This Parabolic SAR forex strategy for Forex features the trading indicator invented by J. Welles. Wilder. This primary trading strategy centers around the SAR – stop and reverse – the idea behind it.

As with any forex trading indicator used in a trading strategy, they all lag price. Could improve most trading strategies by utilizing price action and a trading indicator such as the Parabolic SAR.

Using Parabolic SAR in Forex trading is no different than using it with any other forex market. The basic idea is:

- If the Parabolic SAR indicator goes from below the candlesticks to above, we have transformed into a down-trending market

- If the forex indicator goes from above to below the chart candlesticks, we now have a market uptrend

The dots that form with the forex Parabolic SAR will also trail each candlestick regardless of the trend direction, improving your trade management.

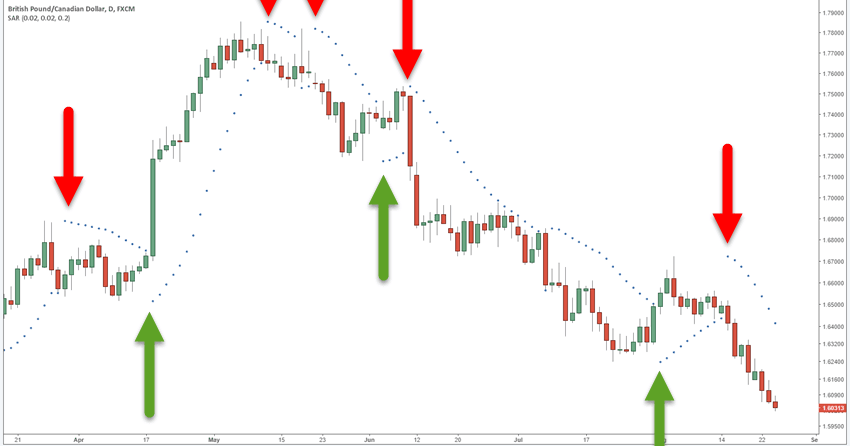

You can see from this chart that using the “stop and reverse” feature of the Parabolic SAR looks quite simple. Another element you may notice is that when the forex market is slowing in momentum, the dots printed on the mt4 chart get closer together.

You can also see that the dots get closer to the chart candlesticks in market consolidations. Some new Forex traders may use the visual aspect of strong and weak momentum as part of their trading strategy.

Parabolic SAR Indicator Settings

We are always fans of using out-of-the-box (default) settings of forex trading indicators, and the forex Parabolic SAR is no other exception. The acceleration factor is set at .02, which may be a number you think to change.

The acceleration setting is what determines the dot separation. Some people may trade volatile forex markets and begin optimizing the Parabolic SAR input value. That is a rabbit hole as many people will over-optimize the past data to give better forex strategy results that play out in the market future.

There is no best setting for the forex Parabolic SAR or any other trading indicator. Use the indicator values and build your trading rules around those. As mentioned earlier, price action will help increase most trading strategies’ outcomes.

Swing Trading or Day Trading The Parabolic SAR – Sell and Buy Signals

Trading rules will dictate your chance of good success with any trading strategy. For the forex Parabolic SAR trading strategy, it is no different. It would be better if you had some rules to determine a sell entry signal and a buy entry signal. On top of that, you have proper good risk protocols to protect the downside.

RELATED 200 EMA Multi-Chart Timeframe Forex Trading Strategy

This image highlights the forex trading opportunities on this chart.

- When the forex Parabolic SAR dots flip to the top of the candlesticks, you have a trading entry signal to the downside, as shown by the red arrows.

- Parabolic SAR indicator dots below candlesticks equals a buy entry signal after the dots move from the top.

To make it even easy to understand, consider the dots as people think of a moving average – dynamic support and resistance. The resistance level holds as long as the dots stay on top of the candlesticks. Support is holding when the color dots are under the candlesticks.

Download a Collection of Indicators, Courses, and EA for FREE

Buy Signals

Once the dots flip underneath the chart candlesticks, we are in an uptrend. You can put an order to go long over the highs of the first chart candlestick that has the dot under it.

Sell Signals

Once the upside flip occurs, please place your order below the low of the candlestick that has the Parabolic SAR dot under it.

Stop Loss

You can place your stop loss beyond the first dot or under the setup candlestick. Remember that a close stop loss(SL) order can be hit even if the trend remains intact. My favorite stop loss(SL) technique uses the Average True Range forex indicator to keep my stop out of the noise.

The rules are the same whether you swing trade or day trading the Parabolic SAR strategy.

Improve the Parabolic SAR Strategy – Using Trendlines

We are not a fan of using a forex indicator for all trading decisions. Technical analysis is a good help and will help you avoid being whipped back and forth. We’ve written about a 5 Minute Forex Scalping Strategy With 200 EMA And Parabolic SAR Indicators but let’s stick to price and the trendlines we use.

We look at an uptrend whenever we have a trend line under the price. We will only take forex Parabolic SAR trades that flip from the dots on top of the price to the downside. We can use the opposite flips for open trade exit or as an excellent opportunity to manage the trade.

You will have some times when you can have chart price consolidations, and in those times, you will want to wait for a chart breakout from consolidation before taking any trades.

Stop loss(SL) placement will be the same as the regular forex Parabolic SAR strategy.

Wrap Up

The Parabolic SAR strategy is a straightforward way to forex trade. Of course, it isn’t straightforward, as you will take some losses, which may discourage many traders.

RELATED 5EMA And 8EMA Forex Trading Strategy

For those who can keep their emotions in check, have tested the strategy, and know what to expect, the losses will be part of doing business.