Welcome to our weekly market analysis from forexcracked.com! Fresh Week Fresh Start.

This article isn’t about telling you when to buy or sell. Instead, it’s about showing you how to approach the market effectively. Every day, I go through the same process before I start trading. Here, I’ll briefly discuss the technical side of what’s happening and what I will do in these situations. Let’s get started.

Upcoming Events for This Week

These events include macroeconomic reports, economic indicators, and generally what’s going on in the world. Only the most important ones are considered here. You can check forexfactory for all the events.

13/5/2024

Nothing big is going on this Monday, just a few members from FOMC talking, and for CHF, SNB Chair Joran is talking.

14/5/2024

We’ve got Claimant Count Change for GBP, Wage Price Index for AUD, US PPI data coming out, and FED Chair Powell speaking. So, keep an eye out for PPI and Powell’s talk – those are the big things happening this Tuesday.

15/5/2024

We’re getting US Retail Sales, Empire State Manufacturing Index, and CPI data. These events can really shake up the market, so pay close attention to the CPI release. It’ll give us clues about what the FED might do with interest rates.

16/5/2024

Nothing major happening for the day, just the US unemployment claims. Nothing to worry about.

17/5/2024

On Friday, we’ve got the CB Leading Economic Index, but it’s not a big deal event-wise. However, it does give us insight into where the economy might be headed. Plus, there’s a FOMC member speaking. So, nothing too serious.

Before we start digging into the analysis, here’s a handy tip: always keep an eye on the US market session and US stock market session, because that’s where most of the action happens. Plus, the stock market and forex market are somewhat connected.

Forex

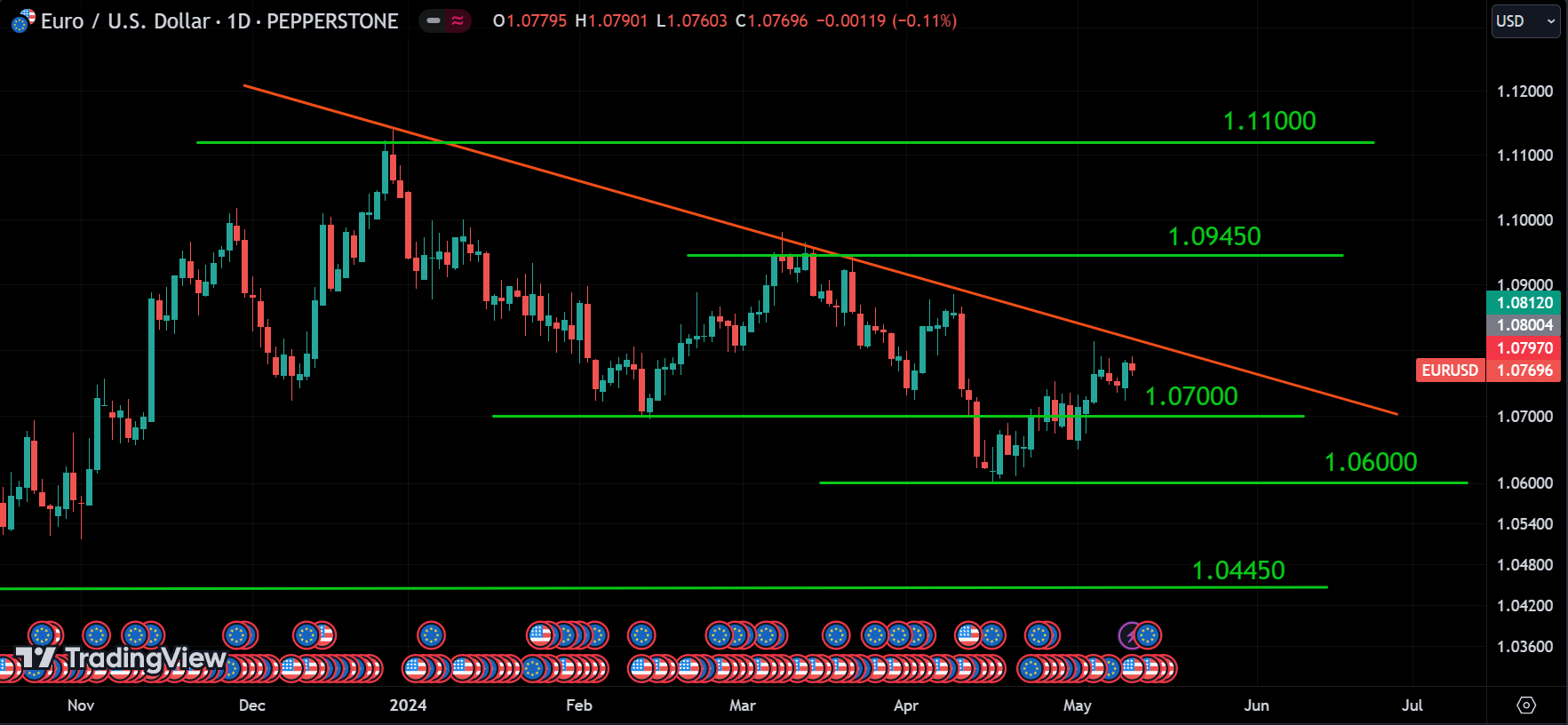

EURUSD:

It’s pretty much the same story as last week for the EURUSD. There’s a clear downward trend, and the price is nearing the resistance level. But this week, we’ve got CPI data coming, which can cause big swings in the market. So, if there’s going to be a breakout, it might happen around the time of the CPI news.

Now, what we can anticipate is this: if the price manages to break above the resistance level, we might see a reversal in the trend, and the price could climb to around 1.08600 or even up to 1.09450. If it surpasses that, it could push further to 1.11000. But, expect some corrections along the way. On the flip side, if the price retreats from the resistance line, it’s more likely to continue its descent towards the areas highlighted in the image.

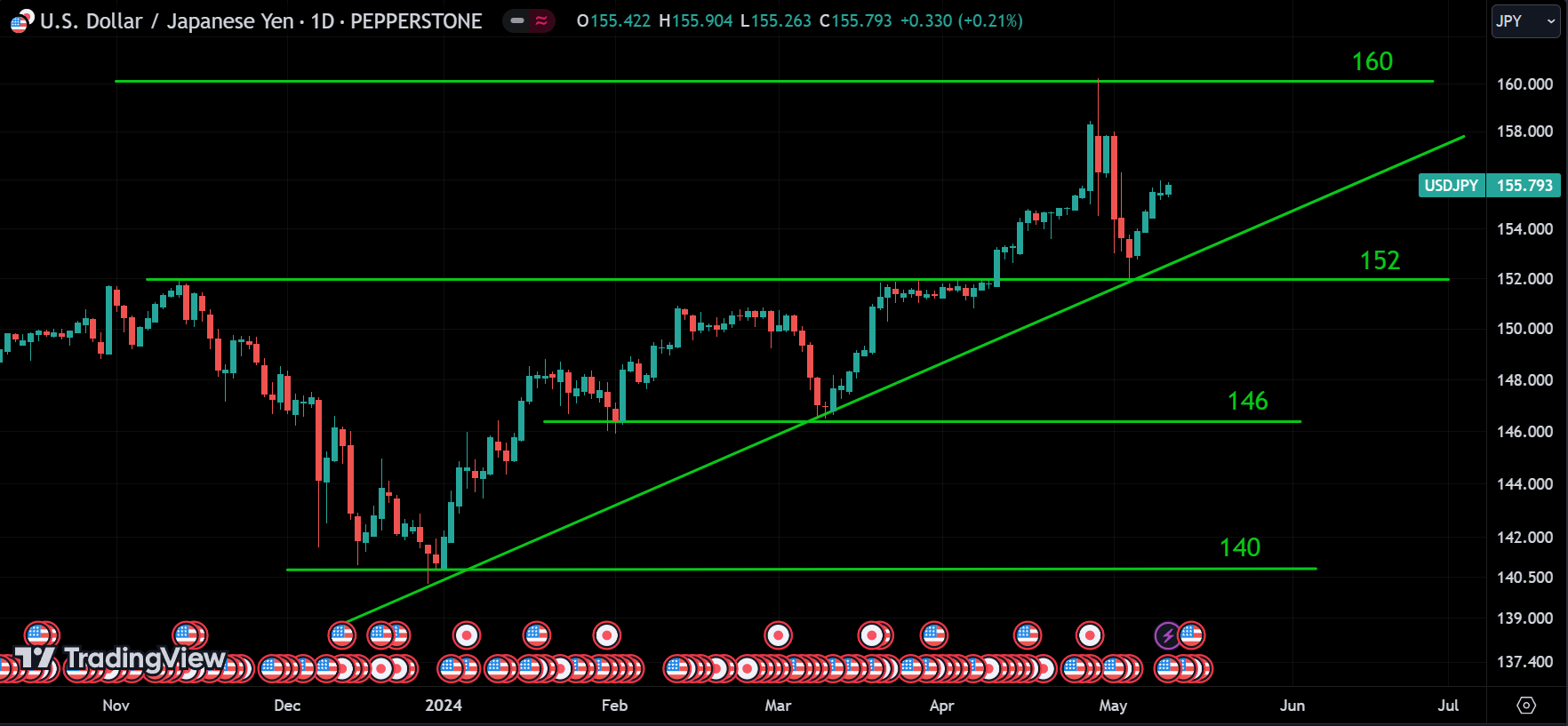

USDJPY:

Regarding USDJPY, as we discussed in the previous article, the price bounced back from the 152 level. Now, it’s on its way back to its all-time high level. There could be some corrections along the way, but it shouldn’t drop below 152 or the trend line that shows the upward trend.

Once again this week, we’ve got CPI data, and it could shake up all the analysis we’ve been discussing. So, keep an eye out for that.

GBPUSD:

GBPUSD is presenting quite a challenge, as I mentioned in the last article. The price is really striving to stay within the 1.25000 range, but there are clear signs of a bearish trend. However, it’s reluctant to move in that direction. After some consolidation, it entered a bearish phase, but couldn’t sustain it, and now it’s sitting after a correction.

With CPI data coming this week, if the USD strengthens, GBPUSD is likely to fall. The bearish trend seems most probable, although I’m not as confident as other analyses. Still, my gut feeling leans towards a bearish outlook. If that holds true, we might see the price drop to 1.23000 before a correction. On the flip side, if the news is unfavorable for the USD, GBPUSD could surge and reach levels around 1.28000. So, let’s wait and see what happens.

USDCHF:

Alright, when it comes to USDCHF, it appears to still be trading within a channel. There was a false breakout, and the price quickly bounced back and is now somewhat consolidating. So, if the trend continues, USDCHF could rise. However, if the trend breaks, it could drop to levels around 0.88800 or 0.87450. To confirm whether the trend is indeed broken, keep a close eye on the 0.90000 level. If the price breaks this level, then it’s officially in a bearish phase. So, if you’re considering a position here, wait for the breakout to confirm it, which seems quite likely considering all the factors from other pairs and CPI data.

USDCAD:

USDCAD is still on the uptrend, as long as the lower trend line doesn’t break. The price remains in a bullish phase and is likely to keep rising. So, keep an eye on both of these lines as they represent the strongest support and resistance levels for USDCAD.

AUDUSD:

AUDUSD is sort of moving sideways, and it’s currently trading near its toughest resistance level of 0.66500. If it can break through this level, we might see the price climb to 0.68500 or higher. However, if it pulls back from that level, we could expect it to drop to around 0.64700 before a correction, or possibly even lower.

NZDUSD:

It looks like NZDUSD is still in a bearish phase and is currently undergoing a correction. The price level of 0.61000 is the toughest resistance for the price. If it can break through this level, the downtrend might be over and a new uptrend could begin. However, it’s more likely to pull back from that level. Make your decisions after the CPI data. Overall, the trend is bearish.

Commodities

GOLD:

Alright, gold is back on its upward trend. We can expect two things from this: either the price breaks the all-time high level of 2400 and continues to rise, or it retraces from the 2400 level to around 2275 or even lower. wait for the breakout before entering a long position.

CRUDE OIL:

Oil is currently in a bearish phase, as we discussed in the previous article. It might drop to 78 or even as low as 72. However, we can anticipate a correction around the 81 range. If the price bounces back from this level, then oil is in a correction phase. But if it manages to break this level, then we can expect the price to continue dropping further.

Cryptocurrency

BTC:

When it comes to BTC, we all anticipate it should rise, but the reality is different. If BTC is indeed in a correction phase, as we discussed in the last article, it could drop to the 50K range. To confirm whether it’s in a correction phase, it’s best to keep an eye on that 60K level. If the price manages to break this level again, then we can somewhat agree that it’s indeed undergoing a correction. The CPI data will influence BTC, so it’s wise to wait for it.

Furthermore, if the price breaks above the slope trend line, it signals an uptrend. So, wait for the breakout to occur and wait for the CPI data before making any decisions.

ETH:

When it comes to ETH, it appears to be in a bearish trend, and the price has failed to break the 2800 price range twice already. Now it’s trading in that range again. So, what we might see is if the price manages to break below the 2800 range, ETH could drop to around the 2000 price range. On the other hand, if ETH can break above the slope trend line, it indicates a trend reversal, and we might expect the price to rise to the 3600 and 4000 range. But, like with BTC, it’s the same story: wait for the breakout and CPI data before making any moves.

Conclusion & Disclaimer

Please share your thoughts on this article: Did you find it helpful? Was it easy to understand, or do you want me to cover different pairs? Write whatever comes to your mind in the comment section. Thank you!

It’s crucial to acknowledge the inherent unpredictability of financial markets. While we strive to offer informed perspectives on upcoming events and trends affecting various instruments, it’s important for readers to conduct their own analysis and exercise prudent judgment.

Encouragement of Independent Analysis

We strongly encourage readers to supplement the information presented here with their own research and analysis. Market dynamics can swiftly change due to a multitude of factors, and individual circumstances may vary. By conducting independent analysis, readers can tailor their strategies to align with their unique goals and risk tolerance.

No Certainty in Market Predictions

It’s vital to recognize that nobody possesses the ability to consistently predict market movements with absolute certainty. Market analysis serves as a tool to assess probabilities and identify potential opportunities, but it’s essential to remain cognizant of the inherent uncertainty in financial markets.

Aligning with High Probability

Rather than aiming for infallible predictions, our goal is to align with high-probability scenarios based on available information and analysis. This approach acknowledges the dynamic nature of markets while seeking to capitalize on opportunities with favorable risk-reward profiles.

Proceed with Caution

Lastly, while market analysis can offer valuable insights, it’s imperative to approach trading and investment decisions with caution. Markets can be volatile, and unforeseen events may impact asset prices unexpectedly. Exercise prudent risk management and consider seeking advice from qualified financial professionals before making any significant financial decisions.

Remember, the journey of financial analysis and investment is a continuous learning process, and embracing a disciplined approach can contribute to long-term success in navigating the complexities of global markets.

Please provide your feedback in the comment section below on how we can further improve our market analysis. Thank you.

Thank you so much for the analysis it is magnificent!!! could you please add XAGUSD?