The Forex market is huge, with over $5 trillion traded daily, and it’s attracting more and more traders looking to boost their profits. But growing your account with personal funds alone can be tough. That’s where proprietary trading firms (prop firms) come in. They let skilled traders use company capital to trade, and in return, take a share of the profits.

Prop trading has been around for decades, mostly with banks and big institutions. But now, retail traders can get in too, thanks to online prop firms offering structured challenges, set rules, and clear payout models. They provide the tools, risk management, and sometimes even mentorship to help traders succeed.

Still, not all prop firms are created equal. Knowing how to choose a prop firm for Forex trading means looking closely at things like their reputation, rules, profit splits, and support. This guide breaks it all down so you can find the right fit for your trading style and goals.

Table of Contents

What is a Prop Firm in Forex Trading?

A proprietary trading firm, often shortened to “prop firm,” is a company that utilizes its own capital to trade financial instruments, including Forex pairs, stocks, commodities, cryptocurrencies, and more. Rather than managing external funds (like hedge funds do), prop firms typically use internal resources or partner capital. Prop firms make money when their traders are profitable.

When you join a prop firm as a trader, you usually undergo some form of evaluation. Once you prove your skills (by meeting certain profit targets or abiding by the firm’s risk rules), you are granted access to a funded account. Any profits you generate in the live funded account are typically split between you and the firm, with the split percentage varying widely from firm to firm. Some might split profits 50/50, while others offer splits up to 80/20, 85/15, or even 90/10 in favor of the trader.

Key Features of a Prop Firm

- Company Capital – Provides traders with capital to trade beyond their personal finances.

- Risk Control – Enforces specific risk management rules to protect the firm’s capital.

- Profit-Sharing – The firm and the trader share generated profits based on a predefined ratio.

- Support – May offer coaching, mentorship, trading software, and educational resources to assist new and existing traders.

- Clear Objectives – Sets performance metrics like daily drawdown, total drawdown, or profit targets.

In the Forex space, these firms have seen a surge in popularity as they open up opportunities for traders who have skill but lack the big capital typically required to generate significant returns.

Why Trade Forex with a Prop Firm Instead of Independently?

You might wonder why you should bother joining a prop firm when you can simply trade on your own. After all, there are no profit splits or monthly fees if you trade your personal account. While it’s true that being completely independent means you keep all your profits, there are considerable advantages to joining a reputable prop firm:

- Leverage and Buying Power – One of the primary advantages is gaining access to larger capital. If you are skilled at generating consistent returns, a bigger account can amplify your profits exponentially. Instead of trading $1,000 of your personal funds, you can potentially trade a $10,000, $200,000, or even larger account funded by the prop firm.

- Risk Cushion – Prop firms help share or even absorb some of the risk. While you do have to follow specific risk management guidelines, you are not putting your personal funds on the line in the same way as you would in your own account. The firm shoulders the financial burden of losses if you meet certain terms.

- Professional Environment – Many prop firms simulate an institutional trading floor experience. You may benefit from direct mentorship, proprietary trading tools, and a network of like-minded individuals. Such an environment can significantly shorten your learning curve.

- Scaling Opportunities – Once you demonstrate consistent profitability, many prop firms offer scaling programs. This can allow your account size to grow incrementally over time, and the best firms provide structured scaling solutions to help you evolve into a high-level professional trader.

- Discipline and Structure – Prop firms impose strict rules on leverage, maximum drawdowns, and risk per trade. This structure can help discipline your trading. It ensures that you have a well-defined methodology to preserve capital and reduce catastrophic losses.

On the other hand, if you value total freedom, no rules about maximum daily drawdowns or required profit targets trading independently might be more appealing. However, for most traders aiming to leverage capital, manage risk efficiently, and learn from an organized system, a well-chosen prop firm can be an excellent stepping stone.

Check Out our Prop Firms List

How to Choose A Prop Firm – Key Factors

Selecting the best prop firm to partner with is a major decision that influences your trading career trajectory. Below are the primary factors you should carefully weigh and how each can affect your experience.

1. Reputation and Track Record

The very first indicator of a reputable prop firm is its history and standing in the trading community. Some questions to ask:

- How long has the firm been operational? A firm that’s been around for several years and has a large pool of successful traders may be more reliable than a newly launched company with no proven track record.

- What do other traders say about them? Look at reviews on social media, trading forums, and reputable review platforms. While not every complaint is accurate, patterns of negative feedback can be a red flag.

- Is there transparency in how they operate? Trustworthy prop firms are transparent about their funding source, fees, and rules. If a prop firm is vague about its ownership, business structure, or relationship with brokers, that might be cause for concern.

Tips for Verifying Reputation

- Seek out independent YouTube reviews or genuine user testimonies on forums like ForexFactory, Reddit’s r/Forex, or dedicated Facebook groups.

- Look for publicly available info on the company’s registration details to ensure they are operating within legal boundaries.

- Check whether the firm actively engages with its community, providing updates, support, or clarifications about policies.

2. Evaluation Process and Challenges

Before you get funded by a prop firm, you typically need to prove yourself through a structured evaluation phase—commonly called a challenge. This stage is designed to test not just your profitability but also your discipline, risk management, and consistency under real-world constraints. While it might seem straightforward, the rules and structure can heavily influence your chances of passing.

Let’s break down the key components that every trader should understand in detail:

Evaluation Duration

Prop firms often give you a fixed period to meet certain objectives. Most challenges last:

- 30 Days – Standard across many firms.

- 60 Days – This allows more flexibility and suits swing or position traders.

- No Time Limit – This is offered by a few firms and is ideal for traders who don’t want the pressure of a countdown.

Your trading style plays a big role here. If you’re a scalper or intraday trader, a 30-day window might be plenty. But if you’re more patient and selective—maybe taking just a few high-conviction trades per week—you’ll benefit from a longer or untimed evaluation.

Profit Targets

Most firms require you to hit a profit target during the evaluation—commonly:

- 5% to 10% on the account within the given time frame.

- Some firms have higher targets for shorter evaluations, which may pressure you into overtrading.

Example: On a $100,000 account with a 10% profit target, you’d need to make $10,000. Depending on the timeframe and rules, this can be easy or nearly impossible without taking on excess risk.

If the target is too aggressive for your strategy, it may push you to take trades you wouldn’t normally take—causing emotional decisions, higher drawdowns, and failed evaluations.

Drawdown Limits: Daily vs. Overall

This is where things get technical—and critical. Understanding drawdown rules can make or break your challenge.

1. Daily Drawdown (DD) Limit

This is the maximum amount of loss you can take in a single day, usually as a percentage of your starting or current balance. Common limits are 4% to 5%, though some firms are stricter (as low as 2%).

Two types:

- Balance-based daily drawdown: Measured against your starting balance each day. So if you begin the day with $100,000 and the daily limit is 5%, you can’t end the day below $95,000, regardless of what happens during the day.

- Equity-based real-time daily drawdown: If your equity (including open trades) drops more than the daily limit at any point during the day—even if the trades recover—you’ve breached the rules and failed.

Example:

- You start the day with $100,000.

- You open trades that go into a $3,000 drawdown (3%).

- Even if they recover to profit later, your equity dropped below the limit and the challenge is failed.

That’s why knowing whether it’s real-time or end-of-day drawdown matters a lot.

2. Overall or Maximum Drawdown (Total DD)

This is the total loss you’re allowed to take over the course of the evaluation, typically between 6% and 10%.

Some firms use:

- Static Drawdown: Your maximum drawdown limit is fixed from the start (e.g., $90,000 on a $100,000 account). It does not move even if your balance grows.

- Trailing Drawdown: The limit moves up as your equity grows. This is more punishing because it “locks in” higher balances and reduces how much you can afford to lose.

Example of Trailing Drawdown:

- You start at $100,000 with a 10% trailing drawdown.

- You grow the account to $105,000. Your new loss limit is now $94,500 (10% from the peak).

- If you draw back to $94,000—even if you were once profitable—you’ve failed.

Trailing drawdowns are tricky and require very cautious equity management. Many traders who pass profit targets still fail challenges due to trailing drawdowns.

Daily Reset Rules

When does your drawdown limit reset?

- Some firms reset your daily drawdown each day based on your starting balance that morning.

- Others don’t reset if your account is in drawdown at the end of the day—this means you’re starting the next day already at a disadvantage.

Also note:

- Some firms don’t allow you to open new trades during the last few hours of the trading day to avoid violating daily drawdowns due to overnight swaps or unexpected spikes.

- A few will close your trades automatically if you hit the drawdown during the session.

Understanding when and how the drawdown resets—daily open? equity snapshot? at end of day?—is key to surviving the challenge.

Cost of the Challenge

Nearly all prop firms charge a fee to join the challenge. These usually range from:

- $50 to $500+ depending on the account size.

- Refundable after passing in many firms, especially if you complete a successful payout on your funded account.

- Some firms even let you keep profits earned during the evaluation, but many don’t.

Look out for:

- Reset fees: If you fail the challenge, you’ll often have to pay again to retry.

- Monthly subscriptions: Some instant funding models charge ongoing platform or data fees.

A firm with a refundable fee, clear reset options, and no surprise charges is ideal especially if you’re still refining your consistency.

How These Rules Impact You

Let’s tie this all together.

- A tight daily drawdown with real-time equity checks can knock you out even if your trades eventually win.

- A high profit target with a short evaluation window may force reckless trading.

- A trailing overall drawdown means you can’t afford any slippage or retracement once you’re up in profits.

- And if the rules aren’t clearly explained, you might break them without even realizing.

Bottom line: The evaluation phase isn’t just a performance test—it’s also a psychological stress test. You need a plan that works within the rules. So choose a firm that gives you the breathing room you need to execute your strategy properly.

What to Look For in a Friendly Evaluation Process

- Real-time drawdowns or end-of-day checks?

- Balance-based or equity-based calculations?

- Static or trailing overall drawdown?

- Can you hold trades overnight or over the weekend?

- Do your trades close automatically at a certain time?

- Are profit targets achievable for your strategy?

- Is there time pressure?

- What happens if you fail—can you retry easily?

All of these details vary by firm. So read the fine print, and choose the one that sets you up for success—not constant stress.

3. Profit Splits and Payout Structures

The profitability of trading through a prop firm is heavily influenced by how the profit split is structured. Typically, splits can range from 50/50 to as high as 90/10.

- Performance-based Scaling – Some firms start at, say, 70/30 or 75/25 in favor of the trader and then increase the trader’s share as they demonstrate consistency.

- Payout Frequency – Check how often you can withdraw profits, weekly, bi-weekly, or monthly. Some firms offer flexible payout schedules once you’ve established a trading history.

- Withdrawal Methods – Ensure the firm has a withdrawal method that’s convenient (bank transfer, PayPal, cryptocurrency, etc.) and confirm any associated fees.

Remember that a higher profit split may come with stricter trading rules. It’s not just about the percentage; it’s also about the overall conditions you must adhere to. Sometimes, a 70/30 split with minimal restrictions may yield better long-term returns than an 85/15 split with highly restrictive risk parameters.

4. Trading Capital and Scaling Opportunities

One major advantage of joining a prop firm is access to more capital. Typical account sizes range from $10,000 up to $200,000 or even $1 million for advanced traders. Larger capital allows for potentially bigger profits, but you need to check:

- Initial Funding Levels – What is the largest account size available upon passing the challenge?

- Scaling Plans – If you prove consistent profitability, does the firm automatically scale you to a higher capital tier? Or do you need to re-challenge or pay additional fees?

- Compound Growth – The best firms allow you to compound your gains. That means if you make 10% on a $100,000 account, your new balance might be $110,000. Some firms, however, reset your balance each month.

Ensure the firm has a clear plan that rewards consistent performance with capital increases. This can be a motivating factor for many traders aiming to grow into large-scale profitability.

5. Risk Management Parameters

Risk management is pivotal in trading. Prop firms often have strict daily or overall drawdown limits, to safeguard capital. Carefully assess whether the rules fit your trading approach:

- Daily Drawdown – If a firm has a daily 5% limit on a $100,000 account, it means you cannot lose more than $5,000 in a single day. Some firms measure this based on starting-day balance, others on real-time equity.

- Overall Drawdown – This might be a fixed amount, like 10% of your account balance, or sometimes a trailing drawdown that increases as your account grows but can never surpass your initial account balance.

- Position Size Restrictions – Some firms set maximum lot sizes, or they might restrict you from scaling into or out of positions in a manner that conflicts with their guidelines.

Make sure these rules are in line with your trading style. If you’re a high-frequency scalper who likes to place multiple trades in quick succession, you want to make sure you aren’t inadvertently violating position size or trade frequency limitations.

6. Fee Structures and Hidden Costs

The majority of reputable prop firms charge an evaluation fee, often called a “challenge fee” or “registration fee.” This fee can be anywhere from $50 for a small account to over $1,000 for a larger one. Always read the fine print to understand:

- Is the Fee Refundable? – Many firms will refund the fee once you pass the challenge. Others might refund it only if you reach a certain number of payouts, while some may not refund fees at all.

- Monthly Data Feeds or Platform Fees – Certain firms might require ongoing subscriptions to their proprietary software or coverage for live data feeds.

- Reset Fees – If you fail the challenge, you might have to pay a reset fee to try again. Find out exactly how much and how resets work.

- Profit Withdrawal Fees – Most prop firms don’t charge withdrawal fees (besides any from the payment provider), but verify if there are hidden administrative costs.

Always be clear on how much you’re paying up front and any potential recurrent costs. A cheap challenge fee might seem attractive, but hidden monthly fees could eat into your profits over time.

7. Trading Platforms and Technology

Next, consider the technological infrastructure of the prop firm:

- Platform Accessibility – Does the firm use popular trading platforms like MetaTrader 4, MetaTrader 5, cTrader, or a custom web-based solution? Make sure you have experience or are comfortable learning the platform they provide.

- Latency and Execution – Quick trade execution is vital, especially for scalpers. If the firm has slow trade execution, you might face increased slippage.

- Server Reliability – You don’t want your trades to be disrupted by server downtime or constant technical glitches.

- Trading Tools – Check if they provide advanced charting packages, risk management dashboards, or other proprietary indicators that might be helpful.

You might also want to confirm whether the firm supports algorithmic or automated trading solutions if that’s part of your trading method.

8. Support, Education, and Community

A supportive environment can make a significant difference in your prop trading journey:

- Mentorship – Some prop firms offer direct access to seasoned traders who provide ongoing tips and market insights.

- Educational Resources – This can include webinars, eBooks, curated market analyses, or step-by-step trading guides.

- Community – Often, established prop firms maintain Discord channels, Slack groups, or forums where traders can share ideas, discuss market events, and support each other. This community aspect can be a game-changer, especially for newer traders.

If you’re an experienced trader, you might not need heavy educational resources, but strong customer service and a vibrant community can still be valuable. Make sure your firm of choice is reachable and responsive should you have any technical or account-related issues.

9. Regulation and Legal Considerations

Regulation is always tricky when it comes to prop firms because many operate worldwide. There is no single, globally recognized authority that supervises all prop firms. However, reputable firms generally:

- Abide by anti-money laundering (AML) regulations and “know your customer” (KYC) procedures.

- Are legally registered in their operational jurisdiction and maintain transparent policies.

- Some might partner with regulated brokers to provide a stable, compliant trading environment.

It’s worth verifying that you, as a trader, have recourse should the firm not honor payouts or abruptly change terms. While official oversight might be limited in certain regions, a reputable firm will demonstrate accountability to its traders and hold itself to high standards.

10. Contract Terms, Flexibility, and Restrictions

Lastly, carefully scrutinize any contract or trader agreement you sign. Look for:

- Time Constraints – Are you required to trade a minimum number of days? Is there a maximum time limit for you to meet certain goals?

- Restrictions on Trading Styles – Some firms forbid news trading, scalping, or holding positions over the weekend. Confirm that your trading approach is allowed.

- Termination Clauses – Understand what actions or rule violations can lead to immediate closure of your funded account.

- Refund Policies – Check if fees (challenge or monthly) can be refunded under specific circumstances, such as passing the evaluation or hitting a profit milestone.

Any contract that seems vague, contradictory, or overly complex may indicate deeper issues. Taking the time to thoroughly review the document can save you headaches in the long run.

Check Out our Prop Firms List

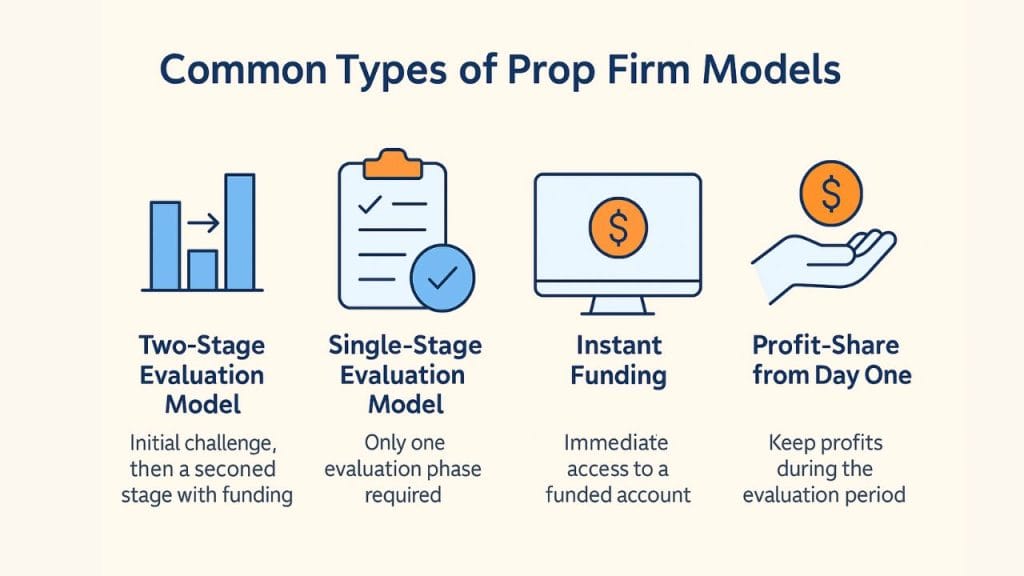

Common Types of Prop Firm Models

Prop firms may follow a variety of structures. Understanding these can help you pick a model that fits your style and goals:

- Two-Stage Evaluation Model – This is arguably the most common. You pass an initial challenge (Stage 1) with certain profit targets and drawdown rules. If you succeed, you move on to Stage 2, which generally has a smaller profit target but the same or slightly relaxed drawdown rules. Upon passing both, you’re funded.

- Single-Stage Evaluation Model – Some firms require only one evaluation phase, which might be longer or have different parameters than typical two-stage models. This can be simpler but might have stricter rules or higher fees.

- Instant Funding – These firms grant you a “live” funded account immediately upon registration or after a very light assessment. Often, the cost is higher because you pay for direct access to capital without going through multiple stages. However, the drawdown rules are usually strict.

- Profit-Share from Day One – Some cutting-edge firms allow you to keep any profits you make during the evaluation period as well. This can be enticing because you don’t “waste” time trading for free or just for the sake of passing a challenge.

- Traditional In-House Desk – Some older prop firms still require you to be physically present at their offices. They may pay a salary plus bonuses on profits. Such firms are less common in the Forex market and more typical in equities or futures trading.

The model you choose will depend on your budget, time horizon, and risk tolerance.

Step-by-Step Process of Joining a Prop Firm

Below is a general roadmap you might follow to get funded by a prop firm:

- Research – Start by creating a short list of reputable firms. Look at reviews, success stories, and terms.

- Compare – Evaluate each firm’s trading rules, cost structures, and profit splits side by side.

- Register and Pay – Sign up for the challenge (or evaluation) and pay the registration fee.

- Undergo Evaluation – Meet the profit targets within the drawdown constraints. This typically involves following your normal trading strategy while respecting the firm’s rules.

- Progress to the Next Stage (if applicable) – If you pass the first stage, you may need to undertake a second stage with modified or lower profit targets, but the same or slightly adjusted risk parameters.

- Funded Account Activation – Once all stages are passed, you receive a funded live account. You will typically sign a trader agreement outlining profit splits, payment schedules, and additional policies.

- Trade, Earn, Withdraw – You trade the funded account, aiming to produce consistent profits while adhering to risk rules. Profits can usually be withdrawn per the firm’s payout schedule, or you can compound them in the account if permitted.

Throughout this process, communication with the firm’s support team is key. Don’t hesitate to ask questions if any rule or aspect is unclear.

Examples of some Prop Firms

- FTMO – One of the most recognizable names in the industry. They use a two-stage evaluation model and offer profit splits of up to 90/10 with scaling potential.

- Funded Trading Plus – Known for its simplicity and user-friendly evaluation environment. Primarily, it focuses on Forex with a transparent approach.

- The5%ers – Focuses on low-risk trading and long-term consistency. They offer a single evaluation model and generally have lower profit targets.

- Oanda Prop Trader – It’s a newer player but it is by a trusted broker (Oanda).

- Crypto Fund Trader – Prop firm that specialize for crypto.

- Check Out our – Prop Firms List

When researching these firms, pay attention to the reviews from real traders, ensuring you note any particular issues or praise they highlight. This can give you an idea of the firm’s reliability, tech infrastructure, and overall user experience.

Red Flags to Watch Out For

The prop trading industry has grown quickly, and not all firms operate with integrity. Here’s what you should be wary of:

- Lack of Transparency – Firms that refuse to disclose critical information like fees, how they generate revenue, or the broker they partner with.

- Overly Generous Claims – If a firm promises 100% profit splits with no strings attached or immediate funding of extremely high amounts for minimal fees, be cautious.

- No Actual Live Trading – Some shady outfits run “fake” challenges using demo accounts without actually sending trades to the market. They might simply collect fees from gullible traders.

- Negative Payout Histories – If many users publicly complain they never received profits or the firm delayed payment indefinitely, that’s a huge red flag.

- Poor Customer Support – If you can’t reach support, or it takes weeks to get a basic response, you’re likely in for a frustrating experience.

Doing your due diligence verifying the firm’s legitimacy by combing through user forums and checking regulatory statuses can help you avoid these pitfalls.

Frequently Asked Questions (FAQ)

How much does it cost to join a prop firm?

Costs vary widely, depending on account size and the firm’s structure. A typical challenge for a $10,000 to $100,000 account might cost between $50 and $600. Some firms charge more for larger accounts. Always double-check whether these fees are refundable and if there are any additional monthly charges.

Is prior trading experience necessary

Many prop firms do not require formal trading education or a specific professional background. However, you do need to pass their evaluation process. In practical terms, this usually requires having a profitable trading strategy and good risk management skills.

Can I trade other markets besides Forex?

Yes, many prop firms let you trade indices, stocks, commodities, or cryptocurrencies, in addition to Forex. Each market may come with its own conditions, such as maximum lot sizes, margin requirements, or specific times you’re allowed to trade.

What happens if I fail the evaluation?

If you fail, your fee is typically non-refundable, though some firms let you retake the challenge at a discounted rate (or the same rate) under certain circumstances. If you repeatedly fail, you may lose the opportunity to join that particular prop firm unless they allow multiple retakes.

How long does it take to receive my profit payouts?

Most firms have a set schedule—weekly, bi-weekly, or monthly. After you submit a payout request, it can take a few business days to process depending on the payment method and the firm’s internal protocols.

Is it possible to hold trades over the weekend?

This varies by firm. Some firms allow it, but you must check if they consider weekend gaps as part of your drawdown or if they impose special margin requirements. Others specifically forbid it to reduce exposure to weekend volatility.

Is it possible to get scammed by a prop firm?

Unfortunately, yes. While many legitimate prop firms exist, some unethical operations only aim to collect challenge fees without paying out profits. Always do thorough research, verify user testimonials, and ask questions if you sense red flags.

Conclusion and Final Thoughts

Joining a prop firm can be a game-changer for your Forex journey. It gives you access to more capital, structure, and a shot at bigger profits—but not all firms are built the same. Some are solid, others… not so much.

Here’s what to keep in mind:

- Reputation matters – Stick with firms that have a proven track record and open communication.

- Know the rules – Make sure the profit targets, drawdown limits, and timelines fit your style.

- Understand the money side – Look at profit splits, fee refunds, and any hidden charges.

- Risk rules are key – A firm with smart risk guidelines will help you grow safely.

- Support helps – Education and community are super helpful, especially if you’re still learning.

- Tech should be solid – Fast execution and stable platforms make a big difference.

- Transparency is non-negotiable – Avoid firms that feel shady or overpromise.

Before committing, compare a few firms and pick one that fits you not just the one with the highest profit split. And remember, the real key to success is still your trading skill and discipline. A good prop firm can boost your career, but only if you’re ready to handle the responsibility that comes with it.