Don’t worry, a Wolfe wave is nothing like that animal up there.

A Wolfe Wave is a natural pattern in the market formed by forces of demand and

supply. It is very versatile and occurs in a wide range of time frames, over minutes or even as long as weeks or months. This pattern has the potential to make your profits every single day.

The pattern is named after Bill Wolfe, a trader who specialized in trading the S&P500 index and who is credited with first describing the Wolfe Wave trading system and inventing the indicator that goes by the same name.

Let’s start by discussing the Wolfe wave characteristics.

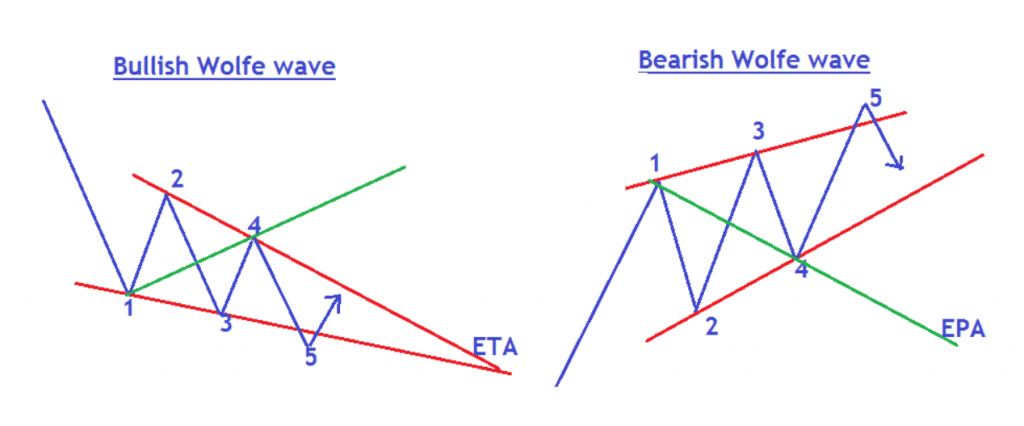

First, take a look at this illustration below;

From our illustration above, a Wolfe Wave pattern consists of five waves, with the

2nd and 4th ones being the retracement waves.

Rules for identification of this pattern include:

- Waves 3-4 must stay within the channel created by 1-2

- Wave 1-2 equals Waves 3-4 (they are symmetrical).

- Wave 4 lies between Waves 1 and 2.

- There is a regular gap between all waves.

- Wave 5 exceeds the trendline created by Waves 1 and 3 and it is the entry zone.

Other features to know about the pattern is the EPA and ETA

Let’s start with the most important; EPA line.

EPA means Estimate Price at Arrival. It estimates how far price will move in extended into the future. Hence, EPA line is the Take profit level

EPA line is always drawn connecting points 1 and 4, regardless of whether the Wolfe wave is bullish or bearish.

Now let’s talk about the ETA line.

This is not very significant in trading the pattern so it is a line that shouldn’t really

bother you. Well, it does no harm to know 1 or 2 things about it.

If you’ve booked aeroplane tickets, you’d know what this means. It stands for

Estimated Time on Arrival.

In Wolfe wave trading, the ETA line is used to estimate at what date price will arrive at the apex of the two converging lines.

But like we mentioned above, the EPA is the most important line so keep your focus on it.

The 3 common places where Wolfe wave can be found are these:

- Channels in an uptrend (look for bearish Wolfe wave)

- Channels in a downtrend (look for bullish Wolfe wave)

- Horizontal channels when the price is consolidating.

Now let’s do the really fun part; how to trade and profit from the Wolfe wave

How to make entries on the Wolfe wave

Here, am assuming we have identified the Wolfe pattern formation on the chart at we are at the point (wave 5). So what exactly triggers the buy or sell signal/entry?

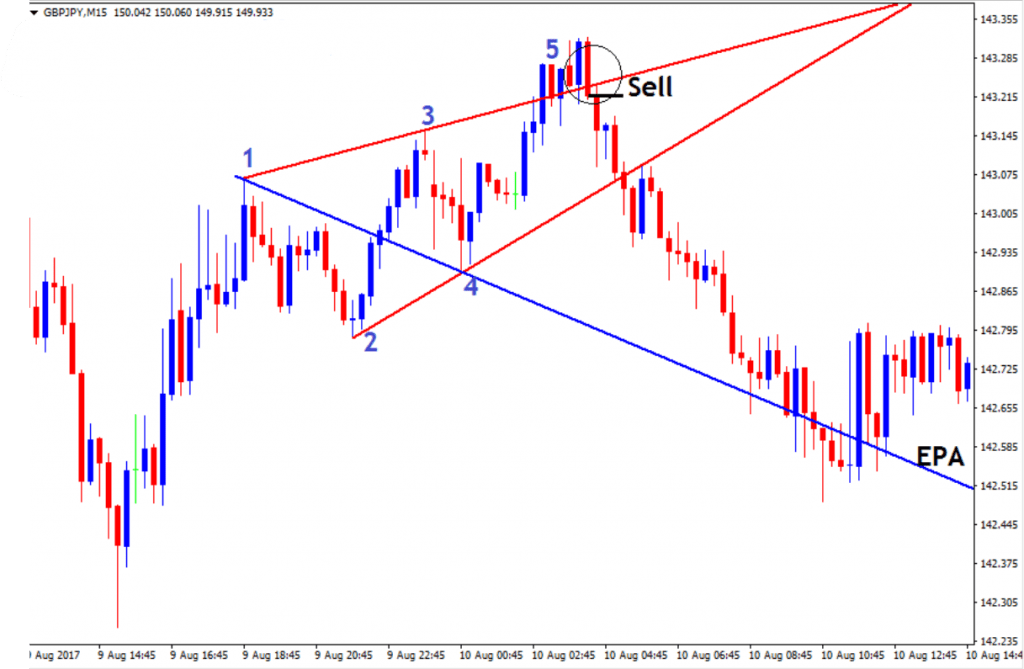

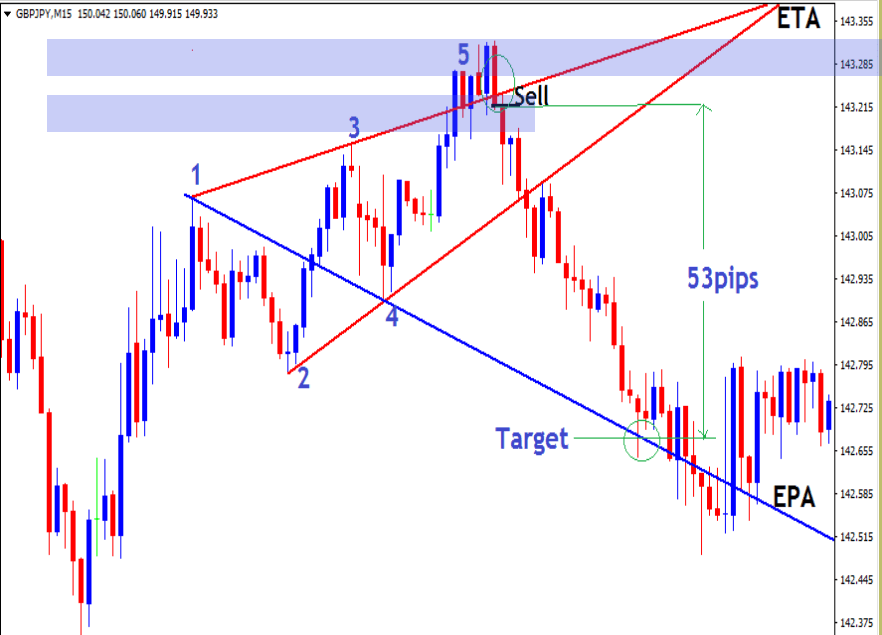

Take a look at the chart below.

From our above GBPJPY, 15-minute chart, the trigger for the sell entry was the

engulfing pattern that closed below the trendline. So it is very important to combine the wave trigger zone with a candlestick pattern for extra confirmation

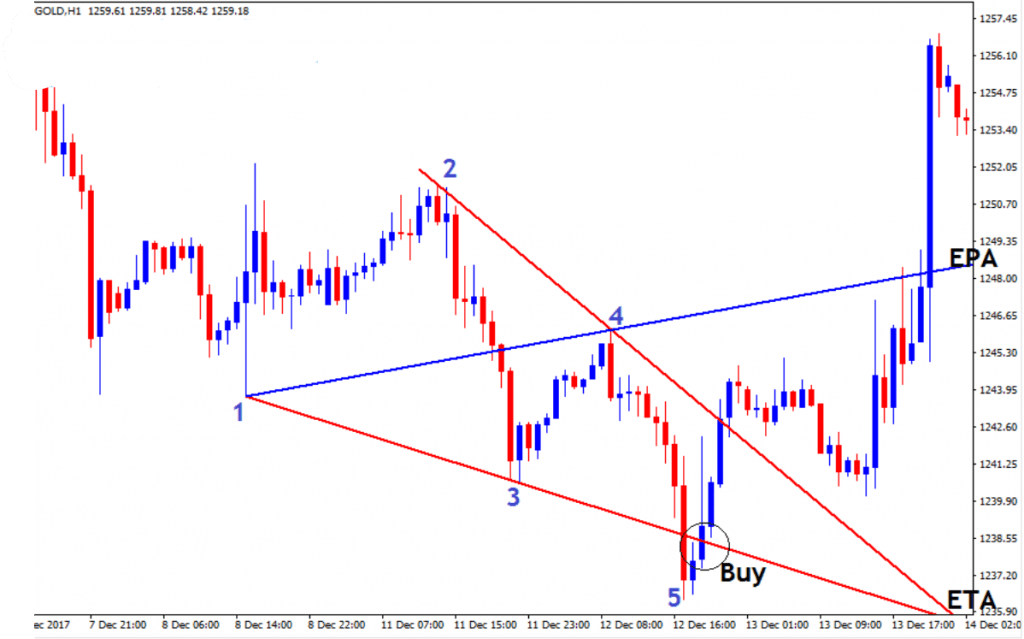

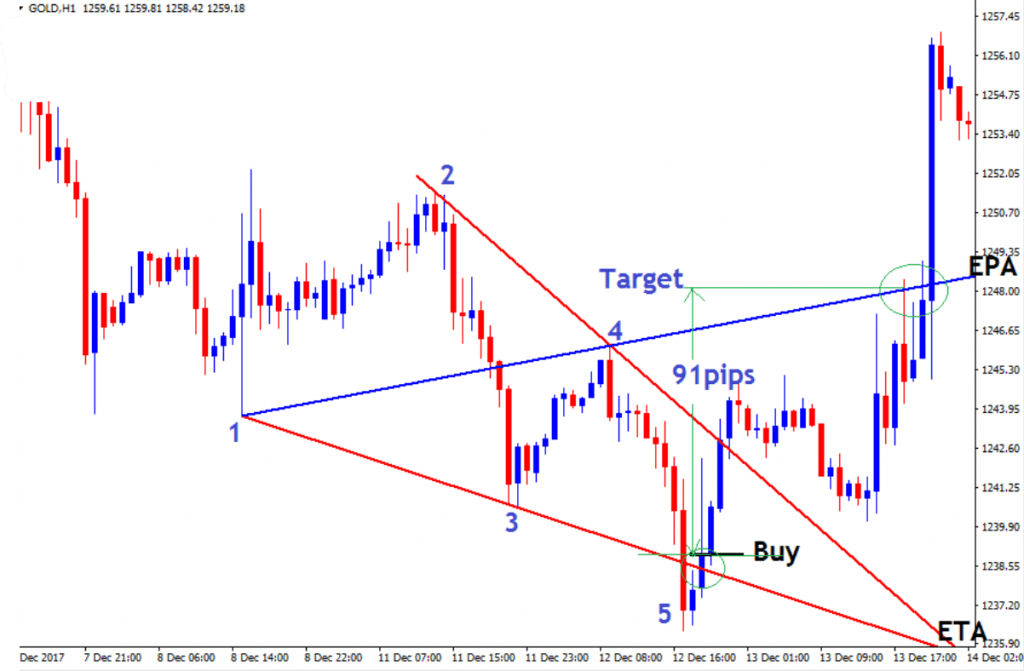

Let’s look at another example below, this is bullish Wolfe wave on the GOLD hourly

chart.

On the above chart, you can see the confirmation for entry was the inverted

hammer on wave 5

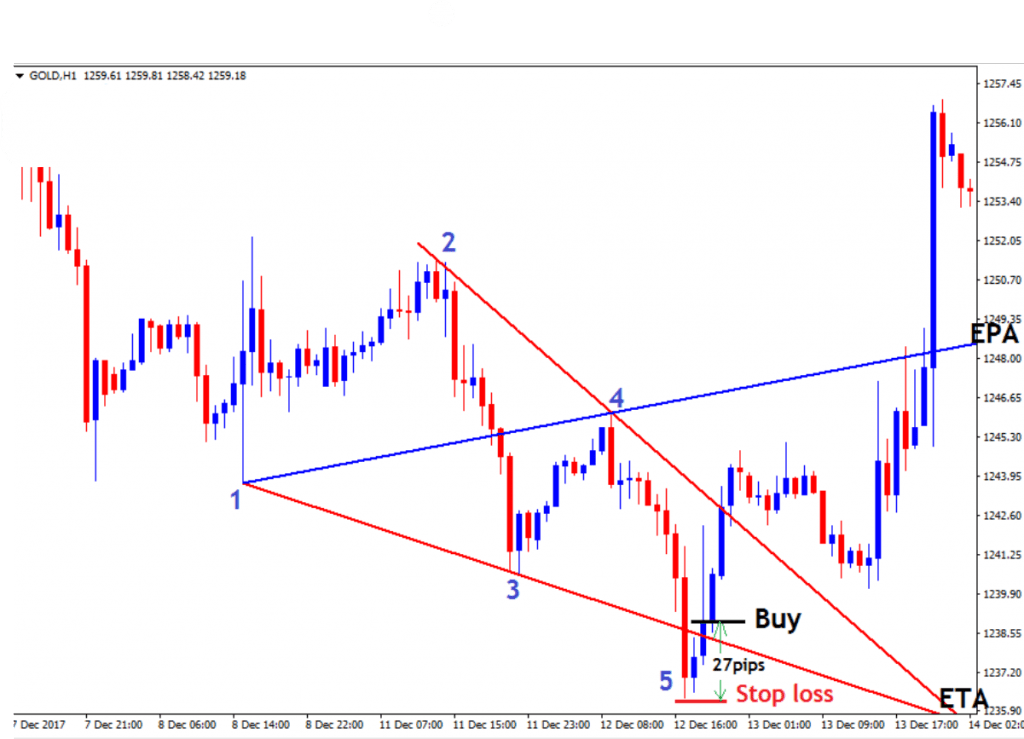

How to Set Stop Loss on the Wolfe wave

Like we mentioned before, a stop loss is your risk control measure. In Wolfe wave trading, the Stop loss for the bearish pattern is placed just above wave 5 as shown in the GBPJPY chart below.

On the bullish Wolfe wave on Gold below, we set the Stop loss just below point 5 as shown below. The lowest low of wave 5

Read More : 1 HOUR FOREX REVERSAL STRATEGY

How to set Profit Targets o Wolfe wave pattern.

The EPA line is the target area on the pattern. EPA line is always drawn connecting points 1 and 4, regardless of whether the Wolfe wave is bullish or bearish.

Take a look at the bearish Wolfe on GBPJPY below. The profit target is when price

hits the EPA line as shown below

Same applies for the Bullish Wolfe wave below on the GOLD Hourly chart. The EPA

line is drawn connecting wave 1 and 2. The target is where price meets the EPA as we mentioned above.

In conclusion, the Wolfe wave pattern is very profitable if you follow the basic

rules. It has one of the best risk-reward ratios i.e the reward is always great as

compared to how much you are risking. The pattern appears on all time frames

and that’s why it has the potential to make you money every single day.

Ok That’s It for The time, Let’s Talk About how to trade forex Double Bottom pattern In next article

Read part 2 : How to Trade Forex Double Top Pattern

I wish everyone successful trading and consistent profits !!

Join Our Forex Forum and Community : Visit

Download a Collection of Indicators, Courses, and EA for FREE