The Simple Bearish Pennant Chart Pattern Forex Trading strategy is a perfect price action trading system that, as a new forex trader, you should have in your trading arsenal.

Different trading setups and situations on your mt4 charts call for other trading systems to be used, and if a forex bearish pennant chart forms, you can use this fx trading system.

The bearish pennant chart pattern forex strategy is the complete opposite of the previous bullish pennant chart pattern forex trading strategy.

Here’s why:

you use the bearish pennant chart trading in a downtrend, and you use a bullish pennant chart pattern in an uptrend.

So what is Bearish Pennant forex Chart Pattern, then? What does it look like?

The Anatomy of The Forex Bearish Pennant Chart Pattern

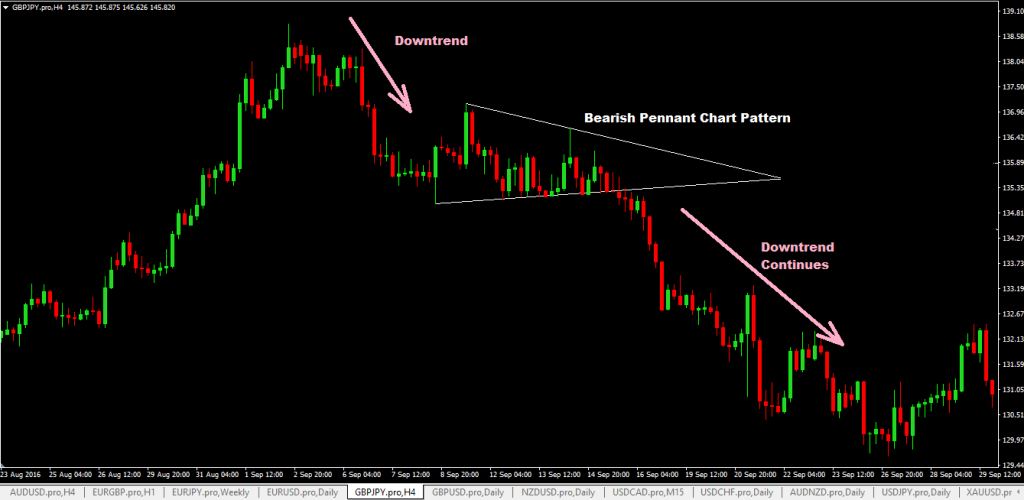

You should expect to see simple bearish pennant chart patterns form in a downtrend.

Here’s what happens:

- a downtrend starts, and chart price starts falling

- After some time, the price will slow down and consolidate, and it is during this time that bearish pennant chart patterns can form.

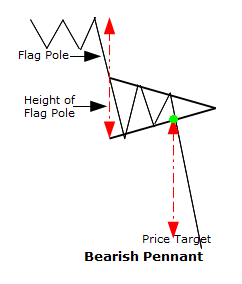

- The three important parts of the bearish pennant chart pattern are the flag pole, the height of the flag pole, and the price target. The chart below shows these:

Here’s what a real-life bearish pennant forex chart pattern looks like:

How To Trade The Forex Bearish Pennant Chart Pattern

There are two ways of simple options where you can trade the forex bearish pennant chart pattern:

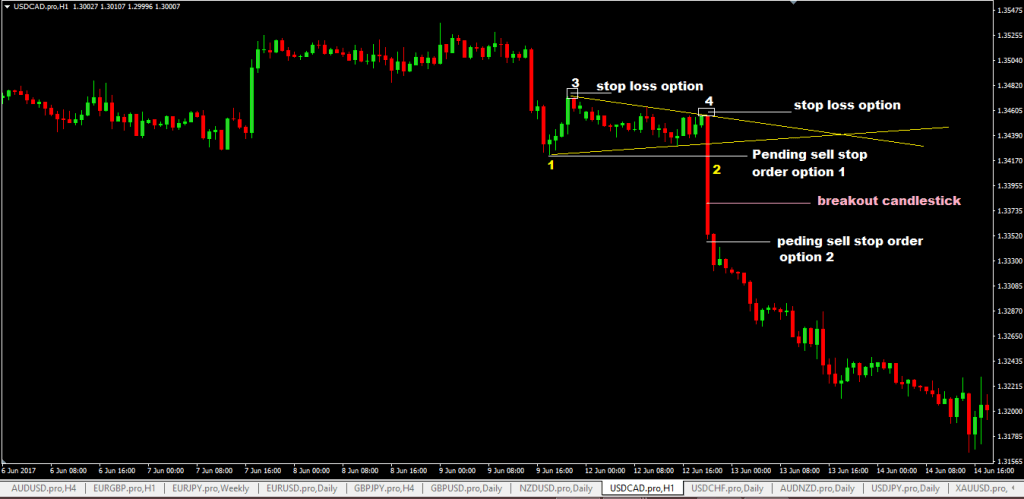

Option 1: Trade the chart breakout of the lowest point of the chart pattern as shown by one on the chart below.

Option 2: trade the breakout candlestick shown by two on the chart below.

Stop-loss can be placed at either three or 4, as shown below.

We will go into detail about Option 1:

- Place a pending sell stop order two pips below the lowest point in the chart pattern.

- place your stop loss(SL) 5-10 pips above point 3

- To take the profit target, use the height of the pattern flag pole to calculate it or use risk: reward (R: R) of 1:3 or use a previous swing low level.

Here’s Option 2:

- place a pending sell stop order two pips below the low of the chart breakout candlestick

- place stop loss(SL) 5-10 pips above the high of the breakout candlestick

- The take-profit calculations would be the exact same as those of option

Advantages of The Simple Bearish Pennant Chart Pattern Forex Strategy

- The risk: rewards are suitable for this simple trading system if your trade works out as anticipated.

- The strategy trading rules are very simple and easy to execute.

Disadvantages of The Simple Bearish Pennant Chart Pattern Forex Strategy

- New forex traders may at first have a bit of difficulty identifying the bearish pennant chart pattern because it can be tough to see unless you are looking for it.

- if the breakout chart candlestick is too long, your stop loss distance is also going to be large, so you should avoid trading such

Read More : Daily Candlestick Breakout Forex Trading Strategy

Thanks Admin.