Introduction We all know that a 100% winning breakout forex strategy is likely to come across if you’re aiming for a minimal amount of pips with a huge stop loss that can withstand months, even years, of the target getting hit. But what if I told you I have a system that produced positive pips 89% of the days traded over three months? And with an average daily pip profit of 31 pips, it’s my closest Strategy to a holy grail. That’s why I want to share it with you.

The Simple Breakout Forex Strategy

This system is based on a simple breakout concept that’s broken down into three times a day to set buy/sell entry orders. This can produce anywhere from 2-6 open trade positions, depending on forex market volatility, ranges, or trending days.

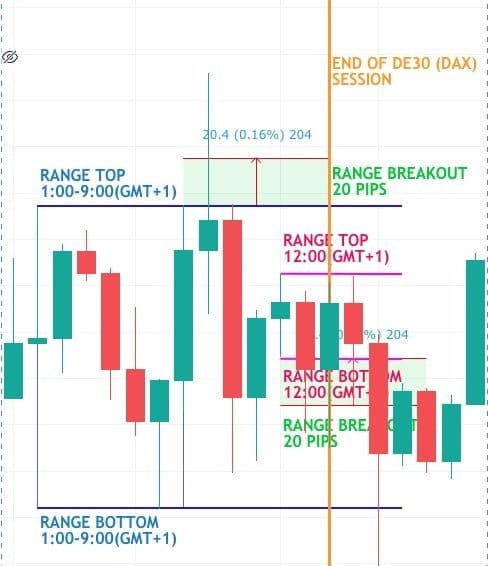

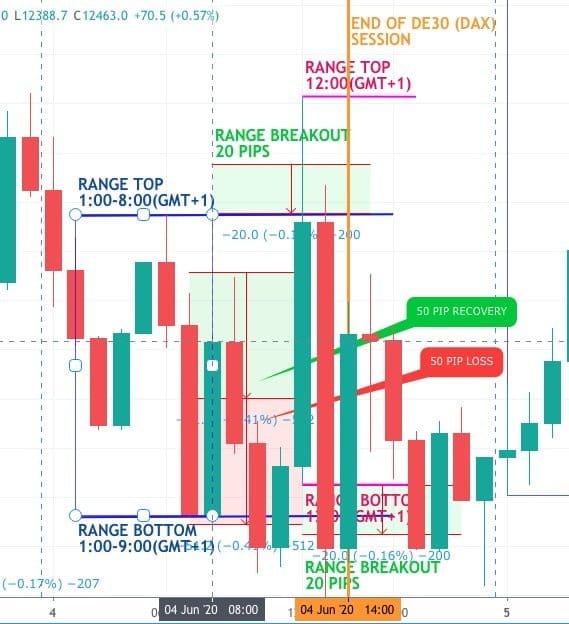

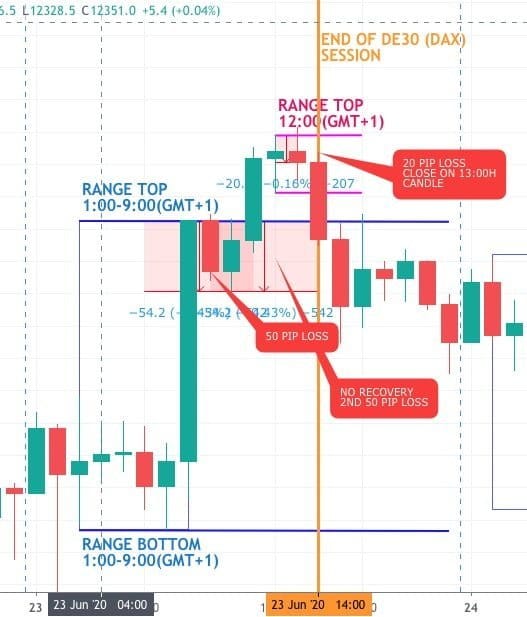

Example of this powerful range breakout forex strategy on the DE30 (DAX)

- Identify a range based on a set of hours each day or 1x1h candle.

- Set buy and sell entry orders at the top of each range.

- TP is always 20 pips, and SL is always 50 pips.

- Set an opposite market order at the bottom of our 50 pips SL (only if the order is opened). This is to recover our loss.

- The recovery Take Profit is always 50 pips with SL 50 pips.

- Close all positions when the next orders are set.

PART 1+2/3

Market: DE30 (DAX)

Range 1: 1:00-9:00(GMT+1)

Range 2: 12:00-13:00(GMT+1)

Range 1: Once we have identified our chart high and low during 1:00-9:00(GMT+1), we will set a buy entry order at the top and a sell entry order at the bottom of the range. In this chart example above, we broke out of the chart range, and Take Profit was cleared (we could have taken more good profit, but we are trying only to target 20pips each trade for consistency).

Range 2: This range is high and low for the 12h candles; again, we repeat the above process. Buy order at the top and sell order at the bottom. Furthermore, TP is always 20 pips. This time, we do not place a market recovery trade if our SL is hit, as it’s very rare that the 12h candle is more significant than 50 pips, so we just set our Stop Loss to the high/low and let the opposite chart trade open to recover 20 pips towards any losses.

Recovery Positions if Stop Loss is hit: All trades during this chart range have a 50 pip Stop Loss; once an order is opened, we set an opposite position where our Stop Loss for the current open trade is. The Take Profit this time is 50pips with a 50pip Stop Loss. This recovers any trade losses from the previous trade. So YES!! There will be days when we lose both open trades and end up with a 100 pip trade loss (this is very rare, as explained earlier, 88% of days end with profit, and with these losses taken into account, we still average a good +30 pip a day).

PART 3/3:

Market: NAS100 (NASDAQ)

Range 3: 8:00-15:00(GMT+1)

Range 3 is an identical copy of the DE30 range one trades. Identified our high and low during 8:00-15:00(GMT+1), we will set a buy order at the top and a sell order at the bottom of the range.

Recovery positions, if Stop Loss is hit: (Repeat range one recovery plan) all trades during this range have a 50 Pip Stop Loss; once an order is opened, we set an opposite position where our Stop Loss for the current open trade is. The Take Profit this time is 50pips with a 50pip Stop Loss. This recovers any losses from the previous trade.

Of course, there are going to be manual adjustments that are learned as you trade a strategy; just one example is if we don’t have a position open during the 1st range and one opens during the 2nd range chart breakout where the TP is in the middle of where the 1st range breakout TP would be, we could always extend the open positions TP to match the 1st positions.

We hope you all enjoy this post as much as We have traded it; it’s the first system in which I have a lot of faith.

My favorite part is the simplicity; you don’t need to watch the screen for hours.

1. Set an alarm on your smartphone 10 minutes before range hours close, draw your range from highs and lows, and set orders.

2. Wait for an alert then one has been opened.

3. Place recovery trade if it’s during ranges 1 or 3.

4. Enjoy your day, get off with your life and leave the forex market to do the rest.

Read More How to Trade Forex DOUBLE BOTTOM PATTERN

Is this strategy applied for all forex pair, admin ?

Hey man, you say your sharing the strategy but there is no link present!

This is market base strategy brother. There is no indicators need.

[…] Resistance Breakout Arrows Indicator For MT4 is essential for intraday forex traders using a breakout strategy. The indicator combines Fractal, CCI, and RSI to provide forex traders with the best BUY and SELL […]