The floor trader’s method forex trading strategy is, in my opinion, one of the best moving average trading strategies around.

Here, we will put our twist on it, and you will learn its simple trading rules and what the mt4 trading setup looks like so you can spot and trade it.

What Is The Forex Floor Traders Method?

The floor traders method trading strategy is a reversal continuation method.

What does that mean? Well, what the reversal continuation forex method means is this:

- the forex market has already established its way, either up or down

- And there will do a forex minor reversal that fails, and then the price continues originally.

And the key to this simple strategy is trying to buy or sell when a minor reversal occurs.

To determine these two factors above, you need:

- Moving average cross-overs to establish trends. The moving averages typically used are the nine exponential and 18 exponential moving averages.

- Once these two exponential moving averages cross over, it indicates a change in trend:

- if the faster nine ema crosses the 19 ema to the upside, it indicates that the trend is up

- if the faster nine ema crosses the 19 ema to the downward, it indicates that the trend is down

So, how do you buy entry and sell on the crossover? Nope. You see,

The best thing about this trading strategy is you wait for a retrace or minor chart reversal to happen against the market trend, and when that happens, you keep your eye open for a forex reversal chart candlestick pattern to form: this gives you the buy or the sell signal.

We may be confusing you here, but once you see the charts below, you will begin to understand how good the floor traders’ method forex trading strategy is.

Required MT4 Timeframes To Trade

You can trade any mt4 timeframes using this strategy.

For currency pairs, smaller spreads/tight spreads can use even a 1-minute timeframe, but we advise against using the floor traders method on currency pairs with large spreads on 1-minute and even 5-minute timeframes.

MT4 Currency Pairs To Trade

You can use the forex floor traders method to trade any currency pair.

The only thing We’ve mentioned above is that if you are trading currency pairs that have large spreads, use at least a 15-minute timeframe and above.

MT4 Forex Indicators Used

The forex floor traders method is based on the nine ema and the 18 ema, but you can try other moving averages (MA) combinations like:

- 7 ema & 14 ema

- or ten ema and 20 ema

- or 25 ema and 50 ema

The simple trading rules will still be the same.

Forex Price Action Trading Signal To Buy Or Sell

It is suggested that you know these 12 fantastic forex reversal candlestick patterns as they are the ones you will look for to buy or sell when they form.

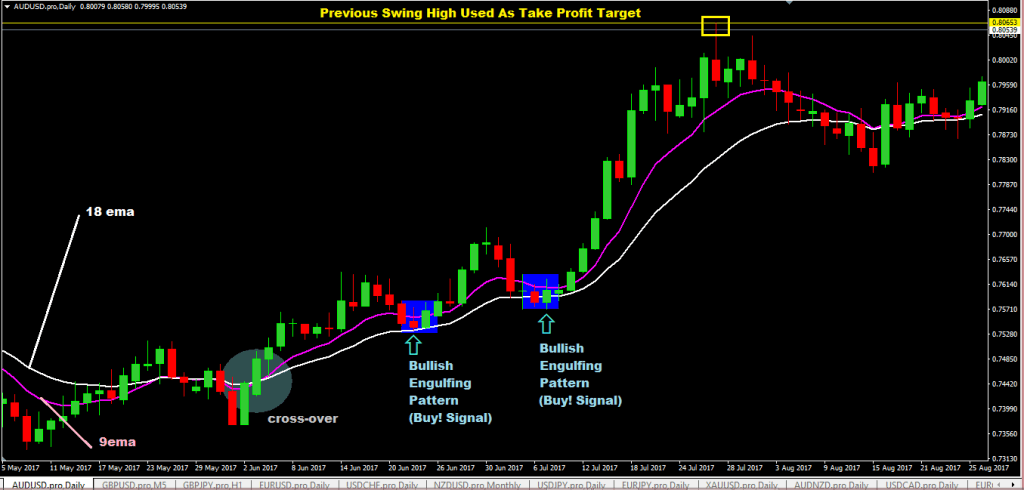

Buying Rules

- Nine ema crosses 18 ema to the upside, signaling that the trend is up. You want to see price move away entirely from the two ema lines as if away from them, but later, it will reverse back and come down and touch one or both of them.

- As soon as the price comes back and touches the ema’s, watch for a “bounce” up the signal from a bullish reversal chart candlestick pattern.

- Put a buy stop order 1-2 pips above the high of the chart bullish reversal chart candlestick pattern.

- Place stop loss(SL) at least 5-10 pips below the low of the bullish reversal candlestick pattern

- To take profit target(TP), We suggest you aim you use previous swing highs or if not, use risk: reward(R: R) of 1:3 and calculate where to take profit(TP).

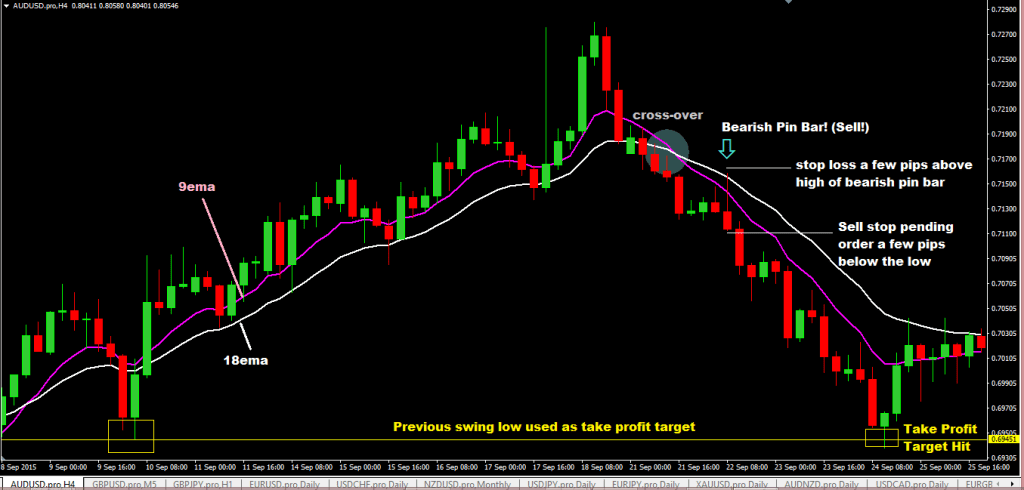

Selling Rules

- 9ema crosses 18ema to the downward, signaling that the trend is down. You want to see price move away entirely from the two ema lines as if away from them, but later, it will reverse back and come up and touch one or both of them.

- Watch for a “bounce” down entry signal from a chart bearish reversal chart candlestick pattern as soon as the market price comes back and touches the emas.

- Put a sell stop order 1-2 pips below the bearish reversal chart candlestick pattern below the low.

- Put stop loss at least 5-10 pips above the high of the bearish reversal candlestick pattern.

- To take profit target, we suggest you aim you use previous chart swing lows or if not, use risk: reward(R: R) of 1:3 and calculate where to take profit(TP).

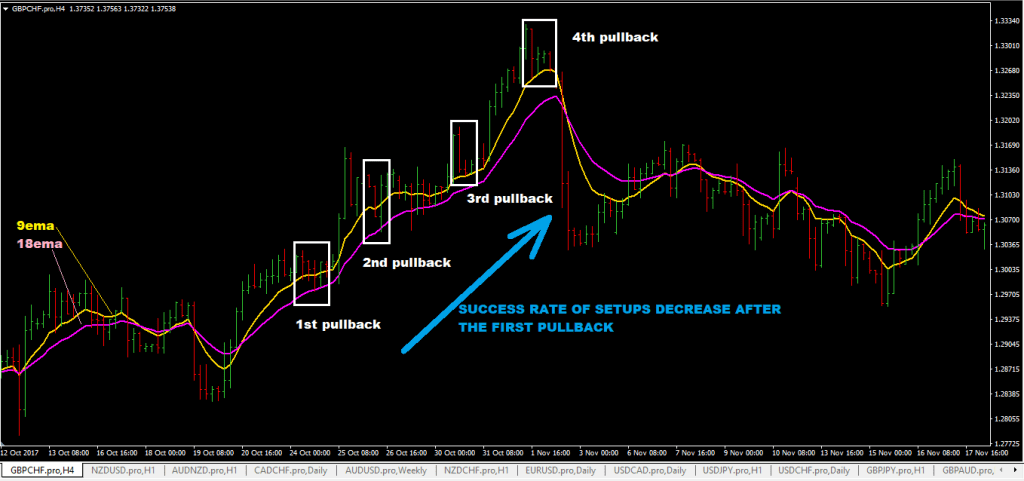

The Different Levels Of Trade Setups

Different levels of chart setups come with varying degrees of success.

The highest percentage of success in the forex floor trader setups comes from those first chart pullbacks after the 9ema and 18 ema crossovers. And after that, each chart setup that forms has less chance of being profitable.

This mt4 chart below should clarify what we are writing here:

So, this means you need to aim to only trade the 1st chart pullback or possibly the 2nd chart pullback.

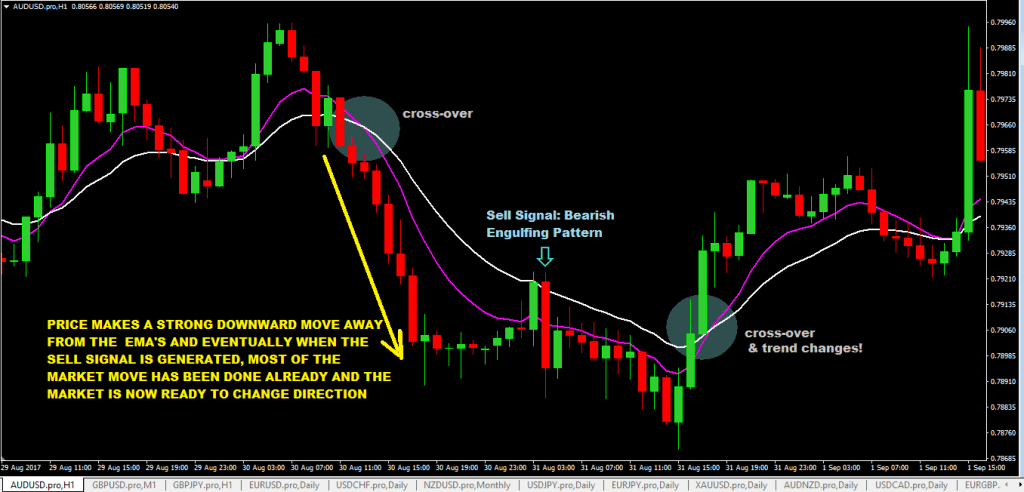

Disadvantages of The Forex Floor Traders Method Trading System

- This is a trend trading strategy, so when the market is not trending, this strategy will perform very poorly.

- Sometimes, the price will escape from the exponential moving average indicators for a long time. When touching them to give a buy entry or sell signal, most of the market moves have already happened, so when you see such a situation, avoid trading it. The chart below shows an example of what we are talking about:

Advantages of The Forex Floor Traders Method Trading Strategy

- works well in a forex trending market

- When used with larger mt4 timeframes like the 4 hr and the daily, the potential to make 99 to 200 – even 500 pips profit is there if you can manage your trade correctly and ride out the trend.