The October 10, 2024 US Consumer Price Index (CPI) report, which will provide inflation data for September 2024, is a key event for the forex market. Several important economic indicators, such as the recent Federal Reserve rate cut, the September unemployment report, and ongoing inflation trends, will shape market expectations and the Federal Reserve’s monetary policy decisions. Let’s explore why this report is so critical.

Latest Economic Developments

Recent Rate Cut

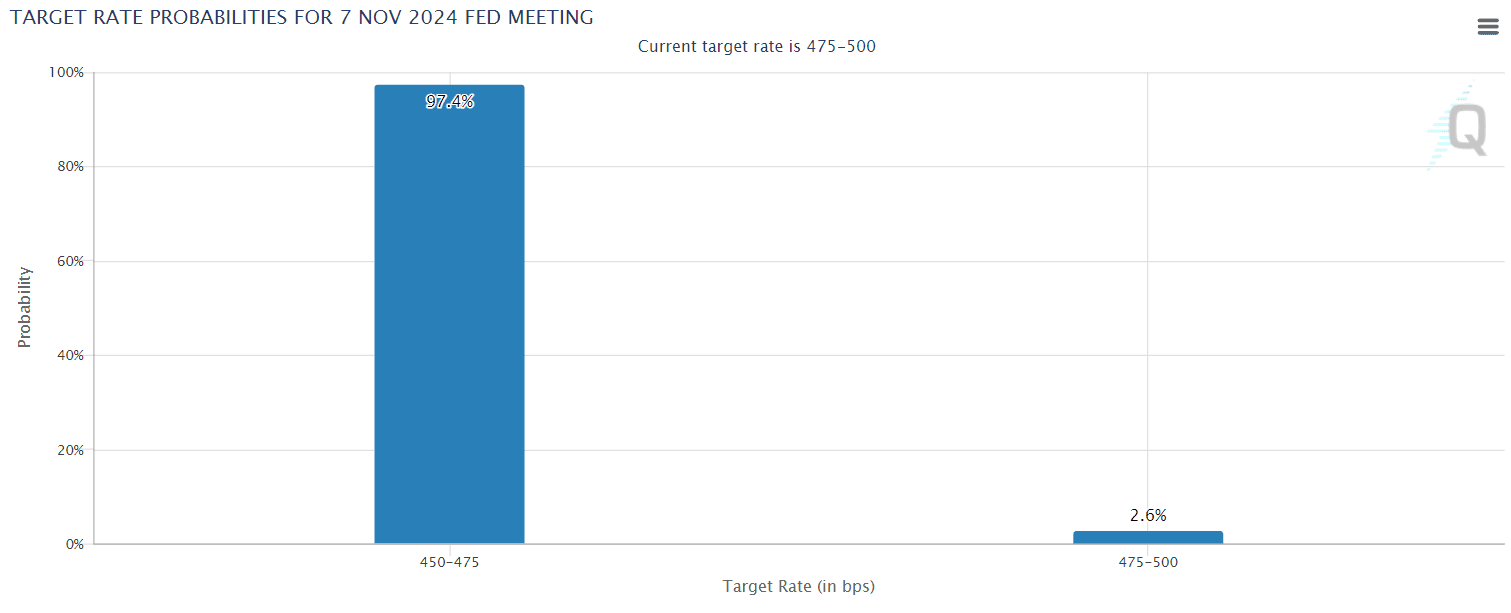

In September 2024, the Federal Reserve made its first rate cut of the year, lowering the federal funds rate by 0.5% to a range of 4.75%-5%. This move was designed to manage slowing economic growth and rising unemployment while still addressing inflationary pressures. However, the Fed remains cautious, indicating that future rate cuts will depend on incoming inflation data. Despite this, the probability of a 25 basis points (bps) cut in the near future remains high.

September Unemployment Report

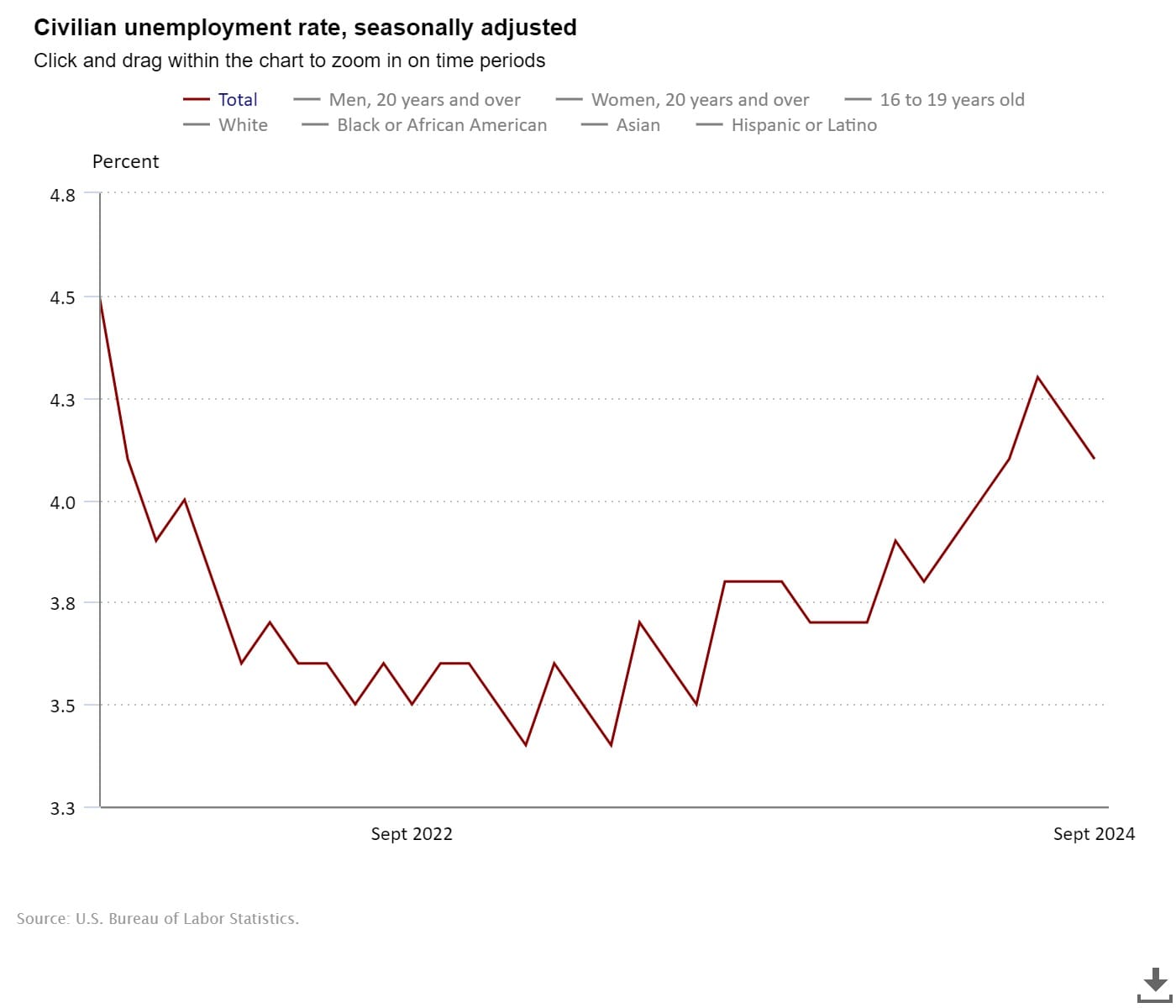

The latest jobs report for September 2024 showed the US economy added 254,000 jobs, significantly exceeding forecasts. The unemployment rate fell to 4.1%, down from 4.3% in August. This strong job growth signals that the labor market remains resilient, which could complicate the Fed’s decision-making if inflation remains high. Although job growth is robust, inflation continues at a 2.5% annual rate.

September CPI Expectations

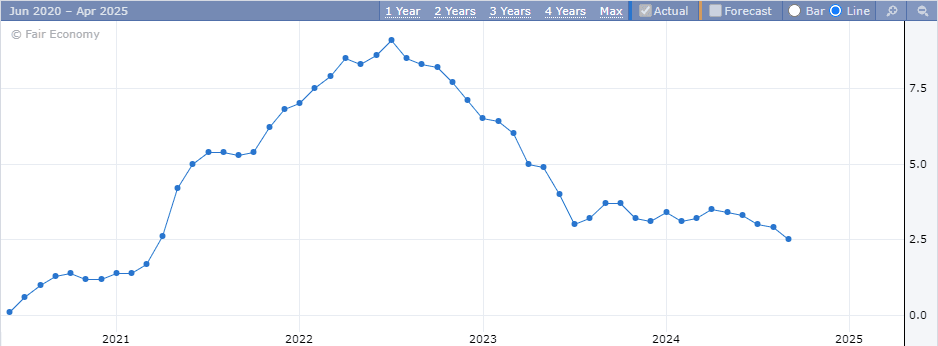

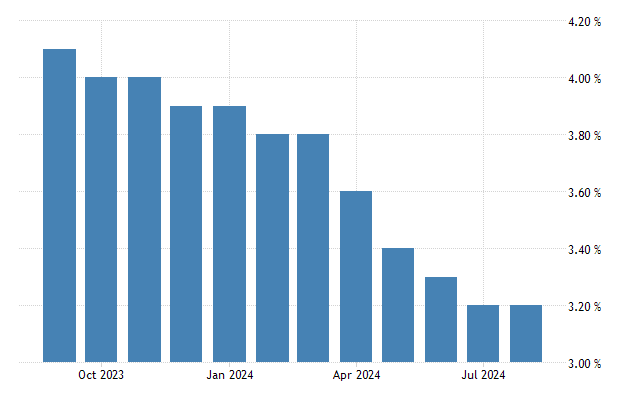

The September 2024 CPI report, set for release on October 10, is expected to show headline inflation easing to 2.3% year-over-year, down from 2.5% in the previous month. This reflects the continued moderation in price increases, especially in energy costs. However, core inflation (excluding food and energy) is projected to remain high at 3.2%, indicating persistent inflationary pressures in shelter and services. This combination of data will be crucial in shaping the Federal Reserve’s approach to future interest rate decisions.

Impact on the Federal Reserve’s Policy

The September 2024 CPI report will likely determine the Fed’s path forward:

- Higher-than-expected CPI: Persistent inflation could force the Fed to delay further rate cuts, reinforcing its current stance of cautious easing. This would likely strengthen the US dollar as traders anticipate higher yields.

- Lower-than-expected CPI: A significant drop in inflation would give the Fed more room to consider additional rate cuts in early 2024, weakening the US dollar and boosting risk-sensitive currencies like the EUR and AUD.

Forex Market Implications

US Dollar Strength: If inflation remains high, the Federal Reserve may maintain current rates longer, which would support the US dollar. Currency pairs like USD/JPY could see upward pressure as traders bet on higher yields.

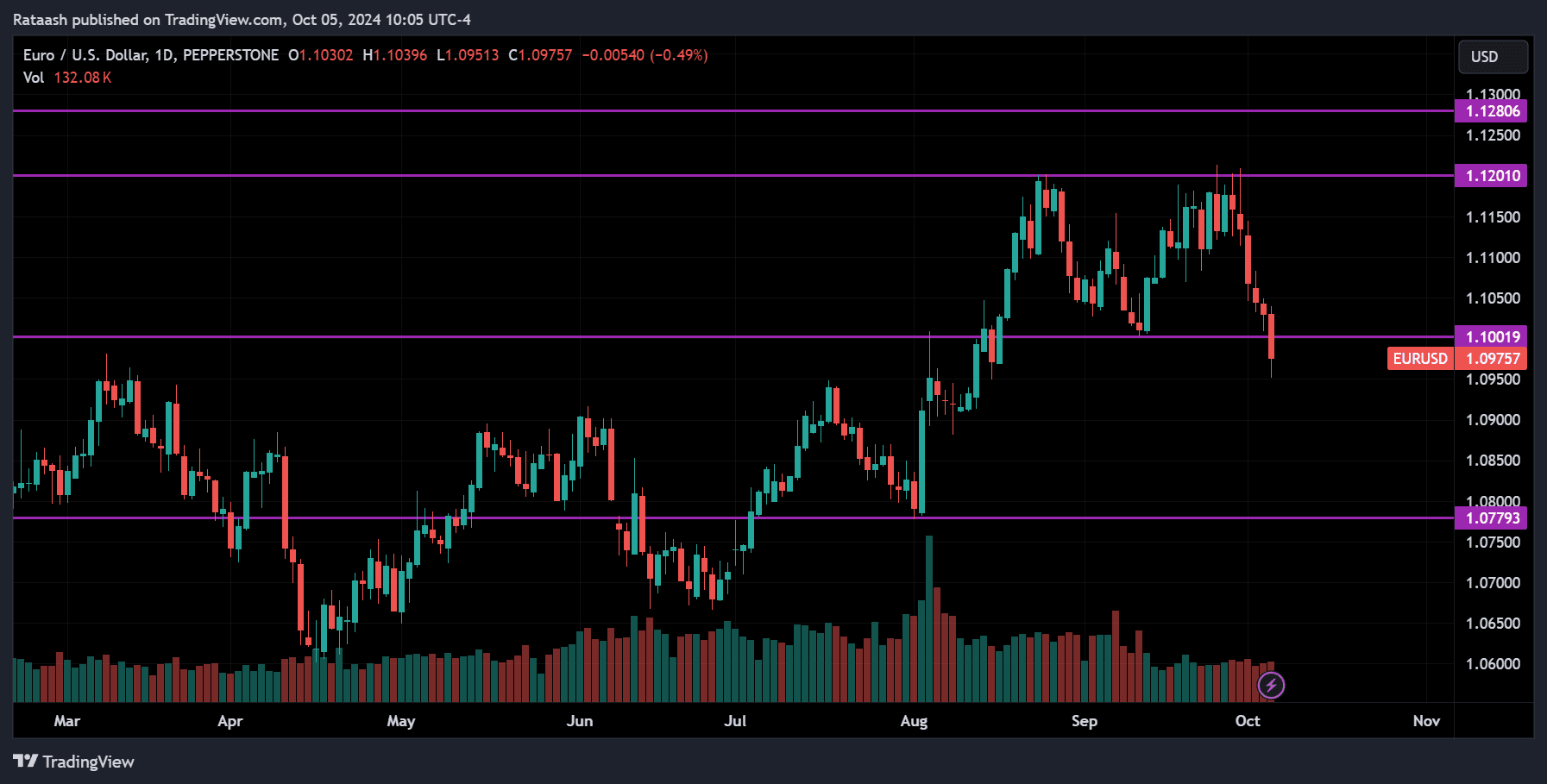

Volatility in USD Pairs: Pairs like EUR/USD and GBP/USD could experience significant volatility based on how the CPI data impacts future rate cut expectations. A lower CPI reading would likely push the dollar lower, benefiting the euro and pound.

Global Risk Sentiment: A dovish Fed stance driven by a lower CPI could boost global risk sentiment, benefiting currencies like the Australian dollar and New Zealand dollar. Conversely, persistent inflation could dampen risk appetite, favoring safe-haven assets like the yen.

Conclusion

The October 10 CPI report will be crucial for shaping expectations around future Federal Reserve policy decisions. Forex traders should prepare for heightened volatility, particularly in USD-related pairs, as this report could set the stage for the next phase of the Fed’s monetary policy and influence currency market movements well into 2024.