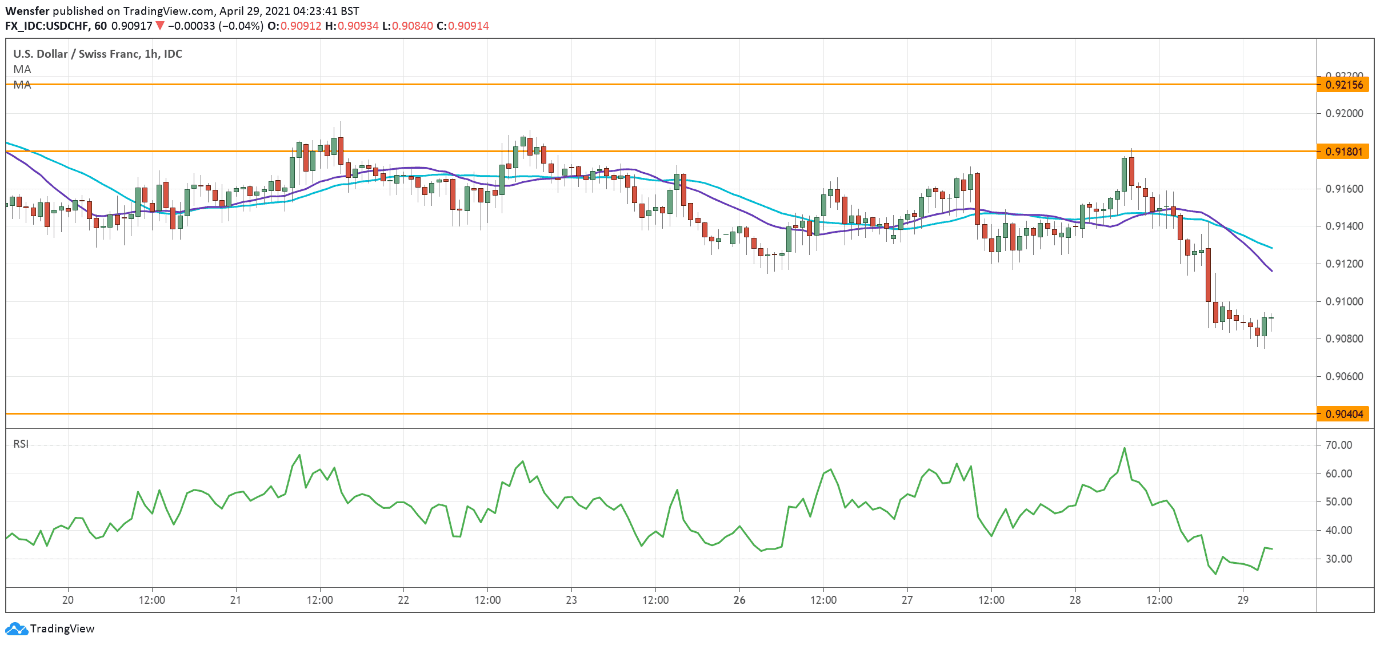

USDCHF breaks below consolidation range

The US dollar remains subdued as the Fed offers no signs of tapering.

After falling below the key level at 0.9220, the bearish MA cross on the daily time frame may keep buyers at bay. Their failure to lift offers around 0.9180 despite a week-long consolidation strongly suggests that sellers are in control.

Any rebound was seen as an opportunity to join the downward movement. A close below 0.9115 could render the greenback vulnerable.

0.9040 would be the next target should there be a new round of sell-off.

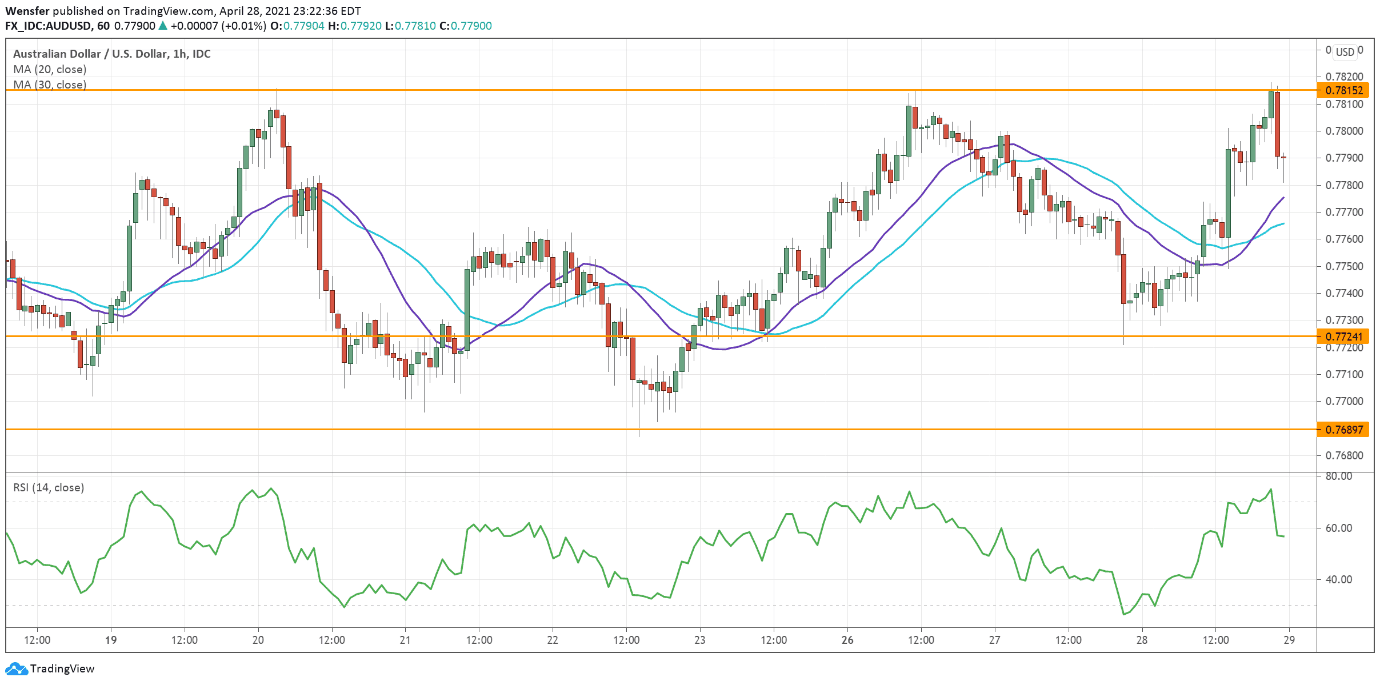

AUDUSD tests double top

The Australian dollar shrugged off March’s weaker-than-expected CPI as risk appetite grew.

The pair has met stiff selling pressure at the supply zone around 0.7820, the origin of last month’s sell-off. However, the Aussie has established a solid base above 0.7700.

As the RSI bounces back into the neutral area from the sub-30 level, the bullish momentum from 0.7725 is a sign of buying the dip.

A breakout above 0.7815 may trigger a runaway rally to 0.7950, a prerequisite to resuming the fourteen-month-long uptrend.

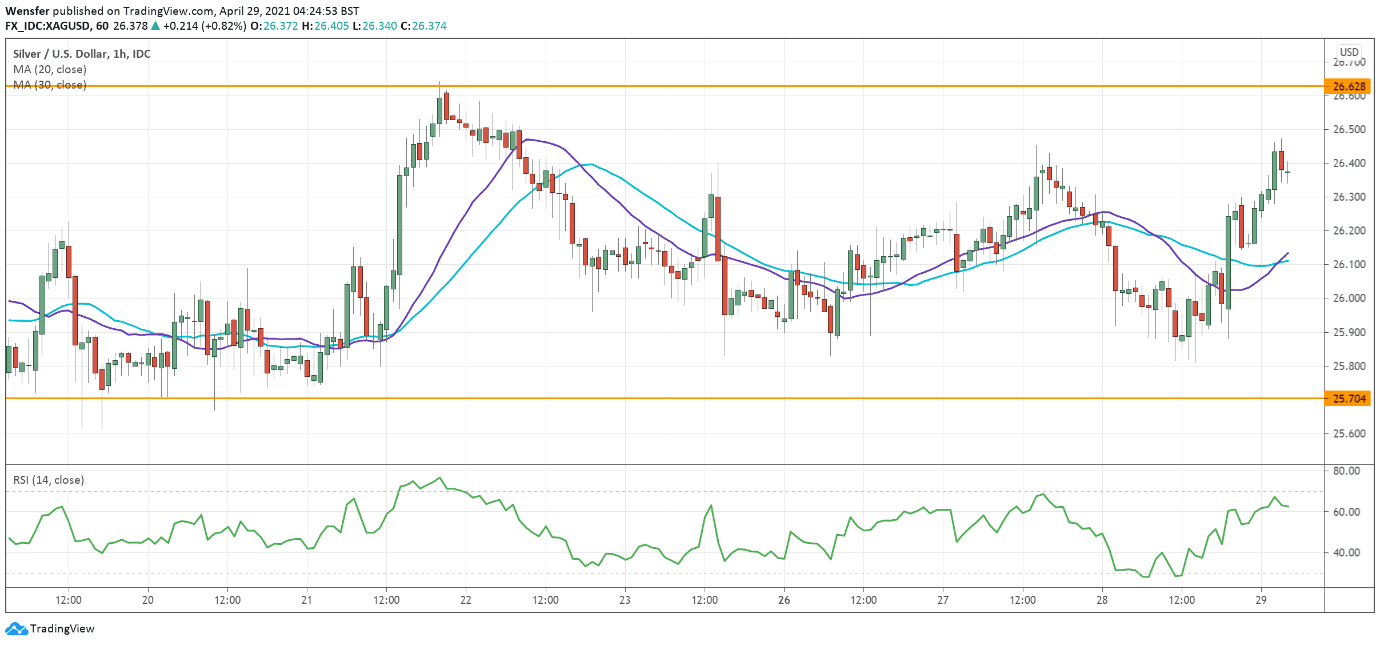

XAGUSD gathers bullish momentum

Silver strengthens as the US dollar’s sell-off continues after the Fed’s cautious tone on inflation. The precious metal has come to rest after reaching the major resistance (26.60) on the daily chart.

The bullish MA cross is an indication of strong buying interest. A breakout above that resistance would confirm the bullish bias and send the price to 28.20.

On the hourly chart, sentiment remains upbeat as long as the price action stays above 25.70.

A bearish breakout could extend the correction towards 25.20.