The Day Trading Simple Breakout Strategy is designed to help traders capitalize on market movements within a single trading day. This strategy leverages the power of channel breakouts and Bollinger Bands Width to filter trades, making it a robust choice for day traders. Additionally, it is suitable for multi-position trading and can be effectively utilized in a martingale approach. The strategy is particularly effective during the London and New York trading sessions, when market volatility tends to be higher.

Simple Breakout Strategy Overview

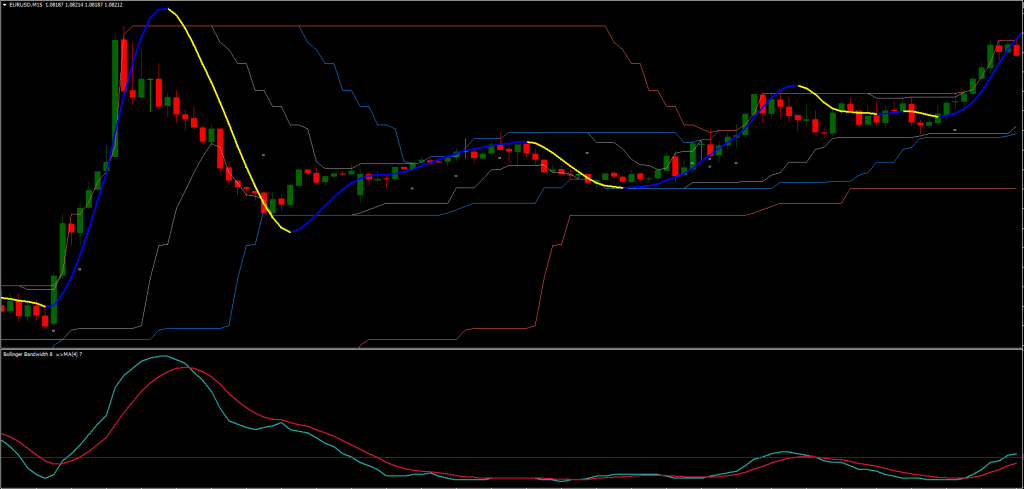

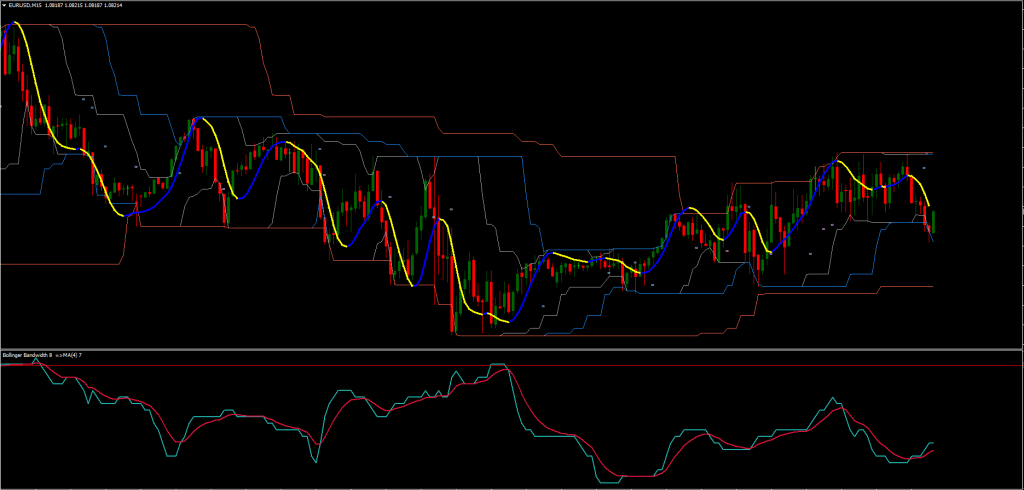

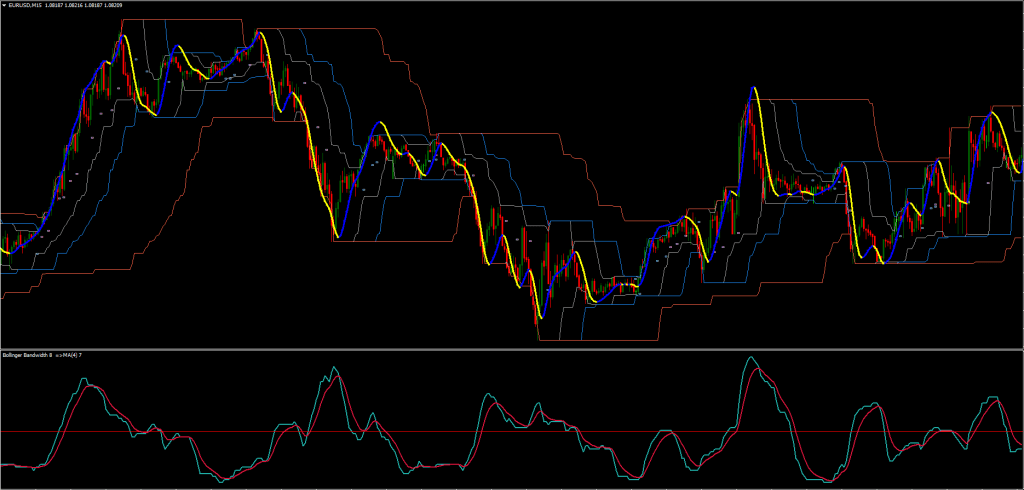

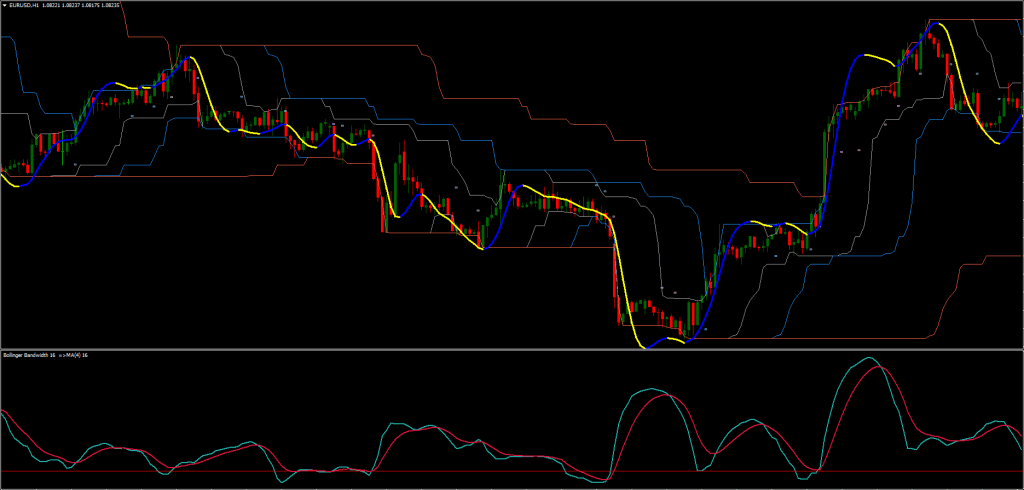

- Channel Breakout: This indicator identifies potential breakout points in the market, allowing traders to enter trades when the price moves beyond a certain threshold.

- Bollinger Bands Width: This serves as a filter, ensuring that trades are only taken when there is sufficient market volatility. The width of the Bollinger Bands indicates the degree of price volatility.

- Scalper Indicator: This indicator helps confirm trade entries and exits based on its color changes.

This Simple Breakout Strategy is entirely manual. The indicators produce the signals, but any decisions to enter the market and set protection or profitable exit stops will depend on the trader. Therefore, the trader must be familiar with the principles of risk and reward and use initial support and resistance areas to set entries and exits.

This Day Trading Strategy can give you trading signals you can take as they are or add your additional chart analysis to filter the signals further, which is recommended. While traders of all experience levels can use this system, practicing trading on an MT4 demo account can be beneficial until you become consistent and confident enough to go live.

You can set Simple Breakout Strategy to send you a signal alert. This is helpful as it means you do not need to stare at the charts all day, waiting for signals to appear, and you can monitor multiple charts simultaneously.

This Day Trading Strategy can be used on any currency pair and other assets such as stocks, commodities, cryptos, precious metals, oil, gas, etc. You can also use it on any time frame that suits you best, from the 1-minute to the 1-month charts. Works best on 15M TimeFrame.

Download a Collection of Indicators, Courses, and EA for FREE

Trading rules for this Day Trading Strategy

Remember to tighten your Stop Losses around High Impact News Releases or avoid trading at least 15 minutes before and after these events when using the Day Trading Strategy.

As always, to achieve good results, remember about proper money management. To be a profitable trader, you must master discipline, emotions, and psychology. It is crucial to know when and when not to trade. Avoid trading during unfavorable times and market conditions like low volume/volatility, beyond major sessions, exotic currency pairs, wider spread, etc.

Buy Signal

- The Bollinger Bands Width is above the filter level, indicating increased volatility.

- The Scalper indicator displays a blue line.

- The Channel Breakout indicator shows a grey dot below the price, signaling a potential upward breakout.

Sell Signal

- The Bollinger Bands Width is above the filter level, confirming adequate market volatility.

- The Scalper indicator displays a yellow line.

- The Channel Breakout indicator shows a grey dot above the price, indicating a potential downward breakout.

Exit Strategy

- Exit the trade when the Scalper indicator changes color, which suggests a potential reversal or end of the current trend.

- Alternatively, exit at a predetermined profit target to lock in gains.

- An initial stop loss should be set between 12 to 18 pips, depending on the currency pairs being traded. This helps manage risk and protect capital in case the market moves against the trade.

Conclusion

The Day Trading Simple Breakout Strategy offers a systematic approach to day trading, combining the strengths of channel breakouts and Bollinger Bands Width. By following the clear trading rules and utilizing the recommended indicators, traders can enhance their chances of success in the market. Whether you are a novice or an experienced trader, this strategy provides a reliable framework for capturing market movements within a single trading day.