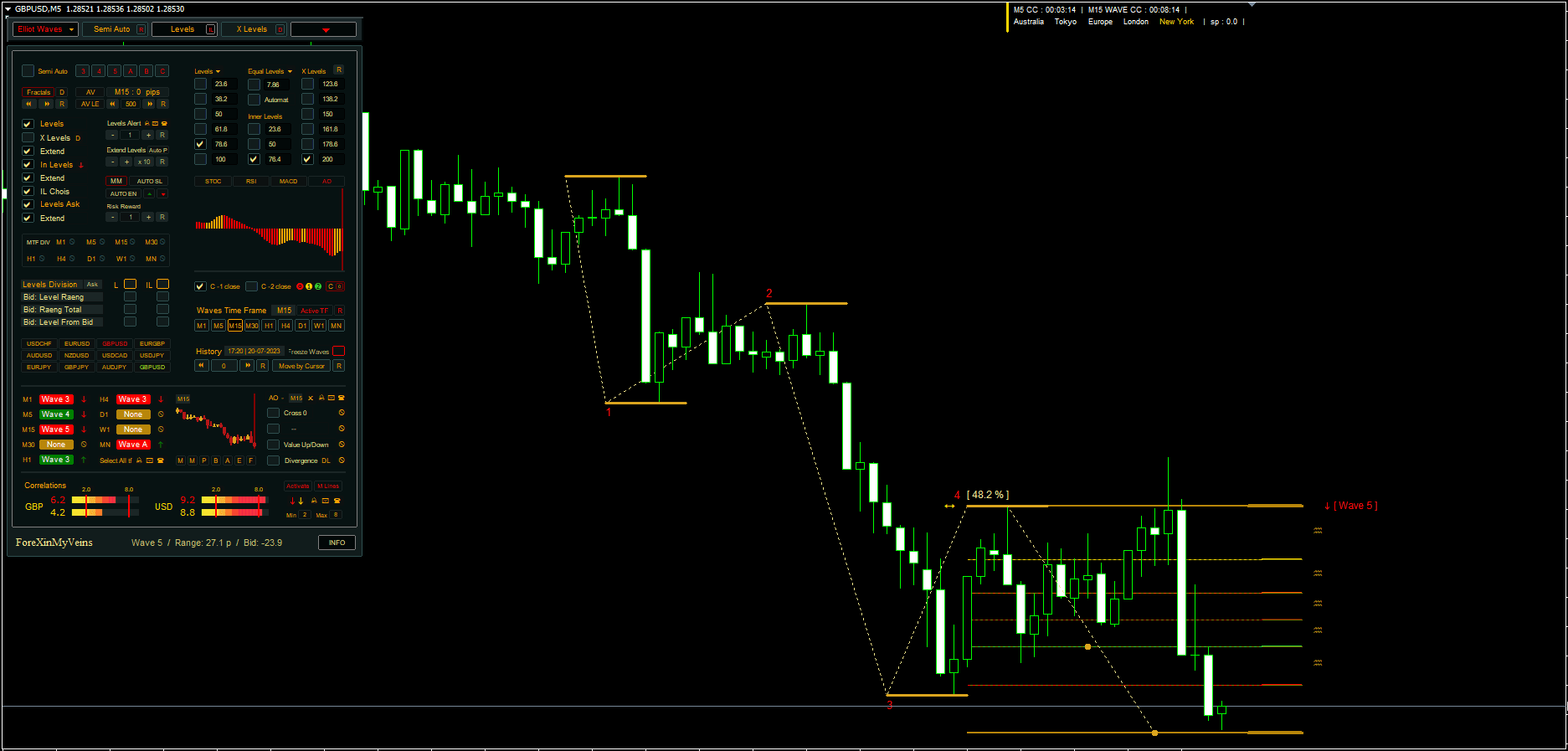

- Identifying Market Cycles and Trends: The first step is identifying whether the market is trending or moving sideways. This can be done by looking at the larger daily, weekly, or monthly timeframe charts. Elliott Wave Theory states that markets move in a 5-3 wave pattern, with the 5-wave pattern (Impulse Waves) representing a trend and the 3-wave pattern (Corrective Waves) representing a counter trend or consolidation period.

- Forecasting Future Price Movements: Traders can predict future price movements by identifying these wave patterns. For instance, if a trader identifies that the market has completed a 5-wave impulse pattern, they may predict a 3-wave corrective pattern to follow. Conversely, if a 3-wave corrective pattern has been completed, a trader may expect a new 5-wave impulse pattern to start.

- Determining Entry and Exit Points: Elliott Waves can also identify potential entry and exit points. For example, if a trader recognizes that a 5-wave pattern is nearing completion, they might open a position to catch the anticipated counter-trend 3-wave pattern. Similarly, a trader may decide to exit or take profit after a 5-wave pattern, anticipating a counter-trend reversal.

- Risk Management: The theory is also employed in risk management. For example, if a trader enters a position expecting a 3-wave correction, but the price breaks past the start of the preceding impulse wave (which should not happen according to the theory), they know their analysis was incorrect, and it’s likely time to exit the trade.

It’s important to note that while Elliott Wave Theory can be a powerful tool, it’s also complex and subject to personal interpretation. Additionally, like all trading strategies, it doesn’t provide guaranteed outcomes. Traders should use it with other technical analysis tools, fundamental analysis, and sound money management principles.

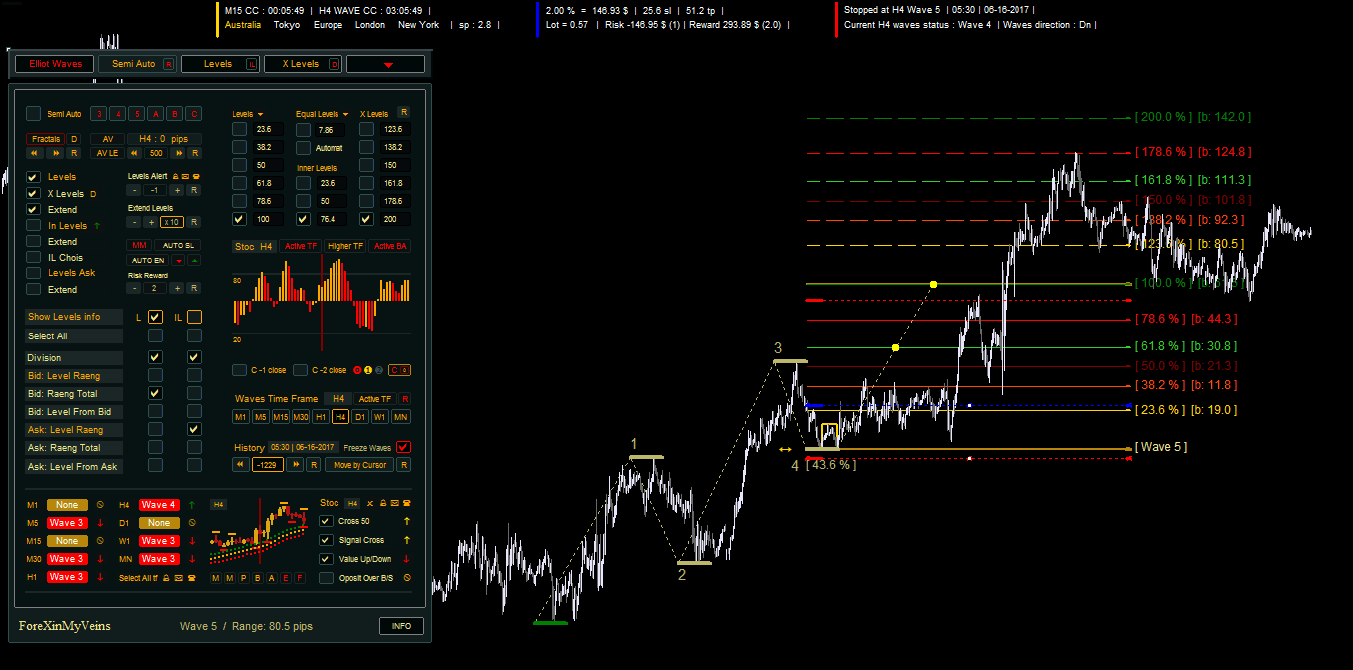

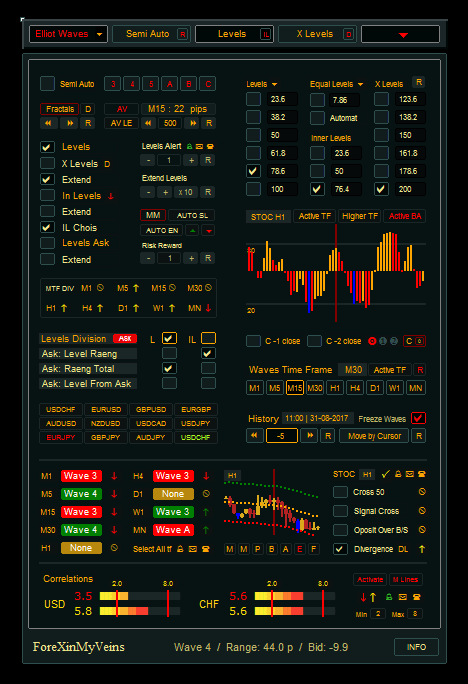

Dashboard Flexibility & Input Customization in Elliott Waves Indicator

A standout feature of the Elliott Waves Indicator is its superior customizability. The software offers over 100 adjustable input parameters, allowing traders to align the system’s operations closely with their unique trading strategies and risk profiles. This includes oscillators, money management settings, wave placement, and more.

Moreover, Elliott Waves Indicator features a comprehensive yet customizable dashboard, providing an easy-to-navigate, information-rich trading hub. Users can tweak the dashboard’s layout, decide what data to display, and set personalized alert systems. This ensures a tailor-made trading environment designed to optimize trading efficiency and profitability.

Download a Collection of Indicators, Courses, and EA for FREE

Features of Auto Elliott Waves Indicator

The Auto Elliott Waves outshines its counterparts with its novel features, such as:

- Automatic Money Management: The software manages your investments with an automatic risk-reward ratio, thereby fostering disciplined and risk-adjusted trading.

- Multi-Time Frame, Multi-Currency Waves Display: It offers an alarm-equipped multi-timeframe and multi-currency wave display. Traders can easily alter the chart time frame and currency directly from the panel.

- Comprehensive Mini Charts: The Elliott Waves Indicator provides mini charts that incorporate Candles, Moving Averages (MAs), Fractals, Average True Range (ATR), Envelopes, Parabolic Stop and Reverse (PSAR), and Bollinger bands, offering an all-encompassing trading view.

- Divergence-Oscillators: With options from four oscillators – Stochastic, RSI, MACD, or AO, the software provides multi-time frame divergence and signaling.

- Automatic Correlations Strength: This newly added feature aids in measuring the correlation between different trading pairs.

- Trading Levels and Fibonacci Levels: Auto Elliott Waves enables the division of trading levels by pips, regular division, or percentages and allows the creation of Fibonacci levels.

- Average Price Movement: This pioneering feature calculates the average price movement between fractal highs and lows of up to 1000 candles back in the wave’s time frame, aiding in accurate price movement predictions.

- Internal Trading Levels: It provides internal levels for each one of the main trading levels.

- Here are some helpful tools to make your trading easier – Analysis Tools

Conclusion

In conclusion, the Auto Elliott Waves Indicator, with its remarkable functionalities and adaptability, serves as an invaluable tool for both novice and experienced traders. Its cutting-edge features and highly customizable dashboard streamline trading, enabling traders to make informed decisions swiftly and effectively. This software is indeed a significant stride forward in automated trading technology.