This is one of the most popular reversal patterns in the market. Very rewarding as

long you understand how to trade the Forex Double Top pattern rightly.

When the pattern has fully formed, the prior uptrend is over, and a

downtrend is likely underway. This is why it’s called reversal patterns.

It forms on all timeframes, all market instruments (forex, stocks, gold, Bitcoin, etc.).However, as simple as that may sound, there are a few critical things that must be present for this topping pattern to be useful (and profitable).

By the time you finish, you will know precisely how to identify a Forex Double Top as well as how to enter and exit the pattern to maximize profits.

Let’s start by looking at the typical characteristics of a double top

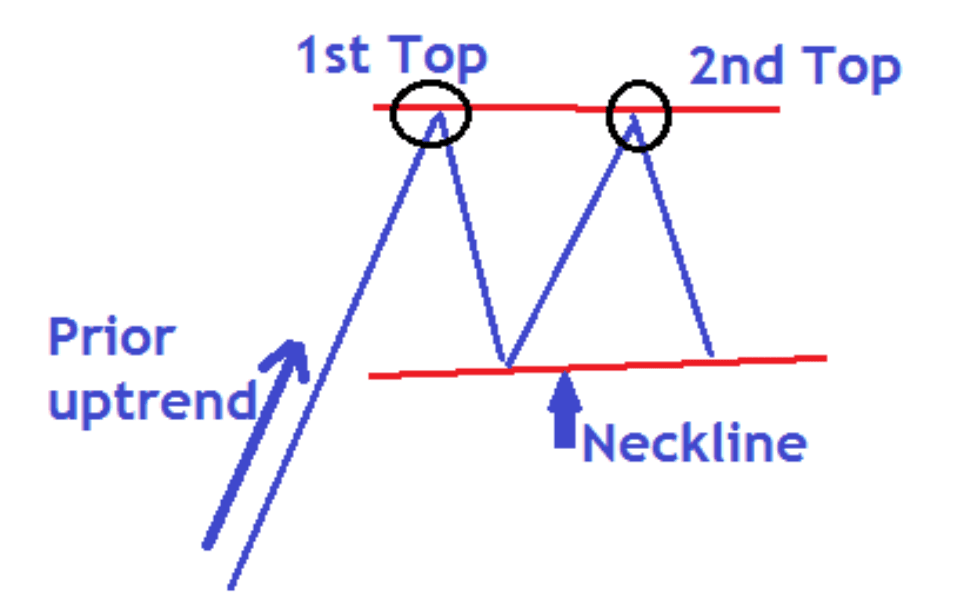

A double top majorly consists of 4 major parts

- Uptrend

- First top

- Second top

- Neckline

Let me show you all the above in an illustration

From our illustration above, the market was in an uptrend. It made an extended

move higher but was quickly rejected by resistance (first top).

The price then fell back into support and subsequently retested the same resistance level (second top). Once again, the market was rejected from this level and falls back into the same support level (neckline).

Why does it form?

The psychology in the pattern is pretty simple. The bulls (buyers) are exhausted after an extended uptrend and some exit positions at the resistance zone. This leads to the formation of the first top.

Some bulls take advantage of the fall and buy the dip in price; they push the price back up toward the old high. Unable to move the price back above the old high, buyers give up, and more sellers come into the market, so prices begin to fall back to support. This leads to the formation of the second top completing the double top structure.

A double top is only confirmed and therefore tradable once the market closes

below the neckline. One common misconception is that the double top pattern becomes tradable once the second top forms.

Now let’s get to the most exciting part, how to trade and of course make profits

daily with the double top pattern.

Trading the double top

There are mainly two ways of making entries on this pattern.

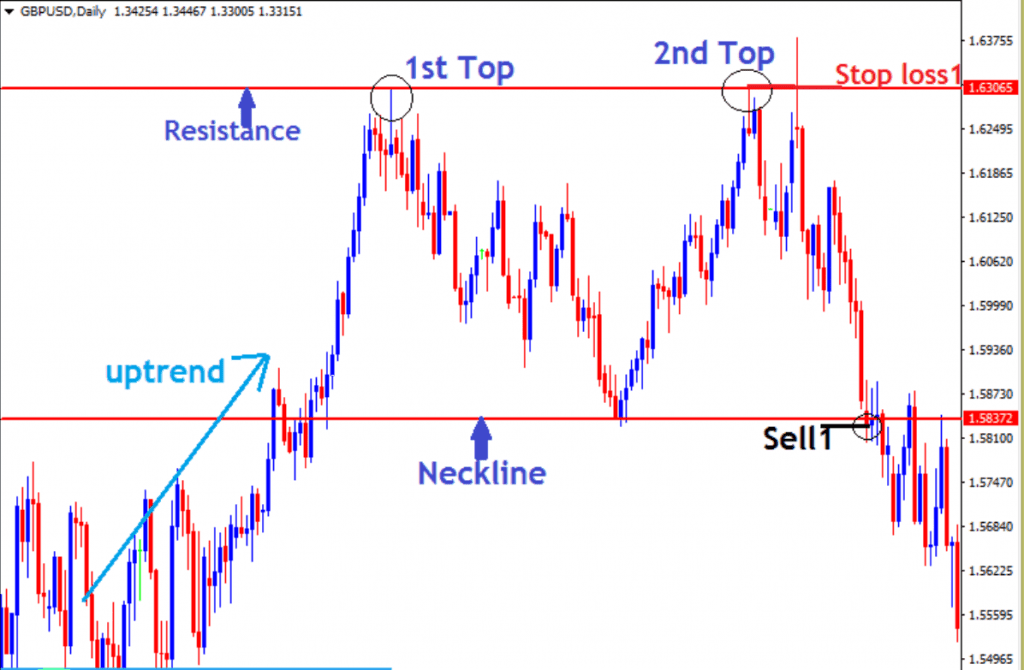

Method1

The first way to trade this pattern is to look for the neckline marked on the chart below. Once the price breaks and closes below the neckline, you can enter the market with a sell order.

In this case, the stop loss is placed above the second double top. If the price trades beyond this point, the pattern has failed, and you do not want to be in the market any longer.

Now let’s look at the second method; this is my preferred and recommended way oftrading a double top

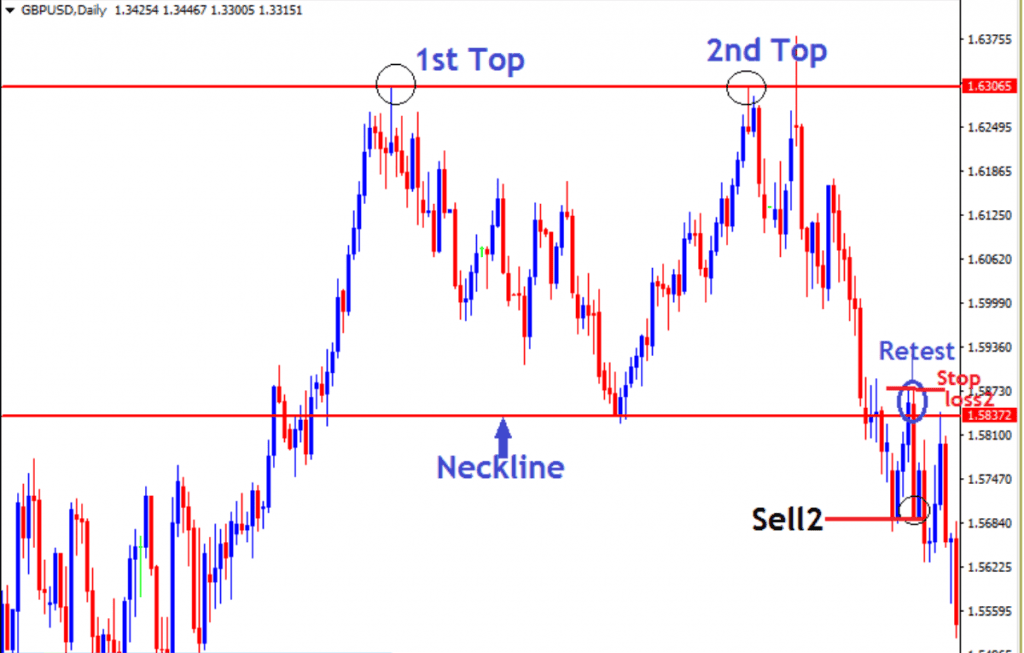

Method 2

In this case, we wait for the price to trade below the neckline (broken support) and then look to place a sell order on a retest of the neckline as resistance (broken support becomes new resistance). The stop loss would go above the recent resistance as shown below

So what we need is a retest of the neckline as new resistance. This ensures a favorable risk to reward ratio, which is an essential ingredient if you wish to succeed in this business over the long-term. This the main reason why I recommend this method of entry.

You risk less and make more since the target stays constant.

At this point, we have now learned how to identify, enter a sell trade, and set a stop loss using a double top. The next is PROFIT TARGET.

Read More : Double extreme EA – [Cost 375$] – For FREE

How to set profit targets on a double top.

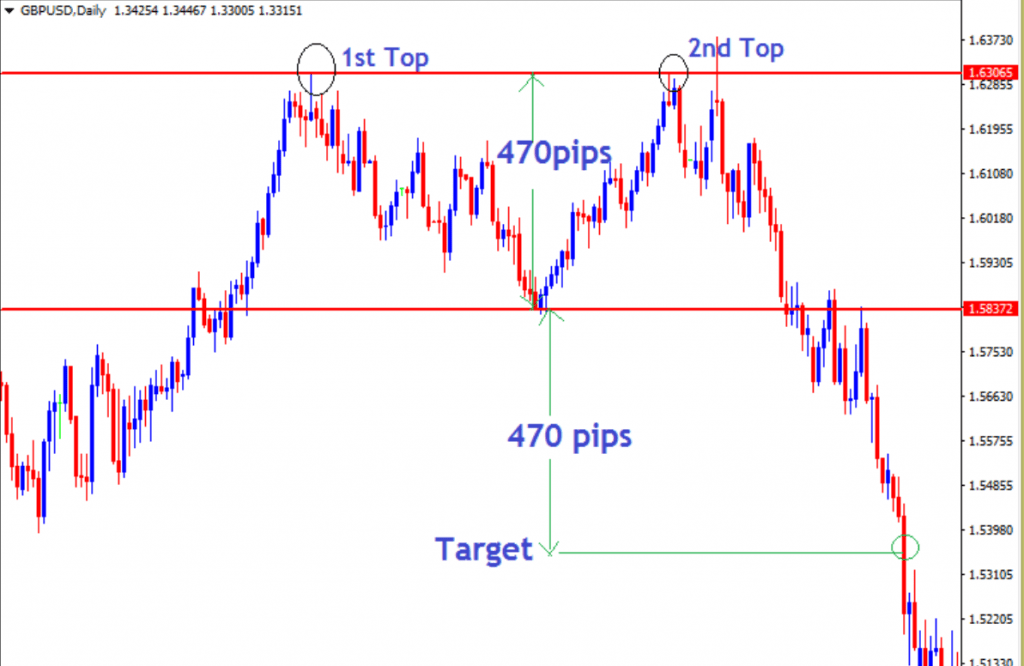

The easiest and traditional way to set a profit target on a double top is a measured objective move.

This is how this is done; you take the distance (height) from the double top

resistance to the neckline and project the same length from the neckline to a

the lower, future point in the market.

Let’s look at the chart below.

The distance from the double top resistance level to the neckline, in this case, is

470 pips. Therefore we would measure an additional 470 pips beyond the neckline to find a possible target, as shown on the chart above.

Pretty simple! Right?

Ok That’s It for The time, Let’s Talk About how to trade forex Wolf Wave pattern In next article

Read part 2 : How to Trade Forex INVERSE HEAD AND SHOULDERS Pattern

I wish everyone successful trading and consistent profits !!

Join Our Forex Forum and Community : Visit

Download a Collection of Indicators, Courses, and EA for FREE

Om please sharm I help my robot is not proper table three days only loss loss loss I am message case you forgot my account profitable robot please name send