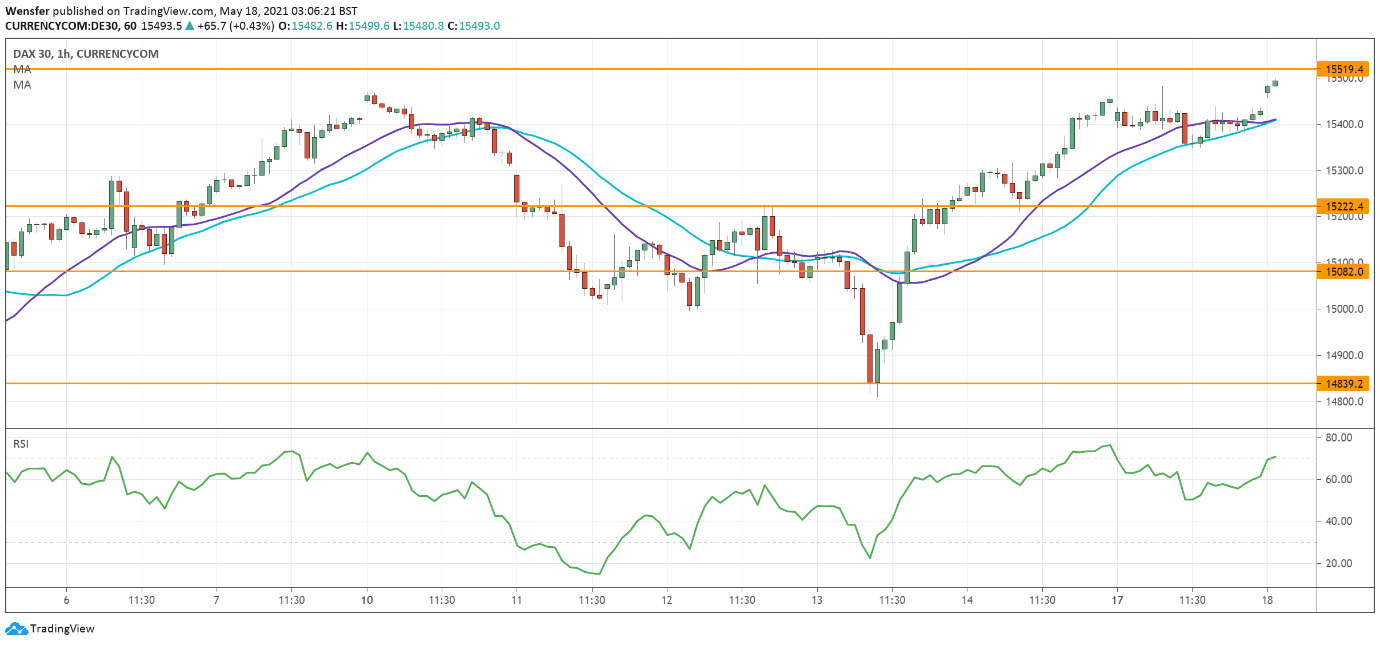

GER 30 retests record high

Germany’s DAX 30 claws back previous losses as the economic outlook brightens.

On the daily timeframe, the latest sideways action has allowed the RSI to drop back to the neutrality area, which is good news for a breakneck bull market.

On the hourly chart, strong momentum above the last leg of the sell-off indicates traders’ conviction in buying the dip.

April’s high at 15520 is the main obstacle and a breakout could push the index to a new record high. 15220 is the closest support in case of a pullback.

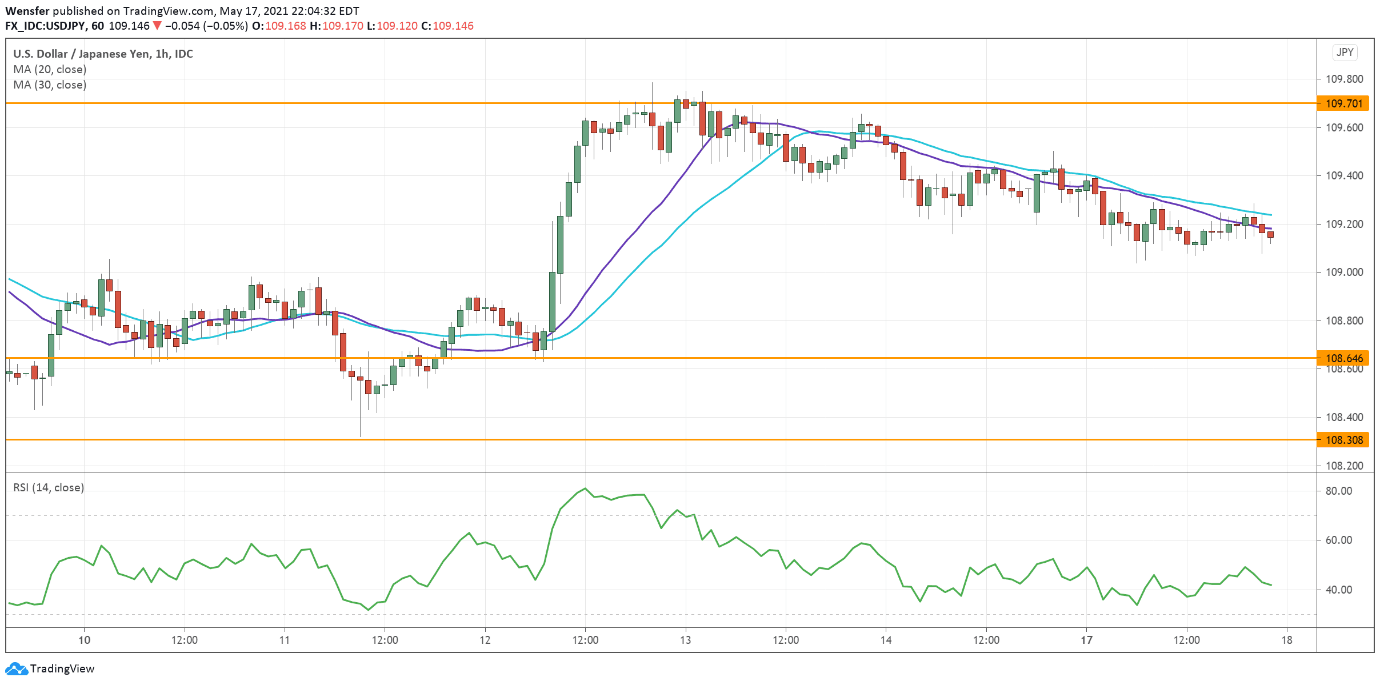

USDJPY retraces for support

The Japanese yen stayed muted as the country’s GDP contracted slightly more than expected in Q1.

The surge above 109.70 is an indication that buyers have regained control after a two-week-long consolidation. The US dollar is pulling back after the RSI overshot to 80.

Buying interests are likely to be found at the demand area between 108.65 and 108.90. Further down, a drop to 108.30 may extend the consolidation.

On the upside, bulls could trigger a broader rally if they succeed in clearing the resistance at 109.70.

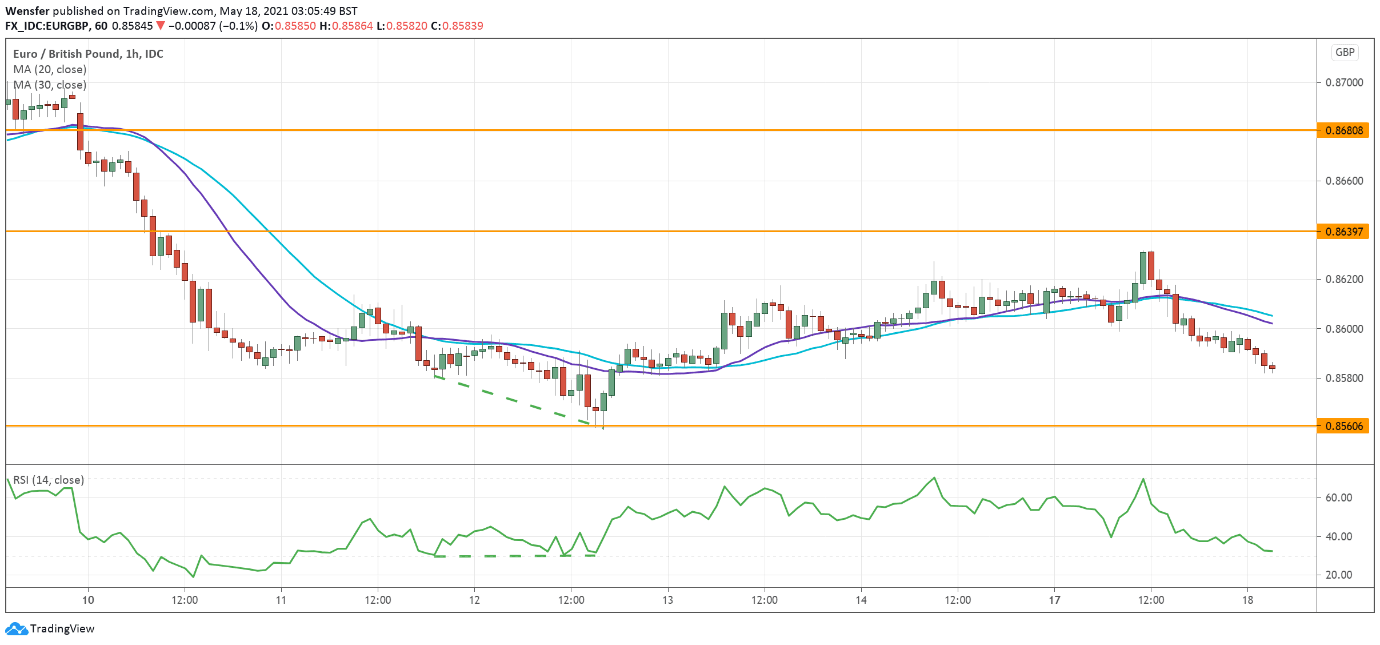

EURGBP recovers after RSI divergence

The euro inched higher after Eurozone bond yields climbed to multi-month highs. The pair is still in a recovery phase following last week’s sell-off.

The RSI divergence has signaled a deceleration in the bearish momentum. The breakout above 0.8610 has prompted more sellers to take profit, lifting pressure on the single currency.

0.8640, support turned into resistance is the next hurdle. A bullish breakout could send the price to 0.8680. 0.8560-90 is the demand area if the pair needs to find bids.