Introduction

I am not a massive fan of short-term trading strategies because it can be hard to overcome the spread.

For example, you like to trade the Forex USD/JPY pair, and your favored broker has a 4-point spread, you need to make 4 points profit to break even.

Nevertheless, I thought I would share a simple forex trading strategy with you that I posted to a previous site that I used to run back in 2014 because it seems to work well just as well today if you wait for the correct set-ups.

Momentum Trading Strategy

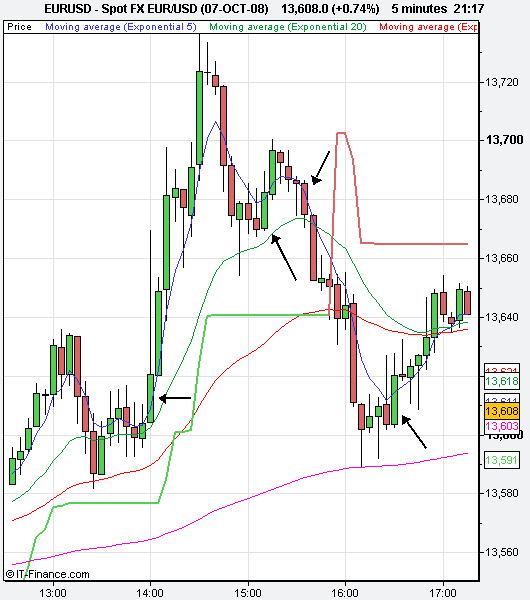

Momentum trading works very well because it gets you into a trade when the market moves powerfully upwards or downwards with real momentum. With this strategy, you will look to open a trade when the price breaks up or downwards after a period of indecision.

That’s because you will find that the price will continue moving in the same direction due to the initial momentum of the breakout.

The criteria are as follows:

- Three consecutive candles on the 5-minute chart where the body is tiny

- strong breakout candle where the body is much larger than the three previous candles

- enter position (with the trend) at the closing price of the breakout candle

- target price = 1-2 times the body of the breakout candle

- stop-loss = high or low of the breakout candle

The first point is critical. You need to see at least three consecutive candles where the price has closed close to its opening price because this is telling you that the buyers and sellers are canceling each other out, and the price is getting ready itself up for a breakout.

This 5-minute price chart of the Forex EUR/USD pair taken from my original post back in 2014 shows you four profitable trades from one single day using this 5-minute momentum forex trading strategy:

Worst and Best Times to Use This Strategy

The drawback of this forex strategy is that it will only work when you have a good amount of volatility.

Because of that, I would say that the good times of the day to use this 5-minute forex momentum strategy would be the opening hour of the London session at 8.00 and 9.00 GMT, and on the opening hour of the New York session because this is when you will see some good price swings.

The absolute worst time of the day to use this forex strategy would be the overnight trading session and when the markets are quiet, and the price is slowly moving.

Other Factors to look for

To up your chances of winning even further, you should also only trade pairs with a high average daily range, as indicated by the ATR forex indicator on the daily chart, and pairs with lower spreads of no more than 2-3 pips at the most.

Final Thoughts

Some of the most profitable forex traders generate the most of their profits from simple price action strategies. This is another example of a strategy that doesn’t require any indicators.

All you need to do is plot a simple candlestick chart and wait until you see three candles in a row where the body is tiny, and trade the valid breakout.

And, of course, not all of these trades will be profitable, as with any trading strategy. Still, if you use good profit targets and stop losses and only trade the major forex currency pairs at the busiest market periods of the day, you will hopefully come out ahead in the long run.

Read More: 5 Minute Forex Scalping Strategy

Download a Collection of Indicators, Courses, and EA for FREE

Wish to crack this too new launch ea for ftmo. Thank you