Welcome to our weekly market forecast series from forexcracked.com!

As the world faces crucial developments, financial markets are reacting to various key events. In the US, all eyes are on upcoming employment data and a speech by Federal Reserve Chair Jerome Powell, which will be critical in shaping expectations for the Fed’s next move on interest rates. Meanwhile, tensions remain high in the Middle East, with global leaders urging de-escalation, especially as Israel and Hezbollah clash, adding uncertainty to global oil markets.

Before we continue with the analysis, if you know little about trading, charts, candlesticks, risk management, or strategies or want to improve your knowledge, consider reading our free forex trading course.

Upcoming Events for This Week

These events include macroeconomic reports, economic indicators, and, generally, what’s going on in the world.

Only the most important events are considered here. You can check the forexfactory.com for all the economic events and yahoo finance for news.

2024.09.30

- The German Preliminary CPI (Consumer Price Index) m/m is being released, showing the change in prices of consumer goods and services. The previous figure was -0.1%, and the forecast is 0.1%. If the actual number is higher than the forecast, it’s positive for the currency. This is an ‘All Day’ event because data is gathered from 6 German states reporting their CPI throughout the day. There are two versions of CPI, released about 15 days apart: Preliminary and Final. The Preliminary release is the Eurozone’s first key consumer inflation data. Since consumer prices make up the bulk of inflation, rising inflation can push the central bank to raise interest rates to control it.

- Canadian banks will be closed in observance of the National Day for Truth and Reconciliation. Banks handle the majority of foreign exchange trading, and when they are closed, the market becomes less liquid. This allows speculators to play a larger role in influencing the market, which can result in periods of abnormally low or abnormally high volatility.

- 13:55 ET: Fed Chair Powell Speaks; He will participate in a moderated discussion titled “A View from the Federal Reserve Board” at the National Association for Business Economics Annual Meeting in Nashville. Audience questions are expected. A more hawkish tone than expected is positive for the currency. As the head of the central bank, which controls short-term interest rates, Powell holds significant influence over the nation’s currency value. Traders closely watch his public engagements, as they often contain subtle hints about future monetary policy decisions.

2024.10.01

- 5:00 ET: EURO CPI Flash Estimate y/y being released, showing the change in the price of goods and services purchased by consumers. The previous figure was 2.2%, and the forecast is 1.9%. Actual greater than forecast is positive for the currency. Eurostat bases this estimate on energy prices and early CPI data from 13 euro area member states. There are two versions of this report: Flash and Final, released about two weeks apart. This early report tends to have a significant impact. Consumer prices make up the majority of inflation, and rising inflation often prompts the central bank to raise interest rates to manage it.

2024.10.02

- There are no major events that could impact the market on this day.

2024.10.03

- German banks will be closed in observance of German Unity Day. Banks handle the majority of foreign exchange trading, and when they are closed, the market tends to become less liquid. This reduced liquidity allows speculators to have a greater influence on the market, which can result in periods of abnormally low or abnormally high volatility.

- 2:30 ET: Swiss CPI m/m release, showing the change in the price of goods and services purchased by consumers. The previous figure was 0.0%, and the forecast is -0.1%. Actual greater than forecast is positive for the currency. Consumer prices make up the majority of inflation, and rising inflation is important for currency valuation because it often leads the central bank to raise interest rates to manage inflation and maintain stability.

2024.10.04

- 8:30 ET: US Unemployment Rate release, showing the percentage of the total workforce that is unemployed and actively seeking work during the previous month. Both the previous and forecast figures are 4.2%. Although considered a lagging indicator, the unemployment rate is a key signal of overall economic health since consumer spending is closely tied to labor market conditions. Unemployment is also a significant factor for those shaping the country’s monetary policy.

Forex Market Forecast

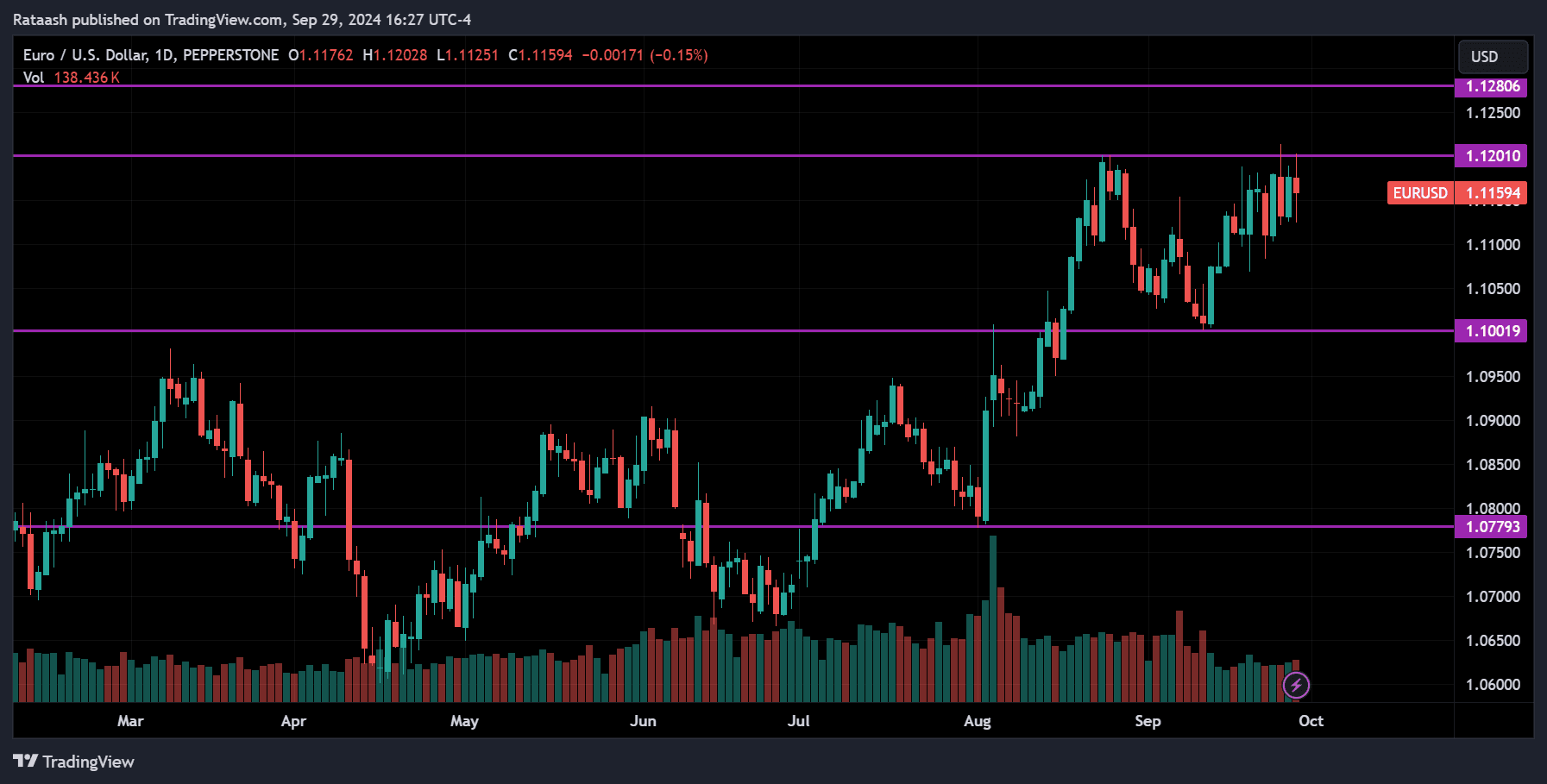

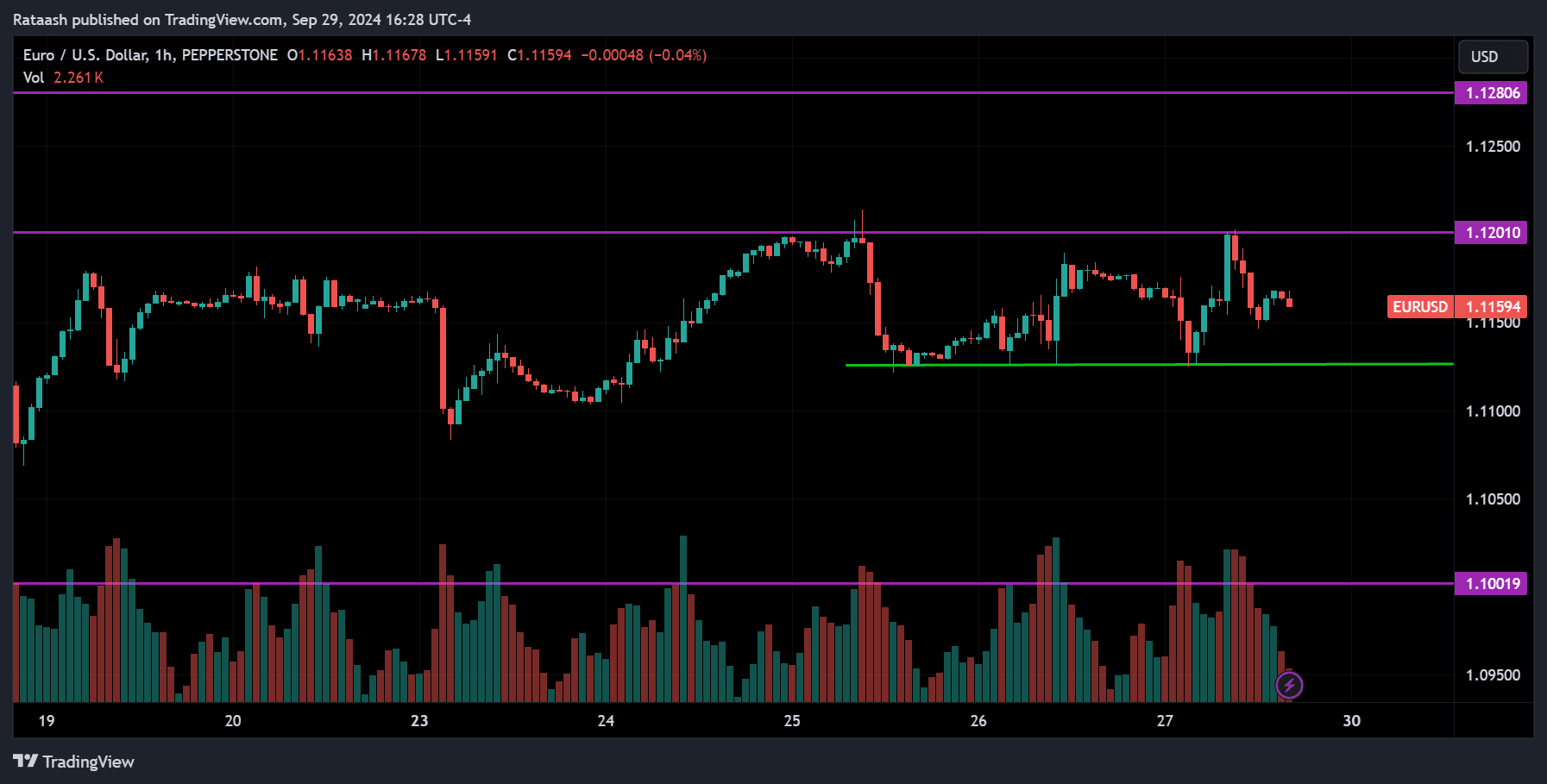

EURUSD:

EURUSD is still in an uptrend, with the price currently holding around the resistance level of 1.12000. If the uptrend continues, we can expect the price to break above this resistance and move up toward the 1.12800 range. However, if the price starts correcting or reversing, there’s support around 1.11250. If the price falls below this level, it could keep dropping toward 1.10000.

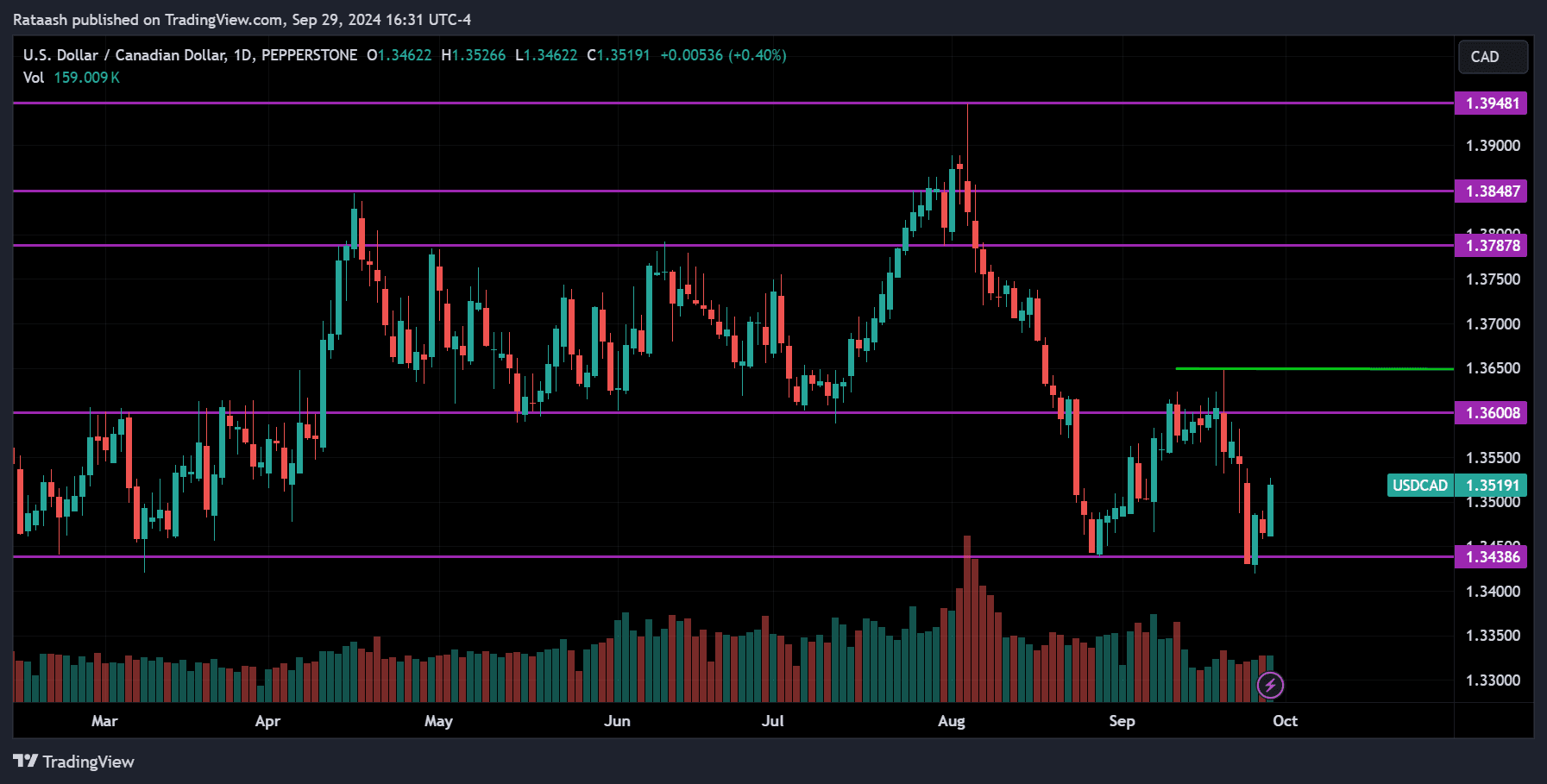

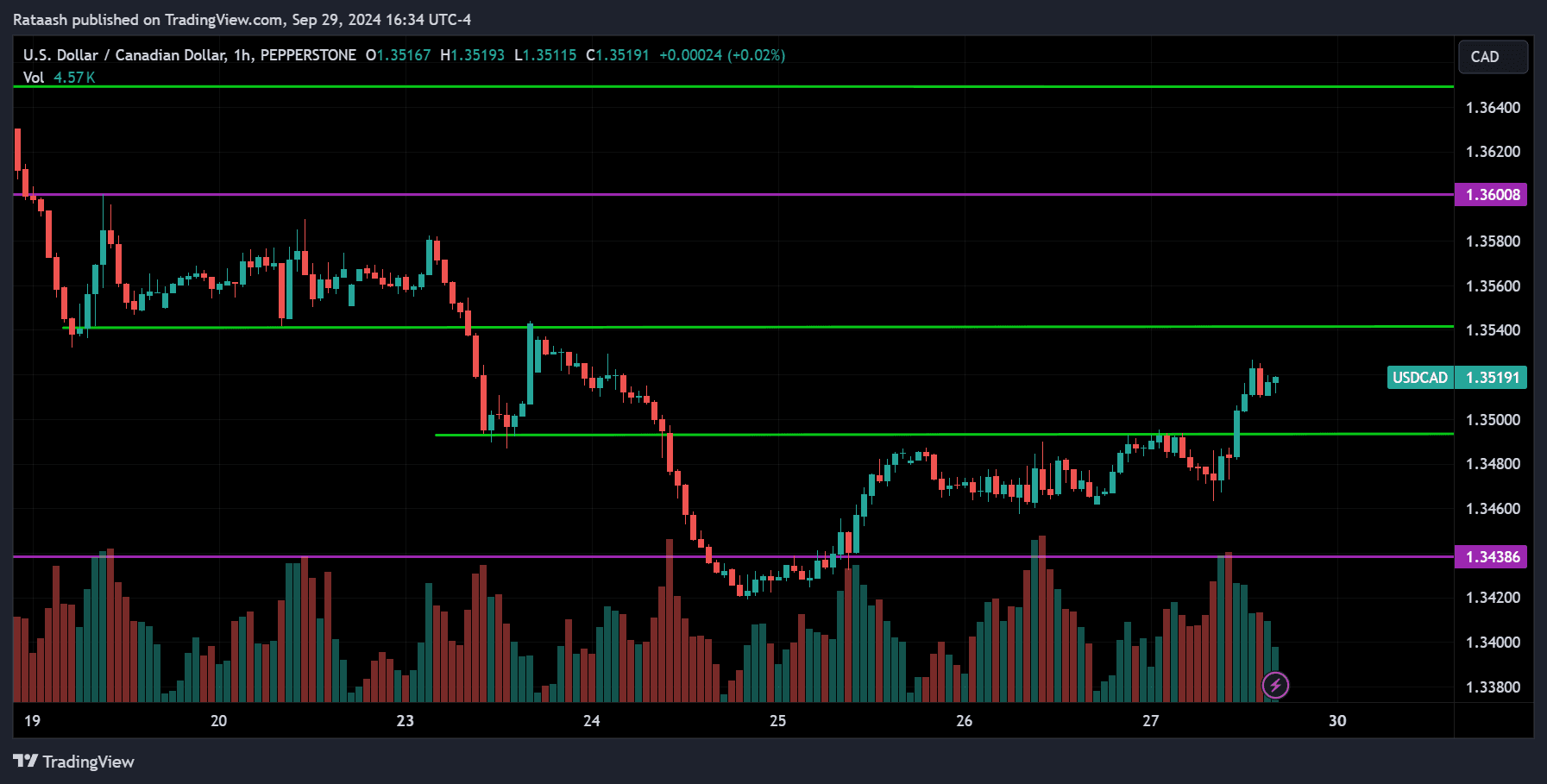

USDCAD:

USDCAD is trending down, but the price is currently pulling back up from the support level of 1.34200 and is now around the resistance level of 1.35400. If this is just a correction, we can expect the price to soon break below the support around 1.35000 and drop back to the 1.34200 support level, potentially breaking below it and continuing to fall. However, if this is a reversal and the price is entering an uptrend, we can expect it to break above the resistance at 1.35400 and move toward 1.36000. If the price breaks above that resistance, it may signal the start of an uptrend.

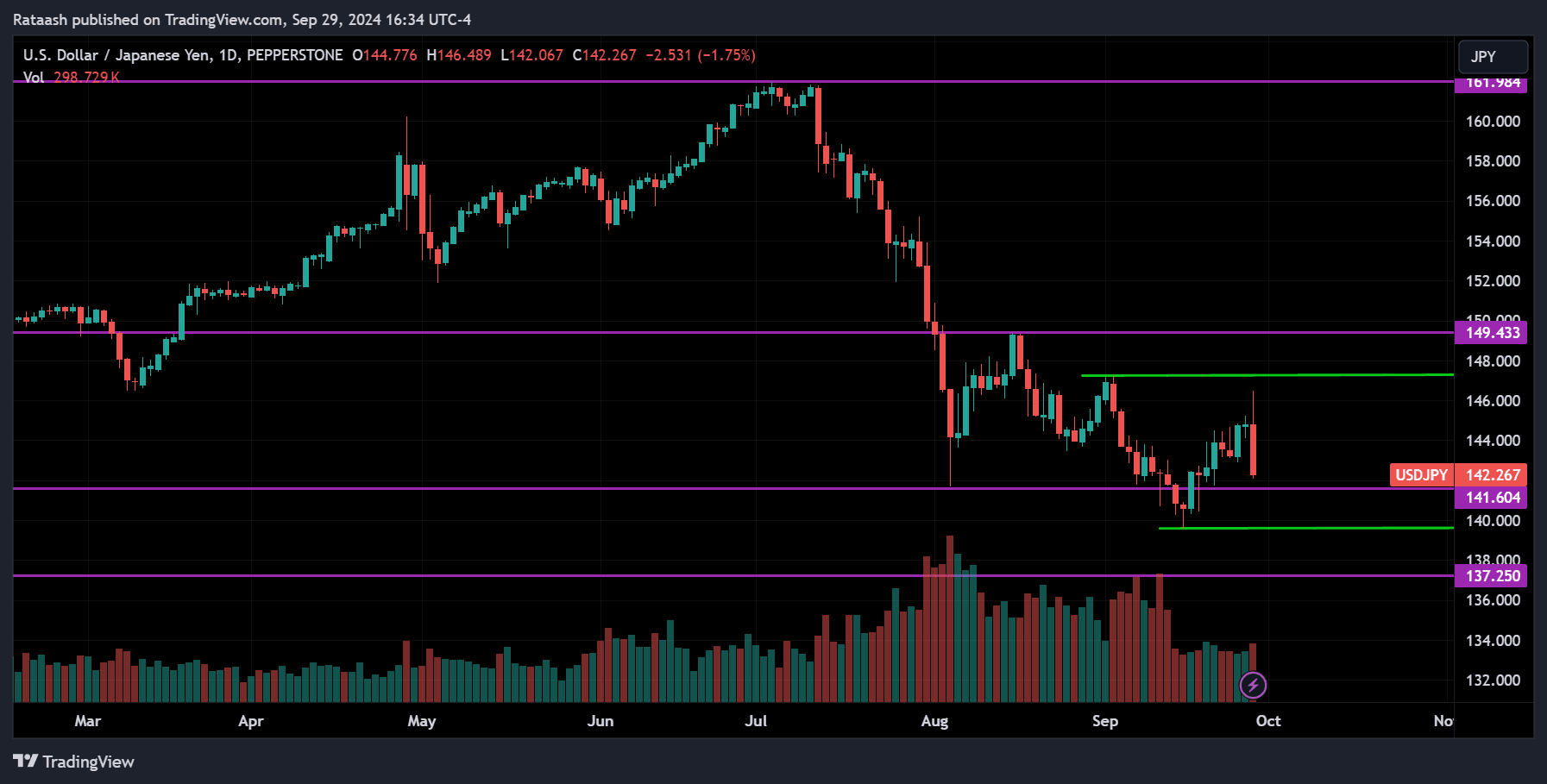

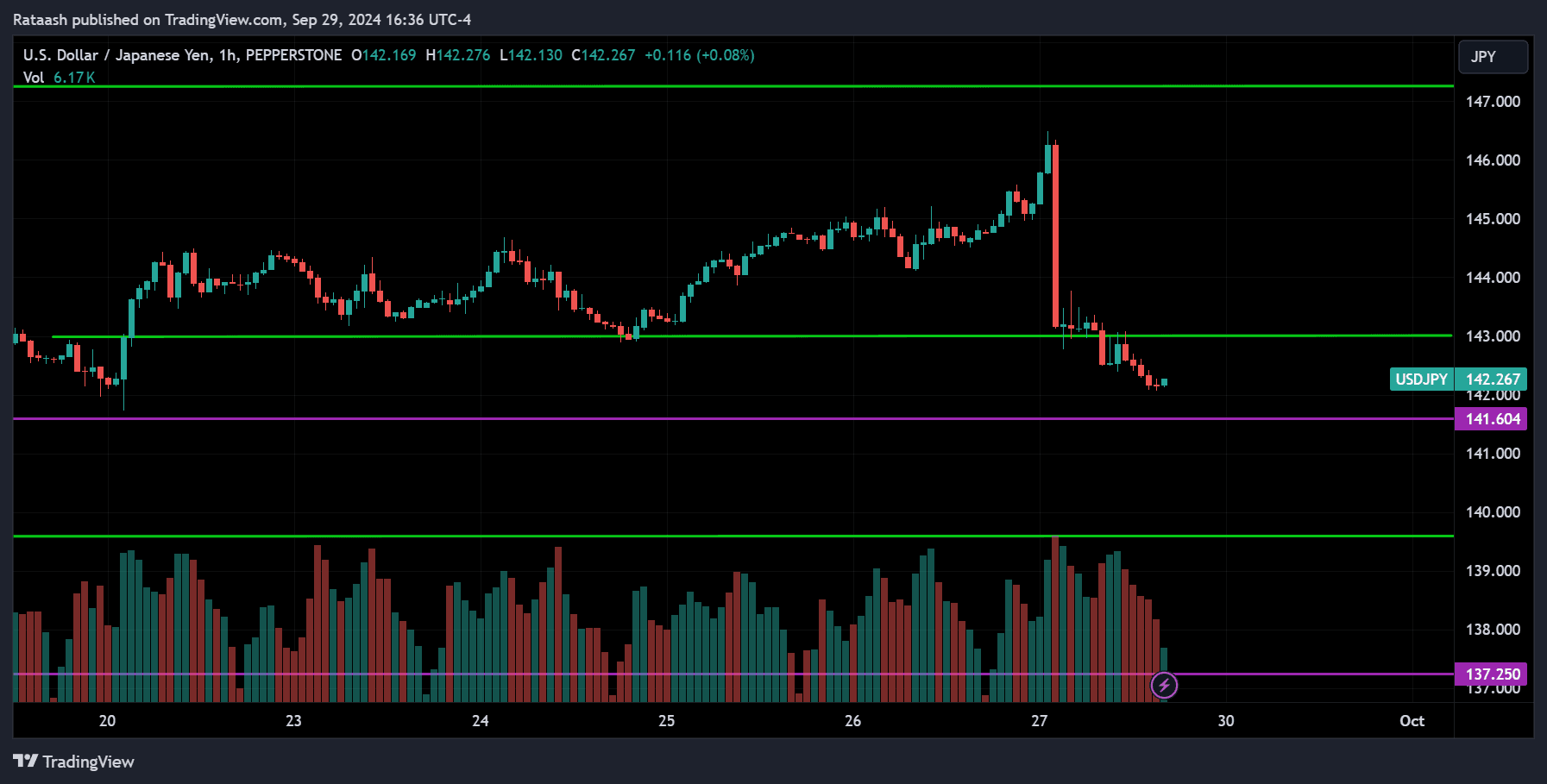

USDJPY:

USDJPY is also trending down, with the price currently below the support level of 143 and nearing the major support at 141.600. We can expect the price to break below this support and continue dropping toward the 140 level, and if that level is broken, it could fall further to 137.250. However, if the price breaks above the resistance at 147, we may assume the price is entering a correction phase or possibly reversing.

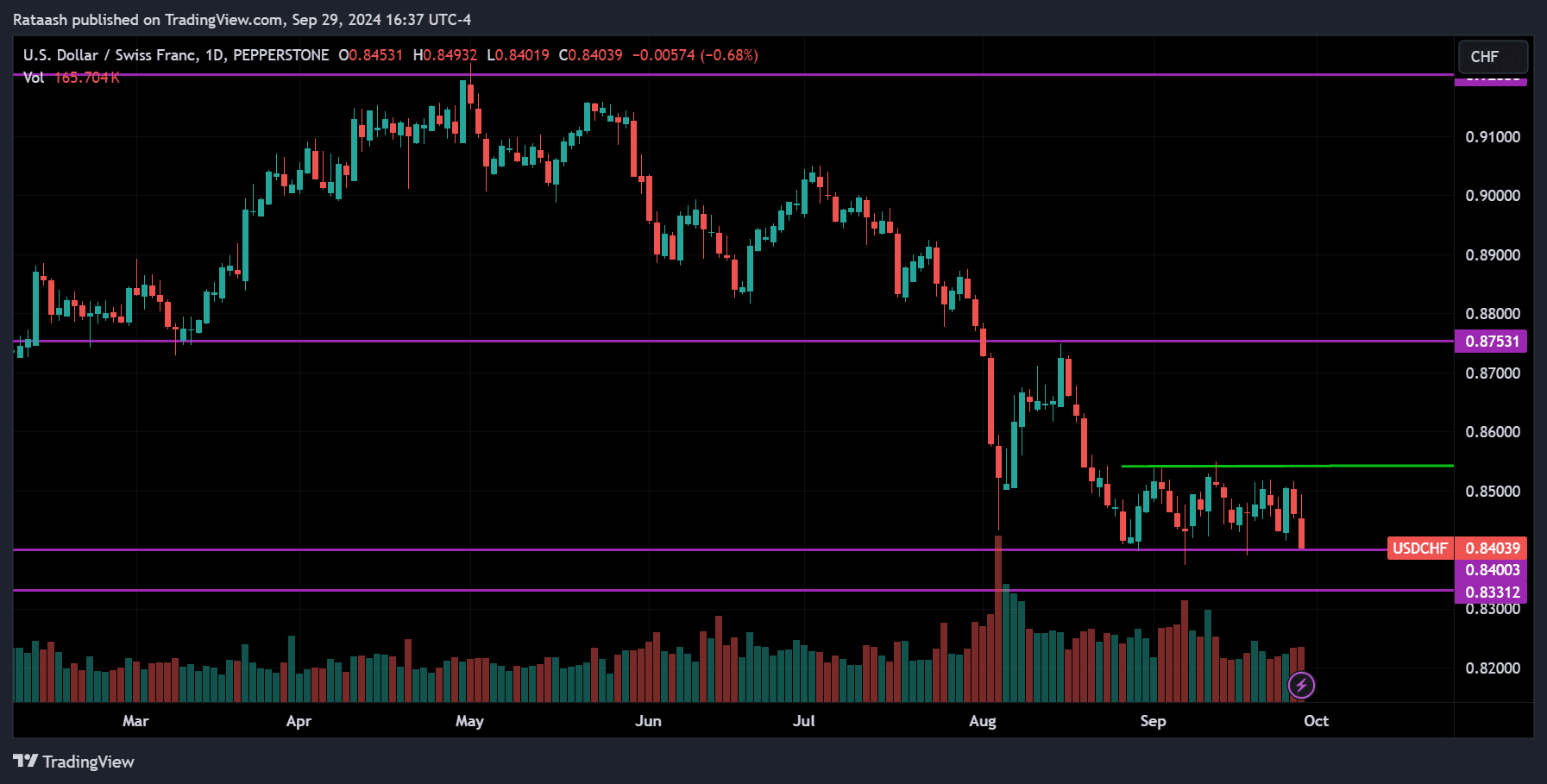

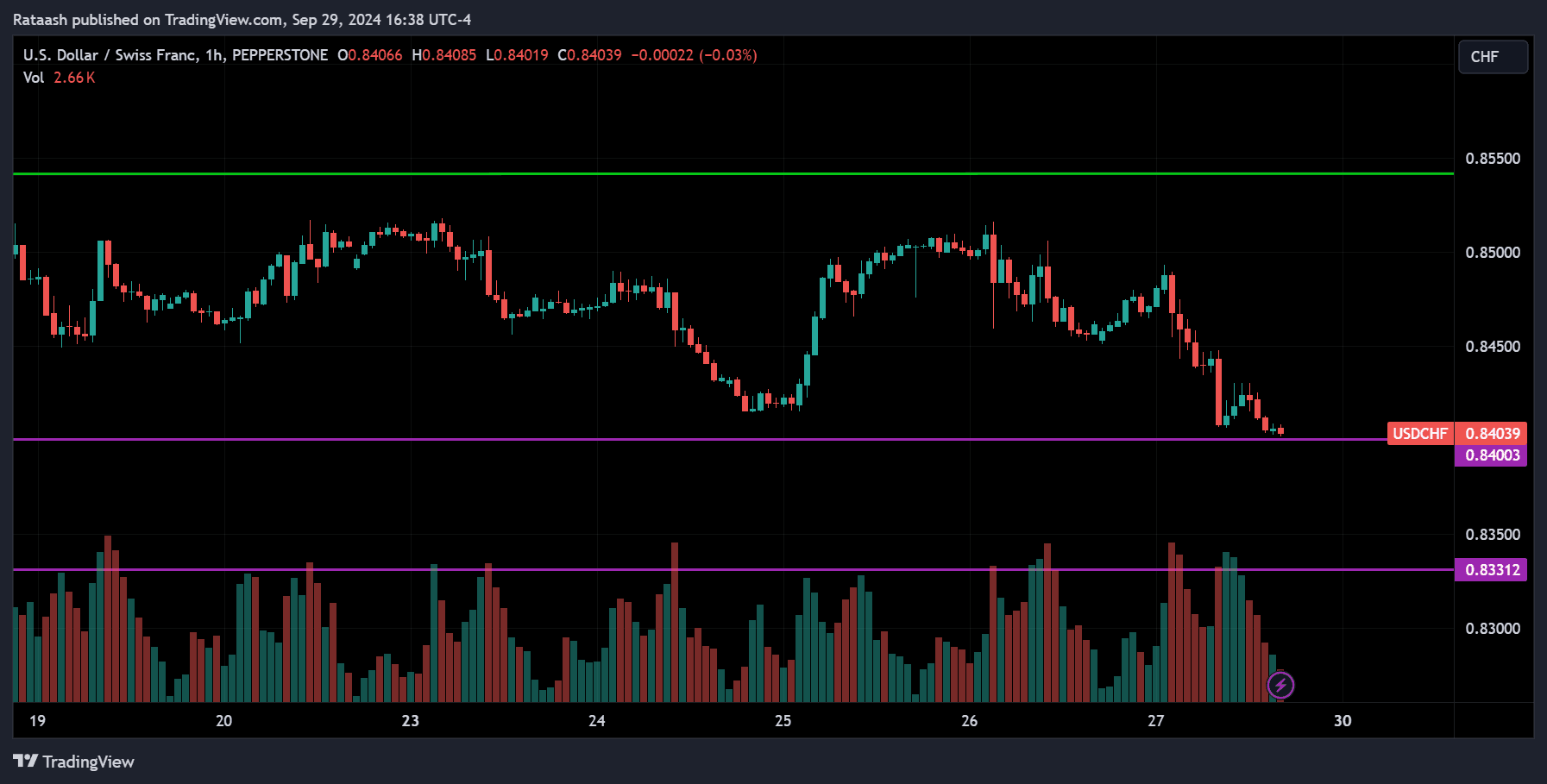

USDCHF:

USDCHF is also trending down, with the price currently consolidating around the support level of 0.84000. If the downtrend continues, we can expect the price to break below this support and move toward the 0.83300 range. If that level is also broken, the price will likely keep dropping. On the other hand, if the price reverses from the 0.84000 support and breaks above the resistance at 0.85500, we can expect it to rise toward the 0.87500 resistance range.

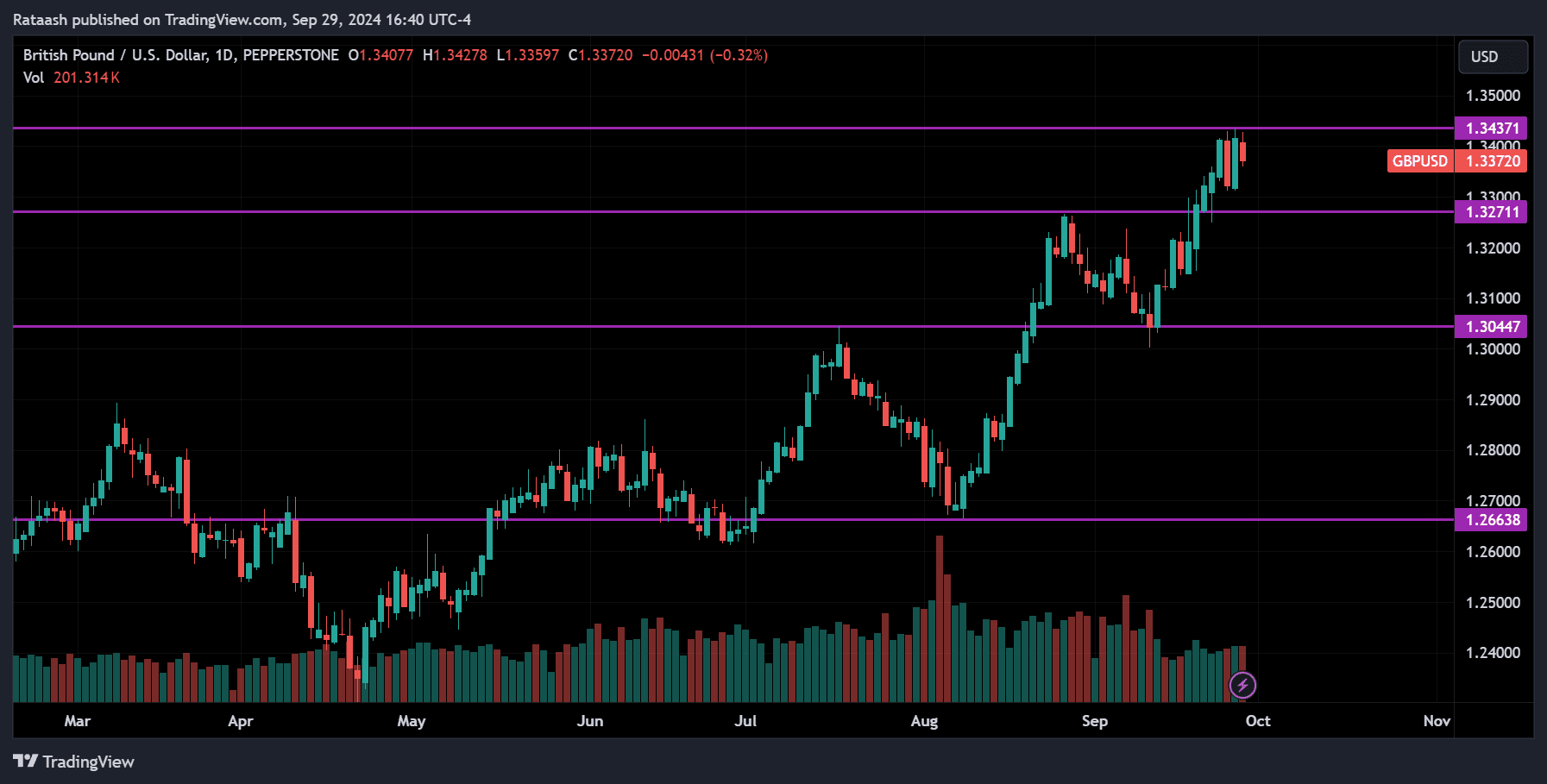

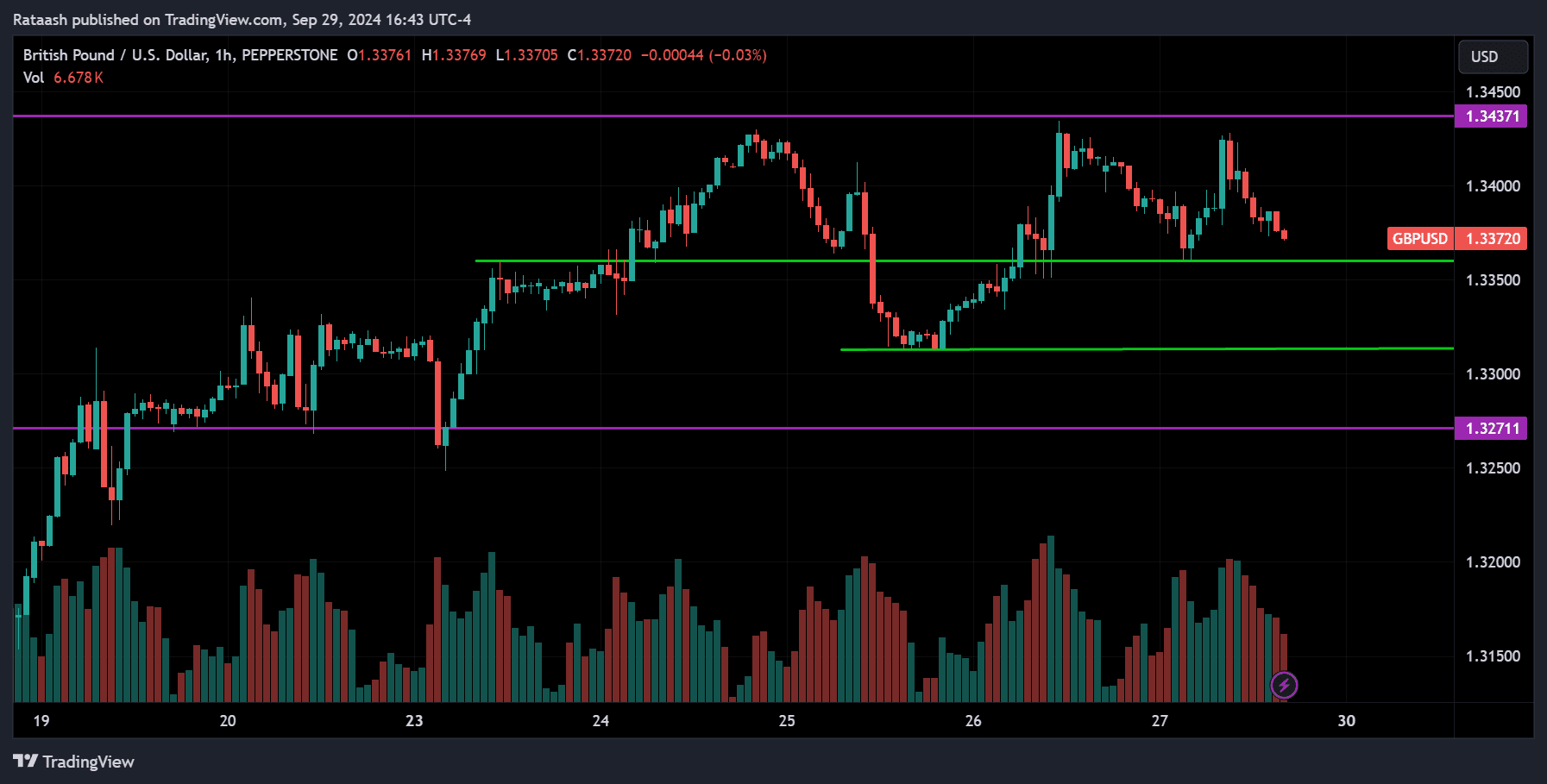

GBPUSD:

GBPUSD is trending up, with the price currently near the resistance level of 1.34500. Looking at the 1-hour chart, there is a small support around 1.33500. If the price breaks below this level, we can expect it to fall toward 1.33000, and if that support is also broken, the price may continue dropping to 1.32700. On the other hand, if the price breaks above the resistance at 1.34500, we can expect the uptrend to continue.

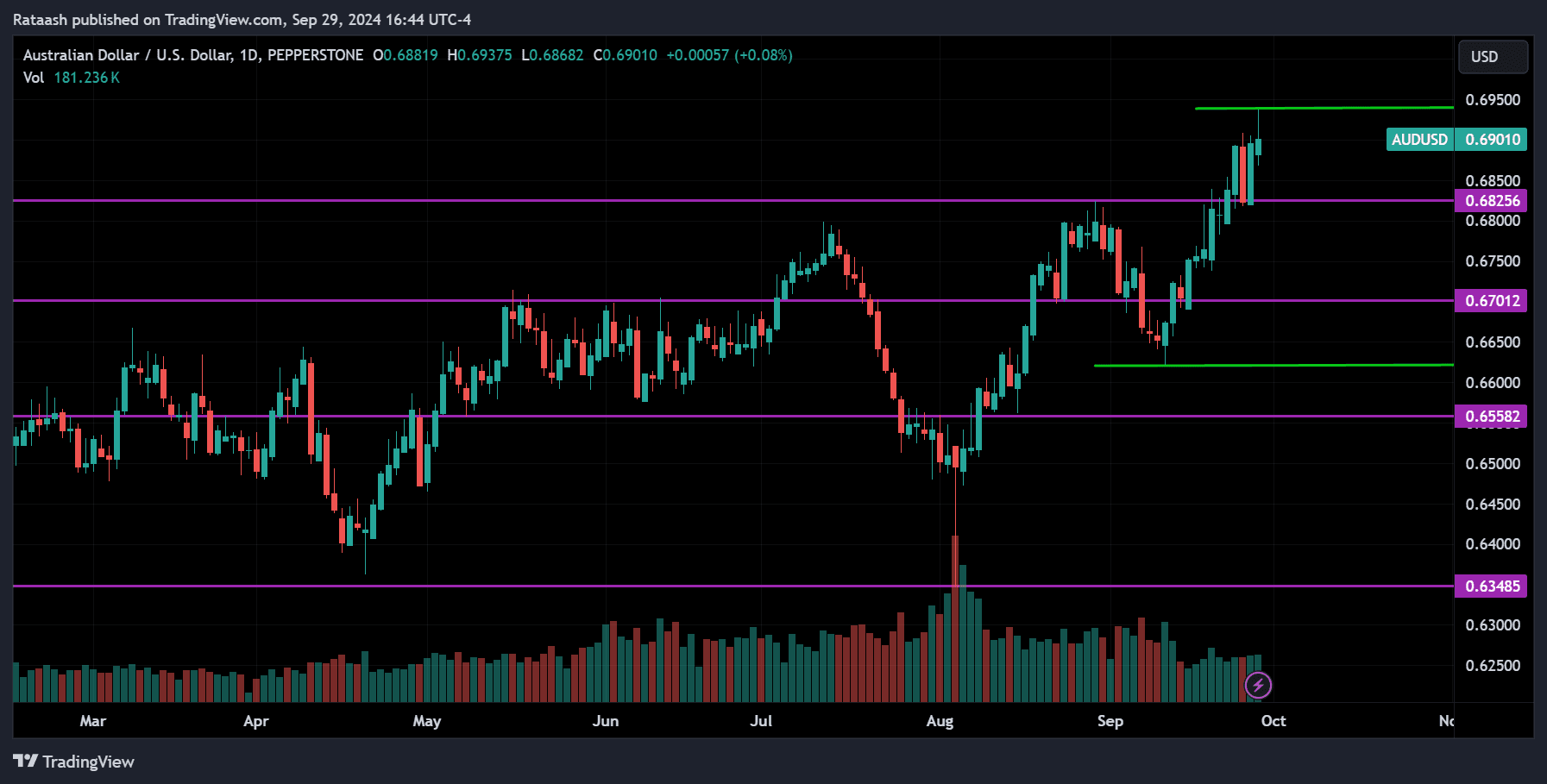

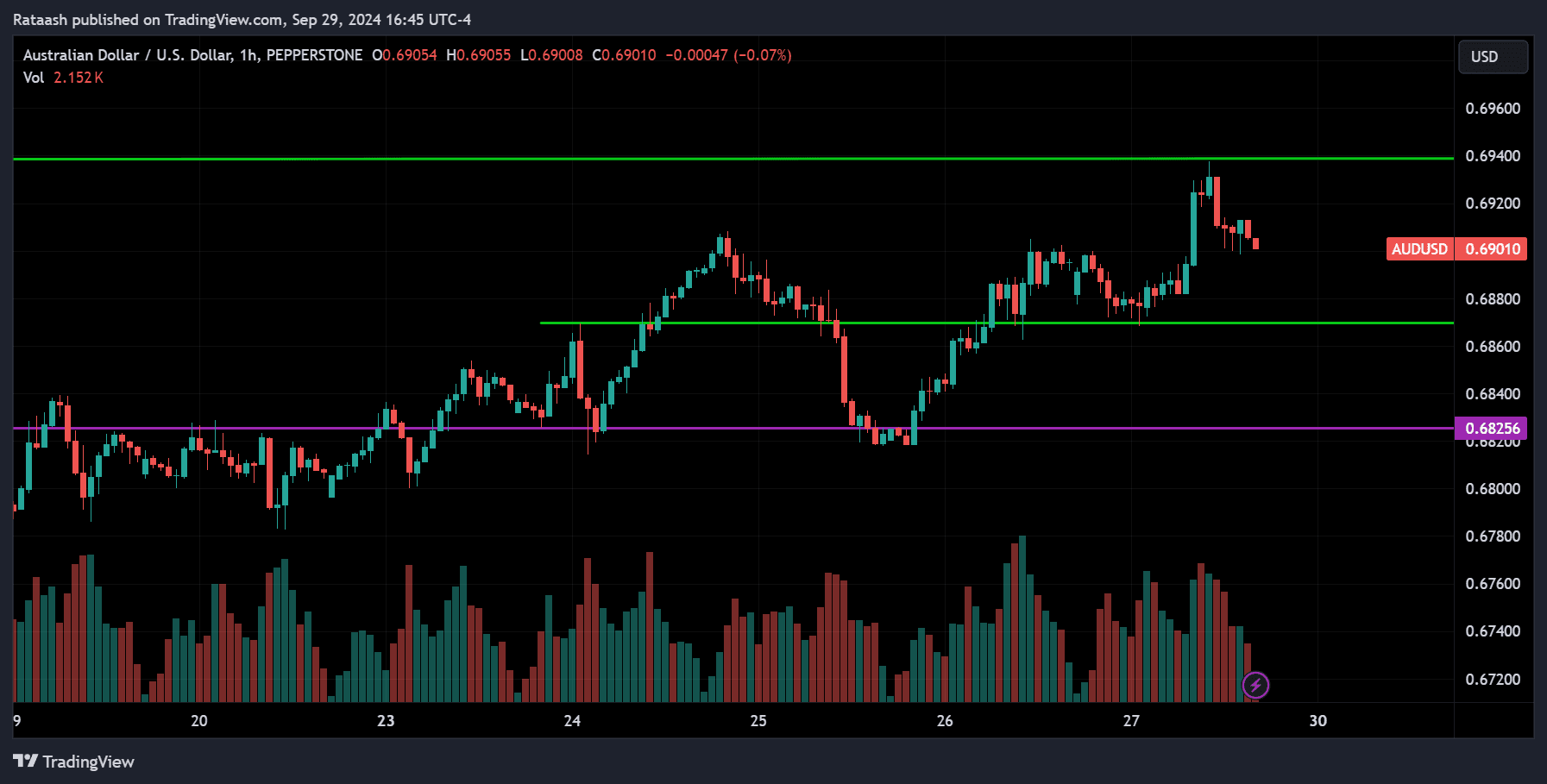

AUDUSD:

AUDUSD is also trending up, with the price currently pulling back from the resistance level of 0.69400. There is support around 0.68800, and if the price breaks below this level, we can expect it to drop toward the 0.68200 range. On the other hand, if the price breaks above the resistance at 0.69400, we can expect the uptrend to continue.

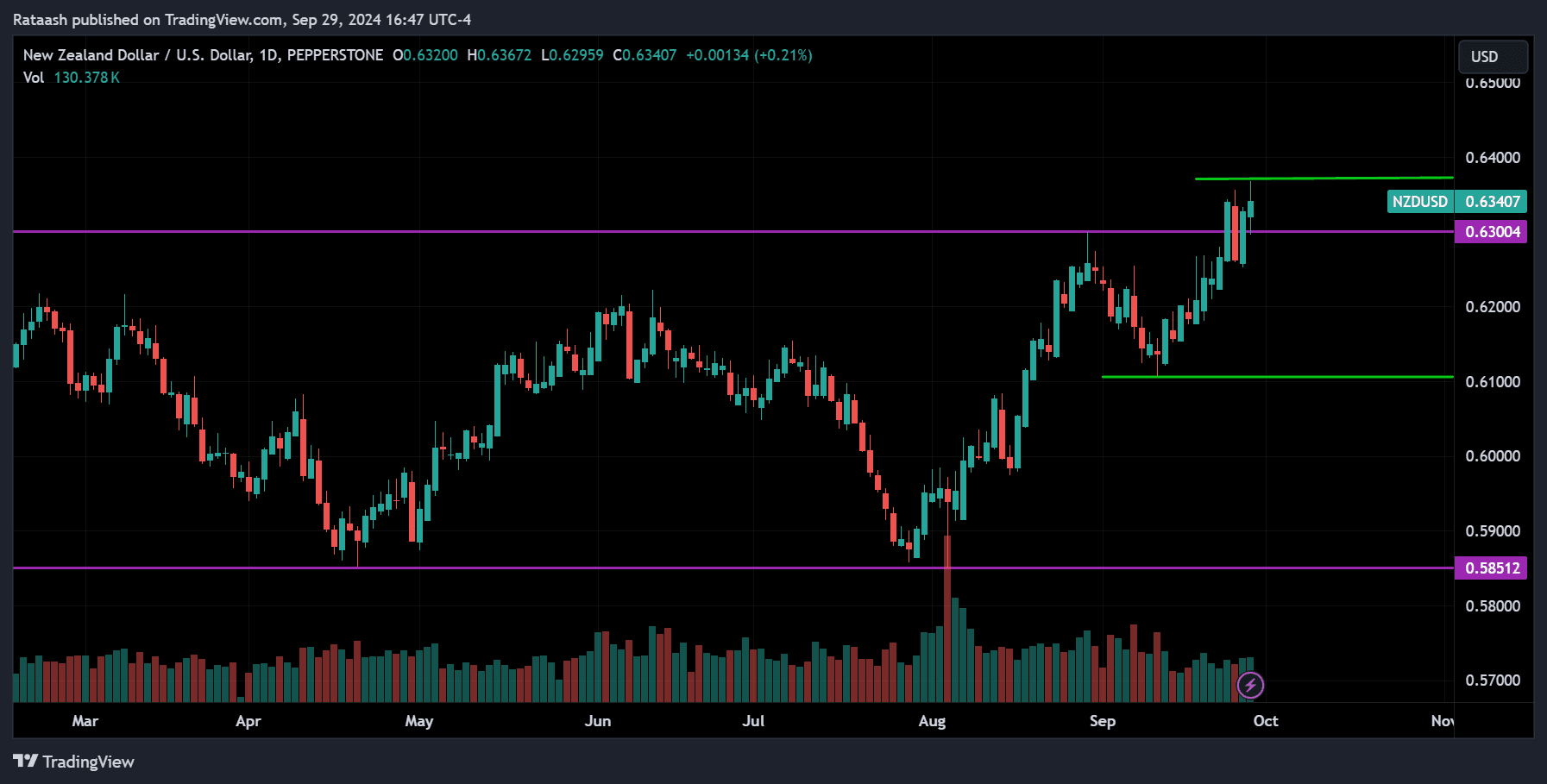

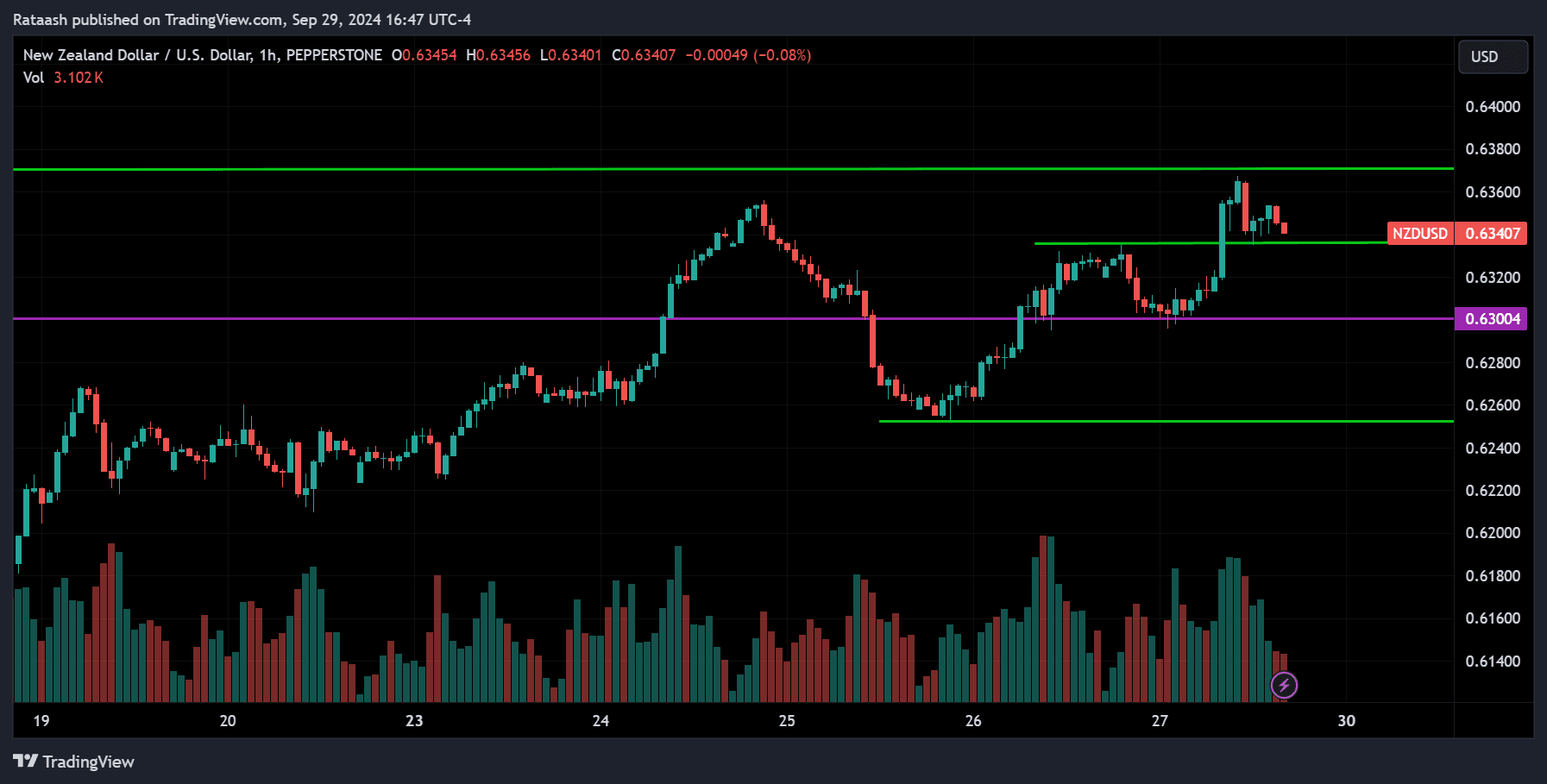

NZDUSD:

NZDUSD is also trending up, with the price currently near the resistance level of 0.64000. Looking at the 1-hour chart, there is major support around 0.63000, and if the price breaks below this level, we can expect it to fall, possibly toward the 0.62600 range. On the other hand, if the price breaks above the resistance at 0.64000, we can expect the uptrend to continue.

Commodities Market Forecast

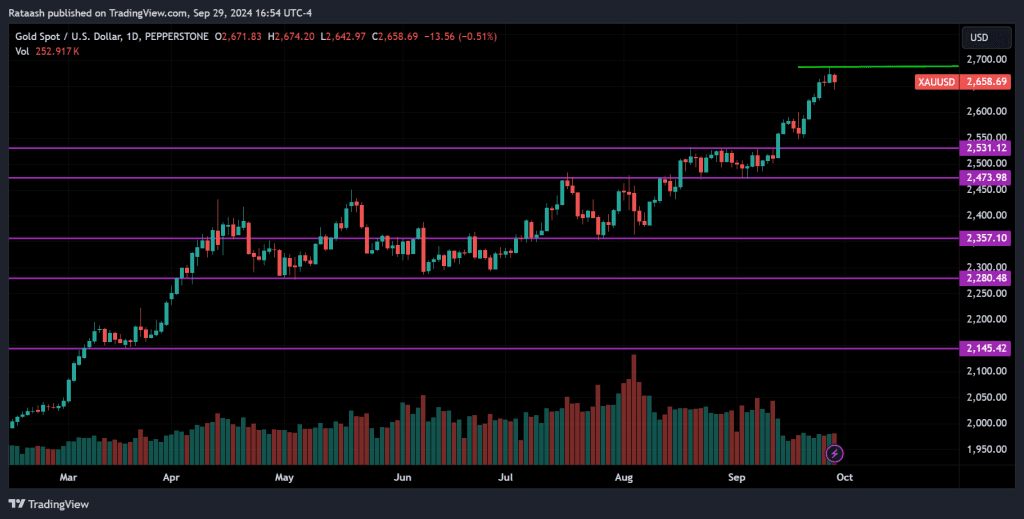

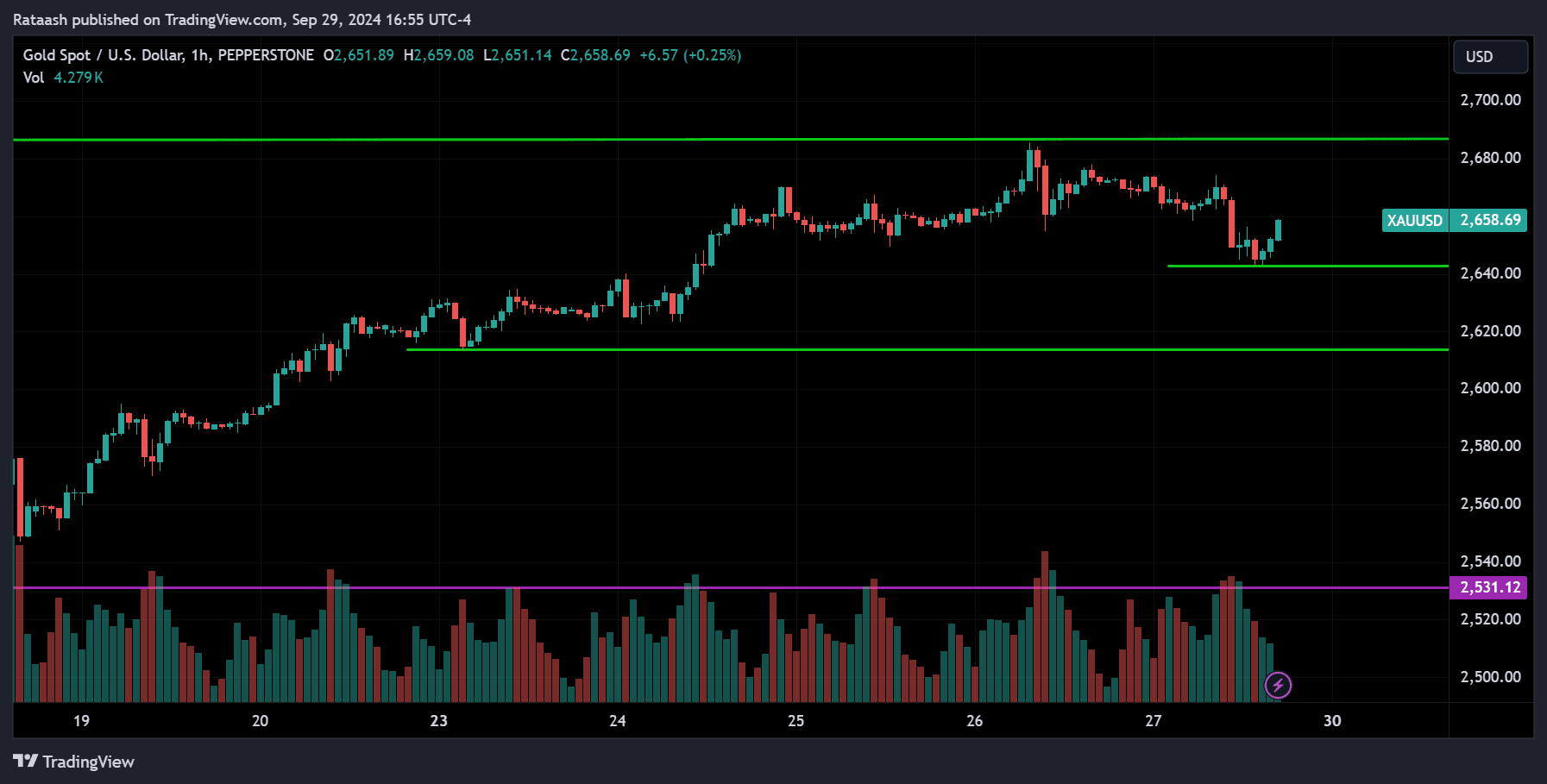

GOLD:

GOLD is at all-time high levels, with the price currently near the resistance of 2700 and pulling back. There is support around 2640, and if the price breaks below this level, we can expect a correction toward the 2620 range. On the other hand, since it’s in an uptrend, if the price breaks above the resistance at 2700, we can expect it to continue rising.

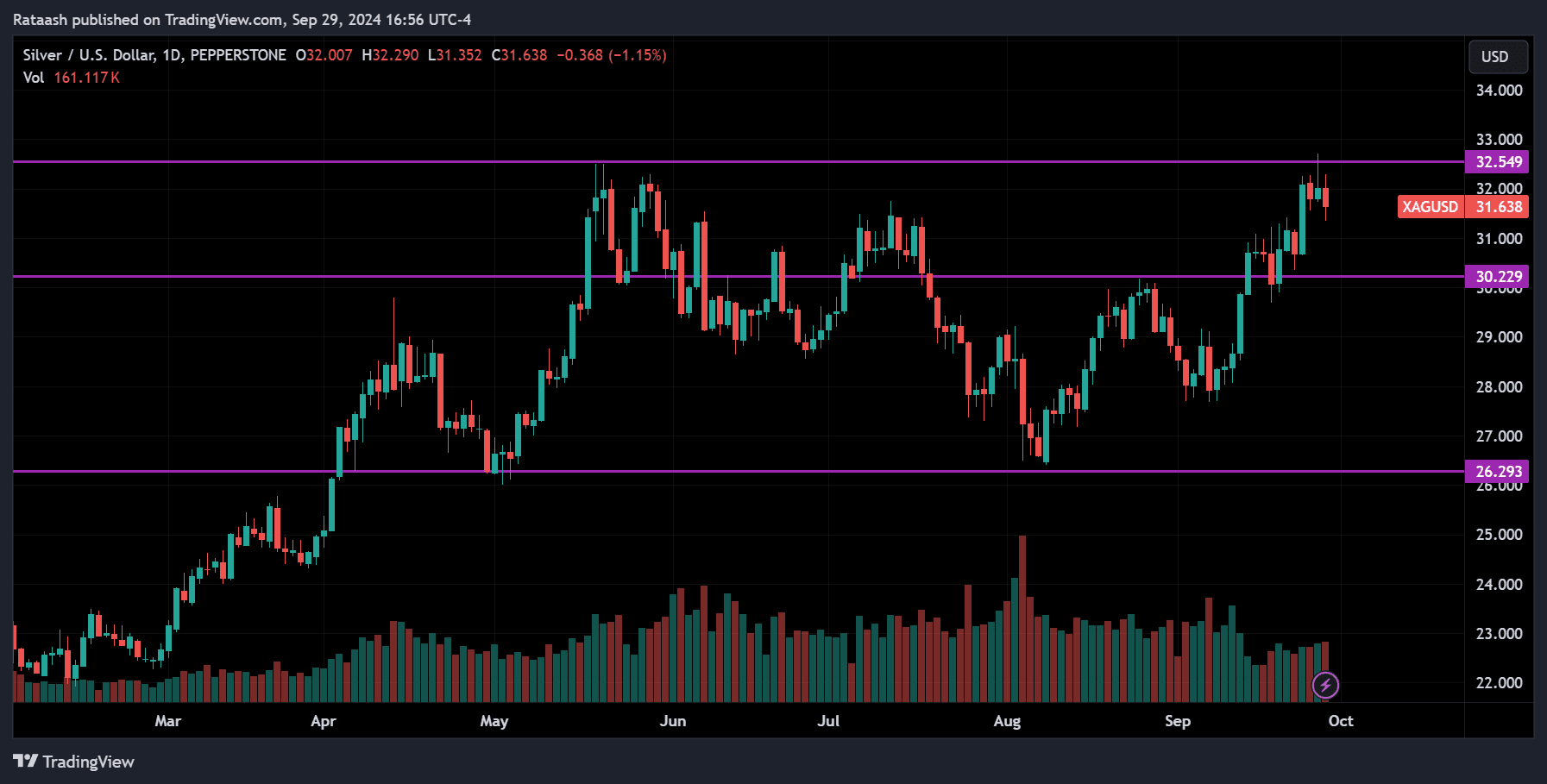

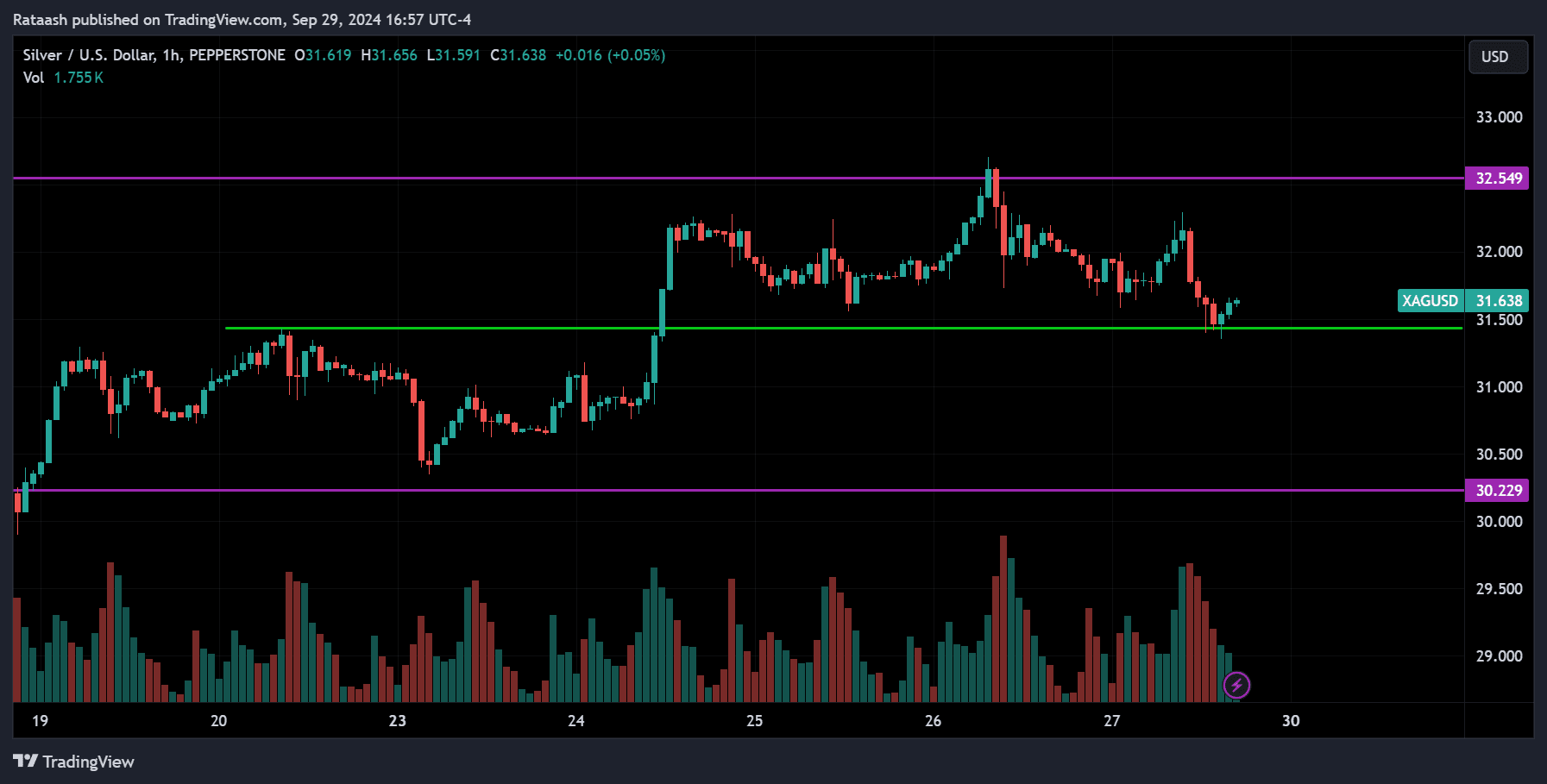

SILVER:

SILVER is also uptrending, with the price currently near the resistance around 32.500. Looking at the 1-hour chart, the price is at the support level of 31.500, and if it breaks below this support, we can expect it to continue dropping toward the 30.200 range. On the other hand, if the price breaks above the 32.500 resistance, we can expect it to continue going up.

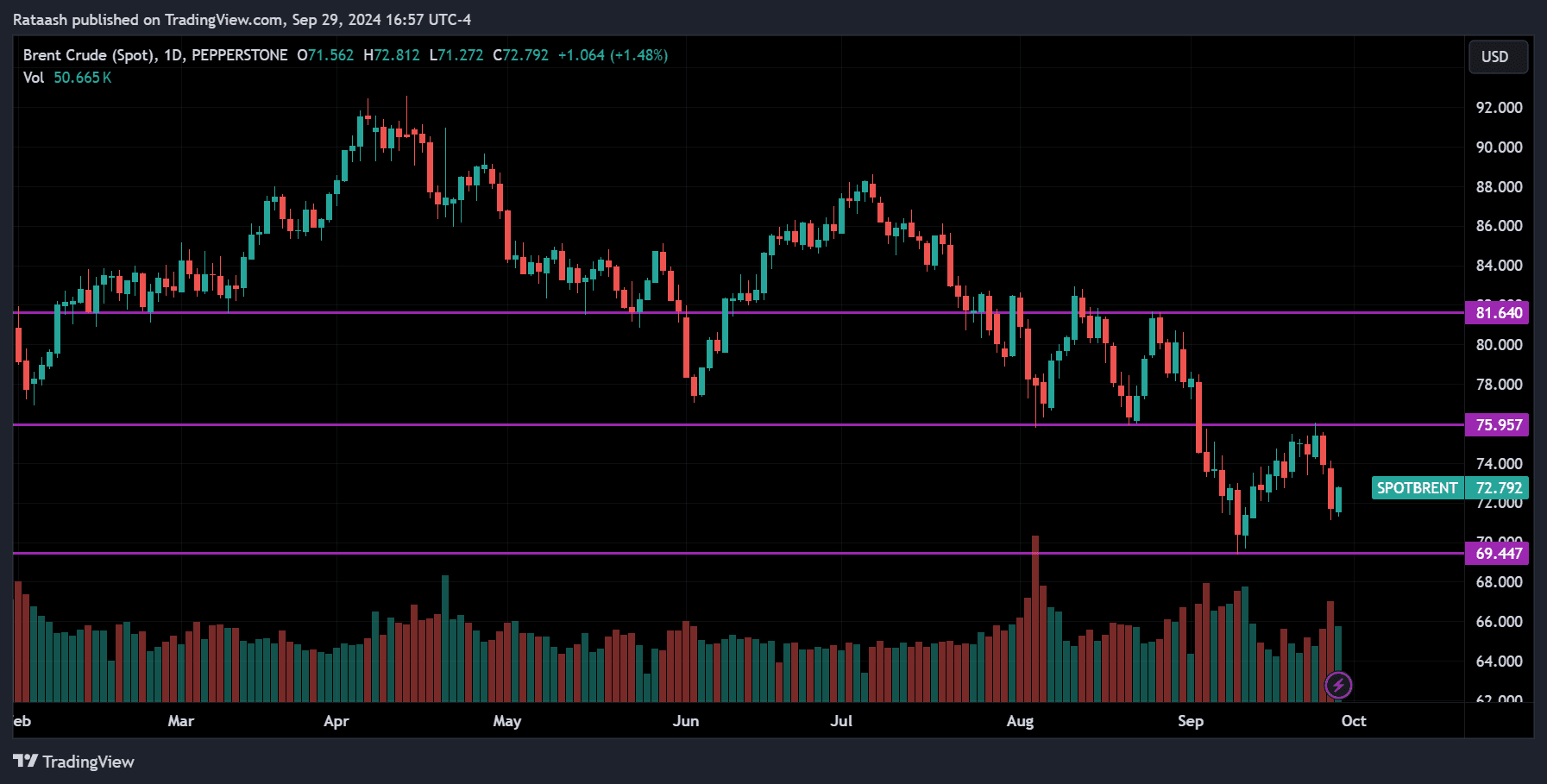

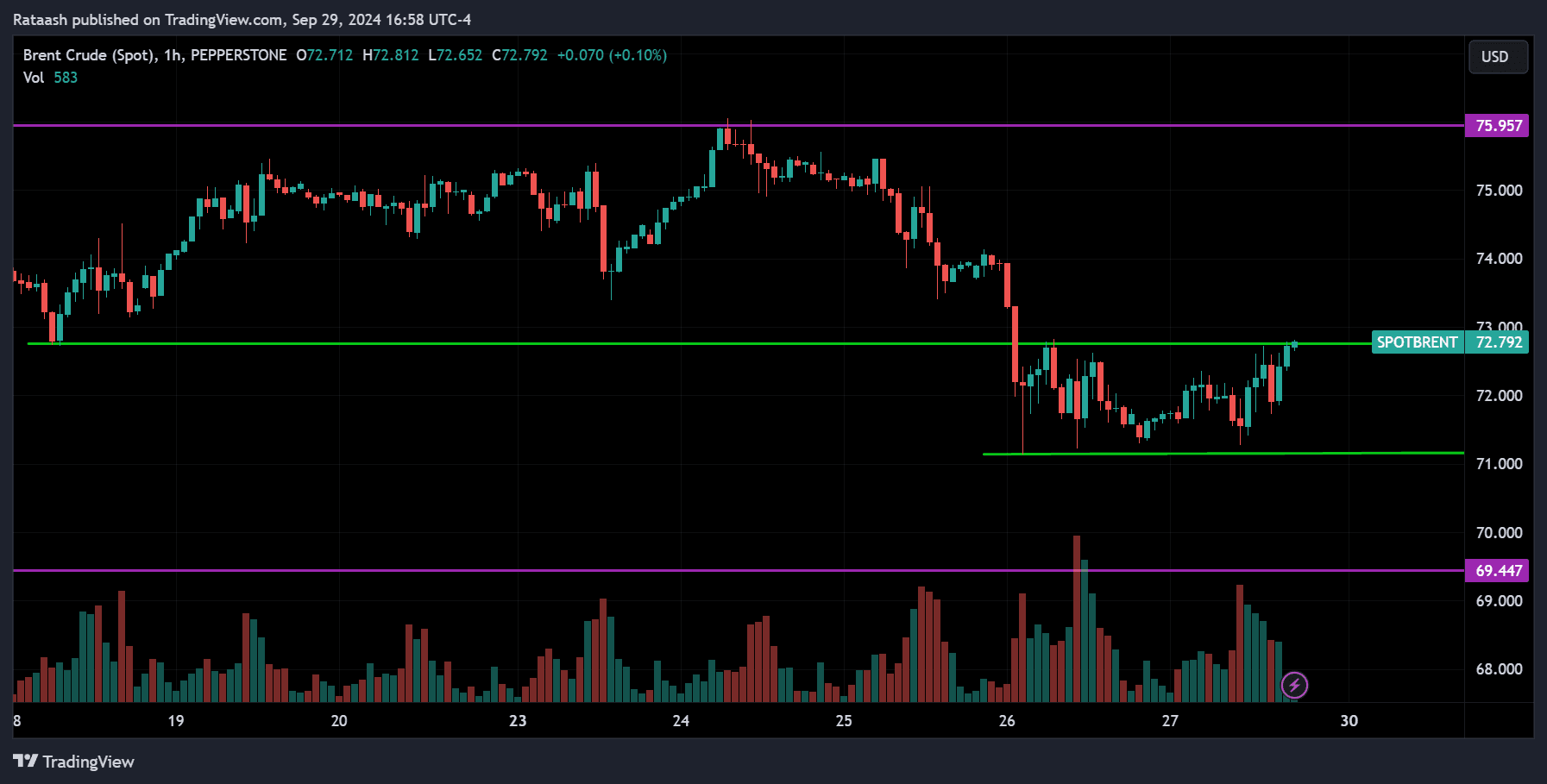

CRUDE OIL:

CRUDE OIL is trending down, with the price nearing the major support around 69.450. Looking at the 1-hour chart, the price is currently at the resistance level of 73, and if it breaks above this level, we can expect the price to continue rising toward the 76 range. However, since the overall trend is down, we can expect the price to break below the support around 71 and continue dropping toward the 69.450 range. If that level is also broken, the price could continue falling further.

Cryptocurrency Market Forecast

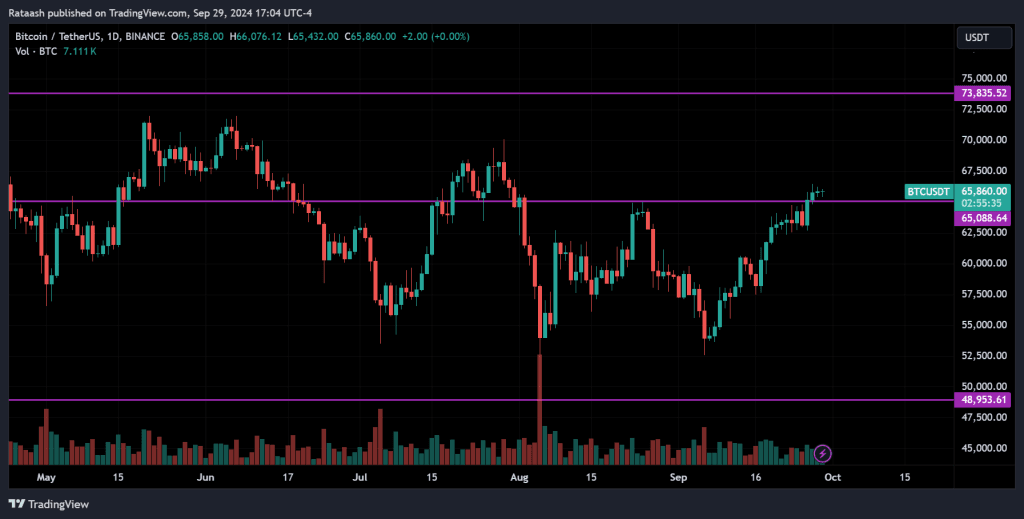

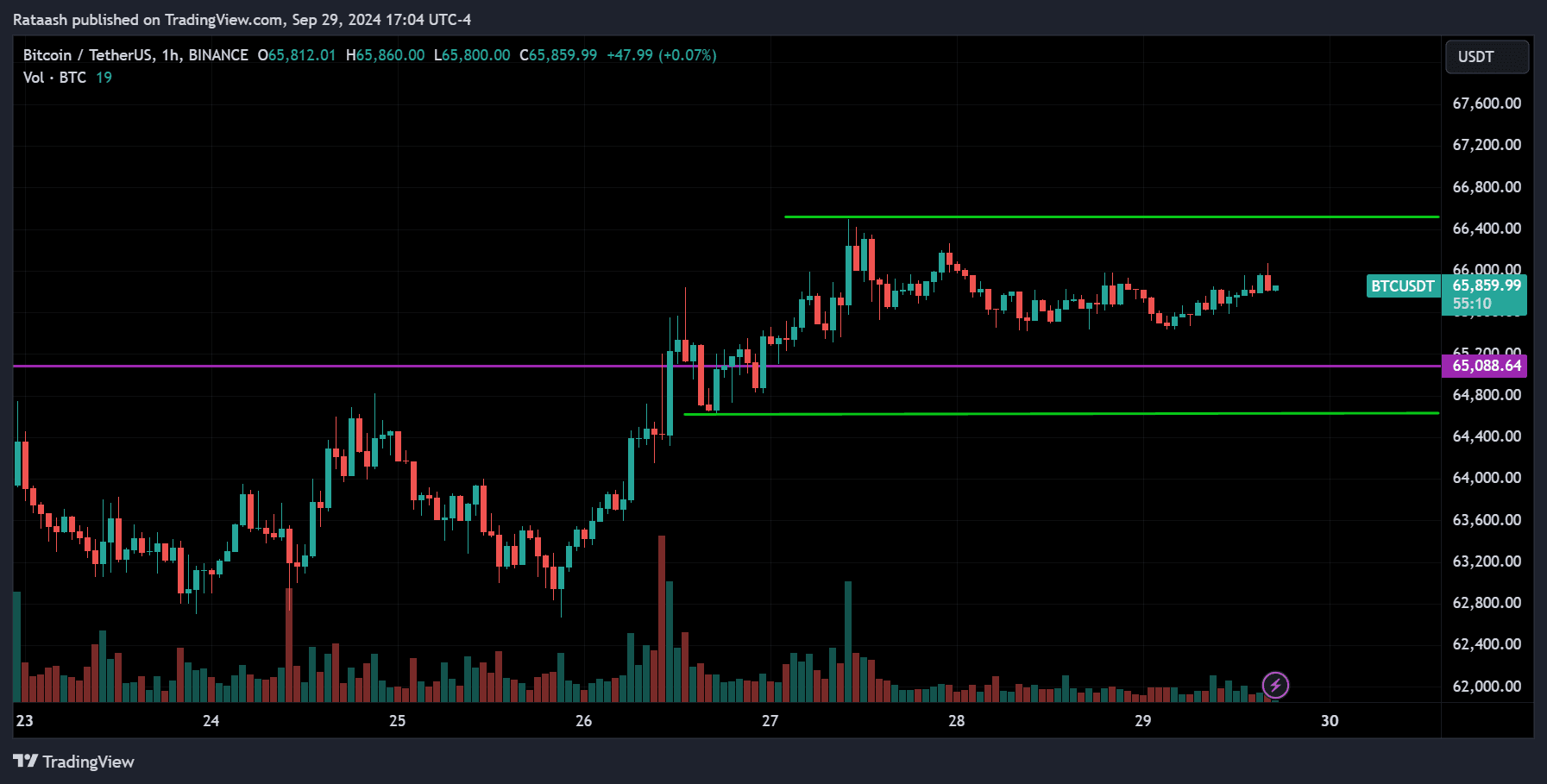

BTC:

BTC is trading above 65000, showing signs of an uptrend, especially with the FED starting to cut rates, which could push the price higher. Looking at the 1-hour chart, the price is currently consolidating. If the price breaks below the support of around 64600, we can expect it to fall further. On the other hand, if the price breaks above the resistance at 66500, we can expect the price to continue rising.

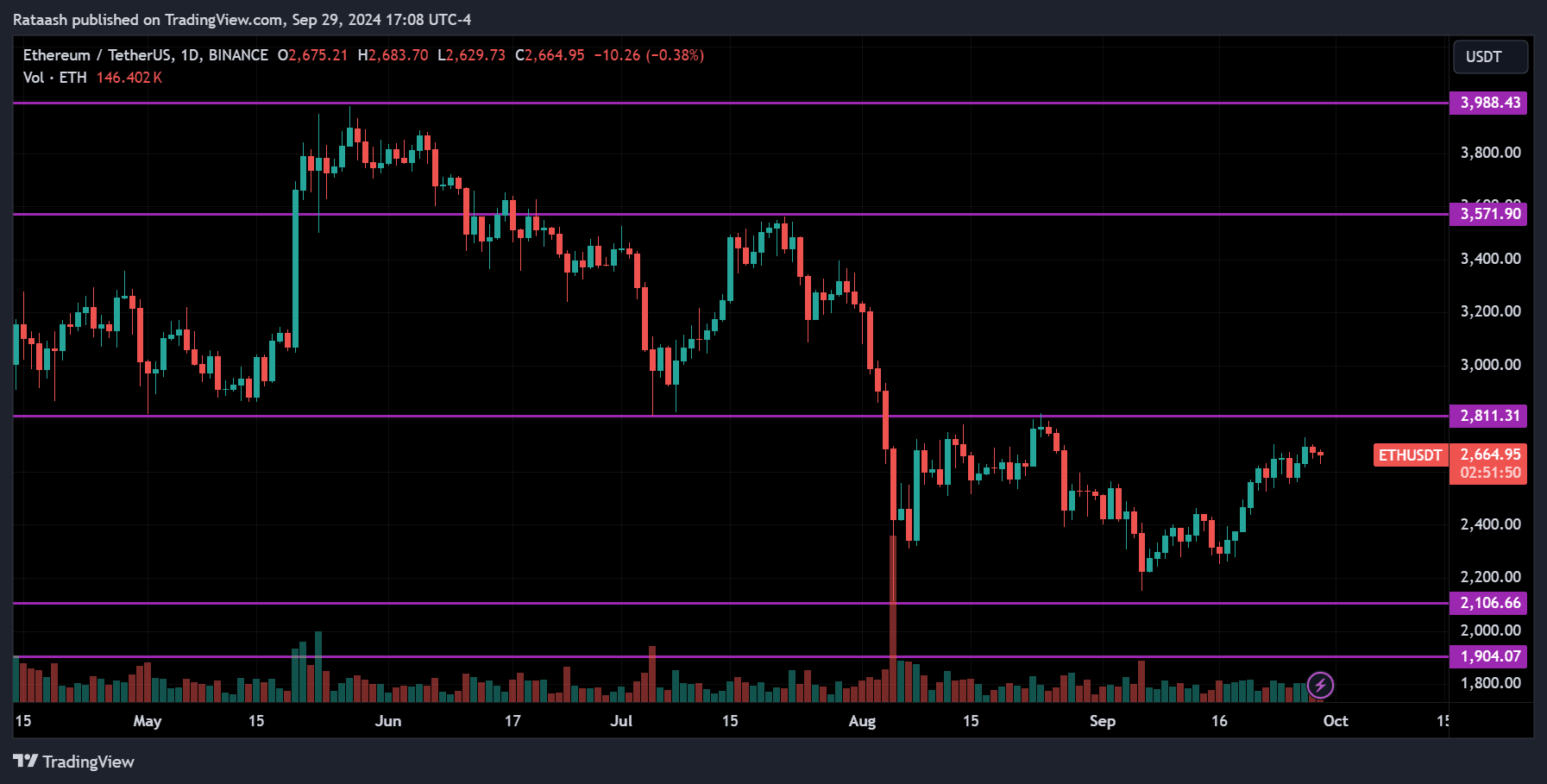

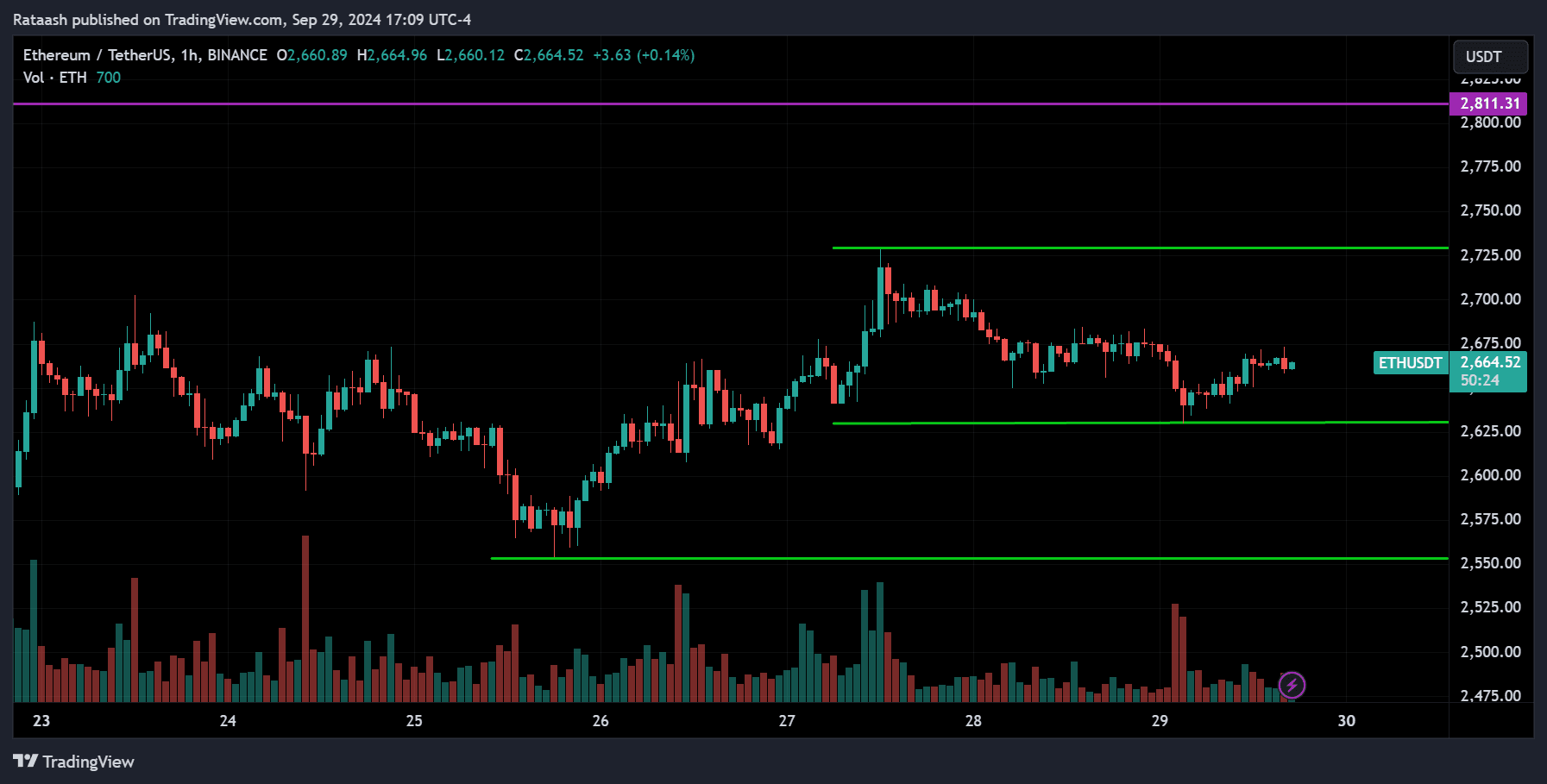

ETH:

ETH is trending down, but it has pulled back, and the price is now near the resistance level of 2800. Looking at the 1-hour chart, there is support around 2625, and if the price breaks below this level, we can expect it to drop toward 2550. On the other hand, if the price breaks above the resistance around 2725, we can expect it to continue rising toward the 2800 range. If that level is also broken, the price could potentially move toward 3500.

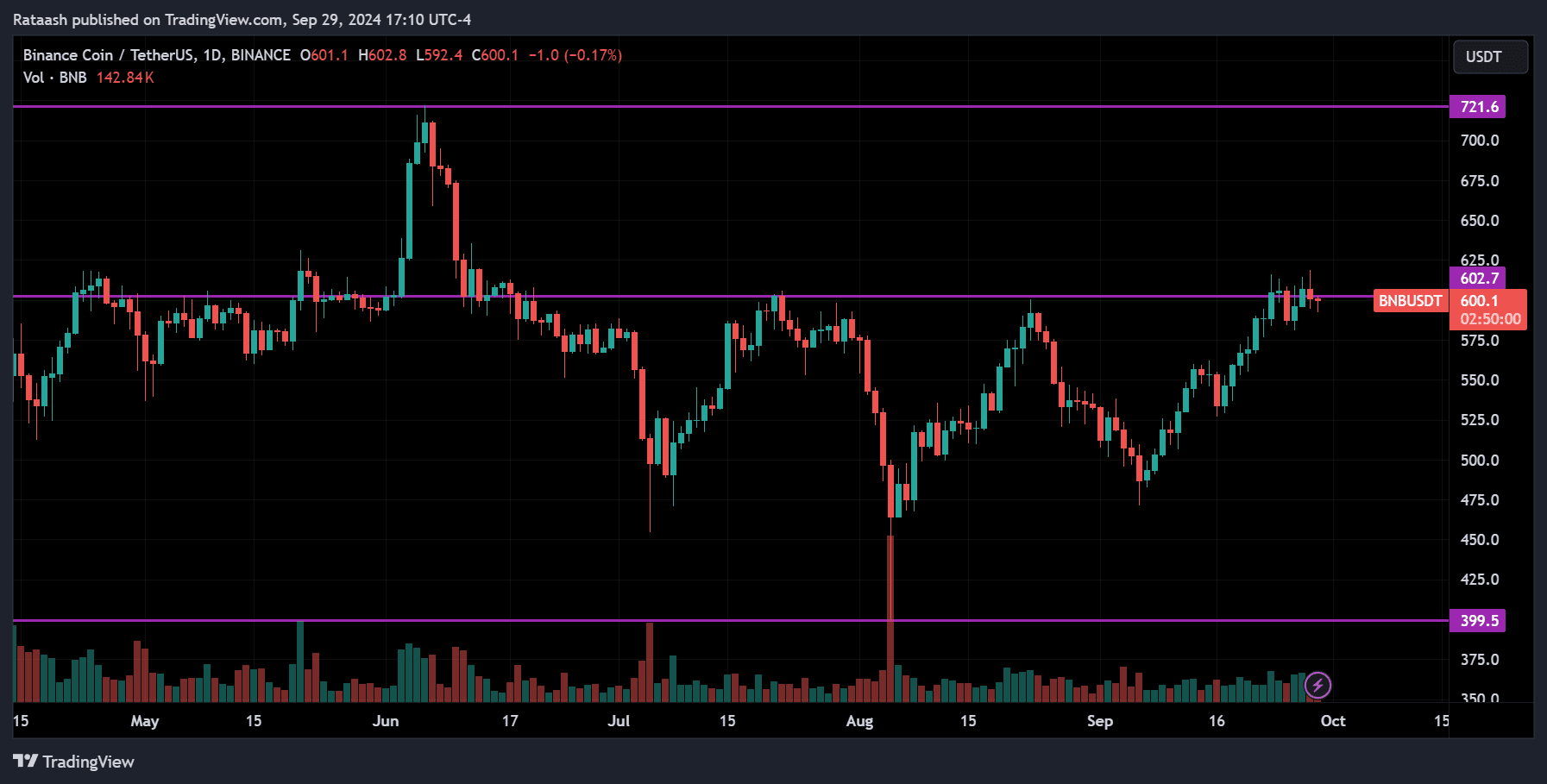

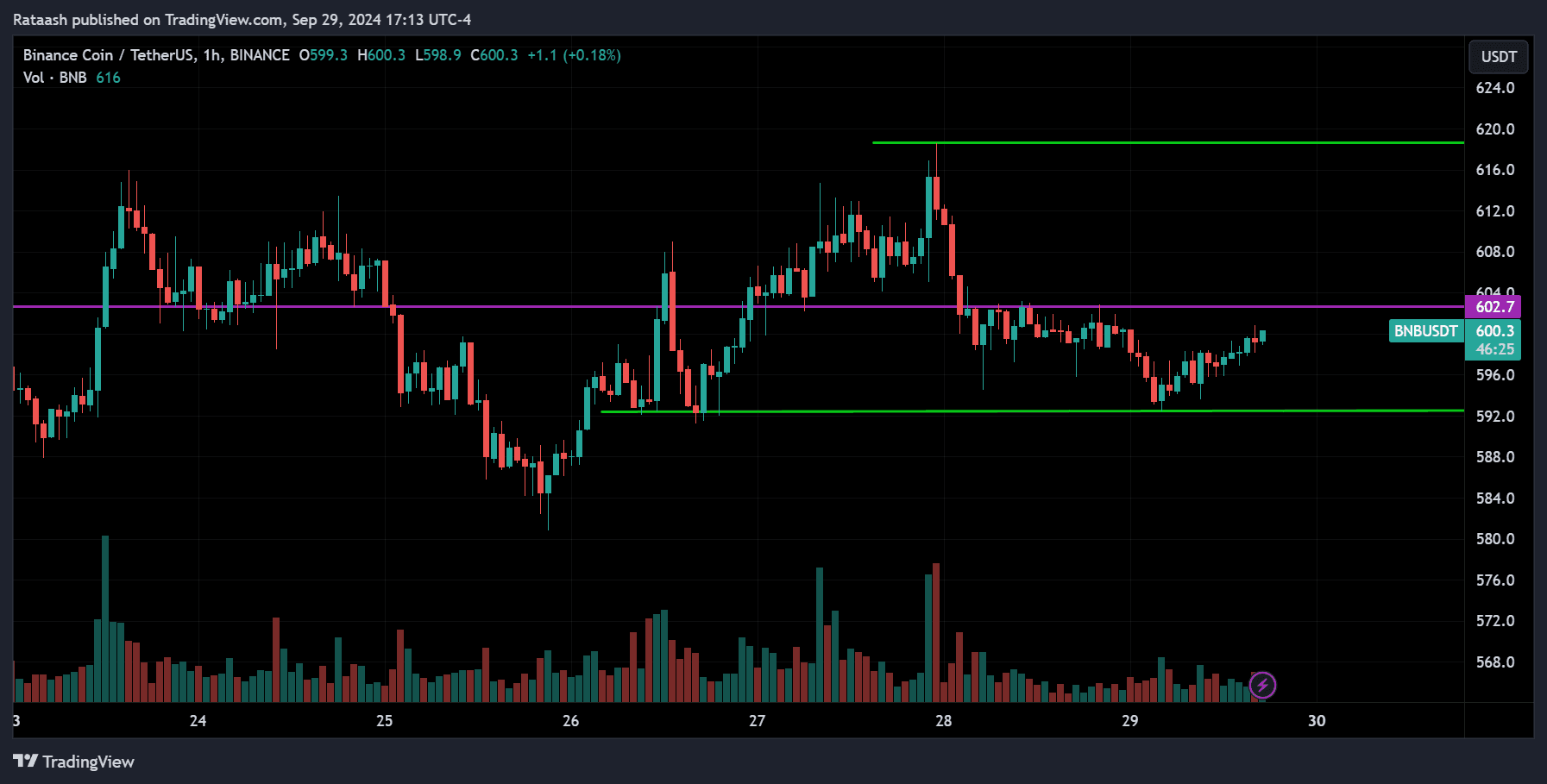

BNB:

BNB is consolidating, with the price currently at the resistance level of 600. If the price breaks above this level, we can expect it to continue rising toward 620, and if that level is also broken, it could push further up to the 720 range. On the other hand, there is a small support of around 592, and if the price breaks below this level, we can expect it to drop toward 580. If that support is also broken, the price could continue falling toward the major support at 400.

Conclusion & Disclaimer

This analysis article isn’t about telling you when to buy or sell. It’s about teaching you how to approach the market effectively. Every day, I follow the same routine before I start trading. Here, I briefly explained the technical aspects of what’s happening and what actions I take in these situations. Your goal is to understand what I do so you can follow the same process on your own.

If you want to learn more about trading and advanced techniques used in the financial markets at a professional level, visit xlearn.

Please provide your feedback in the comment section below on how we can further improve our market analysis. Thank you.

It’s crucial to acknowledge the inherent unpredictability of financial markets. While we strive to offer informed perspectives on upcoming events and trends affecting various instruments, it’s important for readers to conduct their own analysis and exercise prudent judgment.

Encouragement of Independent Analysis

We strongly encourage readers to supplement the information presented here with their own research and analysis. Market dynamics can swiftly change due to a multitude of factors, and individual circumstances may vary. By conducting independent analysis, readers can tailor their strategies to align with their unique goals and risk tolerance.

No Certainty in Market Predictions

It’s vital to recognize that nobody possesses the ability to predict market movements with absolute certainty consistently. Market analysis serves as a tool to assess probabilities and identify potential opportunities, but it’s essential to remain cognizant of the inherent uncertainty in financial markets.

Aligning with High Probability

Rather than aiming for infallible predictions, our goal is to align with high-probability scenarios based on available information and analysis. This approach acknowledges the dynamic nature of markets while seeking to capitalize on opportunities with favorable risk-reward profiles.

Proceed with Caution

Lastly, while market analysis can offer valuable insights, it’s imperative to approach trading and investment decisions with caution. Markets can be volatile, and unforeseen events may impact asset prices unexpectedly. Exercise prudent risk management and consider seeking advice from qualified financial professionals before making any significant financial decisions.

Remember, the journey of financial analysis and investment is a continuous learning process, and embracing a disciplined approach can contribute to long-term success in navigating the complexities of global markets.

THANK YOU & HAPPY TRADING!!!

![Weekly Market Forecast - Forex, Commodities & Cryptocurrencies [2024.09.30] ForexCracked.com](https://www.forexcracked.com/wp-content/uploads/2024/09/Weekly-Market-Forecast-Forex-Commodities-Cryptocurrencies-2024.09.30-ForexCracked.com_.jpg)