New to forex currency trading and looking for some good and simple but effective forex trading techniques? You’re in the best place.

In this quick and straightforward guide, we’ll give you a rundown of 7 simple forex trading strategies for beginners. Each one is straightforward to understand and suitable for anyone who’s building up their skills.

By taking their time to master these fundamentals correctly, you’ll make simple good trades with confidence. And you set yourself up to try more good advanced trading techniques down the line.

Forex Breakout trading

Breakout trading is a straightforward forex trading style, making it a good choice for beginners. Let’s look at how it works; let’s define the term “Forex breakout.”

Simply a “Forex breakout” is any price movement outside a marked support or resistance area. Forex Breakouts can occur when prices increase above Chart resistance areas, known as “bullish” breakout chart patterns. They can also happen when prices lower below support areas, known as “bearish” breakout patterns.

Breakout trading is an essential strategy because breakouts frequently represent the launch of increased market volatility. By staying for a break in a price position, we can use volatility to our use by joining a new trend when it begins.

With forex breakout trades, the target is to enter the market when the price makes a breakout move and continue to ride the trade until the volatility is over.

But when, exactly, should we enter the market?

Some forex pros advise diving at the moment a support or resistance level is breached. Others suggest waiting before long enough to ensure that the breakout does in fact, signal a true up or downtrend.

When placing your stop loss, place it above or below the breakout candle, at a minimum. This will help you to tie your bets to previous support or resistance levels.

Forex Moving average crossover

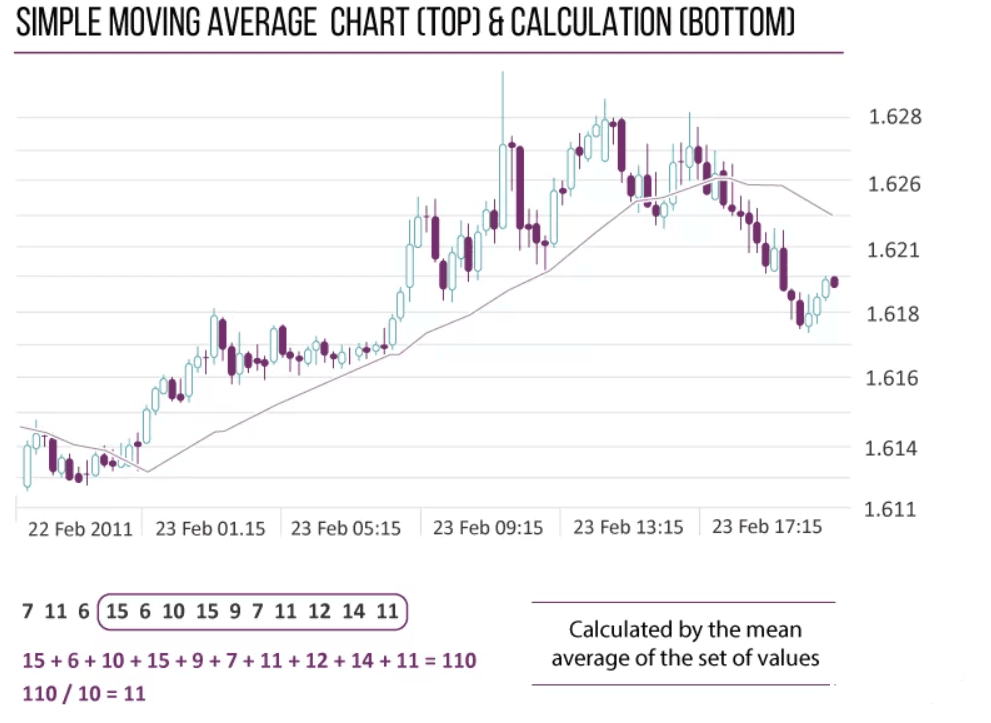

Moving average (MA) is a simple and easy technical analysis tool that smooths out price data by creating a constantly updated average price. That average can take over different periods – anything from 20 minutes to three days, to 30 weeks, or any other time a trader chooses.

Moving average strategies are viral and tailored to any time frame, suiting long-term forex investors and short-term traders.

A reason to create a moving average is to identify trend direction and determine support and resistance levels.

When currency prices cross over their moving averages, it often generates a trading signal for technical forex traders. For example, a trader might sell if a price bounces off or crosses the MA from above to close below the moving average.

Simple price crossovers

Price crossovers are one of the leading moving average trading forex strategies. A simple chart price crossover happens when a price crosses below or above a moving average, signaling a change in trend.

Using two moving averages

Other forex trading techniques use two moving averages: one shorter and one longer. When the shorter-term MA crosses over the longer-term MA, it’s a buy signal, as it shows that the trend is shifting up. This is commonly known as a “golden cross.”

On the other hand, when the shorter-term Moving average crosses below the longer-term MA, it’s a sell signal, as it shows that the trend is shifting down. This is widely known as a “dead cross” or “death cross.”

Carry trade

Carry trade is a simple type of forex trading whereby traders look to profit by taking good advantage of interest rate differentials between different countries. It is important to note that while it was popular, it can, however, be very risky.

This forex strategy works because forex currencies bought and held overnight will pay a forex trader the interbank interest rate (of that country from which the currency was bought from). A forex trader executing carry trade “borrows from” a low-interest-rate currency to fund the purchase of a currency that will provide a higher rate.

A trader using this forex strategy wants to profit from the very difference between the rates, which can be substantial depending on the leverage used.

Carry trade is one of many the most popular forex trading strategies in the forex market, but this trading style can be very risky; these trades are often highly leveraged and overcrowded.

Common trading pairs include the AUD/JPY and NZD/JPY because the interest rate spreads of those currency pairs are very high.

Suppose you’re very interested in maths. In that case, the daily interest from forex carry trade can be simply calculated as follows: interest Daily = [IR (long currency) – IR (short currency)]/ 365 x notional value.

Forex Fundamental analysis

In fundamental analysis, forex traders look at a country’s economic fundamentals to understand whether a currency is undervalued or overvalued. They also use the information to view how its value is likely to move relative to another currency in the future.

Fundamental analysis can be very complex, involving the many elements of a country’s economic data to indicate future trade and investment trends. It can be easily simplified by concentrating on a few major indicators.

Some of the most critical factors that can affect a country’s economy and currency include retail sales, CPI, industrial production, GDP, inflation, purchasing managers index data, housing data, and more.

Trend trading

Trend trading is another popular and good forex trading strategy. It’s also easy for new beginners to learn and follow.

The technique involves identifying a downward or upward trend in a currency price movement and then choosing trade entry and exit points. These points are based on positioning the currency’s price within the direction and the trend’s relative strength.

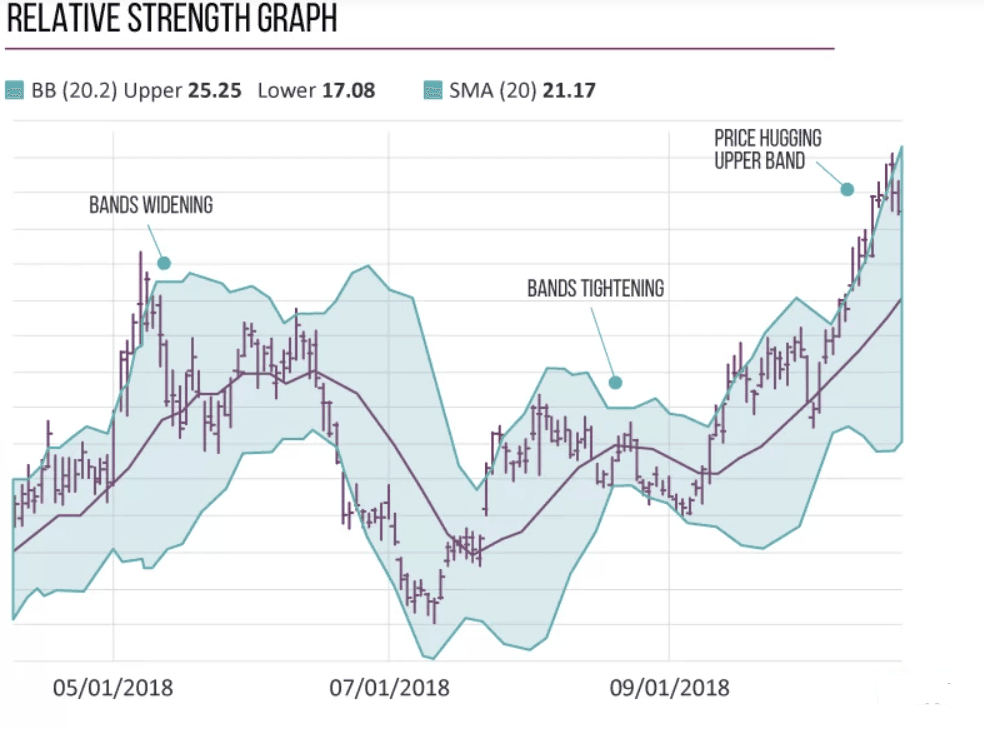

Trend traders use many different tools and indicators to evaluate trends, such as moving averages, relative strength indicators(RSI), volume measurements, directional indices, and stochastic.

Range trading

Range trading is a simple and popular trading strategy based on the idea that prices often hold within a steady and noticeable range for a given period. It’s most effective in currency markets with stable and noticeable economies and currencies that aren’t often used to surprise news events.

Range forex traders rely on being able to buy and sell at predictable highs and lows of resistance and support frequently, sometimes repeatedly over one or more trading sessions.

Range traders may use the same tools as trend traders to identify good trade exit and entry levels, including the relative strength index, the commodity channel index, and stochastic.

Forex Momentum trading

Momentum trading and Forex momentum indicators are based on the idea that strong chart price movements in a particular direction are a very good sign that a price trend will continue in that exact direction for some time.

Similarly, weakening movements will indicate that a trend has lost strength and could be headed for a reversal.

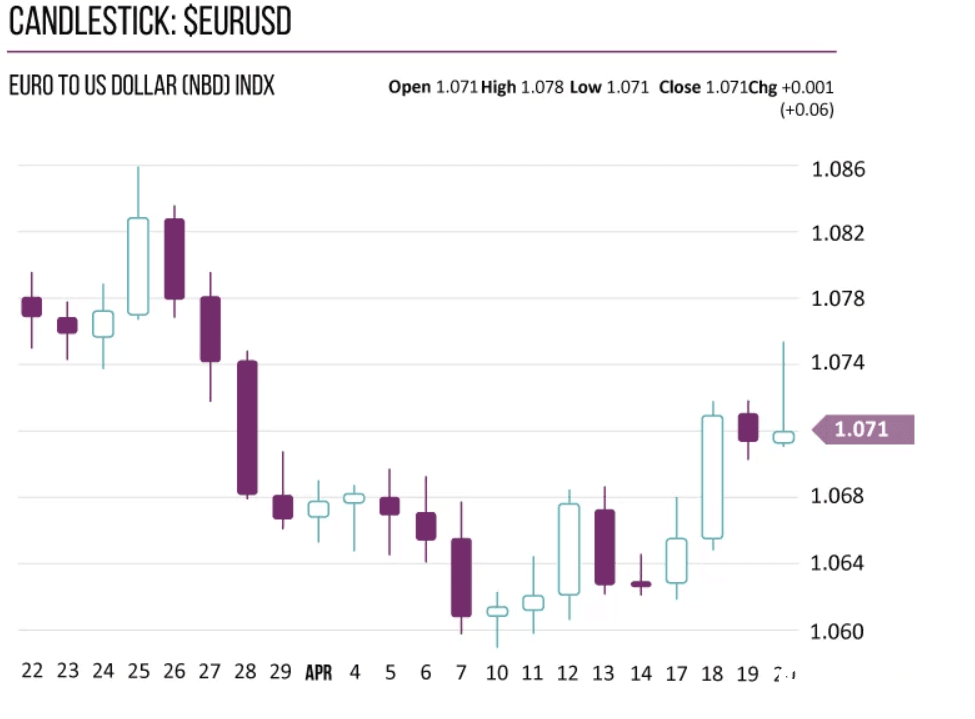

Momentum strategies may consider price and volume and often use visual analysis tools like oscillators and candlestick charts.

Read More: Forge Your Own Forex Trading Strategy

Download a Collection of Indicators, Courses, and EA for FREE

The biggest problem with this information is in lack of detailed discusion along with charting examples. when you put time into someting, make it with heart not just to get people visit.

[…] the transaction size based on your preference. Thus this feature will allow you to adjust your trading conditions according to your risk tolerance and market conditions.The EA works best on a 4-hour time […]

[…] the transaction size based on your preference. Thus this feature will allow you to adjust your trading conditions according to your risk tolerance and market conditions.The EA works best on a 4-hour time […]