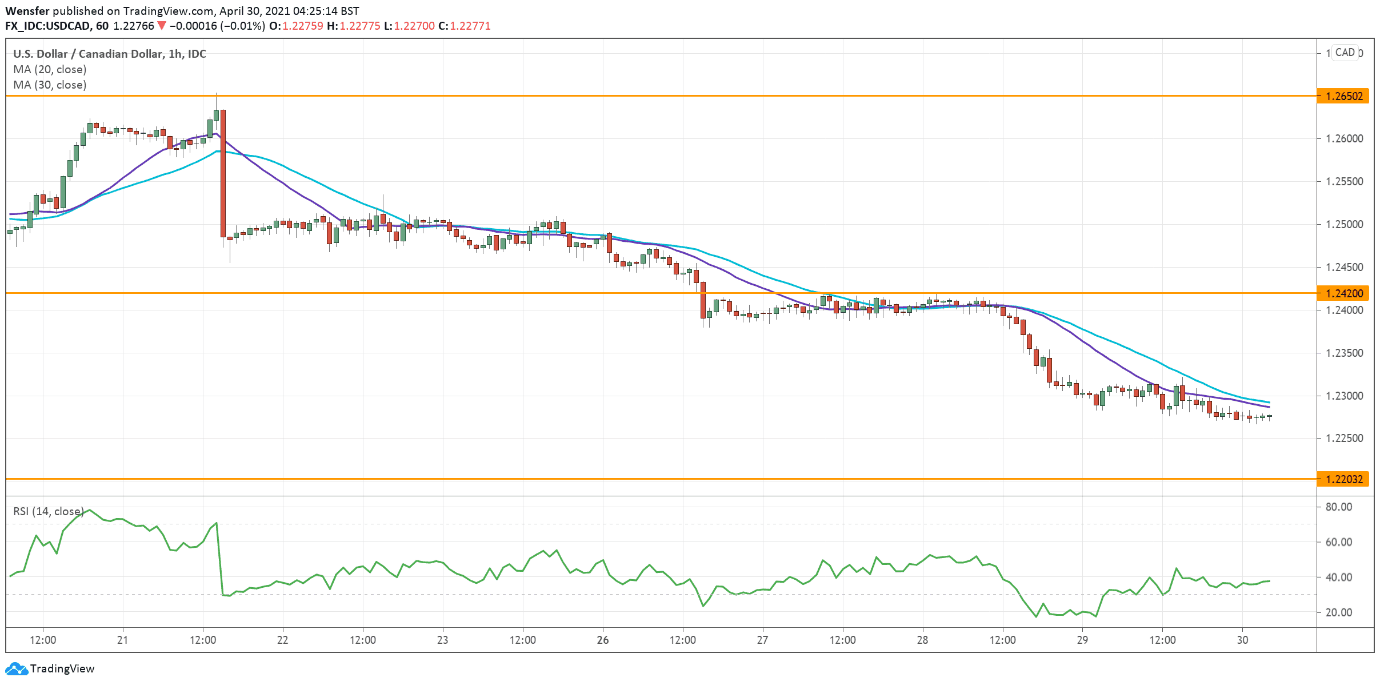

USOIL speeds up runaway rally

WTI crude oil gained momentum after EIA data showed a sharp reduction in US inventories.

The bullish momentum has accelerated following a breakout above the intermediate resistance level at 64.3. The previous high at 66.40 would be next as sentiment turns around.

There is limited risk to the downside as the RSI shows a double top in the overbought area. The 20-hour moving average has acted as support and may do so in case of another retracement.

Failing that, 63.60 would be the second line of defense.

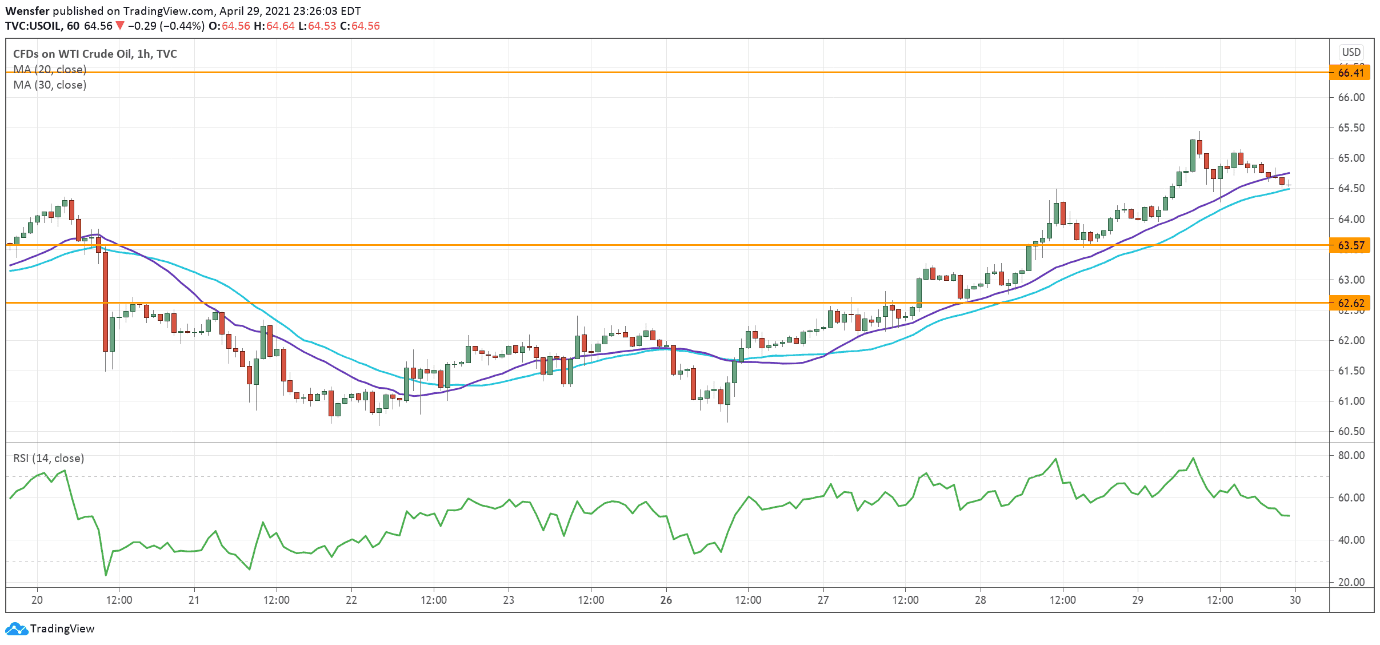

NAS 100 meets tough resistance

Stronger-than-expected quarterly results lift market optimism as the earnings season is in full swing.

The index has been struggling to keep its head above 14070 after it resumed the uptrend above February’s high at 13900. The RSI’s repeated incursions in the overbought area are a sign of exhaustion in the supply zone.

A bearish breakout below 13880 suggests a lack of conviction so far from the buy-side.

13720 between the 20 and 30-day moving averages on the daily chart would be a critical support to monitor.

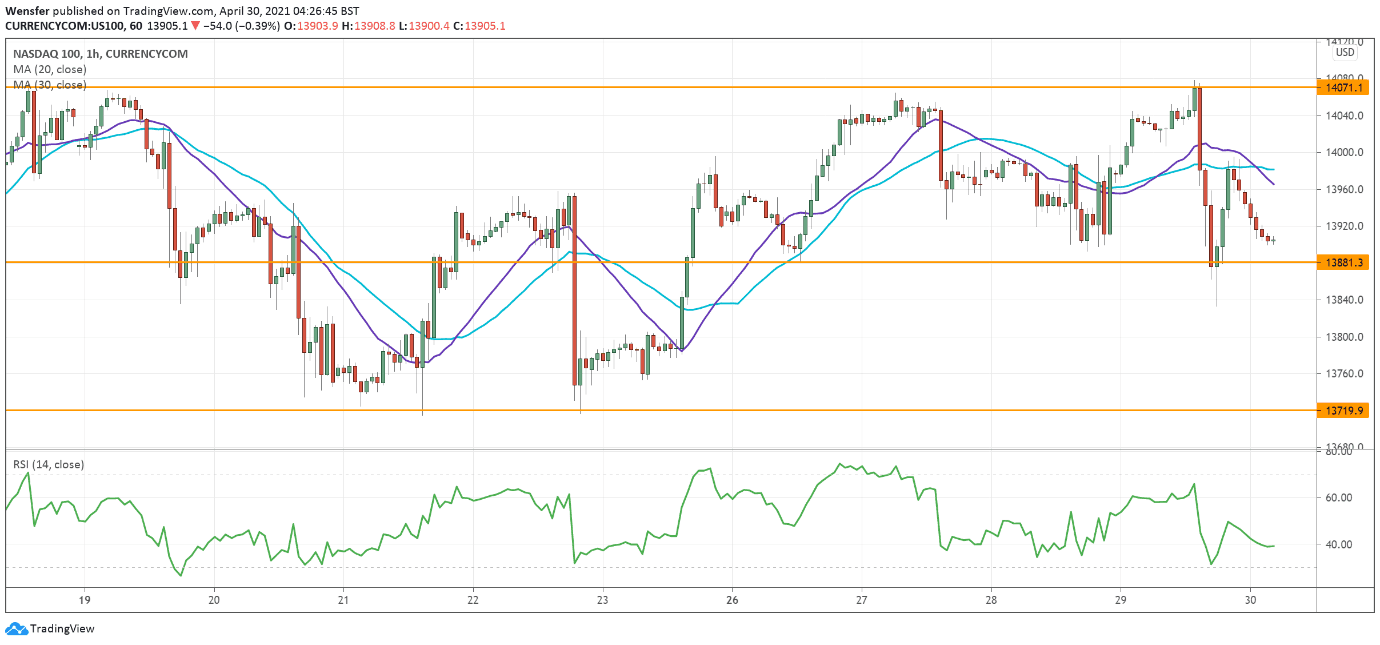

USDCAD rebounds briefly after sell-off

The US dollar struggles as core personal consumption expenditures fell short of expectations. After falling below the short-term support at 1.2370 the greenback has come under increasing pressure.

An oversold RSI may prompt sellers to take profit, offering the pair a chance to claw back some losses. Though the price action remains vulnerable to the downside. 1.2420 is a major resistance that would cap any velleity to rebound.

1.2200 would be the next target when selling pressure picks up again.