Swing trading in the Forex market revolves around capturing gains in a currency pair over a few days to several weeks. Trend following, one of the most popular swing trading strategies, involves identifying and following the prevailing market direction. This strategy capitalizes on the momentum of a trend until it shows signs of reversal.

Table of Contents

Understanding Trend Following

Trend following is based on the principle that markets often move in trends. A trend is a consistent movement in a single direction—either upward (bullish) or downward (bearish). Trend followers aim to identify these trends early and ride them until there are indications of a reversal.

Idea Behind Forex Trend Following Strategy

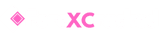

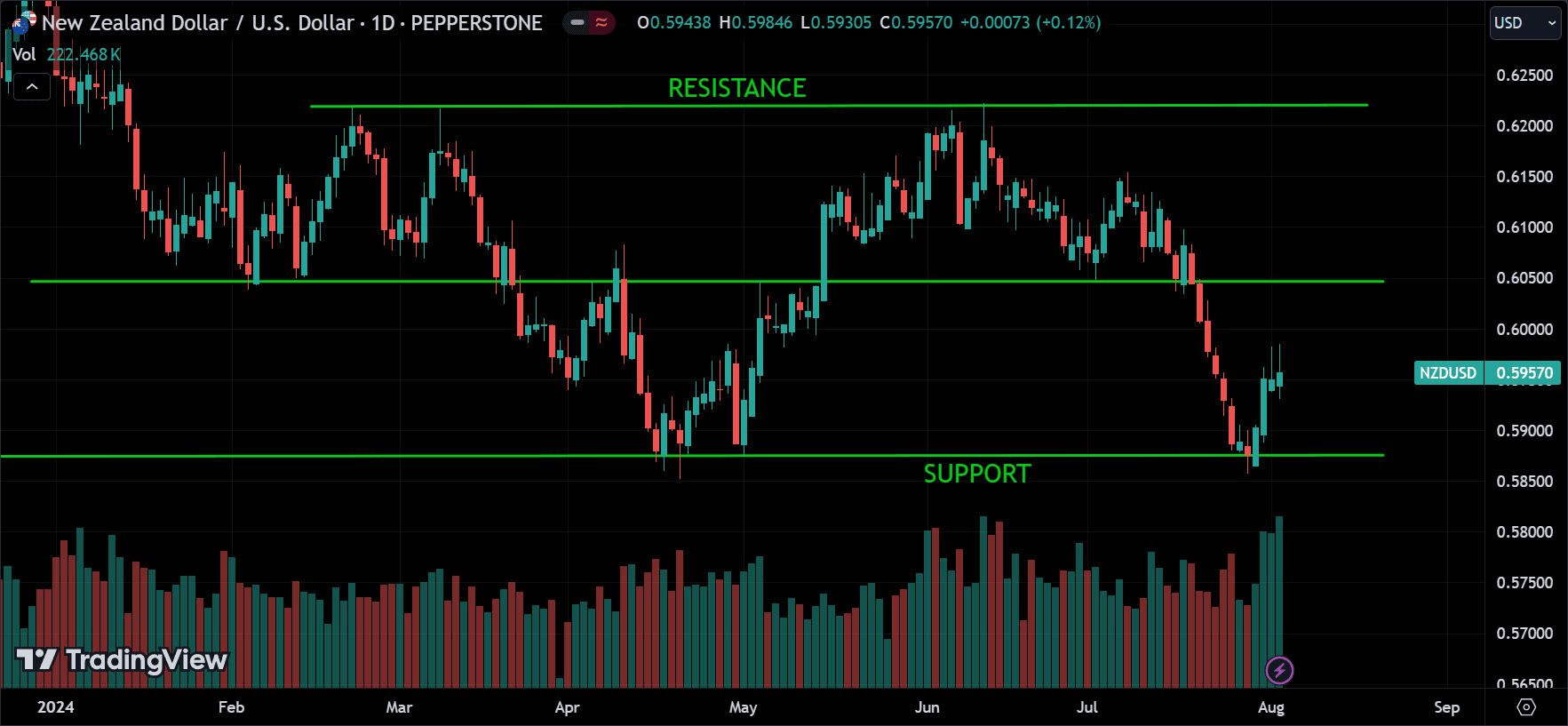

The idea behind the trend-following strategy is simple: prices move in trends, and these trends last for a certain period. Our goal is to capitalize on these movements. There are three main types of trends: uptrend, downtrend, and sideways trend (also known as a ranging market). This strategy focuses on using both uptrends and downtrends.

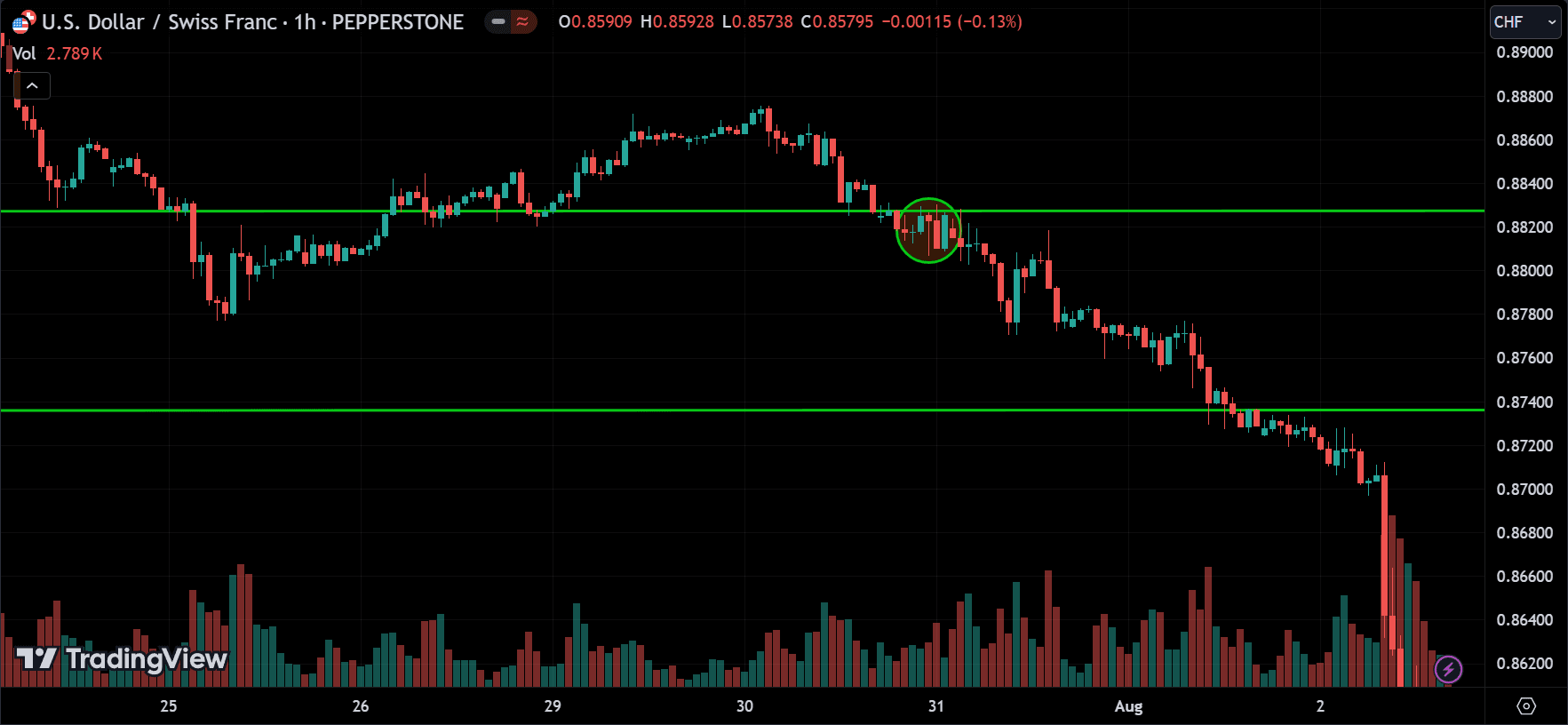

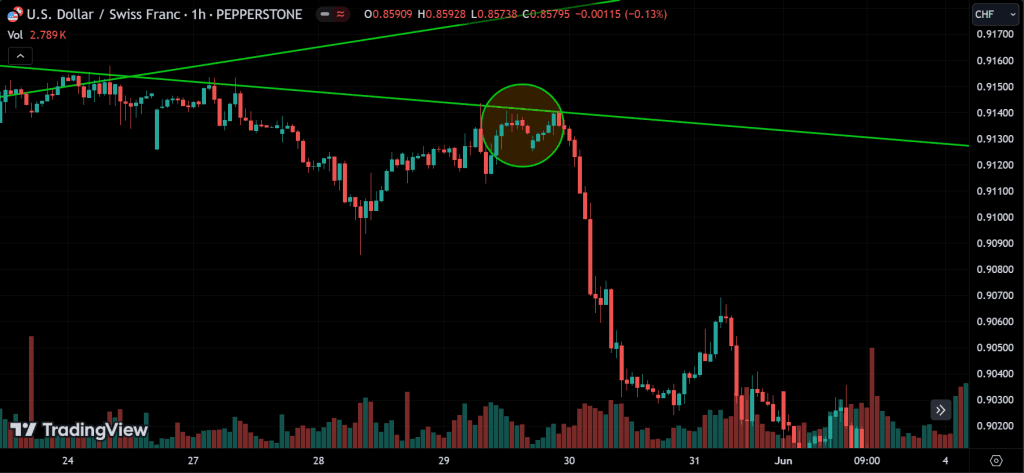

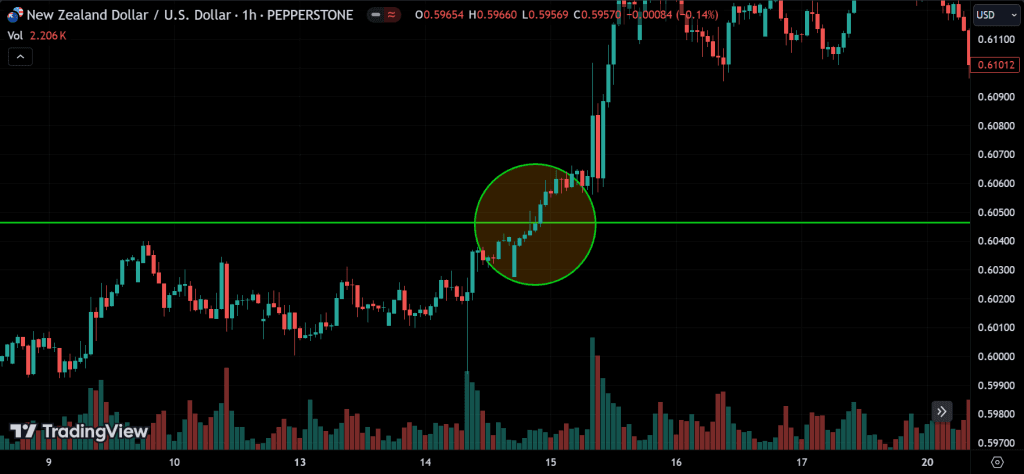

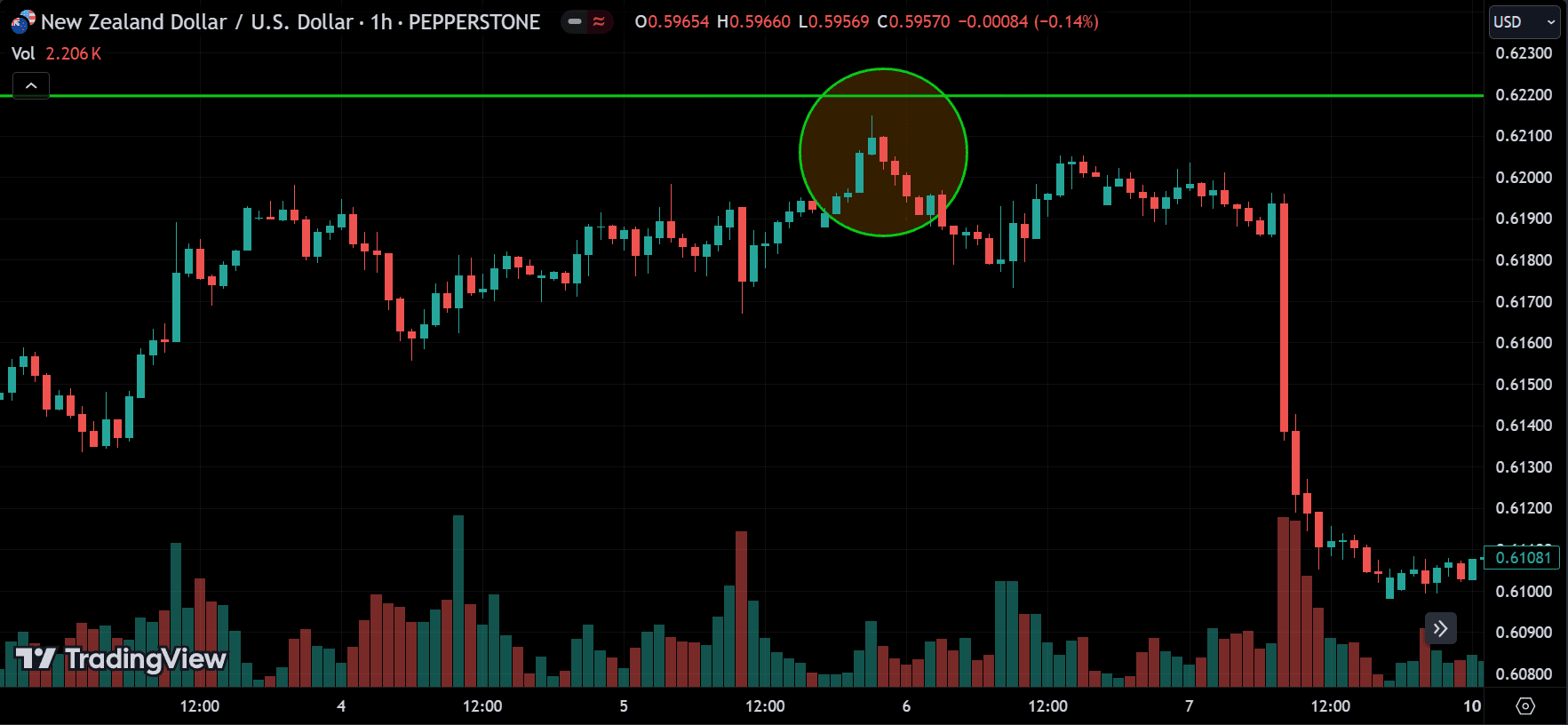

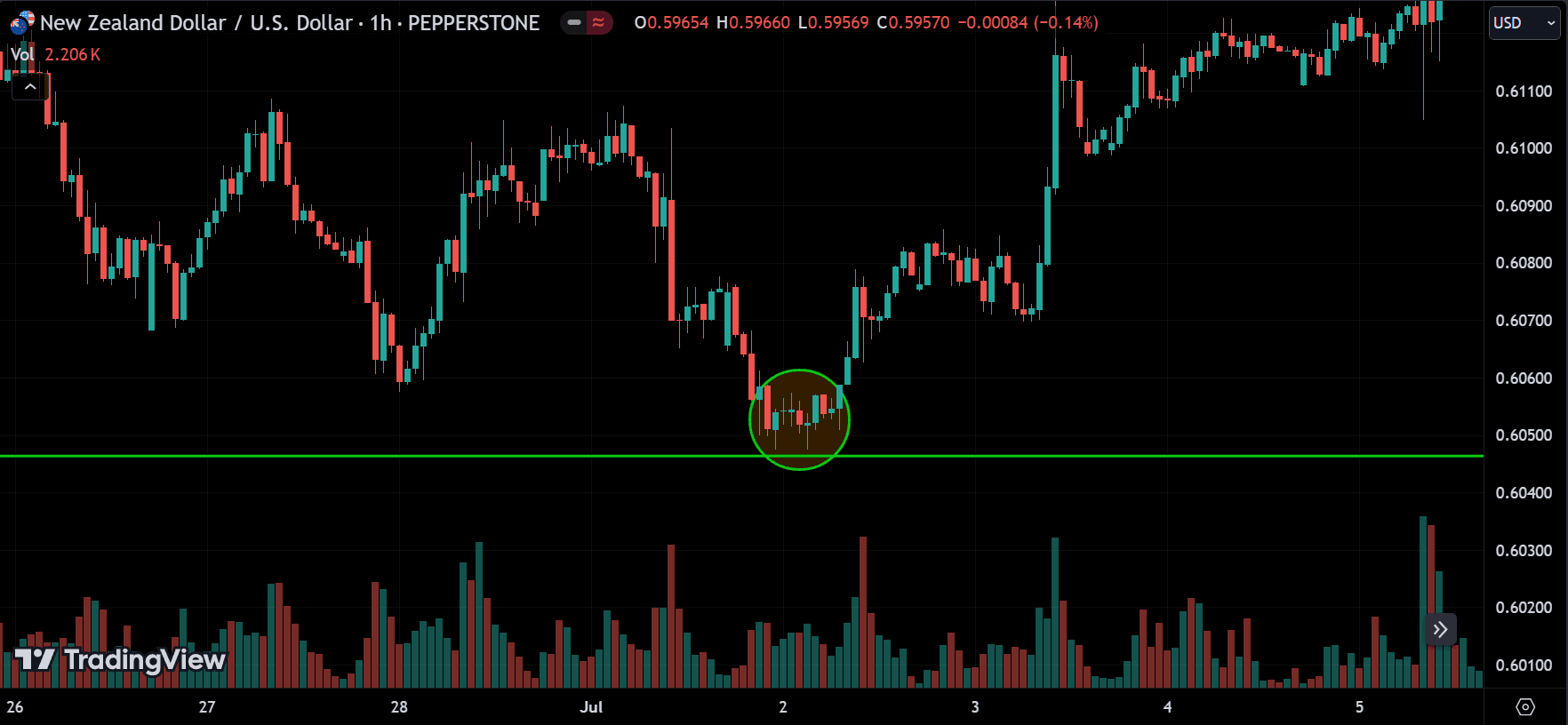

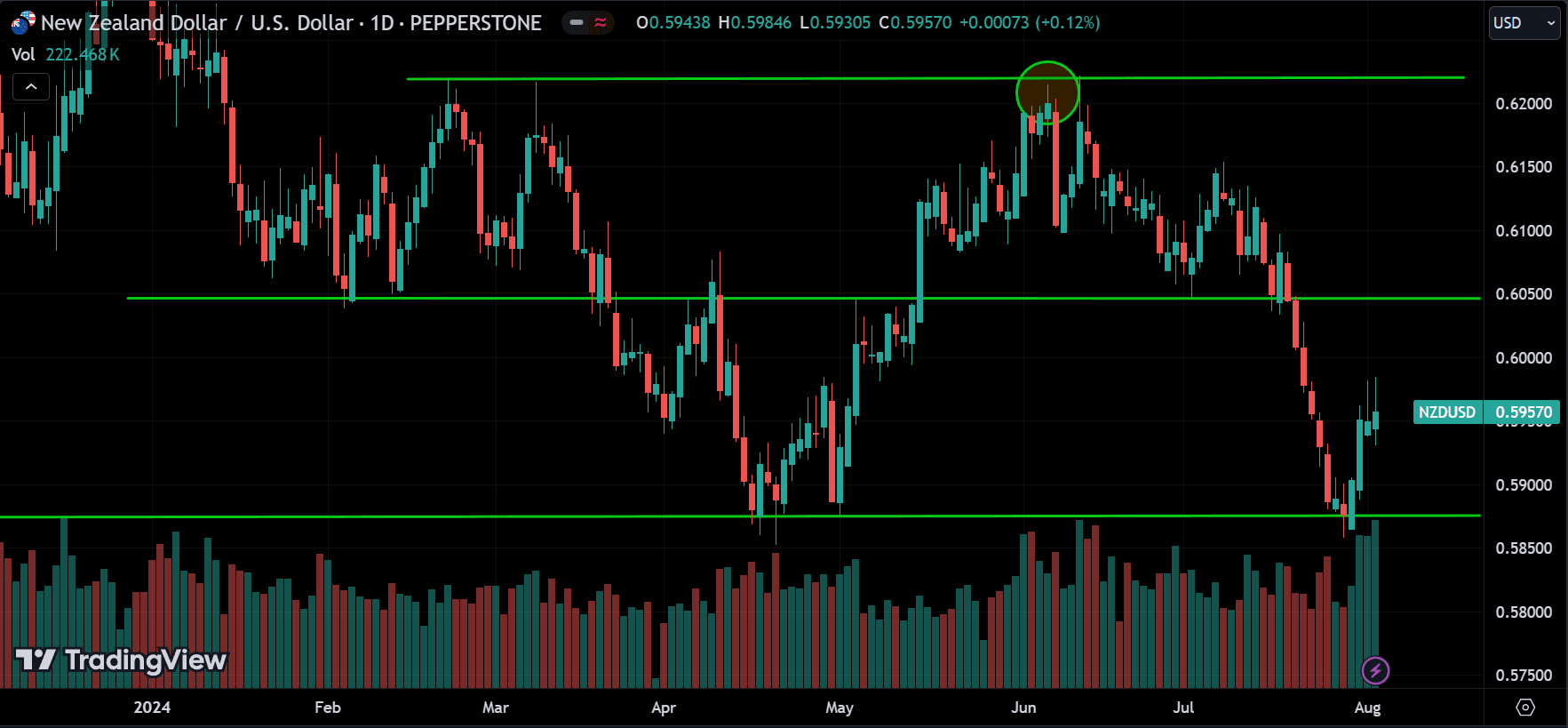

Price changes direction at major support and resistance levels. Our job is to identify these levels and determine which trend the market is currently experiencing. If the price makes higher highs and higher lows, the market is in an uptrend. If the price makes lower lows and lower highs, the market is in a downtrend.

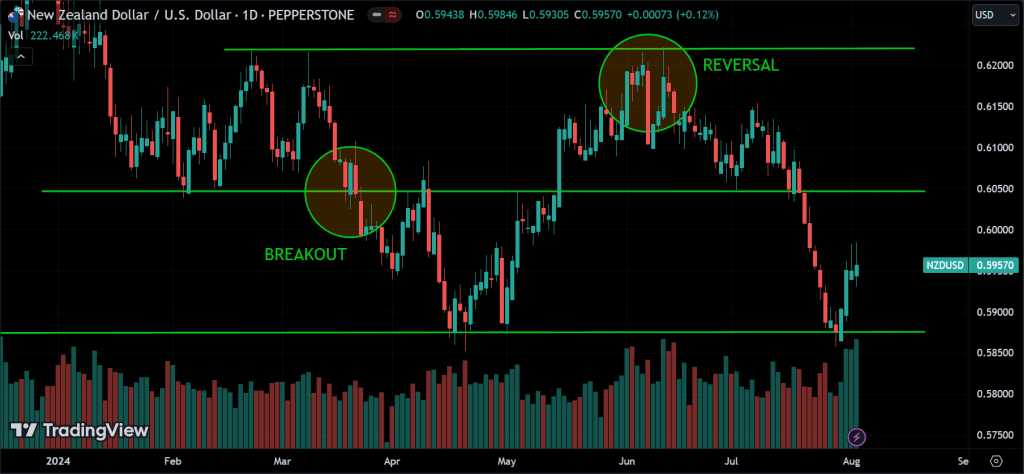

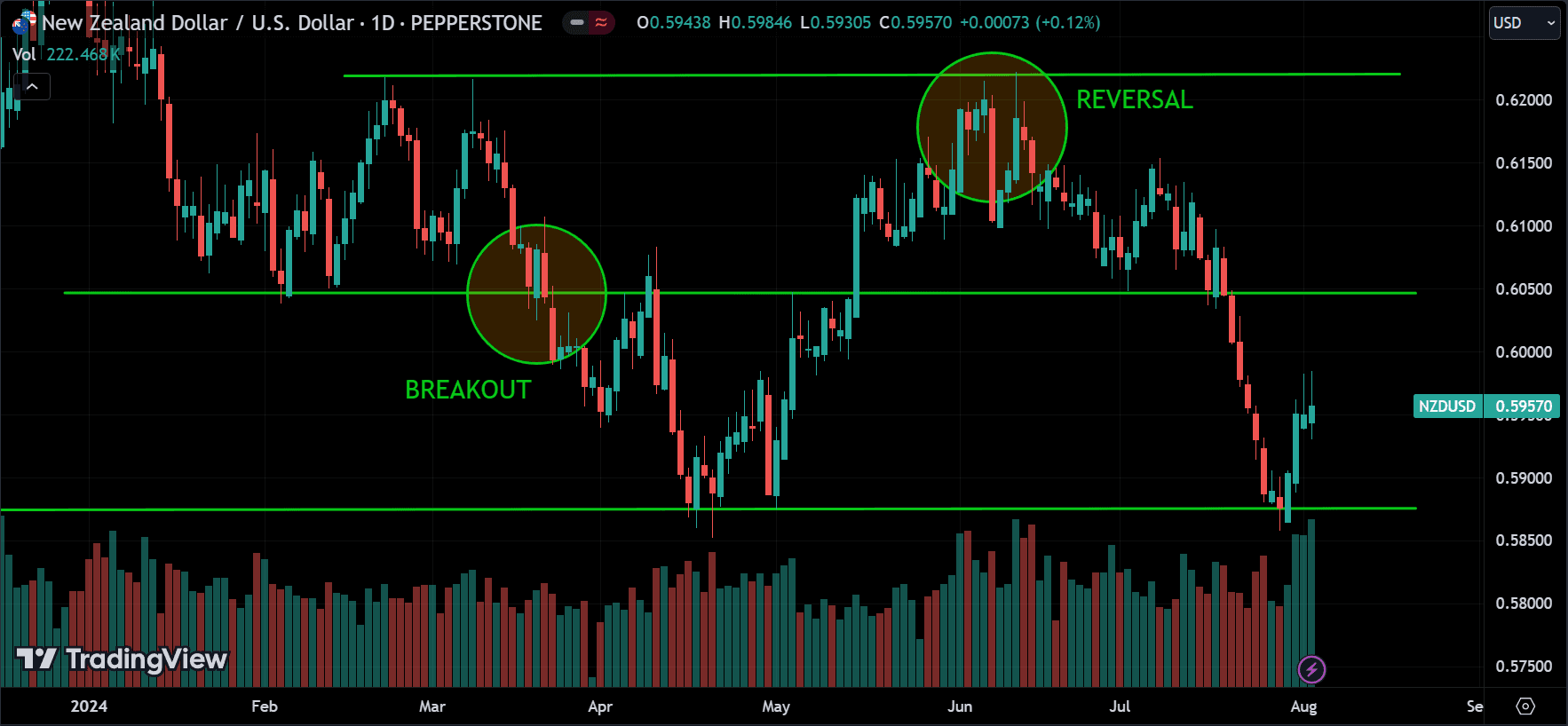

Understanding Breakout

A breakout indicates that the price will continue in the direction of that breakout. For example, if the price breaks above a resistance level, we can expect it to move to the next resistance level. Conversely, if the price breaks below a support level, we can expect it to move to the next support level.

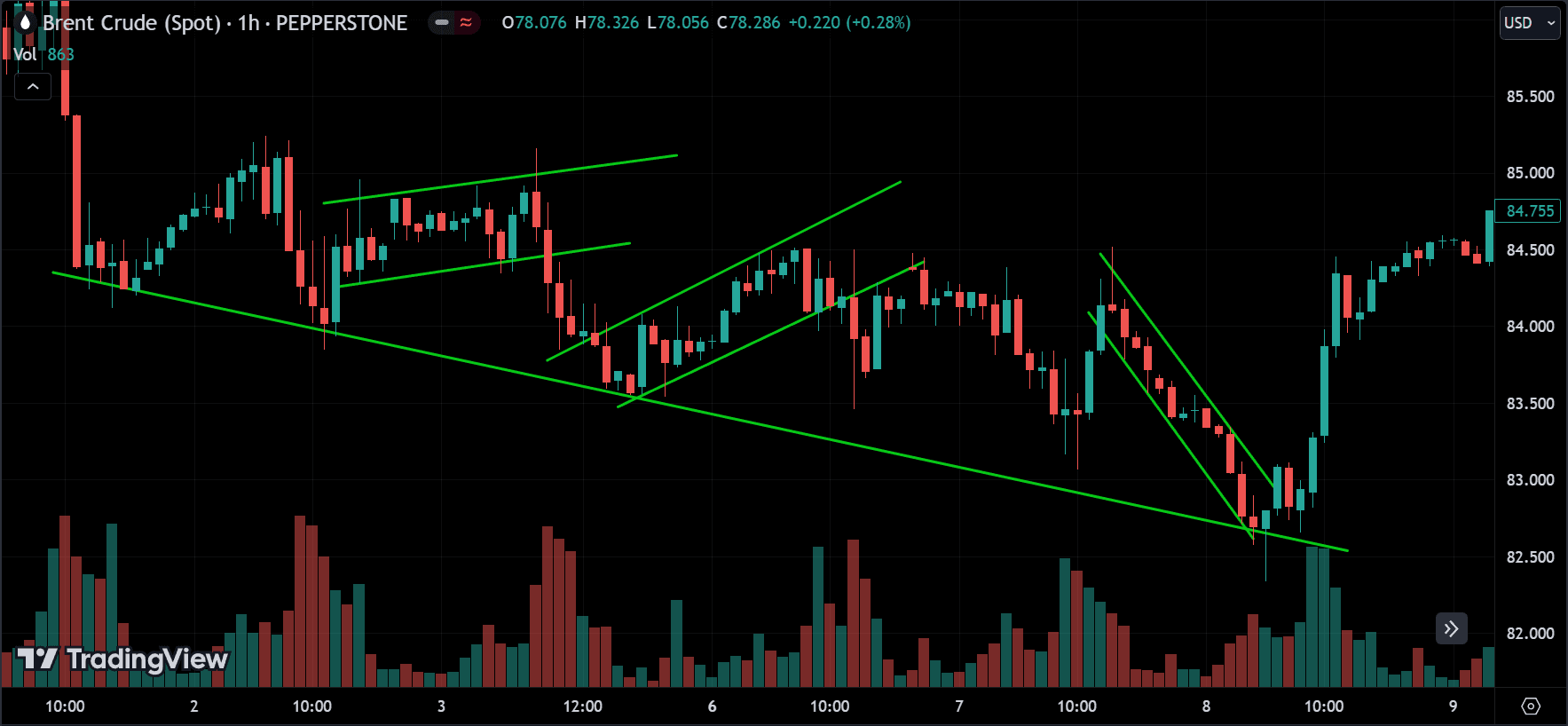

Understanding Trend Length

There are three types of trends: long-term, medium-term within the long-term, and short-term within the medium-term. Our goal is to enter a position when all three trends are moving in the same direction. If all three show an uptrend, we can be more confident that the price will keep going up and is less likely to hit the stop loss.

Understanding Reversals

Reversals are usually seen through candlestick patterns around major support and resistance levels. When you see a reversal at these levels, and the price starts moving in that direction, it is more likely to continue. If the price breaks the previous support or resistance level in the same direction, we can confirm that the price is indeed moving in that direction. The more breakouts we have, the stronger the trend becomes.

Executing the Trading Strategy

Now that you know our entry signals are breakouts and reversals, you enter a position right after a proper breakout or reversal. Be cautious of false breakouts and reversals; sometimes, they are easy to spot, but other times, what looks like a proper signal can go against you. This is normal with the strategy. Your goal is to be right more often than wrong on average.

True vs False Breakouts

For a true breakout, you want the breakout candle to be full or big and close below or above the broken support or resistance level. The next candle should move in the same breakout direction; for example, after an upward breakout, you want the next candle to be green, not red, or show indecision like a doji.

True vs False Reversals

For a reversal, you need proper price action behavior. After a doji candle, look for a candle that clearly shows a reversal signal. You don’t want another doji or a candle showing lot of opposite pressure. Understanding price action takes experience, and it’s something you learn over time. Our market analysis articles can guide you in understanding price action. With time and practice, you’ll start to recognize proper reversals and breakouts.

Incorporating Multi-Time Frame Analysis

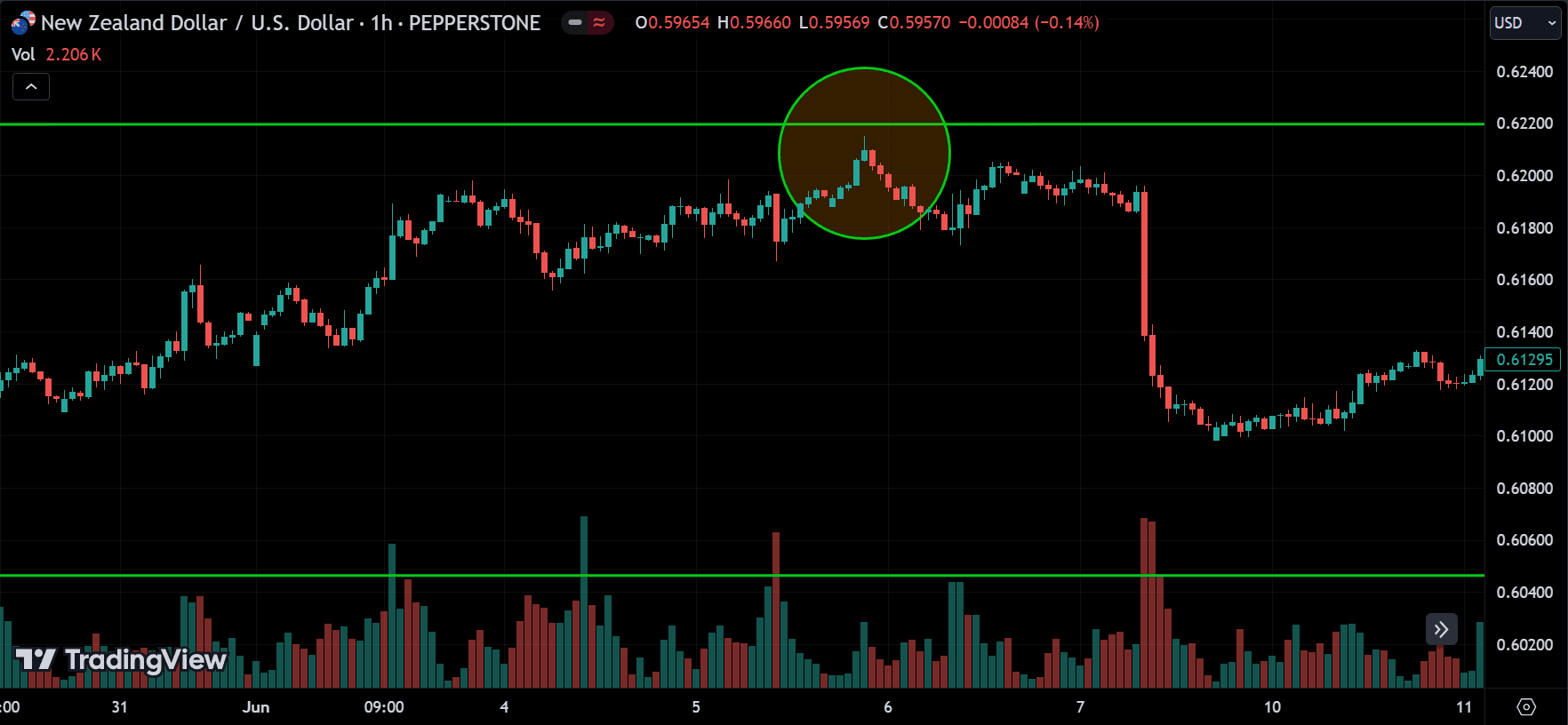

You can also use multi-time frame analysis for this strategy. For example, look for the trend on a 4-hour or daily chart, and execute the trade on a 1-hour chart. Personally, I find the best combination is using the daily and 1-hour charts, which is why I focus on these two timeframes in my market analysis articles.

Entry Signal:

As we discussed above, our entry signal will be a breakout or reversal. You have to act quickly because this is price action. Only one single entry.

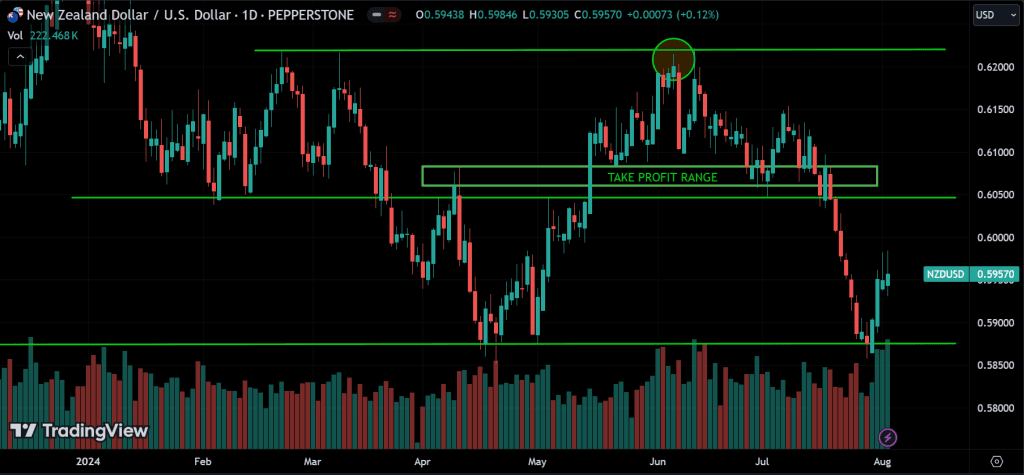

Take Profit Signal:

This depends on the trader’s approach. For example, I like to take my profit when the trade is going well and has made enough returns, broken a few levels, and I feel the price might exhaust. I don’t wait for the trend to change; I take profits just before it does. This is usually just below major resistance levels or just above major support levels. You can try different variations and see what works best for you.

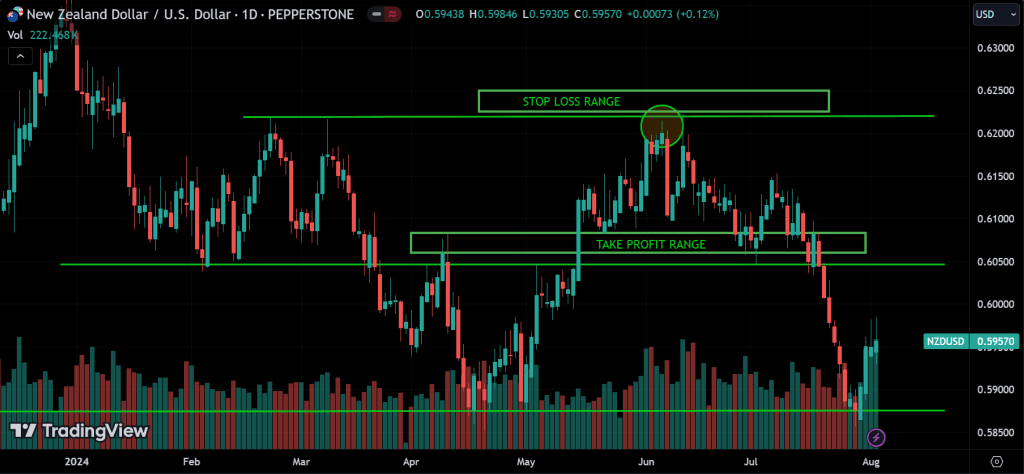

Stop Loss Signal:

For the stop loss, if you are entering a long trade after a breakout, place the stop loss just below the resistance level, where the price is unlikely to reach due to market noise. Leave enough space for fluctuations, but if the price breaks that level, it means the trend is changing, and you should exit the position. Place the stop loss just above the support level for a short trade.

Trading Plan Implementation

| STRATEGY | TREND FOLLOWING |

| TRADING STYLE | SWING-TRADING |

| STRATEGY TYPE | MOMENTUM |

| HOLDING PERIOD | FEW HOURS TO DAYS(VARIES DEPENDS ON THE TRADER) |

| ASSET SELECTION | LIQUID FX PAIRS |

| TIME FRAME | 15M / 1H / 4H / D |

| ENTRY SIGNAL | BREAKOUTS & REVERSALS |

| ENTRY STYLE | SINGLE MARKET ENTRY |

| TAKE PROFIT SIGNAL | PRICE REACHING MAJOR SUPPORT OR RESISTANCE LEVELS |

| TAKE PROFIT STYLE | SINGLE LIMIT ORDER |

| POSITION SIZING | SINGLE ENTRY 2% RISK |

| STOP LOSS | 2% RISK, NEAR SUPPORT/RESISTANCE |

| BAIL OUT INDICATORS | STONG FUNDAMENTAL NEWS |

Download a Collection of Indicators, Courses, and EA for FREE

If you are unfamiliar with a trading plan and don’t know how to implement it correctly, consider reading that article.

Once you find the best setup for your strategy and plan, write it down like shown above and follow it every time you trade. This is very important for your trading mindset.

Advantages of Trend Following Swing Trading

- Simplicity – Trend following is a simple and easy-to-understand strategy that relies on widely known price action. This method involves analyzing price movements to identify trends, making it accessible for many traders.

- Profit Potential – By capturing the majority of a trend, traders have the potential to achieve significant profits. This approach allows them to take advantage of the larger price movements within the trend.

- Reduced Stress – Swing trading requires less monitoring compared to day trading, reducing stress and time commitment.

Disadvantages of Trend Following Swing Trading

- False Signals –Trend following can give false signals in choppy or sideways markets. To understand the current market trend, you can follow our market analysis series. We provide insights into the trends of major forex pairs right now.

- Late Entries – Waiting for confirmation can lead to late entries and missing part of the move. If you miss an opportunity, don’t chase it. Instead, wait for the next proper entry.

- Market Conditions – This strategy works best in trending markets but may not do well in ranging markets. To counter this, you can use another strategy designed to cater to varying market conditions.

Conclusion

Trend following swing trading is a powerful strategy for capturing significant price movements in the Forex market. Traders can achieve consistent success by identifying, confirming, and riding trends while employing robust risk management. However, to maximize the effectiveness of this strategy, it’s essential to stay disciplined and adapt to changing market conditions.