Welcome to the weekly market analysis series from forexcracked.com!

Before we continue with the analysis, if you don’t know much about trading, charts, candlesticks, risk management, or strategies, or if you want to improve your knowledge, consider reading our free forex course.

Upcoming Events for This Week

These events include macroeconomic reports, economic indicators, and, generally, what’s going on in the world.

Only the most important events are considered here. You can check the forexfactory.com for all the economic events and yahoo finance for news.

2024.08.05

Some Canadian banks are closed for the Civic Holiday. Banks handle most of the foreign exchange trading. When they are closed, the market has less liquidity, and speculators play a bigger role. This can cause unusual low and high volatility in CAD currency pairs.

2024.08.06

00:30 ET: The Reserve Bank of Australia releases its monetary policy statement. This is one of the main ways the RBA communicates with investors about monetary policy. It includes their decision on interest rates and comments on the economic conditions that influenced their choice. Most importantly, it talks about the economic outlook and hints at future decisions. This will cause high volatility in AUD currency pairs.

18:45 ET: New Zealand releases its Unemployment Rate, showing the percentage of the workforce that is unemployed and actively seeking jobs in the last quarter. Even though it is a lagging indicator, the number of unemployed people is a key sign of economic health because consumer spending is closely linked to job market conditions. This will cause high volatility in NZD currency pairs.

2024.08.07

22:40 ET: RBA Governor Bullock speaks at the Annual Rotary Lecture in New South Wales, with audience questions expected. As the head of the central bank that controls short-term interest rates, she has the most influence on the nation’s currency value. Traders closely watch her public appearances for subtle hints about future monetary policy. This can impact AUD currency pairs.

23:00 ET: The Reserve Bank of New Zealand releases Inflation Expectations q/q. This shows the percentage that business managers expect prices of goods and services to change each year over the next 2 years. Future inflation expectations can lead to actual inflation, as workers often demand higher wages if they believe prices will rise. This can impact NZD currency pairs.

2024.08.08

There are no events that could significantly impact the markets.

2024.08.09

8:30 ET: Canada releases its unemployment rate, showing the percentage of the workforce that is unemployed and actively looking for jobs in the past month. Though it’s usually seen as a lagging indicator, the number of unemployed people is a key sign of economic health because consumer spending is closely linked to job market conditions.

Forex Market Analysis

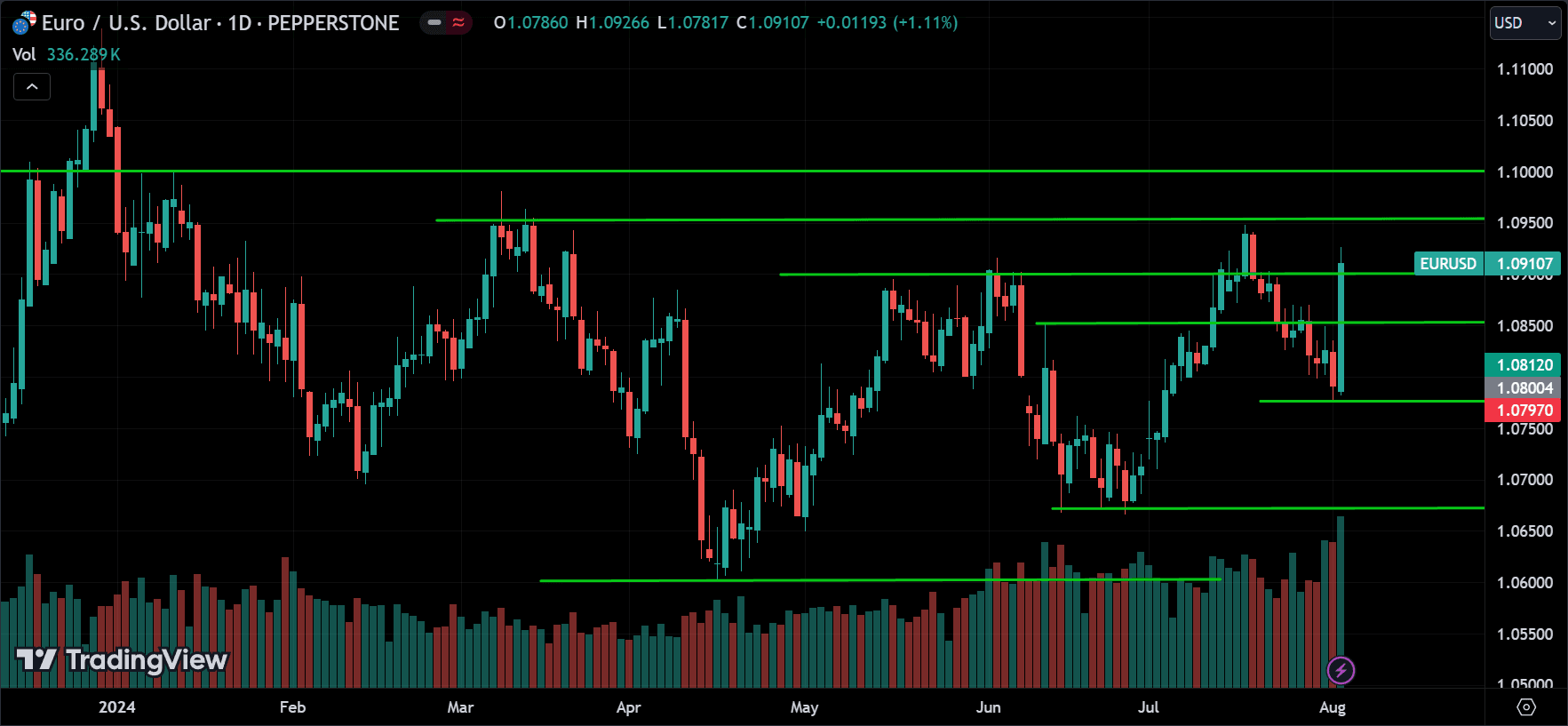

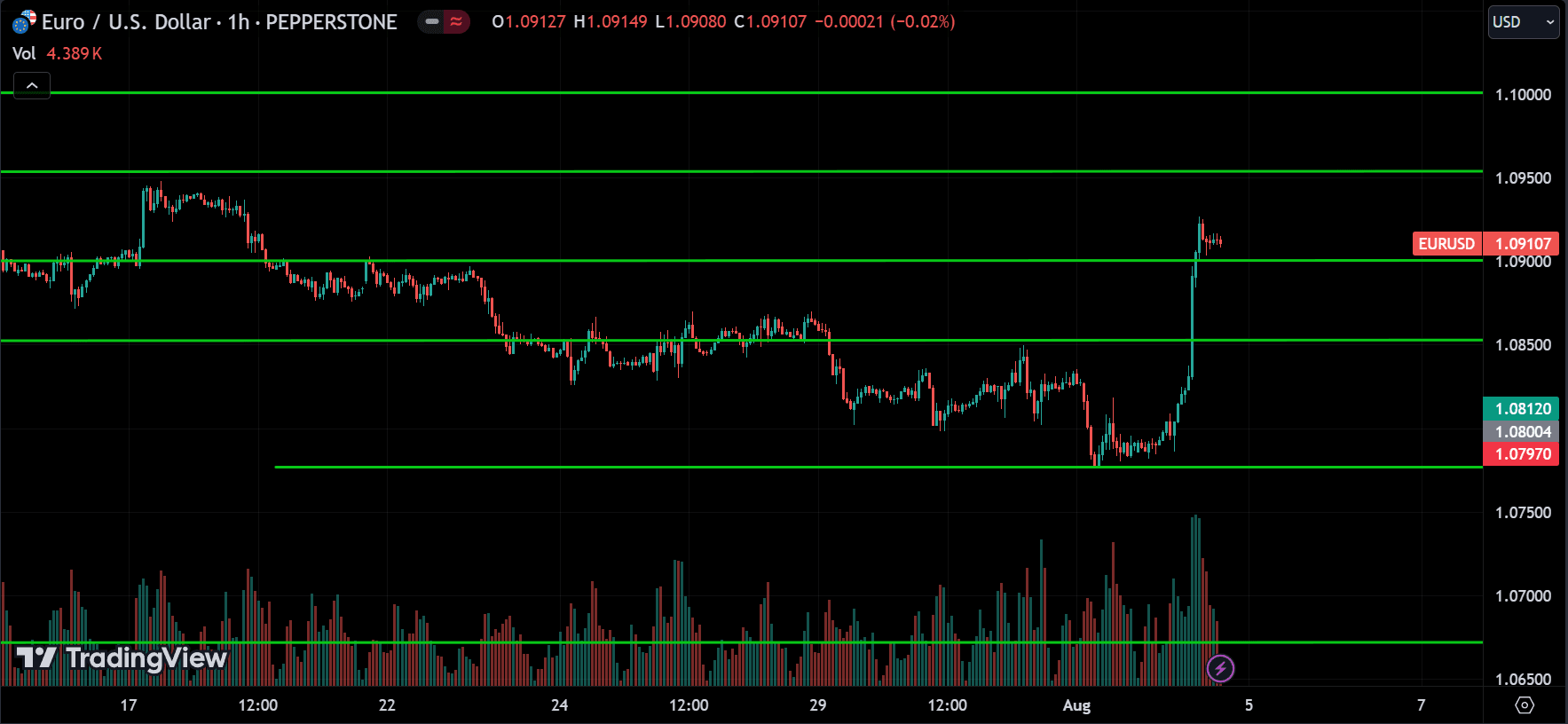

EURUSD:

EURUSD has shifted to an uptrend from the 1.08000 level and is now trading above the 1.09000 resistance, heading towards the next resistance around 1.09500. We might see a pullback at this resistance level, or the price could break above it and continue to rise. Watch for breakouts.

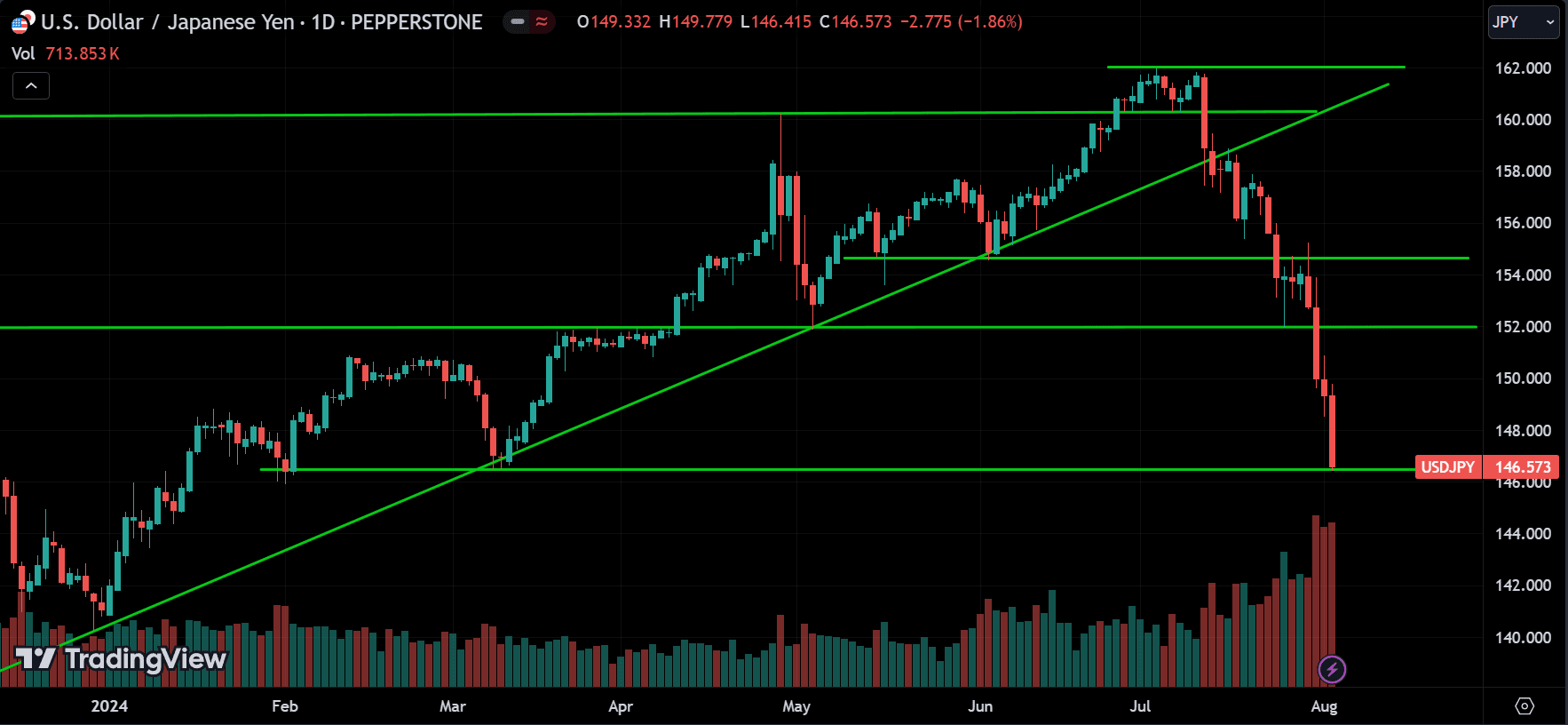

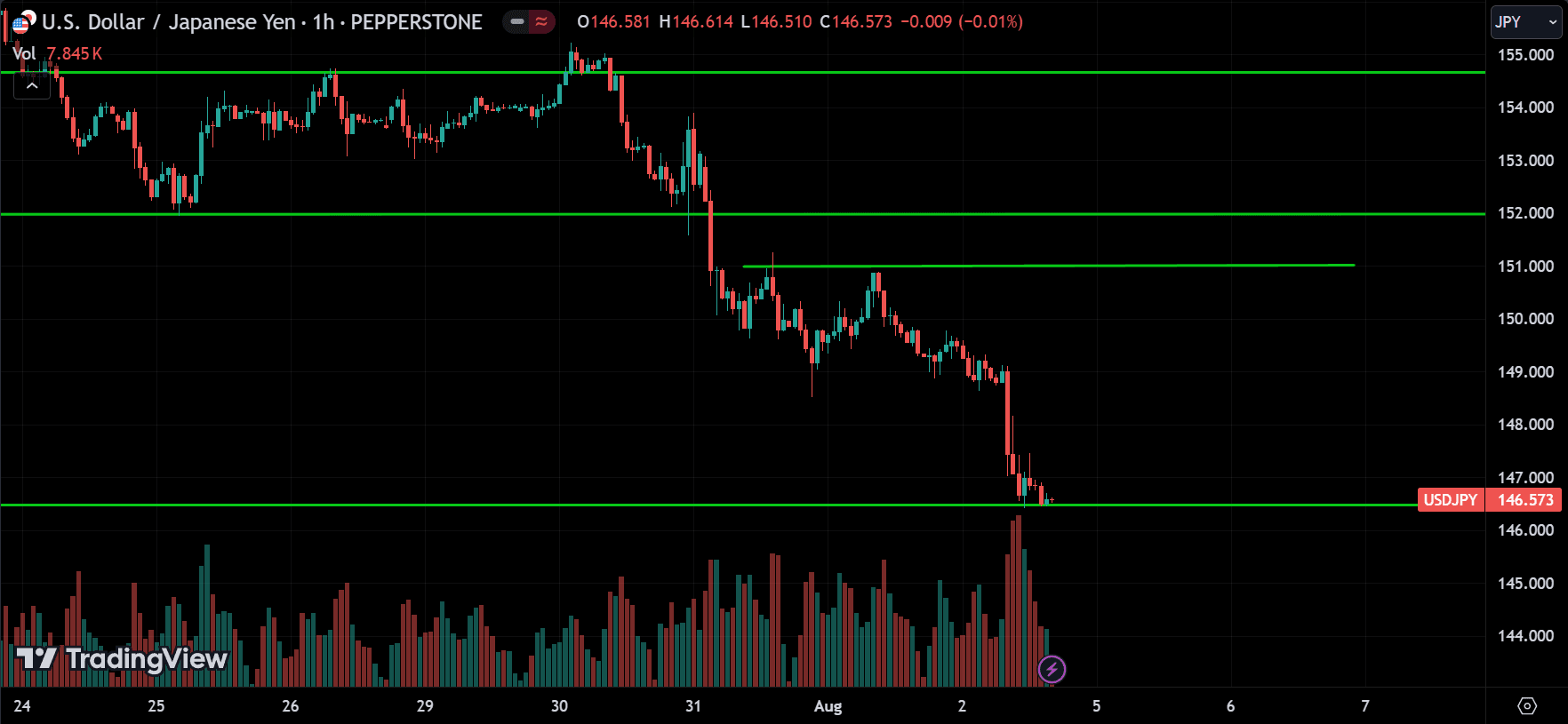

USDJPY:

USDJPY is trending down and is currently at the major support level of 146.000. If the price breaks below this support, we can expect the downtrend to continue. However, the price could also pull back and start moving towards 151.000. Watch for both a reversal and a breakout around 146.

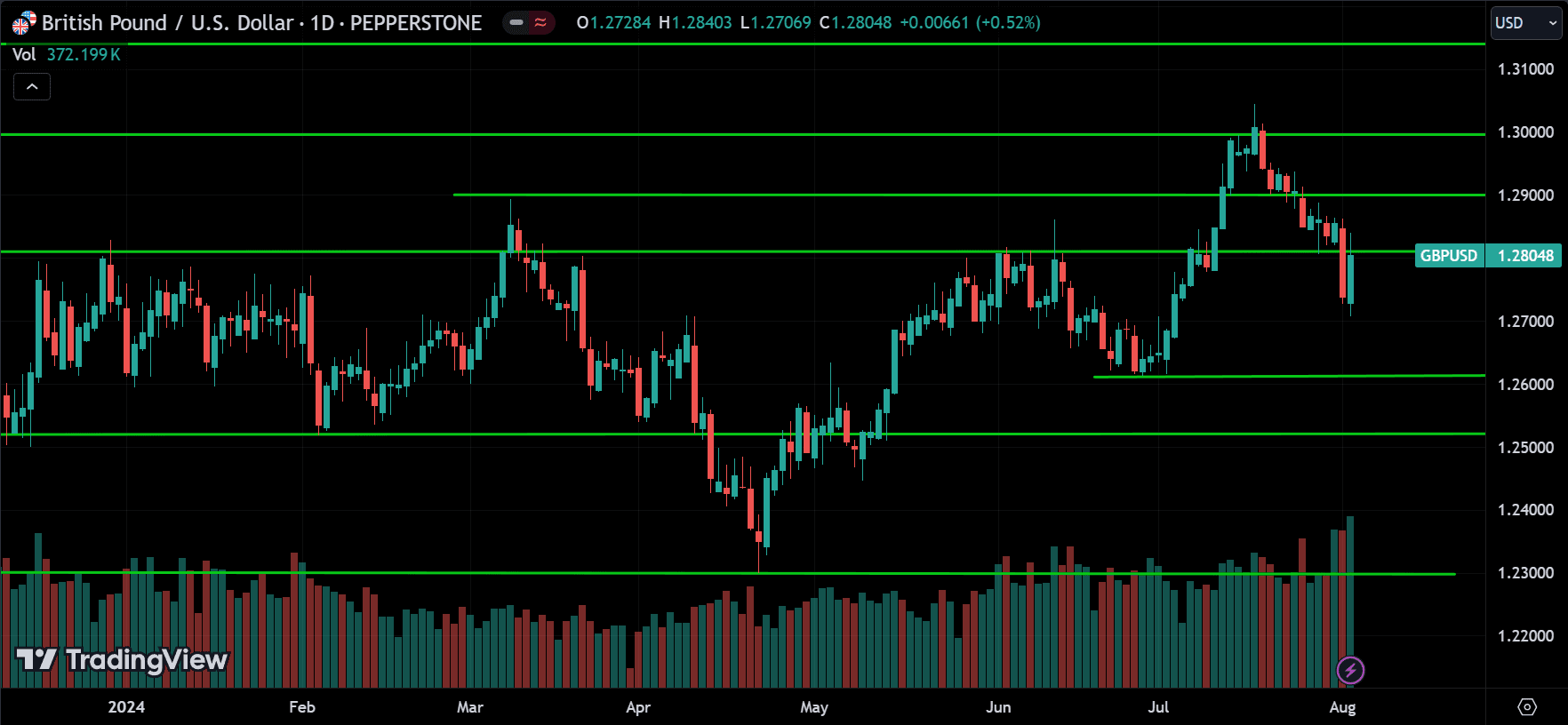

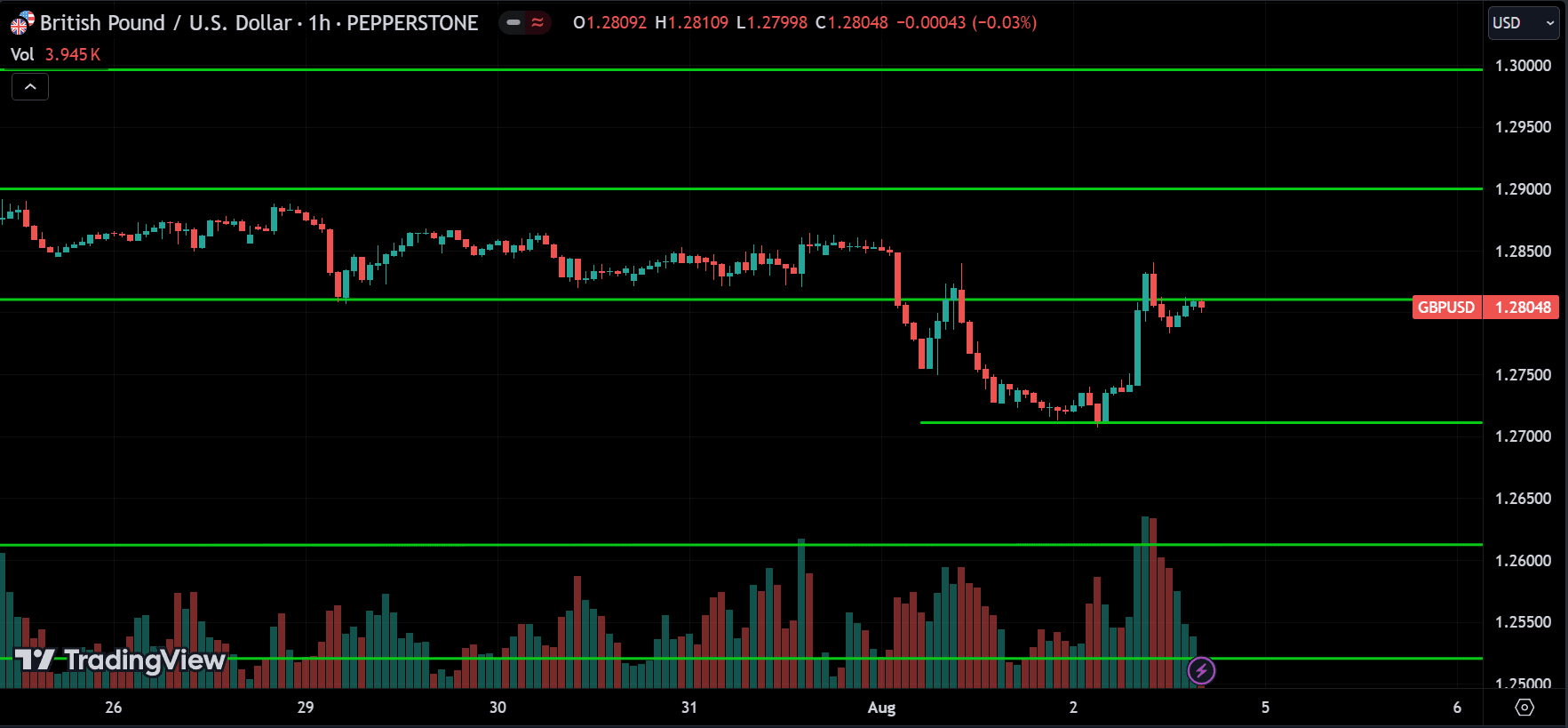

GBPUSD:

GBPUSD is trending down. It recently found support around the 1.27000 level and pulled back to 1.28500. Now, there’s resistance around 1.29000. The price might start dropping from that level, or if it breaks above, we can expect a new uptrend to begin. also watchout for price breaking below the 1.27000 support.

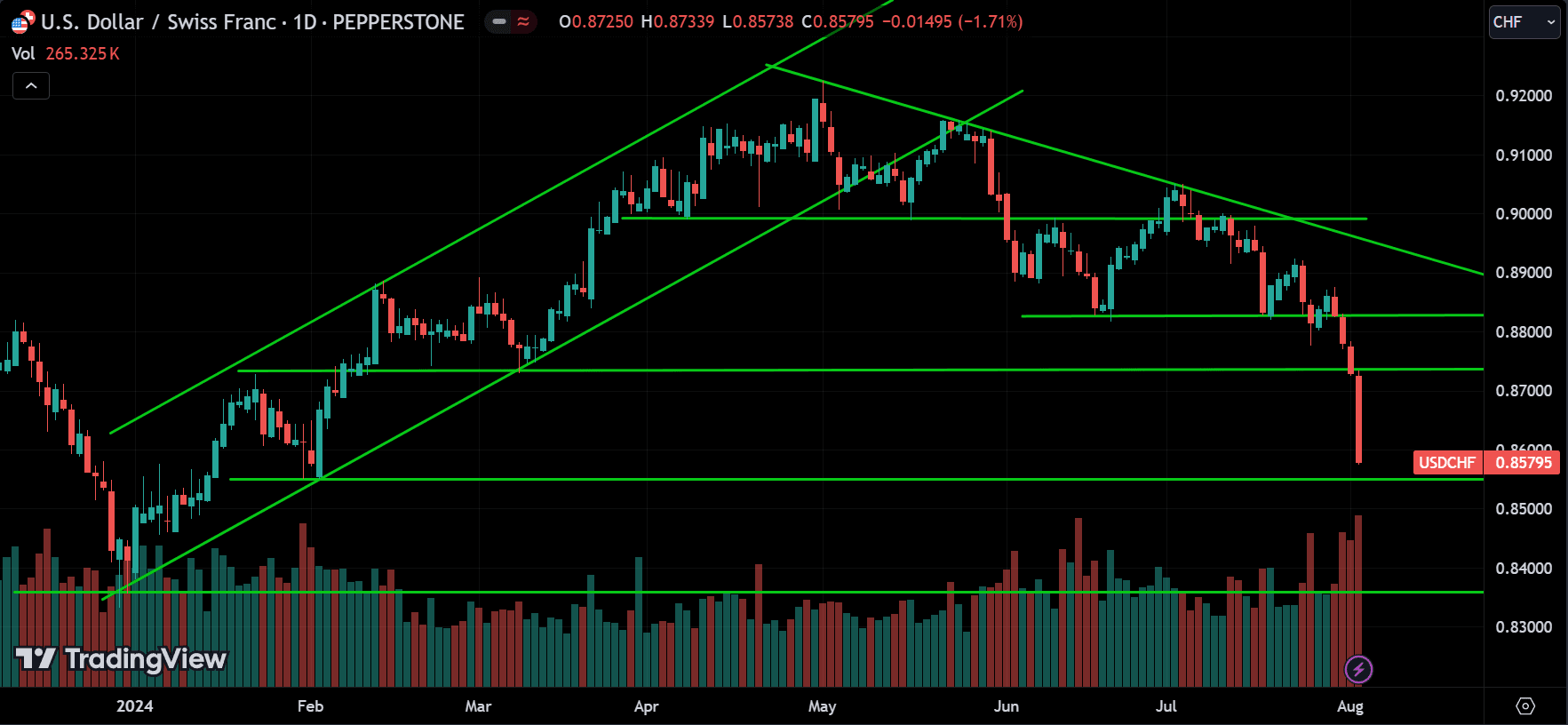

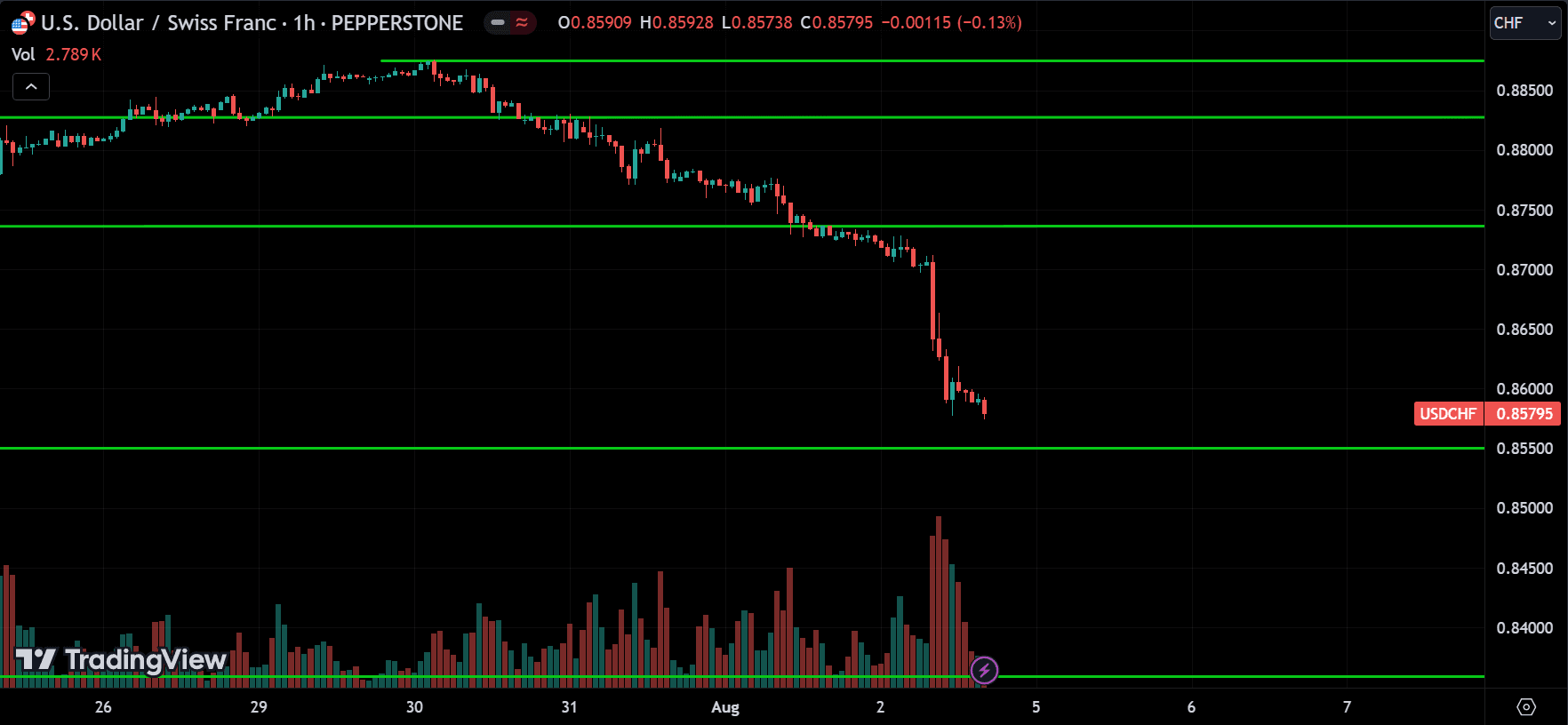

USDCHF:

USDCHF is also trending down and nearing a major support level at 0.85500. We might see a pullback at this level, or if the price breaks below it, we can expect it to continue dropping to the next support.

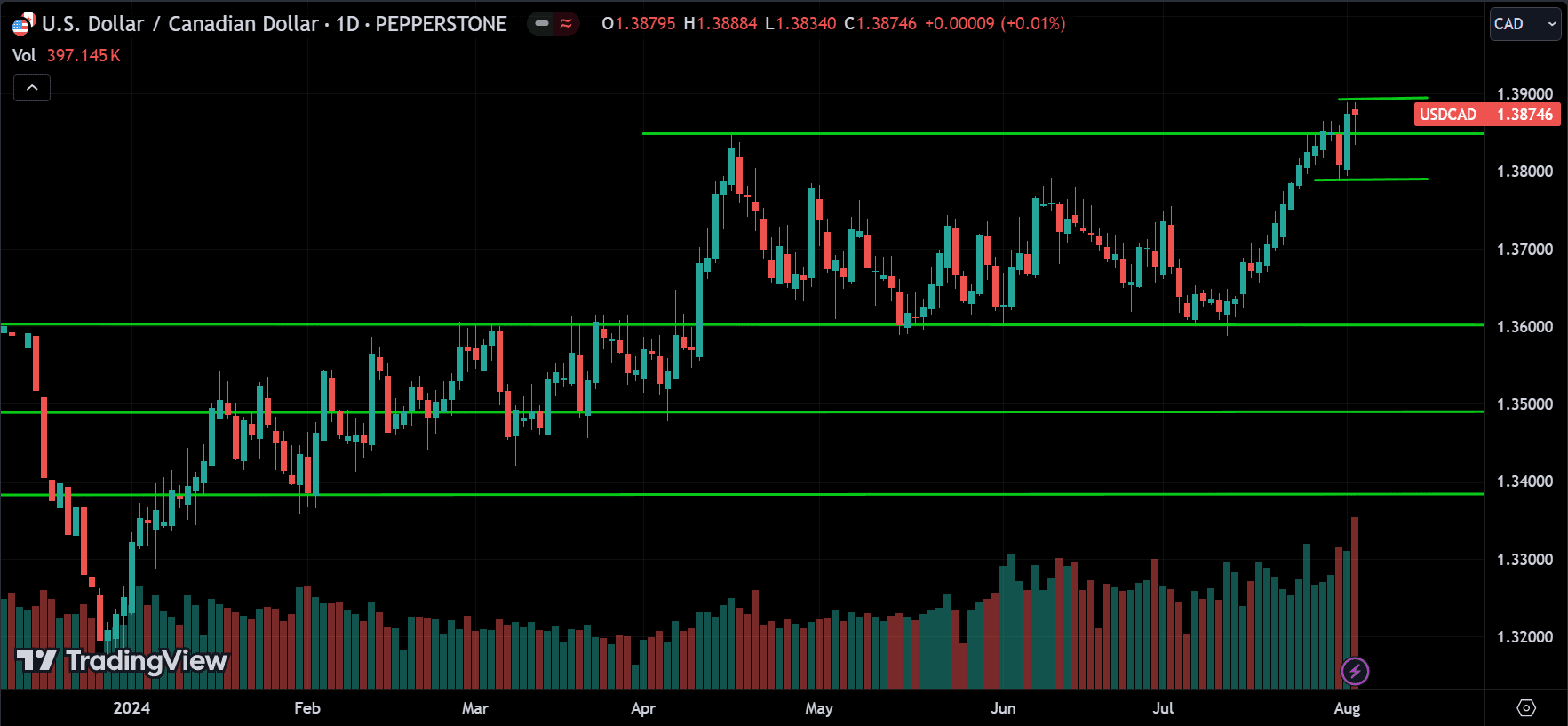

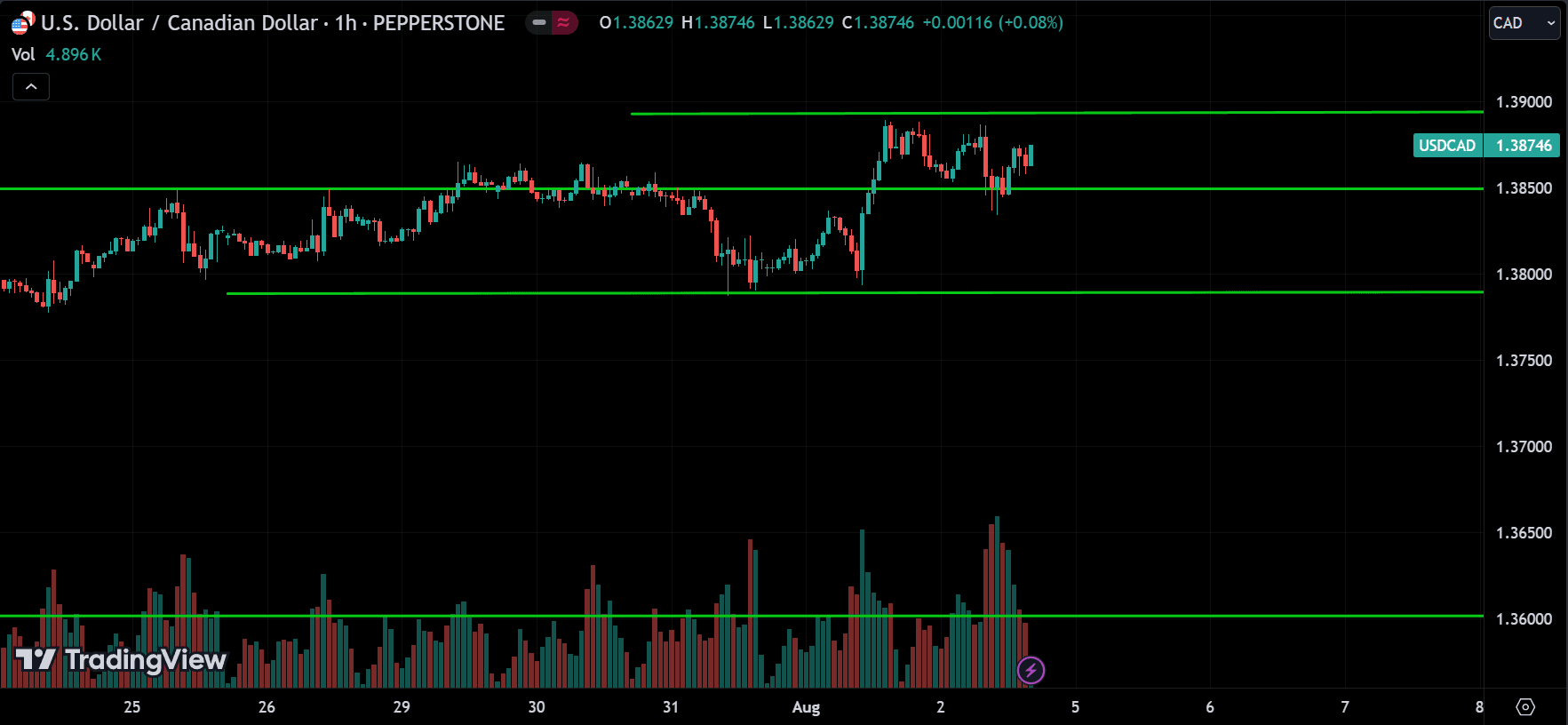

USDCAD:

USDCAD is trending up and currently consolidating around the resistance level of 1.39000. If the price breaks above this level, the uptrend should continue. However, if the price pulls back from this level, it could drop to 1.38000. If 1.38000 is also broken, we can expect a new downtrend.

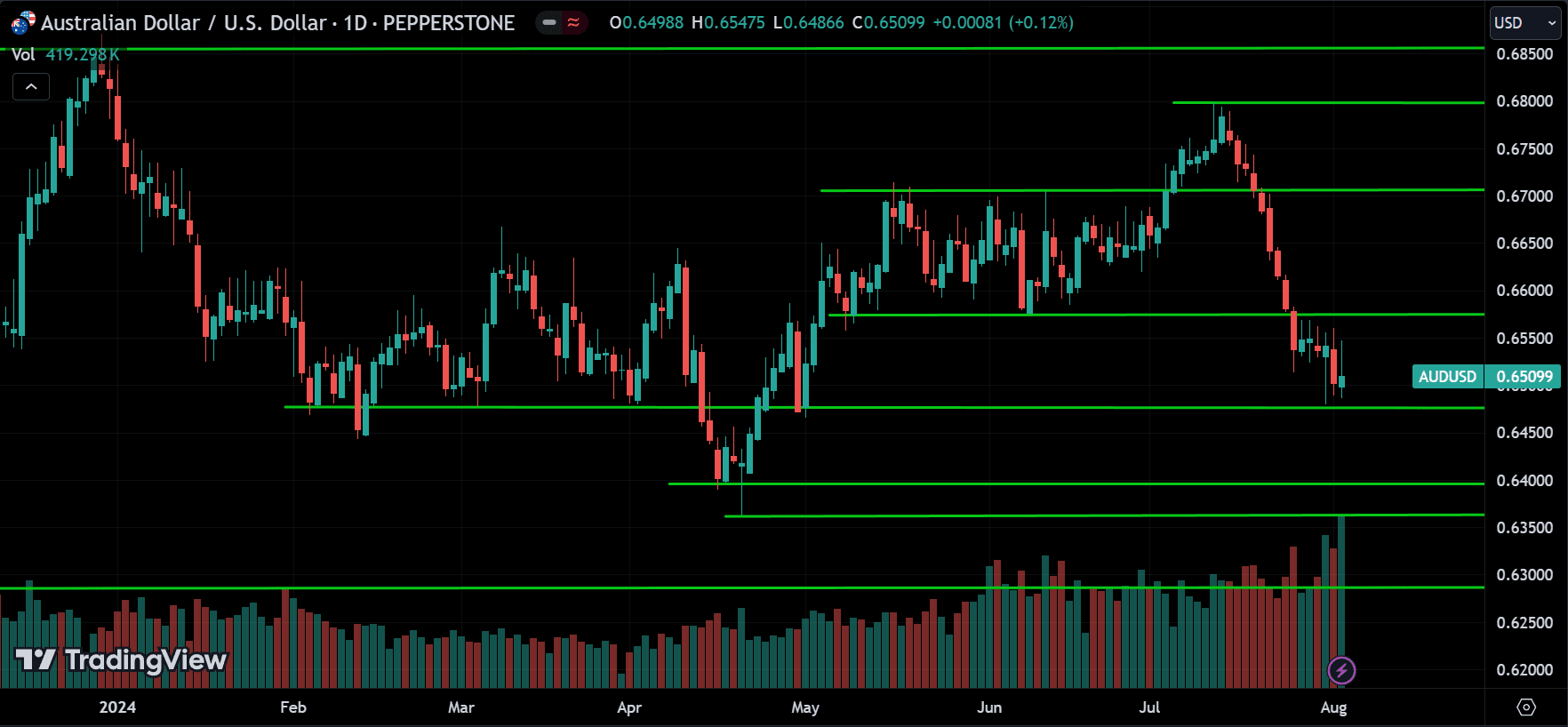

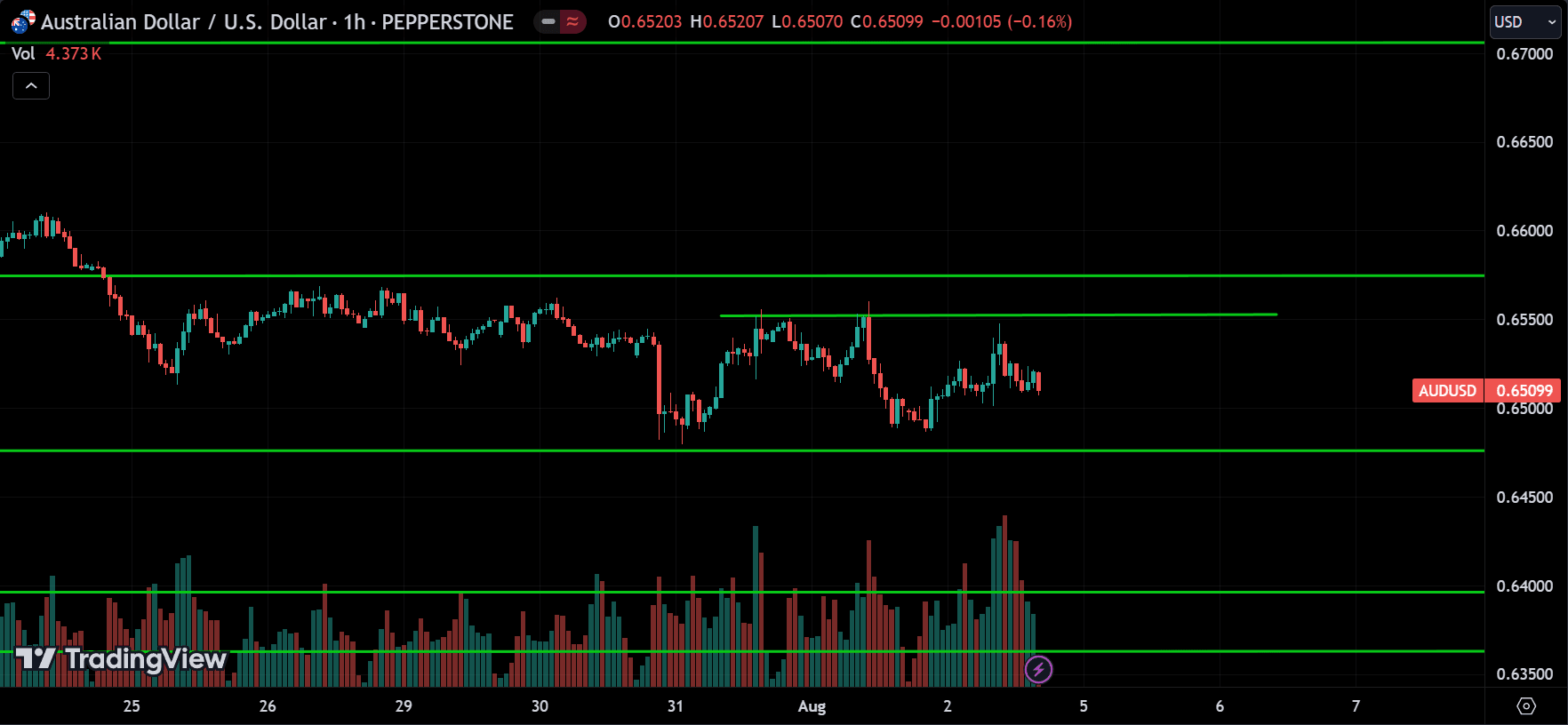

AUDUSD:

AUDUSD is trending down, but on the 1-hour chart, the price is consolidating between the support at 0.64850 and resistance at 0.65500. A breakout will decide the future direction. Since it’s a major support level, the price might break above the resistance and go up. However, it could also break below the support and drop further. Wait for the breakout to confirm the direction.

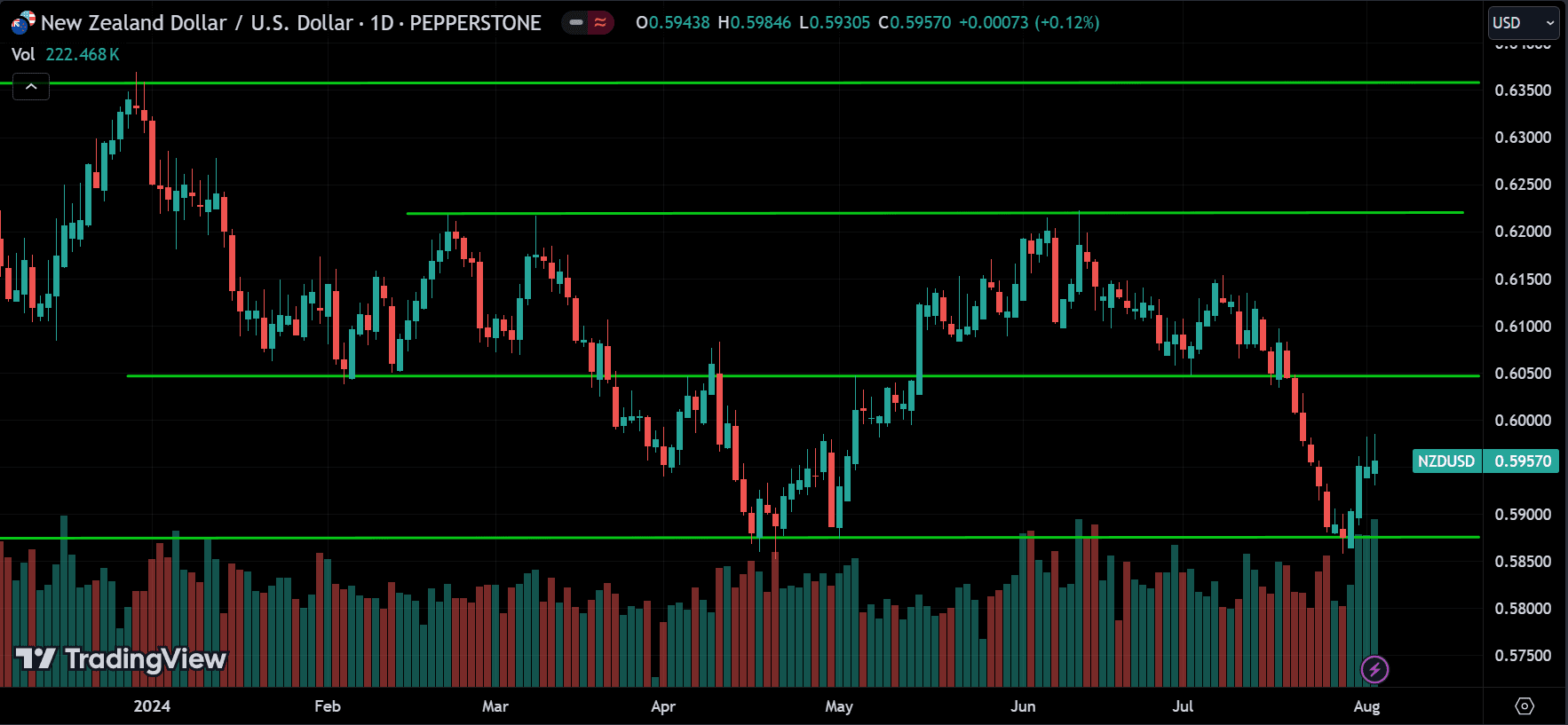

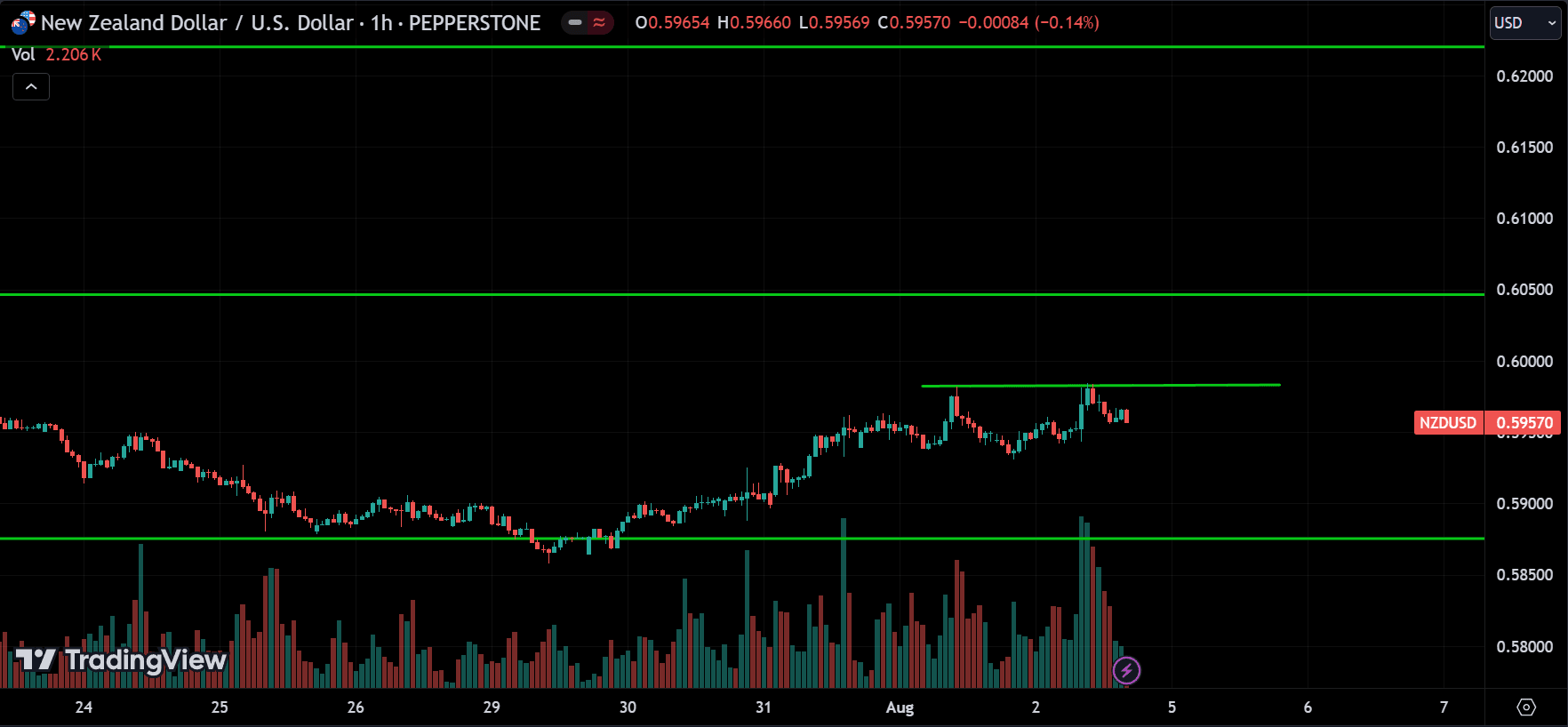

NZDUSD:

NZDUSD is pulling back from the major support level of 0.58500, indicating a possible uptrend. However, there’s resistance around 0.60000. If the price breaks above this level, it may continue up to 0.60500. If 0.60500 is also broken, the uptrend is confirmed. But the price could also drop from the 0.60000 resistance and fall back to the major support at 0.58500. If 0.58500 is broken, the downtrend continues. Watch for breakouts.

Download a Collection of Indicators, Courses, and EA for FREE

Commodities Market Analysis

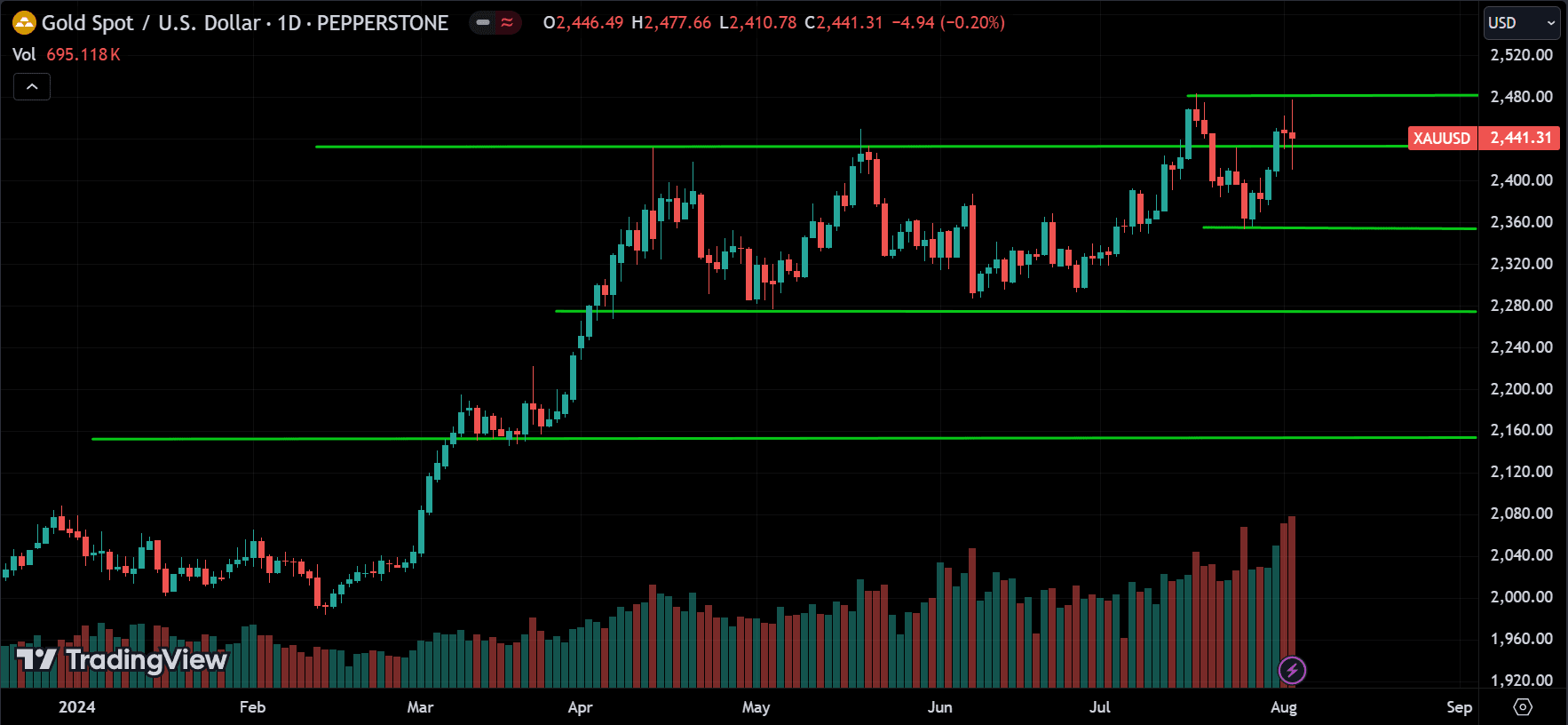

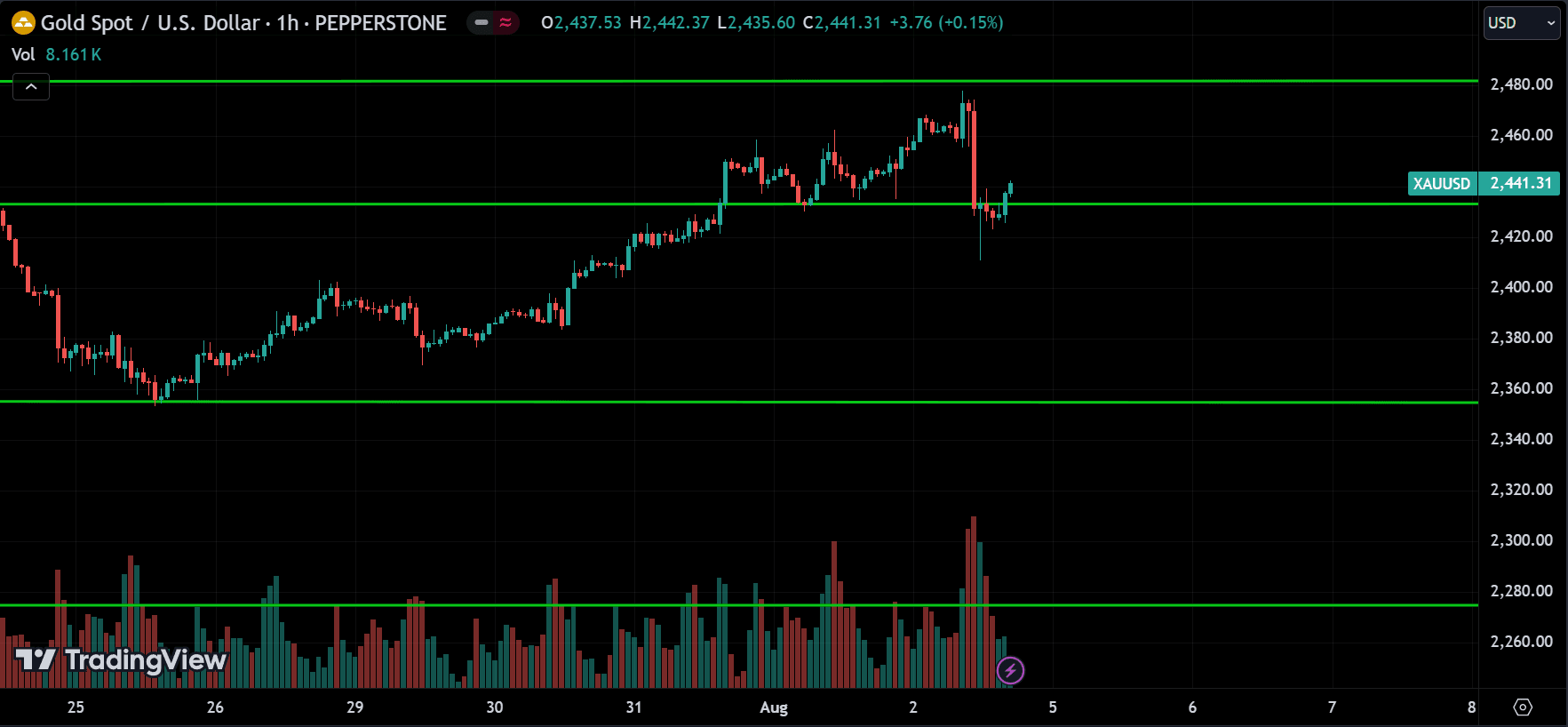

GOLD:

Gold is in an uptrend and at all-time high levels. There’s resistance around 2480. If the price breaks above this level, it can continue up and make new highs. Fear of recession will attract buyers, pushing the price higher. We could also see a pullback to support levels.

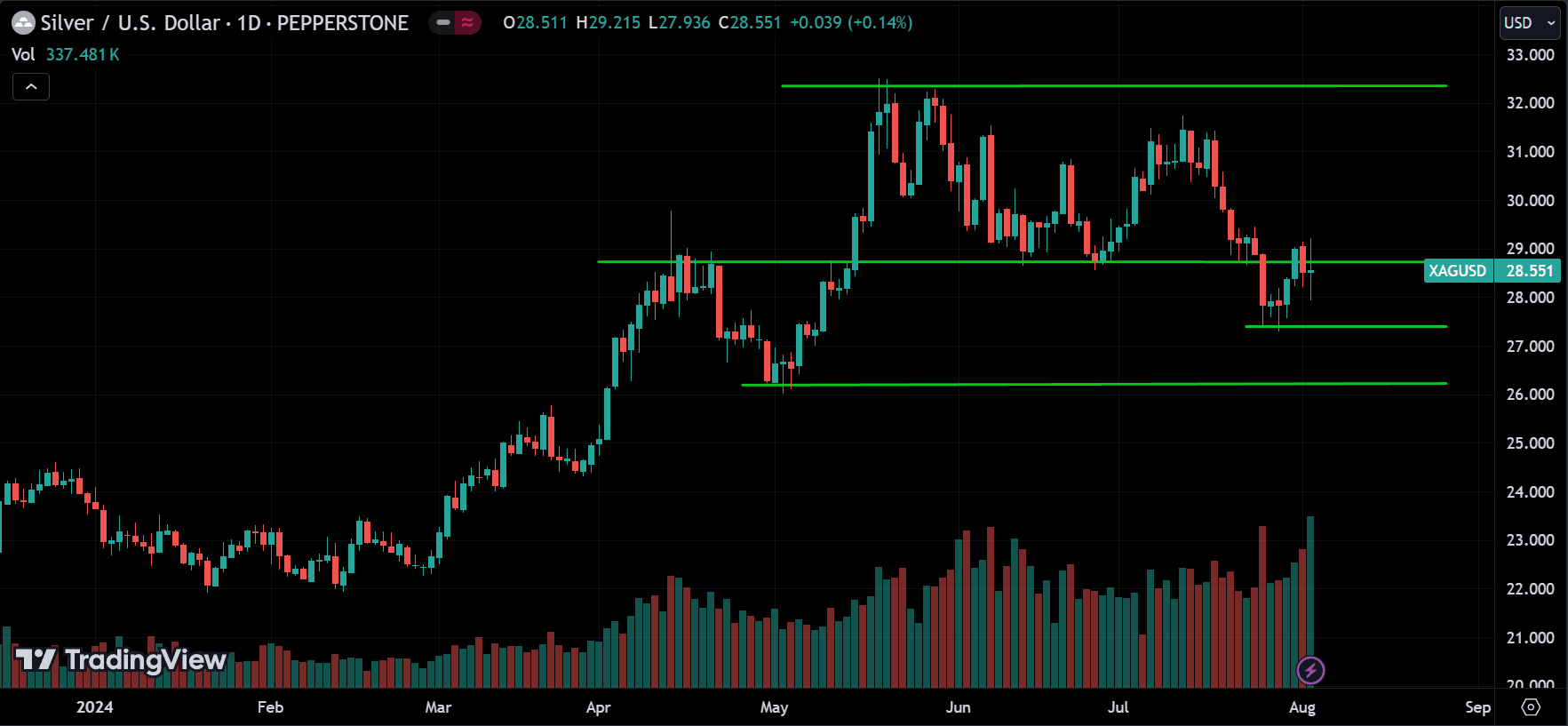

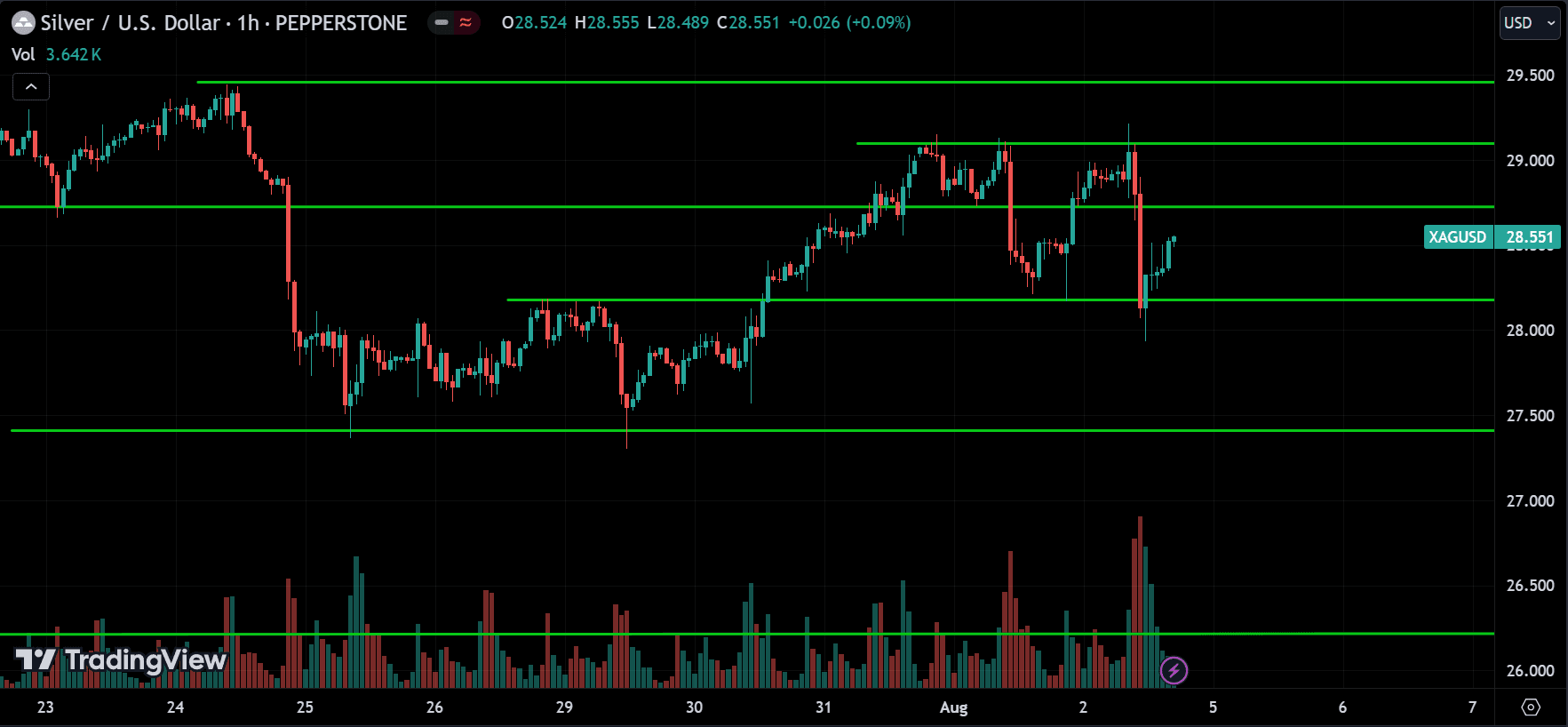

SILVER:

Silver is pulling back from the support at 28. There is major resistance just above 29. The price might pull back as it did before, or it could break above and reach 29.500. If it breaks 29.500, it might continue to rise. However, if the price breaks below the 28 support level, it could drop to 27.500. If 27.500 is broken, it will keep dropping.

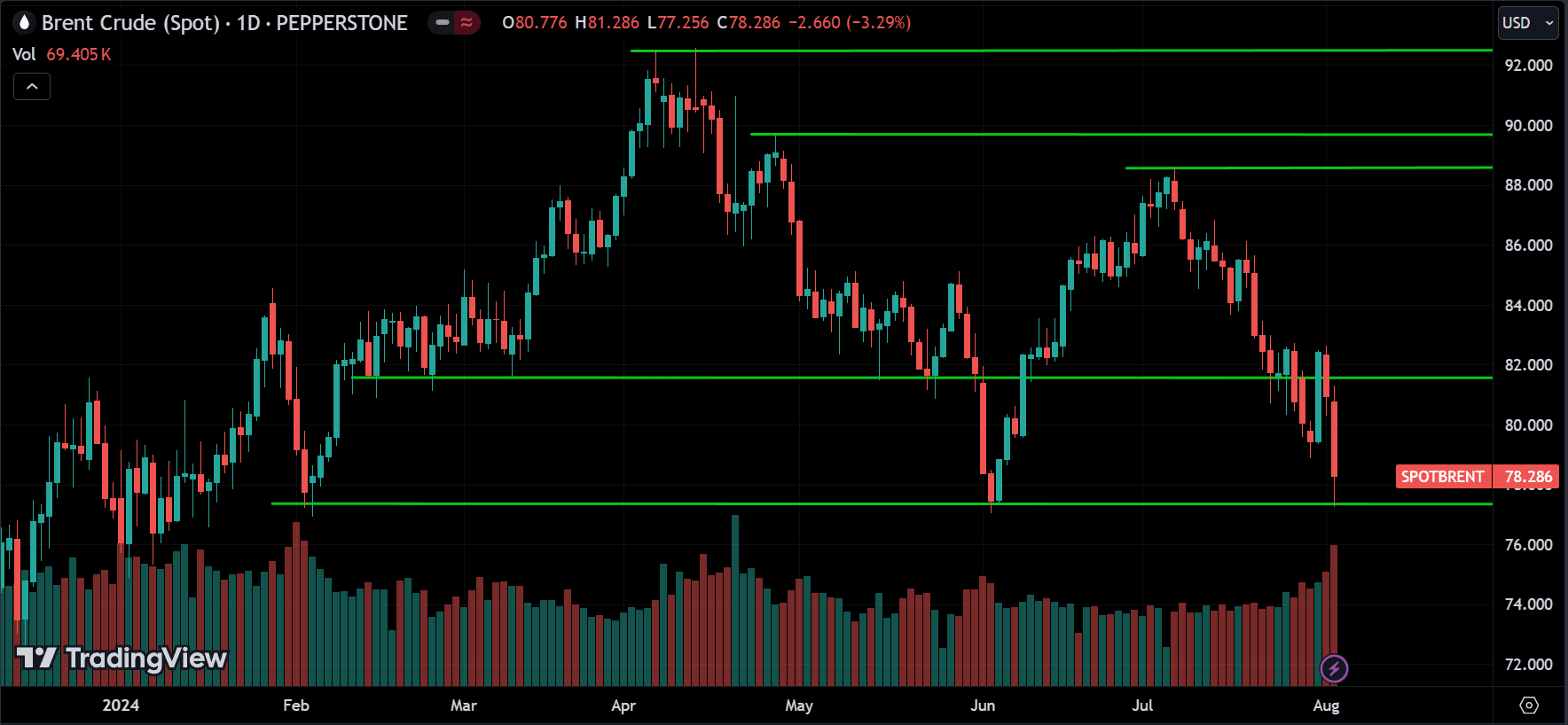

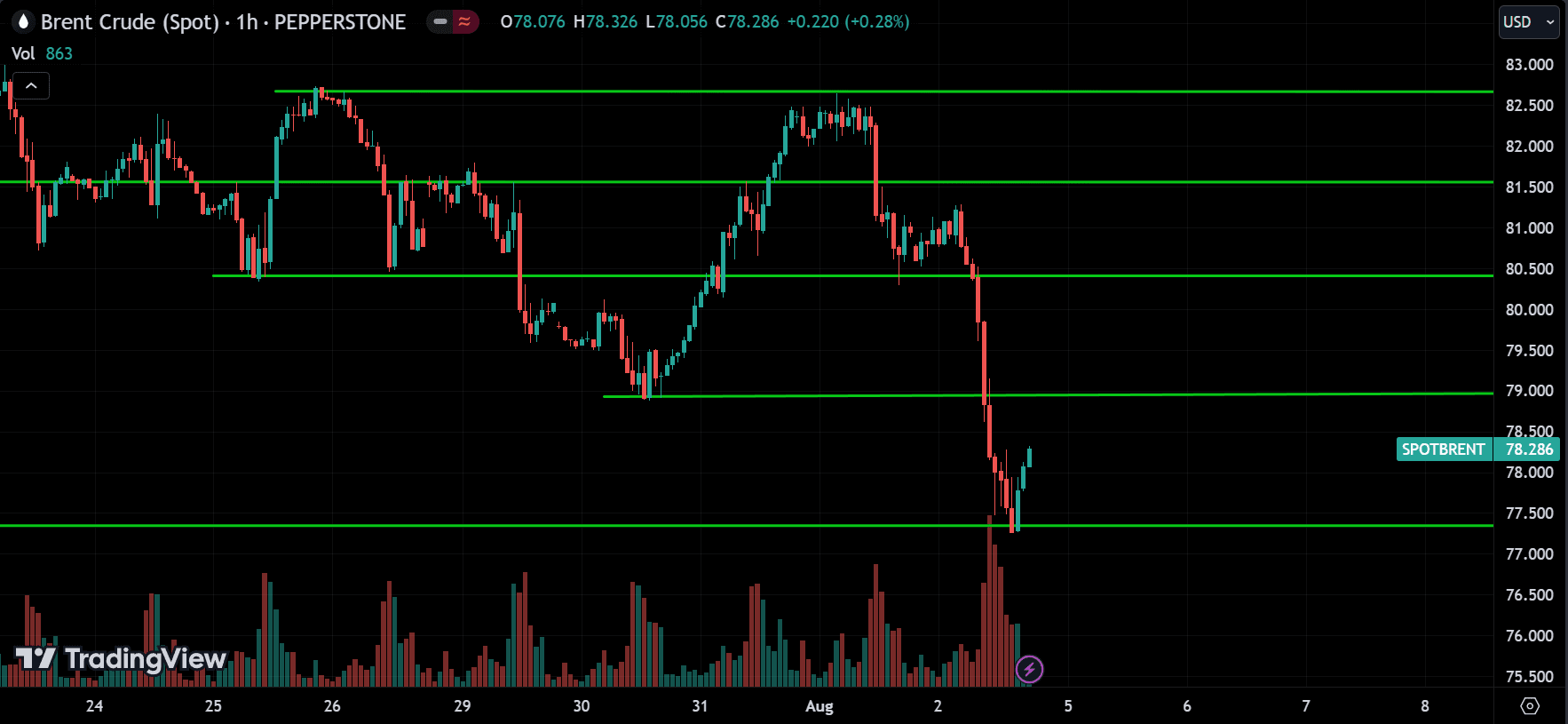

CRUDE OIL:

Oil is trending down and is at a major support level of 77.500. It’s pulling back, and there is resistance around 79. If the price breaks above this level, a new uptrend might start. However, if it reverses from that resistance and drops back to the support and breaks below it, the price will likely continue to drop.

Cryptocurrency Market Analysis

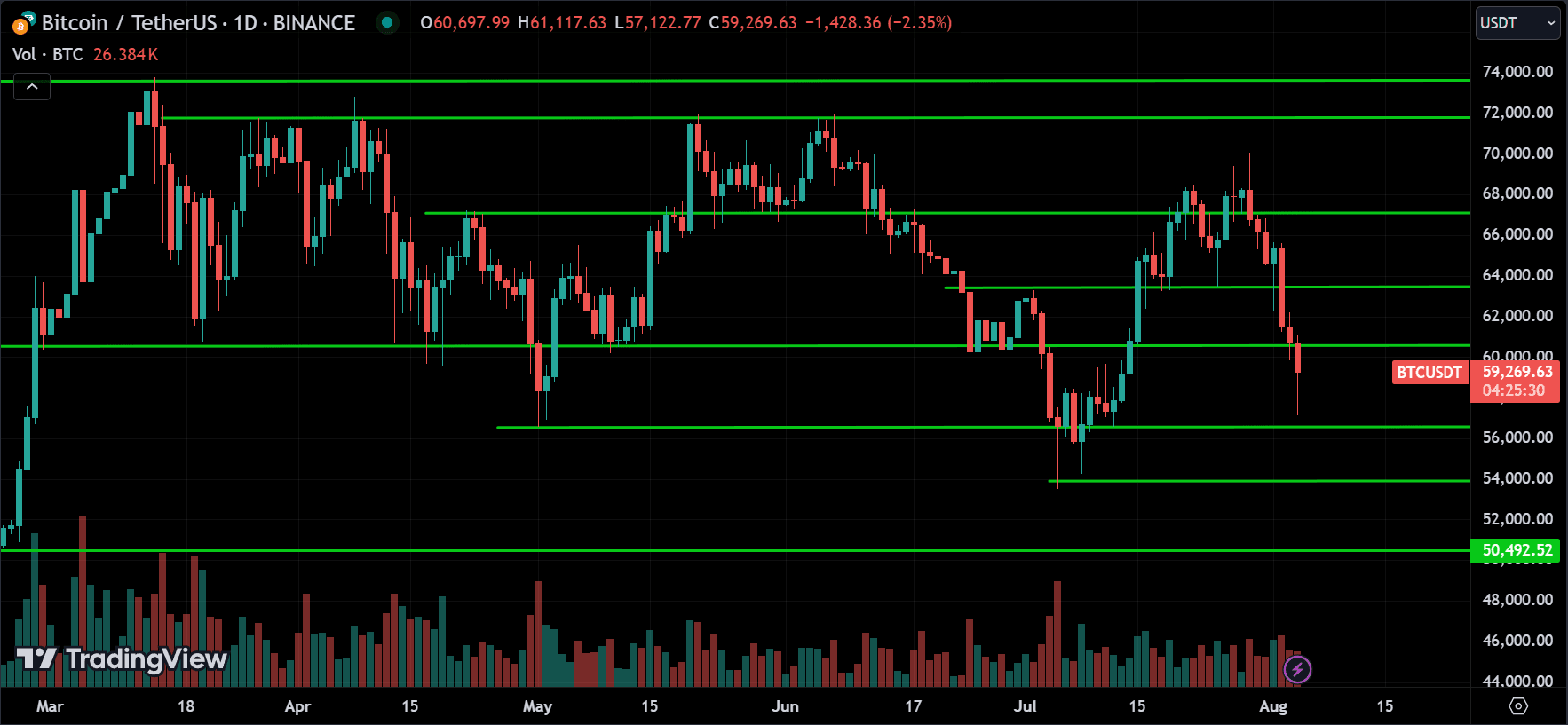

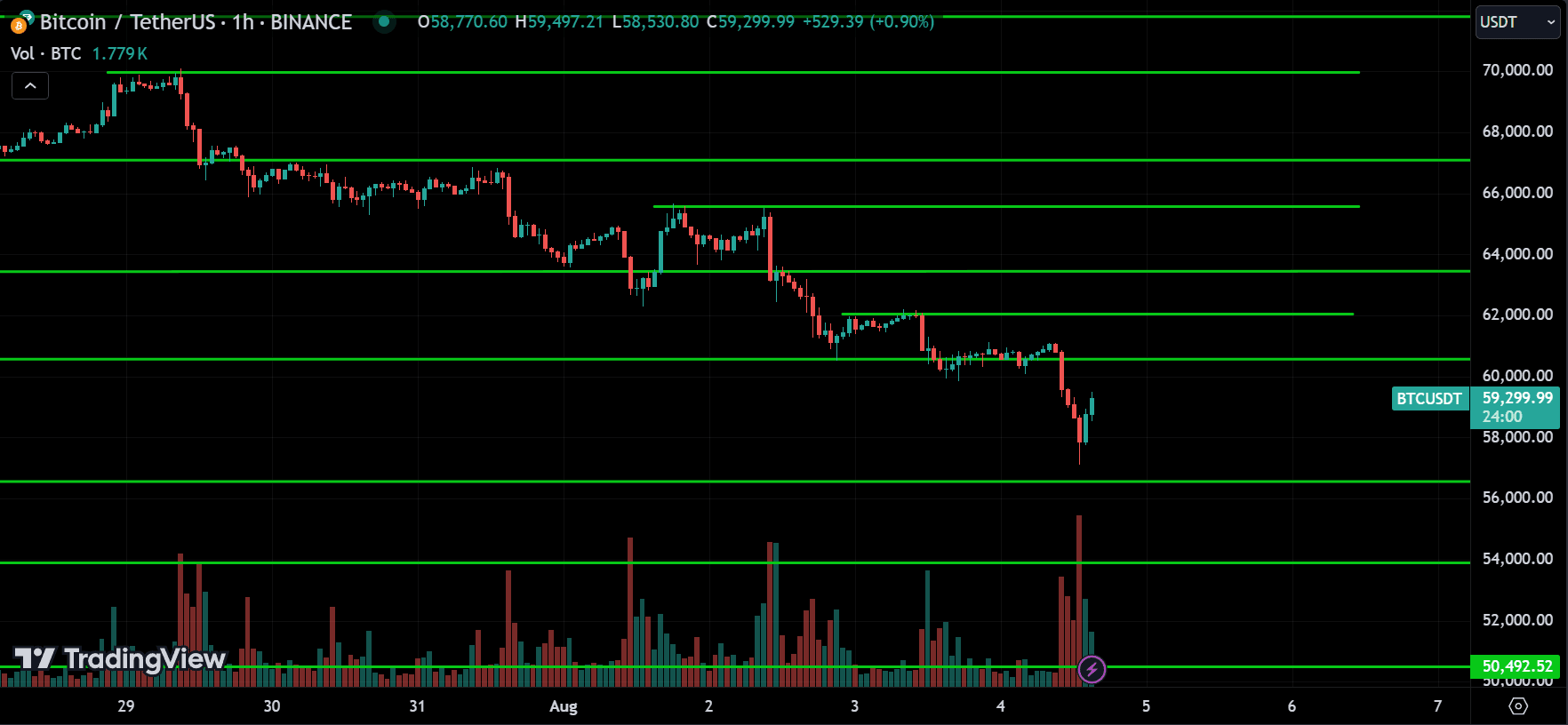

BTC:

Bitcoin (BTC) is trending down. It recently pulled back from the 56000 support level. Since it’s trending down, the price might break below this support and continue dropping to the next support levels. However, if the price breaks above the 62000 resistance, it might start to turn around.

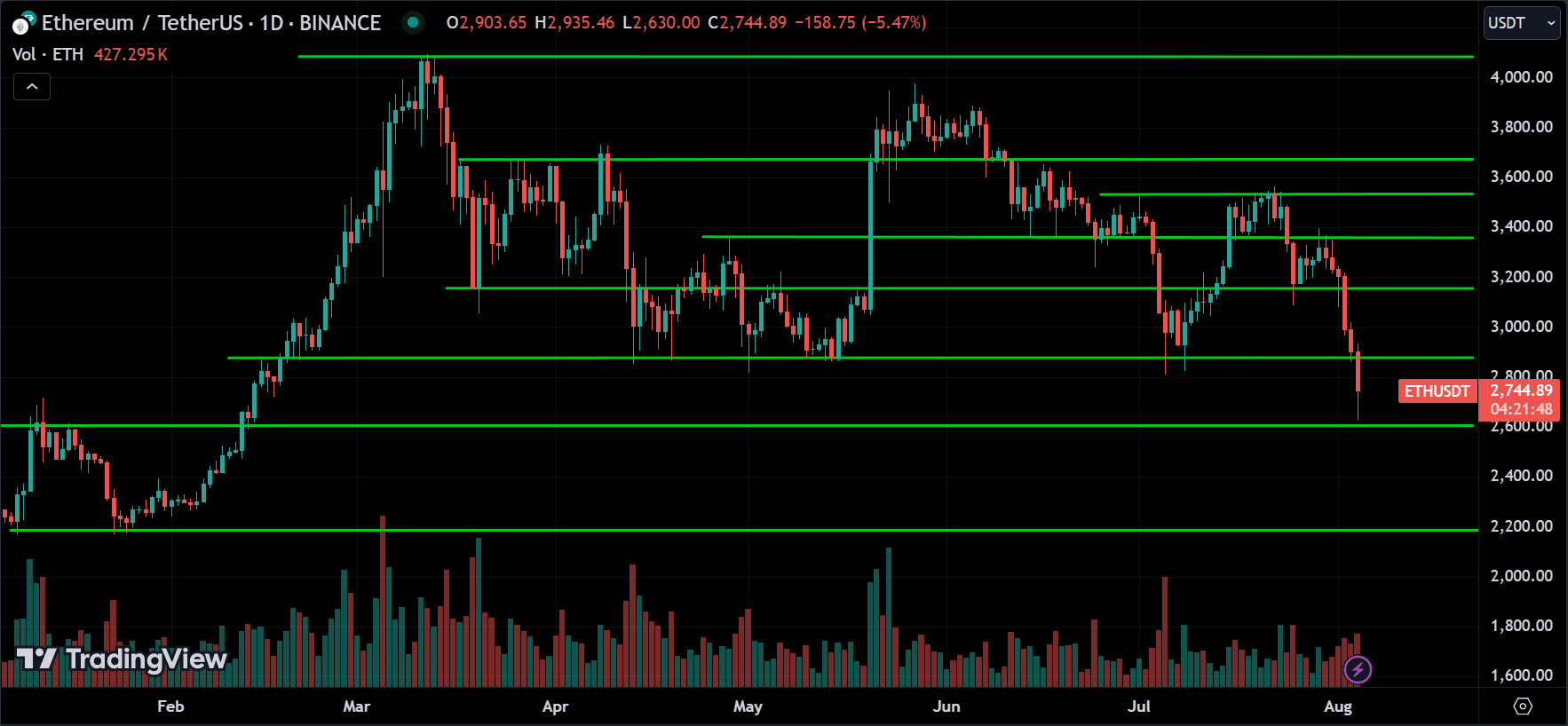

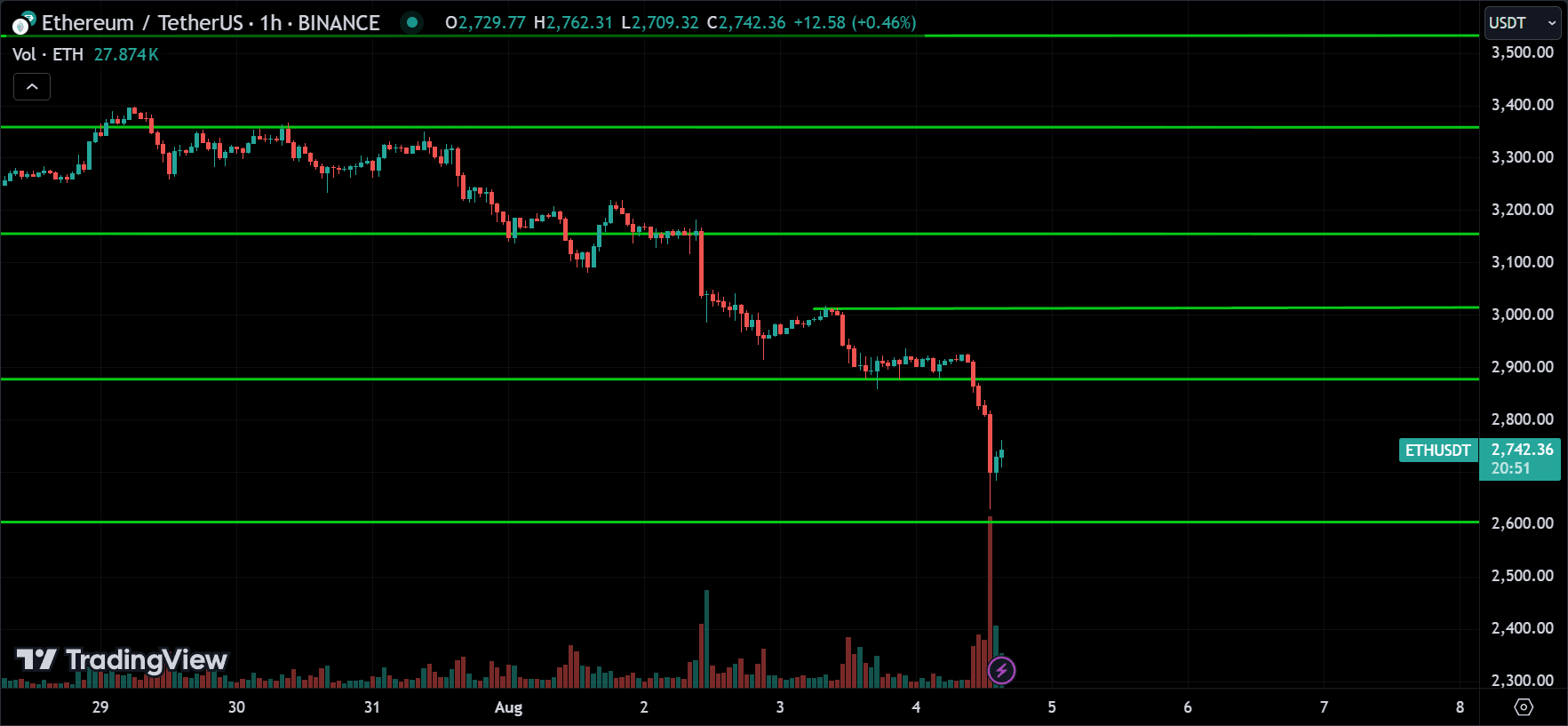

ETH:

ETH is also trending down. It pulled back from the 2600 support level. If the price breaks above 2900, it might start going up. But since it’s downtrending, it’s more likely to break below 2600 and drop further to 2200.

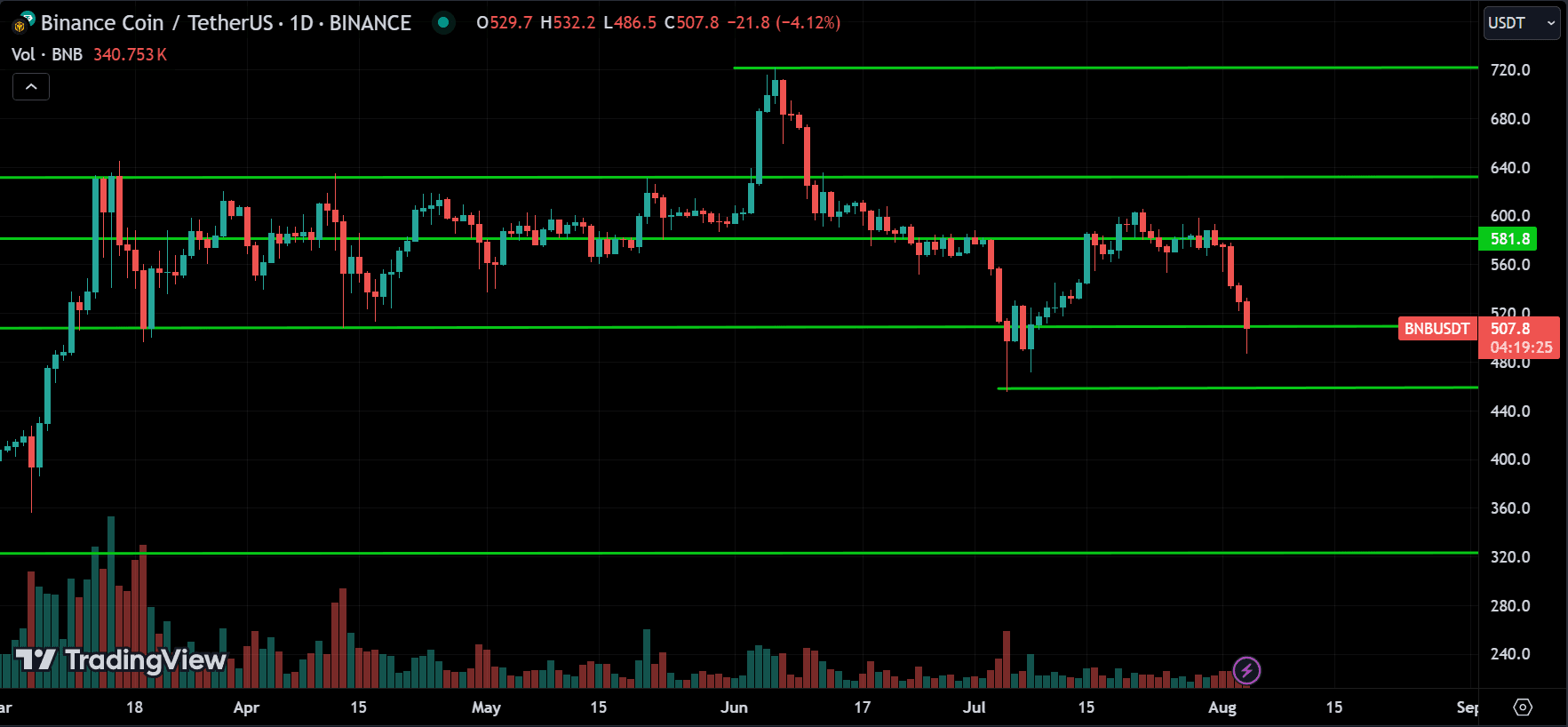

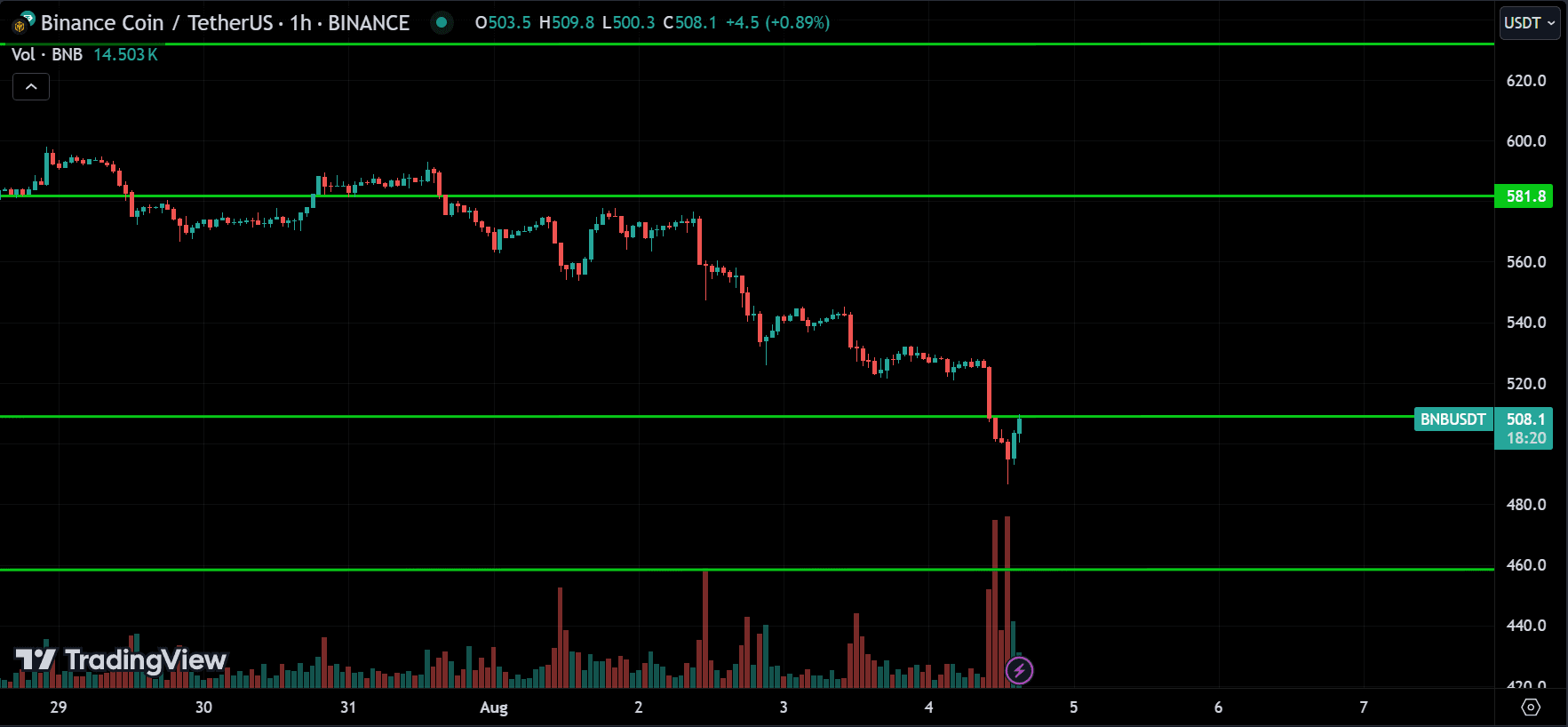

BNB:

BNB is mostly consolidating, but the 1-hour chart shows a slight downtrend. The price is around the 480 support level. If the price breaks above 540, it might start going up. However, watch for the price breaking below 460, although it could also reverse around that level.

Conclusion & Disclaimer

This analysis article isn’t about telling you when to buy or sell. It’s about teaching you how to approach the market effectively. Every day, I follow the same routine before I start trading. Here, I briefly explained the technical aspects of what’s happening and what actions I take in these situations. Your goal is to understand what I do so you can follow the same process on your own.

The market can change its behavior without notice, so it’s best to analyze it every day. The ForexCracked version covers all the important assets in details for the week in one article. Meanwhile, the xlearn version focuses more on daily analysis for day traders. If you want to follow daily analysis for Forex, US Stocks & Cryptocurrencies check out this section on xlearnonline.com

Please provide your feedback in the comment section below on how we can further improve our market analysis. Thank you.

Acknowledging the inherent unpredictability of financial markets is crucial. While we strive to offer informed perspectives on upcoming events and trends affecting various instruments, readers should conduct their own analysis and exercise prudent judgment.

Encouragement of Independent Analysis

We strongly encourage readers to supplement the information presented here with their own research and analysis. Market dynamics can swiftly change due to a multitude of factors, and individual circumstances may vary. By conducting independent analysis, readers can tailor their strategies to align with their unique goals and risk tolerance.

No Certainty in Market Predictions

It’s vital to recognize that nobody can consistently predict market movements with absolute certainty. Market analysis serves as a tool to assess probabilities and identify potential opportunities, but it’s essential to remain cognizant of the inherent uncertainty in financial markets.

Aligning with High Probability

Rather than aiming for infallible predictions, our goal is to align with high-probability scenarios based on available information and analysis. This approach acknowledges the dynamic nature of markets while seeking to capitalize on opportunities with favorable risk-reward profiles.

Proceed with Caution

Lastly, while market analysis can offer valuable insights, it’s imperative to approach trading and investment decisions with caution. Markets can be volatile, and unforeseen events may impact asset prices unexpectedly. Exercise prudent risk management and consider seeking advice from qualified financial professionals before making any significant financial decisions.

Remember, the journey of financial analysis and investment is a continuous learning process, and embracing a disciplined approach can contribute to long-term success in navigating the complexities of global markets.

THANK YOU & HAPPY TRADING!!!

![Weekly Market Analysis [2024.08.05] Key Support and Resistance Levels for Major Forex Pairs - Bitcoin to 50500 ForexCracked.com](https://www.forexcracked.com/wp-content/uploads/2024/08/Weekly-Market-Analysis-2024.08.05-Key-Support-and-Resistance-Levels-for-Major-Forex-Pairs-Bitcoin-to-50500-ForexCracked.com_.jpg)

Thanks admin appreciate it!