The Moving Average Convergence Divergence (MACD) indicator is one of the most popular tools traders use to identify trends and potential reversals in the forex market. Combining the power of the MACD with an advanced AI tool like ChatGPT can lead to a profitable MACD strategy that enhances decision-making and maximizes returns. In this guide, we’ll cover the essential elements of the MACD indicator, how to integrate it with ChatGPT for deeper insights, and a step-by-step process for executing trades based on this ChatGPT Trading Strategy.

What is the MACD Indicator?

The MACD is a trend-following momentum indicator that shows the relationship between two moving averages of a security’s price. It consists of three components:

- MACD Line: This is calculated by subtracting the 26-period Exponential Moving Average (EMA) from the 12-period EMA. It shows the short-term price movements relative to longer-term movements.

- Signal Line: A 9-period EMA of the MACD line. This acts as a trigger for buy or sell signals.

- Histogram: The difference between the MACD line and the signal line. It visually represents the momentum of the price and helps detect trends.

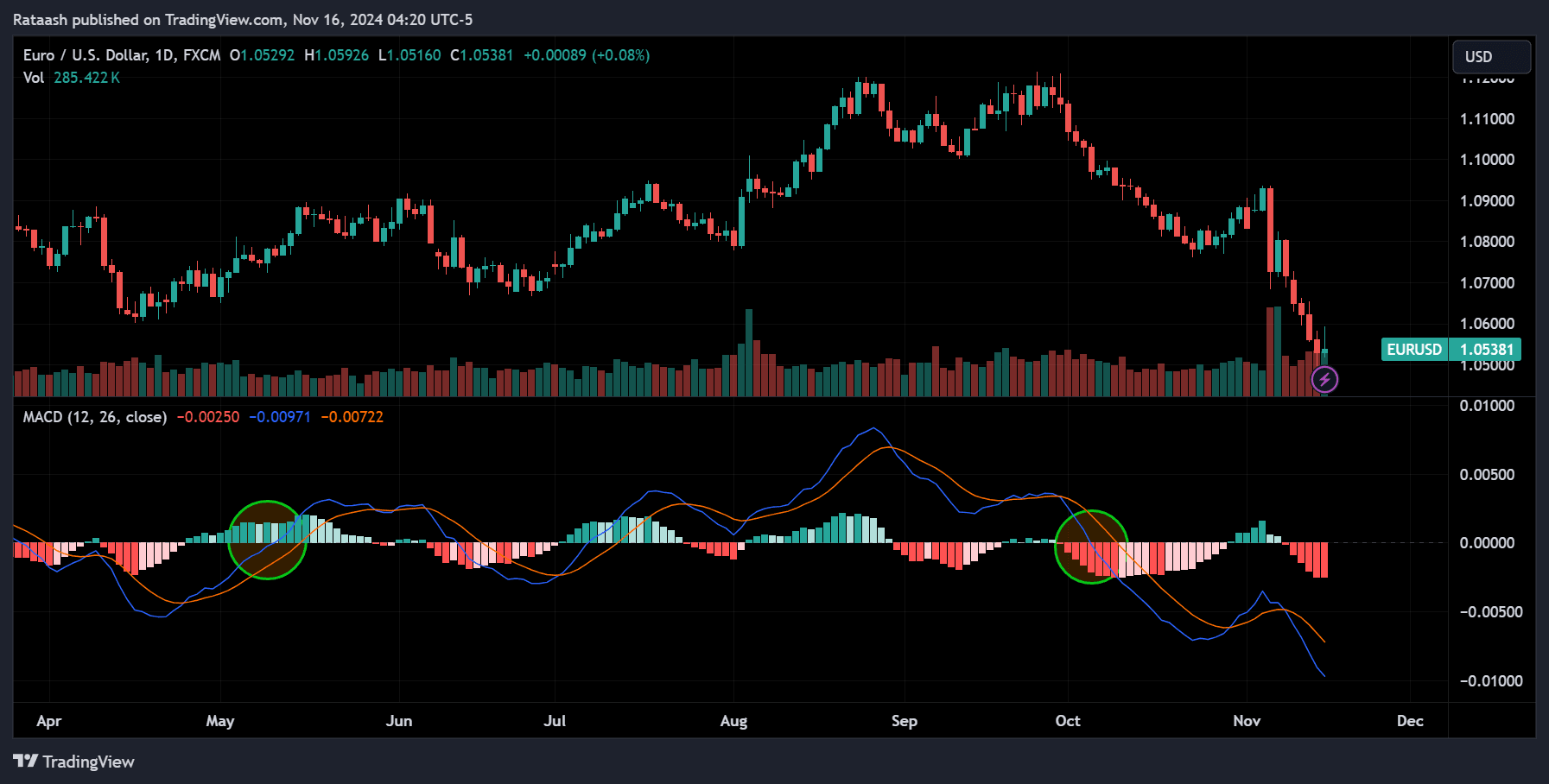

The key signal generated by the MACD is when the MACD line crosses above or below the signal line.

Understanding MACD Signals

Before diving into the strategy, it’s important to understand the key signals the MACD generates:

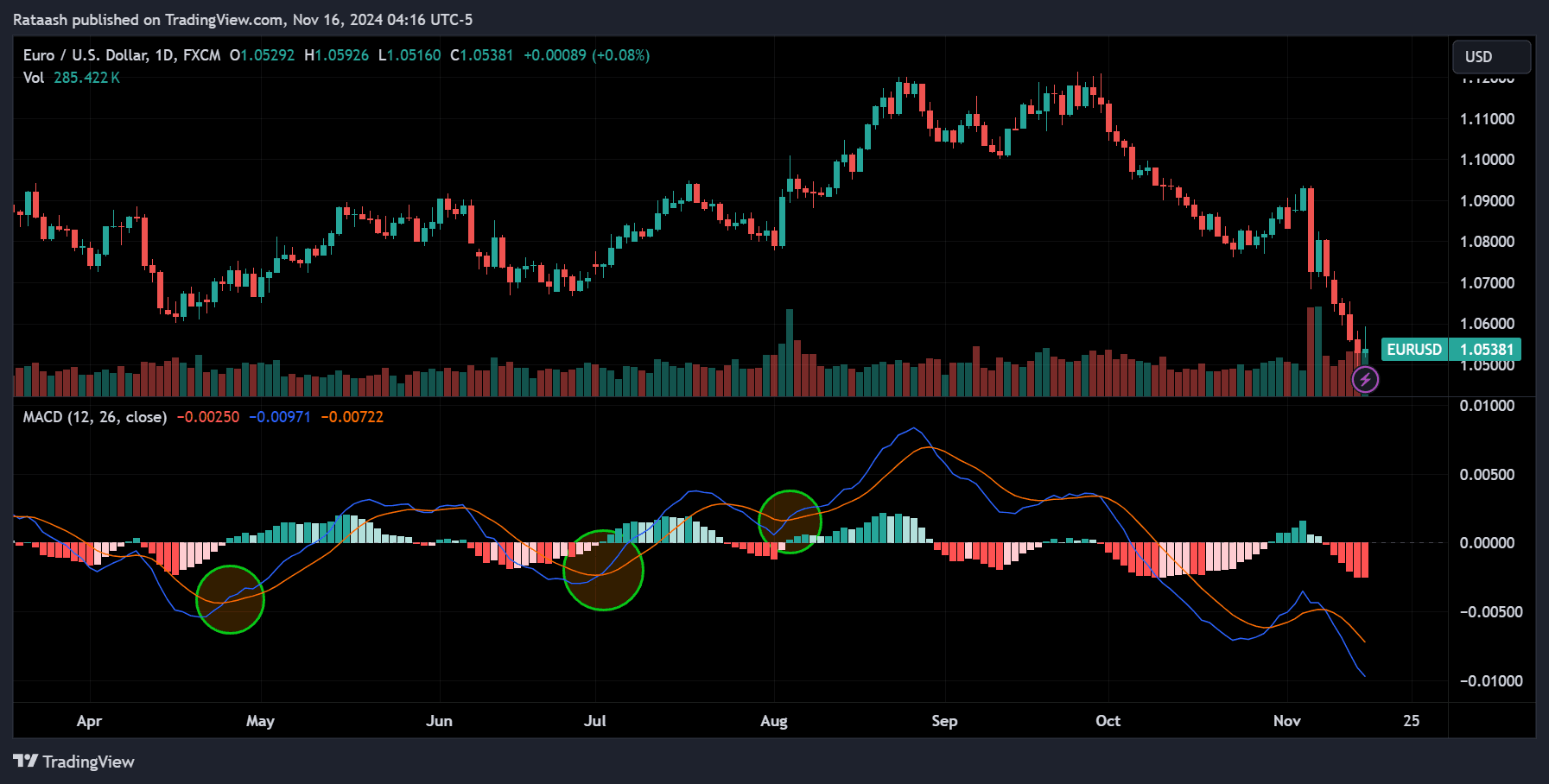

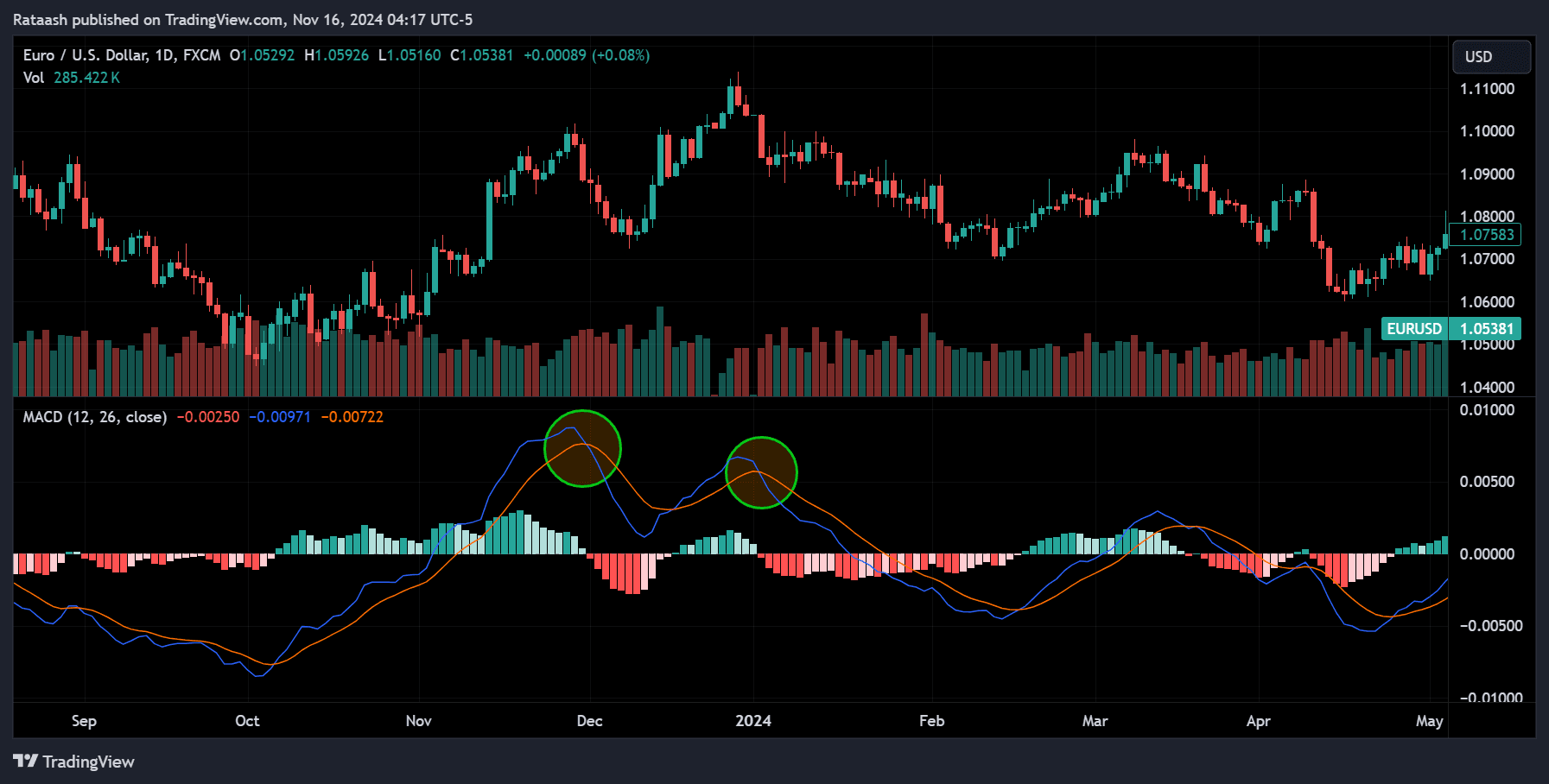

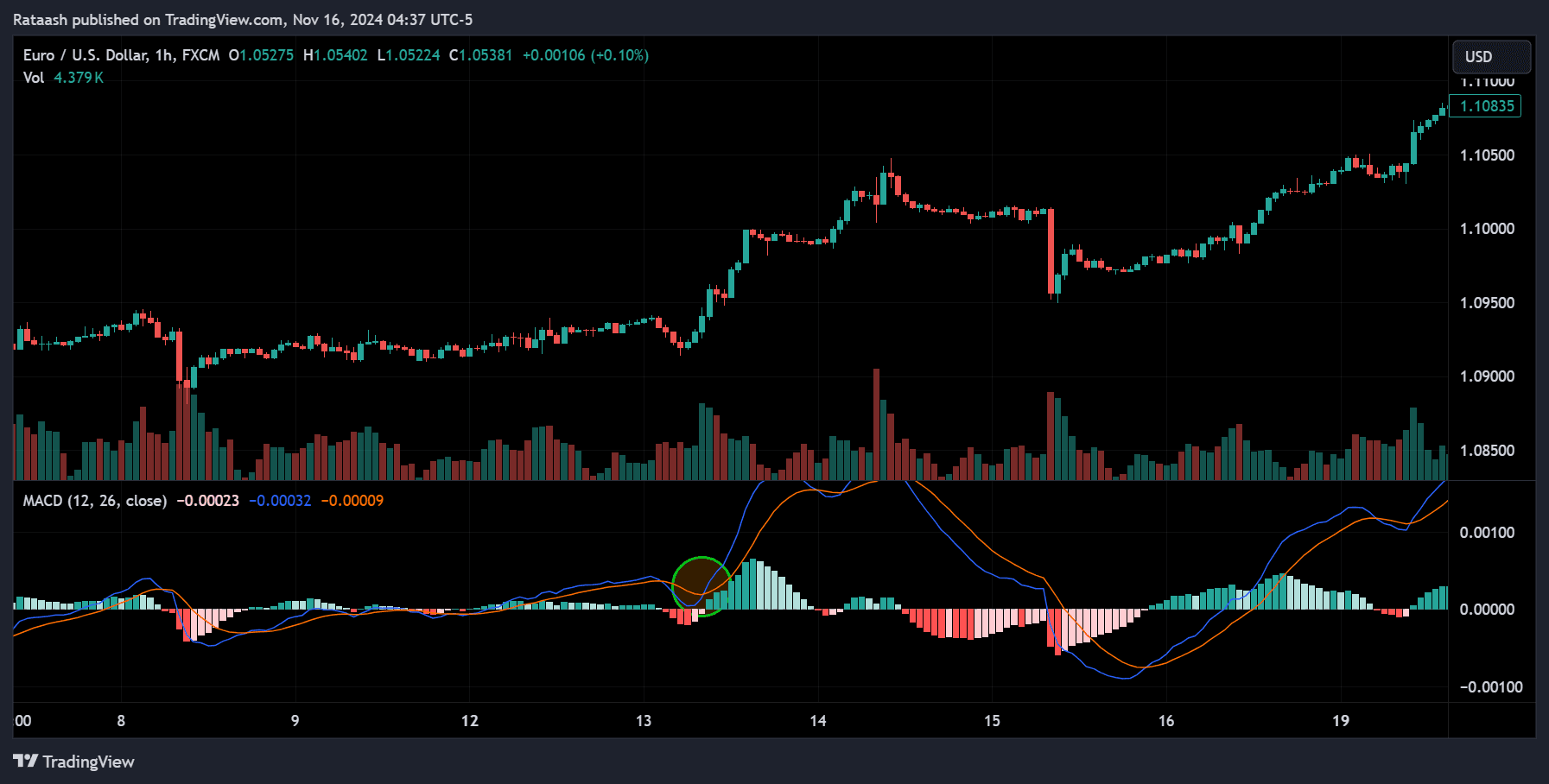

- Bullish Signal (Buy) – When the MACD line crosses above the signal line, it indicates upward momentum, signaling a buy opportunity.

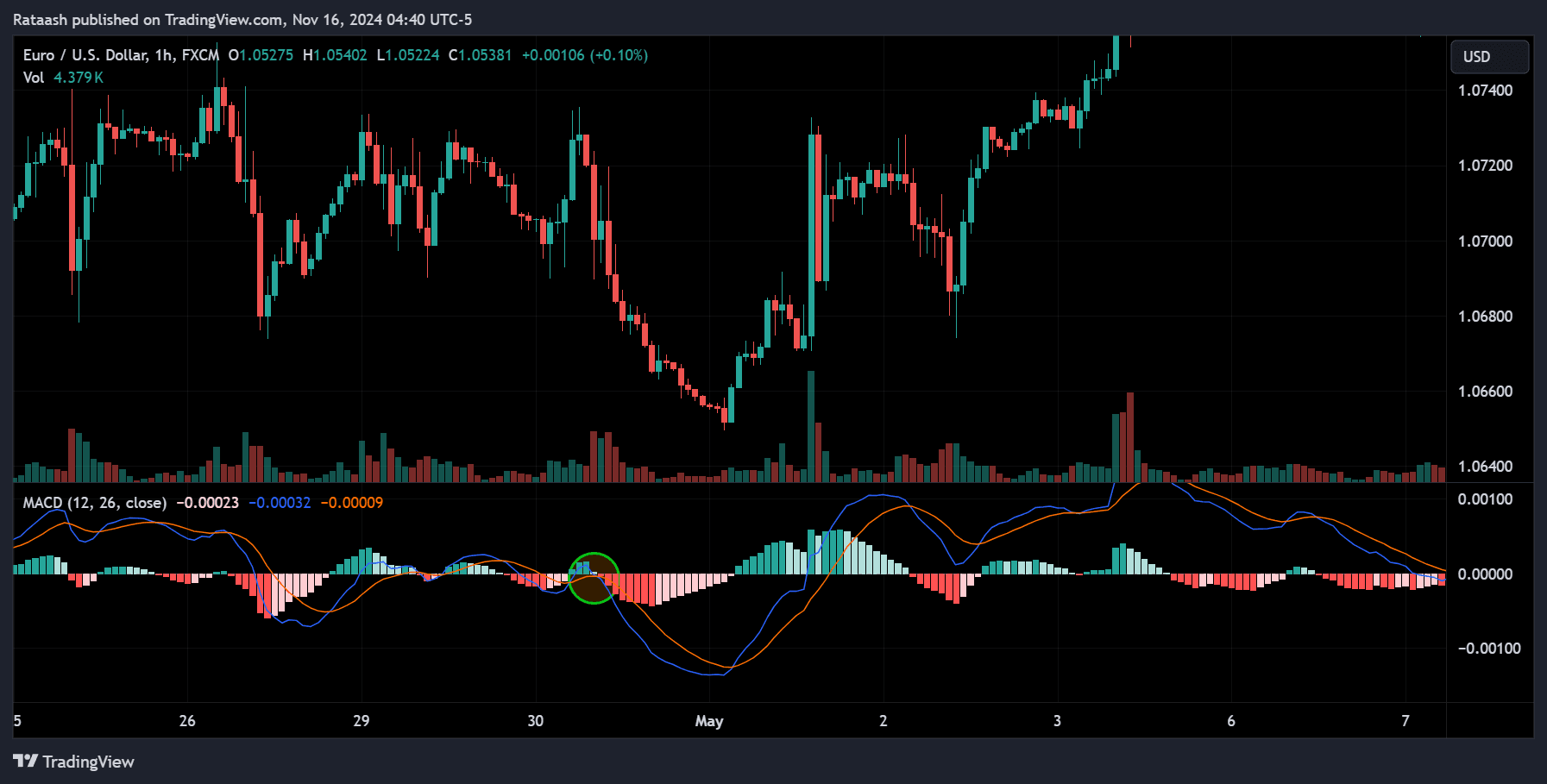

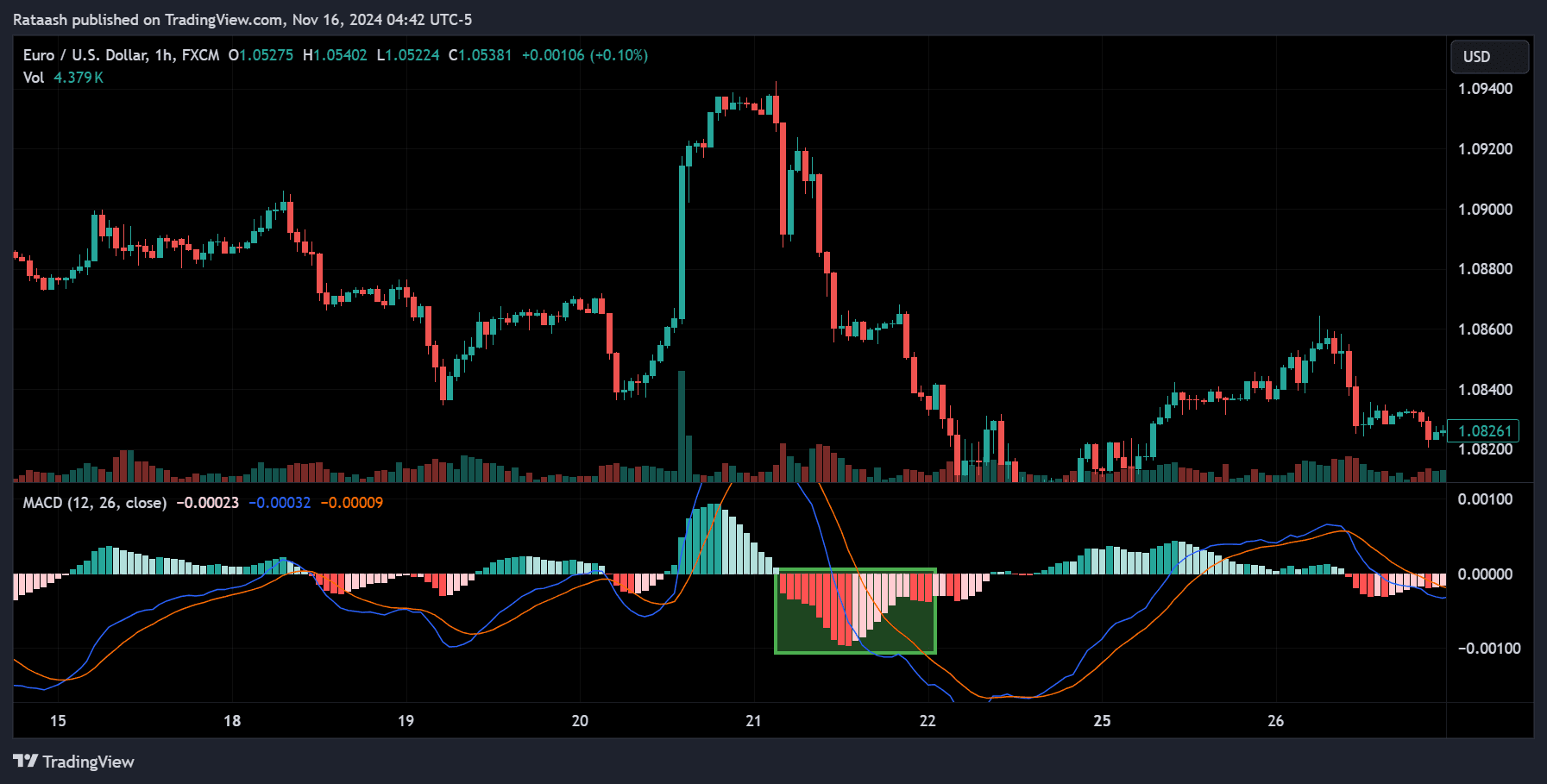

- Bearish Signal (Sell) – When the MACD line crosses below the signal line, it signals downward momentum, indicating a sell opportunity.

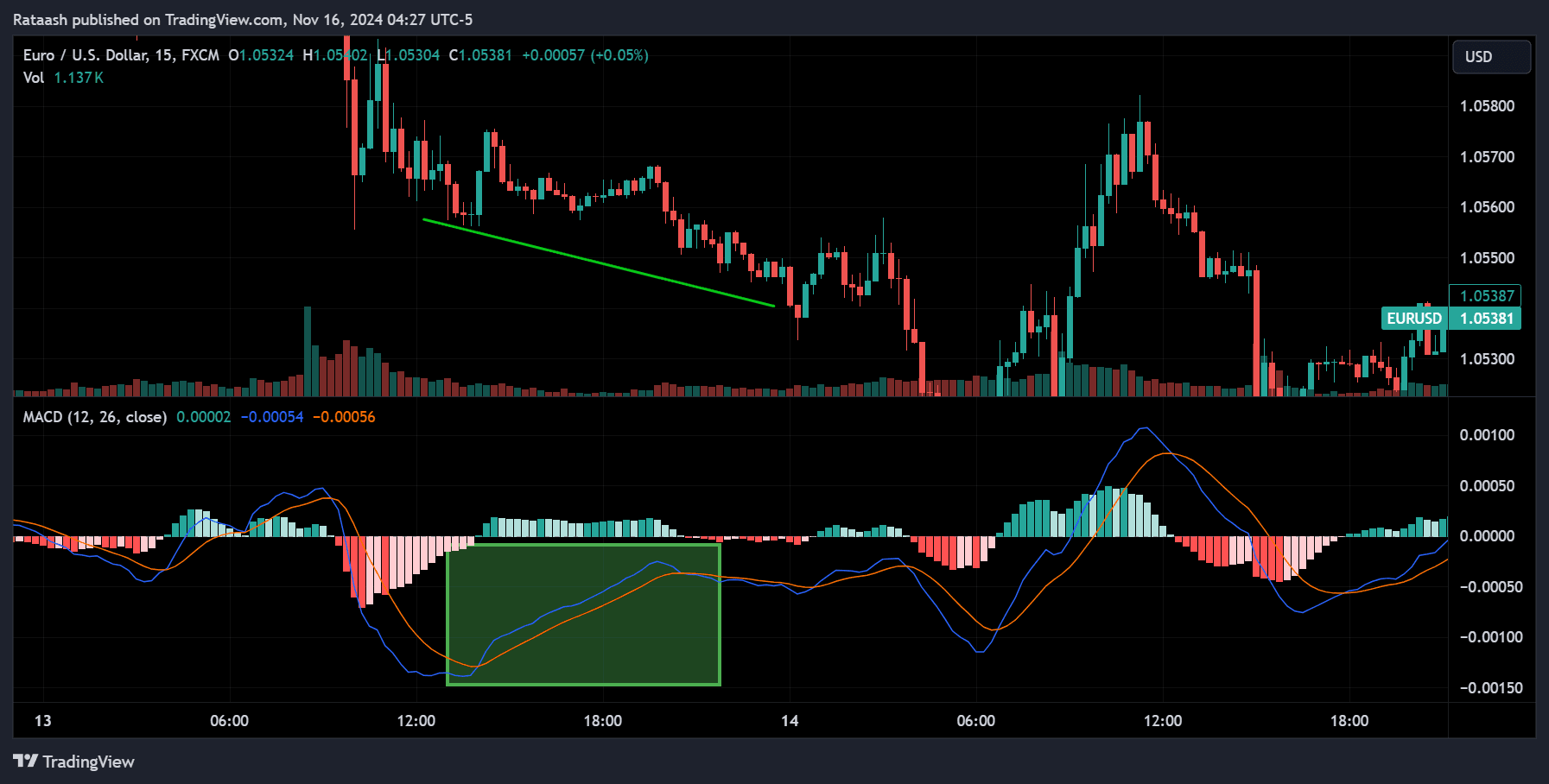

- Divergences – MACD divergence occurs when the price moves in the opposite direction of the MACD, often indicating a potential reversal.

- Zero Line Cross – When the MACD line crosses the zero line, it suggests a trend reversal. If the MACD crosses from below to above the zero line, it’s a bullish signal; if it crosses from above to below, it’s a bearish signal.

Integrating ChatGPT into the MACD Strategy

ChatGPT can act as a powerful tool when combined with MACD-based strategies. Here’s how:

- Data Analysis and Signal Confirmation – ChatGPT can be programmed to confirm MACD signals by analyzing fundamental data or cross-referencing with other technical indicators such as RSI, stochastic oscillators, or Bollinger Bands.

- Trade Sentiment Analysis – ChatGPT can scan news articles, social media posts, and economic reports to assess overall market sentiment, helping traders decide if the MACD signals align with broader market trends.

- Custom Alerts and Automation – With the right API integration, ChatGPT can monitor real-time charts and notify traders when certain conditions in the MACD strategy are met. For advanced traders, it can even automate entries and exits.

Step-by-Step Guide to ChatGPT Trading Strategy

Step 1: Set Up Your Chart and MACD Indicator

Before starting the ChatGPT trading strategy, you need to ensure your trading platform is set up correctly:

- Open your trading platform (e.g., MetaTrader, TradingView, or any other platform that supports MACD).

- Apply the MACD indicator to the chart. Use the default settings:

- MACD Line: 12-period EMA minus 26-period EMA

- Signal Line: 9-period EMA

- Histogram: The difference between the MACD line and the signal line

- Set your chart time frame to 1-hour or 4-hour for short- to medium-term trades or daily for longer-term trades.

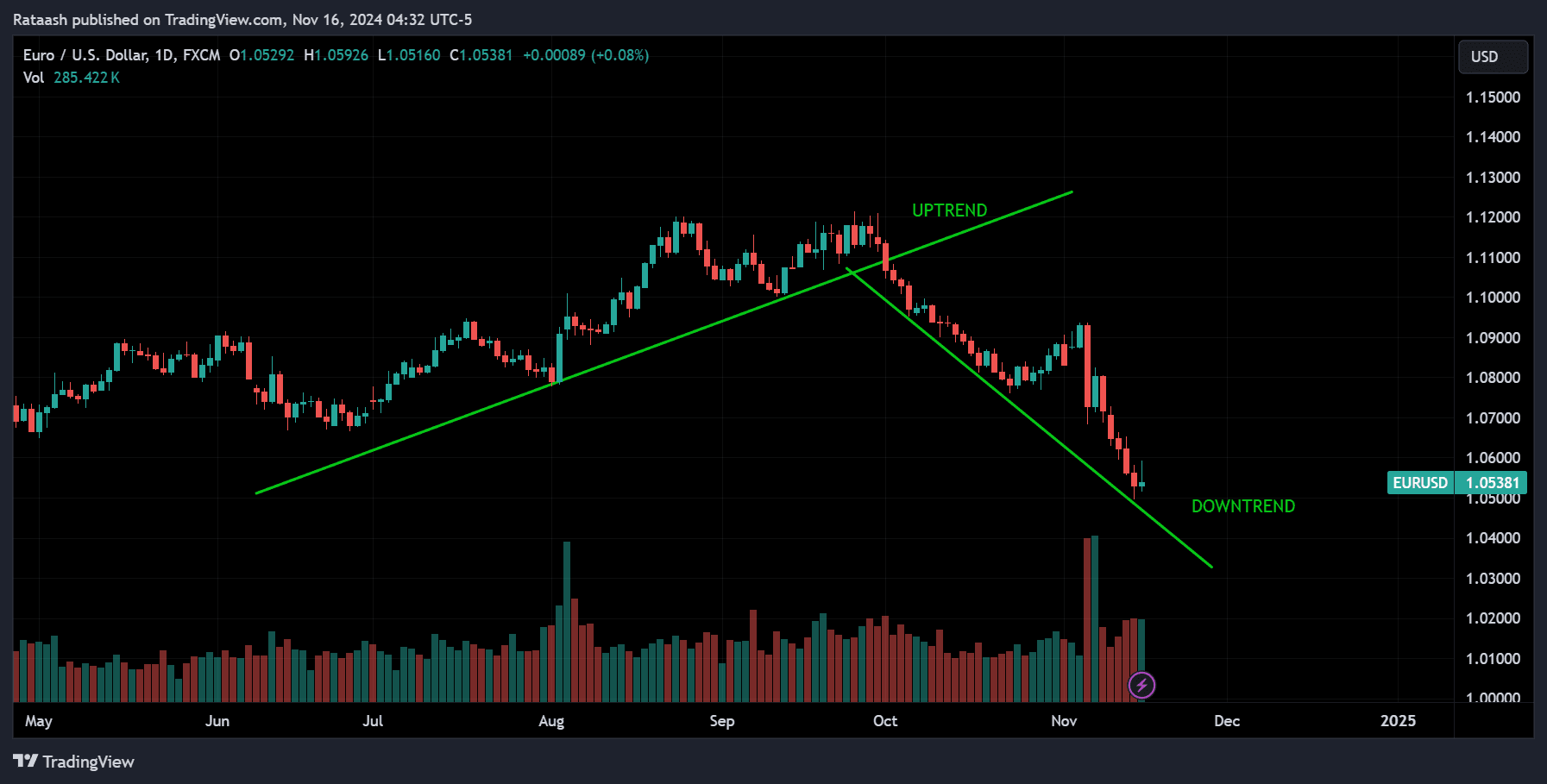

Step 2: Identify the Market Trend

The MACD strategy works best in trending markets. To filter out false signals, it’s essential first to determine the market’s overall trend. You can use the following methods:

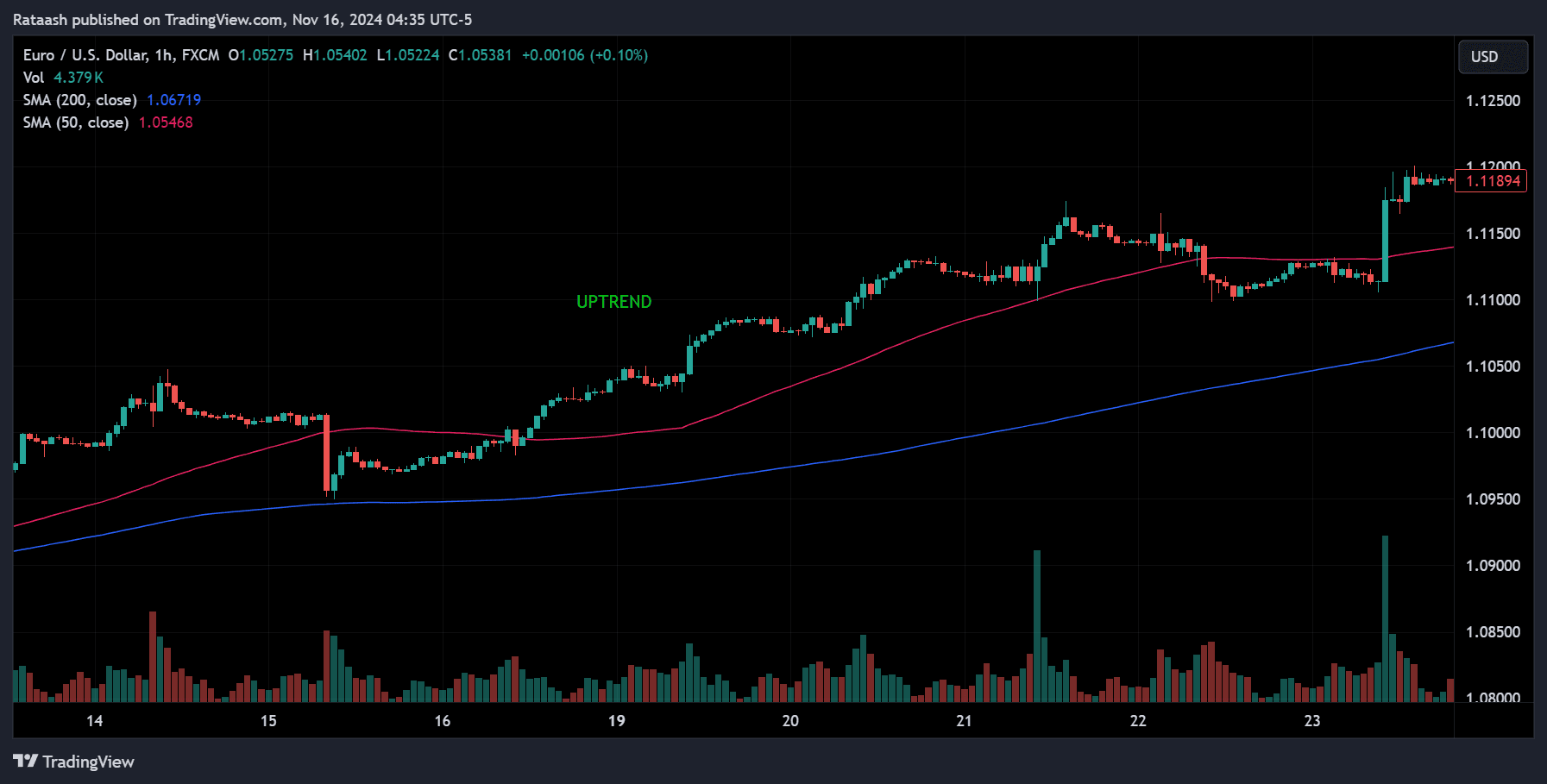

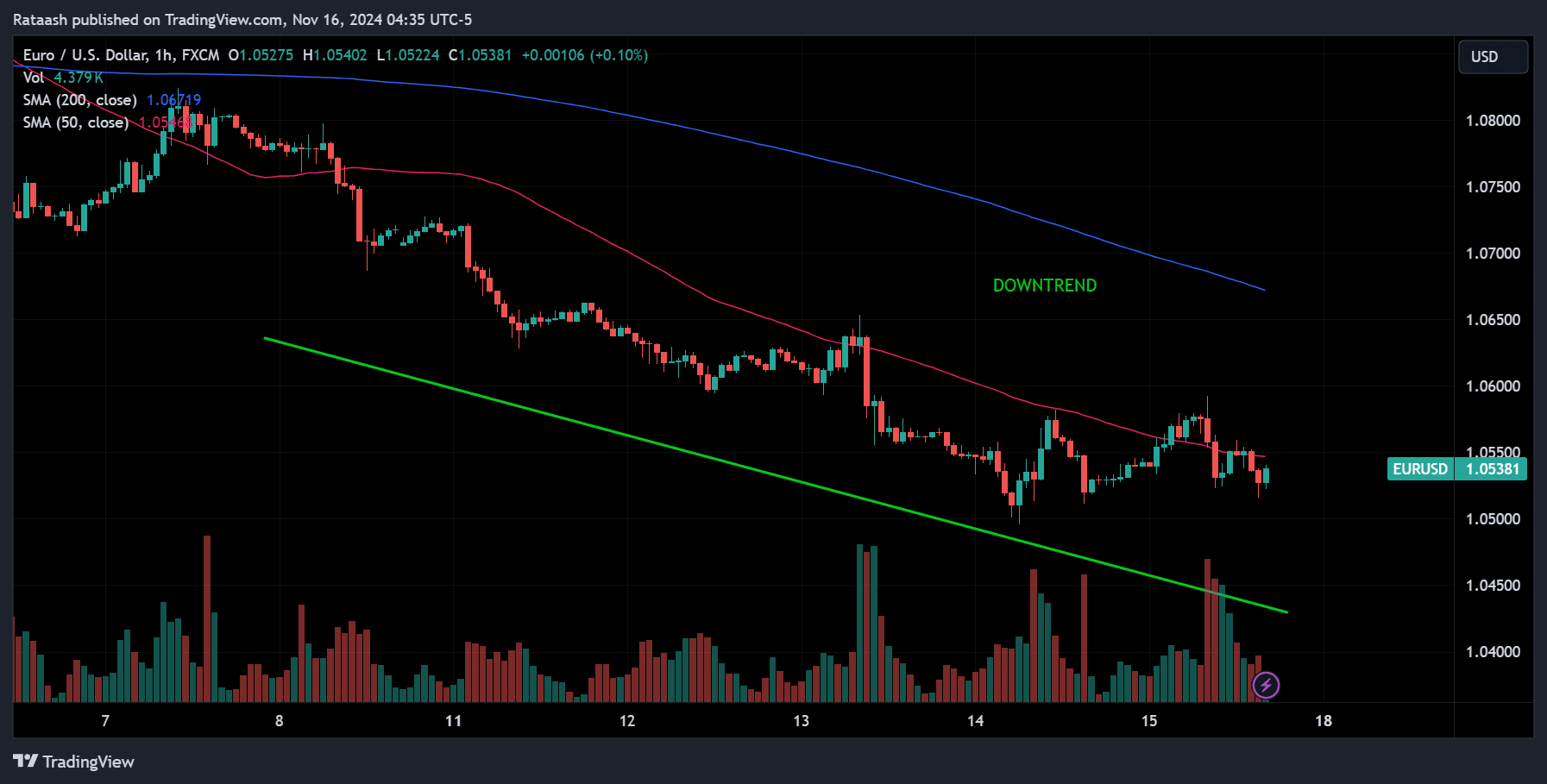

- Higher Time Frames – Check the daily or weekly chart to see if the currency pair is in a clear uptrend or downtrend.

Download a Collection of Indicators, Courses, and EA for FREE

- Simple Moving Averages – Add 50-day and 200-day moving averages to your chart. If the price is above both, it confirms an uptrend; if it’s below both, it confirms a downtrend.

Step 3: Look for MACD Crossovers

Once the trend is identified, you can move forward by analyzing the MACD for crossovers:

- Buy Signal – In an uptrend, wait for the MACD line to cross above the signal line while both lines are above the zero line. This crossover confirms bullish momentum, and you can prepare for a long entry.

- Sell Signal – In a downtrend, look for the MACD line to cross below the signal line while both are below the zero line. This suggests bearish momentum, signaling a short entry.

Step 4: Use the MACD Histogram to Gauge Momentum

The histogram can be used as an early warning signal for potential trend reversals:

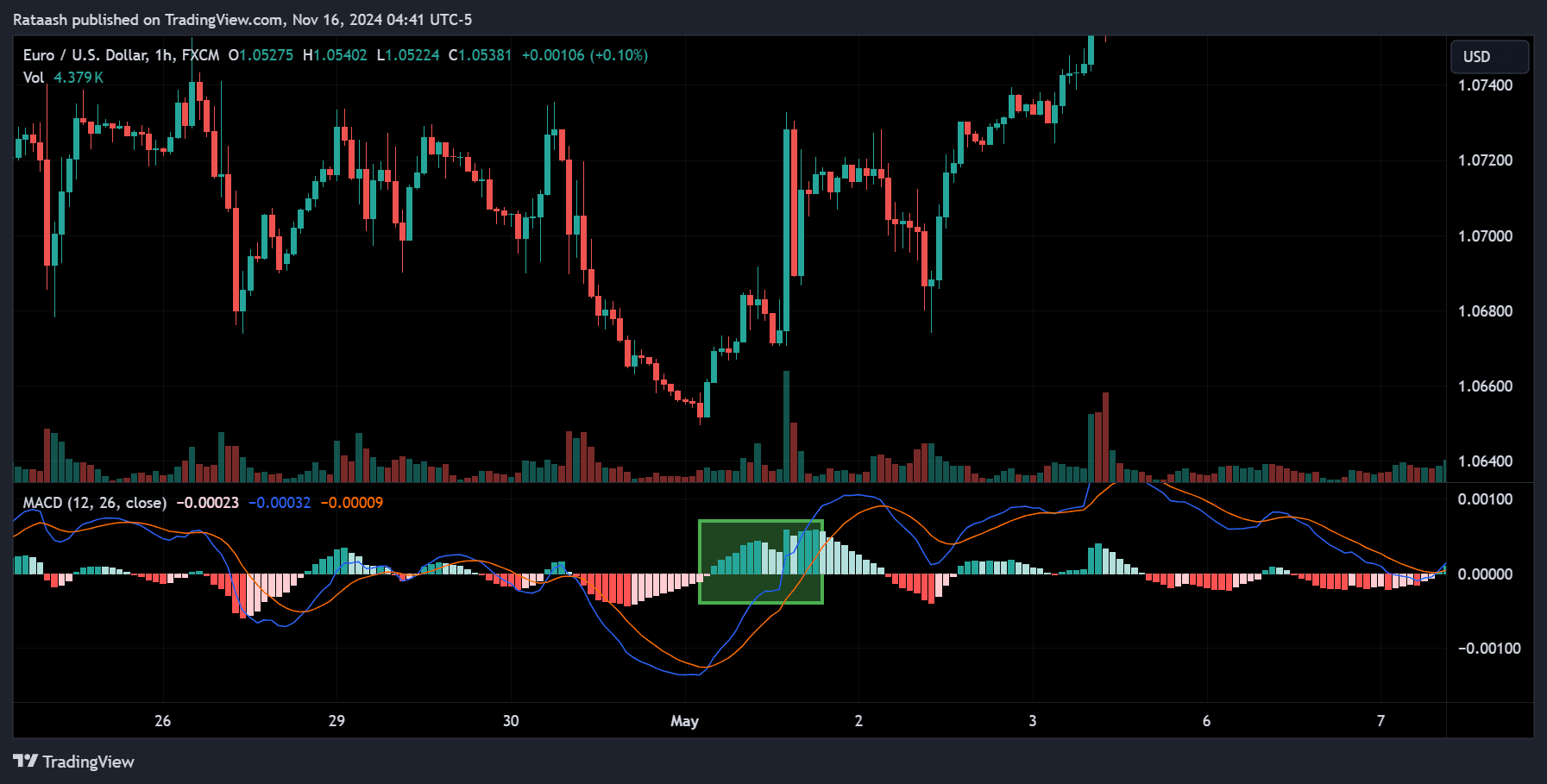

- Increasing Histogram Bars – When the histogram bars grow taller, it means that the momentum is strengthening, so you can confidently enter the trade.

- Decreasing Histogram Bars – If the bars start shrinking, the momentum is weakening, which can be a signal to exit the trade or tighten your stop-loss.

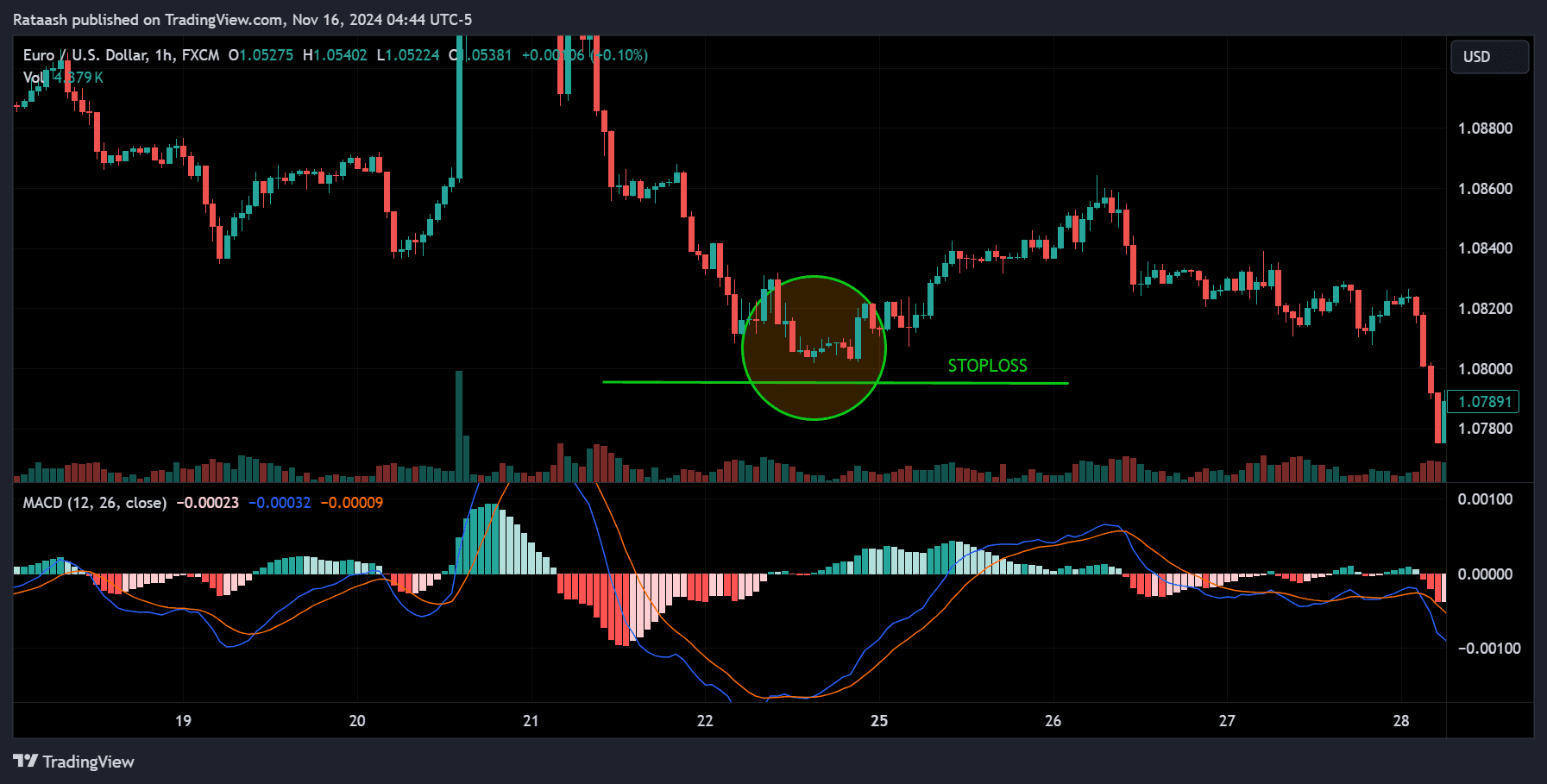

Step 5: Risk Management with Stop-Loss and Take-Profit Levels

No strategy is complete without proper risk management. Here’s how you can protect your capital when using the ChatGPT Trading Strategy:

- Stop-Loss Placement – Place your stop-loss just below the recent swing low (for buy trades) or above the recent swing high (for sell trades).

- Take-Profit Target – You can set take-profit levels based on key support/resistance zones, Fibonacci levels, or a fixed risk-reward ratio of 1:2 or higher.

- Trailing Stops – As the trade moves in your favor, you can adjust your stop-loss to lock in profits. ChatGPT can automate this process by monitoring price movements.

Step 6: Use ChatGPT for Market Analysis and Confirmation

Now that you have identified a trade setup using the MACD, you can use ChatGPT to confirm your trade by:

- Sentiment Analysis – Input market news into ChatGPT and ask it to summarize the sentiment surrounding the currency pair. If the sentiment aligns with your technical analysis, it strengthens the case for your trade.

- Fundamental Data – ChatGPT can help you analyze upcoming economic events, central bank announcements, or geopolitical news that may affect your trade. For instance, if you’re trading EURUSD, check for any impending ECB policy changes.

- Trend Confirmation with Additional Indicators – You can ask ChatGPT to analyze other technical indicators, such as RSI (Relative Strength Index) or stochastic oscillators, to verify that the MACD signal aligns with these tools.

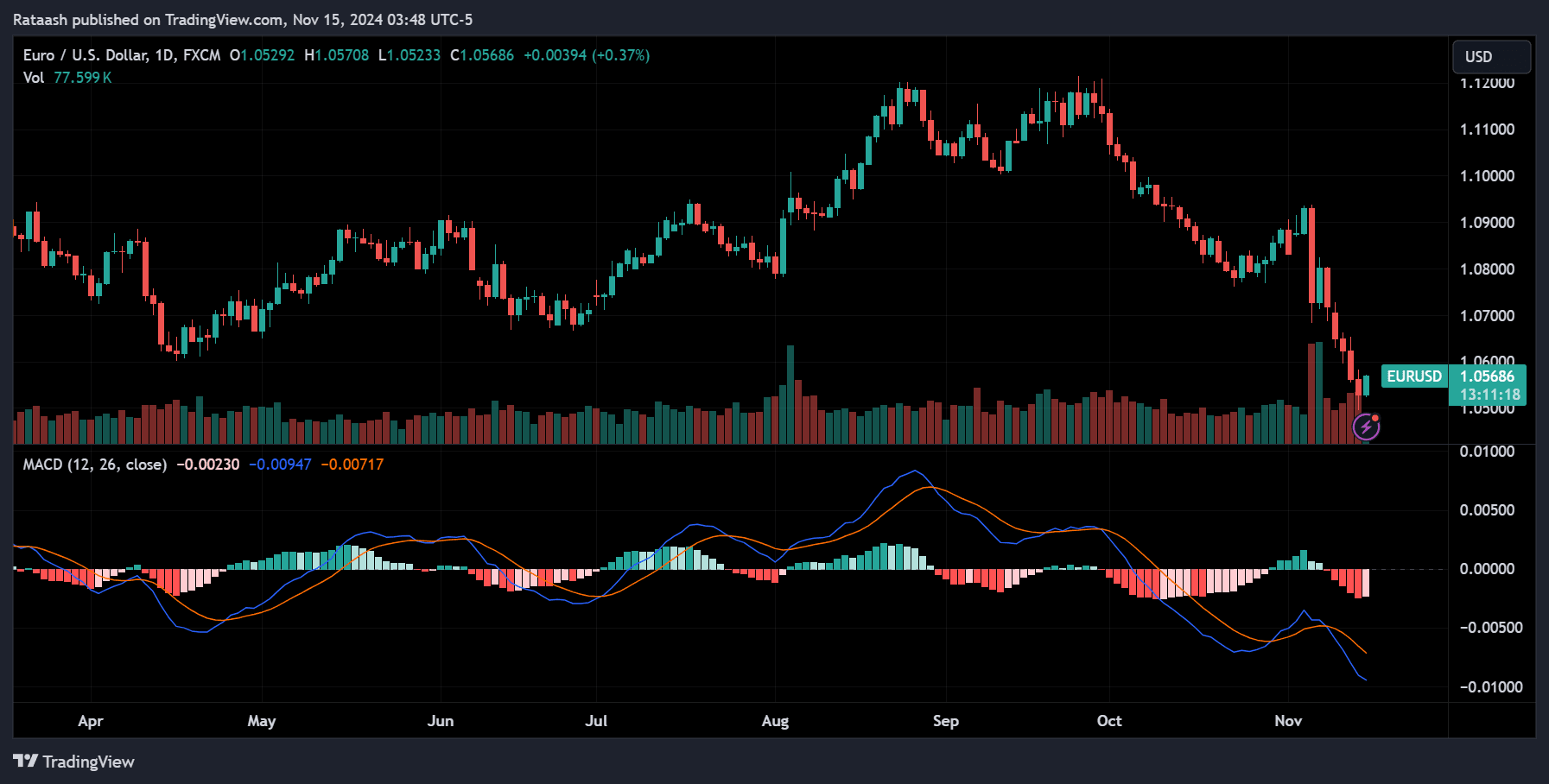

Example Trade Using the ChatGPT MACD Forex Strategy

Let’s walk through a hypothetical trade on the EURUSD pair using this strategy:

- Market Context – EURUSD is in an uptrend on the daily chart.

- MACD Setup – On the 4-hour chart, the MACD line crosses above the signal line with both lines above the zero line. The histogram bars are growing, showing increasing bullish momentum.

- Entry Point – Place a buy order as soon as the MACD crossover is confirmed.

- Stop-Loss – Set your stop-loss just below the recent swing low, approximately 30 pips away.

- Take-Profit – Set your take-profit at twice the distance of your stop-loss (e.g., 60 pips) or at a key resistance level.

- ChatGPT Confirmation – Ask ChatGPT to analyze recent ECB news and check sentiment for EURUSD. If it’s bullish, proceed with the trade confidently.

- Trade Execution – As the price moves in your favor, monitor the MACD histogram and adjust your stop-loss accordingly.

Final Thoughts: Advantages of the ChatGPT MACD Forex Strategy

The integration of MACD and ChatGPT provides traders with a unique edge. Not only can the MACD identify precise technical signals, but ChatGPT can provide valuable insights by analyzing real-time data, market sentiment, and news events. This combination ensures that your trades are well-informed and backed by both technical and fundamental analysis.

Key Advantages:

- Simple yet powerful trend-following system

- Confirmation from multiple data sources using ChatGPT

- Real-time trade alerts and sentiment analysis

- Strong risk management tools

By using the MACD Strategy consistently, you’ll be able to spot profitable opportunities in the forex market while reducing the risk of false signals. Remember to backtest this ChatGPT Trading Strategy and fine-tune it according to your preferred currency pairs and time frames.