Order Blocks in forex are fundamentally a reflection of the buying and selling activities of large market participants. These blocks can be seen as the footprints of the financial giants – the banks, institutions, and significant traders whose actions shape the market trends. Understanding these blocks is like having a roadmap in the complex forex trading journey, offering insights into potential market movements.

The purpose of this article is to demystify the concept of order blocks (OB). Here, we aim to delve deep into the intricacies of OB, unraveling their types, the strategies for trading them, and the technical tools that can be leveraged. Whether you’re a novice trader just starting or a seasoned professional looking to refine your strategies, this comprehensive guide will equip you with a thorough understanding of order blocks.

We will explore how different types of OBs influence trading decisions, discuss the strategies to trade effectively using these blocks and introduce the various technical indicators that can help identify these pivotal points in the market. Furthermore, this article will link to other in-depth discussions, providing a well-rounded perspective.

So, let’s embark on this journey to unlock the secrets of forex order blocks, a journey that promises to enhance your trading acumen and potentially pave the way to greater success in the forex market.

Understanding Order Blocks in Forex Trading

In forex trading, order blocks stand as a cornerstone concept, crucial for any trader seeking to navigate the intricate waves of the currency market. These blocks, often misunderstood or overlooked by novices, are the linchpins in understanding market dynamics and trader psychology.

Definition and Significance

At its core, an order block is a substantial accumulation of buy or sell orders set at a particular price range by large financial institutions and traders. These entities, often called “smart money,” have the market clout to influence currency prices significantly. An order block is typically identified following a strong price movement; it represents the price range where the market direction was decisively changed by these substantial orders.

Understanding OBs is significant because they often act as key turning points in the market. They are where big players enter or exit trades, which can lead to the formation of new trends or the reversal of current ones. Recognizing these blocks helps traders align their strategies with these powerful market forces, potentially leading to more informed and successful trading decisions.

Types of Order Blocks

OBs can be broadly classified into two categories:

- Bullish Order Blocks: These are formed after a significant downward price movement, where large players enter buy positions. A bullish block is a potential ‘springboard’ for upward price movements.

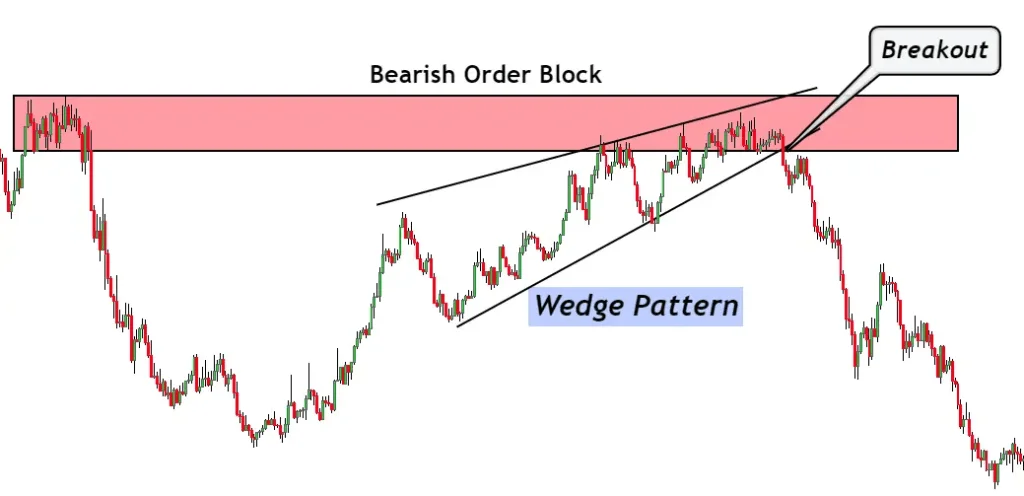

- Bearish Order Blocks: Conversely, these blocks occur after a significant upward price movement and indicate where large players start selling. They often precede downward trends.

Recognizing these blocks isn’t merely about spotting a large order. It’s about identifying areas where there is a consolidation of buy or sell sentiment, leading to a substantial impact on price direction.

Historical Context and Market Impact

The concept of order blocks arises from the broader theory of supply and demand. Historically, markets move based on the imbalance between buyers and sellers, and OBs are a direct manifestation of this imbalance. When a large number of orders are placed at a specific price range, it indicates a strong belief by big players that this level is significant for the market’s future direction.

OBs are not static; they evolve as the market sentiment changes. Recognizing it gives traders an insight into potential support and resistance areas. A bullish block, once breached, can turn into a resistance zone if the price falls back into it. Similarly, bearish blocks can become a support zone under the right conditions.

Trading Strategies Using Order Blocks in Forex Trading

After understanding the concept of order blocks, the next crucial step is to learn how to incorporate this knowledge into practical trading strategies. Effective use of OBs can significantly enhance a trader’s ability to make informed decisions, aligning their actions with the movements of the market’s major players.

Basic Strategies for Trading Order Blocks

- Identifying Potential Reversals: Traders often use OBs to spot potential reversal points in the market. For instance, a bullish block identified after a downtrend may signal a possible upward reversal. Traders might enter a long position near the bottom of this block, anticipating a price rise.

- Breakout Trades: Another strategy involves trading breakouts from these blocks. If the price moves convincingly beyond an block, it can indicate the start of a new trend. Traders may enter trades in the direction of the breakout, expecting the trend to continue.

- Retracement Entries: Sometimes, after a breakout, prices retrace back to the OB before continuing in the direction of the breakout. Traders can use these retracements as entry points, placing trades at the block level with a view that the initial breakout trend will resume.

Advanced Strategies

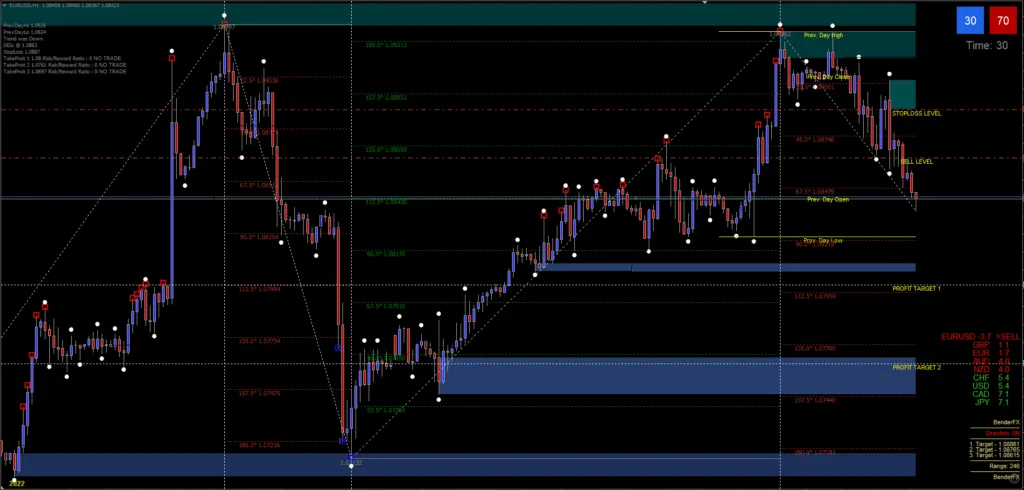

- Confluence with Technical Indicators: Combining order block analysis with other technical indicators (like moving averages, RSI, and Fibonacci retracements) can provide a more robust trading strategy. For instance, if a bullish block coincides with a significant Fibonacci retracement level, it may reinforce the potential for an upward move.

- Multi-timeframe Analysis: Utilizing order blocks across different timeframes can offer a more comprehensive market view. A bullish block on a daily chart backed by a similar pattern on a weekly chart can indicate a strong long-term bullish sentiment.

Technical Tools and Indicators for Trading Order Blocks in Forex

Incorporating order blocks into trading strategies is significantly enhanced by the use of technical tools and indicators. These tools help traders to identify blocks more accurately and make more informed decisions. Below, we explore some key indicators and tools relevant to trading with OBs in the forex market.

Overview of MT4 Indicators for Order Blocks

- MT4 Order Blocks Indicator – This comprehensive indicator showcases bullish and bearish blocks, offering display and sensitivity settings customization. Traders can adjust the tool to highlight the entire candle or just the body and set the length of OB lines for clearer visualization. Its intelligent design differentiates between mitigated and unmitigated OBs, while real-time alerts inform traders of significant developments.

- Unmitigated Order Blocks Indicator for MT4 – The Unmitigated Order Blocks Indicator is a pivotal tool in identifying significant, uncountered buy or sell orders placed by institutional traders. It focuses on instances where these large orders have not been mitigated, highlighting potential areas for price reactions in the future.

- Origin Order Block MT4 Indicator – This tool focuses on identifying the ‘origin’ points of major price moves – essentially the initial order blocks that sparked significant bullish or bearish trends. It’s beneficial for spotting potential entry points for trend-following strategies.

- MT4 Breaker Blocks Indicator – Distinct from regular order blocks, Breaker Blocks represent the aftermath of a stop hunt, where the price penetrates an OB instead of respecting it. This indicator is handy for spotting potential trading entries post-price inversion, making it a valuable tool for traders aiming to capitalize on significant market movements triggered by institutional trading activities.

- ZeusArrow Order Block Indicator – The ZeusArrow Indicator leverages the Smart Money Concept to enhance trading precision and profitability. It’s a non-repaint, non-lag tool that tracks order block rejections, providing traders with early entry signals. With its promise of a low-risk and high-reward ratio, the ZeusArrow Indicator stands out as a sophisticated tool for identifying lucrative trading opportunities in the forex market.

Advanced Techniques and Algorithmic Trading with Order Blocks in Forex

Moving beyond the basics, there are advanced techniques in utilizing order blocks for forex trading, especially when combined with algorithmic trading strategies. This section of your article can delve into these sophisticated approaches, offering insights into how traders can leverage technology and deeper analytical methods to enhance their trading performance.

Unlocking Advanced Techniques in Order Block Trading

- Pattern Recognition and Order Blocks: Advanced traders often combine the concept of OBs with pattern recognition techniques. This involves identifying recurring patterns that form around OBs, providing clues about potential market movements.

- Correlation Analysis: This technique involves analyzing the correlation between different currency pairs and how order blocks in one pair might affect another. Understanding these relationships can open up new trading opportunities.

- Sentiment Analysis: Integrating market sentiment data with order block analysis can provide a more comprehensive view. For instance, if a bullish block is formed when the market sentiment is predominantly bearish, it could signal a strong potential for a trend reversal.

Conclusion: Harnessing the Power of Order Block in Forex Trading

As we conclude this comprehensive exploration of order blocks in forex trading, it’s important to reflect on the key insights and strategies discussed. OBs are not just a theoretical concept; they are practical tools that can significantly enhance a trader’s ability to navigate the complex forex market when understood and applied correctly.

Recap of Key Points

- Understanding the Basics: We began by defining order blocks and their importance in the forex market, laying the foundation for more advanced discussions.

- Strategies for Trading: We delved into various strategies for trading using OBs, highlighting basic and advanced approaches for both novice and experienced traders.

- Technical Tools and Indicators: Exploring MT4 indicators specific to order blocks provided a practical guide to identifying and capitalizing on these market elements.

- Advanced Techniques and Algorithmic Trading: We ventured into advanced techniques and algorithmic trading, offering insights for those looking to incorporate technology-driven strategies in their trading.

The Path to Trading Success

Trading forex using order blocks is a journey of continuous learning and adaptation. The strategies and tools discussed in this article are just the starting point. As the market evolves, so should your strategies and risk management techniques. Regularly reviewing and updating your approach is key to staying relevant and profitable in the dynamic forex market.

A Word of Encouragement

Whether you are just starting in forex trading or are an experienced trader looking to refine your strategies, remember that success in forex trading is a blend of knowledge, strategy, and psychological resilience. Understanding order blocks, combined with diligent practice and risk management, can open new doors to trading success.

Thanks Admin for the EA OB