The Bollinger Bands mt4 Indicator 5 Minute Forex Scalping Strategy is a straightforward scalping system that you can use to scalp the forex trading market when the market is in a trending flat.

You sell when the price touches the upper Bollinger bands, and you buy when the chart price touches the lower Bollinger bands.

For the middle Bollinger band, when chart price touches it, you move your stop loss to break even.

Trading Requirements & Parameters

Timeframe: 5 minutes

Currency Pairs: EURUSD, GBPUSD

Indicator: Bollinger bands (with default settings)

Trading Sessions: trade only during London and New York mt4 Trading Sessions

Ok, when the Bollinger bands forex indicator, there are three lines, and each of these three lines serves a purpose in this 5-minute scalping system:

- the upper Bollinger band is used for selling or taking profit from a buy trade made from the lower band

- The lower Bollinger band is used for buying or taking profit from a sell trade made from the upper band.

- The middle line is a 20 simple moving average forex indicator, and you use this for moving your stop loss(SL) to breakeven (so now your trade is very much risk-free).

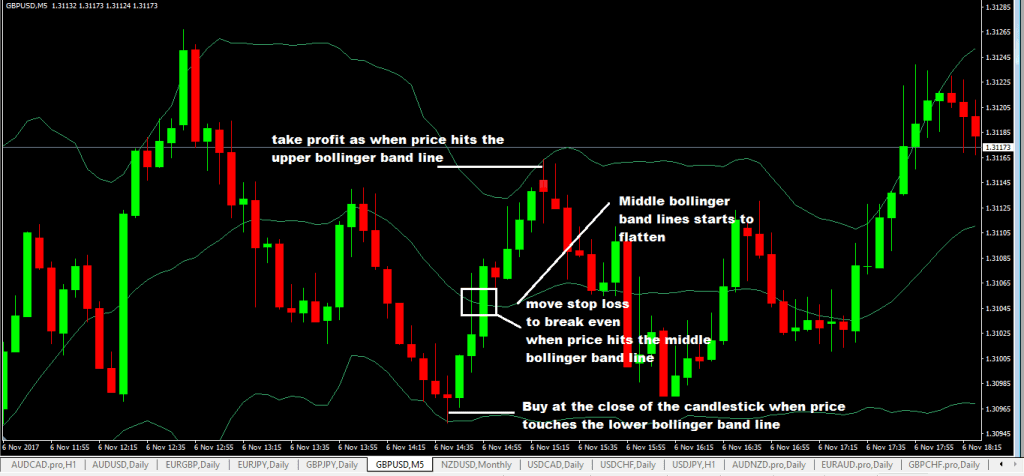

Strategy Buying Rules

- Middle Bollinger band must be flat or just starting to get flat.

- Chart price then hits the lower Bollinger band line later.

- At the close of the chart candlestick, you can execute a buy market order or place a buy stop pending order one pip above the high of the candlestick.

- for stop loss, place it ten pips outside of the lower Bollinger band line

- and take profit when the price hits the mt4 upper Bollinger band line (do not wait for the candlestick to close, as soon as the price hits the upper band line, take your profit as quickly as possible)

- Trade management: when the price goes up and hits the middle Bollinger band line, move your stop loss(SL) to break even (so this becomes a very much risk-free trade).

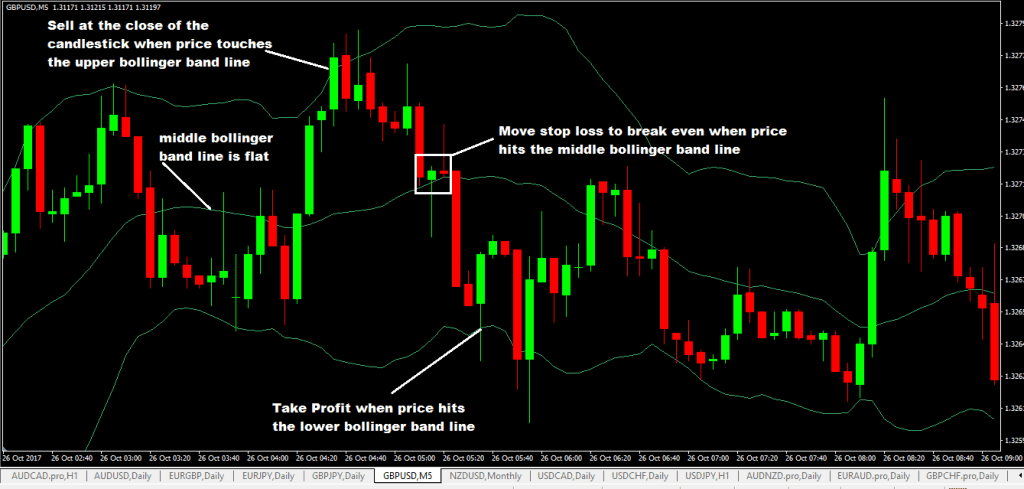

Selling Rules

- Middle Bollinger band must be flat or starting to get flat.

- wait for when chart price then hits the upper Bollinger band line sometime later

- At the close of the chart candlestick, you can execute a sell market order or place a sell stop pending order one pip below the candlestick’s low.

- for stop loss, place it ten pips outside of the lower Bollinger band line

- and take profit when the chart price hits the lower Bollinger band line (do not wait for the candlestick to close, as soon as the price hits the lower band line, take your profit as quickly as possible)

- Trade management: when the price goes up and hits the middle Bollinger band line, move your stop loss(SL) to break even (this is a risk-free trade).

Another Way To Trade This Simple Forex Scalping Strategy

- When the price touches the mt4 upper Bollinger band line, instead of executing a sell mt4 market order or placing a sell stop order under any candlestick’s low, why not wait for one of these bearish forex reversals candlesticks patterns to form? And then use this to place your sell stop order.

- Similarly, but on the opposite, place a buy stop order only when you see a bullish chart reversal candlestick pattern form when the price touches the lower Bollinger band line.

Disadvantages of The Bollinger Bands 5 Minute Forex Scalping Strategy

As in any mt4 forex trading strategy, each trading system has its disadvantages mainly due to the market conditions; for example, a trend trading system will perform a bit poorly in a flat or ranging market.

Here are the disadvantages of this simple scalping forex trading strategy:

- This forex scalping system will perform poorly in a strong trending market.

- sometimes when the price hits the upper or lower forex Bollinger band lines, it will keep going for a while before reversing

- The risk: reward(R: R) may not be great if the range is between the upper and lower mt4 Bollinger band line too narrow, so it may be advisable to consider this before you place a trade.

Advantages of The Forex Scalping Strategy

- In a flat or ranging market, this system has the big potential to perform well.

Good

[…] indicator follows the principles of traditional Bollinger Bands. It uses standard deviation and moving averages to plot the […]