Welcome to our weekly market forecast series from forexcracked.com!

The Federal Reserve recently cut its key interest rate by 50 basis points, bringing it down to a range of 4.75% to 5%. This marks the first rate reduction since March 2020, and it represents a significant shift from the previous 14-month period of maintaining a high rate to combat inflation. The move has been interpreted as the Fed transitioning its focus towards supporting economic growth while balancing inflation and employment risks.

Fed Chair Jerome Powell emphasized the importance of taking a balanced approach to avoid reducing policy restraint too quickly, which could disrupt inflation control, or too slowly, which could weaken economic activity and employment. The Fed’s actions have already influenced the markets, with major indexes like the S&P 500 and Nasdaq seeing gains following the rate cut.

Looking ahead, the Fed has signaled the possibility of further rate cuts over the next few months, with policymakers projecting additional reductions by year-end. This ongoing adjustment in monetary policy will likely have a notable impact on the USD and related financial markets.

Before we continue with the analysis, if you don’t know much about trading, charts, candlesticks, risk management, or strategies, or if you want to improve your knowledge, consider reading our free forex trading course.

Upcoming Events for This Week

These events include macroeconomic reports, economic indicators, and, generally, what’s going on in the world.

Only the most important events are considered here. You can check the forexfactory.com for all the economic events and yahoo finance for news.

2024.09.23

There are no significant events on this day that could affect the forex market.

2024.09.24

- 0:30 ET: Australia will release its Cash Rate and RBA Rate Statement. The interest rate on overnight loans between banks is expected to stay at 4.35%. If the actual rate is higher than expected, it’s good for the currency. While the rate decision is often already reflected in the market, the RBA Rate Statement gets more attention as it discusses future plans. Short-term interest rates are crucial for currency value, and traders use other data to predict rate changes. This is a high-impact event for AUD pairs.

- 1:05 ET: BOJ Gov Ueda Speaks at a meeting with business leaders in Osaka. If BOJ Governor Kazuo Ueda is more hawkish than expected, it’s positive for the currency. As the head of the central bank, which sets short-term interest rates, he has a major influence on the value of the nation’s currency. Traders carefully listen to his speeches for clues about future monetary policy and interest rate changes. This will affect JPY pairs.

- 1:30 ET: RBA Press Conference. The conference has two parts: first, a prepared statement is read, followed by a Q&A session. The questions often lead to unscripted answers that can cause strong market reactions. If the tone is more hawkish than expected, it’s good for the currency. This is the RBA’s main way of sharing its thoughts on monetary policy, including the reasons behind recent interest rate decisions, the economic outlook, and inflation. It also provides hints about future policies, which can impact AUD pairs.

- 10:00 ET: US CB Consumer Confidence report will be released. Consumer confidence is a key indicator of spending, which makes up most of the economy. The previous reading was 103.3 and the forecast is 103.5. If the actual number is higher than the forecast, it’s good for the currency. This will affect USD pairs.

- 13:10 ET: BOC Gov Macklem Speaks at a fireside chat during the Institute of International Finance and Canadian Bankers Association Canada Forum in Toronto. Audience questions are expected. As the head of the central bank, which sets short-term interest rates, he has the most influence on the nation’s currency value. Traders closely watch his public appearances for hints about future monetary policy. If his tone is more hawkish than expected, it’s good for the currency and may impact CAD pairs.

- 21:30 ET: Australia will release its CPI y/y report, showing the change in the price of goods and services purchased by consumers. The previous reading was 3.5%, and the forecast is 2.8%. If the actual number is higher than expected, it’s good for the currency. Consumer prices make up most of overall inflation, which is key for currency value because higher inflation can lead the central bank to raise interest rates. This is a highly volatile event for AUD pairs.

2024.09.25

There are no significant events on this day that could affect the forex market.

2024.09.26

- 3:30 ET: The Swiss National Bank will release its monetary policy statement and interest rate decision. The previous rate was 1.25%, and the forecast is 1.00%. If the actual rate is higher than expected, it’s good for the currency. Short-term interest rates are crucial for currency value, as traders use other indicators to predict future rate changes. This event will have a strong impact on CHF pairs.

- 4:00 ET: SNB Press Conference by the SNB Chairman and Governing Board Members. Held quarterly, it lasts about an hour and has two parts: first, they read prepared statements, then they take press questions. The Q&A often leads to unscripted answers that can cause market volatility. This is one of the main ways the SNB shares its views on monetary policy and the economic outlook. This will have an impact on CHF pairs.

- 8:30 ET: The US will release its Final GDP q/q report, which shows the annualized change in the inflation-adjusted value of all goods and services produced. The previous reading was 3.0% and the forecast is 2.9%. If the actual number is higher than expected, it’s good for the currency. Although this is quarterly data, it’s reported in an annualized format (quarterly change x4). There are three versions of GDP released a month apart: Advance, Preliminary, and Final. The Advance release has the most impact. This is the main measure of economic activity and a key indicator of the economy’s health. This will affect USD pairs.

- 9:20 ET: Fed Chair Powell Speaks with pre-recorded remarks at the US Treasury Market Conference in New York. If his tone is more hawkish than expected, it’s good for the currency. As the head of the central bank, which sets short-term interest rates, he has the most influence on the nation’s currency value. Traders closely watch his public comments for hints about future monetary policy. This will affect USD pairs.

2024.09.27

- 8:30 ET: Canada will release its GDP m/m report, showing the change in the inflation-adjusted value of all goods and services produced. The previous reading was 0.0% and the forecast is 0.1%. This is the most comprehensive measure of economic activity and a key indicator of the economy’s health. This will impact CAD pairs.

- 8:30 ET: The US will release the Core PCE Price Index m/m, which shows changes in the price of goods and services bought by consumers, excluding food and energy. The previous and forecast values are both 0.2%. If the actual figure is higher than expected, it’s good for the currency. Unlike Core CPI, it focuses only on items consumed by individuals, weighted by total spending. It’s the Federal Reserve’s main measure of inflation, and rising prices can lead to higher interest rates. This will impact USD pairs.

Forex Market Analysis

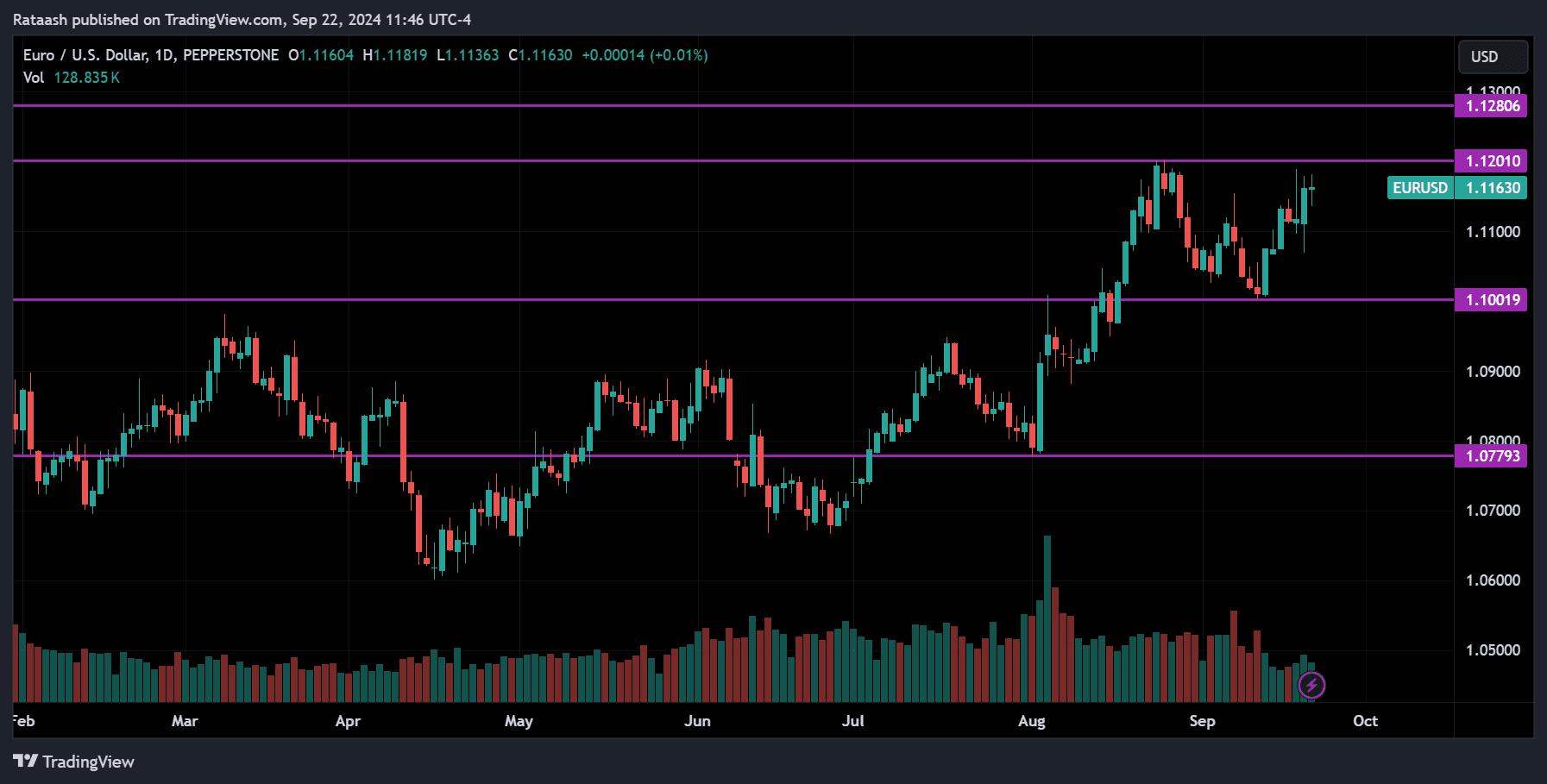

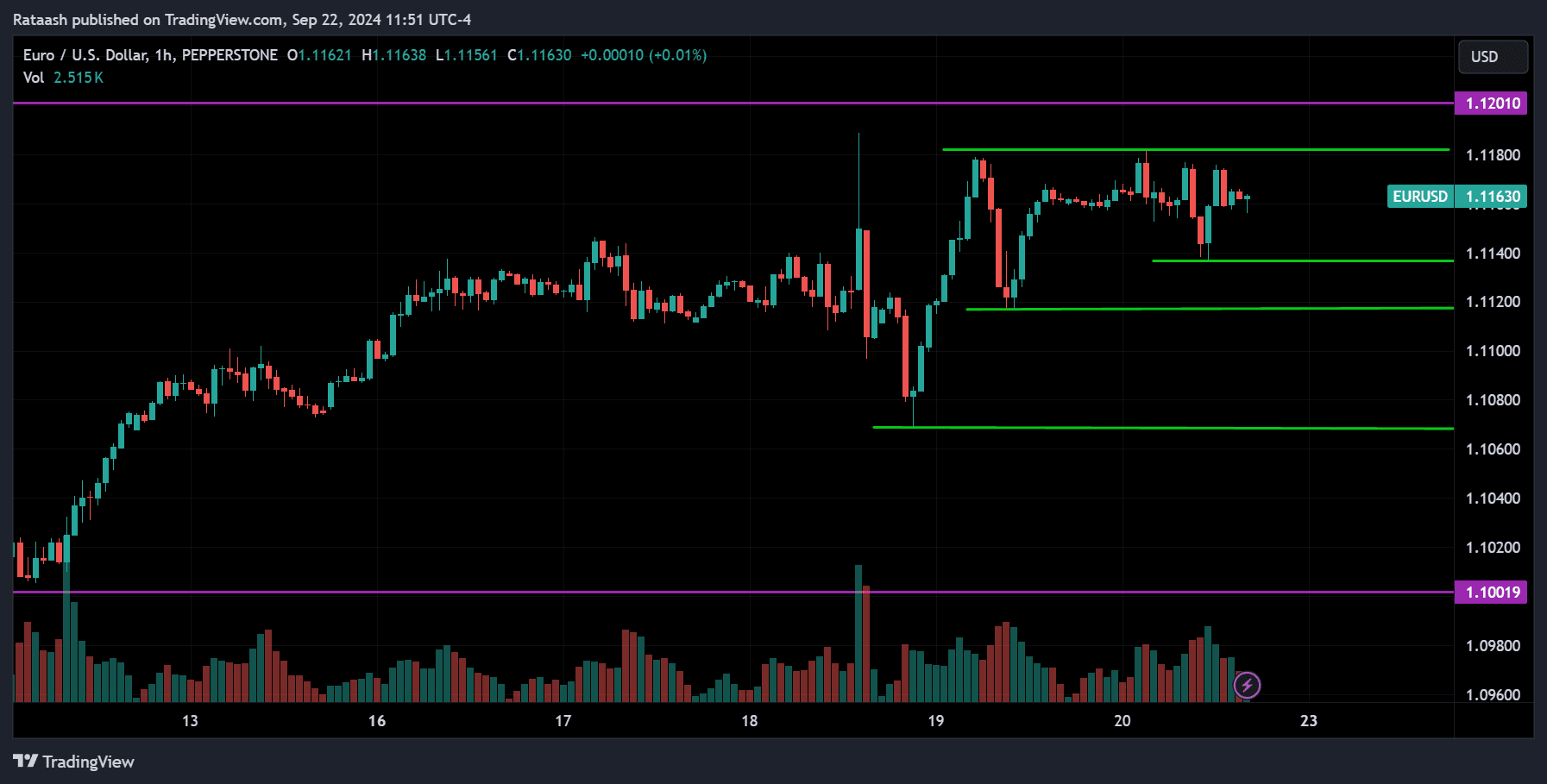

EURUSD:

EURUSD is trending up overall, and the price recently pulled back from the 1.12000 resistance level and is now testing that zone again. Since the trend is bullish, we may see the price break above this resistance and continue toward the 1.13000 level. However, if the price reverses and drops below the 1.11200 support, it could fall to 1.10700, and if that level breaks too, the next target would be around 1.10000.

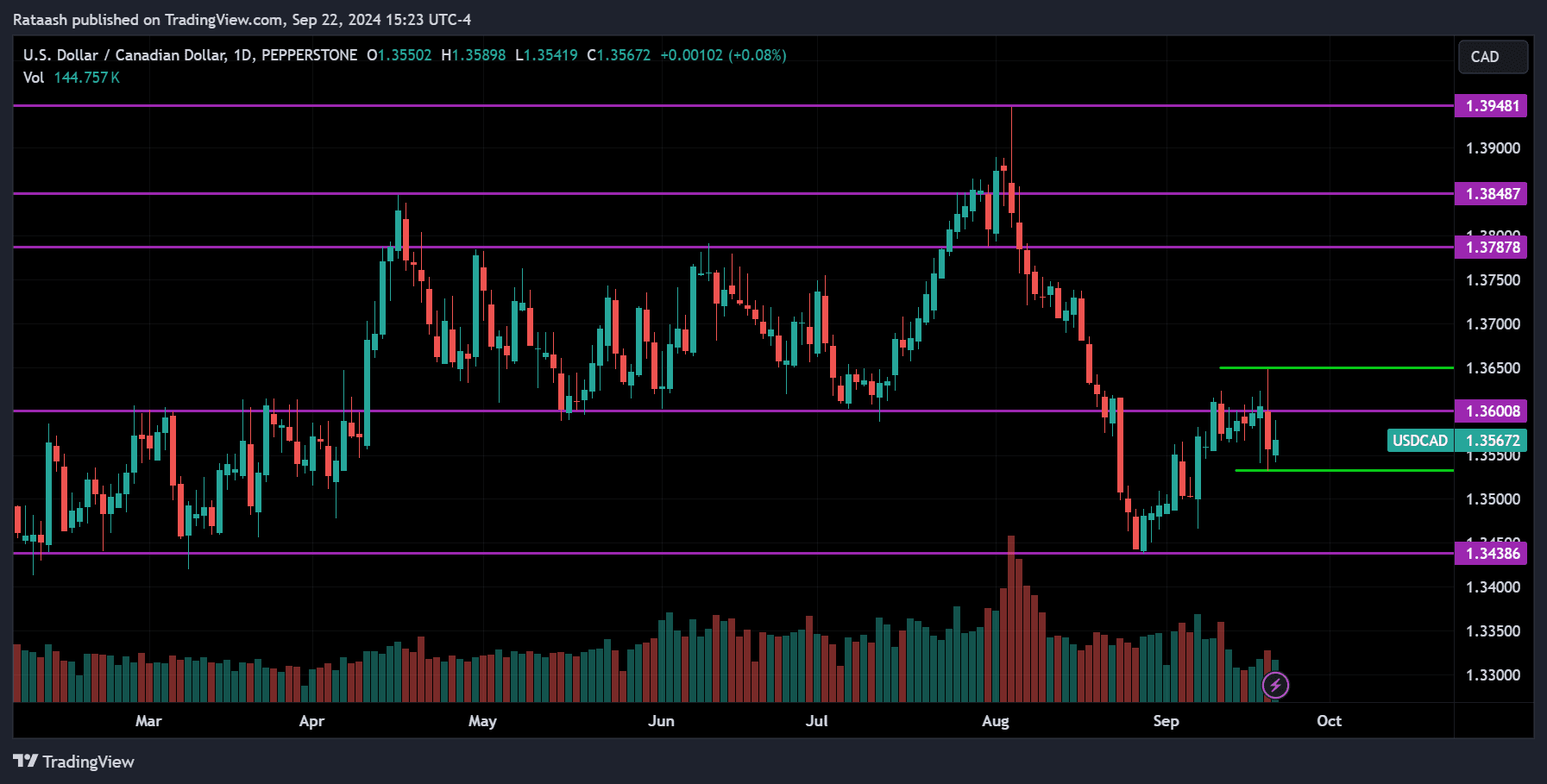

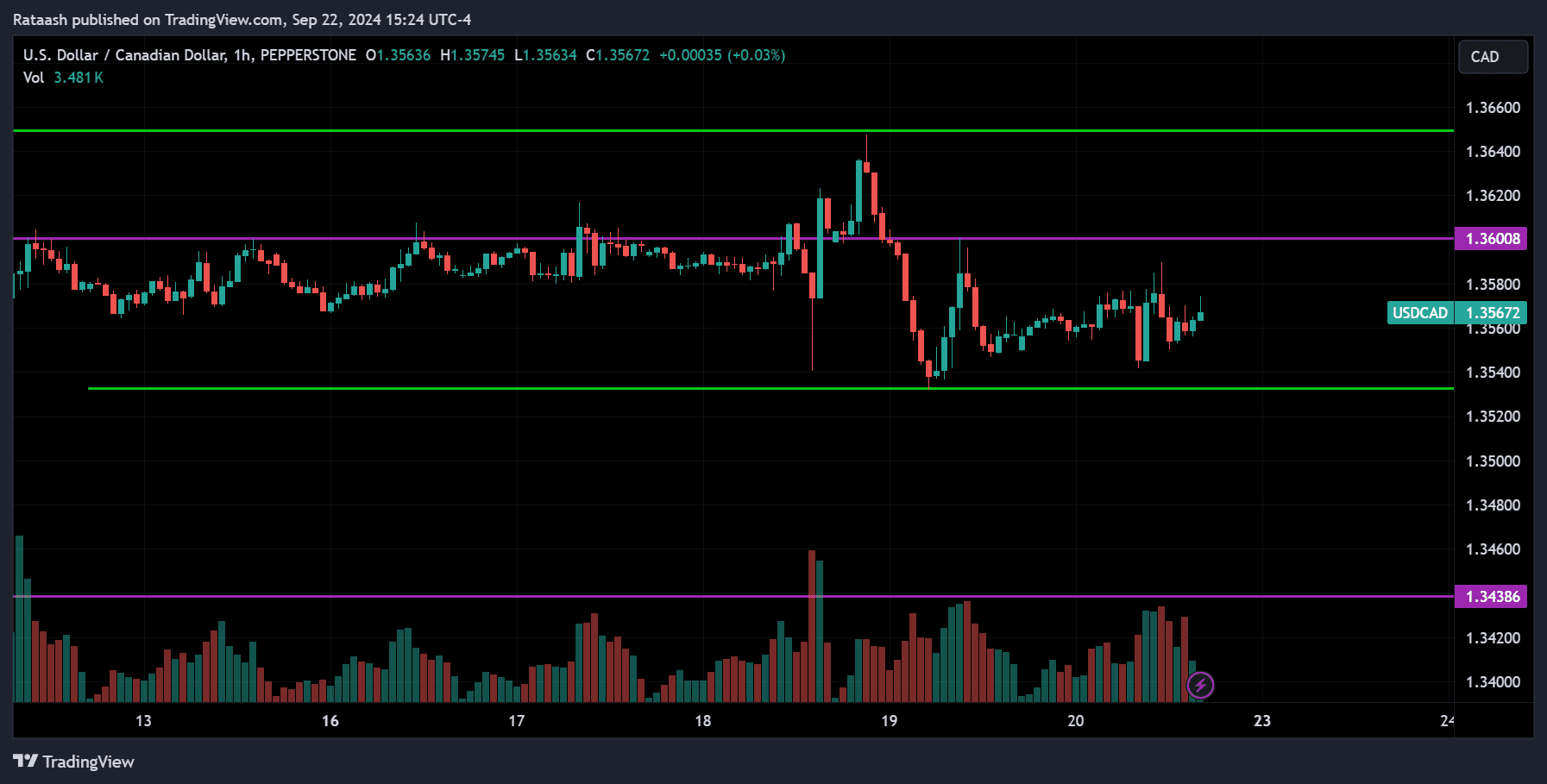

USDCAD:

USDCAD is in a downtrend overall. The price recently pulled back from the 1.34500 support level and is now consolidating around the 1.36000 resistance. There is support around 1.35400—if the price drops below this level, it could fall further to the 1.34400 support. If this level also breaks, the downtrend may continue. However, if the price starts to move up from the 1.35400 support and breaks above 1.36000, it could signal a new uptrend. A break above the 1.36600 resistance would confirm the uptrend, potentially pushing the price toward the 1.37800 range.

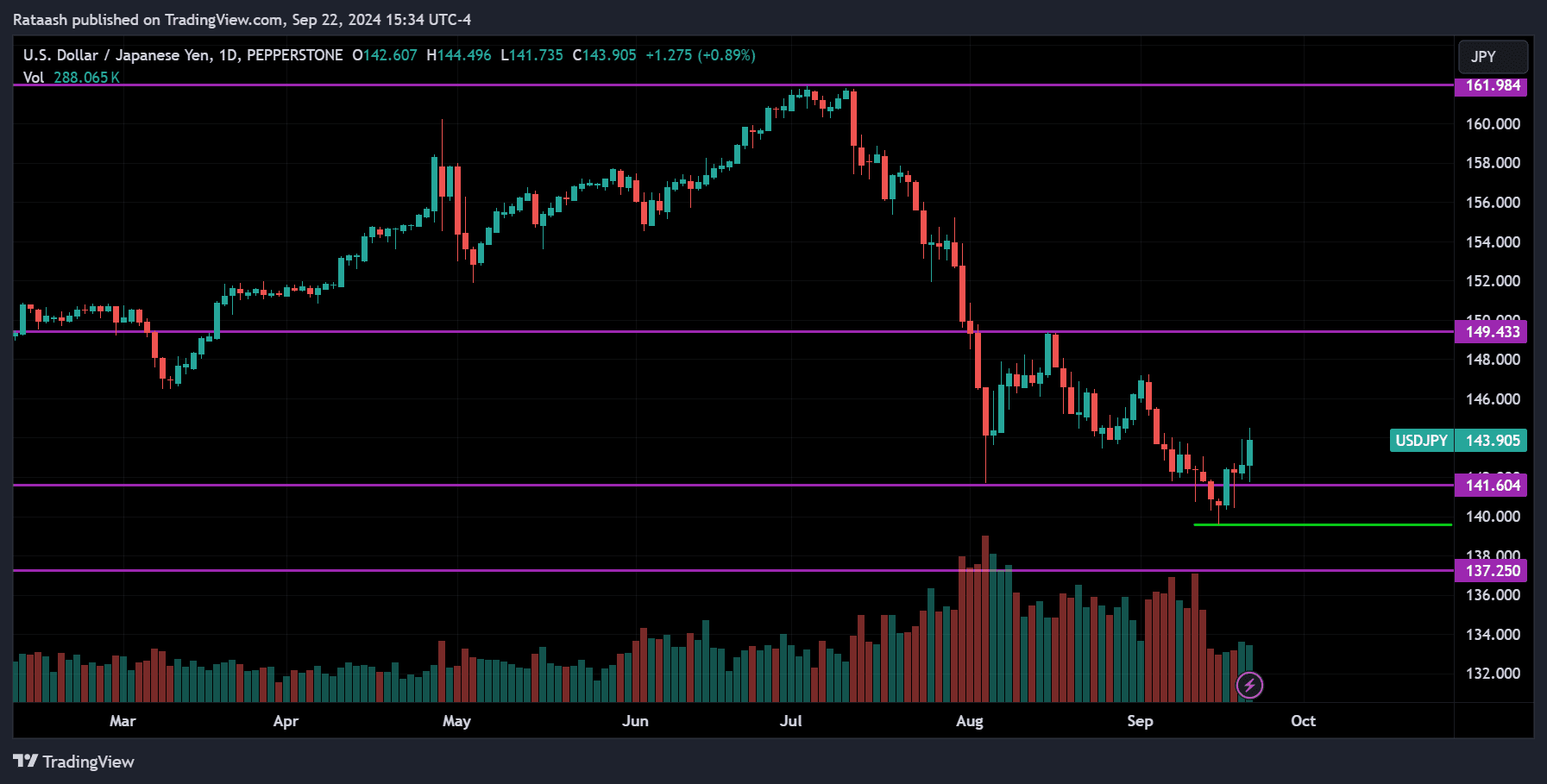

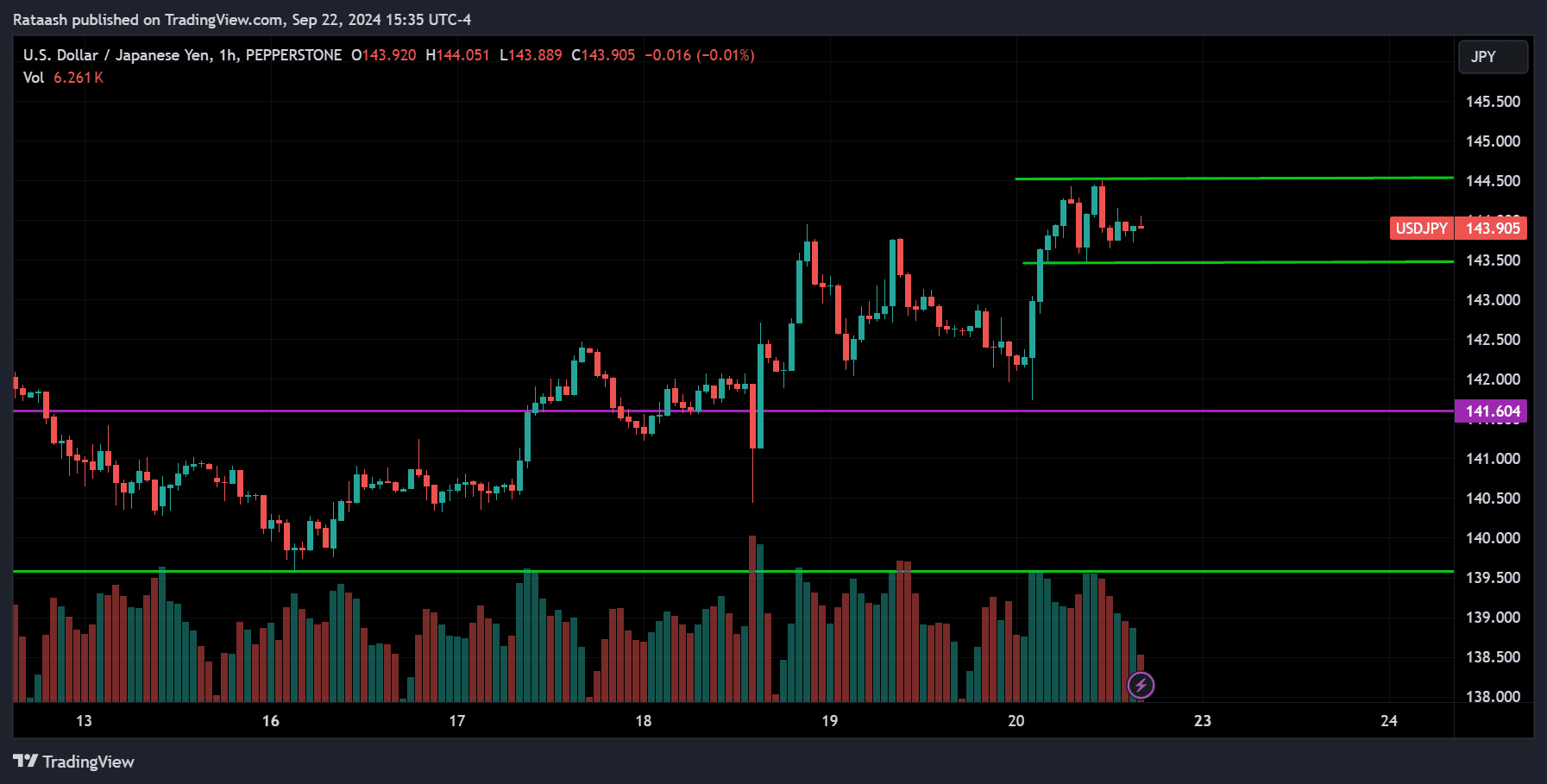

USDJPY:

USDJPY is in a downtrend overall. The price recently bounced up from the 139.500 support and is now at the 144.500 resistance level. If it breaks above this resistance, the price could continue up toward 149.500. However, since the overall trend is still down, the price may drop below the 143.500 support and fall to 141.600, and if that level also breaks, it could return to 139.500.

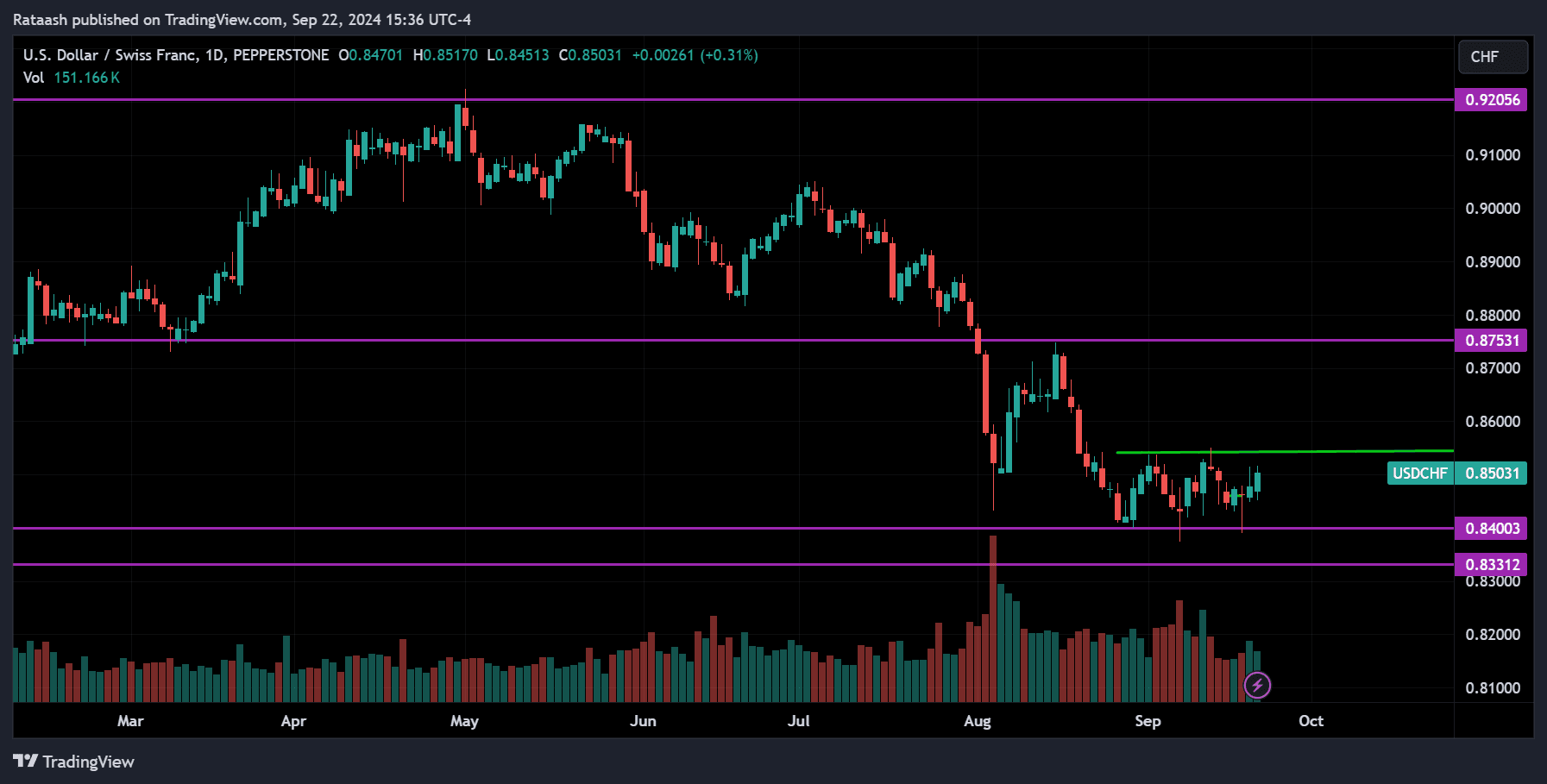

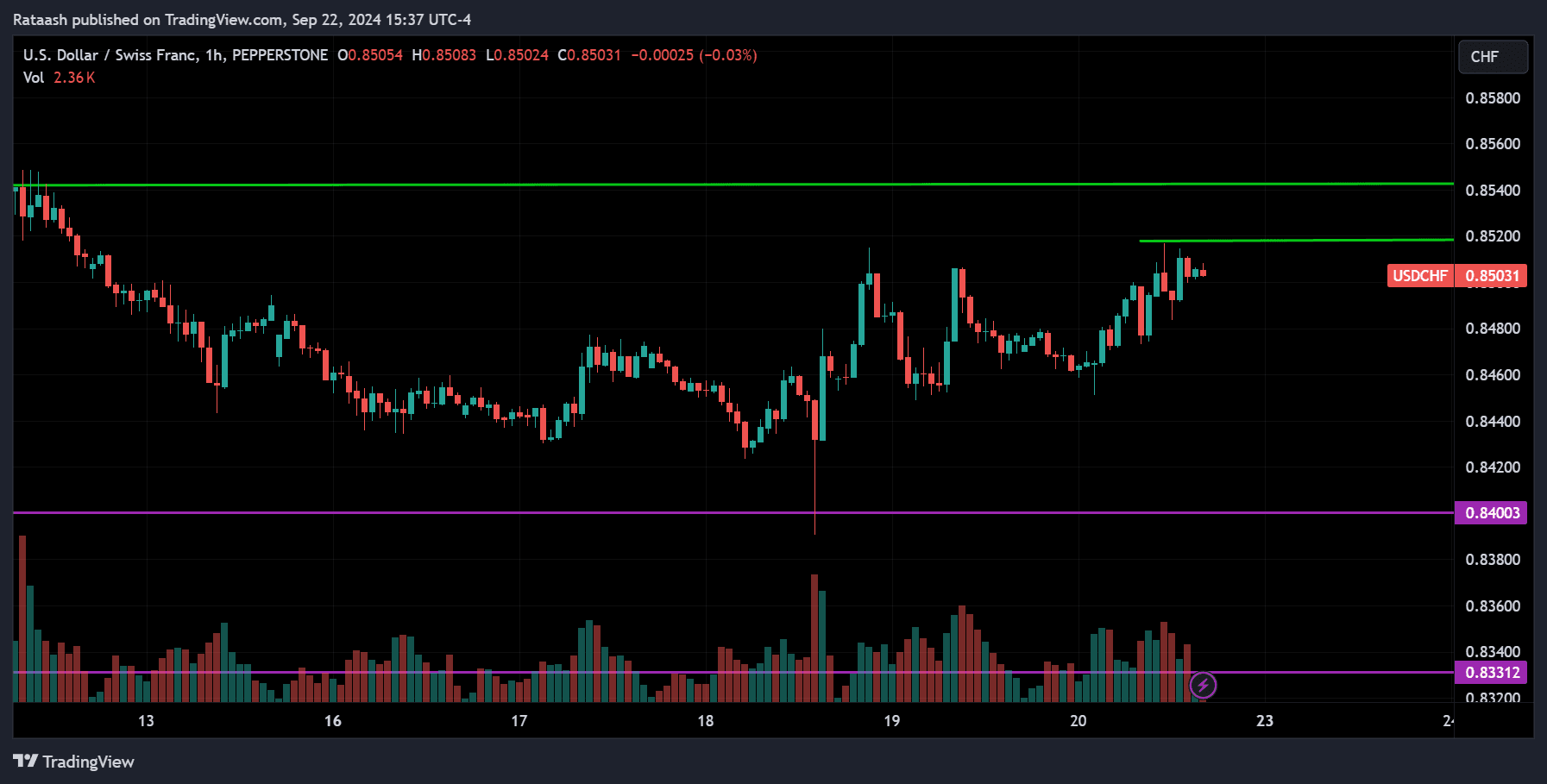

USDCHF:

USDCHF is trending down and currently consolidating around the 0.84000 support level. There is minor resistance at 0.85400—if the price breaks above this level, it could indicate the start of an uptrend or a correction, potentially moving toward the 0.87500 range. If it breaks above this range, we can confirm an uptrend. However, since the overall trend is still down, the price may drop from the 0.85200 resistance and head back towards 0.84000.

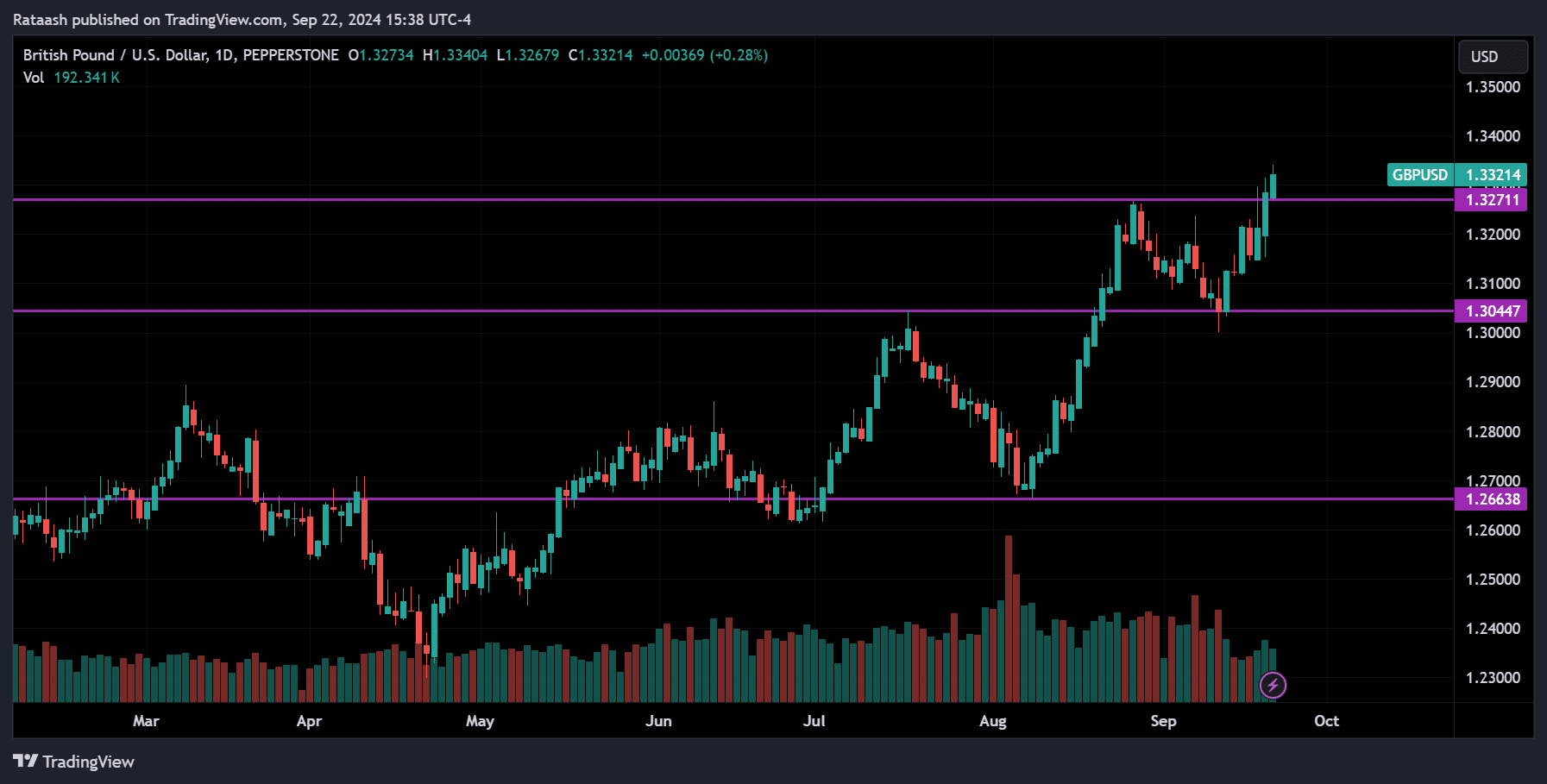

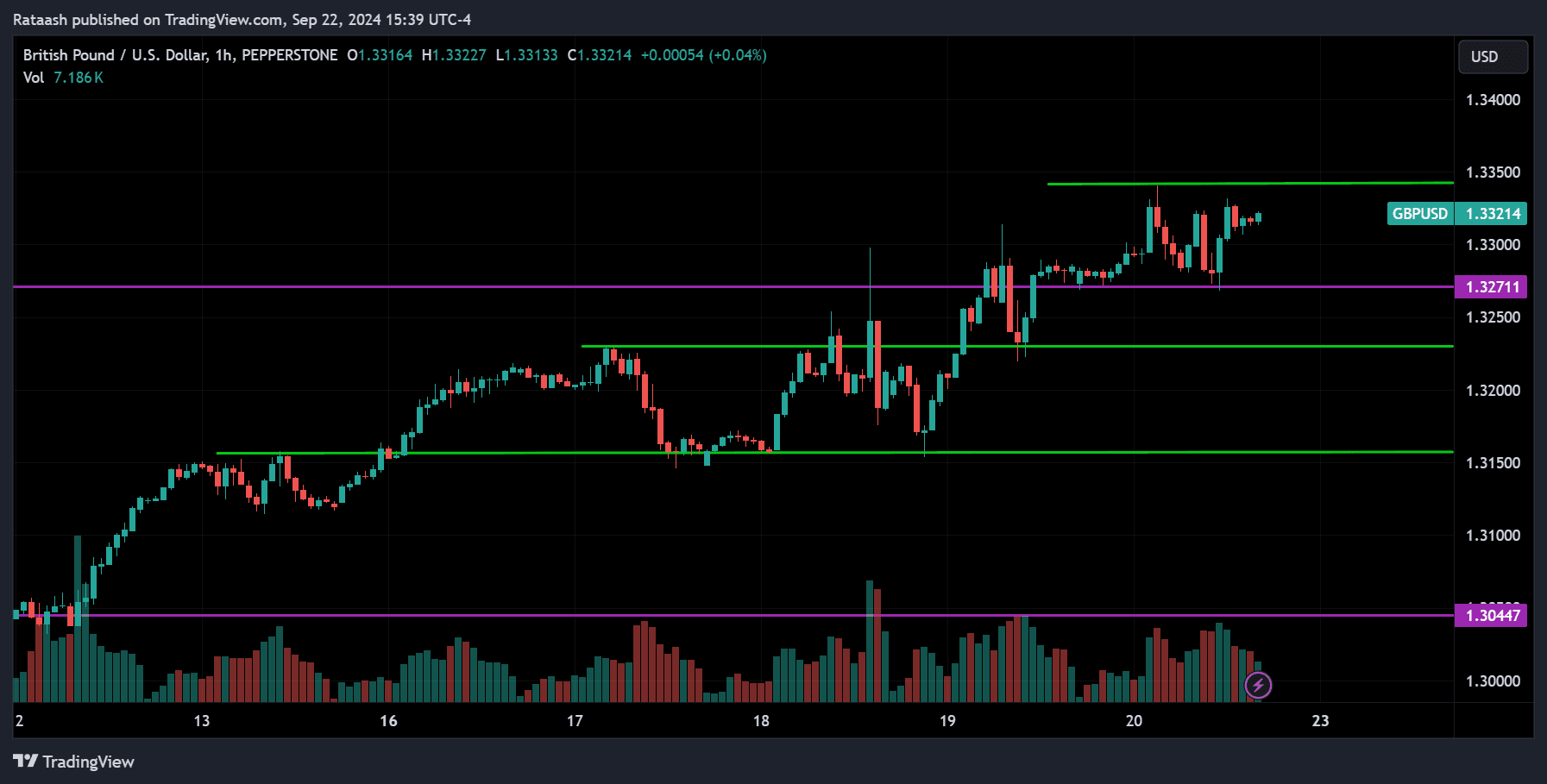

GBPUSD:

GBPUSD is trending up overall and recently broke above the major 1.32700 resistance level, so we can expect the price to continue rising. On the 1-hour chart, there is resistance around 1.33500. If the price breaks above this level, it could move toward the next resistance, usually near round numbers. However, if the price drops below the previous resistance, now support, at 1.32700, it may fall to the 1.32400 range. If that level breaks, the next targets are 1.31500 and then the major support at 1.30500.

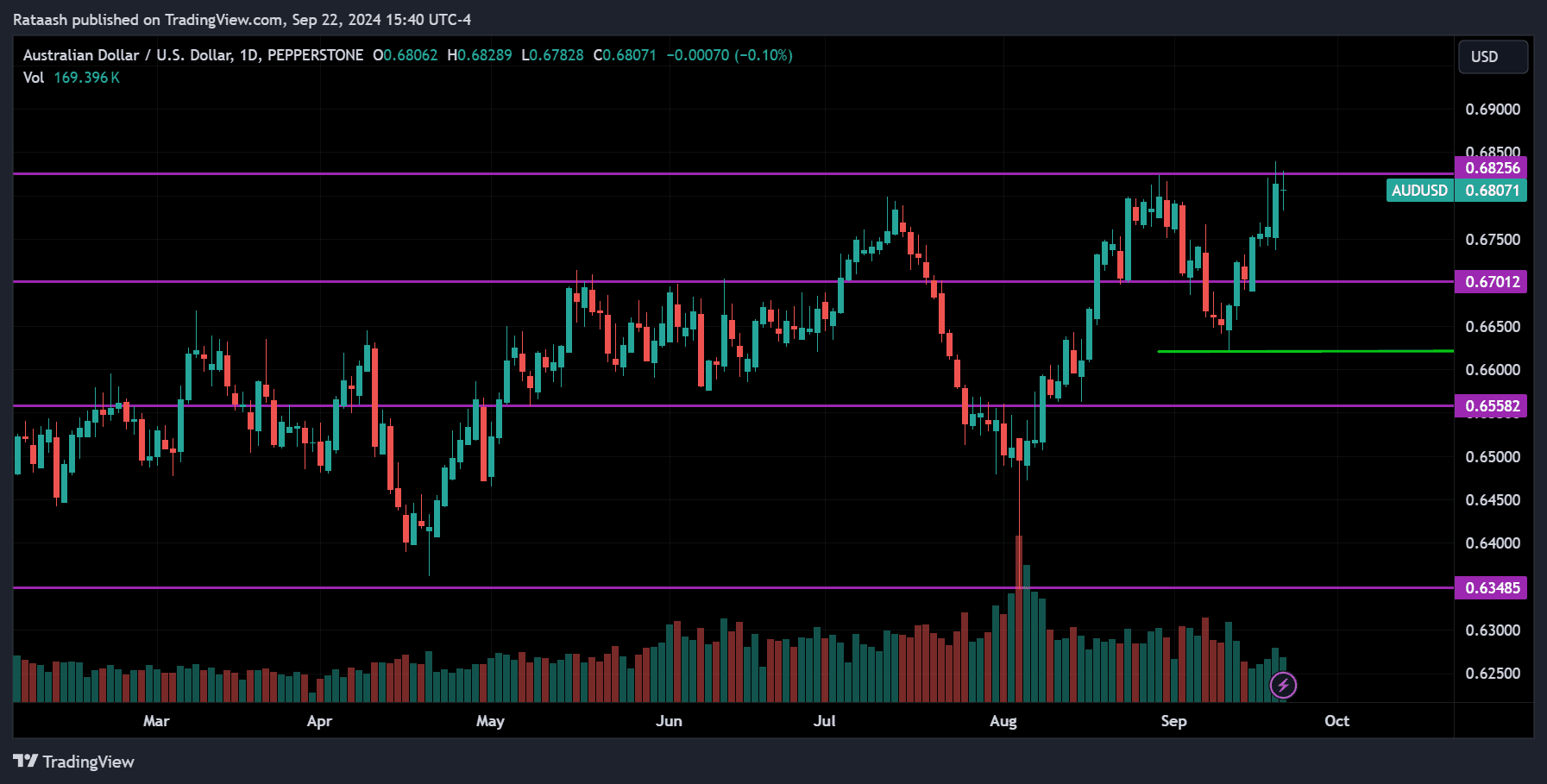

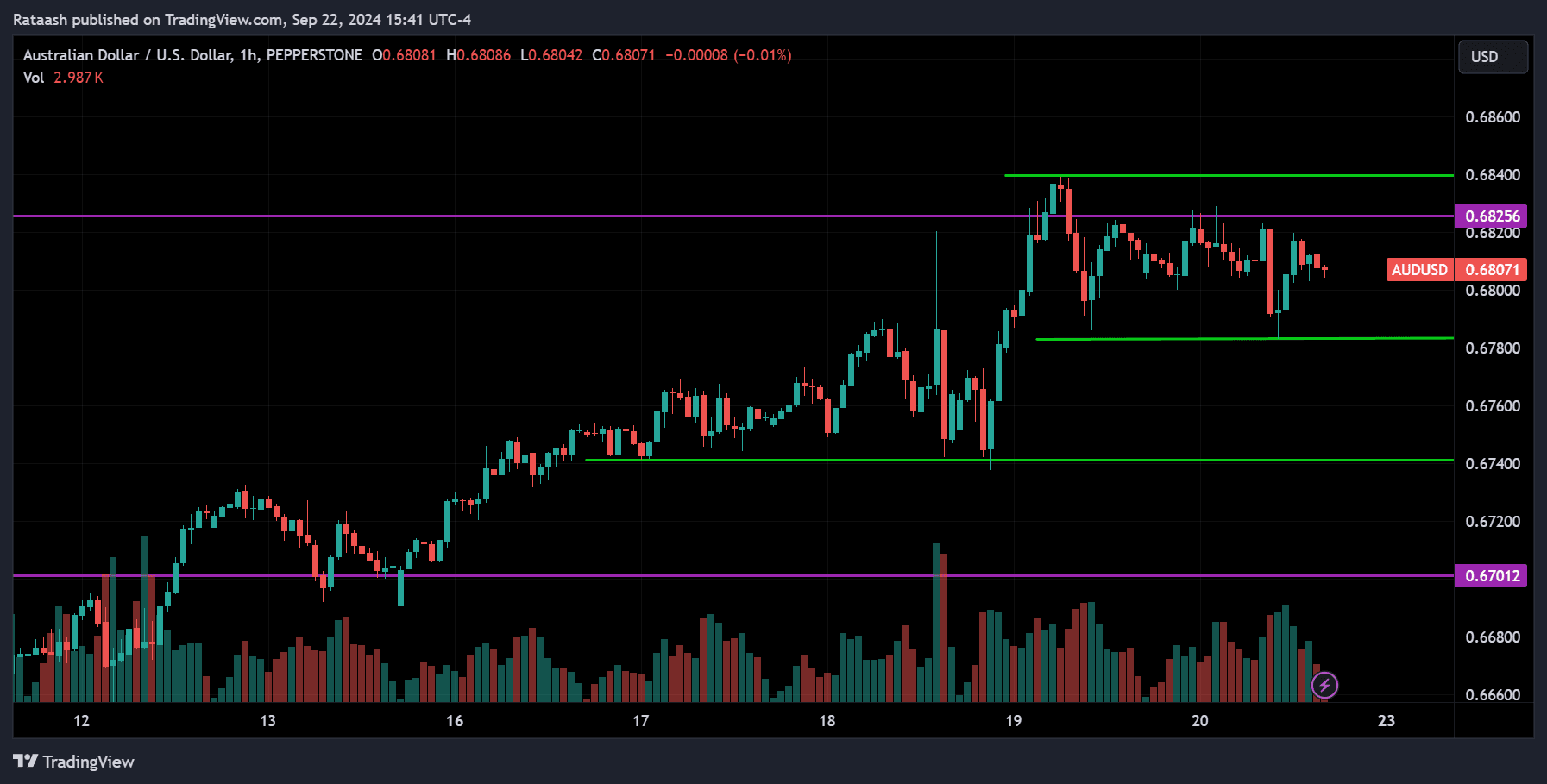

AUDUSD:

AUDUSD is trending up, currently at the major resistance level of 0.68250. There is a minor resistance around 0.68400—if the price breaks above this, we can expect it to continue rising. On the other hand, there is a small support around 0.67800—if the price drops below this, it could fall to 0.67400. If that level breaks, the next target would be 0.67000.

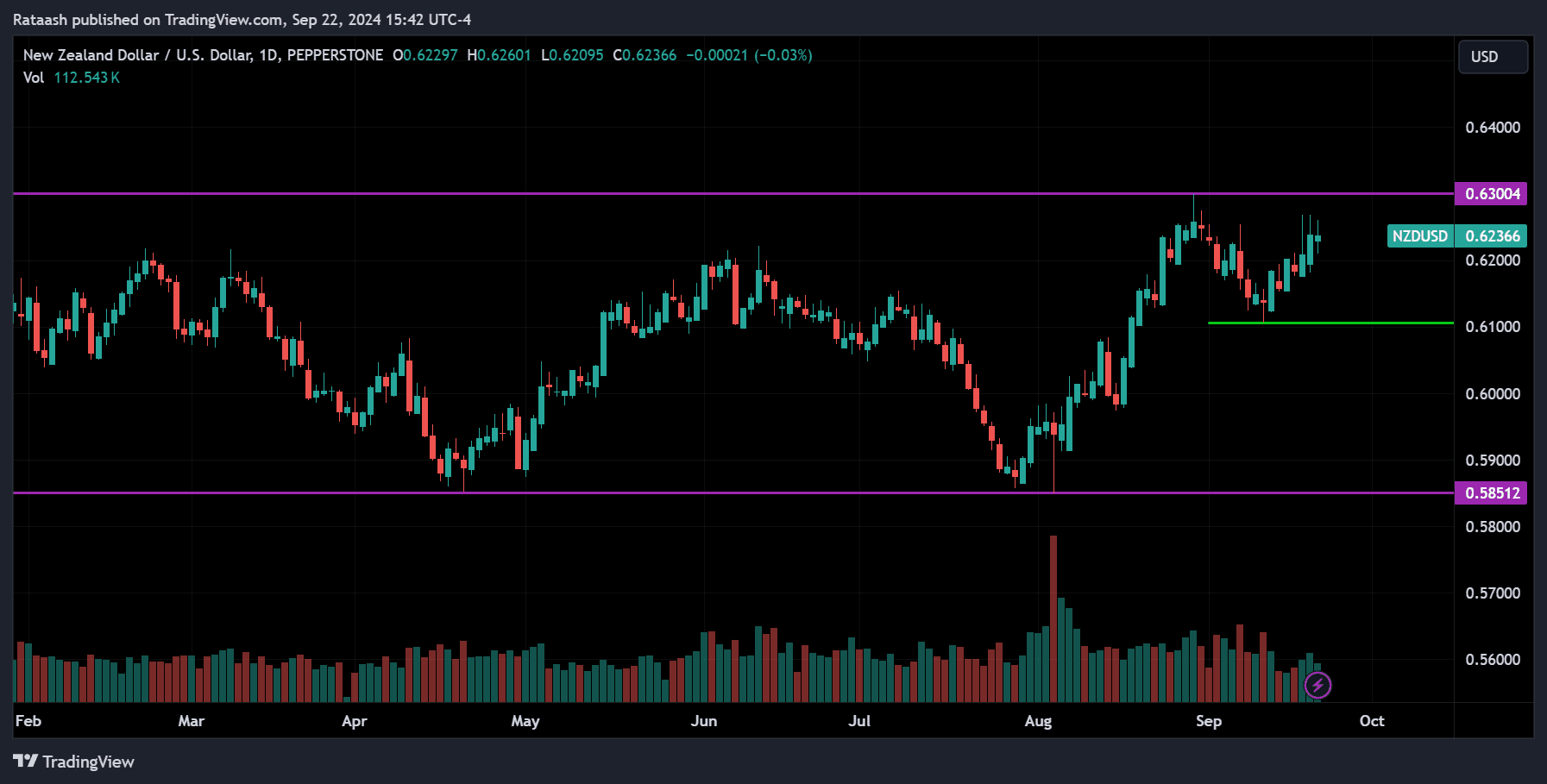

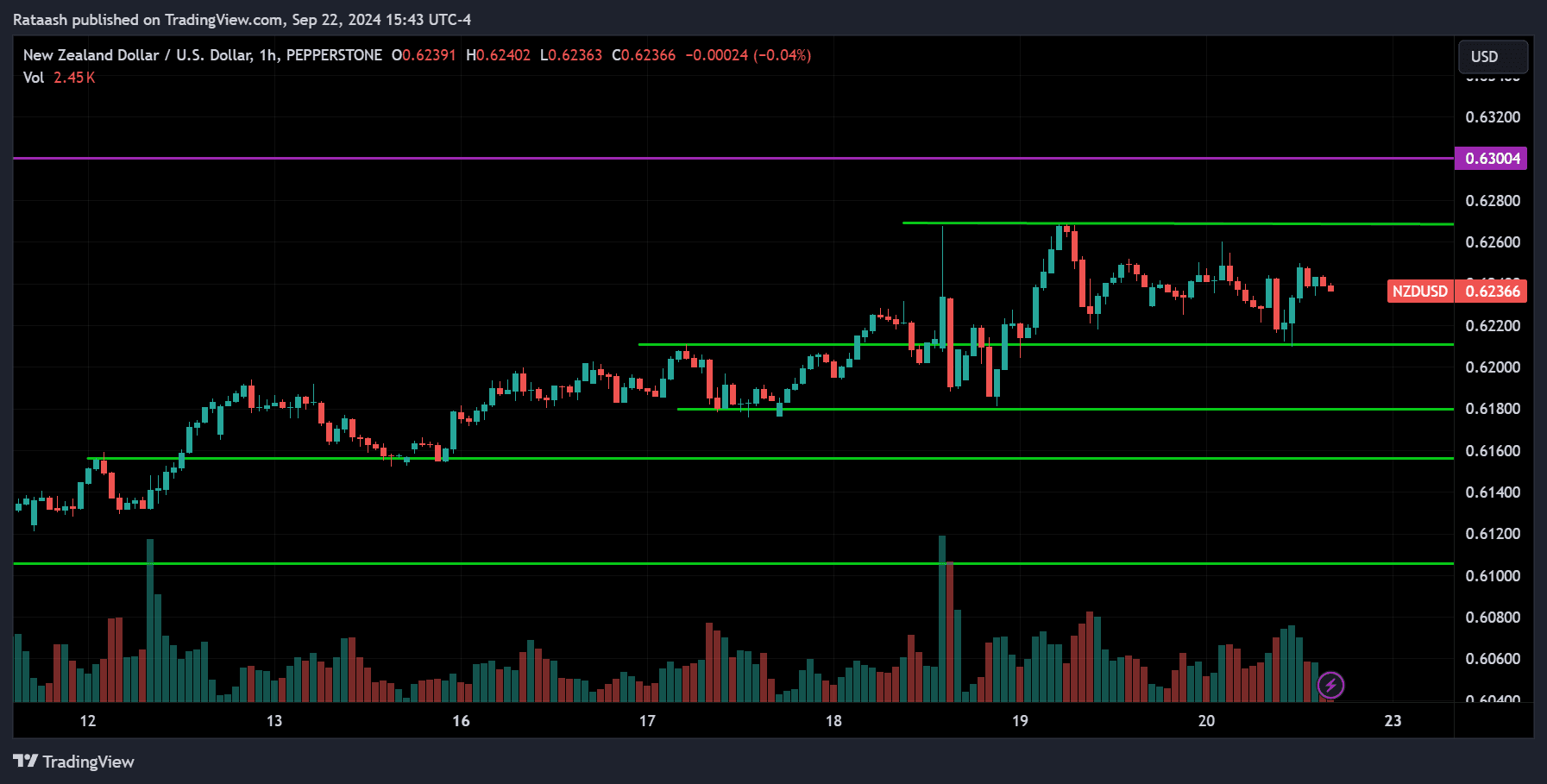

NZDUSD:

NZDUSD is moving sideways overall, but on the daily chart, you can see a small uptrend forming. The price is now approaching the 0.63000 resistance level. We might see a reversal at this resistance, causing the price to drop toward the support levels marked on the chart. If each support level is broken, the next target will be the following support. However, if the price breaks above the 0.63000 resistance, we can expect the uptrend to continue.

Commodities Market Analysis

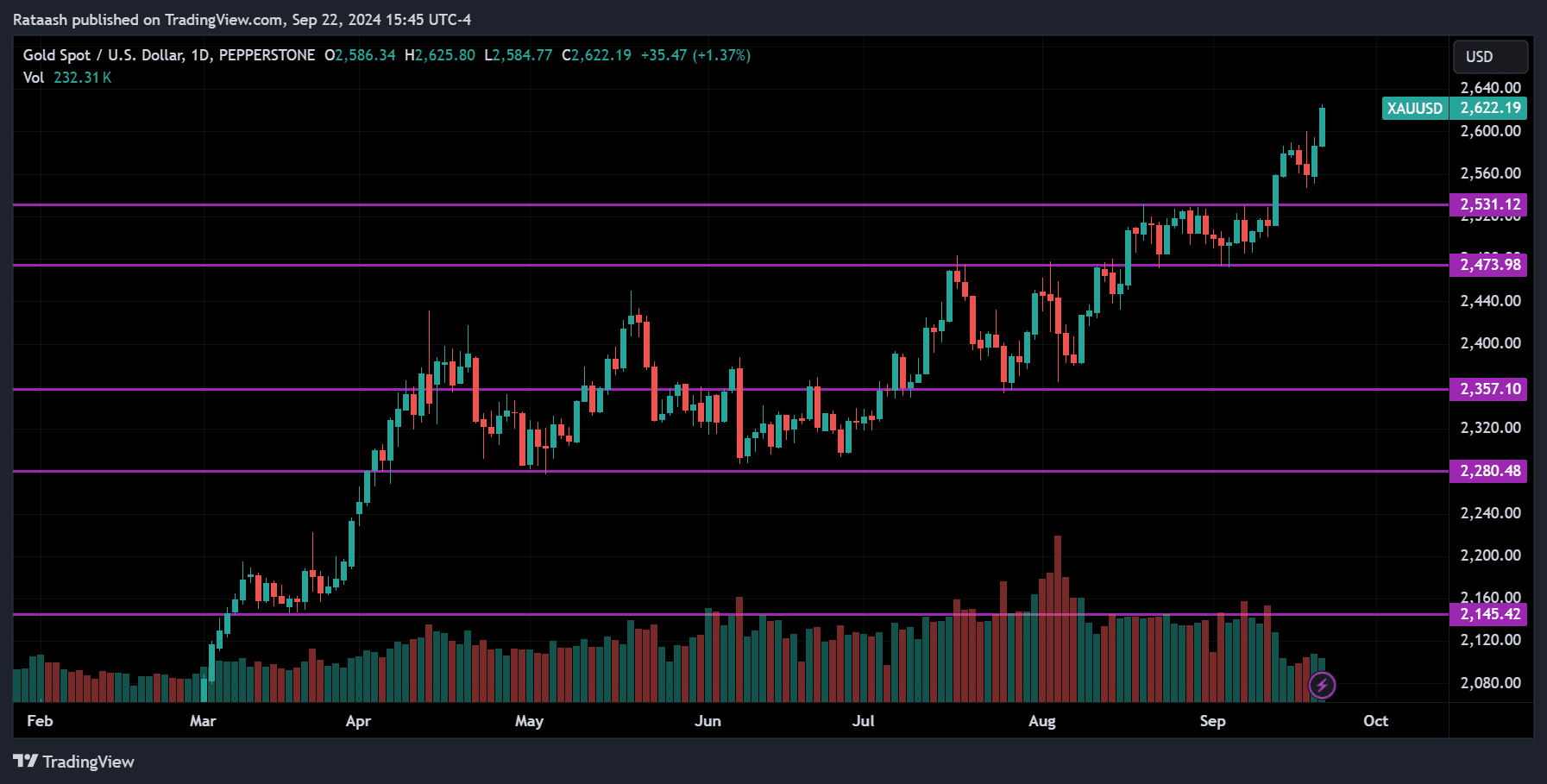

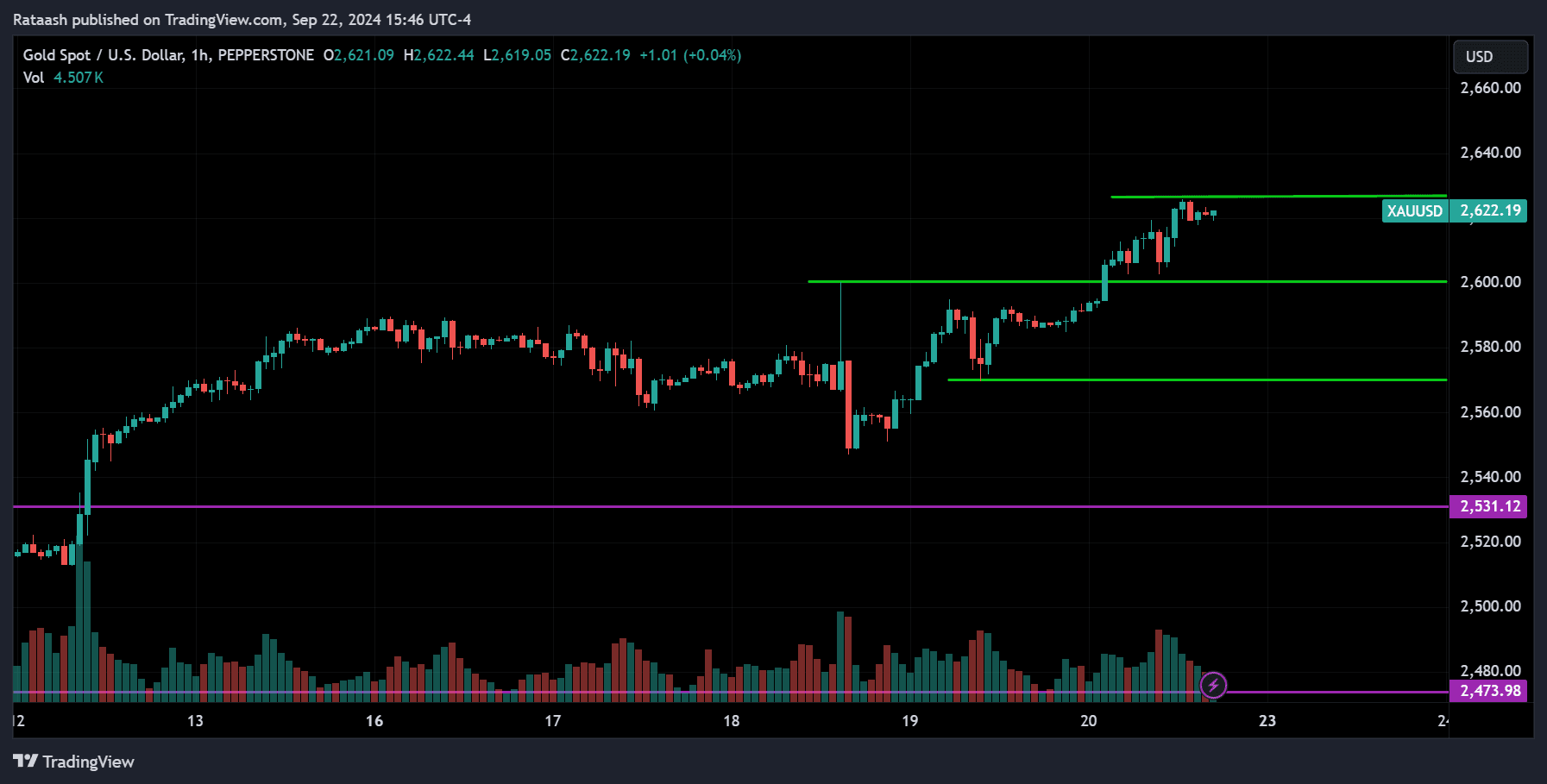

GOLD:

GOLD is currently at its all-time high levels. On the 1-hour chart, there is minor support around 2600. If the price breaks below this level, it could indicate a correction, and we might see the price fall to the next support levels. As long as it stays above 2500, the uptrend remains intact.

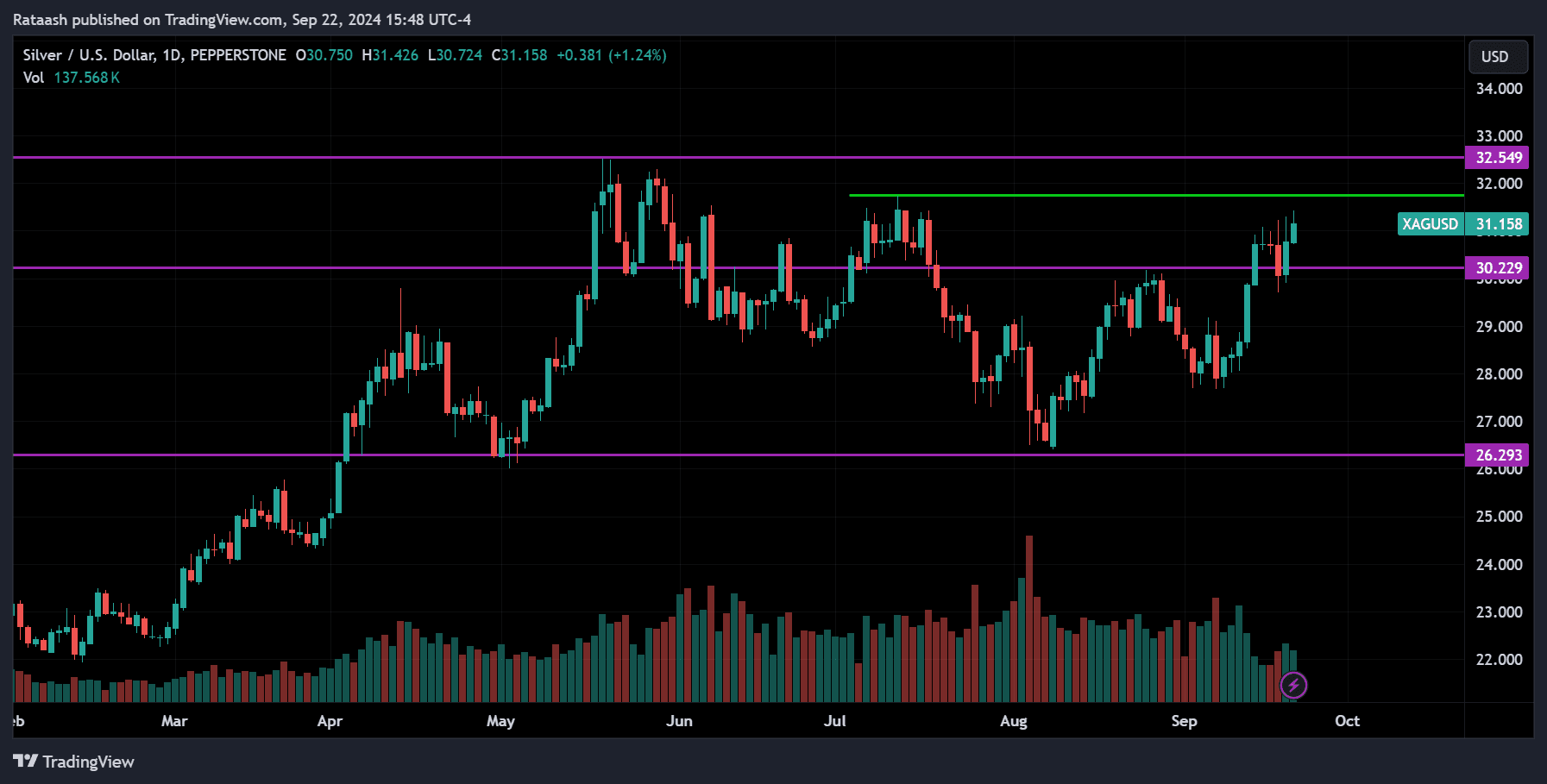

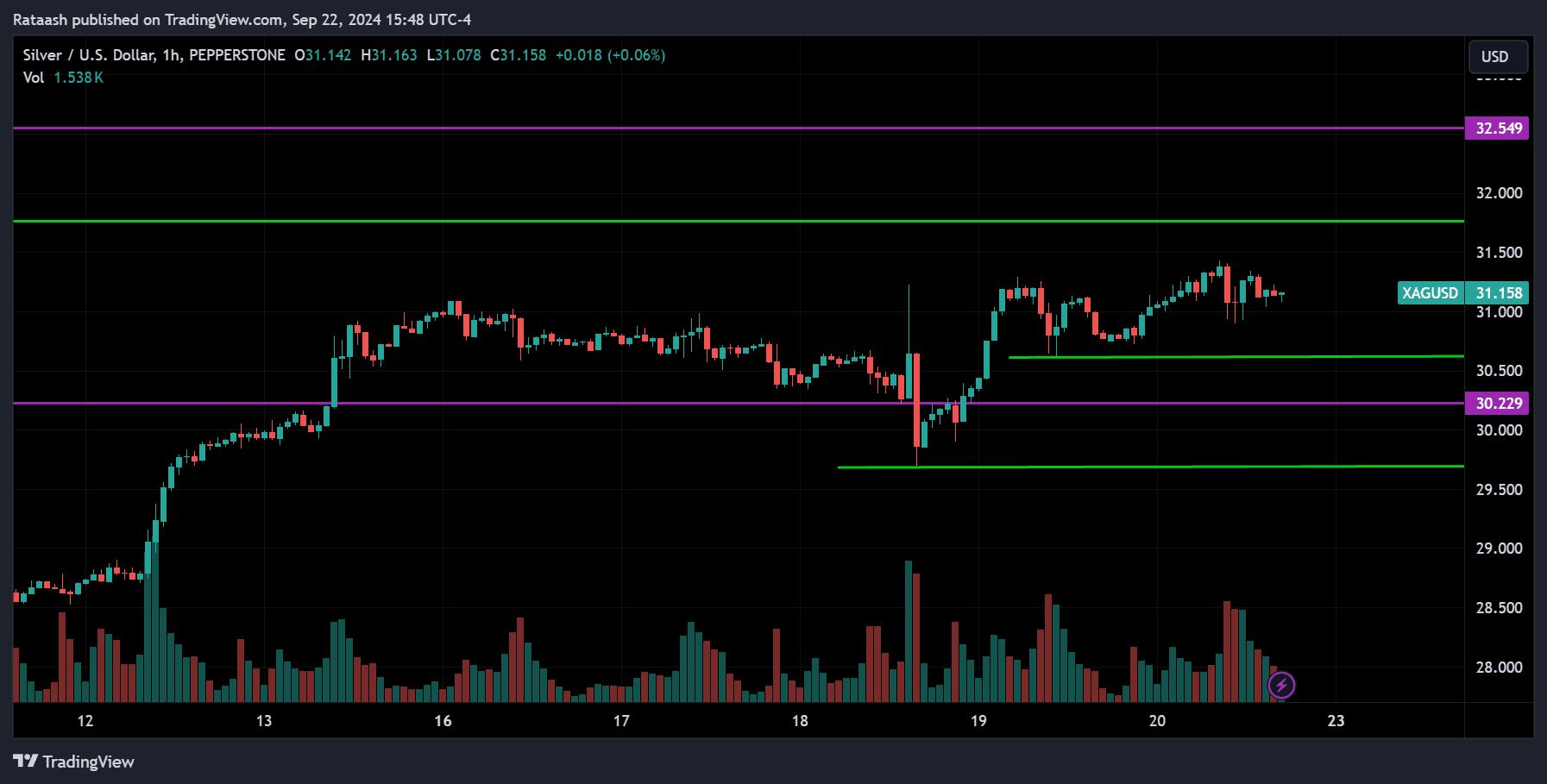

SILVER:

XAGUSD (Silver) is mostly consolidating, but in the medium term, there is a small uptrend. The price is approaching the 32 resistance level. If it breaks above this level, the price could continue upward toward the major resistance at 32.500. If this level is also broken, we can expect the uptrend to continue. However, if the price starts to fall and breaks below the 30 support, we may see a reversal, with the price potentially dropping to 29.500.

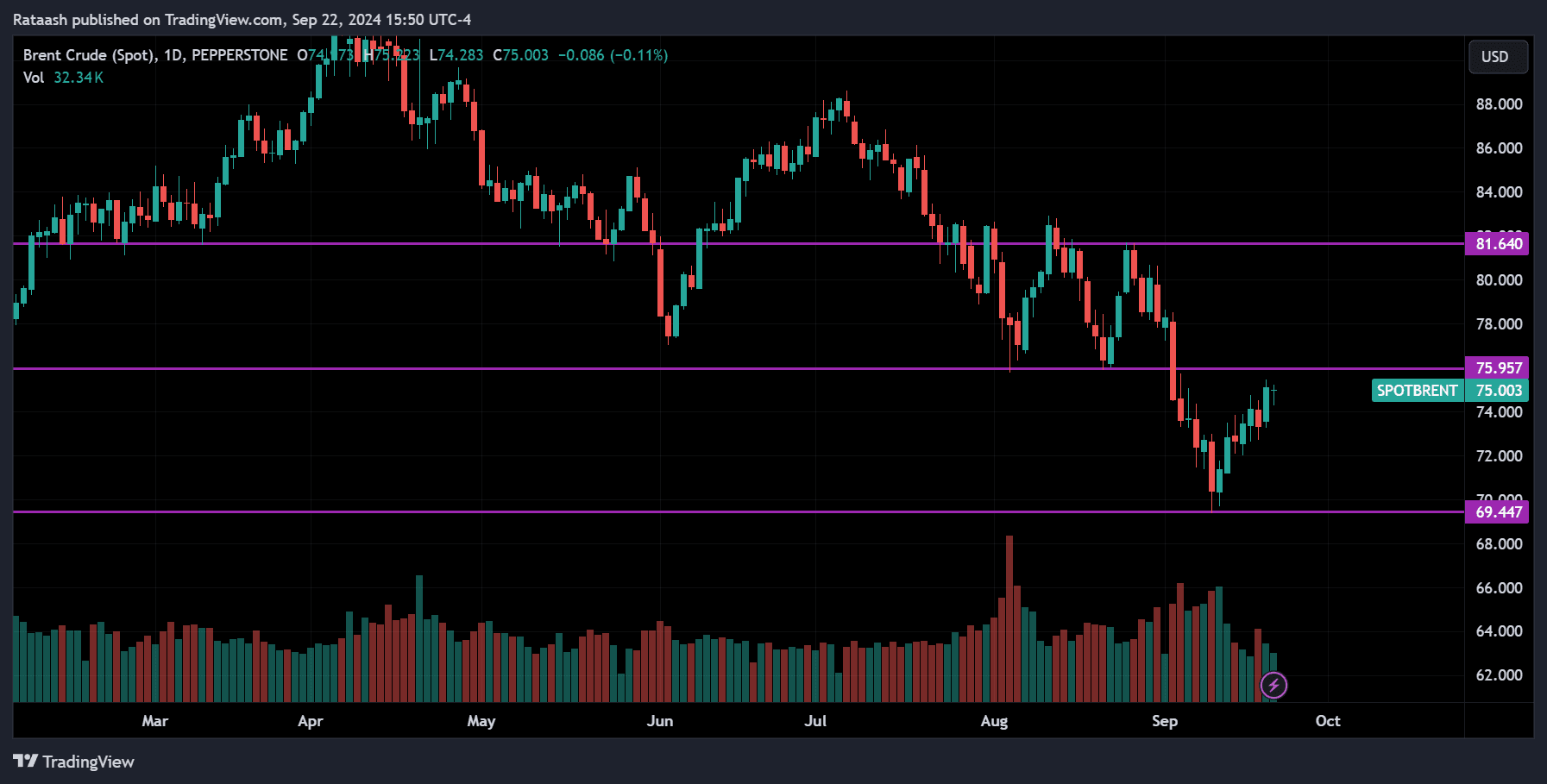

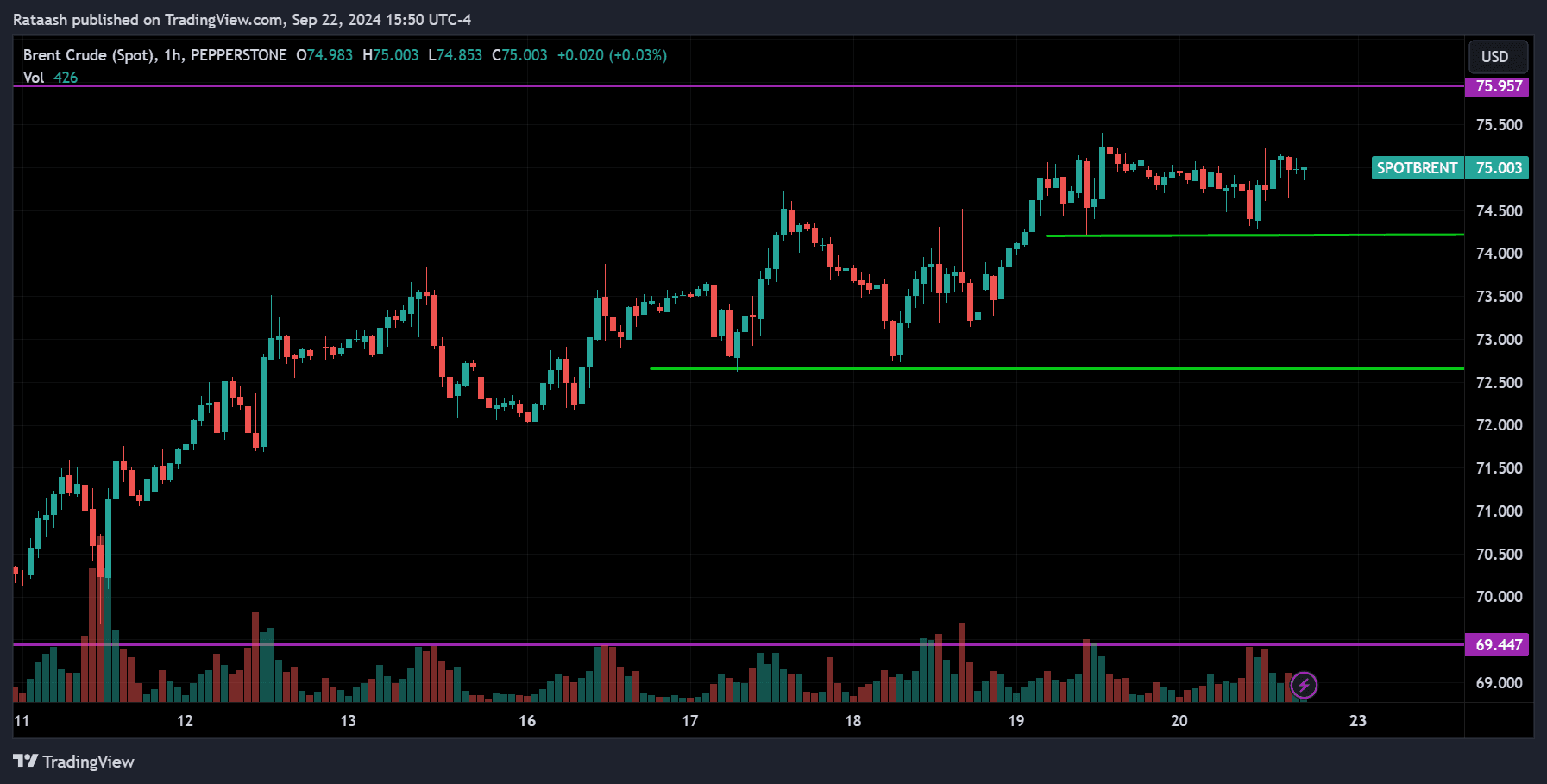

CRUDE OIL:

Crude Oil is mostly trending down, but the price is currently pulling back from the 69.500 support level and is nearing the 76 resistance level. If the price breaks above this resistance, it could signal the start of an uptrend. However, if the price drops below the 74.250 support, it could fall further to 72.500, and if that level also breaks, it might head back down toward 69.500.

Cryptocurrency Market Analysis

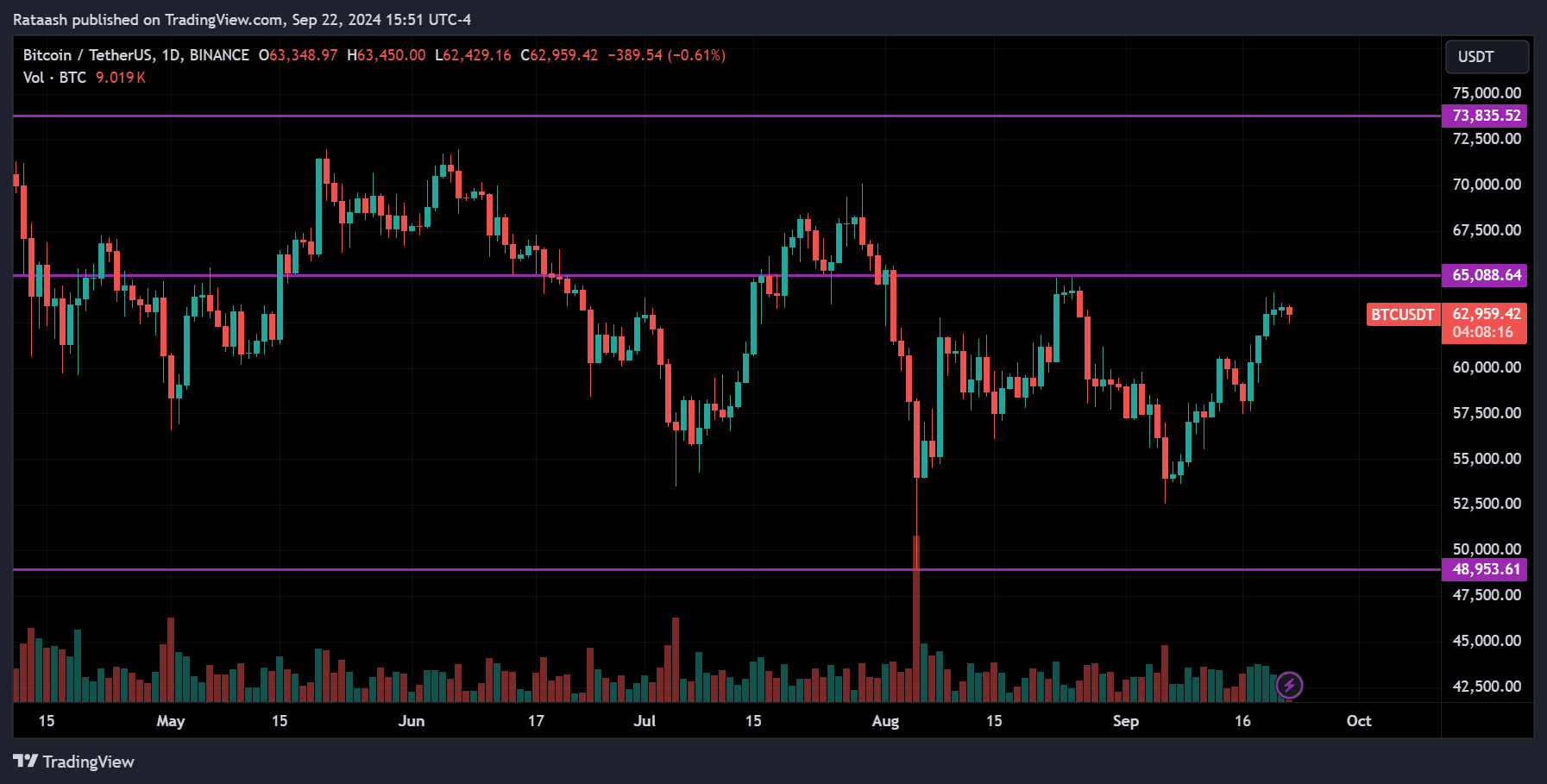

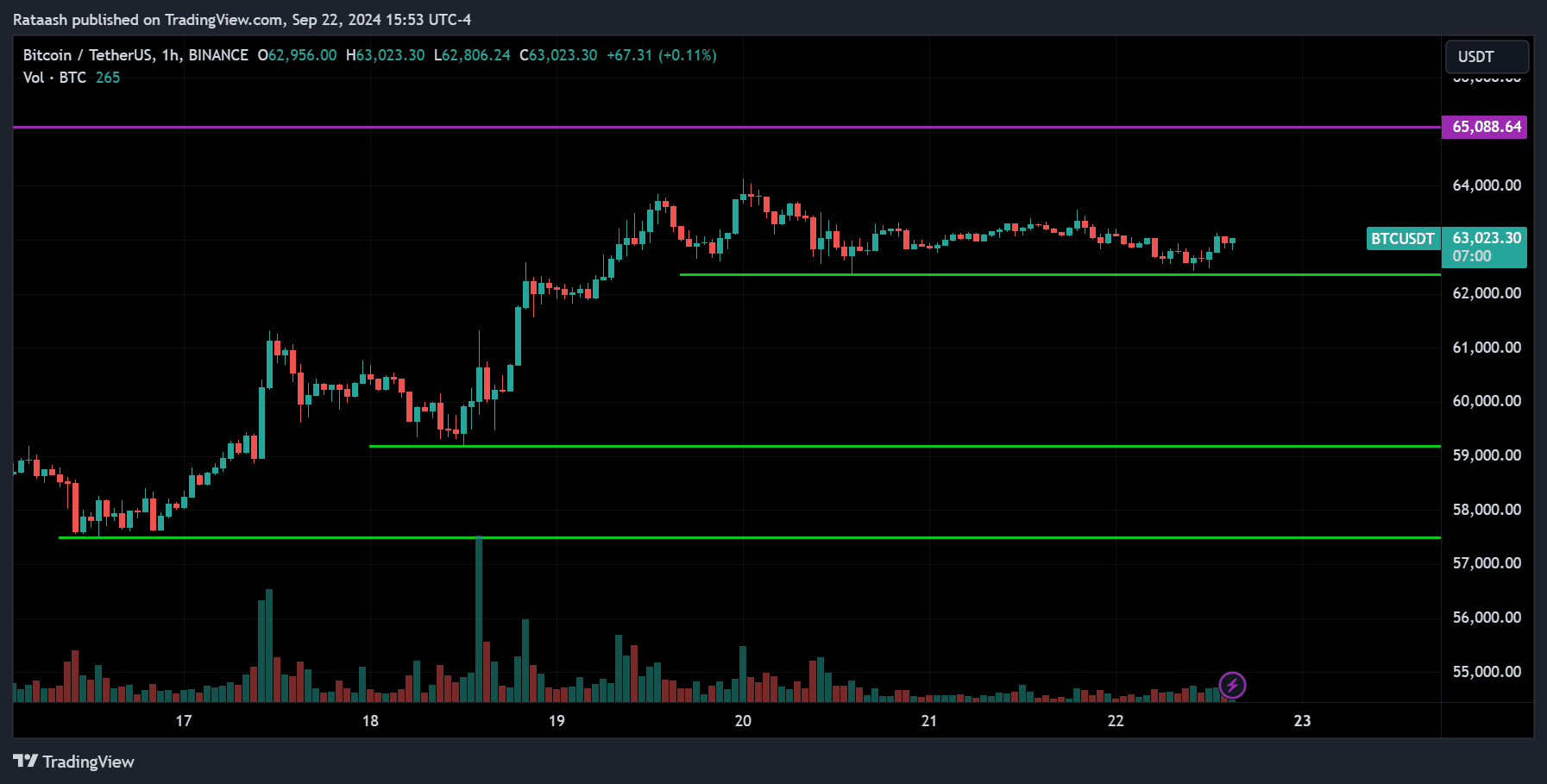

BTC:

BTC is currently consolidating, moving up and down within a range. The price is nearing the 65000 resistance level. If it breaks above this level, we could see BTC continue its rise toward the 70000 range. On the other hand, there is support around 62000—if the price breaks below this, it could drop further toward 59000.

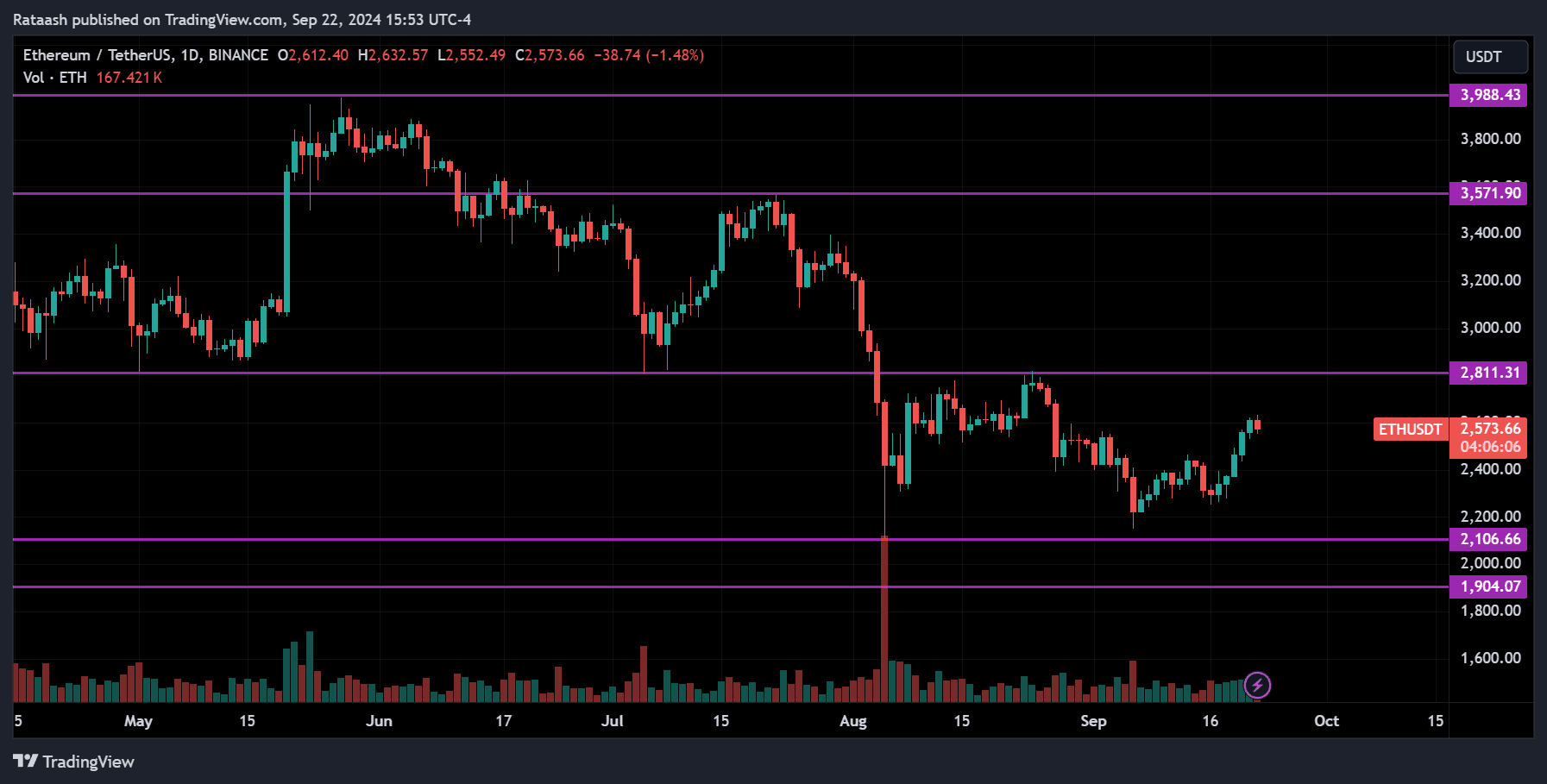

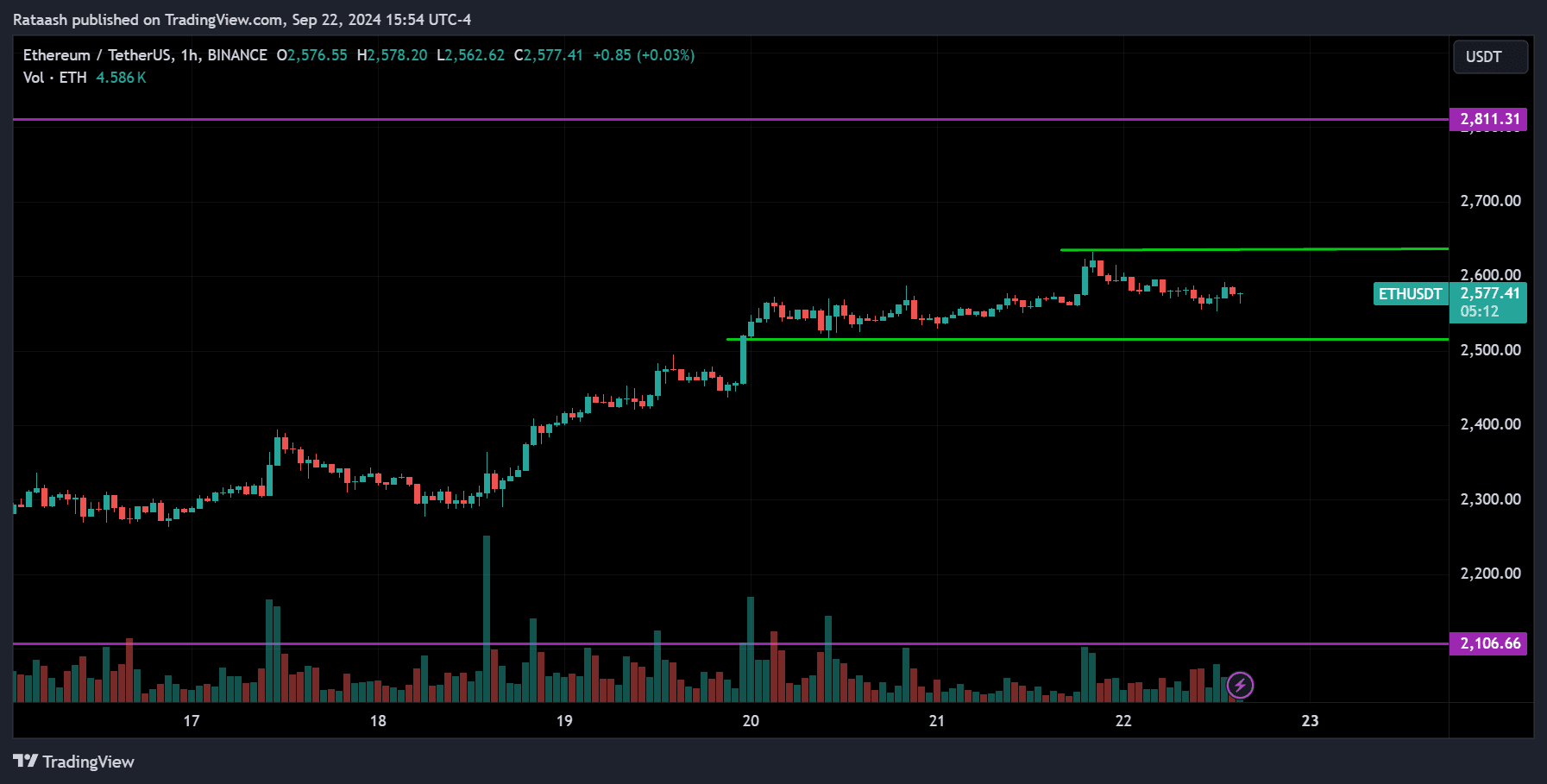

ETH:

ETH is generally trending down, but the price is pulling back up from the 2100 support level and heading toward the 2800 resistance. On the 1-hour chart, it’s consolidating with resistance around the 2650 range. Since it’s showing an uptrend in the medium term, we can expect the price to break above this resistance and continue toward 2800. On the other hand, if the price falls below the 2500 support, it could drop back down to the 2100 range.

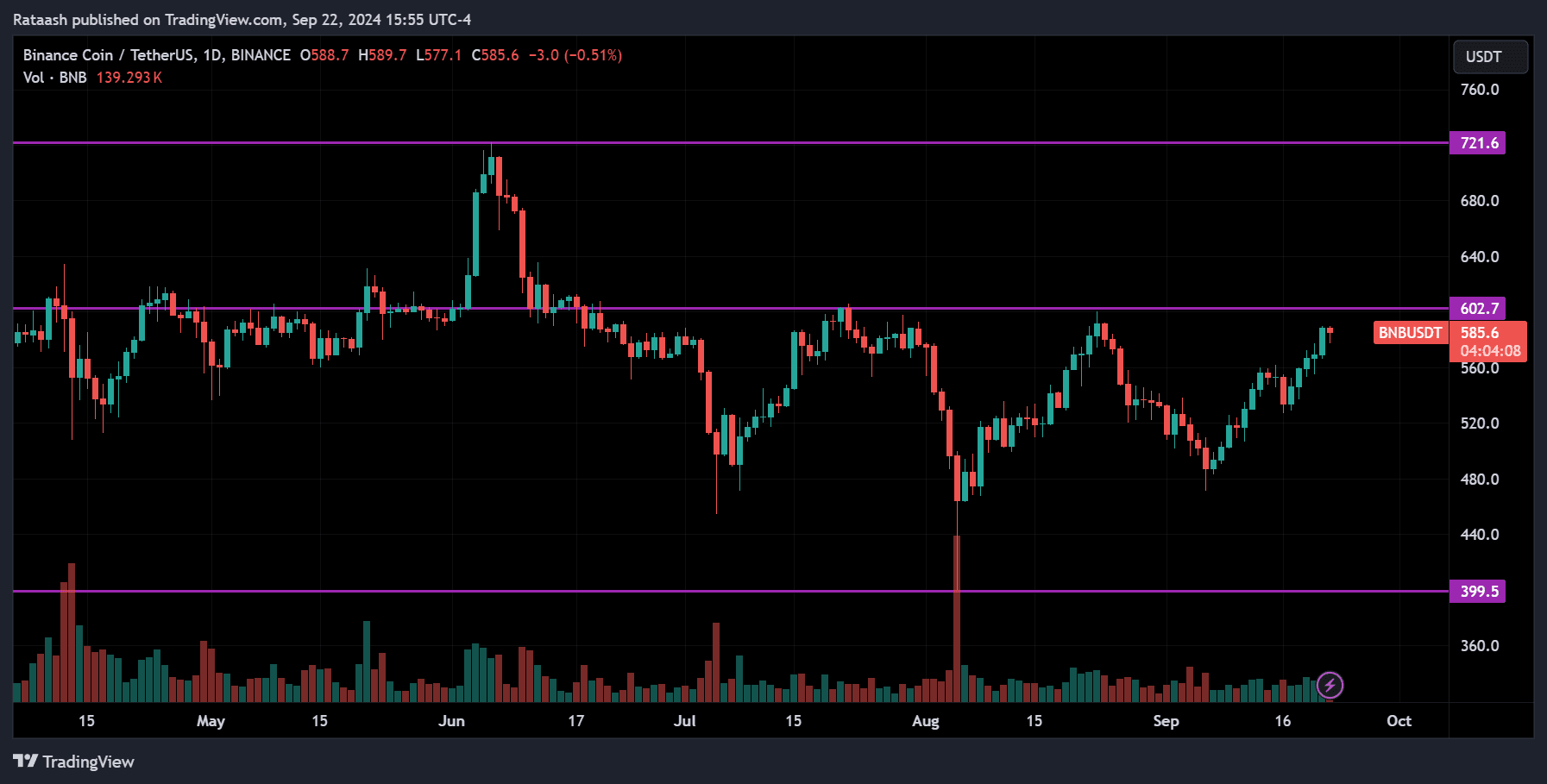

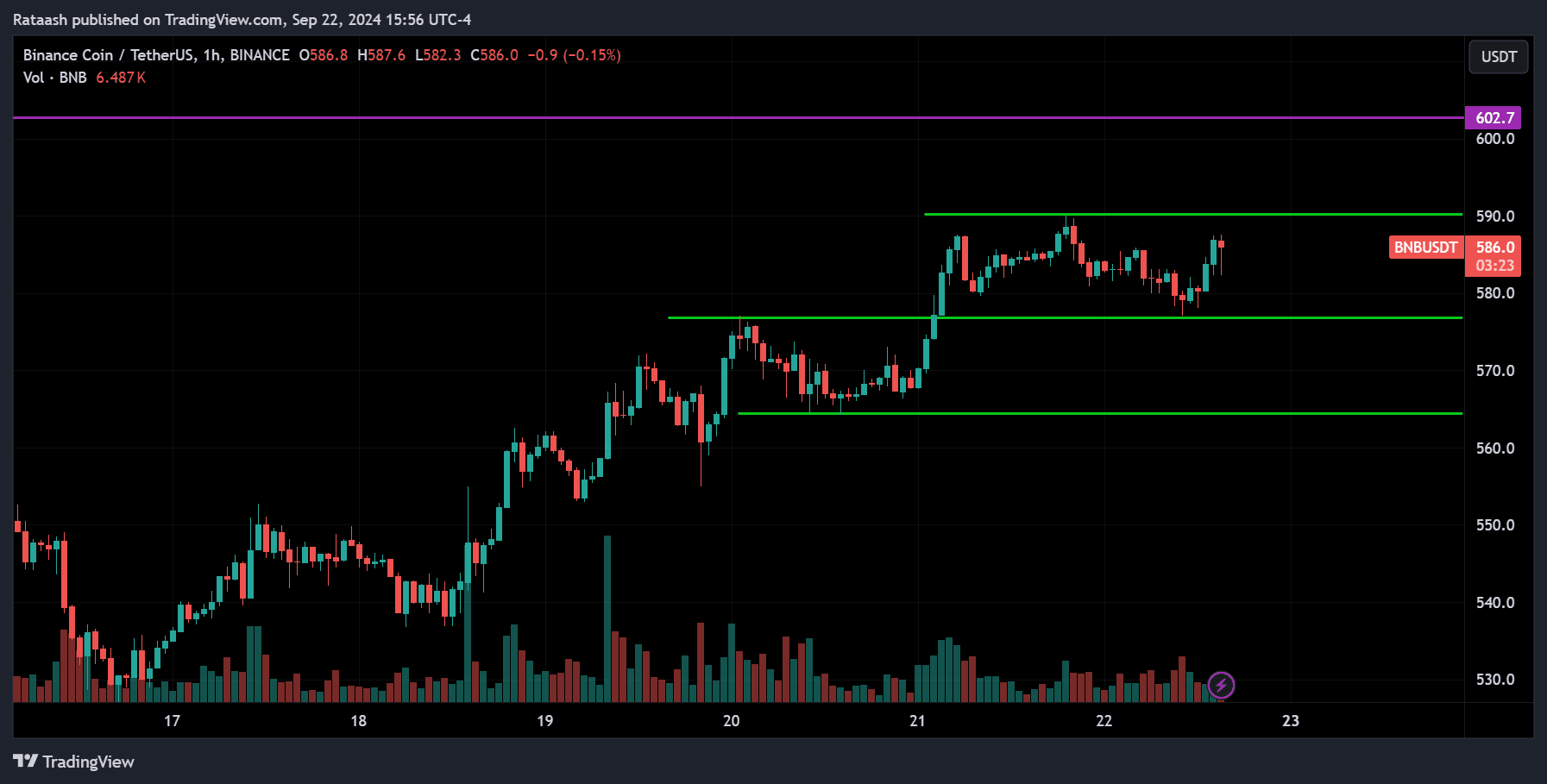

BNB:

BNB is currently consolidating near the 600 resistance level. On the 1-hour chart, there is a minor resistance around 590—if the price breaks above this, it could reach 600 and either pull back or break out further. If it breaks out, the price may continue upward. However, if the price drops below the 580 support, it could fall to the 565 range, and if that level also breaks, it might head down toward the 450 range.

Conclusion & Disclaimer

Now, let’s discuss interest rates and their impact on assets. The Fed usually cuts rates when markets are down, but this time, it happened when markets were near all-time highs. Lower interest rates mean borrowing costs less, and savings accounts offer lower returns. This encourages people to invest rather than save, which can drive markets higher. When the Fed cuts rates, people have more money to spend, and if they invest in stocks or crypto, it often pushes the market up.

In the forex market, lower interest rates increase the supply of the currency, making it less valuable. So, if there are more rate cuts expected, the USD could weaken. For example, in EURUSD, a weaker dollar means one euro can buy more dollars, likely pushing EURUSD higher in the long run. However, since market behavior can be unpredictable, it’s better to focus on strategies that can profit in any market condition rather than betting on a single outcome.

If you want to understand this better, it’s important to learn about the business cycle, monetary policy, and the role of the FOMC (Federal Open Market Committee). These topics explain how the economy moves through different phases, how central banks manage interest rates to control inflation and growth, and how these decisions impact financial markets. By understanding these concepts, you’ll have a clearer view of why the FED adjusts interest rates and how it affects various assets.

Please provide your feedback in the comment section below on how we can further improve our market analysis. Thank you.

This analysis article isn’t about telling you when to buy or sell. It’s about teaching you how to approach the market effectively. Every day, I follow the same routine before I start trading. Here, I briefly explained the technical aspects of what’s happening and what actions I would take in these situations. Your goal is to understand what I do so you can follow the same process on your own.

If you want to learn more about trading and advanced techniques used in the financial markets at a professional level, visit xlearn.

Acknowledging the inherent unpredictability of financial markets is crucial. While we strive to offer informed perspectives on upcoming events and trends affecting various instruments, readers should conduct their own analysis and exercise prudent judgment.

Encouragement of Independent Analysis

We strongly encourage readers to supplement the information presented here with their own research and analysis. Market dynamics can swiftly change due to a multitude of factors, and individual circumstances may vary. By conducting independent analysis, readers can tailor their strategies to align with their unique goals and risk tolerance.

No Certainty in Market Predictions

It’s vital to recognize that nobody possesses the ability to predict market movements with absolute certainty consistently. Market analysis serves as a tool to assess probabilities and identify potential opportunities, but it’s essential to remain cognizant of the inherent uncertainty in financial markets.

Aligning with High Probability

Rather than aiming for infallible predictions, our goal is to align with high-probability scenarios based on available information and analysis. This approach acknowledges the dynamic nature of markets while seeking to capitalize on opportunities with favorable risk-reward profiles.

Proceed with Caution

Lastly, while market analysis can offer valuable insights, it’s imperative to approach trading and investment decisions with caution. Markets can be volatile, and unforeseen events may impact asset prices unexpectedly. Exercise prudent risk management and consider seeking advice from qualified financial professionals before making any significant financial decisions.

Remember, the journey of financial analysis and investment is a continuous learning process, and embracing a disciplined approach can contribute to long-term success in navigating the complexities of global markets.

THANK YOU & HAPPY TRADING!!!

![Weekly Market Forecast [2024.09.23] - Fed Rate Cut Impact, Trading Opportunities & Market Outlook ForexCracked.com](https://www.forexcracked.com/wp-content/uploads/2024/09/Weekly-Market-Forecast-2024.09.23-Fed-Rate-Cut-Impact-Trading-Opportunities-Market-Outlook-ForexCracked.com_.jpg)