Hi, welcome to our forex forecast weekly market analysis article series!

Let’s wrap up what we know about the economy. First, inflation is still above 2%, currently around 2.9%. This week, the CPI data is being released, and inflation is expected to be 2.6%. The FED announced they will start cutting interest rates in September. The markets are mostly high, which is unusual since rate cuts usually happen when markets are down, but that’s not the case this time.

When interest rates go down, borrowing becomes cheaper, so more people borrow and invest in businesses and financial markets because it’s better than saving at low rates. When the FED mentioned in their last meeting that they plan to adjust policy, the market started to react to that. When they cut rates, the value of the USD decreases, meaning EURUSD will likely go up as the USD weakens.

This is what should happen, but markets can be unpredictable. The key takeaway is that the USD will likely weaken if rates are cut, and the markets are already factoring in those cuts. Also, the upcoming inflation report is important for determining future interest rates. Keep this in mind.

Before we continue with the analysis, if you don’t know much about trading, charts, candlesticks, risk management, or strategies, or if you want to improve your knowledge, consider reading our free forex course.

Upcoming Events for This Week

These events include macroeconomic reports, economic indicators, and, generally, what’s going on in the world.

Only the most important events are considered here. You can check the forexfactory.com for all the economic events and yahoo finance for news.

2024.09.09

There are no major events that could impact the forex market on this day.

2024.09.10

- 2:00 ET: The UK will release its Claimant Count Change, which shows how many more people applied for unemployment benefits in the last month. The previous count was 135.0K, and the forecast is 95.5K. If the actual number is lower than the forecast, it’s positive for the currency. Although it’s a lagging indicator, the number of unemployed people is a key sign of the economy’s health, as consumer spending often depends on job conditions. Unemployment is also a key factor for those setting the country’s monetary policy.

- 8:10 ET: BOC Governor Macklem is speaking at the Canada-United Kingdom Chamber of Commerce in London. If his speech is more hawkish than expected, it’s good for the currency. As the head of the central bank, which manages short-term interest rates, he has more influence over the value of Canada’s currency than anyone else. Traders pay close attention to his speeches, as they often contain hints about future monetary policy.

2024.09.11

- 2:00 ET: The UK is releasing its GDP m/m, which shows the change in the total value of goods and services produced by the economy. The previous figure was 0.0%, and the forecast is 0.2%. If the actual number is higher than the forecast, it’s good for the currency. GDP is the broadest measure of economic activity and the main indicator of the economy’s health.

- 8:30 ET: The US is releasing its CPI y/y, which shows the change in the price of consumer goods and services — essentially a measure of inflation. The previous figure was 2.9%, and the forecast is 2.6%. If the actual number is higher than the forecast, it’s good for the currency. Consumer prices make up most of inflation, and inflation matters for currency because rising prices can push the central bank to raise interest rates to keep it under control.

2024.09.12

- 8:15 ET: The Eurozone is releasing its Main Refinancing Rate, which is the interest rate on key refinancing operations that supply most of the banking system’s liquidity. The previous rate was 4.25%, and the forecast is 3.65%. If the actual rate is higher than the forecast, it’s good for the currency. Short-term interest rates are the most important factor in currency valuation, and traders use other indicators to predict future rate changes. The rate is set by a vote among ECB board members and central bank governors, but the vote details are not made public.

- 8:30 ET: The US is releasing its PPI m/m, which shows the change in the price of finished goods and services sold by producers. The previous figure was 0.1%, and the forecast is 0.2%. If the actual number is higher than the forecast, it’s good for the currency. PPI is a leading indicator of consumer inflation—when producers raise their prices, these higher costs are usually passed on to consumers.

- 8:45 ET: ECB Press Conference with the ECB President and Vice President speaking. It happens 8 times a year, about 45 minutes after the Minimum Bid Rate is announced. The press conference lasts around an hour and has two parts—a prepared statement is read first, followed by press questions. The questions often lead to unscripted answers, which can cause strong market movements. The conference is webcasted on the ECB website with a slight delay. This is the main way the ECB communicates with investors about monetary policy, covering the reasons behind the latest interest rate decisions and the economic outlook and giving hints about future policy changes.

2024.09.13

There are no major events that could impact the forex market on this day.

This Week’s Forex Forecast

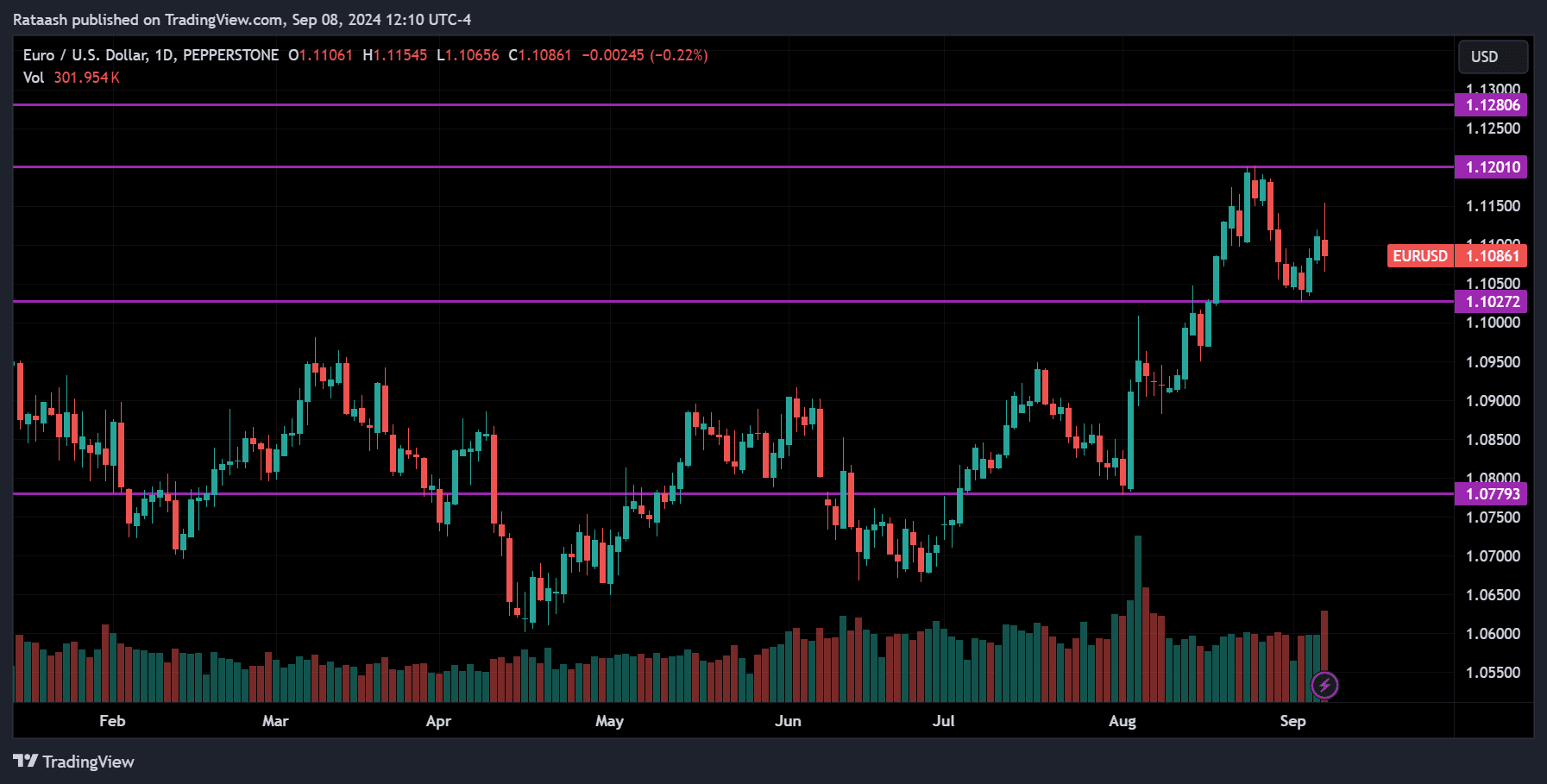

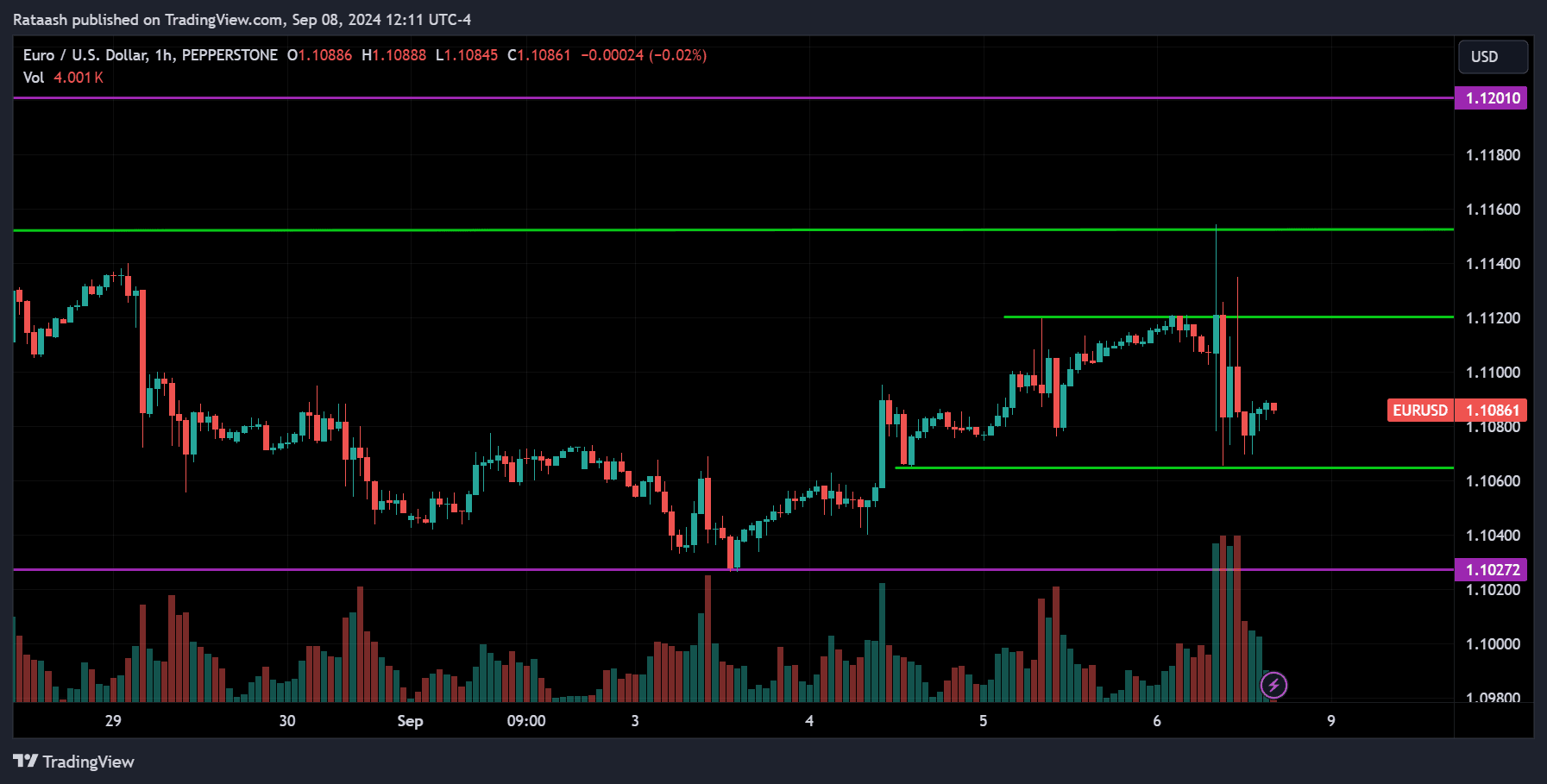

EURUSD

EURUSD is in an uptrend. The price recently pulled back from the resistance at 1.12000 to the support around 1.10200 and has now started to rise again. On the 1-hour chart, the price is currently at the support level of 1.10600. Since the overall trend is bullish, we can expect the price to bounce from this support and move up to the 1.11200 resistance level, possibly breaking above it and continuing the uptrend. However, if the price breaks below the 1.10600 support, it may drop to 1.10200, and if that level is broken, it could fall further toward 1.09500.

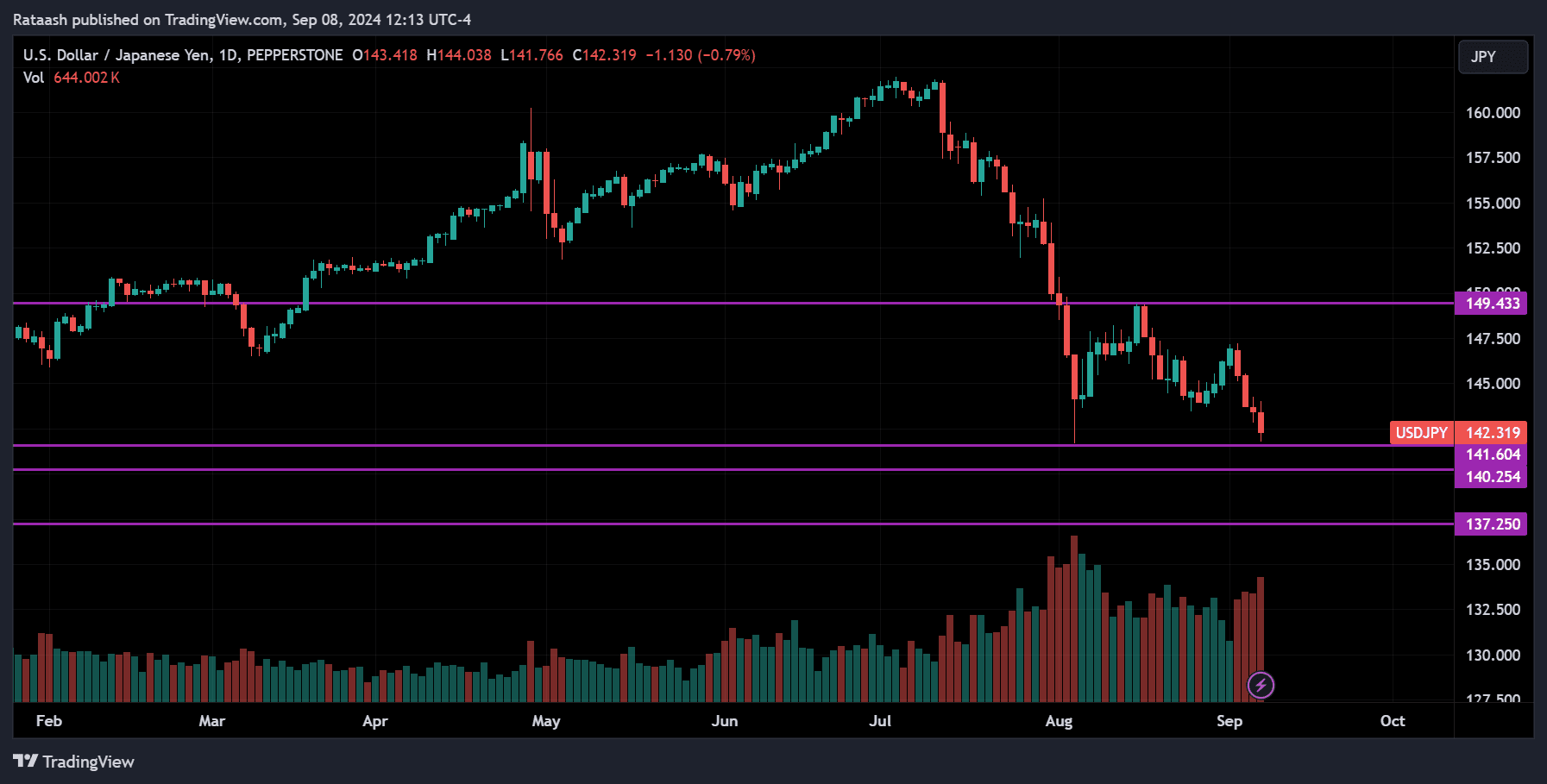

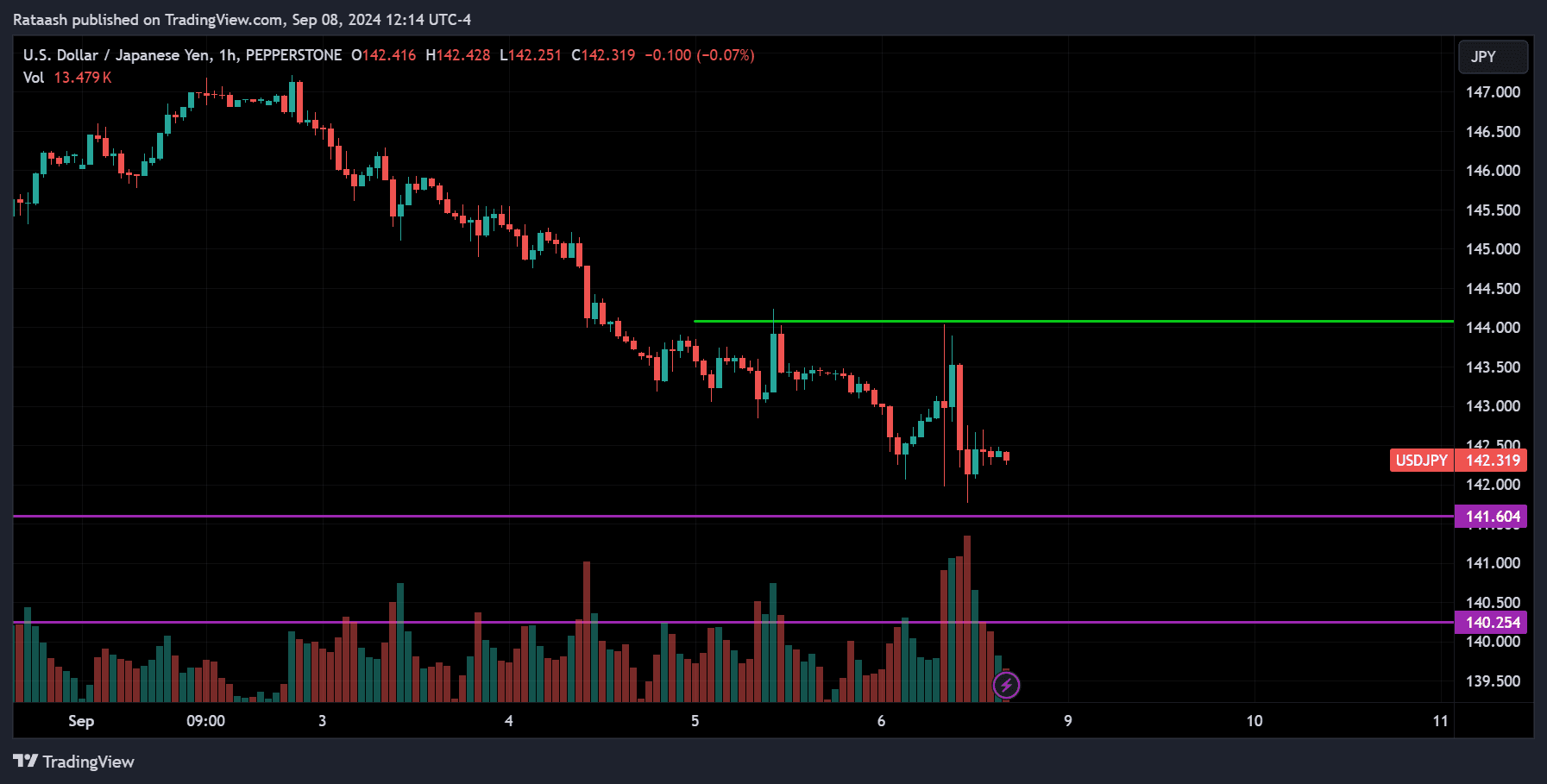

USDJPY

USDJPY is trending down, with the price nearing the support level of 141.600. Since it’s in a downtrend, we can expect the price to break below this support and continue toward 140.250. However, we could also see a reversal around these support levels, so watch for the price bouncing from support and heading toward the 144.000 resistance level. If the price breaks above this level, it could signal the start of an uptrend.

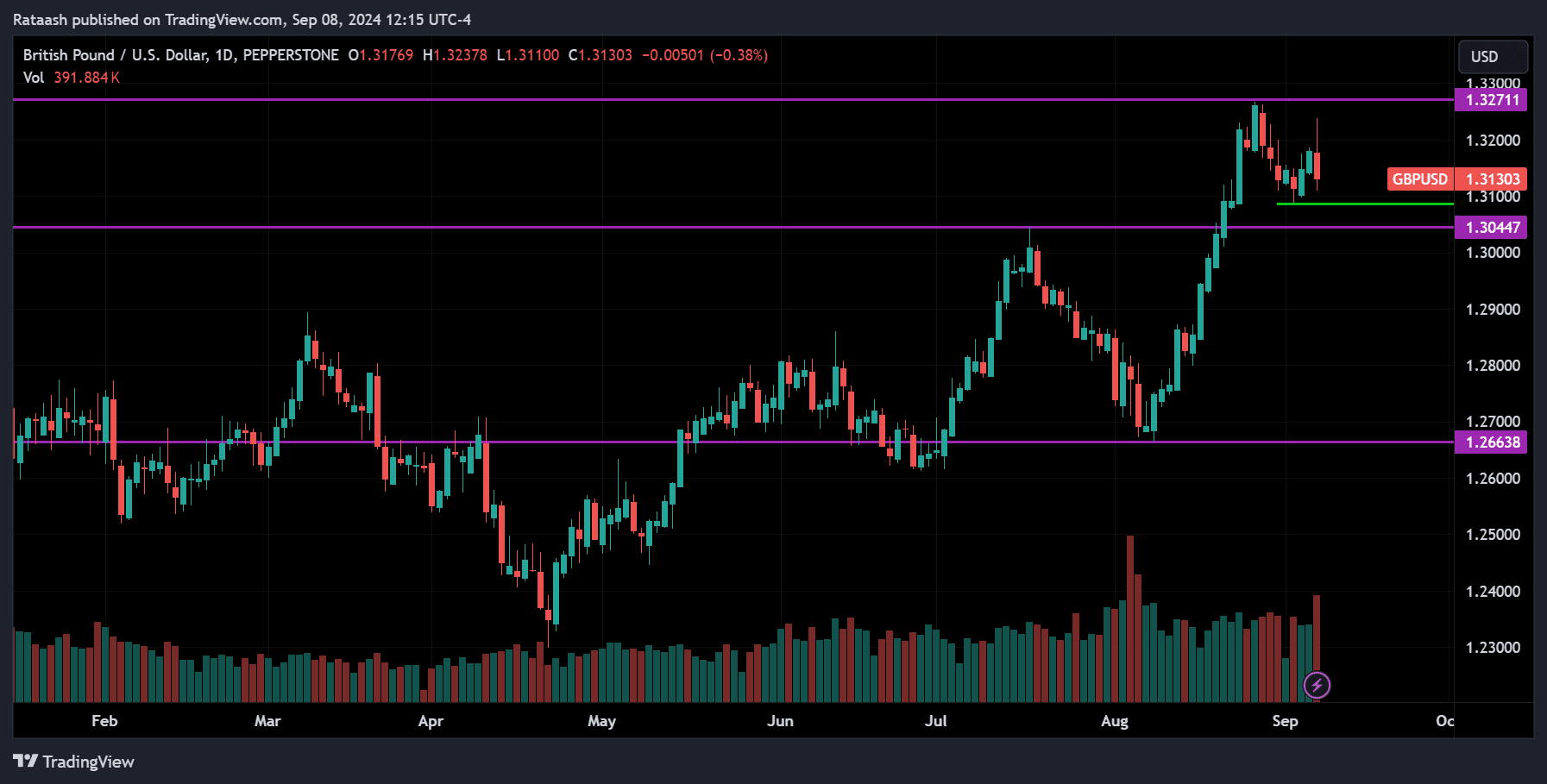

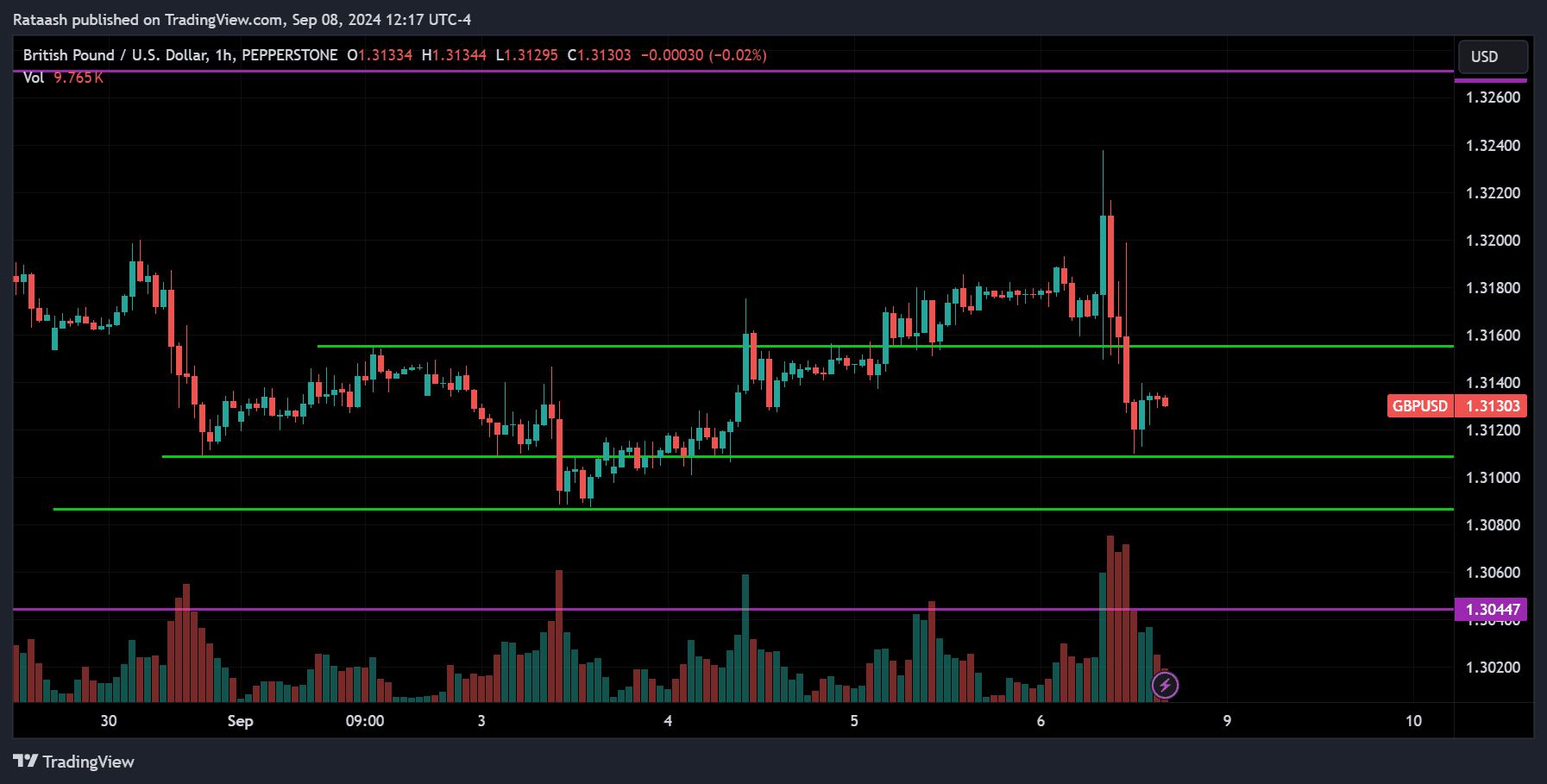

GBPUSD

GBPUSD is trending up, but the price is currently in a correction phase and trying to recover. Right now, the price is at the support level of 1.31200. Since the overall trend is bullish, and the price is attempting to climb back, we can expect it to rise, break above the 1.31600 resistance, and head toward the 1.32600 level. However, if the price breaks below the supports around 1.31000 and 1.30800, it may drop to the 1.30450 range and either pull back or continue lower. If it breaks below 1.30000, it could signal the start of a downtrend.

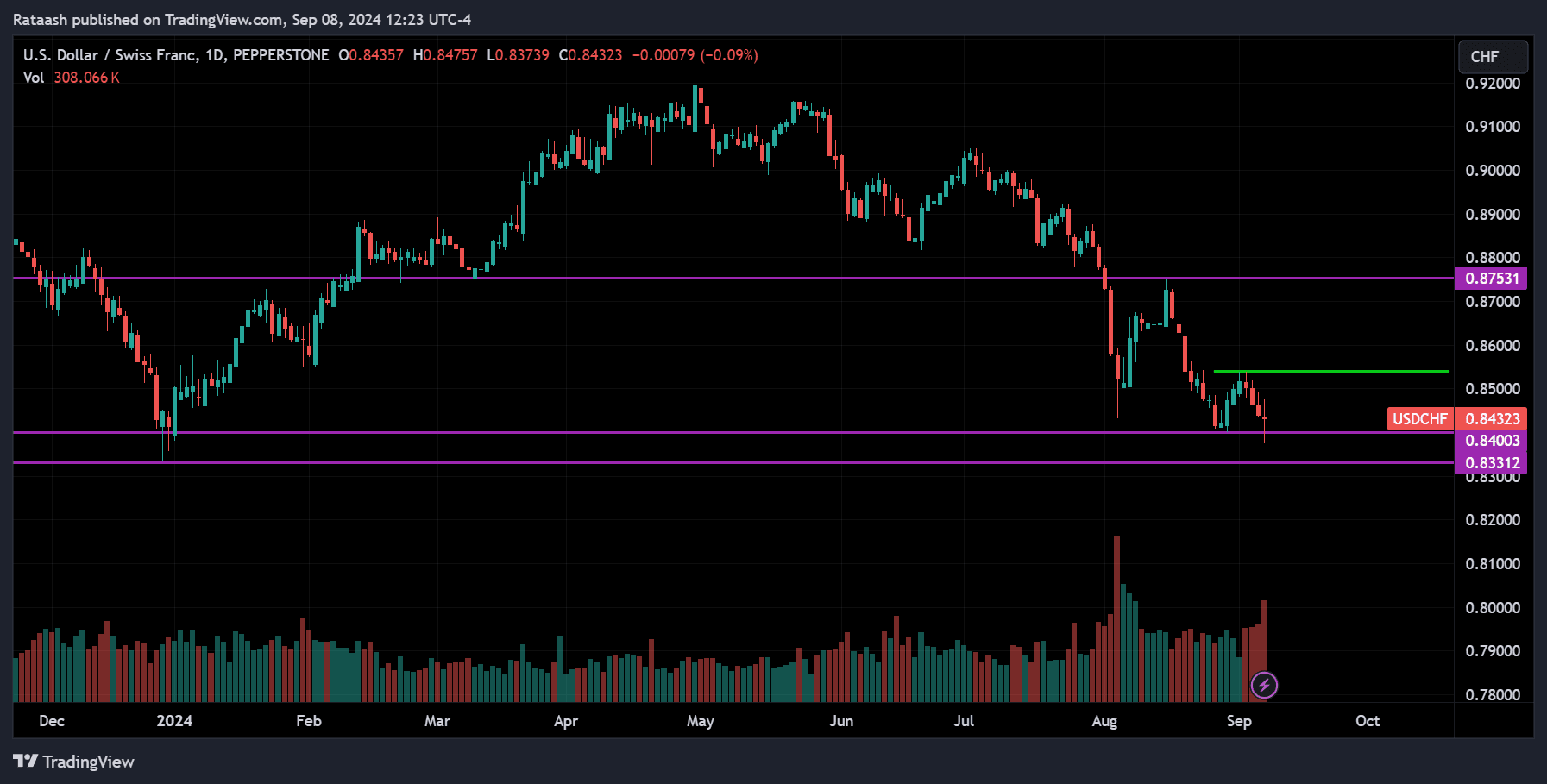

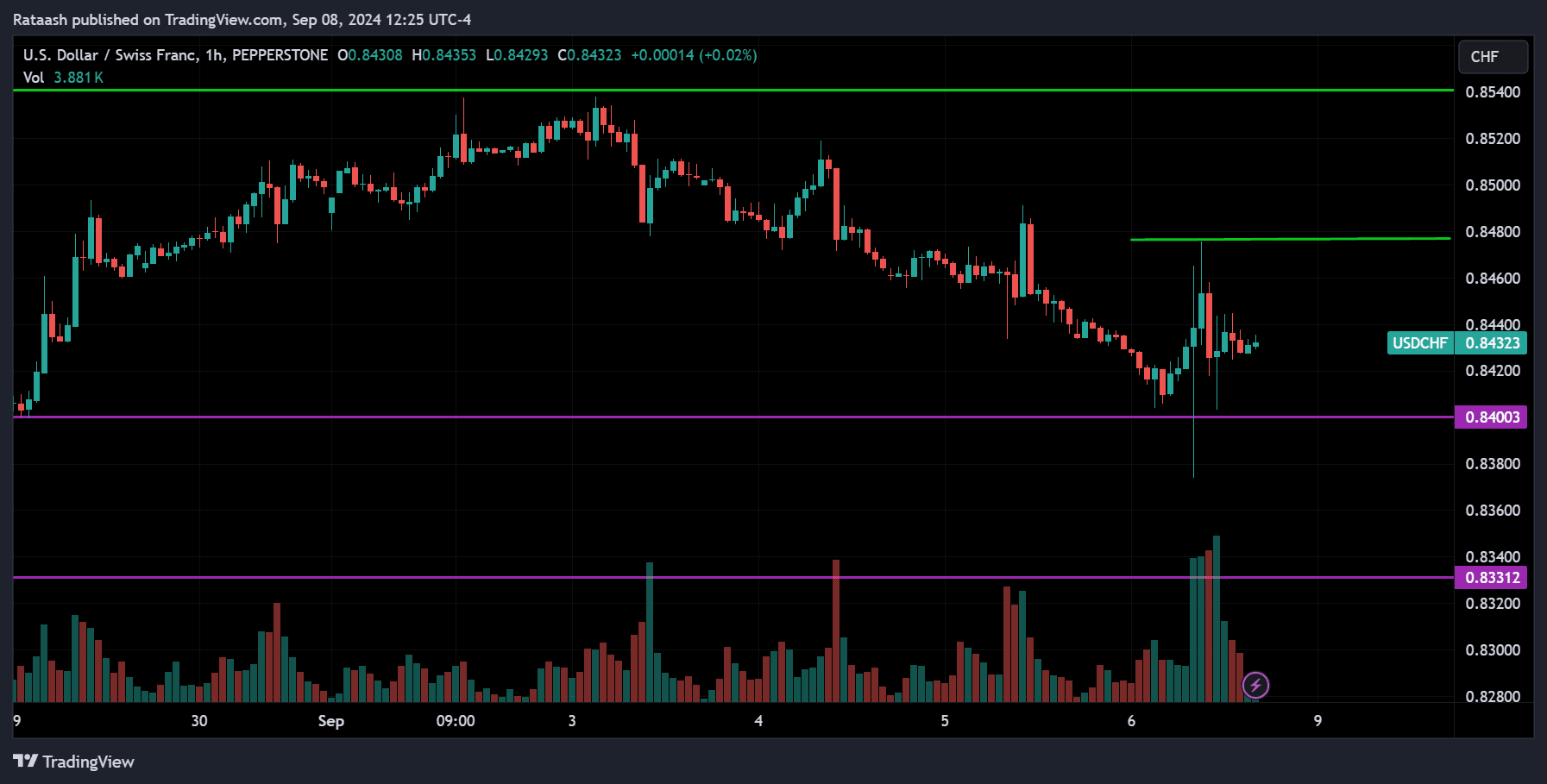

USDCHF

USDCHF is also trending down, with the price currently nearing the support level of 0.84000 and consolidating. There is resistance around 0.84800. Since the overall trend is down, we can expect the price to break below the support at 0.84000 and continue toward the 0.83300 range. However, watch for the price to potentially reverse and start going back up, breaking above the 0.84800 resistance. If that happens, an uptrend could begin, and the price may head toward 0.85400.

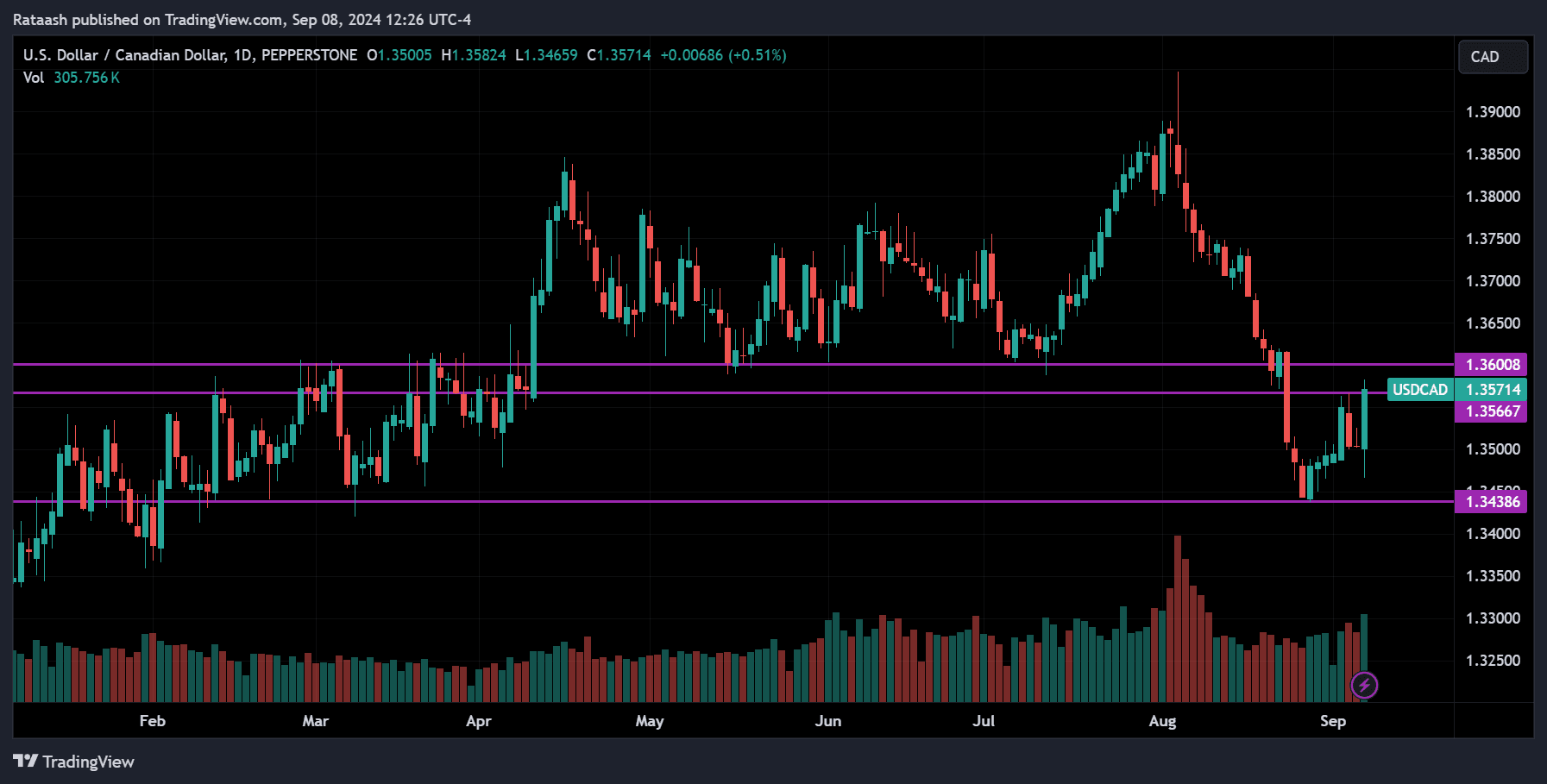

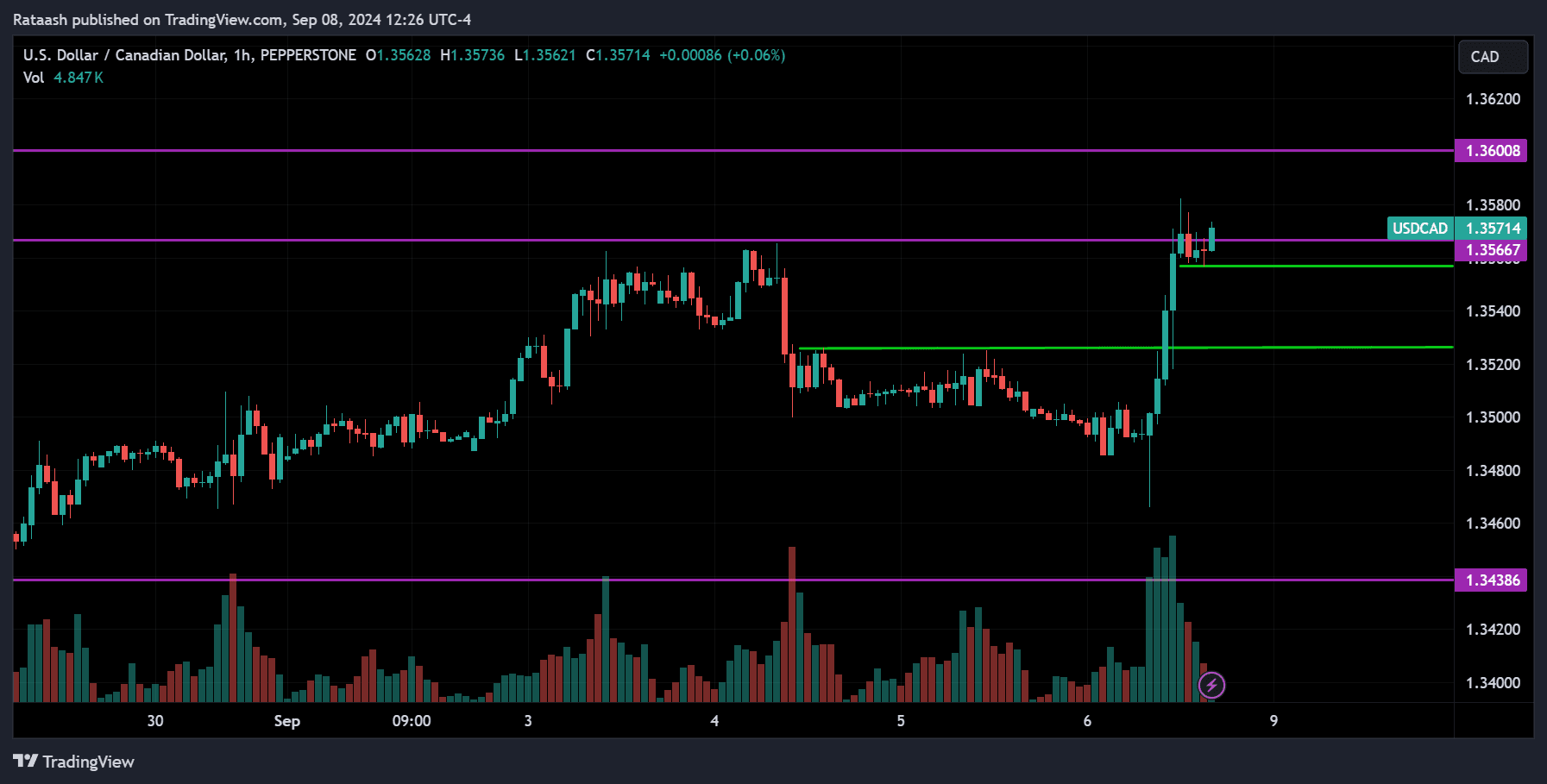

USDCAD

USDCAD was trending down, but after reaching support around 1.34400, the price started to go back up and is now at the resistance of 1.35500. If an uptrend has started, we can expect the price to continue rising and break above the major resistance at 1.36000, continuing its upward movement. However, the price could also reverse around these levels if the downtrend is still in play, so watch for that. If the price breaks below the current small support around 1.35600, we can expect it to drop to the 1.35200 range, and if that level is also broken, it may fall back toward 1.34400.

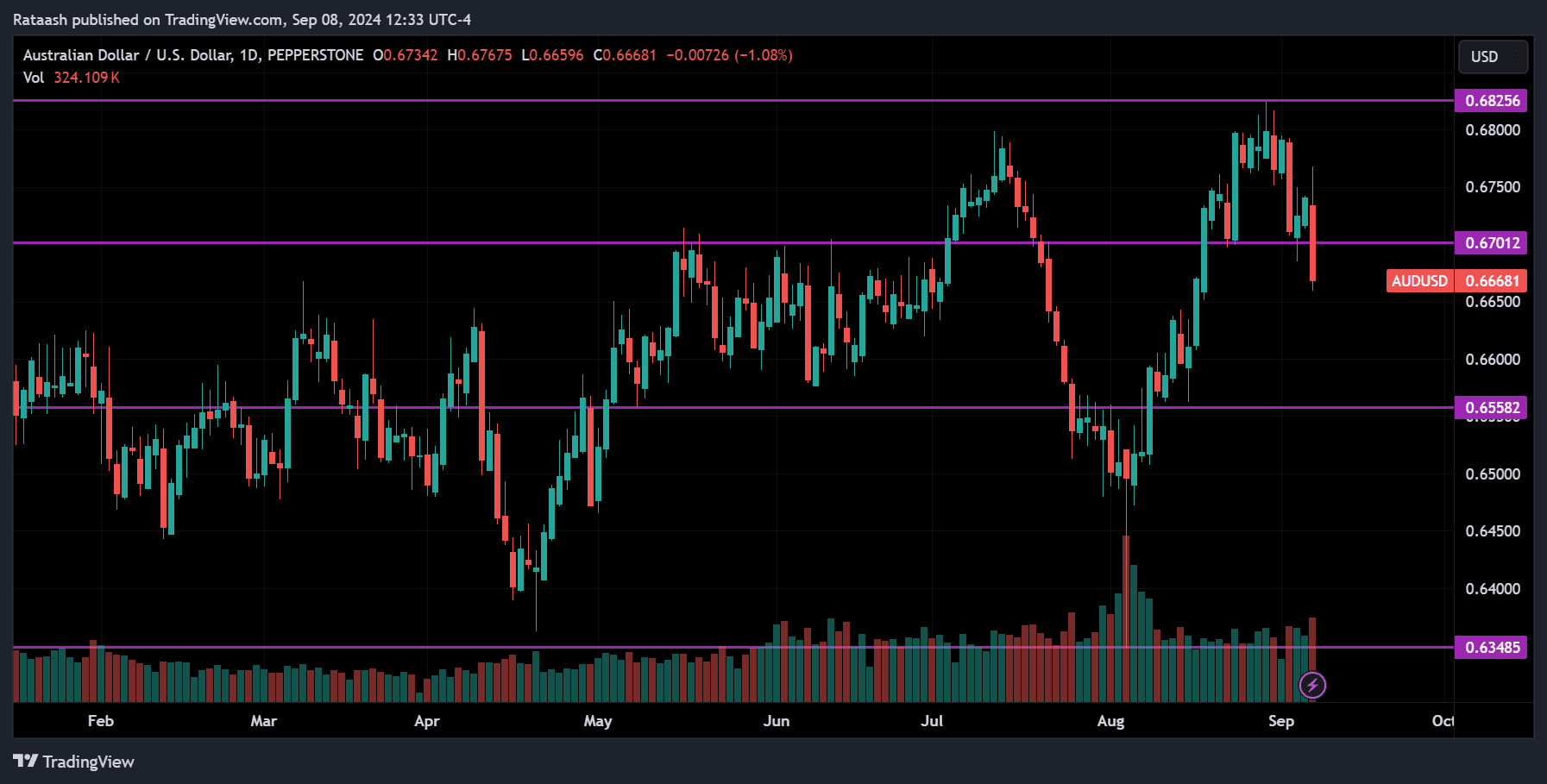

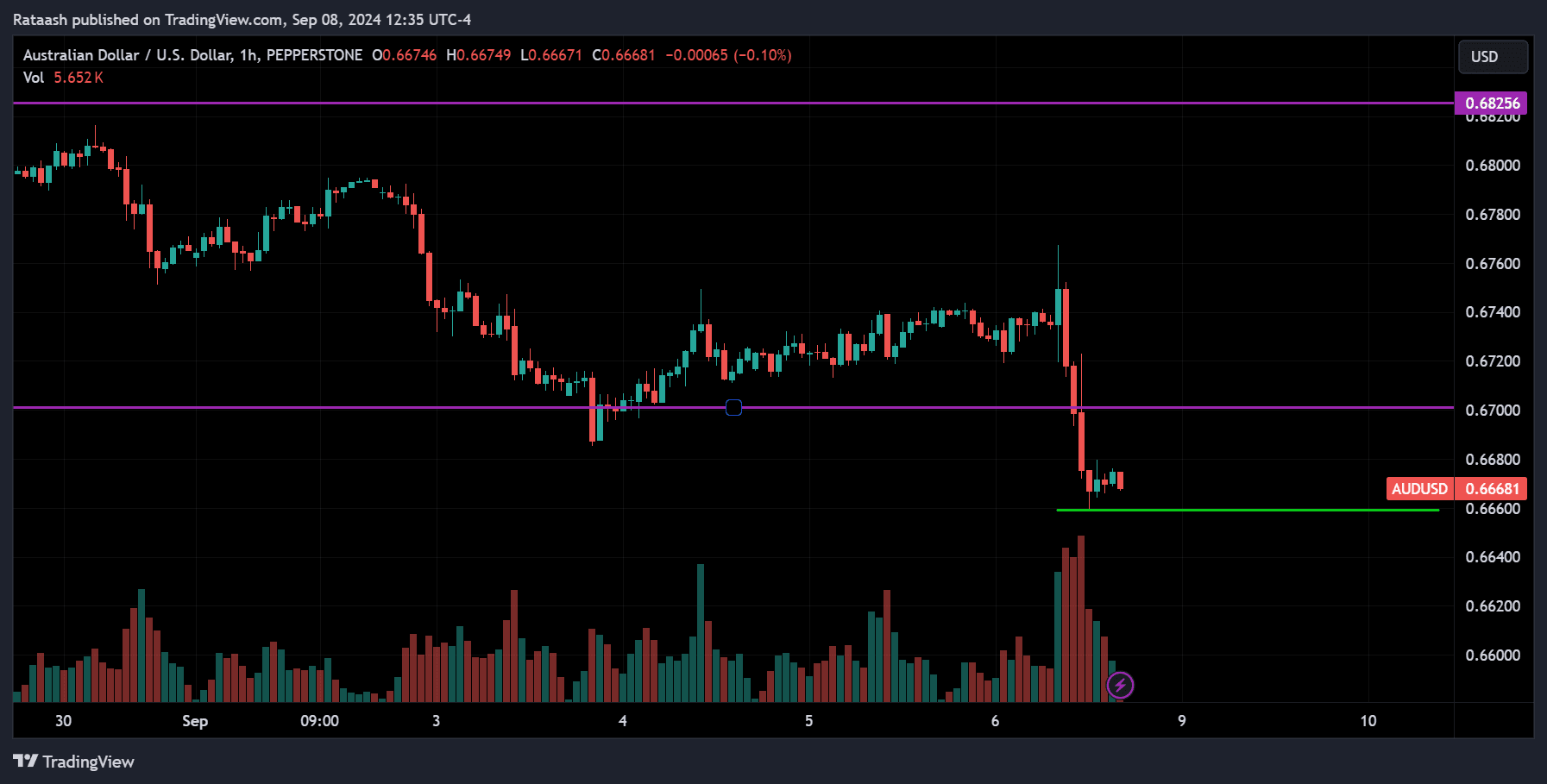

AUDUSD

AUDUSD is currently in a downtrend. After reaching the resistance level around 0.68250, the price started to drop and broke below the major support at 0.67000, confirming the downtrend. Now, there is support around 0.66500. Since the price is trending down, we can expect it to break below this support and continue dropping toward the 0.65500 range. However, the price could also start moving back up for a correction or reversal. Watch for the price breaking back above 0.67000—if it does, it indicates a correction or reversal, and the price could reach 0.67250.

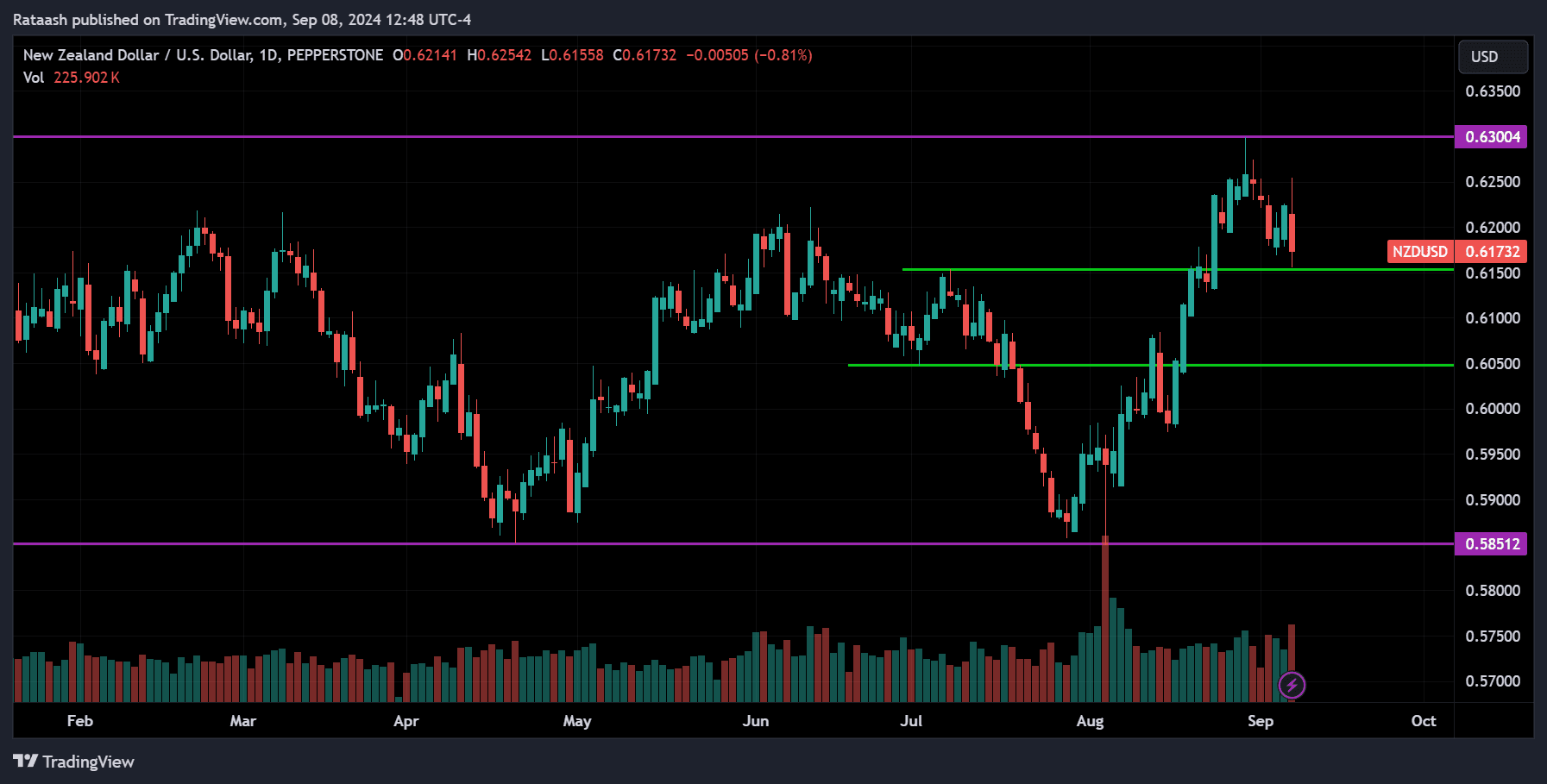

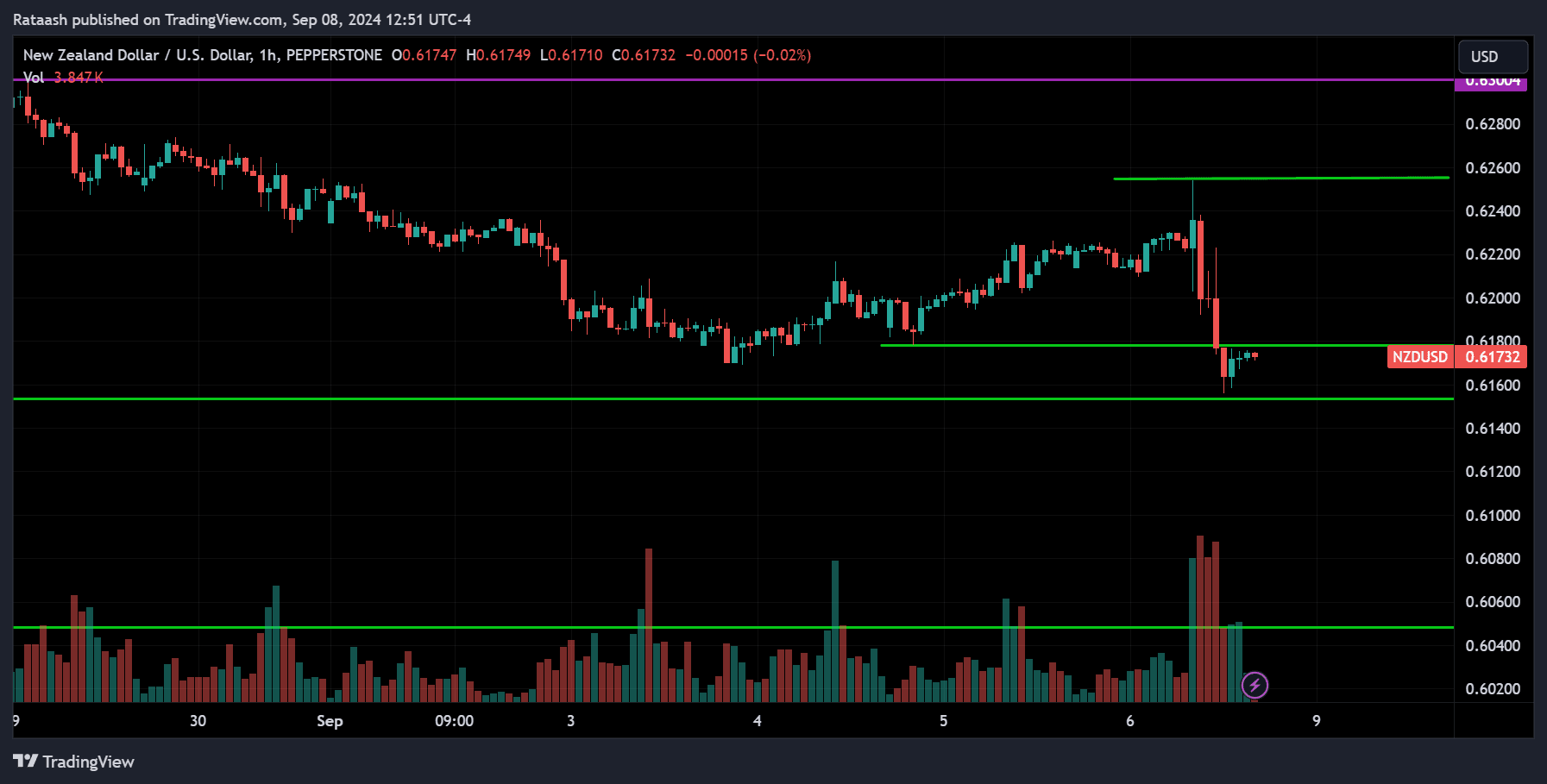

NZDUSD

NZDUSD is overall trending up but has pulled back from the major resistance level at 0.63000 and is now at the support level around 0.61600. If this is just a correction, we can expect the price to start going back up from this support toward the 0.62600 range. However, if it’s a reversal, we can expect the price to break below the support at 0.61600 and continue toward the 0.60600 range.

This Week’s Commodities Market Forecast

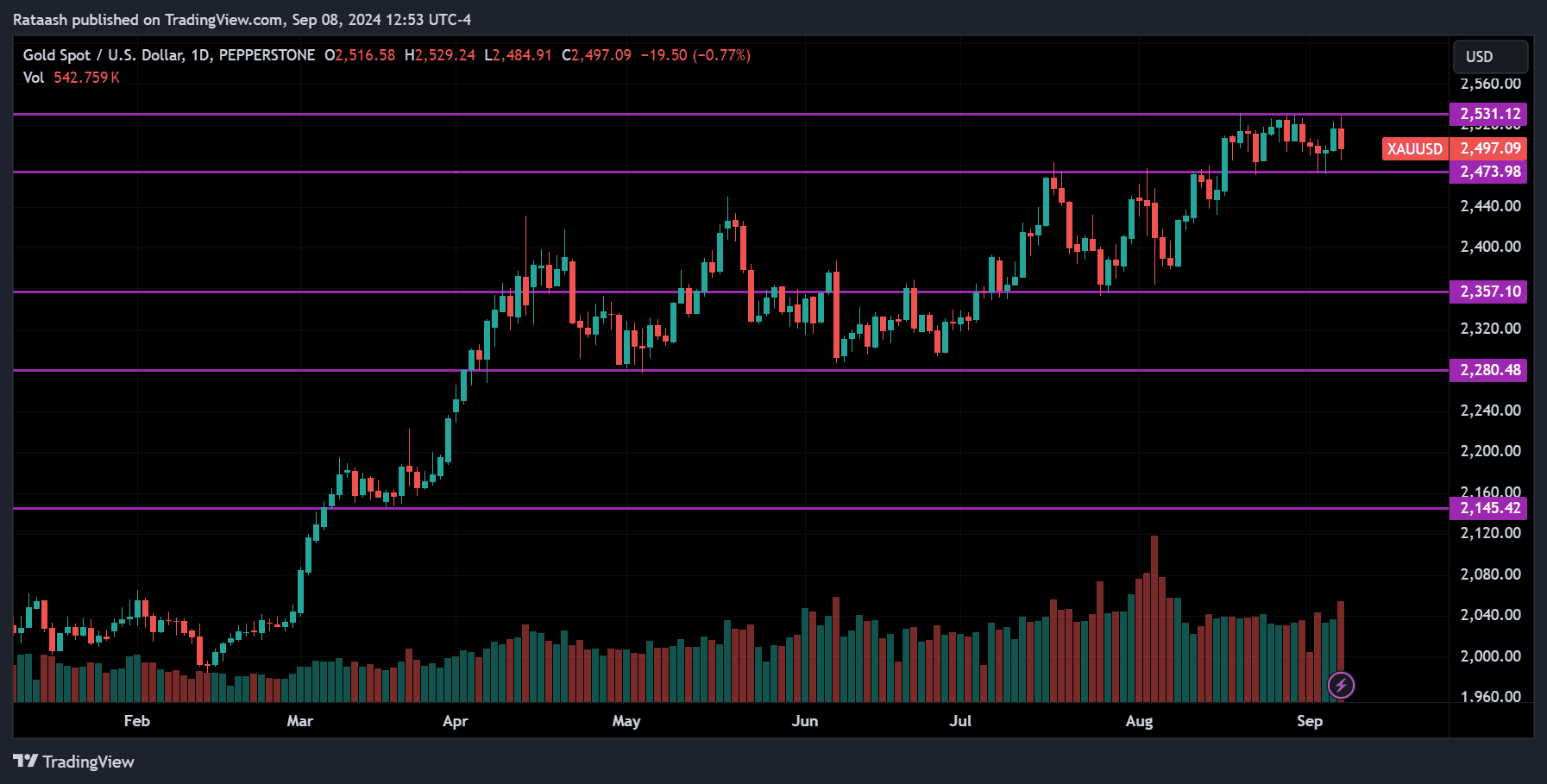

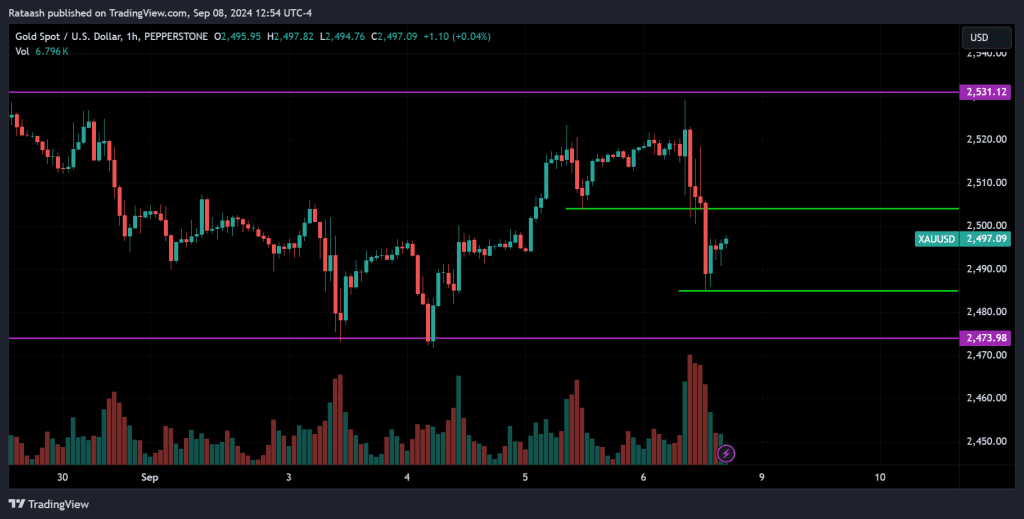

XAUUSD

XAUUSD is trading near its all-time high levels, with the price currently consolidating between the major support at 2470 and the major resistance at 2530. It is now at support around 2485 and pulling back up. The overall trend is bullish, and if the price breaks above the small resistance around 2505, we can expect it to head toward 2530. If that level is broken, it will confirm the uptrend. However, if the price starts to drop and breaks below the support at 2470, we can expect the price to begin a downtrend.

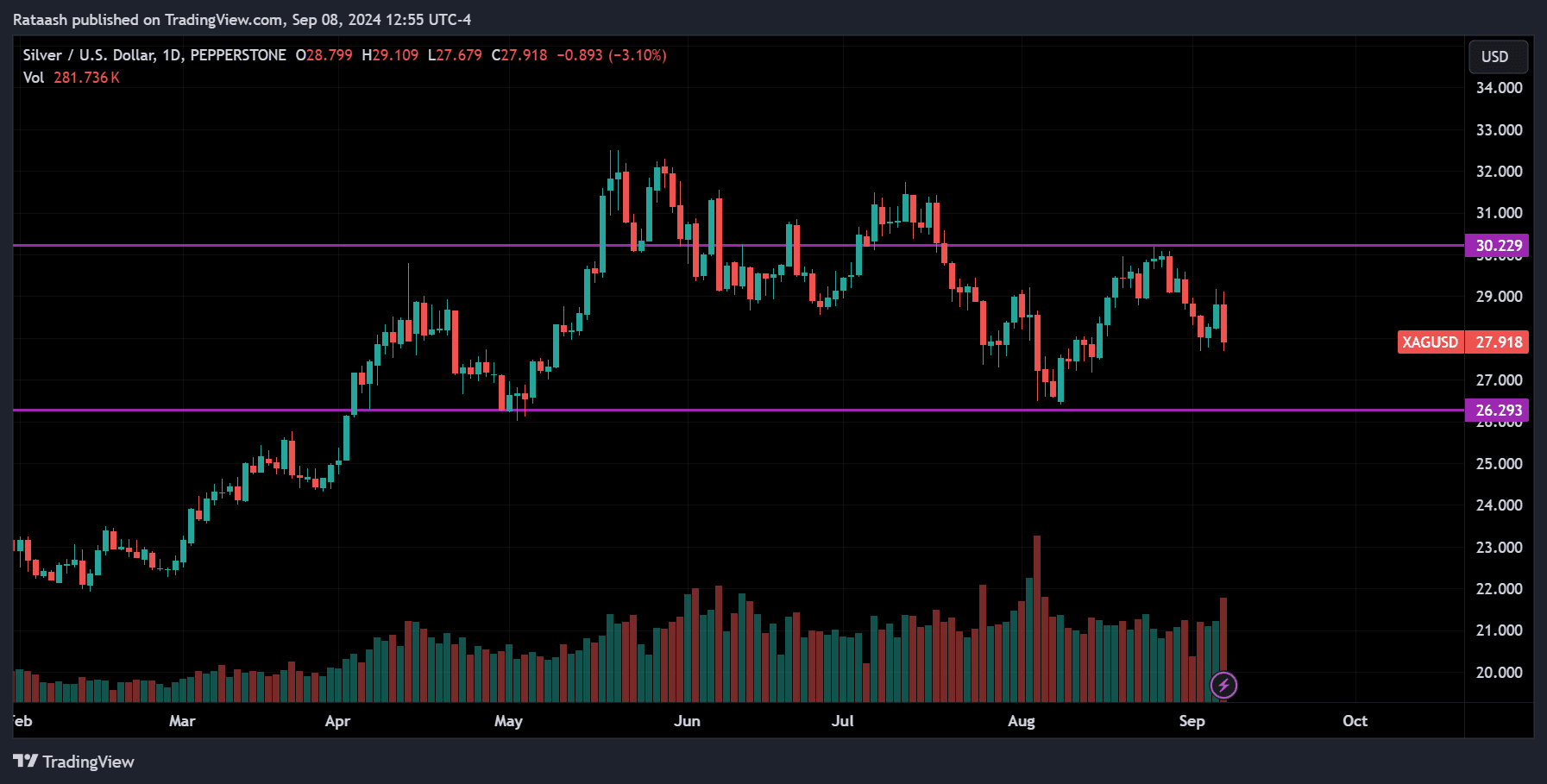

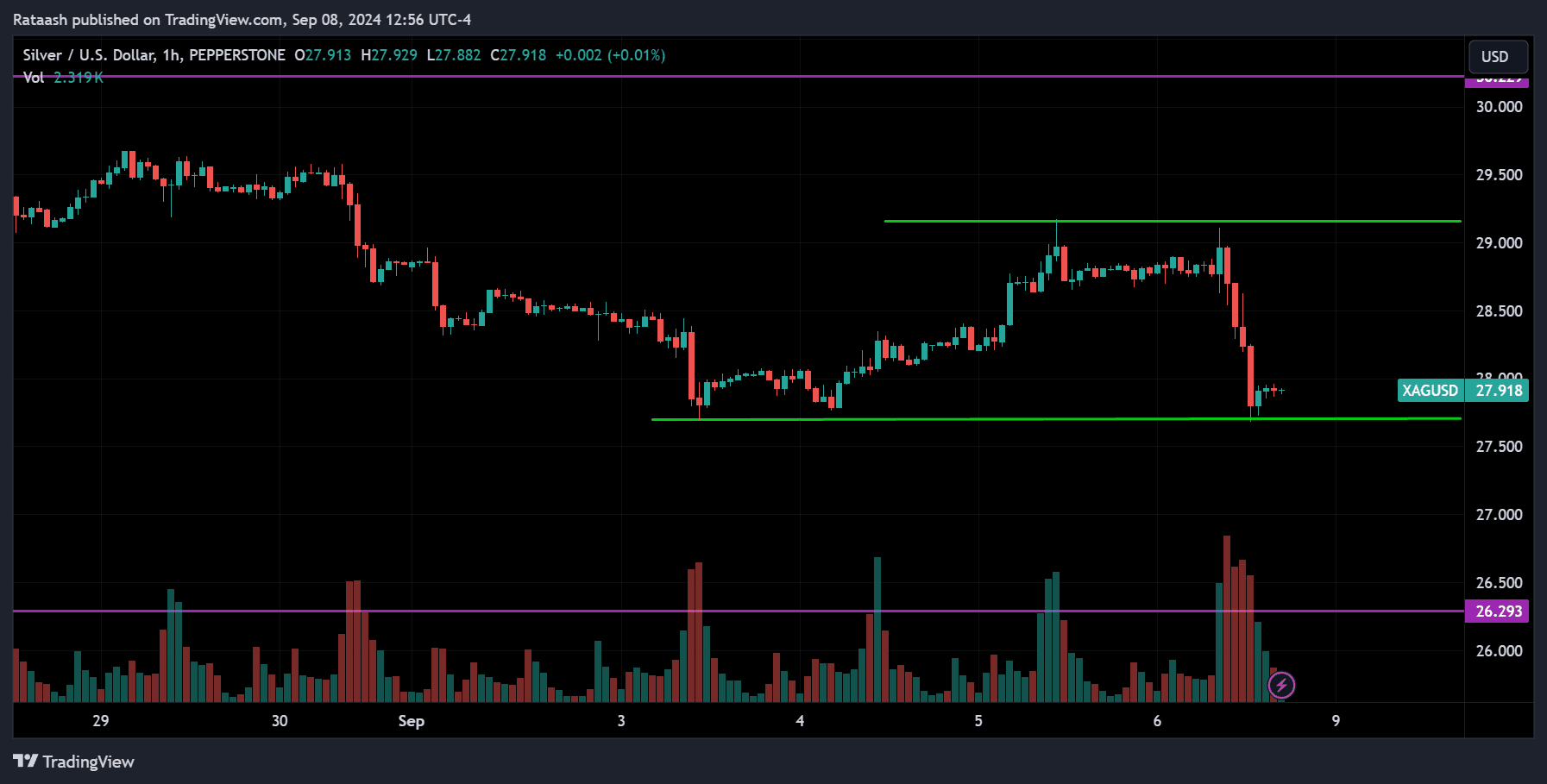

XAGUSD

XAGUSD is mostly consolidating, with the strongest support around the 26.30 level and the strongest resistance around 30.30. The price is currently trading near a small support level. If the price breaks below this support, we can expect it to drop to the major support at 26.30, where it may pull back or break below and start trending down. On the other hand, if the price starts moving up from its current level and breaks above the resistance at 29.250, we can expect it to head toward the major resistance at 30.30, where it may either pull back or break above and continue rising.

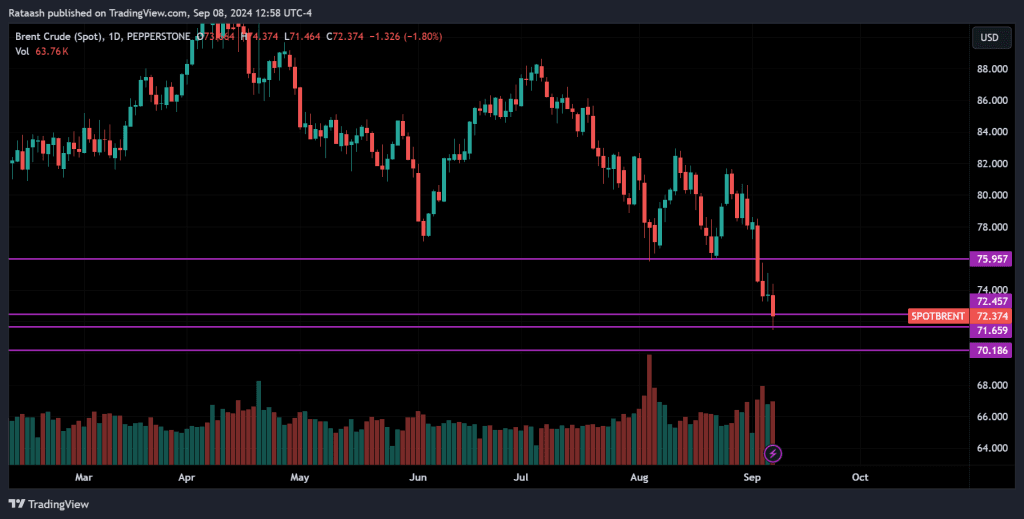

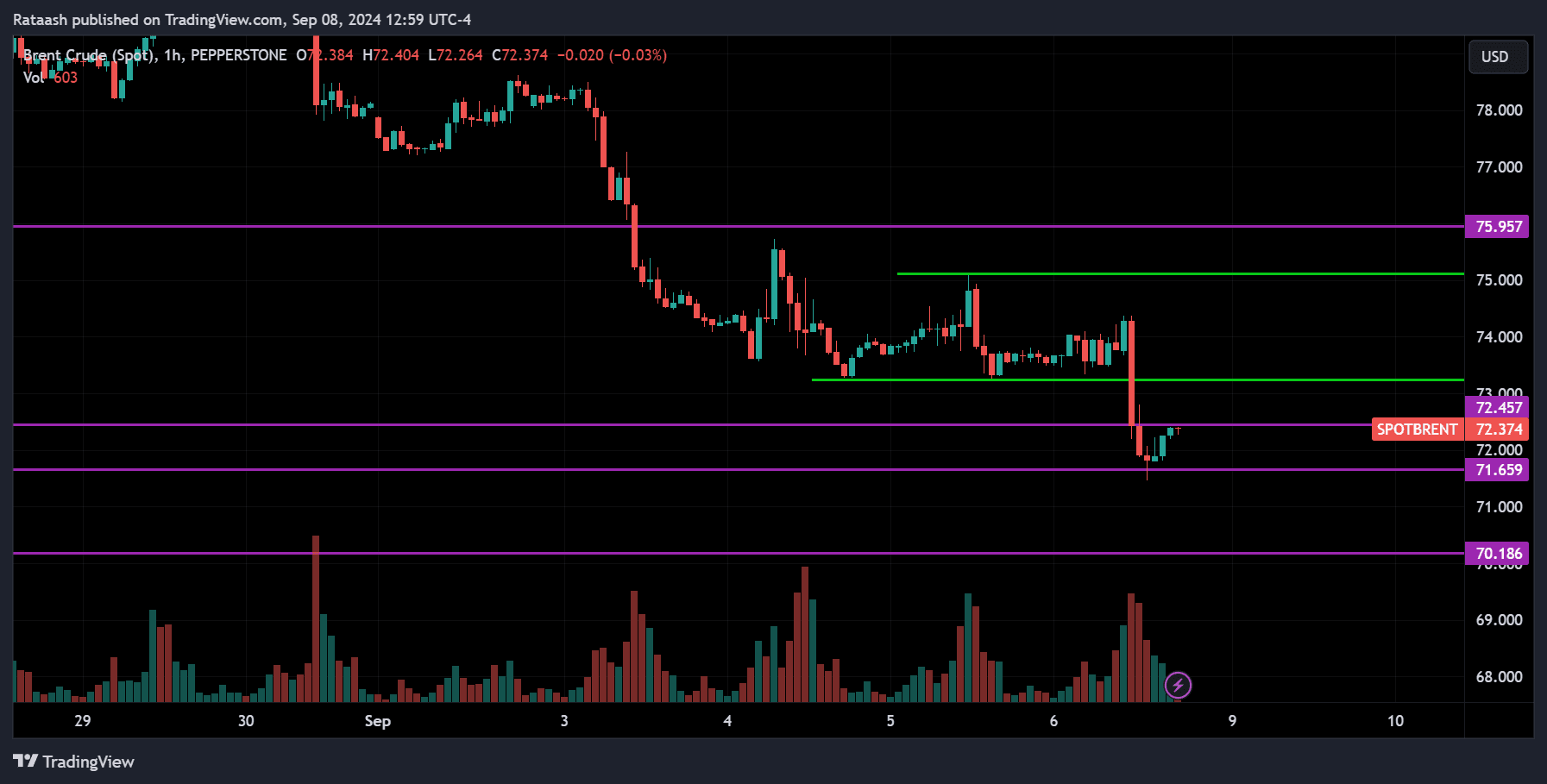

CRUDE OIL

Crude oil is trending down overall, but the price is currently pulling back up from the support level at 71.650. There is resistance around 72.500, and if the price breaks above it, we can expect it to rise to the 73 range. If that level is also broken, the price could continue toward 75. However, since the overall trend is down, we can also expect the price to start dropping again and break below 71.650. If that happens, the price could drop to the 70 range, and if that level is broken, the price may continue to decline further.

This Week’s Cryptocurrency Market Forecast

BTC

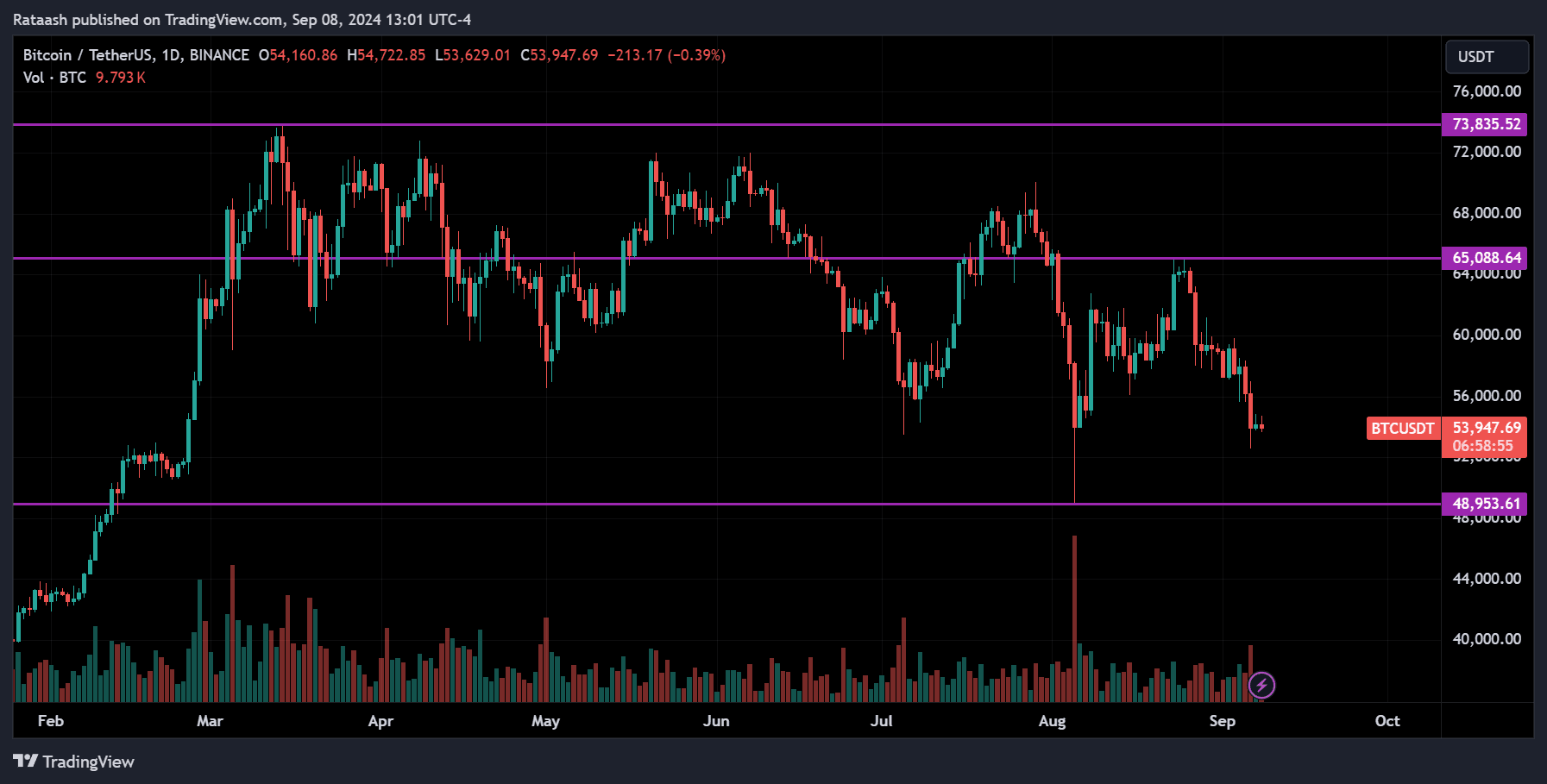

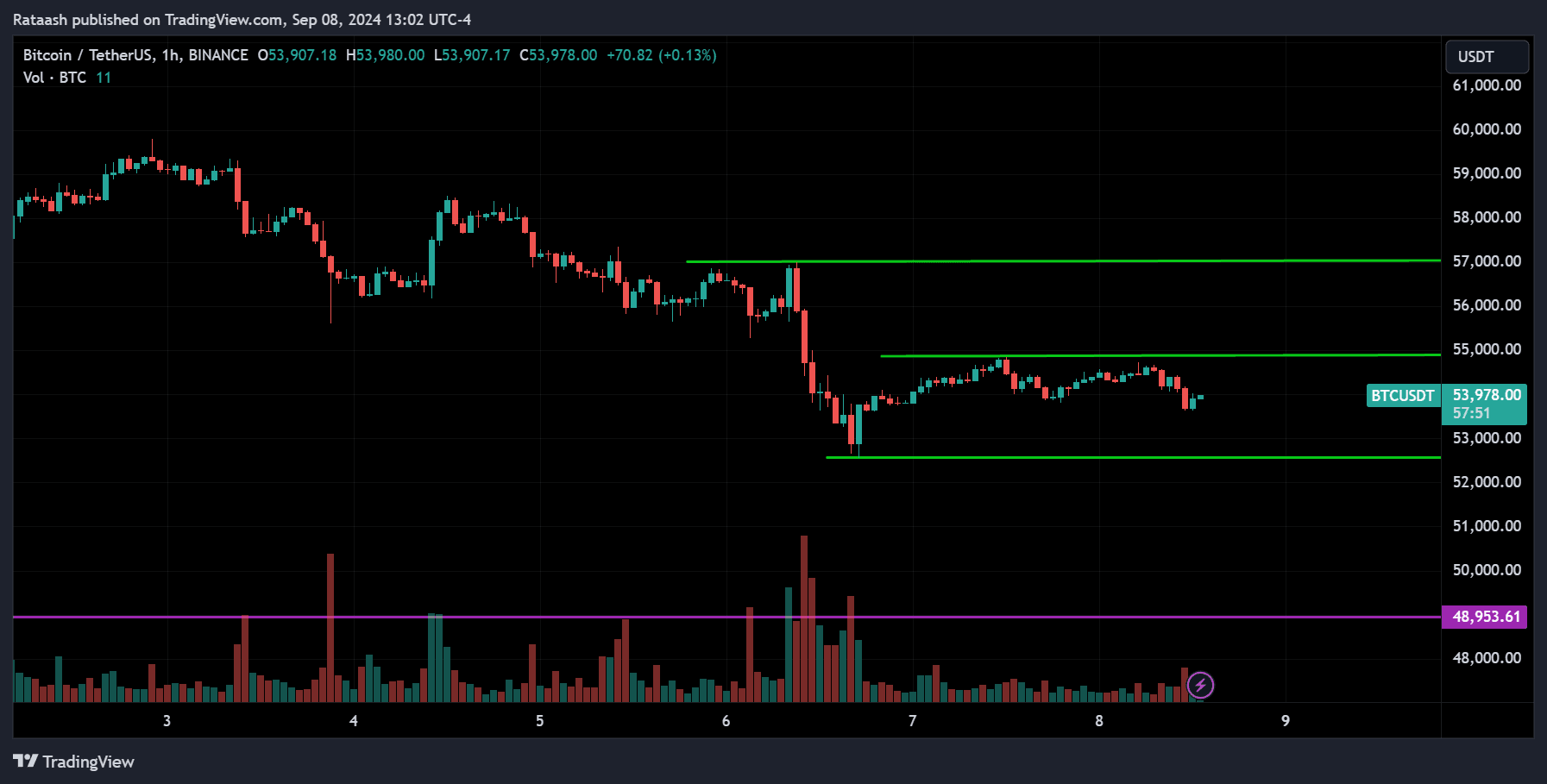

Looking at Bitcoin in the long term, you can see that the price has been consolidating for quite some time. Not only is it consolidating, but the value seems to be gradually decreasing as the lows keep getting lower, which is a sign of a potential downtrend. However, it could also mean that Bitcoin is pulling back before a major move upwards, as often happens before a big breakout. Currently, the price is consolidating, and there is support around the 53,500 range. If the price breaks below this level, we can expect it to drop toward the 49,000 range. On the other hand, if the price breaks above the resistance around 55,000, it could head toward 57,000. The key takeaway is that when these levels are broken, the price is likely to continue in the direction of the breakout. So, it’s essential to draw key levels on the chart, wait for a breakout, confirm the trend, and make your trade decisions accordingly.

ETH

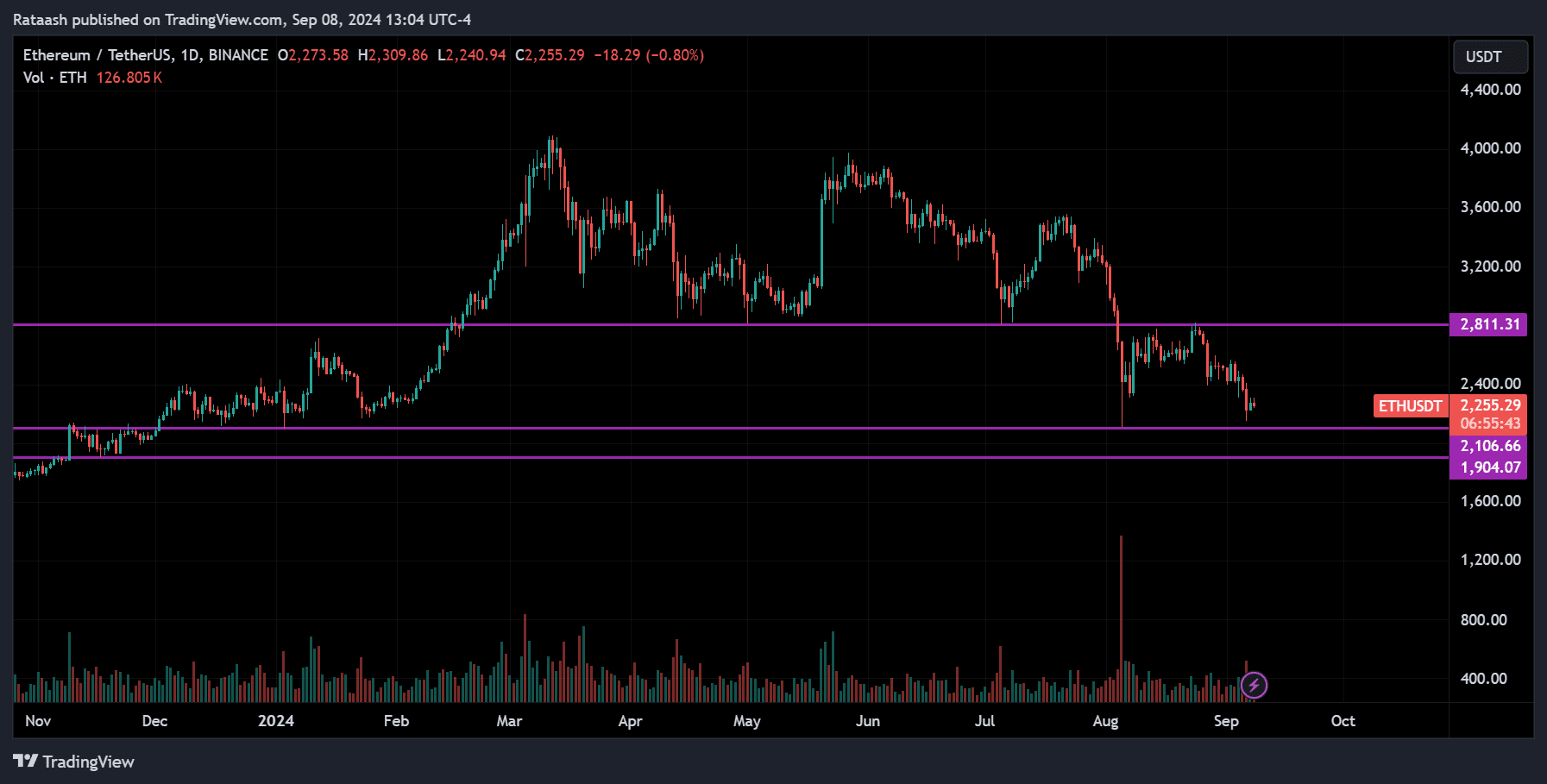

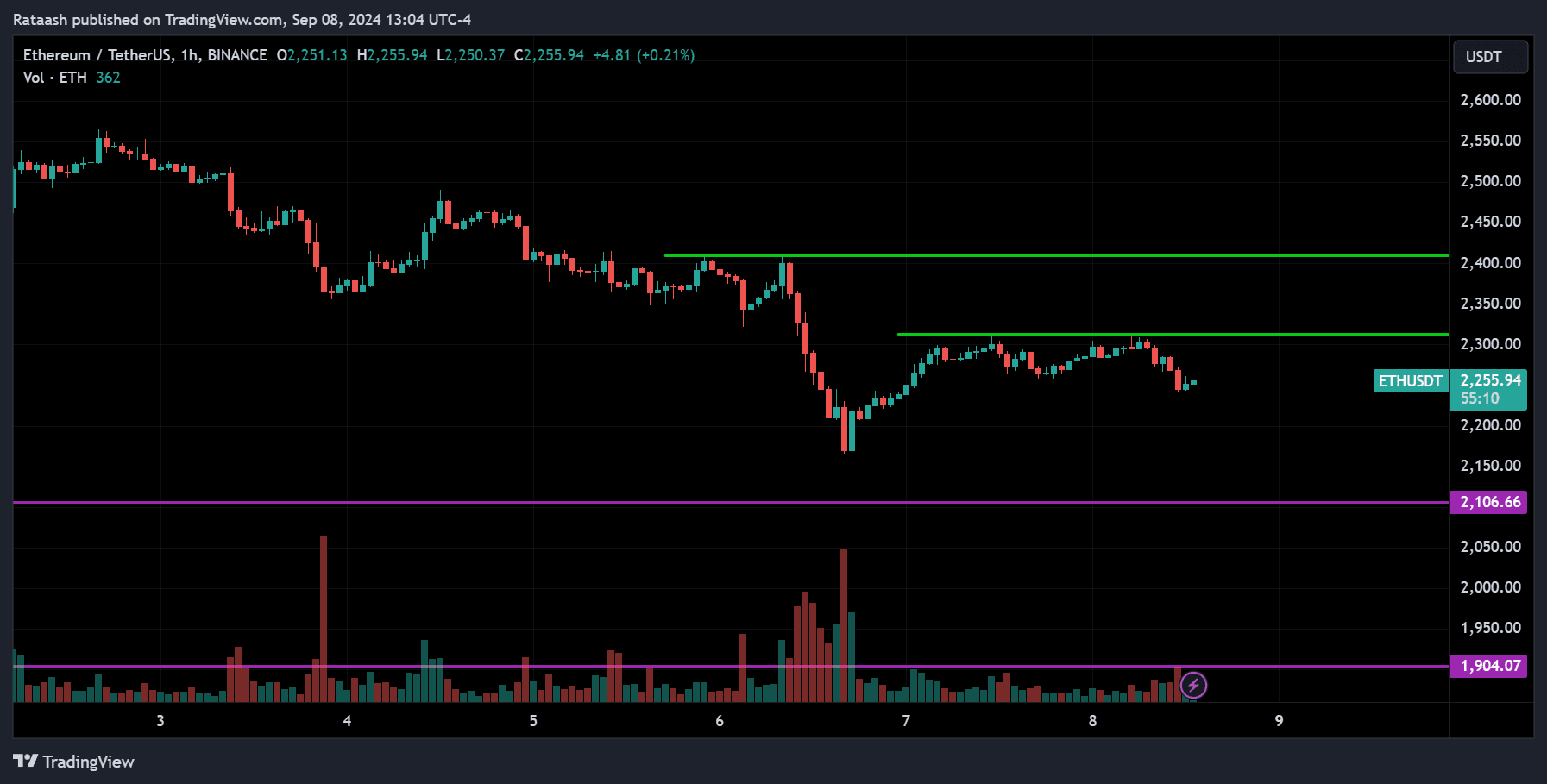

ETH is also trending down, with the price near the major support around 2100. Right now, the price is consolidating around the resistance at 2300. If the price breaks above this level, we can expect it to continue toward 2400, and if that level is also broken, it may start an uptrend. On the other hand, if the price starts to drop and breaks below the support at 2100, we can expect it to fall toward 1900.

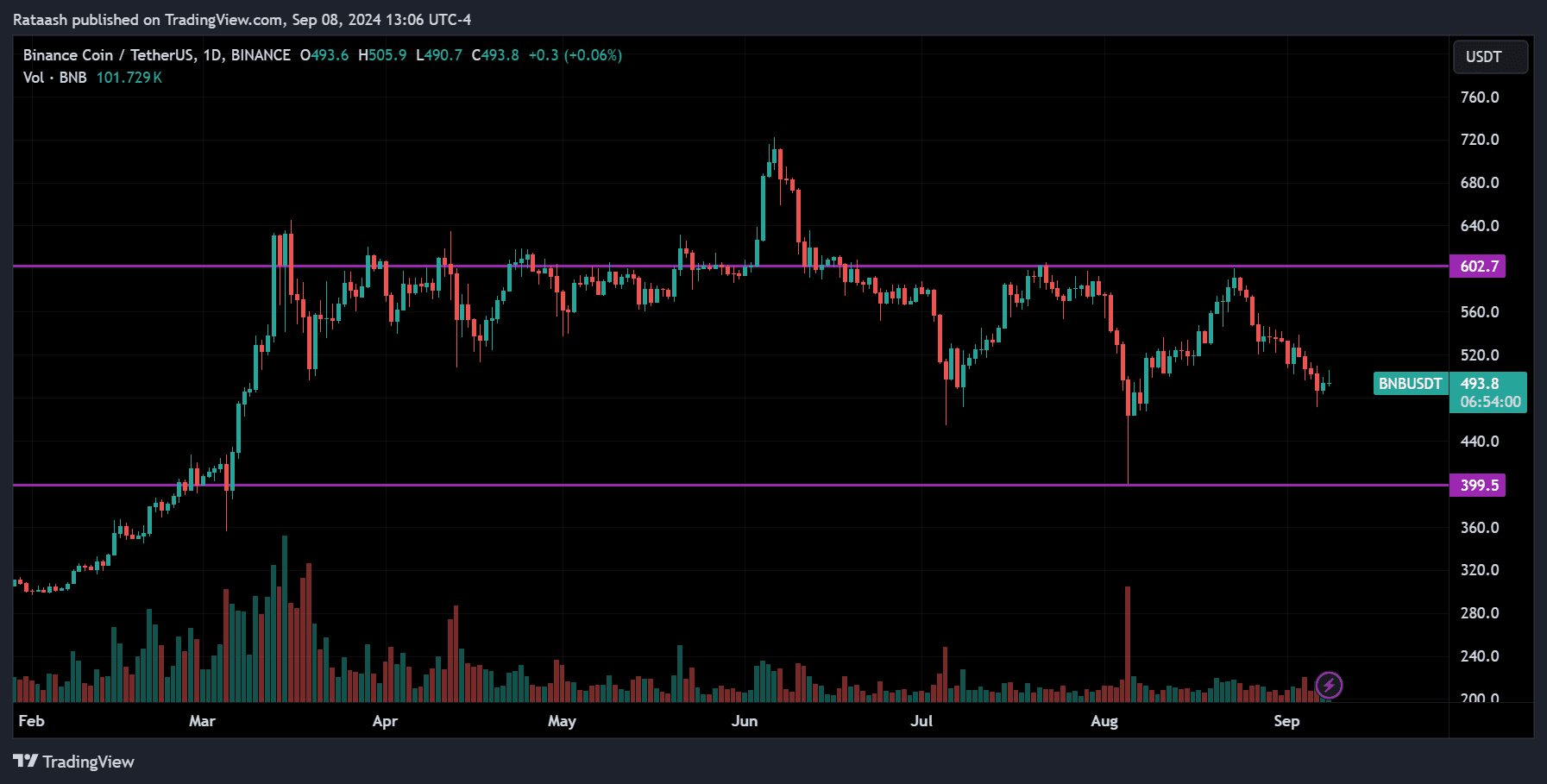

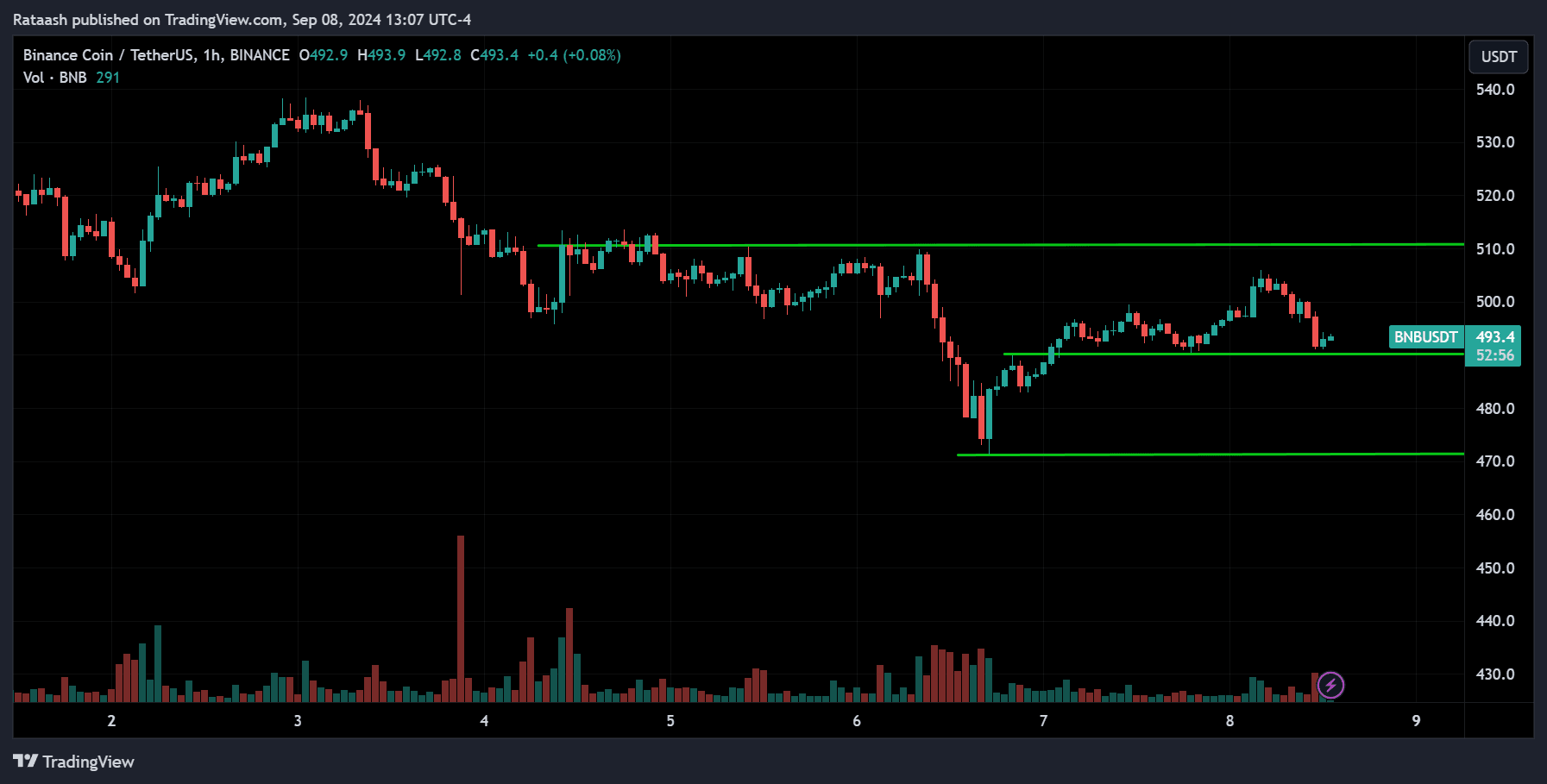

BNB

BNB is overall consolidating. The price recently bounced down from the resistance level at 600 and is now pulling back from the support at 470, nearing the resistance at 510. If the price breaks above the resistance at 510, we can expect it to rise back toward the 600 level. On the other hand, if the price breaks below the support at 490, we can expect it to drop to the 470 level, and if that level is also broken, the price may continue to decline further.

Conclusion & Disclaimer

“If you’re interested in more market analysis articles on Forex, US Stocks, Cryptocurrencies, or financial markets in general, check out xlearnonline.com. If you enjoy my articles here, you’ll love xlearn. Peace!” – rataash

This analysis article isn’t about telling you when to buy or sell. It’s about teaching you how to approach the market effectively. Every day, I follow the same routine before I start trading. Here, I briefly explained the technical aspects of what’s happening and what actions I take in these situations. Your goal is to understand what I do so you can follow the same process on your own.

Please provide your feedback in the comment section below on how we can further improve our market analysis. Thank you.

Acknowledging the inherent unpredictability of financial markets is crucial. While we strive to offer informed perspectives on upcoming events and trends affecting various instruments, readers should conduct their own analysis and exercise prudent judgment.

Encouragement of Independent Analysis

We strongly encourage readers to supplement the information presented here with their own research and analysis. Market dynamics can swiftly change due to a multitude of factors, and individual circumstances may vary. By conducting independent analysis, readers can tailor their strategies to align with their unique goals and risk tolerance.

No Certainty in Market Predictions

It’s vital to recognize that nobody possesses the ability to predict market movements with absolute certainty consistently. Market analysis serves as a tool to assess probabilities and identify potential opportunities, but it’s essential to remain cognizant of the inherent uncertainty in financial markets.

Aligning with High Probability

Rather than aiming for infallible predictions, our goal is to align with high-probability scenarios based on available information and analysis. This approach acknowledges the dynamic nature of markets while seeking to capitalize on opportunities with favorable risk-reward profiles.

Proceed with Caution

Lastly, while market analysis can offer valuable insights, it’s imperative to approach trading and investment decisions with caution. Markets can be volatile, and unforeseen events may impact asset prices unexpectedly. Exercise prudent risk management and consider seeking advice from qualified financial professionals before making any significant financial decisions.

Remember, the journey of financial analysis and investment is a continuous learning process, and embracing a disciplined approach can contribute to long-term success in navigating the complexities of global markets.

THANK YOU & HAPPY TRADING!!!

![Weekly Forex Forecast [2024.09.09] - USD Weakening Amid Interest Rate Cuts, Key Levels and Trends for Major Forex Pairs & Commodities ForexCracked.com](https://www.forexcracked.com/wp-content/uploads/2024/09/Weekly-Forex-Forecast-2024.09.09-USD-Weakening-Amid-Interest-Rate-Cuts-Key-Levels-and-Trends-for-Major-Forex-Pairs-Commodities-ForexCracked.com_-1.jpg)