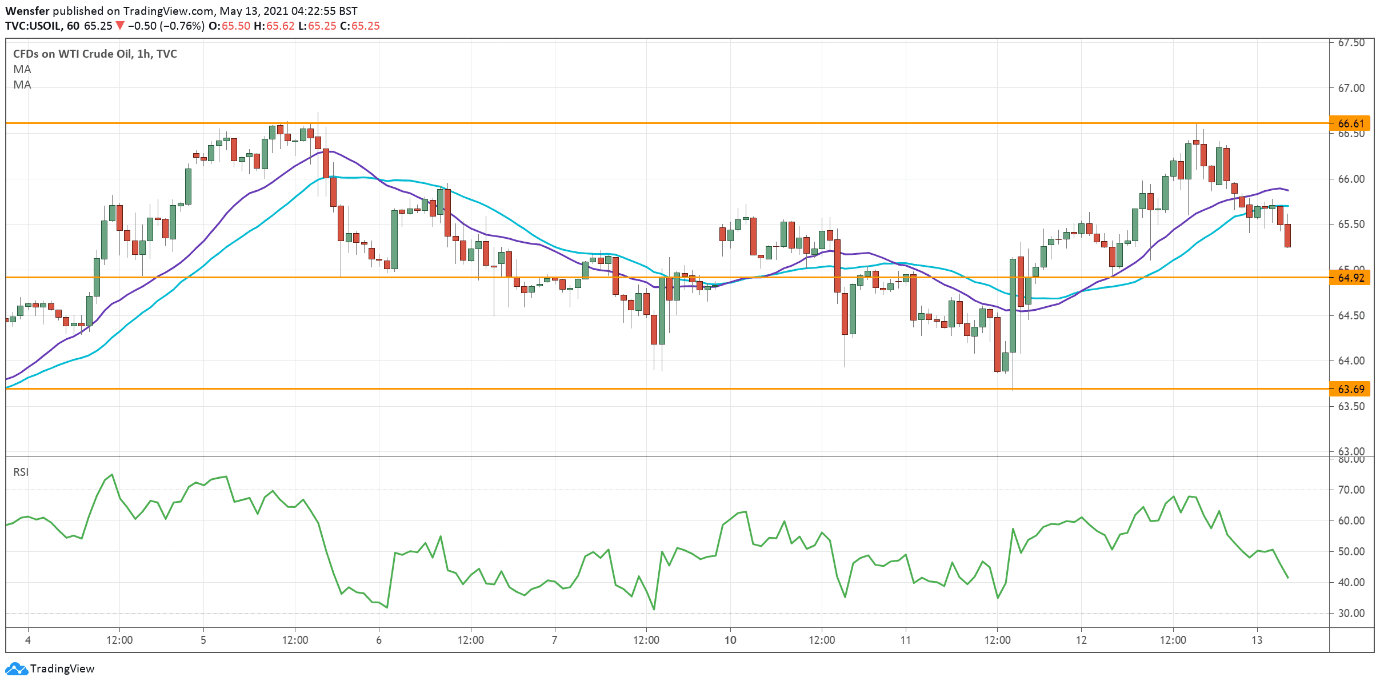

USDJPY rebounds from Fibonacci level

The US dollar jumped after April’s CPI rose 3% YoY nearly doubling markets’ expectations.

The greenback has found solid support after a double-dip at the 61.8% (108.30) Fibonacci retracement level.

The bullish momentum above 109.20 indicates buyers’ commitment to pushing beyond the recent consolidation range. A close above 109.70 could open the path towards 110.50.

With the RSI in the overbought area, profit-taking may briefly drive the price south, 108.65 is the closest support in case of a pullback.

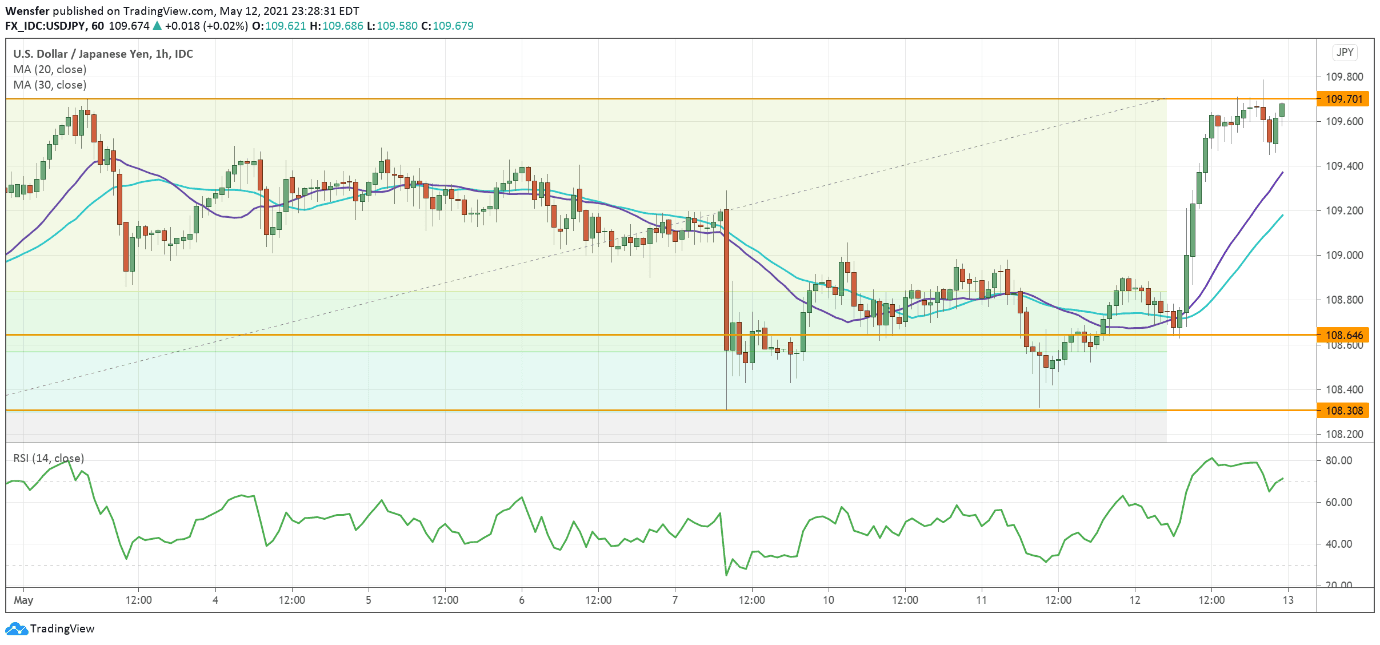

GBPUSD reaches supply zone

Sterling retreats as the greenback rallies across the board on upbeat inflation. The pair has met stiff selling pressure at the supply zone (1.4200) on the daily chart.

A combination of profit-taking and surging interest for the US dollar could trigger a deep correction. An RSI divergence suggests a loss in the upward momentum, and when this happens in the proximity of a major resistance may foreshadow a reversal.

1.4010 then 1.3890 are the next support levels if buyers start to dump their stakes.

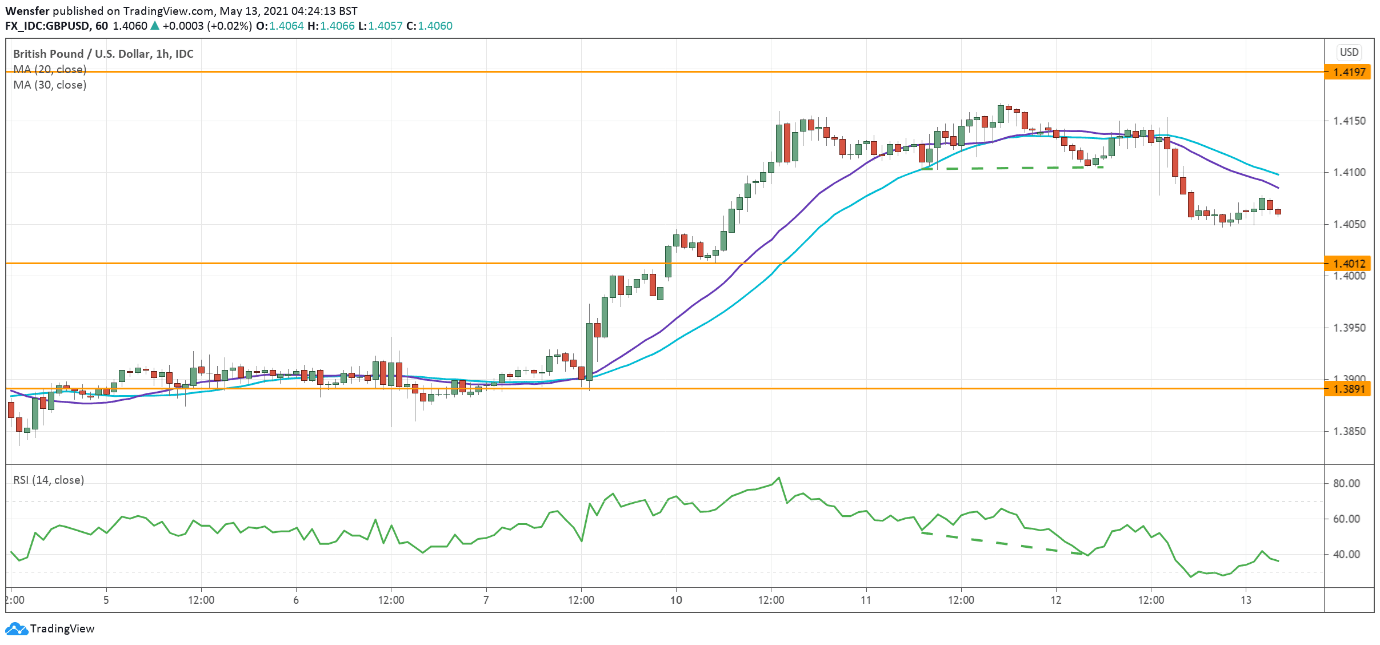

USOIL rises towards March’s high

WTI crude climbed after the International Energy Agency said demand would outpace supply.

The price action has kept its bullish bias after it bounced back from the demand zone around 64.00 which lies on the 20-day moving average. A close above the previous peak at 66.60 would prompt more buyers to join the rally.

Last March’s high at 67.90 would be the next target and its clearance may send the price towards 70s. On the downside, the previous resistance at 64.90 has turned into a support.