Welcome to this week’s market analysis from ForexCracked.com! As we delve into the upcoming economic events and key market movements, remember that staying informed is crucial for successful trading. Whether you’re a seasoned trader or just starting, our insights will help you confidently navigate the forex market.

This week’s market analysis covers key economic events, including Canada’s CPI release, the FOMC Meeting Minutes, and the Jackson Hole Symposium. We also provide insights into the current trends and potential movements for major currency pairs and commodities, helping you stay ahead in the market.

Before we continue with the analysis, if you know little about trading, charts, candlesticks, risk management, or strategies or want to improve your knowledge, consider reading our free forex course.

Upcoming Events for This Week

These events include macroeconomic reports, economic indicators, and, generally, what’s happening in the world.

Only the most important events are considered here. You can check the forexfactory.com for all the economic events and yahoo finance for news.

2024.08.19

There are no major events scheduled for this day.

2024.08.20

- 8:30 ET: Canada’s CPI (Consumer Price Index) for the month will be released. This measures the change in prices for goods and services bought by consumers. The previous reading was -0.1%, and the forecast is 0.4%. If the actual number is higher than the forecast, it’s positive for the currency. This is the most important inflation report because it’s released early and covers a wide range of items. Unlike other reports, this number isn’t adjusted for seasonal factors, making it a key figure to watch. Consumer prices make up most of inflation, and inflation affects currency value because rising prices can lead the central bank to raise interest rates to control inflation.

2024.08.21

- 14:00 ET: FOMC Meeting Minutes will be released. This is a detailed record of the Federal Open Market Committee’s most recent meeting, giving deep insights into the economic and financial factors that influenced their decision on interest rates. If the minutes are more hawkish than expected, it’s good for the currency. This report is scheduled 8 times a year, 3 weeks after the Federal Funds Rate is announced.

2024.08.22

- Jackson Hole Symposium: The Economic Policy Symposium in Jackson Hole, Wyoming, is attended by central bankers, finance ministers, academics, and financial market participants worldwide. While the meetings are closed to the press, officials often speak with reporters during the day. Central banker’s and key officials’ comments and speeches can cause significant market volatility.

2024.08.23

- 8:30 ET: Canada will release its Retail Sales m/m report, showing the change in the total value of sales at the retail level. The previous figure was -0.8%, and the forecast is -0.3%. If the actual number is higher than the forecast, it’s positive for the currency. This report is the main measure of consumer spending, which makes up most of the overall economic activity.

- 10:00 ET: Fed Chair Powell is scheduled to speak about the economic outlook at the Jackson Hole Economic Policy Symposium in Wyoming. As the head of the central bank, which controls short-term interest rates, he has more influence on the nation’s currency value than anyone else. Traders closely watch his speeches because he often hints at future monetary policy changes.

- Jackson Hole Symposium: The Economic Policy Symposium in Jackson Hole, Wyoming, is attended by central bankers, finance ministers, academics, and financial market participants worldwide. While the meetings are closed to the press, officials often speak with reporters during the day. Central bankers and key officials’ comments and speeches can cause significant market volatility.

- 15:00 ET: BOE Governor Bailey is scheduled to speak at the Jackson Hole Economic Policy Symposium in Wyoming. As the head of the central bank, which controls short-term interest rates, he has more influence on the nation’s currency value than anyone else. Traders closely watch his public appearances because he often hints at future monetary policy changes.

Forex Market Analysis

EURUSD:

![EURUSD Forex Price Action Technical Analysis [2024.08.19]

forexcracked.com](https://www.forexcracked.com/wp-content/uploads/2024/08/EURUSD-D-2.png)

![EURUSD Forex Price Action Technical Analysis [2024.08.19]

forexcracked.com](https://www.forexcracked.com/wp-content/uploads/2024/08/EURUSD-H-3.png)

EURUSD is trending up and is currently at the resistance level of 1.10600. We might see a pullback around this point, but if the uptrend is strong, the price could break above this resistance and keep going up. 1.09600 is a strong support level for the price.

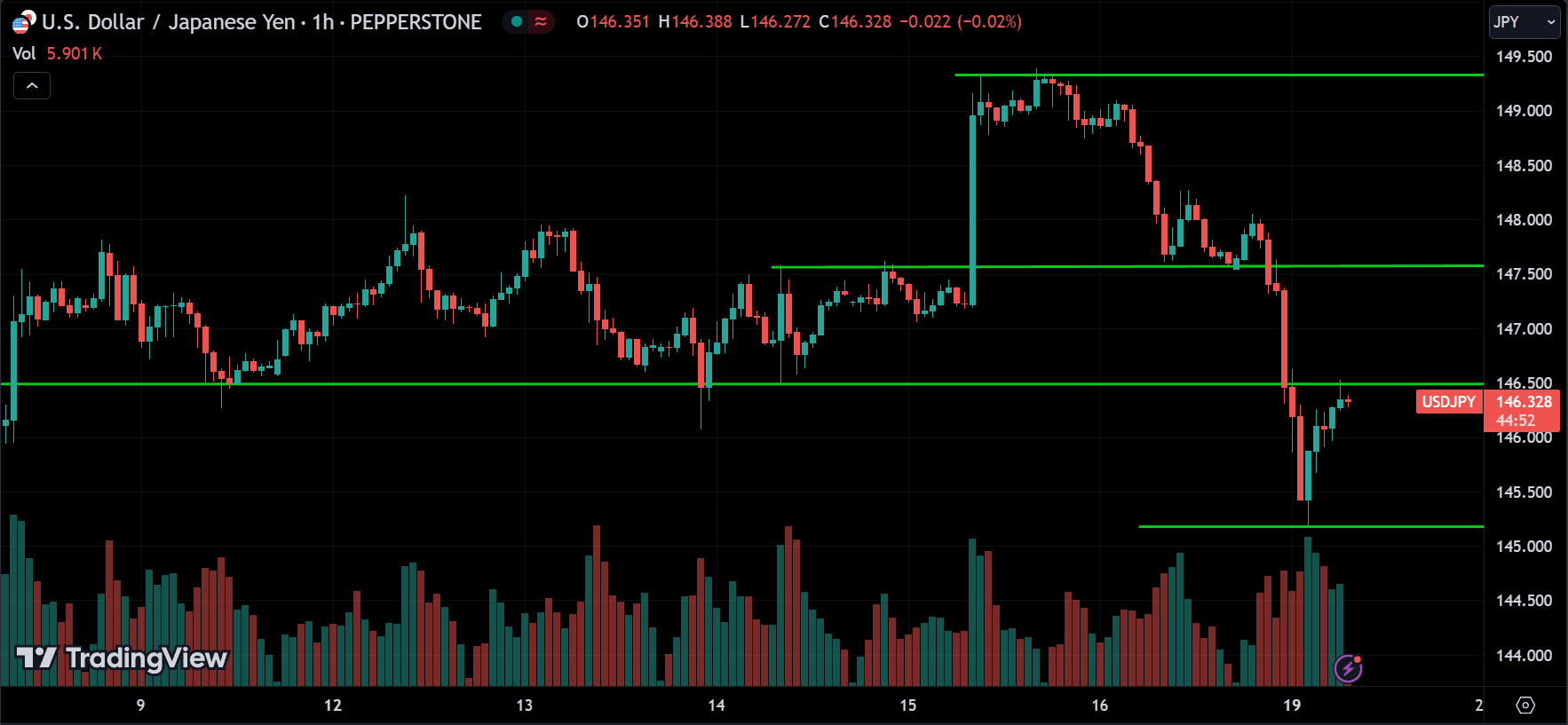

USDJPY:

![USDJPY Forex Price Action Technical Analysis [2024.08.19]

forexcracked.com](https://www.forexcracked.com/wp-content/uploads/2024/08/USDJPY-D-2.png)

USDJPY was trending down, but after reaching the 142 support level, it pulled back and is now trading above that level. Currently, the price is pulling up from the 145 support level and is at the resistance of 146.500. If the price breaks above this resistance, we can expect it to continue going up. However, if the price retraces from the resistance and breaks below the support, the downtrend could continue.

GBPUSD:

![GBPUSD Forex Price Action Technical Analysis [2024.08.19]

forexcracked.com](https://www.forexcracked.com/wp-content/uploads/2024/08/GBPUSD-D-2.png)

![GBPUSD Forex Price Action Technical Analysis [2024.08.19]

forexcracked.com](https://www.forexcracked.com/wp-content/uploads/2024/08/GBPUSD-H-3.png)

GBPUSD is trending up, and the price is getting close to the resistance level of 1.30000. We might see a pullback or reversal around this resistance, or the price could break above it and continue going up. So, keep an eye out for both pullbacks and reversals.

USDCHF:

![USDCHF Forex Price Action Technical Analysis [2024.08.19]

forexcracked.com](https://www.forexcracked.com/wp-content/uploads/2024/08/USDCHF-D-2.png)

![USDCHF Forex Price Action Technical Analysis [2024.08.19]

forexcracked.com](https://www.forexcracked.com/wp-content/uploads/2024/08/USDCHF-H-2.png)

USDCHF is trending down, but after hitting the support level of 0.84000, the price reversed and went up to 0.87400 before dropping to a support level of 0.86200. Now, we can expect the price to rise from this support to the 0.87400 resistance. If the resistance is broken, the uptrend could continue. However, watch out for the price breaking below the support, as that could signal a bearish trend.

USDCAD:

![USDCAD Forex Price Action Technical Analysis [2024.08.19]

forexcracked.com](https://www.forexcracked.com/wp-content/uploads/2024/08/USDCAD-D-2.png)

![USDCAD Forex Price Action Technical Analysis [2024.08.19]

forexcracked.com](https://www.forexcracked.com/wp-content/uploads/2024/08/USDCAD-H-2.png)

USDCAD is trending down, with major support around 1.36000. Currently, the price is at the 1.36600 support level and is pulling back. If the price breaks below this support, we can expect it to continue dropping toward 1.36000. However, if the price goes up and breaks above the 1.37400 resistance, we can expect it to continue rising.

AUDUSD:

![AUDUSD Forex Price Action Technical Analysis [2024.08.19]

forexcracked.com](https://www.forexcracked.com/wp-content/uploads/2024/08/AUDUSD-D-2.png)

![AUDUSD Forex Price Action Technical Analysis [2024.08.19]

forexcracked.com](https://www.forexcracked.com/wp-content/uploads/2024/08/AUDUSD-H-2.png)

AUDUSD is trending up and is currently at the resistance level of 0.67000. If the price breaks above this level, we can expect it to continue toward 0.68000, with a possible pullback or further rise to 0.68500. On the other hand, be on the lookout for reversals around these resistance levels.

NZDUSD:

![NZDUSD Forex Price Action Technical Analysis [2024.08.19]

forexcracked.com](https://www.forexcracked.com/wp-content/uploads/2024/08/NZDUSD-D-2.png)

![NZDUSD Forex Price Action Technical Analysis [2024.08.19]

forexcracked.com](https://www.forexcracked.com/wp-content/uploads/2024/08/NZDUSD-H-2.png)

NZDUSD is also trending up, and the price is at the resistance level of 0.60800. If the price breaks above this level, we can expect it to continue rising toward the 0.61500 range. However, we might also see a pullback around this level. Watch out for the price breaking below 0.59800—if that happens, we can expect it to drop toward the 0.58800 range.

Commodities Market Analysis

XAUUSD:

![XAUUSD Commodities Price Action Technical Analysis [2024.08.19]

forexcracked.com](https://www.forexcracked.com/wp-content/uploads/2024/08/XAUUSD-D-3.png)

![XAUUSD Commodities Price Action Technical Analysis [2024.08.19]

forexcracked.com](https://www.forexcracked.com/wp-content/uploads/2024/08/XAUUSD-H-2.png)

XAUUSD (Gold) is trading at all-time high levels, having surpassed the 2500 range. There’s a small resistance around the 2510 range. If the price breaks above this level, the uptrend is likely to continue. However, if the price breaks below the 2480 support range, we can expect Gold to drop toward 2440.

XAGUSD:

![XAGUSD Commodities Price Action Technical Analysis [2024.08.19]

forexcracked.com](https://www.forexcracked.com/wp-content/uploads/2024/08/XAGUSD-D-2.png)

![XAGUSD Commodities Price Action Technical Analysis [2024.08.19]

forexcracked.com](https://www.forexcracked.com/wp-content/uploads/2024/08/XAGUSD-H-2.png)

Silver (XAGUSD) was trending down, but after reaching support around 26, it reversed and is now at the 29 resistance level. As it consolidates, if the price breaks above this resistance, we can expect it to continue rising. On the other hand, if the price breaks below the 28.500 range, we could see it drop further.

CRUDE OIL:

![CRUDE OIL Commodities Price Action Technical Analysis [2024.08.19]

forexcracked.com](https://www.forexcracked.com/wp-content/uploads/2024/08/OIL-D-2.png)

![CRUDE OIL Commodities Price Action Technical Analysis [2024.08.19]

forexcracked.com](https://www.forexcracked.com/wp-content/uploads/2024/08/OIL-H-2.png)

Oil is trending down, with the next support around the 78 range. If the price breaks below this level, it could continue dropping toward the 77 and 75 ranges. However, we might see a reversal around the major support at 77, so keep an eye out for that.

Cryptocurrency Market Analysis

BTC:

![BTC Crypto Price Action Technical Analysis [2024.08.19]

forexcracked.com](https://www.forexcracked.com/wp-content/uploads/2024/08/BTC-D-2.png)

![BTC Crypto Price Action Technical Analysis [2024.08.19]

forexcracked.com](https://www.forexcracked.com/wp-content/uploads/2024/08/BTC-H-2.png)

Bitcoin is trading between the support at 56000 and the resistance at 63000. The price is currently heading down, and if it breaks below the 56000 range, we can expect it to drop further. On the other hand, if the price breaks above 60000, it could rise toward 63000. If that level is also broken, the uptrend could continue.

ETH:

![ETH Crypto Price Action Technical Analysis [2024.08.19]

forexcracked.com](https://www.forexcracked.com/wp-content/uploads/2024/08/ETH-D-2.png)

![ETH Crypto Price Action Technical Analysis [2024.08.19]

forexcracked.com](https://www.forexcracked.com/wp-content/uploads/2024/08/ETH-H-2.png)

ETH is also trending down. After hitting the 2520 support, the price pulled back up to the 2680 resistance but is now dropping again. If the price breaks below 2520, it could drop even further. However, if it reverses and goes back up, it might break above 2680 and start an uptrend.

BNB:

![BNB Crypto Price Action Technical Analysis [2024.08.19]

forexcracked.com](https://www.forexcracked.com/wp-content/uploads/2024/08/BNB-D-2.png)

BNB is mostly trending down, but it’s in an uncertain phase right now. The price is currently at the 530 support level. If it breaks below this level, it could drop to 510. However, the price might also start going up from 530 and move toward 550. If it breaks above 550, we could see an uptrend.

Conclusion & Disclaimer

This analysis article isn’t about telling you when to buy or sell. It’s about teaching you how to approach the market effectively. Every day, I follow the same routine before I start trading. Here, I briefly explained the technical aspects of what’s happening and my actions in these situations. Your goal is to understand what I do so you can follow the same process on your own.

The market can change its behavior without notice, so it’s best to analyze it daily. The ForexCracked version covers all the important assets in detail for the week in one article. Meanwhile, the xlearn version focuses more on daily analysis for day traders. If you want to follow daily analysis for Forex, US Stocks & Cryptocurrencies, check out this section on xlearnonline.com

Please provide your feedback in the comment section below on how we can further improve our market analysis. Thank you.

Acknowledging the inherent unpredictability of financial markets is crucial. While we strive to offer informed perspectives on upcoming events and trends affecting various instruments, readers should conduct their own analysis and exercise prudent judgment.

Encouragement of Independent Analysis

We strongly encourage readers to supplement the information presented here with their own research and analysis. Market dynamics can swiftly change due to a multitude of factors, and individual circumstances may vary. By conducting independent analysis, readers can tailor their strategies to align with their unique goals and risk tolerance.

No Certainty in Market Predictions

It’s vital to recognize that nobody possesses the ability to predict market movements with absolute certainty consistently. Market analysis serves as a tool to assess probabilities and identify potential opportunities, but it’s essential to remain cognizant of the inherent uncertainty in financial markets.

Aligning with High Probability

Rather than aiming for infallible predictions, our goal is to align with high-probability scenarios based on available information and analysis. This approach acknowledges the dynamic nature of markets while seeking to capitalize on opportunities with favorable risk-reward profiles.

Proceed with Caution

Lastly, while market analysis can offer valuable insights, it’s imperative to approach trading and investment decisions with caution. Markets can be volatile, and unforeseen events may impact asset prices unexpectedly. Exercise prudent risk management and consider seeking advice from qualified financial professionals before making any significant financial decisions.

Remember, the journey of financial analysis and investment is a continuous learning process, and embracing a disciplined approach can contribute to long-term success in navigating the complexities of global markets.

THANK YOU & HAPPY TRADING!!!